India Public Cloud Market Outlook to 2030

Region:Asia

Author(s):Abhinav kumar

Product Code:KROD2368

December 2024

87

About the Report

India Public Cloud Market Overview

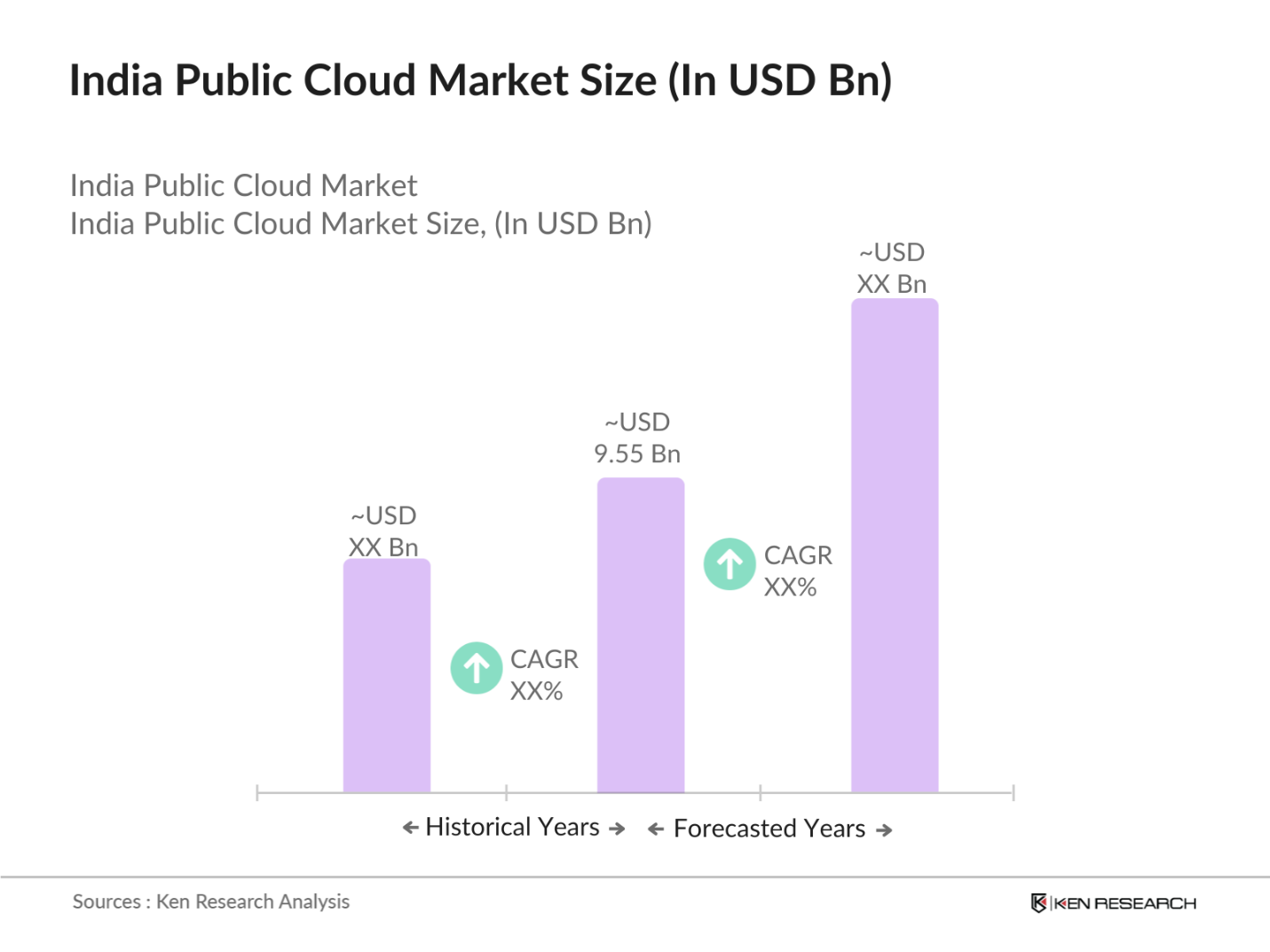

- The India Public Cloud Market is valued at USD 9.55 billion, driven by the rapid adoption of cloud solutions across various industries. A major factor propelling this growth is the increasing shift towards digital transformation by enterprises, aiming to enhance operational efficiency. The governments Digital India initiative has also played a significant role in encouraging organizations to adopt cloud-based solutions.

- India's metropolitan cities like Bangalore, Mumbai, and Hyderabad dominate the public cloud market due to their status as key tech hubs, hosting a significant portion of the countrys IT and software development companies. These cities are home to data centers established by leading global cloud providers, bolstering their dominance. Additionally, the presence of numerous startups and SMEs in these regions, alongside large-scale enterprise adoption, has further solidified their stronghold in the public cloud space.

- The Ministry of Electronics and Information Technology (MeitY) has developed several cloud computing policies to foster cloud adoption in India. These policies provide guidelines for public cloud usage by government bodies, encouraging the migration of public services to cloud infrastructure. By 2024, the government is expected to increase cloud investments, with MeitY allocating significant resources for cloud-based e-governance services. MeitY has also set security and data localization standards to ensure cloud service providers meet the compliance needs of the Indian market.

India Public Cloud Market Segmentation

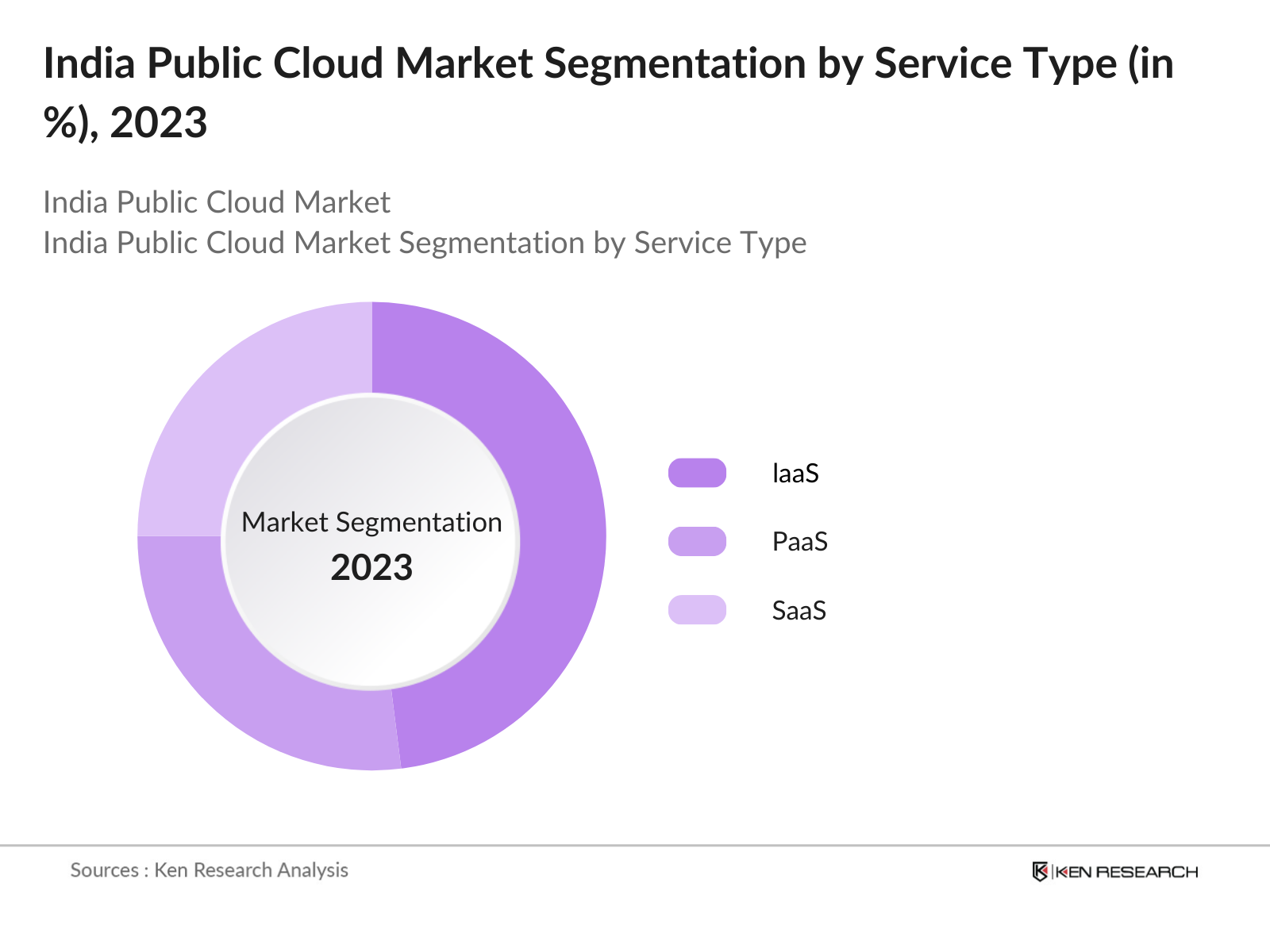

By Service Type: Indias Public Cloud Market is segmented by service type into Infrastructure as a Service (IaaS), Platform as a Service (PaaS), and Software as a Service (SaaS). Among these, IaaS has garnered the largest market share due to its scalability, cost-effectiveness, and ability to cater to various industries requiring robust infrastructure capabilities. Major enterprises and startups alike are migrating to IaaS platforms to manage and store massive amounts of data, making this sub-segment critical for market growth.

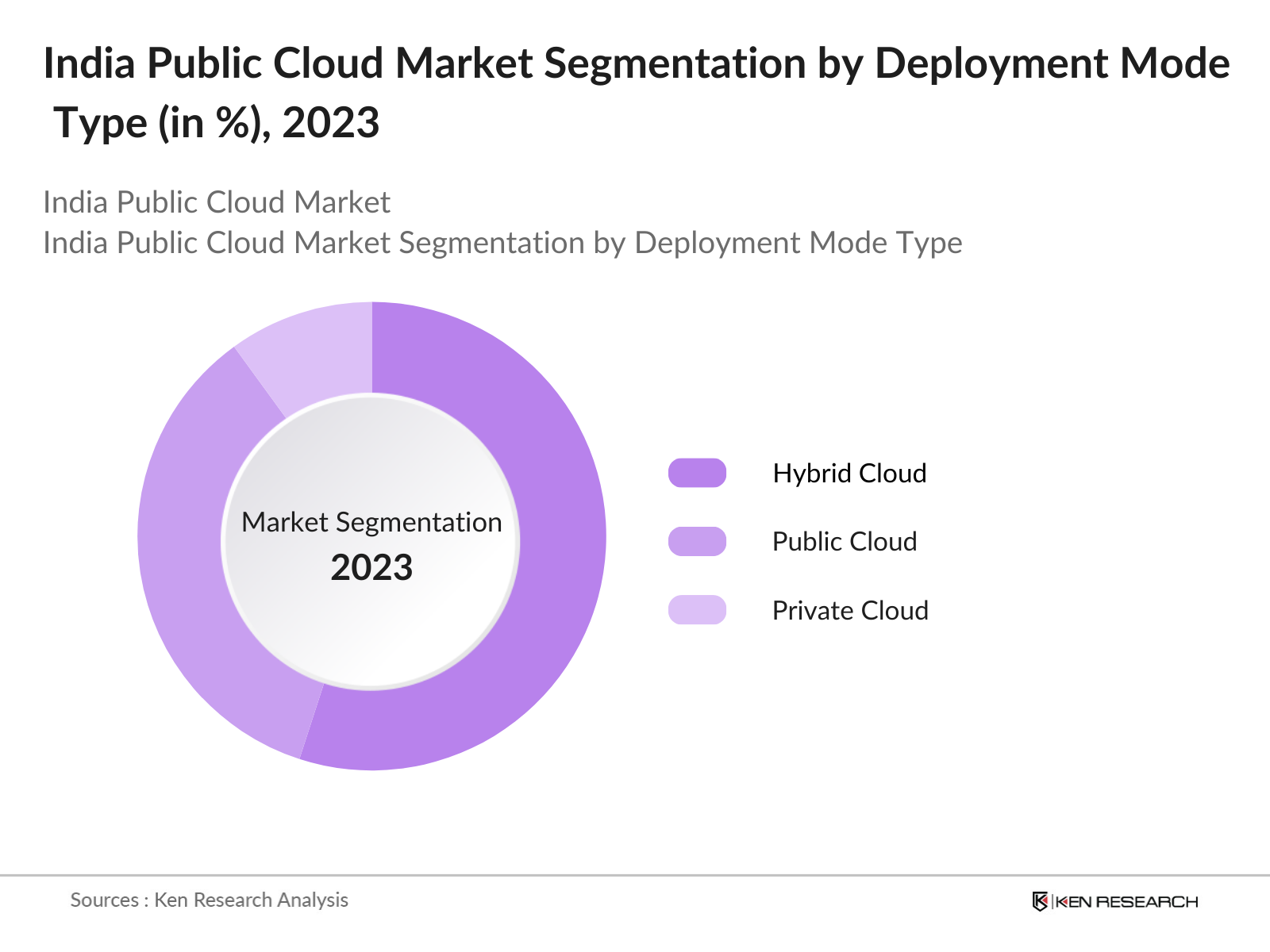

By Deployment Mode: The Public Cloud Market in India can be segmented by deployment mode into Public Cloud, Private Cloud, and Hybrid Cloud. Hybrid Cloud dominates this segment due to its flexibility in combining on-premise infrastructure with public cloud services. Organizations prefer the hybrid model as it allows them to keep sensitive data in-house while taking advantage of the scalability and cost-effectiveness of public cloud services. The adoption of Hybrid Cloud solutions has risen significantly due to compliance needs and the need for data privacy, especially in industries such as BFSI and government sectors.

India Public Cloud Market Competitive Landscape

The India Public Cloud market is highly competitive and dominated by global giants as well as home-grown players. The market is characterized by frequent innovations and expansions by key players to gain a competitive edge. The following are some of the leading companies.

|

Company Name |

Establishment Year |

Headquarters |

|

Amazon Web Services |

2006 |

Seattle, USA |

|

Microsoft Azure |

2010 |

Redmond, USA |

|

Google Cloud |

2008 |

California, USA |

|

IBM Cloud |

2007 |

New York, USA |

|

Oracle Cloud |

2012 |

Redwood City, USA |

India Public Cloud Industry Analysis

India Public Cloud Market Growth Drivers

- Digital Transformation Initiatives: The rapid shift toward digitalization in India is boosting public cloud adoption. In 2023, the Indian government allocated INR 3,073 crore ($400 million) to promote digital transformation through initiatives like Digital India. Public cloud solutions are integral in providing scalable infrastructure to support the digital services being launched nationwide, such as e-governance and digital payments. Cloud-based platforms are increasingly adopted by enterprises to manage large-scale digitization, especially in sectors like banking and healthcare. This trend is further supported by the growing availability of affordable internet access across the country.

- Increased Adoption of Cloud-based Solutions: Indian enterprises are adopting cloud solutions at an accelerated rate. According to the Ministry of Electronics and Information Technology (MeitY), more than 70% of large Indian enterprises have migrated critical workloads to the cloud by 2024, driven by the need for scalability, agility, and operational efficiency. For instance, sectors like BFSI and retail are using cloud platforms for their digital operations, with major cloud providers reporting significant increases in usage.

- Rise of Startups and SMEs Driving Cloud Demand: India's startup ecosystem is one of the largest globally, contributing notably to cloud demand. Small and medium-sized enterprises (SMEs) are also increasingly leveraging cloud services for affordable access to enterprise-grade infrastructure. According to data from the Ministry of Micro, Small, and Medium Enterprises, over 1 million SMEs have adopted cloud solutions for business operations like customer management, digital payments, and supply chain automation. This trend underscores the growing reliance of Indias startup and SME sectors on cloud infrastructure.

India Public Cloud Market Challenges

- Data Localization Regulations (Compliance and Legal): Indias data localization regulations mandate that certain categories of data be stored within the country. According to MeitY's guidelines, all financial, healthcare, and government data must be stored on local servers by 2024, complicating compliance for global cloud providers. Many enterprises face challenges in ensuring that their cloud infrastructure complies with these regulations, which may require significant infrastructure investment. The high costs of setting up local data centers have caused delays in cloud adoption for some global players, impacting their ability to expand operations in India.

- Security and Privacy Concerns in Cloud Computing: Despite the increased adoption of cloud computing, security remains a significant concern for enterprises in India. According to the National Cyber Security Coordinator, India faced over 18 million cyberattacks targeting cloud infrastructures in 2023 alone. As a result, businesses are investing heavily in cloud security solutions to safeguard sensitive data. The Indian government has introduced several cybersecurity policies, including the 2022 National Cybersecurity Strategy, which mandates that cloud service providers meet stringent security standards.

India Public Cloud Market Future Outlook

Over the next few years, the India Public Cloud Market is expected to witness significant growth driven by ongoing digital transformation initiatives, the expansion of data centers, and a surge in demand for flexible, scalable, and cost-effective cloud solutions. The shift toward Hybrid Cloud adoption, government initiatives like Digital India, and increasing cloud investments by global players will further accelerate market growth. Additionally, advancements in artificial intelligence (AI), machine learning (ML), and edge computing integrated with cloud infrastructure will create new growth avenues for the market.

Market Opportunities

- Expansion of Edge Computing (Infrastructure): Edge computing is witnessing substantial growth in India as more organizations look to reduce latency in cloud services. By 2023, India had established over 100 edge data centers, driven by investments from telecom providers and cloud service companies. This infrastructure is crucial for applications such as IoT and autonomous vehicles, where real-time data processing is necessary. Edge computing is expected to further accelerate public cloud growth by enabling hybrid models where computing power is distributed closer to users.

- Integration of AI and Machine Learning with Cloud Platforms: Artificial intelligence (AI) and machine learning (ML) are becoming integral to cloud platforms, with Indian companies leading in adoption. According to MeitY, over 30% of cloud service demand in 2023 was driven by AI and ML workloads. Industries such as retail, healthcare, and financial services are increasingly leveraging AI-driven cloud solutions for predictive analytics, customer service automation, and fraud detection. This trend is anticipated to drive further investment in public cloud platforms, as AI and ML require scalable cloud infrastructures.

Scope of the Report

|

Cloud Type |

Public Cloud Private Cloud Hybrid Cloud |

|

Service Type |

IaaS PaaS SaaS DRaaS |

|

End-User Industry |

BFSI, IT & Telecom Healthcare Government Retail & E-Commerc Manufacturing |

|

Deployment Mode |

Public Cloud Private Cloud Hybrid Cloud |

|

Region |

North India South India East India West India |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing to This Report:

Government Agencies (Ministry of Electronics and Information Technology)

Cloud Service Companies

IT and Telecom Companies

Banking, Financial Services, and Insurance (BFSI) Companies

Healthcare Industries

Retail and E-Commerce Companies

Venture Capital Firms and Private Equity Investors

Data Center Operation Companies

Companies

Players Mentioned in the Report:

Amazon Web Services (AWS)

Microsoft Azure

Google Cloud

IBM Cloud

Oracle Cloud

Alibaba Cloud

Tata Communications

NTT Communications

Wipro Cloud Services

Infosys Cloud Services

HCL Technologies

Tech Mahindra Cloud

SAP Cloud Services

VMware Cloud

Salesforce Cloud

Table of Contents

1. India Public Cloud Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Industry Ecosystem Analysis

1.4 Overview of Key Market Metrics

2. India Public Cloud Market Size (In USD Bn)

2.1 Historical Market Size

2.2 Year-on-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. India Public Cloud Market Analysis

3.1 Growth Drivers

3.1.1 Digital Transformation Initiatives

3.1.2 Increased Adoption of Cloud-based Solutions

3.1.3 Rise of Startups and SMEs Driving Cloud Demand

3.1.4 Government Digital India Initiative

3.2 Market Challenges

3.2.1 Data Localization Regulations (Compliance and Legal)

3.2.2 Security and Privacy Concerns in Cloud Computing

3.2.3 High Cost of Migration for Large Enterprises

3.3 Opportunities

3.3.1 Expansion of Edge Computing (Infrastructure)

3.3.2 Integration of AI and Machine Learning with Cloud Platforms

3.3.3 Rising Investments in Data Centers by Global Cloud Players

3.4 Trends

3.4.1 Hybrid Cloud Adoption

3.4.2 Multi-cloud Strategy Implementation

3.4.3 Rise in SaaS Offerings (Software-as-a-Service)

3.5 Government Regulation

3.5.1 Cloud Computing Policies Under MeitY (Ministry of Electronics and Information Technology)

3.5.2 Data Protection Bill and Its Impact on Cloud Infrastructure

3.5.3 Public Procurement Policy for Cloud Computing

3.5.4 NASSCOM Initiatives Supporting Cloud Adoption

3.6 SWOT Analysis

3.7 Porters Five Forces Analysis

3.8 Competitive Landscape and Ecosystem Analysis

4. India Public Cloud Market Segmentation (In Value %)

4.1 By Cloud Type

4.1.1 Public Cloud

4.1.2 Private Cloud

4.1.3 Hybrid Cloud

4.2 By Service Type

4.2.1 Infrastructure as a Service (IaaS)

4.2.2 Platform as a Service (PaaS)

4.2.3 Software as a Service (SaaS)

4.2.4 Disaster Recovery as a Service (DRaaS)

4.3 By End-User Industry

4.3.1 BFSI

4.3.2 IT & Telecom

4.3.3 Healthcare

4.3.4 Government

4.3.5 Retail & E-Commerce

4.3.6 Manufacturing

4.4 By Deployment Mode4.4.1 Public Cloud

4.4.2 Private Cloud

4.4.3 Hybrid Cloud

4.5 By Region

4.5.1 North India

4.5.2 South India

4.5.3 East India

4.5.4 West India

5. India Public Cloud Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Amazon Web Services (AWS)

5.1.2 Microsoft Azure

5.1.3 Google Cloud

5.1.4 IBM Cloud

5.1.5 Oracle Cloud

5.1.6 Alibaba Cloud

5.1.7 Tata Communications

5.1.8 NTT Communications

5.1.9 Wipro Cloud Services

5.1.10 Infosys Cloud Services

5.1.11 HCL Technologies

5.1.12 Tech Mahindra Cloud

5.1.13 SAP Cloud Services

5.1.14 VMware Cloud

5.1.15 Salesforce Cloud

5.2 Cross Comparison Parameters (Revenue, Number of Data Centers, Geographic Reach, No. of Employees, Market Share, Headquarters, Partner Network, Cloud Service Portfolio)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.4.1 Expansion of Data Center Facilities

5.4.2 Cloud Infrastructure Investments

5.5 Mergers and Acquisitions in the Cloud Market

5.6 Venture Capital Funding in Cloud Startups

5.7 Government Grants and Incentives for Cloud Infrastructure

5.8 Private Equity Investments in Cloud Market

6. India Public Cloud Market Regulatory Framework

6.1 Cloud Security Guidelines by CERT-In (Computer Emergency Response Team)

6.2 Data Localization Norms by RBI

6.3 Compliance with GDPR (General Data Protection Regulation) for Indian Cloud Providers

6.4 Cloud Service Provider Certification Guidelines by STQC (Standardization Testing and Quality Certification)

7. India Public Cloud Future Market Segmentation (In Value %)

7.1 By Cloud Type

7.2 By Service Type

7.3 By End-User Industry

7.4 By Deployment Mode

8.5 By Region

8. India Public Cloud Market Analysts Recommendations

8.1 TAM/SAM/SOM Analysis

8.2 Growth Strategies for Indian Enterprises

8.3 Marketing and Sales Optimization Initiatives

8.4 Strategic Investment Opportunities in Public Cloud Sector

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

This step involves creating a detailed market ecosystem encompassing all key stakeholders in the India Public Cloud market. It includes gathering secondary data from government reports, industry databases, and proprietary databases to map critical market variables such as service demand, pricing models, and technological advancements.

Step 2: Market Analysis and Construction

In this stage, historical data is analyzed to assess trends and market penetration rates across service types and deployment models. The data is compiled to estimate total market revenue and the contribution of each sub-segment, which aids in generating accurate forecasts.

Step 3: Hypothesis Validation and Expert Consultation

Through telephonic and email interviews with industry experts from leading cloud service providers, hypotheses are validated to provide in-depth market insights. These insights are cross-referenced with quantitative data to ensure reliability.

Step 4: Research Synthesis and Final Output

A synthesis of collected data is done to form a comprehensive market analysis. The insights are further validated through direct engagements with public cloud providers and customers, ensuring accuracy and actionable results for stakeholders.

Frequently Asked Questions

01. How big is the India Public Cloud Market?

The India Public Cloud market was valued at USD 9.55 billion, with significant growth driven by rising demand for scalable, cost-effective cloud solutions across industries like BFSI, healthcare, and IT.

02. What are the challenges in the India Public Cloud Market?

Challenges include regulatory compliance regarding data localization, security and privacy concerns in cloud computing, and high costs of cloud migration for large enterprises.

03. Who are the major players in the India Public Cloud Market?

Key players include Amazon Web Services, Microsoft Azure, Google Cloud, IBM Cloud, and Oracle Cloud, dominating the market due to their extensive data center networks, partnerships, and advanced service offerings.

04. What are the growth drivers of the India Public Cloud Market?

The market is driven by factors such as the growing demand for cloud services due to digital transformation, increased adoption by startups, and favorable government policies promoting cloud usage.

05. How is Hybrid Cloud impacting the India Public Cloud Market?

Hybrid Cloud has become the dominant deployment model in India due to its flexibility, allowing businesses to combine on-premise and public cloud infrastructure, meeting both scalability and compliance needs.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.