India Proton Exchange Membrane Fuel Cell Market Outlook to 2030

Region:Asia

Author(s):Yogita Sahu

Product Code:KROD6953

December 2024

98

About the Report

India Proton Exchange Market Overview

- The India Proton Exchange Membrane Fuel Cell (PEMFC) market is valued at USD 110 million, based on a five-year historical analysis. The increasing focus on renewable energy and government incentives for hydrogen infrastructure drive this market. PEMFC technologys scalability and quick response time make it particularly suitable for applications in transportation and stationary power generation.

- India has become a key player in the PEMFC sector, with cities like Mumbai and Bengaluru emerging as hubs for fuel cell technology. These cities benefit from robust industrial ecosystems, high investment inflows, and government support, which together contribute to their dominance in this sector. Additionally, the focus on reducing emissions in urban transportation further supports the growth of PEMFC solutions in these regions.

- Launched with a budget allocation of INR 19,500 crore in 2024, the National Hydrogen Mission aims to position India as a leading player in green hydrogen production, an essential input for PEM fuel cells. The missions objectives include establishing a robust hydrogen economy and reducing production costs through tax incentives and research grants.

India Proton Exchange Market Segmentation

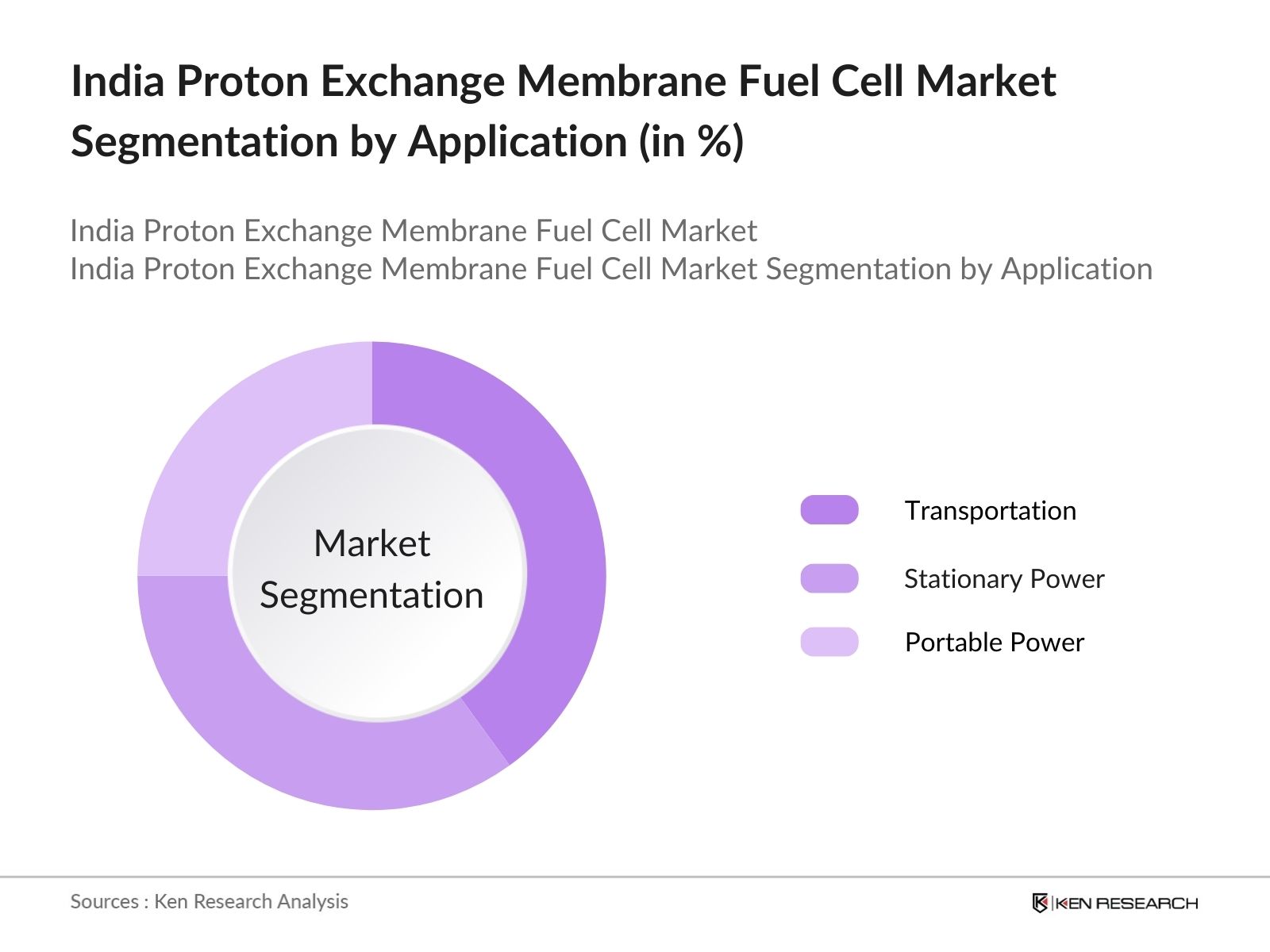

By Application: The market is segmented by application into transportation, stationary power generation, portable power generation, and residential backup. The transportation sub-segment holds a dominant market share within the application category, driven by the adoption of hydrogen-powered vehicles and government policies supporting fuel cell electric vehicles (FCEVs). Leading auto manufacturers are investing in PEMFC technology due to its scalability and environmental benefits, making it a key player in the clean transportation sector.

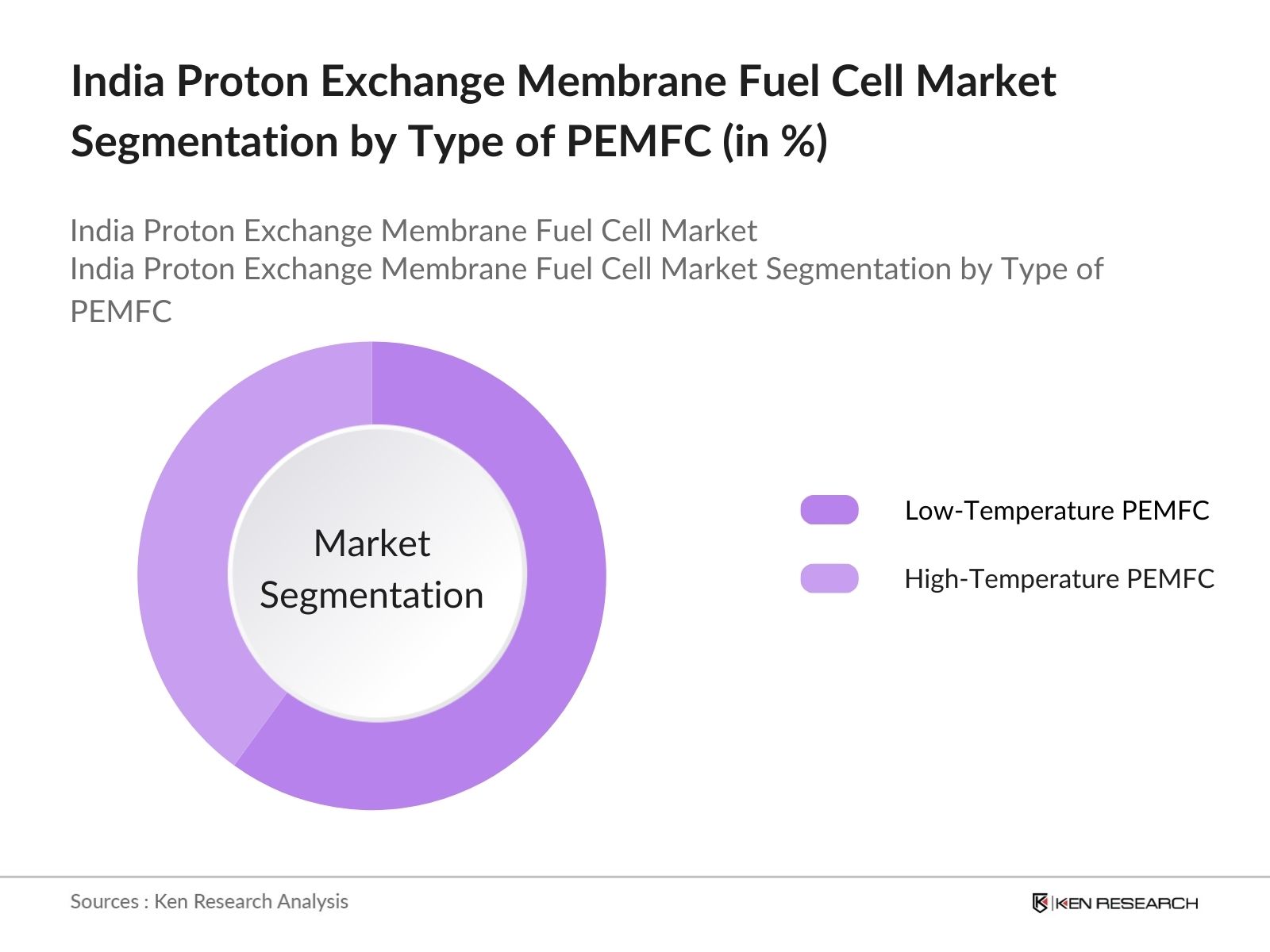

By Type of PEMFC: The market is categorized by type into low-temperature and high-temperature PEMFCs. Low-temperature PEMFCs dominate this segment due to their efficiency and widespread use in transportation and portable applications. Their lower operating temperatures make them suitable for compact applications with rapid startups, contributing to their preference for mobile applications in particular.

India Proton Exchange Market Competitive Landscape

The market is led by a few dominant players who focus on extensive research and development, strategic collaborations, and market diversification. The presence of both domestic and international companies has fostered a competitive environment.

India Proton Exchange Membrane Fuel Cell Market Analysis

Market Growth Drivers

- Increase in Demand for Clean and Renewable Energy Sources: Indias rising energy demand, currently pegged at around 1.6 billion tons of oil equivalent annually, is driving a shift towards renewable and cleaner energy solutions like proton exchange membrane (PEM) fuel cells. In 2024, the Indian government allocated a budget of INR 19,500 crore to promote green hydrogen, targeting 5 million metric tons of production annually by 2030.

- Increasing Industrial and Commercial Adoption of PEM Fuel Cells: By 2024, over 100 megawatts of fuel cell capacity are operational across sectors like logistics, manufacturing, and data centers in India. With policies encouraging decarbonization in heavy industries, India is likely to see a significant uptick in fuel cell adoption for energy backup and sustainable manufacturing.

- Government Support and Incentives for Green Hydrogen and Fuel Cell Technologies: The Indian government has earmarked substantial funds to support green hydrogen initiatives, including PEM fuel cell deployment. In 2024, the National Hydrogen Energy Mission aims to establish more than 300 hydrogen refueling stations nationwide, setting the foundation for PEM fuel cell infrastructure.

Market Challenges

- High Capital Costs of PEM Fuel Cell Systems: In 2024, the initial cost of a PEM fuel cell system in India is between INR 4,500 and INR 7,000 per kilowatt, which is substantially higher than conventional diesel generators. This cost barrier restricts market entry, especially for small and medium enterprises (SMEs) that are unable to shoulder the capital investment required for PEM systems.

- Limited Availability of Hydrogen Infrastructure: As of 2024, India has fewer than 20 operational hydrogen refueling stations across the country, which impedes the scalability of hydrogen-based PEM fuel cells for vehicles and other applications. With the limited refueling infrastructure, logistical challenges increase for companies looking to integrate PEM fuel cells, particularly in the transportation sector.

India Proton Exchange Membrane Fuel Call Market Future Outlook

Over the next five years, the India PEMFC industry is expected to experience strong growth driven by the increasing adoption of green hydrogen technologies and government initiatives. The anticipated advancements in PEMFC efficiency and cost-effectiveness are likely to broaden their applications across sectors, particularly in automotive and industrial power solutions.

Future Market Opportunities

- Expansion of Hydrogen Infrastructure for Transportation: Over the next five years, the Indian government is projected to increase hydrogen refueling stations nationwide to over 200 by 2029, enabling large-scale deployment of PEM fuel cell-powered vehicles. This infrastructure expansion will make hydrogen-powered PEM vehicles more viable for long-haul transport, especially in urban logistics and intercity transit, driving significant growth in the PEM fuel cell market.

- Rising Adoption in Industrial Backup Power Solutions: By 2028, Indias industrial sector, with an estimated annual energy demand of over 800 terawatt-hours, will see increasing adoption of PEM fuel cells as backup power solutions. PEM fuel cells offer a cleaner alternative to diesel generators, which aligns with Indias target to reduce industrial emissions.

Scope of the Report

|

Application |

Transportation Stationary Power Portable Power Residential |

|

Type of PEMFC |

Low-Temperature High-Temperature |

|

End-User Industry |

Automotive Industrial Commercial Utility Providers |

|

Fuel Type |

Pure Hydrogen Reformed Methanol Hydrogen-Compressed Gas |

|

Region |

Northern India Southern India Eastern India Western India |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Automotive Manufacturers

Hydrogen Fuel Infrastructure Providers

Energy and Power Generation Companies

Government and Regulatory Bodies (National Hydrogen Mission)

Venture Capitalist and Investor Firms

Banks and Financial Institution

Private Equity Firms

Hydrogen and Fuel Cell Research Institutes

Companies

Players Mentioned in the Report:

Ballard Power Systems Inc.

Plug Power Inc.

Cummins Inc.

Intelligent Energy Limited

AVL List GmbH

Bloom Energy

Ceres Power Holdings PLC

Doosan Fuel Cell America, Inc.

FuelCell Energy, Inc.

Hydrogenics Corporation

Table of Contents

India Proton Exchange Membrane (PEM) Fuel Cell Market Overview

Definition and Scope

Market Taxonomy

Market Growth Rate (CAGR, Adoption Trends)

Market Segmentation Overview

India Proton Exchange Membrane (PEM) Fuel Cell Market Size (In USD Million)

Historical Market Size (Revenue Analysis, Volume Trends)

Year-On-Year Growth Analysis (Market Growth Patterns)

Key Market Developments and Milestones (Product Launches, Strategic Initiatives)

India Proton Exchange Membrane (PEM) Fuel Cell Market Analysis

Growth Drivers (Hydrogen Adoption, Clean Energy Mandates)

Government Initiatives towards Hydrogen Economy

Increasing Demand for Clean Energy Solutions

Technological Advancements in Fuel Cell Technology

Rising Adoption in the Transportation Sector

Market Challenges (Cost, Infrastructure, Supply Chain)

High Initial Investment Costs

Limited Hydrogen Infrastructure

Technical Challenges in Fuel Cell Deployment

Opportunities (Green Energy, Collaboration, R&D)

Expansion in Renewable Energy Integration

Potential in Backup Power Solutions

International Collaborations and Partnerships

Trends (Vehicle Electrification, Smart Systems Integration)

Adoption of Fuel Cells in Electric Vehicles

Development of Portable Fuel Cell Applications

Integration with Smart Grid Systems

Government Regulations (Policy Support, Compliance Standards)

National Hydrogen Energy Mission

Subsidies and Incentives for Fuel Cell Adoption

Environmental Standards and Compliance

SWOT Analysis (Strengths, Weaknesses, Opportunities, Threats)

Stakeholder Ecosystem (Value Chain, Key Participants)

Porter’s Five Forces Analysis (Competitive Pressure Metrics)

Competition Ecosystem (Market Positioning, Strategies)

India Proton Exchange Membrane (PEM) Fuel Cell Market Segmentation

By Type (In Value %, Technology Adoption Trends)

High Temperature PEMFC

Low Temperature PEMFC

By Material (In Value %, Innovation Analysis)

Membrane Electrode Assembly

Hardware

By Application (In Value %, Industry Use Cases)

Stationary

Mobile

Portable

Others

By End-Use Industry (In Value %, Adoption by Sector)

Automotive

Industrial

Commercial

Residential

By Region (In Value %, Regional Growth Patterns)

North India

West and Central India

South India

East and Northeast India

India Proton Exchange Membrane (PEM) Fuel Cell Market Competitive Analysis

Detailed Profiles of Major Companies (Business Strategies, Innovations)

Ballard Power Systems

Plug Power Inc.

Cummins Inc.

Doosan Fuel Cell

Hyundai Motor Company

Nedstack Fuel Cell Technology

Nuvera Fuel Cells

Panasonic Corporation

Robert Bosch GmbH

SFC Energy AG

Horizon Fuel Cell Technologies

Intelligent Energy Limited

ITM Power PLC

PowerCell Sweden AB

Toshiba Energy Systems & Solutions Corporation

Cross Comparison Parameters (Number of Employees, Headquarters, Inception Year, Revenue, Product Portfolio, R&D Investment, Market Share, Strategic Initiatives)

Market Share Analysis (Competitor Market Penetration)

Strategic Initiatives (Partnerships, Technology Collaborations)

Mergers and Acquisitions (Market Consolidation Trends)

Investment Analysis (Venture Capital, Equity Funding)

Venture Capital Funding (Growth Financing Insights)

Government Grants (Subsidy Allocations)

Private Equity Investments (Market Expansion Funding)

India Proton Exchange Membrane (PEM) Fuel Cell Market Regulatory Framework

Environmental Standards (Emission Norms, Sustainability Targets)

Compliance Requirements (Testing and Certification)

Certification Processes (Industry Standards)

India Proton Exchange Membrane (PEM) Fuel Cell Future Market Size (In USD Million)

Future Market Size Projections (Forecasted Growth Metrics)

Key Factors Driving Future Market Growth (Technology Evolution, Policy Support)

India Proton Exchange Membrane (PEM) Fuel Cell Future Market Segmentation

By Type (In Value %, Market Growth Contribution)

By Material (In Value %, Advancements and Innovations)

By Application (In Value %, Key Areas of Deployment)

By End-Use Industry (In Value %, Emerging Market Segments)

By Region (In Value %, Regional Performance Trends)

India Proton Exchange Membrane (PEM) Fuel Cell Market Analysts’ Recommendations

Total Addressable Market (TAM)/Serviceable Available Market (SAM)/Serviceable Obtainable Market (SOM) Analysis

Customer Cohort Analysis (Demographic and Behavioral Insights)

Marketing Initiatives (Promotional Strategies)

White Space Opportunity Analysis (Market Gaps, Emerging Niches)

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase entails creating a comprehensive ecosystem map covering all stakeholders in the PEMFC market. This step involves extensive desk research, combining secondary databases with proprietary data to gather information at the industry level, defining critical variables that impact market dynamics.

Step 2: Market Analysis and Construction

This phase involves compiling historical data on PEMFC market penetration, product usage across segments, and market revenue. An in-depth assessment of quality metrics across application areas ensures reliability in revenue estimates and market sizing.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses are generated based on initial research and then validated through CATIs with industry experts. These consultations provide valuable insights from industry practitioners and are essential for refining data and ensuring accuracy.

Step 4: Research Synthesis and Final Output

In this phase, key PEMFC manufacturers are engaged to gather in-depth information on product segments, sales, and consumer preferences. This final interaction serves to cross-verify statistics derived through a bottom-up approach, thereby ensuring a holistic and validated analysis of the PEMFC market.

Frequently Asked Questions

How big is the India Proton Exchange Membrane Fuel Cell Market?

The India Proton Exchange Membrane Fuel Cell Market is valued at USD 1.3 billion, supported by substantial government backing and corporate investment into hydrogen infrastructure.

What are the challenges in the India PEMFC Market?

Key challenges include high initial costs, supply chain complexities in hydrogen distribution, and a general lack of consumer awareness around hydrogen as a clean energy source.

Who are the major players in the India PEMFC Market?

Major players include Ballard Power Systems, Plug Power, and Cummins Inc., known for their focus on R&D and technology innovation in the PEMFC space.

What drives growth in the India PEMFC Market?

Growth is driven by government incentives, increased R&D in green hydrogen, and rising applications in both stationary and transportation power sectors.

What are the top applications of PEMFCs in India?

Top applications include transportation, stationary power generation, and portable power solutions, with the transportation sector showing the highest adoption.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.