India Ready-to-Eat (RTE) Food Market Outlook to 2030

Region:Asia

Author(s):Vijay Kumar

Product Code:KROD7796

November 2024

94

About the Report

India Ready-to-Eat Food Market Overview

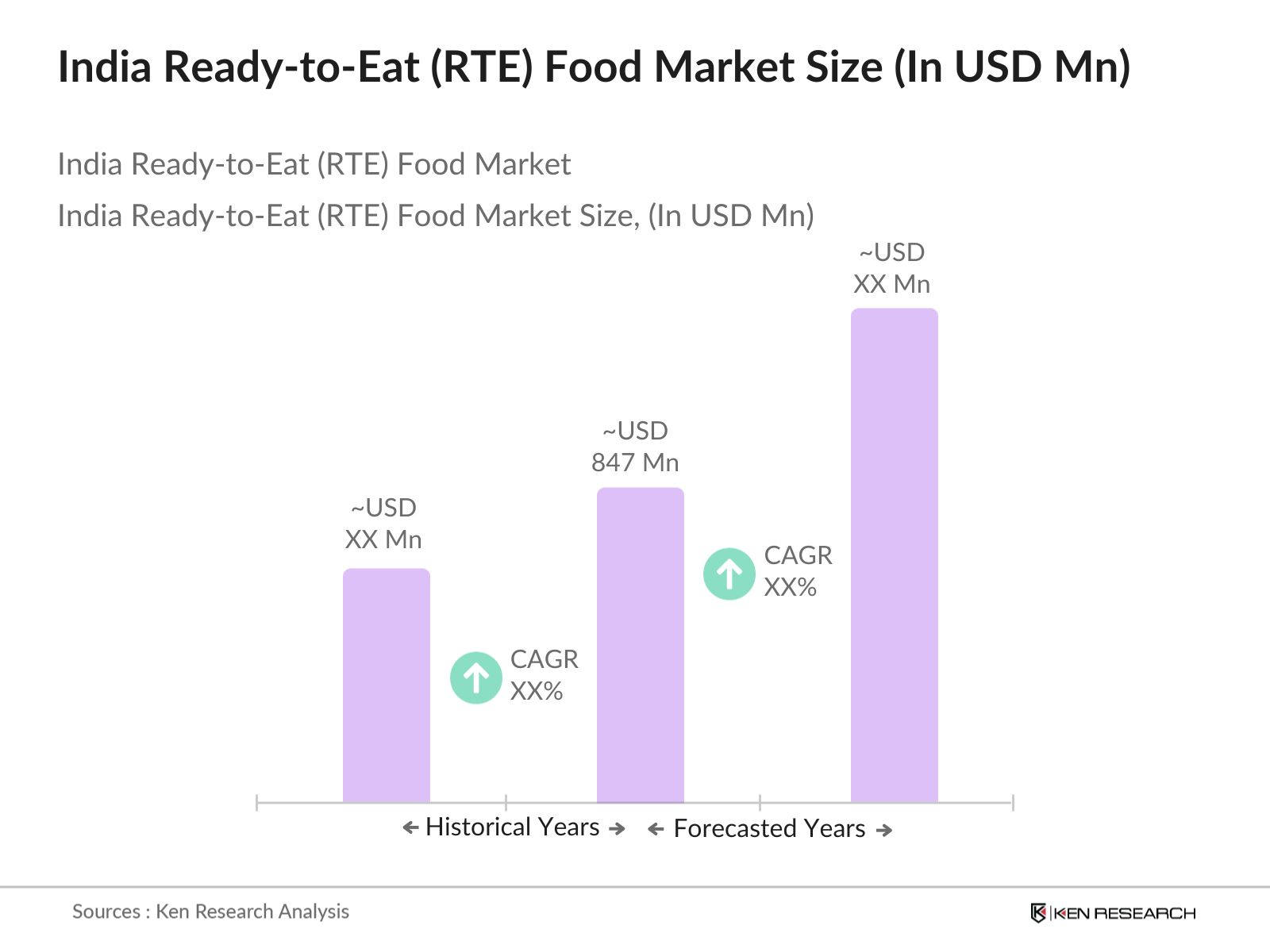

- The India Ready-to-Eat (RTE) Food market, valued at USD 847 million based on a five-year historical analysis, is driven primarily by changing consumer lifestyles, rapid urbanization, and an increase in disposable incomes. The growing preference for convenience foods, especially among young working professionals and millennials, has led to a surge in demand. Additionally, the expansion of e-commerce and organized retail has further enhanced the accessibility of RTE products across the country.

- The dominant regions in Indias RTE food market include metro cities like Delhi, Mumbai, Bengaluru, and Hyderabad. These cities dominate the market due to their high concentration of working professionals, dual-income households, and exposure to global food trends. Additionally, the fast-paced lifestyles in these urban areas create a strong demand for convenient meal solutions. The availability of cold chain infrastructure in these cities further supports the growth of this segment.

- The Food Safety and Standards Authority of India (FSSAI) has set strict guidelines for RTE food products, including mandatory labeling, nutritional information, and ingredient lists. In 2024, FSSAI issued updated guidelines to ensure that RTE products meet safety and quality standards, with over 200,000 inspections carried out across India. These regulations help protect consumers and ensure that the RTE market maintains high standards of food safety and compliance.

India Ready-to-Eat Food Market Segmentation

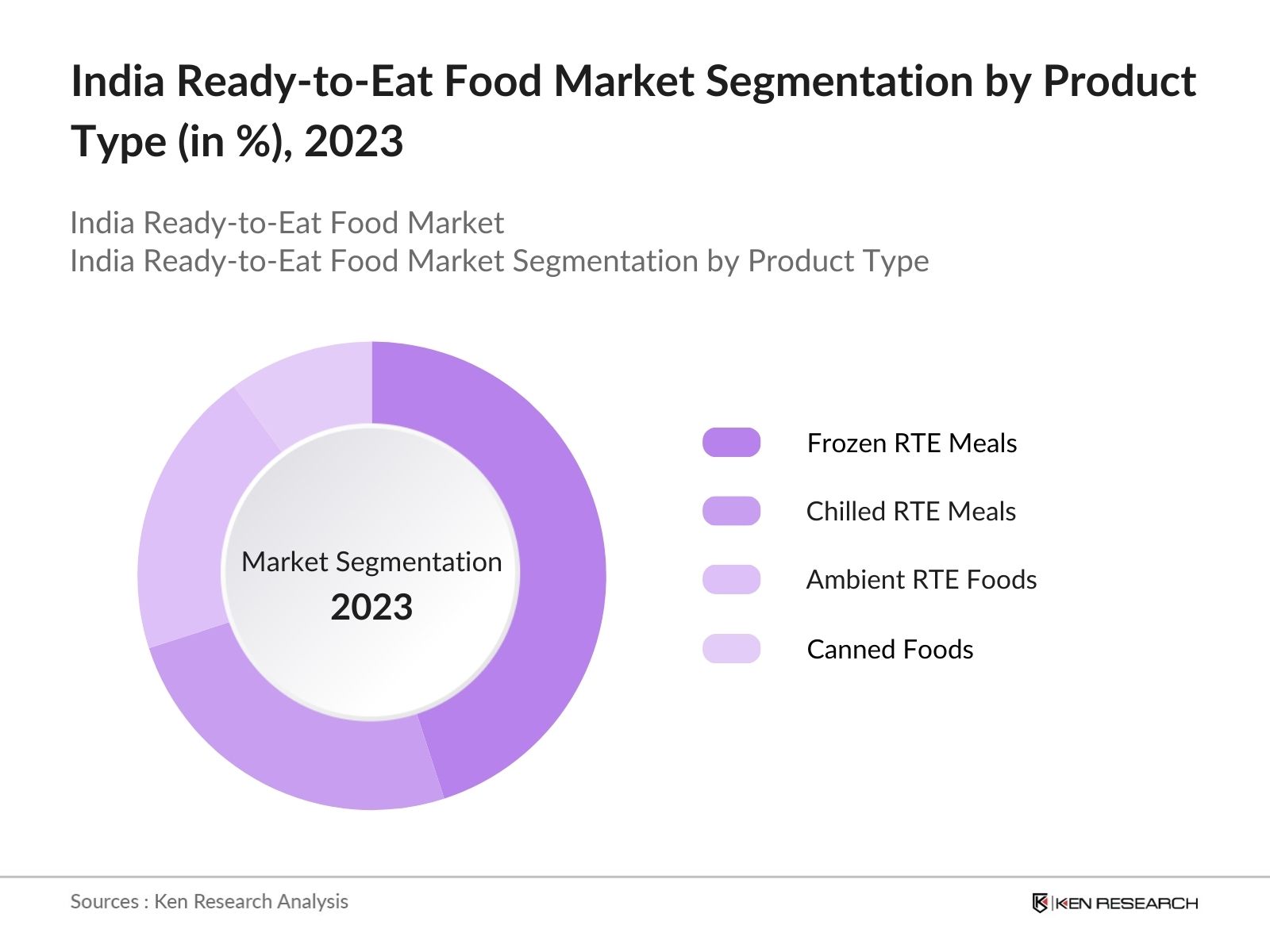

By Product Type: India's Ready-to-Eat Food market is segmented by product type into Frozen Ready-to-Eat Meals, Chilled Ready-to-Eat Meals, Ambient/Instant RTE Foods, and Canned Foods. Among these, frozen RTE meals dominate the market share. This dominance is largely due to the growing preference for long-lasting meal options that can be stored easily without immediate consumption. Consumers in urban areas are increasingly leaning towards frozen foods for their convenience, variety, and longer shelf life.

By Distribution Channel: Indias Ready-to-Eat Food market is segmented by distribution channel into Supermarkets/Hypermarkets, Convenience Stores, Online Retail, and Specialty Stores. Supermarkets/Hypermarkets dominate the distribution channel segment due to their widespread presence in urban and semi-urban areas, offering a wide variety of RTE products. The convenience of selecting from a broad range of products under one roof has made these stores the primary shopping destination for many consumers.

India Ready-to-Eat Food Competitive Landscape

The India Ready-to-Eat Food market is dominated by a mix of domestic and multinational players, each striving to expand their market share by introducing innovative product offerings, improving packaging, and investing in better distribution networks. Companies like ITC Limited, MTR Foods, and McCain Foods India are key players that leverage their extensive brand equity and distribution networks to maintain a strong foothold in the market.

India Ready-to-Eat Food Industry Analysis

Growth Drivers

- Rising Urbanization and Shift Towards Convenience Foods: India's urban population is projected to reach 600 million by 2025, according to World Bank data. This increase in urbanization is driving demand for convenience foods, especially ready-to-eat (RTE) products, as busy urban lifestyles favor quick meal solutions. In 2024, India's labor force participation rate stood at 48%, amplifying the need for convenient food options. The rise of double-income households has also accelerated this shift, with time-strapped professionals opting for easy-to-prepare meals, contributing to the robust demand for RTE products.

- Increasing Workforce Participation of Women: Indias female workforce participation increased to 27% in 2024, creating higher demand for convenience foods, especially among working women balancing professional and household responsibilities. This demographic shift has led to an upsurge in the consumption of RTE products, which offer time-saving alternatives without compromising on nutrition. With more women entering the labor force, particularly in urban centers, the demand for quick, pre-packaged meals has become a significant driver for the RTE market.

- Growth in Organized Retail and E-Commerce (Distribution and Accessibility): In 2024, Indias organized retail sector reached 12 million stores, including supermarkets and hypermarkets that have expanded the availability of RTE foods across the country. Moreover, e-commerce sales have risen to $80 billion, with RTE products becoming a key category within the online grocery segment. This growth in both physical and digital retail infrastructure has made RTE foods more accessible to consumers across urban and semi-urban areas, facilitating the widespread adoption of these products.

Market Challenges

- Cold Storage Infrastructure Gaps: Indias cold storage capacity in 2024 remains limited, with only 35 million metric tons available, a significant shortfall compared to the needs of its agricultural and processed food sectors. This lack of adequate cold chain infrastructure leads to spoilage and wastage of perishable RTE products, hampering market growth. The government has acknowledged this challenge and is implementing policies to boost cold storage capacity, but gaps in distribution and logistics remain a critical bottleneck.

- Price Sensitivity of Indian Consumers: The Indian consumer market is highly price-sensitive, with a significant portion of the population earning less than $5.50 per day as of 2024, according to the World Bank. This price sensitivity presents a challenge for RTE food manufacturers, who must balance affordability with the need to offer nutritious, high-quality products. Price-conscious consumers often prioritize lower-cost options, which may limit the penetration of premium RTE food offerings, especially in rural and semi-urban areas.

India Ready-to-Eat Food Market Future Outlook

Over the next five years, the India Ready-to-Eat Food market is expected to exhibit robust growth, driven by a confluence of factors such as increasing urbanization, the rise in dual-income households, and the growing demand for convenient food solutions. The continued expansion of the e-commerce sector is also likely to play a pivotal role in shaping the future of the RTE food market.

Market Opportunities

- Expansion in Tier II and Tier III Cities: In 2024, Indias Tier II and Tier III cities, home to approximately 400 million people, represent a vast untapped market for RTE food products. Increasing disposable incomes and the gradual shift towards organized retail in these cities offer immense growth opportunities for manufacturers. Government initiatives to enhance retail infrastructure in smaller cities are expected to further drive the penetration of RTE foods, positioning these cities as key growth areas for the industry.

- Introduction of Innovative and Healthy RTE Variants (Organic, Gluten-Free, Plant-Based): Indias plant-based food market was valued at $60 million in 2024, reflecting rising consumer interest in plant-based and gluten-free options within the RTE sector. Manufacturers are increasingly launching innovative RTE products catering to health-conscious consumers, with organic, low-calorie, and nutrient-dense options gaining popularity. This trend presents significant opportunities for companies to capitalize on the growing demand for healthy alternatives in the RTE food category.

Scope of the Report

|

Product Type |

Frozen RTE Meals Chilled RTE Meals Ambient RTE Foods Canned Foods |

|

Distribution Channel |

Supermarkets/Hypermarkets Convenience Stores Online Retail Specialty Stores |

|

Consumer Group |

Millennials Working Professionals Health-Conscious Consumers |

|

Packaging Type |

Flexible Packaging Rigid Packaging Single-Serve Packaging |

|

Region |

North India South India East India West India |

Products

Key Target Audience

Investments and Venture Capitalist Firms

Government and Regulatory Bodies (FSSAI, Ministry of Food Processing Industries)

Ready-to-Eat Food Manufacturers

Retailers and Supermarkets

Cold Chain Logistics Providers

Packaging Technology Companies

E-commerce Platforms

Distributors and Wholesalers

Companies

Players Mentioned in the Report

ITC Limited

Nestl India Ltd.

MTR Foods

McCain Foods India

Haldirams

Britannia Industries

Gits Food Products Pvt. Ltd.

Godrej Tyson Foods

Tata Consumer Products

Dabur India Ltd.

Table of Contents

1. India Ready-to-Eat Food Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Key Market Indicators (Urbanization, Shift in Consumer Behavior, Disposable Income Growth)

1.4 Market Segmentation Overview (Convenience Foods, Distribution Channels, Packaging Formats)

2. India Ready-to-Eat Food Market Size (In INR Bn)

2.1 Historical Market Size

2.2 Year-on-Year Growth Analysis (Impact of Economic Growth, Inflation Rates, Consumer Spending)

2.3 Key Market Developments and Milestones (Launch of New RTE Products, Retail Expansion, M&A Activities)

3. India Ready-to-Eat Food Market Analysis

3.1 Growth Drivers

3.1.1 Rising Urbanization and Shift Towards Convenience Foods

3.1.2 Increasing Workforce Participation of Women

3.1.3 Growth in Organized Retail and E-Commerce (Distribution and Accessibility)

3.1.4 Adoption of Health-Conscious RTE Products

3.2 Market Challenges

3.2.1 Cold Storage Infrastructure Gaps

3.2.2 Price Sensitivity of Indian Consumers

3.2.3 Quality and Safety Concerns (Regulatory Compliance, Food Safety Standards)

3.3 Opportunities

3.3.1 Expansion in Tier II and Tier III Cities

3.3.2 Introduction of Innovative and Healthy RTE Variants (Organic, Gluten-Free, Plant-Based)

3.3.3 Government Schemes Supporting Food Processing Industries (PLI Scheme)

3.4 Trends

3.4.1 Growth in Demand for Frozen and Refrigerated RTE Foods

3.4.2 Shift Towards Single-Serve Packaged Foods (Convenience for Nuclear Families and Young Professionals)

3.4.3 Increasing Investment in R&D for Long-Shelf-Life Products

3.5 Government Regulation

3.5.1 FSSAI Guidelines for RTE Products

3.5.2 Taxation and Import Duties on Packaged Foods

3.5.3 Subsidies for Cold Chain Infrastructure Development

3.6 SWOT Analysis

3.7 Stake Ecosystem (Producers, Suppliers, Distributors, Retailers, and Consumers)

3.8 Porters Five Forces (Bargaining Power of Suppliers, Threat of New Entrants, Competitive Rivalry)

3.9 Competition Ecosystem

4. India Ready-to-Eat Food Market Segmentation

4.1 By Product Type (In Value %)

4.1.1 Frozen Ready-to-Eat Meals

4.1.2 Chilled Ready-to-Eat Meals

4.1.3 Ambient/Instant RTE Foods

4.1.4 Canned Foods

4.2 By Distribution Channel (In Value %)

4.2.1 Supermarkets/Hypermarkets

4.2.2 Convenience Stores

4.2.3 Online Retail

4.2.4 Specialty Stores

4.3 By Consumer Group (In Value %)

4.3.1 Millennials

4.3.2 Working Professionals

4.3.3 Health-Conscious Consumers

4.4 By Packaging Type (In Value %)

4.4.1 Flexible Packaging

4.4.2 Rigid Packaging

4.4.3 Single-Serve Packaging

4.5 By Region (In Value %)

4.5.1 North India

4.5.2 South India

4.5.3 East India

4.5.4 West India

5. India Ready-to-Eat Food Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Nestl India Ltd.

5.1.2 ITC Limited

5.1.3 Haldirams

5.1.4 MTR Foods

5.1.5 Britannia Industries

5.1.6 Gits Food Products Pvt. Ltd.

5.1.7 McCain Foods India Pvt. Ltd.

5.1.8 Godrej Tyson Foods

5.1.9 Tata Consumer Products

5.1.10 Dabur India Ltd.

5.1.11 Patanjali Ayurved Ltd.

5.1.12 PepsiCo India

5.1.13 Adf Foods Ltd.

5.1.14 Bikanervala Foods Pvt. Ltd.

5.1.15 Kohinoor Foods Ltd.

5.2 Cross Comparison Parameters (Number of Employees, Revenue, Market Share, Product Portfolio, Innovation Capacity, Distribution Network, Brand Equity, R&D Spending)

5.3 Market Share Analysis (Value and Volume)

5.4 Strategic Initiatives (Partnerships, Joint Ventures, Product Launches)

5.5 Mergers and Acquisitions

5.6 Investment Analysis (Private Equity, Venture Capital)

5.7 Government Grants (Subsidies for Food Processing Units)

5.8 Private Equity Investments

6. India Ready-to-Eat Food Market Regulatory Framework

6.1 FSSAI Food Safety and Quality Regulations

6.2 Compliance with Labeling and Packaging Guidelines

6.3 Certification Processes for RTE Manufacturers

7. India Ready-to-Eat Food Future Market Size (In INR Bn)

7.1 Future Market Size Projections (Impact of Consumer Preferences, Global Supply Chains)

7.2 Key Factors Driving Future Market Growth (Increase in Disposable Income, Health-Conscious Product Launches, Convenience Factor)

8. India Ready-to-Eat Food Future Market Segmentation

8.1 By Product Type (In Value %)

8.2 By Distribution Channel (In Value %)

8.3 By Consumer Group (In Value %)

8.4 By Packaging Type (In Value %)

8.5 By Region (In Value %)

9. India Ready-to-Eat Food Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort Analysis (Consumer Behavior Trends, Spending Patterns)

9.3 Marketing Initiatives (Digital Marketing, Social Media Campaigns)

9.4 White Space Opportunity Analysis (Untapped Markets, Innovative Product Formats)

Research Methodology

Step 1: Identification of Key Variables

The research process begins by mapping out the entire ecosystem of the India Ready-to-Eat Food Market. This involves collecting secondary data from proprietary databases, industry reports, and public resources to identify the key variables that influence the market. Variables such as consumer behavior, distribution networks, and pricing trends are analyzed in this phase.

Step 2: Market Analysis and Construction

In this phase, we analyze historical data on the India RTE market, focusing on market penetration and revenue generation across various segments. The data is assessed for accuracy and reliability by cross-referencing with industry benchmarks, ensuring that the market size and growth rates are consistent with actual market dynamics.

Step 3: Hypothesis Validation and Expert Consultation

To validate the findings from the secondary research, we conduct expert interviews using CATI methods. Industry experts, including professionals from major RTE food manufacturers, provide valuable insights on market trends, challenges, and growth opportunities. These insights are critical to refining our market estimates.

Step 4: Research Synthesis and Final Output

The final stage involves synthesizing the data from primary and secondary research, providing a comprehensive analysis of the India Ready-to-Eat Food Market. The analysis is validated through discussions with industry stakeholders, and the final output includes accurate market size, segment shares, and growth projections.

Frequently Asked Questions

01. How big is India Ready-to-Eat Food Market?

The India Ready-to-Eat (RTE) Food market, valued at USD 847 million based on a five-year historical analysis, is driven primarily by changing consumer lifestyles, rapid urbanization, and an increase in disposable incomes.

02. What are the challenges in India Ready-to-Eat Food Market?

Challenges include the lack of cold chain infrastructure, price sensitivity among consumers, and stringent food safety regulations imposed by FSSAI, which can affect product development and distribution.

03. Who are the major players in the India Ready-to-Eat Food Market?

Key players in the market include ITC Limited, Nestl India, Haldirams, MTR Foods, and McCain Foods India. These companies dominate the market due to their strong distribution networks and brand equity.

04. What are the growth drivers of India Ready-to-Eat Food Market?

The market is propelled by urbanization, increasing workforce participation of women, and the growing popularity of e-commerce platforms, which make RTE products more accessible to consumers.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.