India Quick Service Restaurant Market Outlook to 2030

Region:Asia

Author(s):Pranav Krishn

Product Code:KROD768

July 2024

100

About the Report

India Quick Service Restaurant Market Overview

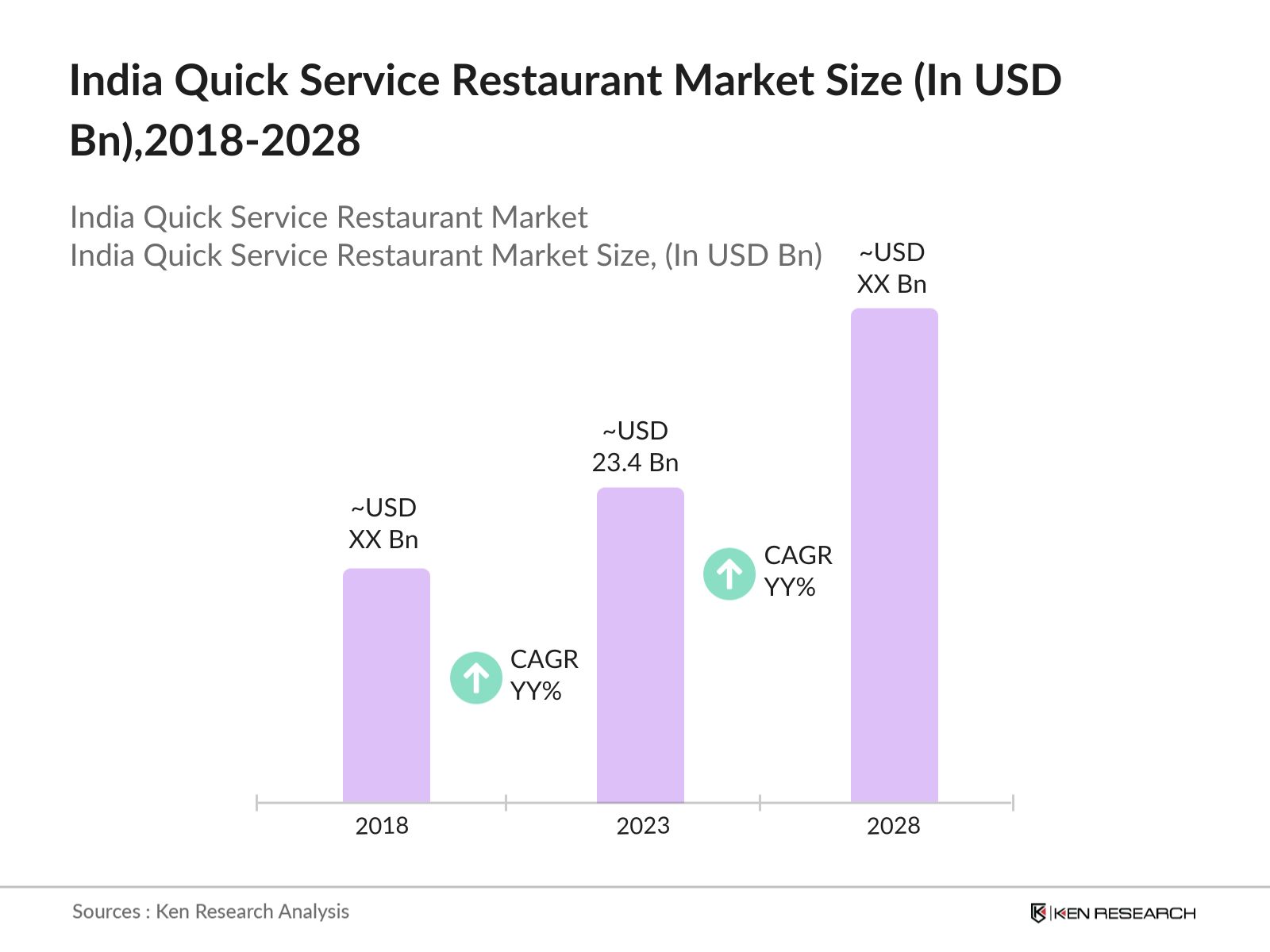

- The India Quick Service Restaurant (QSR) market, valued at USD 23.45 billion in 2023, demonstrates rapid growth fueled by urbanization, evolving lifestyle preferences, and the rising disposable incomes of the middle class.

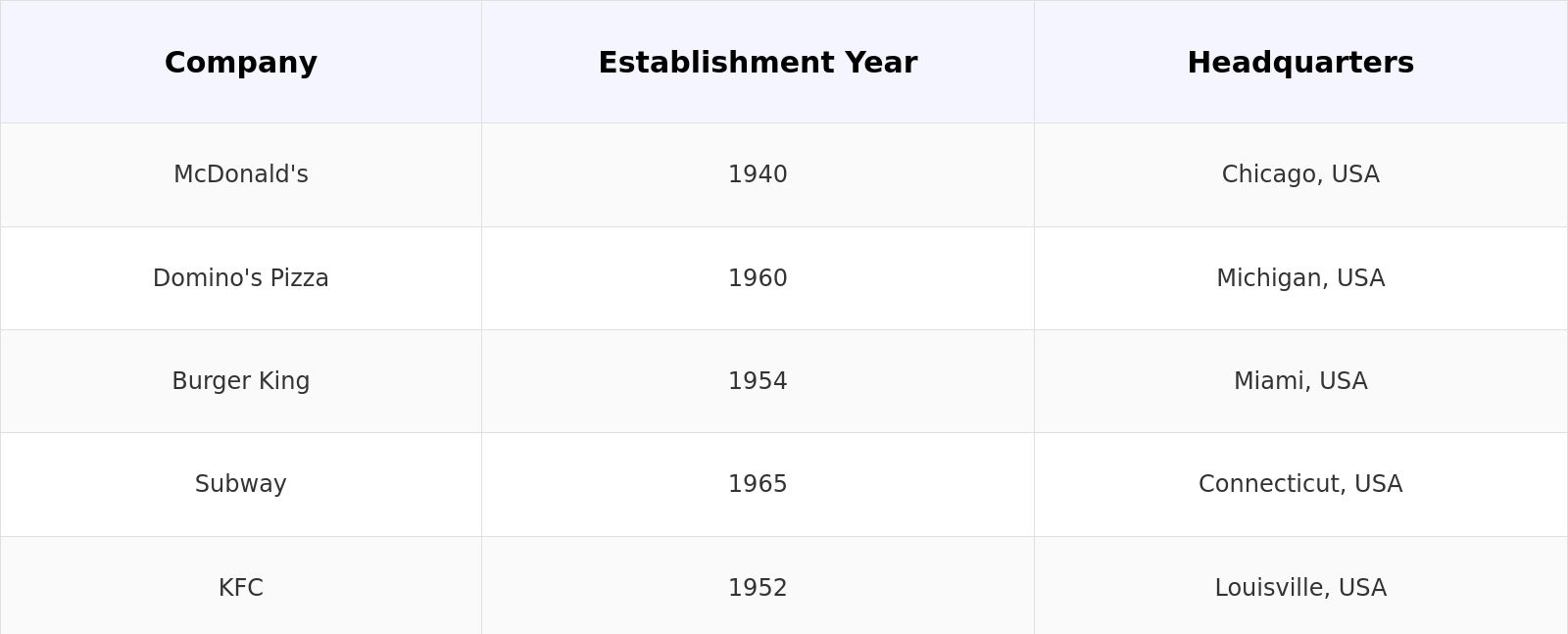

- Leading players in the market include McDonald's, Domino's, KFC, Burger King, and Subway. These companies dominate due to their extensive network, strong brand equity, and continuous innovation in menu and service.

- In 2023, McDonald's India announced a strategic partnership with Zomato to enhance their delivery capabilities. This collaboration aims to leverage Zomato's vast delivery network to increase McDonald's reach and efficiency in order processing and delivery. This development indicates the growing importance of delivery services in the QSR sector.

India Quick Service Restaurant Market Analysis

- The fast-paced urban lifestyle in cities like Mumbai, Delhi, and Bangalore has increased the demand for quick and convenient meal options. The urban population in India grew by over 31 million people between 2018 and 2023, driving the growth of QSRs. The growth of food delivery platforms like Zomato and Swiggy has made QSR food more accessible to a broader audience. These platforms collectively process over 1.5 million orders daily, showcasing the increasing reliance on delivery services.

- The QSR market significantly impacts the Indian economy by creating numerous employment opportunities, promoting entrepreneurship, and contributing to the growth of the allied sectors such as logistics, packaging, and food processing.

- The North Indian region, particularly Delhi NCR, dominates the QSR market. This is due to its high urbanization rate, higher per capita income, and a dense population of young professionals who prefer fast food.

India Quick Service Restaurant Market Segmentation

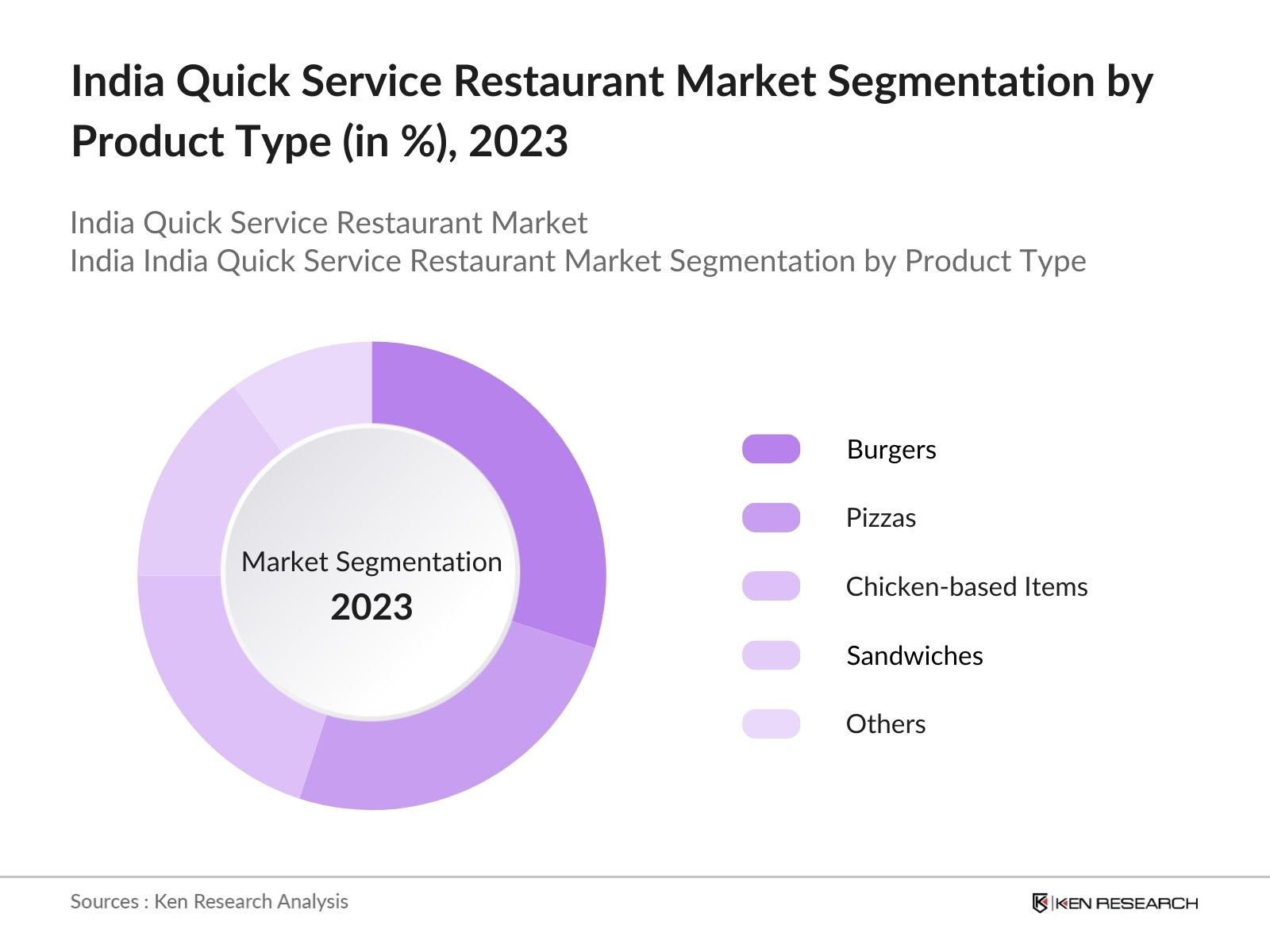

By Product Type: In 2023, the India quick service restaurant market is segmented by product type into burgers, pizzas, chicken- based items, sandwiches and others. Burgers dominate due to their widespread appeal, affordability, and widespread customization options, making them a favorite among diverse customer segments.

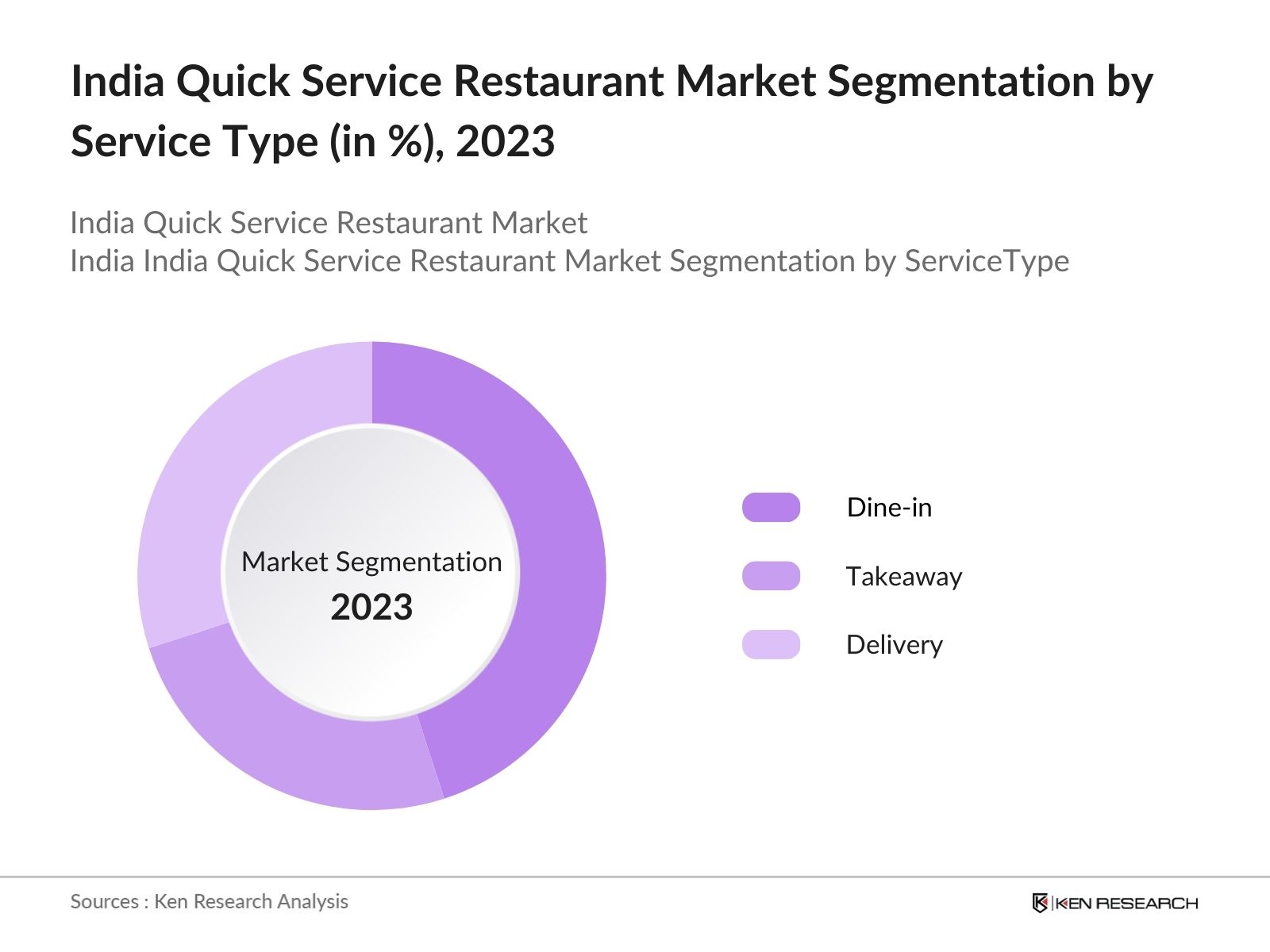

By Service Type: In 2023, the India quick service restaurant market is segmented by service type into dine- in, takeaway and delivery. Dine-in services dominate the segment due to consumer preference for a comprehensive dining experience, including ambiance, service, and immediate consumption of freshly prepared food. Additionally, special promotions and loyalty programs offered by restaurants for in-house dining, combined with the cultural emphasis on social gatherings, further boost the popularity of dine-in services.

By Consumer Age Group: In 2023, the India quick service restaurant market is segmented by consumer age into 15-24, 25-34, 35-44, and 45+. The dominance of the 15-24 age stems from their urban lifestyle, increasing disposable incomes, and a preference for fast, convenient food choices. This demographic seeks affordable dining options that fit their fast-paced lives. As urbanization continues and young consumers drive trends, QSRs cater to their preferences, making this age group the largest market segment.

India Quick Service Restaurant Competitive Landscape

- Jubilant FoodWorks, the master franchisee for Domino's Pizza in India, announced plans to significantly expand its store network. The company aims to increase its Domino's Pizza outlets from 2,793 to over 5,500 across six global markets in the medium term. Specifically, in India, JFL has set an ambitious target to open 4,000 Domino's stores in the mid-term, up from its previous goal of 3,000.

- In 2023, Tim Hortons, the Canadian coffee chain, entered the Indian market with plans to open 250 outlets over the next five years. This is in line with the trend of international food and beverage brands expanding their presence in the growing Indian market.

- KFC India has introduced automated kiosks in select outlets, allowing customers to place orders without human intervention. This is aimed at reducing wait times and improving service efficiency. Such technological advancements are being adopted by major food service players to enhance the customer experience.

India Quick Service Restaurant Industry Analysis

India Quick Service Restaurant Industry Growth Drivers

- Increasing Disposable Income: India's per capita income increased from INR 87,623 in 2011-12 to INR 1,50,000 in 2020-21, according to the Ministry of Statistics and Programme Implementation. This rise in disposable income has led to higher spending on dining out and takeaways.

- Rise of Food Delivery Platforms: The expansion of food delivery platforms like Zomato and Swiggy has revolutionized the QSR market. As of 2021, these platforms facilitated over 1.5 million orders daily across India. The convenience of online ordering and home delivery has made it easier for consumers to access QSR food, boosting sales and encouraging restaurants to expand their delivery services.

- Young Population Demographics: With over 50% of India's population under the age of 25, according to the National Statistical Office, there is a significant demand for trendy and quick meal options. This young demographic prefers fast food due to its affordability, taste, and convenience.

India Quick Service Restaurant Industry Challenges

- High Competition: This intense competition leads to price wars, which can squeeze profit margins. New entrants and small players face significant challenges in establishing a foothold against established brands like McDonald's and Domino's, which dominate with their extensive marketing and operational capabilities.

- Health and Nutritional Concerns: Increasing awareness about health and nutrition is influencing consumer choices, posing a challenge for traditional QSRs known for their high-calorie and fast-food menus. A survey by the National Sample Survey Office (NSSO) in 2020 revealed that 45% of urban consumers are now more conscious of their dietary intake, opting for healthier food alternatives.

- Regulatory Compliance: Food Safety and Standards Authority of India (FSSAI), adds to the operational costs for QSRs. Regular audits, compliance with labeling standards, and hygiene maintenance require significant investment in training and infrastructure. Non-compliance can result in penalties and damage to brand reputation, making it imperative for QSRs to prioritize regulatory adherence.

India Quick Service Restaurant Market Recent Developments

- KFC's Introduction of Vegan Products (2023): KFC introduced a new range of vegan products in 2023 to cater to the increasing demand for plant-based foods. This move aligns with the global trend towards healthier and sustainable eating habits and helps KFC attract a wider customer base that prefers vegetarian and vegan options.

- Sustainability Initiatives: There is a growing emphasis on sustainability within the QSR industry. Brands are adopting eco-friendly packaging solutions, reducing plastic usage, and implementing waste management practices. A 2022 study by the Confederation of Indian Industry (CII) reported that 40% of QSRs have started using biodegradable packaging, appealing to environmentally conscious consumers and setting new industry standards.

India Quick Service Restaurant Market Future Outlook

The India Quick Service Restaurant (QSR) market is projected to witness a significant growth by 2028. This growth is primarily driven by increasing urbanization, rising disposable incomes, and the expanding young population inclined towards fast food.

Future Trends

-

- Healthier Menu Options: The shift towards healthier eating habits is driving QSRs to innovate their menus. This trend is pushing brands to introduce salads, smoothies, and vegan products to cater to health-conscious customers, thereby expanding their customer base.

- Regional and Local Cuisine: Incorporating regional and local flavors into QSR menus is gaining popularity. Consumers' preference for familiar tastes and traditional dishes has led QSRs to introduce localized menu items. For instance, McDonald's launched the McAloo Tikki and McSpicy Paneer to cater to Indian tastes. This trend is helping QSRs attract a broader audience and differentiate themselves in a competitive market.

Scope of the Report

|

By Product Type |

Burgers Pizzas Chicken-based Items Sandwiches Others |

|

By Service Type |

Dine-in Takeaway Delivery |

|

By Consumer Age Group |

15-24 25-34 35-44 45+ |

Products

Key Target Audience – Organizations and Entities Who Can Benefit by Subscribing This Report:

QSR Franchise Owners and Operators

Food and Beverage Investors

Restaurant Chains and Groups

Food Delivery Service Providers

Supply Chain and Logistics Companies

Food Packaging Manufacturers

Advertising and Marketing Agencies

Kitchen Equipment Manufacturers

Government and Regulatory Bodies

Technology Providers for Food Services (POS systems, AI solutions)

Banks and Financial Institutions

Time Period Captured in the Report:

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2028

Companies

Players Mentioned in the Report:

McDonald's

Domino's

KFC

Burger King

Subway

Pizza Hut

Starbucks

Taco Bell

Costa Coffee

Barbeque Nation

Café Coffee Day

Haldiram's

Bikanervala

Goli Vada Pav

Nirula's

Table of Contents

1. India Quick Service Restaurant Market Overview

1.1 India Quick Service Restaurant Market Taxonomy

2. India Quick Service Restaurant Market Size (in USD Bn), 2018-2023

3. India Quick Service Restaurant Market Analysis

3.1 India Quick Service Restaurant Market Growth Drivers

3.2 India Quick Service Restaurant Market Challenges and Issues

3.3 India Quick Service Restaurant Market Trends and Development

3.4 India Quick Service Restaurant Market Government Regulation

3.5 India Quick Service Restaurant Market SWOT Analysis

3.6 India Quick Service Restaurant Market Stake Ecosystem

3.7 India Quick Service Restaurant Market Competition Ecosystem

4. India Quick Service Restaurant Market Segmentation, 2023

4.1 India Quick Service Restaurant Market Segmentation by Product Type (in %), 2023

4.2 India Quick Service Restaurant Market Segmentation by Service Type (in %), 2023

4.3 India Quick Service Restaurant Market Segmentation by Consumer Age Group (in %), 2023

5. India Quick Service Restaurant Market Competition Benchmarking

5.1 India Quick Service Restaurant Market Cross-Comparison (no. of employees, company overview, business strategy, USP, recent development, operational parameters, financial parameters and advanced analytics)

6. India Quick Service Restaurant Market Future Market Size (in USD Bn), 2023-2028

7. India Quick Service Restaurant Market Future Market Segmentation, 2028

7.1 India Quick Service Restaurant Market Segmentation by Product Type (in %), 2028

7.2 India Quick Service Restaurant Market Segmentation by Service Type (in %), 2028

7.3 India Quick Service Restaurant Market Segmentation by Consumer Age Group (in %), 2028

8. India Quick Service Restaurant Market Analysts’ Recommendations

8.1 India Quick Service Restaurant Market TAM/SAM/SOM Analysis

8.2 India Quick Service Restaurant Market Customer Cohort Analysis

8.3 India Quick Service Restaurant Market Marketing Initiatives

8.4 India Quick Service Restaurant Market White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1 Identifying Key Variables:

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry level information.Â

Step 2 Market Building:

Collating statistics on India Quick Service Restaurant Market over the years, penetration of marketplaces and service providers ratio to compute revenue generated for India Quick Service Restaurant Industry. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.Â

Step 3 Validating and Finalizing:

Building market hypothesis and conducting CATIs with industry experts belonging to different companies to validate statistics and seek operational and financial information from company representatives.Â

Step 4 Research output:

Our team will approach multiple Quick Service Restaurant companies and understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from Quick Service Restaurant companies.Â

Frequently Asked Questions

01 How big is the India Quick Service Restaurant market?

The India Quick Service Restaurant (QSR) market, valued at USD 23.45 billion in 2023, demonstrates rapid growth fueled by urbanization, evolving lifestyle preferences, and the rising disposable incomes of the middle class.

02 Who are the major players of India Quick Service Restaurant Market?

The major players of the India Quick Service Restaurant Market are McDonald's, Domino's, KFC, Burger King and Subway. These companies dominate due to their extensive network, strong brand equity, and continuous innovation in menu and service.

03 What factors drive for the India Quick Service Restaurant market?

Factors driving the India Quick Service Restaurant market include increasing urbanization, rising disposable incomes, and the expanding young population inclined towards fast food. The convenience of online ordering and home delivery has made it easier for consumers to access QSR food, boosting sales and encouraging restaurants to expand their delivery services.

04 What are the challenges in India Quick Service Restaurant market?

Main challenges of the India Quick Service Restaurant market include operational costs, regulatory compliance, intense competition, and supply chain issues. This intense competition leads to price wars, which can squeeze profit margins.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.