India PVC Pipe Market Outlook to 2030

Region:Asia

Author(s):Abhinav kumar

Product Code:KROD3069

November 2024

81

About the Report

India PVC Pipe Market Overview

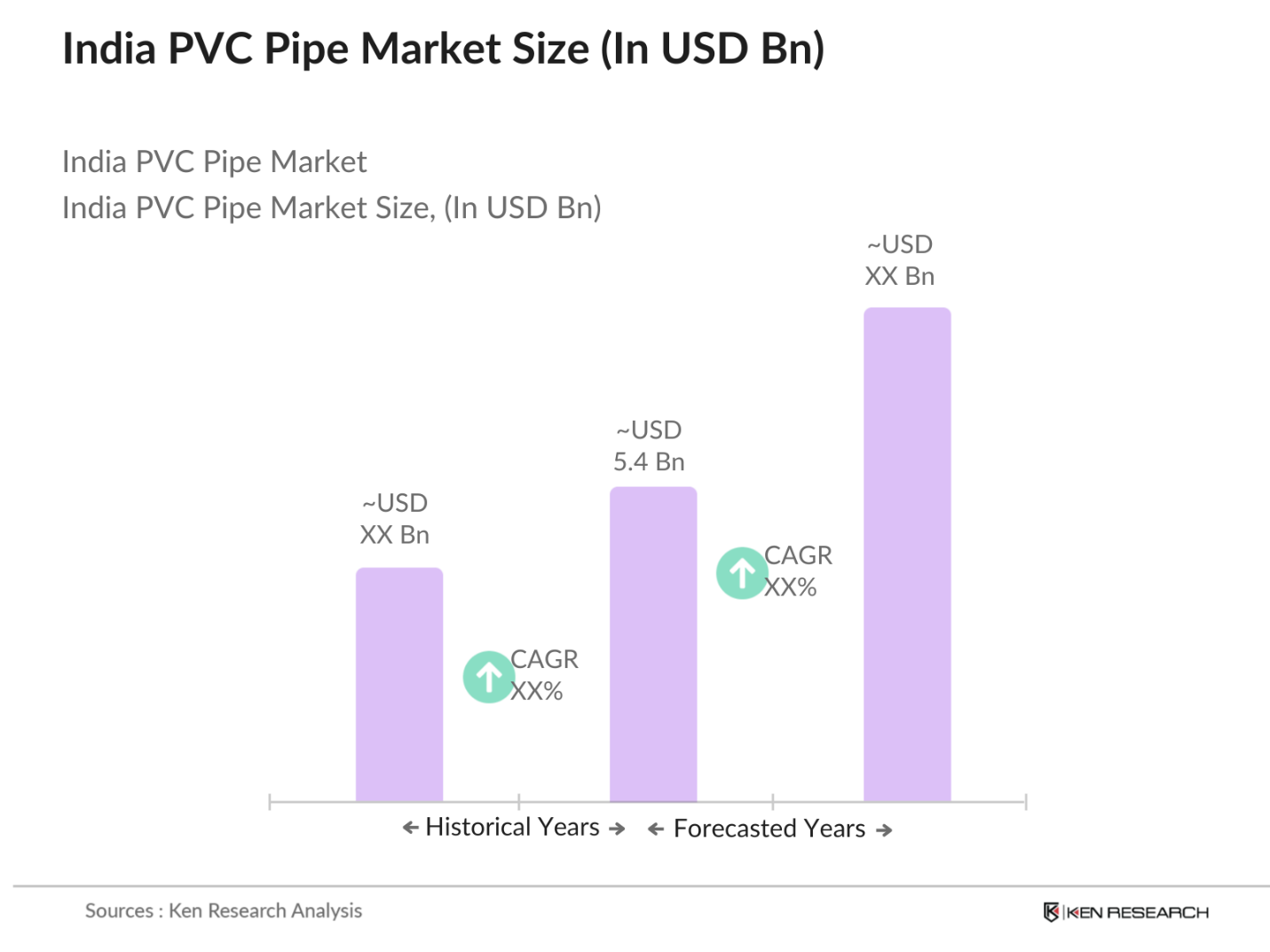

- The India PVC Pipe market, based on a historical analysis, is valued at USD 5.4 billion. This growth is driven by increasing investments in the agricultural sector, extensive infrastructure projects, and government-led initiatives supporting water and sanitation across the country. As the population and urbanization continue to rise, there is heightened demand for durable and cost-effective piping solutions, making PVC pipes a preferred choice due to their longevity, resistance to corrosion, and affordability.

- Regions like North and South India have emerged as the leading areas within the PVC pipe market. North Indias dominance is primarily due to large-scale infrastructure projects and agricultural reliance on irrigation, while South India sees significant demand owing to ongoing industrial development and urban expansion. Additionally, high awareness and adoption of modern water management solutions in urban centers within these regions bolster the markets growth.

- PVC pipes in India must comply with standards set by the Bureau of Indian Standards (BIS), ensuring product quality and safety in drinking water applications. The BIS enforces guidelines that cover material specifications, pipe dimensions, and pressure ratings, safeguarding public health in water supply projects where PVC pipes are extensively used.

India PVC Pipe Market Segmentation

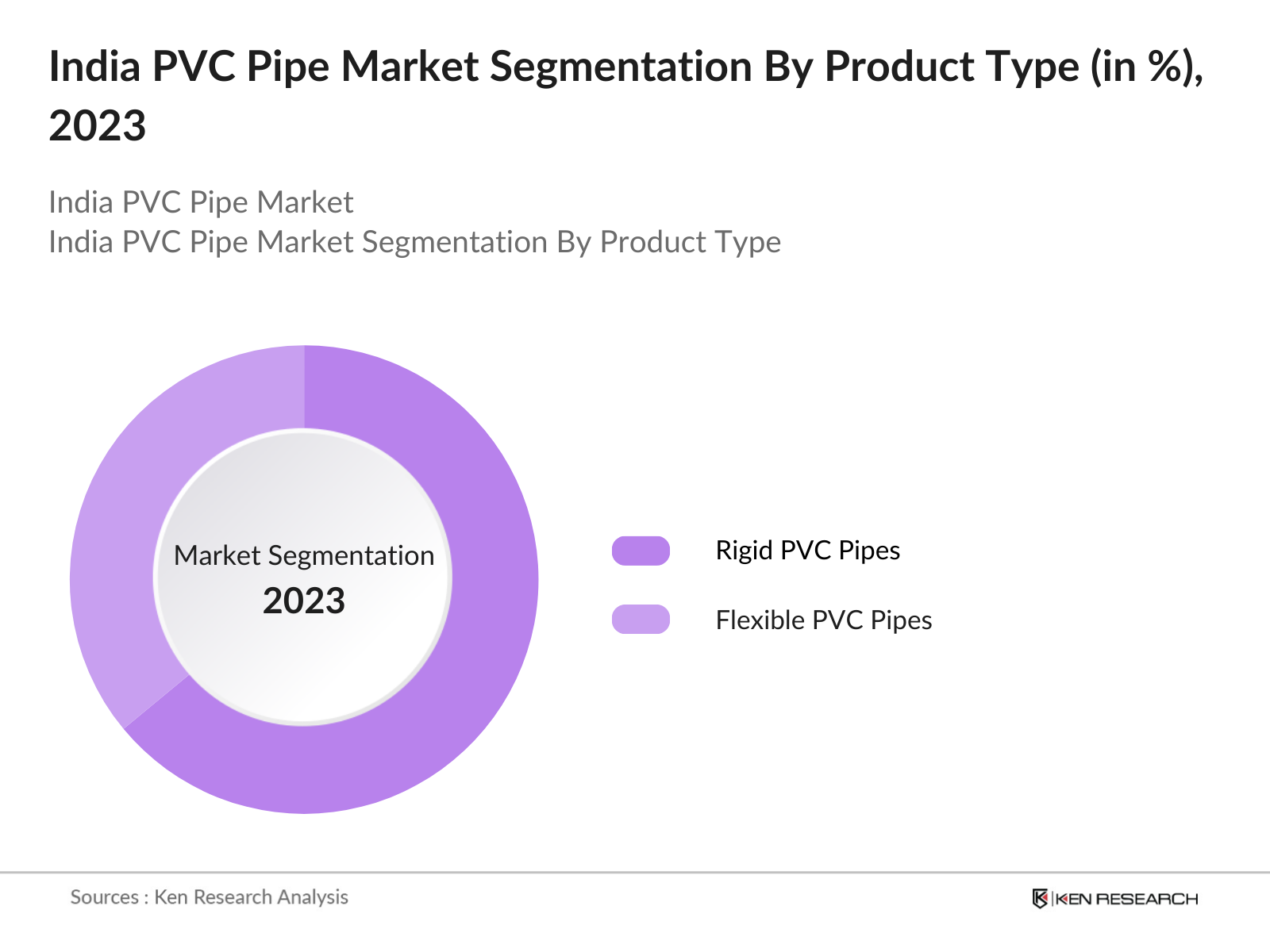

By Product Type: The India PVC pipe market is segmented by product type into Rigid PVC Pipes and Flexible PVC Pipes. Rigid PVC pipes hold a dominant share due to their extensive use in large-scale infrastructure projects and agricultural irrigation. Their durability and ability to withstand high-pressure applications make them an ideal choice for these sectors. Government projects focused on water supply and sanitation also boost the demand for rigid PVC pipes, ensuring steady growth within this segment.

By Application: The market is further segmented by application into Agriculture, Building and Construction, and Industrial. The agricultural segment dominates due to extensive reliance on PVC pipes for efficient water management in irrigation. With rising agricultural activities and initiatives to improve irrigation systems across the country, the demand for PVC pipes in agriculture continues to grow. This segment benefits from government subsidies, further encouraging farmers to adopt these solutions.

India PVC Pipe Market Competitive Landscape

The India PVC Pipe market is dominated by several established players who offer a range of innovative and high-quality products. The competitive landscape includes both domestic and international companies that have established a significant market presence through strong distribution networks and brand recognition.

India PVC Pipe Industry Analysis

Growth Drivers

- Infrastructure Expansion: India is witnessing an upsurge in infrastructure projects, with substantial investment allocated to the Pradhan Mantri Awas Yojana (PMAY), which aims to build millions of houses nationwide. The National Infrastructure Pipeline (NIP) has earmarked over 111 trillion INR for infrastructure projects by 2025, of which a large portion is focused on enhancing water and sanitation systems across urban and rural areas. This growth in infrastructure supports demand for durable, reliable PVC pipes, widely used in urban construction and public water supply.

- Government Initiatives for Water Supply and Sanitation: Under the Jal Jeevan Mission, the government aims to provide piped drinking water to rural households by 2024, an initiative requiring extensive PVC piping networks. To date, nearly 10 million homes have gained access, with funding of approximately 3 trillion INR allocated to achieve universal water access. This drive is enhancing PVC demand, especially in rural areas, as PVC pipes are highly suitable for sustainable and cost-effective water systems.

- Industrialization and Urbanization: Indias urban population is projected to exceed 600 million by 2025, a rise which intensifies the need for robust urban infrastructure, including water supply systems where PVC pipes are extensively utilized. With over 30% of the population now residing in urban areas, large-scale housing projects are spurring PVC demand, given their cost-effectiveness and adaptability. Investment in industrial hubs further boosts the PVC pipe sector as factories and warehouses adopt PVC for efficient plumbing and drainage solutions.

Market Challenges

- Raw Material Price Volatility: PVC pipes rely heavily on raw materials derived from petroleum products, making them susceptible to price fluctuations in crude oil. In 2024, crude oil prices averaged around 75 USD per barrel, impacting PVC production costs. This volatility affects manufacturers ability to maintain stable prices, challenging both production and sales within the PVC pipe market.

- Environmental Concerns Related to PVC: Concerns about the environmental impact of PVC, especially related to disposal and plastic pollution, have spurred demand for alternatives. PVC production releases chlorine and other harmful substances, with 2024 estimates suggesting that PVC manufacturing accounts for significant CO2 emissions, raising environmental issues that affect market acceptance. Regulatory bodies are increasingly encouraging eco-friendly practices, adding pressure to the PVC industry.

India PVC Pipe Market Future Outlook

The India PVC Pipe market is expected to experience sustained growth over the next five years, driven by expanding infrastructure projects, increasing agricultural needs, and rising urbanization. Government initiatives focused on water conservation and sustainable agriculture are set to play a pivotal role in supporting market expansion. Additionally, advancements in pipe manufacturing technology, such as recyclable and lead-free PVC solutions, are expected to attract a broader customer base across both urban and rural sectors, ensuring steady demand and market penetration.

Opportunities

-

Emerging Smart Irrigation Systems: As India advances in agricultural technology, smart irrigation systems are gaining traction, with PVC pipes being a critical component due to their low cost and efficiency in water transportation. Government initiatives like the Pradhan Mantri Krishi Sinchayee Yojana (PMKSY) are providing financial aid for smart irrigation equipment, fostering growth in PVC usage as farmers transition to more effective systems.

- Technological Advancements in Manufacturing: Manufacturers are adopting innovative PVC processing technologies, including automation and precision extrusion methods, to improve durability and reduce production costs. Advances in material sciences have led to lighter, more robust PVC pipes suited for various applications, enhancing their adoption across residential and industrial sectors. Investments in these technologies also contribute to lower manufacturing emissions, aligning with Indias environmental goals.

Scope of the Report

|

Product Type |

Rigid PVC Pipes Flexible PVC Pipes |

|

Application |

Agriculture Building and Construction Industrial |

|

Material Type |

UPVC CPVC |

|

End-User |

Domestic Commercial |

|

Region |

North India South India East India West India |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing to This Report:

PVC Pipe Manufacturing Industries

Water Management and Irrigation Companies

Construction and Infrastructure Development Companies

Industrial Piping Solution Provider Companies

Agriculture and Irrigation Equipment Distributor Companies

Government and Regulatory Bodies (Ministry of Jal Shakti, Bureau of Indian Standards)

Investor and Venture Capitalist Firms

Real Estate Development Companies

Companies

Players Mentioned in the Report

Finolex Industries

Astral Poly Technik Ltd

Supreme Industries Ltd

Prince Pipes and Fittings Ltd

Jain Irrigation Systems Ltd

Ashirvad Pipes

Ori-Plast Ltd

Kankai Pipes & Fittings

Dutron Group

Skipper Limited

Table of Contents

1. India PVC Pipe Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. India PVC Pipe Market Size (In INR Mn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. India PVC Pipe Market Analysis

3.1 Growth Drivers

3.1.1 Infrastructure Expansion

3.1.2 Government Initiatives for Water Supply and Sanitation

3.1.3 Industrialization and Urbanization

3.1.4 Increasing Demand in Agricultural Sector

3.2 Market Challenges

3.2.1 Raw Material Price Volatility

3.2.2 Environmental Concerns Related to PVC

3.2.3 Competition from Alternative Materials

3.3 Opportunities

3.3.1 Emerging Smart Irrigation Systems

3.3.2 Technological Advancements in Manufacturing

3.3.3 Rise in Export Opportunities

3.4 Trends

3.4.1 Shift Towards Lead-Free PVC Pipes

3.4.2 Adoption of Recyclable and Sustainable Materials

3.4.3 Integration with Smart Water Management Systems

3.5 Government Regulation

3.5.1 Bureau of Indian Standards (BIS) Compliance

3.5.2 Environmental Standards for PVC Usage

3.5.3 Subsidies and Grants for Agricultural Use

3.5.4 Water Conservation and Management Policies

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Porters Five Forces Analysis

3.9 Competition Ecosystem

4. India PVC Pipe Market Segmentation

4.1 By Product Type (In Value %)

4.1.1 Rigid PVC Pipes

4.1.2 Flexible PVC Pipes

4.2 By Application (In Value %)

4.2.1 Agriculture

4.2.2 Building and Construction

4.2.3 Industrial

4.3 By Material Type (In Value %)

4.3.1 UPVC (Unplasticized PVC)

4.3.2 CPVC (Chlorinated PVC)

4.4 By End-User (In Value %)

4.4.1 Domestic

4.4.2 Commercial

4.5 By Region (In Value %)

4.5.1 North India

4.5.2 South India

4.5.3 East India

4.5.4 West India

5. India PVC Pipe Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Finolex Industries

5.1.2 Astral Poly Technik Ltd

5.1.3 Supreme Industries Ltd

5.1.4 Prince Pipes and Fittings Ltd

5.1.5 Jain Irrigation Systems Ltd

5.1.6 Ashirvad Pipes

5.1.7 Ori-Plast Ltd

5.1.8 Kankai Pipes & Fittings

5.1.9 Dutron Group

5.1.10 Skipper Limited

5.1.11 Tirupati Structurals Ltd

5.1.12 Harso Steels Pvt Ltd

5.1.13 Plasto Group

5.1.14 Vectus Industries Ltd

5.1.15 Parryware Roca Pvt Ltd

5.2 Cross Comparison Parameters (Headquarters, Revenue, Employee Strength, Regional Presence, Product Portfolio, Certifications, R&D Investments, Key Partnerships)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Private Equity Investments

5.8 Government Grants and Subsidies

6. India PVC Pipe Market Regulatory Framework

6.1 BIS Standards and Compliance

6.2 Environmental Regulations for PVC Manufacturing

6.3 Certification and Quality Assurance Standards

6.4 Compliance with International Trade Policies

7. India PVC Pipe Future Market Size (In INR Mn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. India PVC Pipe Future Market Segmentation

8.1 By Product Type (In Value %)

8.2 By Application (In Value %)

8.3 By Material Type (In Value %)

8.4 By End-User (In Value %)

8.5 By Region (In Value %)

9. India PVC Pipe Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Segmentation and Preference Analysis

9.3 Marketing and Sales Strategy Recommendations

9.4 Identification of White Space Opportunities

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involved mapping the Indian PVC Pipe market landscape, covering all significant stakeholders, including manufacturers, suppliers, and end-users. Extensive secondary research was conducted, utilizing both public and proprietary databases to gather market-specific data.

Step 2: Market Analysis and Construction

Historical data was compiled and analyzed, focusing on market segments such as agriculture, industrial applications, and building and construction. This analysis allowed us to construct accurate market size estimations and segmentation insights for the PVC Pipe industry.

Step 3: Hypothesis Validation and Expert Consultation

Key market hypotheses were validated through consultations with industry experts, including product managers and decision-makers across prominent PVC pipe companies. This provided direct insights into sales performance, consumer preferences, and technological advancements within the market.

Step 4: Research Synthesis and Final Output

The final analysis included a synthesis of findings, verified through interactions with PVC pipe manufacturers. The final output provides a comprehensive, data-backed overview of the Indian PVC Pipe market, focusing on current trends, growth drivers, and market segmentation.

Frequently Asked Questions

01. How big is the India PVC Pipe Market?

The India PVC Pipe market is valued at USD 5.4 billion, with significant growth driven by expanding infrastructure projects and government initiatives aimed at improving water and sanitation infrastructure.

02. What are the key challenges in the India PVC Pipe Market?

Key challenges include the volatile pricing of raw materials and environmental concerns associated with PVC. Additionally, competition from alternative materials like HDPE and metal pipes adds pressure to market dynamics.

03. Who are the major players in the India PVC Pipe Market?

Major players include Finolex Industries, Astral Poly Technik Ltd, Supreme Industries Ltd, Prince Pipes and Fittings Ltd, and Jain Irrigation Systems Ltd, known for their extensive product range and strong market presence.

04. What factors are driving growth in the India PVC Pipe Market?

The market growth is primarily driven by increasing investments in agriculture, urban development projects, and government-led initiatives supporting water supply and sanitation. Technological advancements in pipe manufacturing further fuel the demand.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.