India Real Estate Brokerage, Advisory & Underwriting, and Loan Syndication Market Outlook to 2030

Region:Asia

Author(s):Shashank Kashyap

Product Code:KR1509

July 2025

80

About the Report

India Real Estate Brokerage, Advisory & Underwriting, and Loan Syndication Market Overview

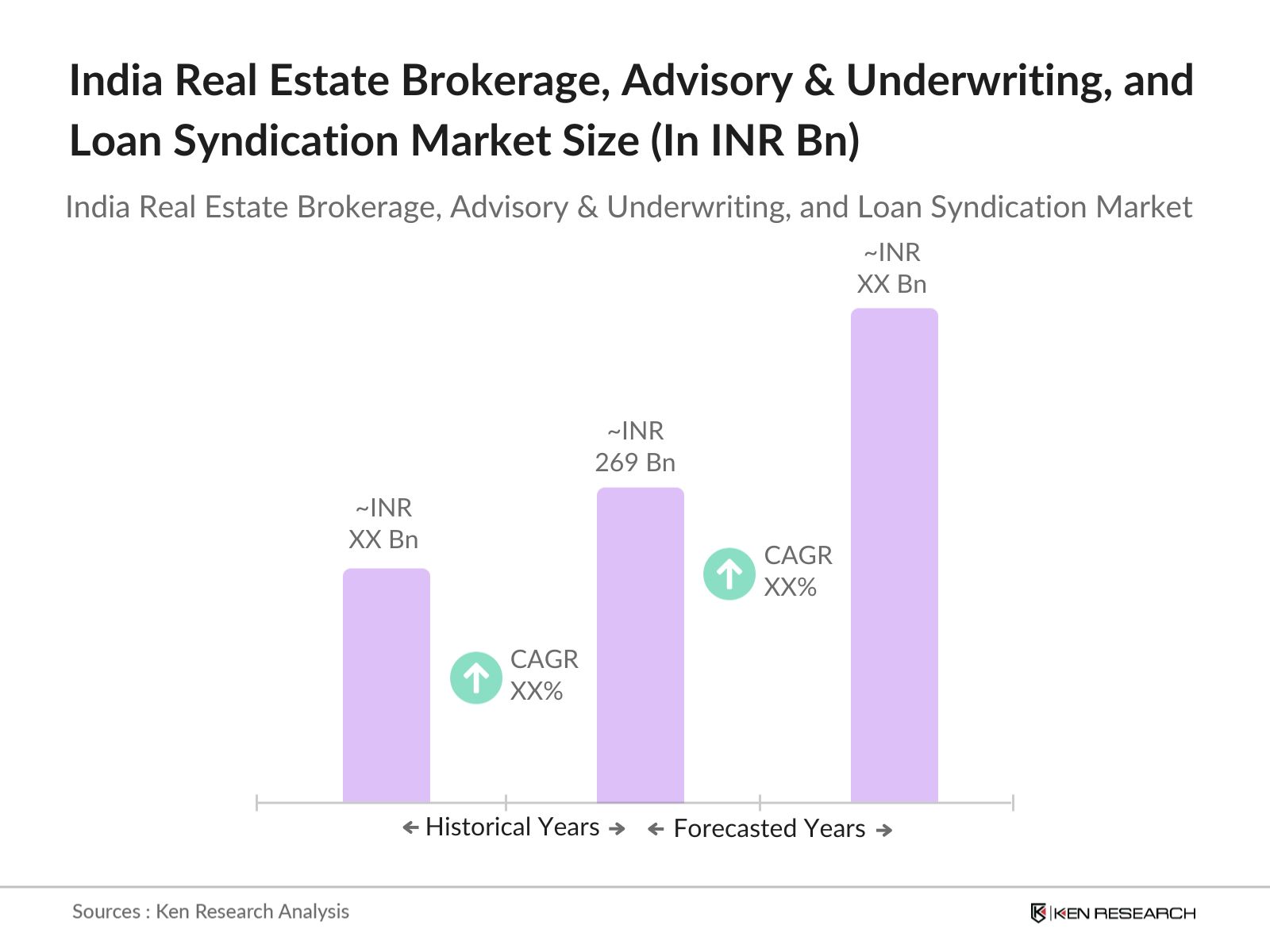

- The India Real Estate Brokerage, Advisory & Underwriting, and Loan Syndication Market was valued at approximately INR 269 billion, based on the most recent industry analysis. This growth is primarily driven by rapid urbanization, rising middle-class income levels, and a sustained demand for both residential and commercial properties. The market has also benefited from favorable government initiatives, expanding infrastructure, and increasing foreign direct investment, which have further stimulated real estate activity and investment.

- Key cities dominating this market include Mumbai, Delhi, and Bengaluru. Mumbai, as the financial capital, attracts significant investments and housing demand due to its economic opportunities. Delhi, the national capital, has a robust real estate market driven by government projects and infrastructure expansion. Bengaluru, known as the Silicon Valley of India, has experienced a boom in commercial real estate, propelled by the IT and technology sectors.

- The Real Estate (Regulation and Development) Act (RERA), implemented by the Indian government, aims to promote transparency and accountability in the real estate sector. The regulation mandates the registration of real estate projects and agents, ensuring buyer protection and reducing fraudulent practices. RERA has significantly improved consumer confidence and contributed to a more organized and transparent real estate market.

India Real Estate Brokerage, Advisory & Underwriting, and Loan Syndication Market Segmentation

By Service Type: The India real estate services market is segmented into Brokerage, Advisory & Underwriting, and Loan Syndication. Among these, Brokerage continues to dominate, generating the highest revenue, with projections indicating sustained leadership through the forecasted period. This is driven by the surge in property transactions, urban migration, and the growing complexity of real estate deals, which necessitate expert guidance.

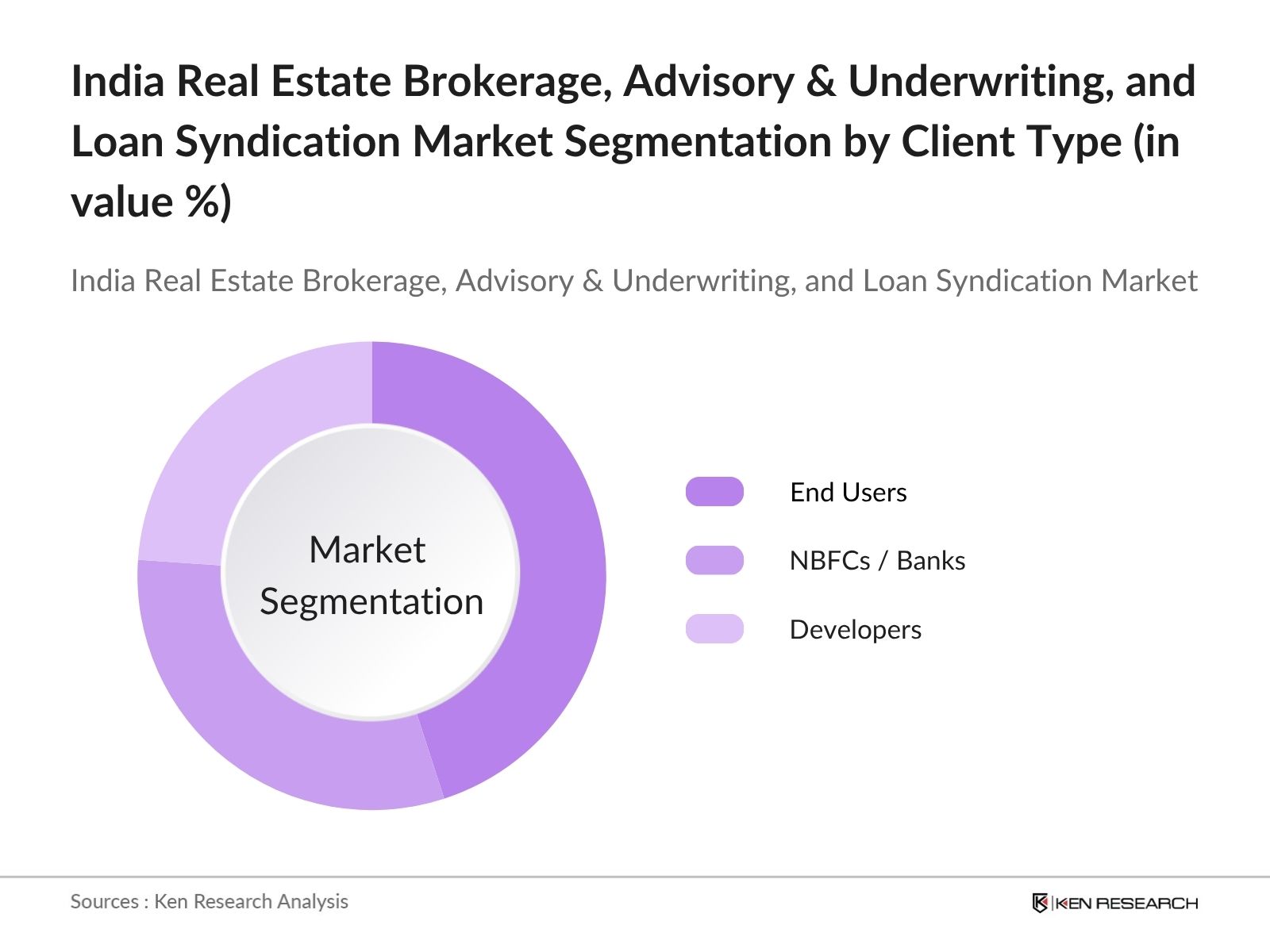

By Client Type: The market is segmented into End Users, NBFCs/Banks, and Developers. Among these, End Users form the largest client segment, driven by rising demand for residential and commercial property transactions requiring professional brokerage and advisory support. NBFCs and Banks contribute significantly through financing, underwriting, and loan structuring services.

By Region: The market is geographically segmented into Metro Cities and Tier 2/3 Cities. Metro cities remain the dominant contributor to overall revenues, supported by high-value transactions, institutional activity, and mature real estate ecosystems. However, Tier 2 and Tier 3 cities are emerging as high-growth zones, fueled by infrastructure development, decentralization of commercial hubs, and increasing investor interest in affordable housing and regional markets.

India Real Estate Brokerage, Advisory & Underwriting, and Loan Syndication Market Competitive Landscape

The India Real Estate Brokerage, Advisory & Underwriting, and Loan Syndication Market is characterized by a competitive landscape with several key players, including major firms such as Knight Frank, JLL India, and CBRE. These companies leverage their extensive networks and expertise to provide comprehensive services across various segments of the real estate market. The market is moderately concentrated, with a mix of established firms and emerging players competing for market share.

India Real Estate Brokerage, Advisory & Underwriting, and Loan Syndication Market Industry Analysis

Growth Drivers

- Growing Incomes and Lifestyle Aspirations Encouraging Premium Housing: The surge in demand for premium and luxury housing is a major growth driver in India’s residential real estate market. In 2023, over 50% of total housing sales came from high-value homes priced above INR 1 crore. Notably, DLF’s The Dahlias sold 173 ultra-luxury units within 9 weeks, while The Arbour sold all 1,137 units in just 3 days. This trend reflects a strong preference for spacious, tech-enabled homes across metro and Tier-1 cities, driven by rising incomes and evolving lifestyle needs.

- Surge in Institutional Funding for Residential Projects: Institutional investment rebounded strongly in CY’24, surpassing INR 75,500 crore across 78 deals—a 51% increase year-on-year—signaling renewed investor confidence. Foreign institutions contributed around 74% of equity, supported by reforms in REITs, RERA, GST, and FDI norms. Residential real estate overtook office as the top capital recipient, while warehousing saw rising interest from logistics and e-commerce. This capital surge, combined with clearer infrastructure policies and investor-developer partnerships, is driving demand for real estate advisory services to navigate deal structuring and market assessment.

- Embedded Fintech is Boosting Home Loan Access: Integrated digital lending is transforming India’s real estate ecosystem. Developers now embed pre-approved home loan offers with flexible EMI structures, easing buyer entry and reducing their own bridge-financing needs. Brokerage platforms and PropTech firms offer API-enabled loan approvals, e-KYC, and automated disbursals, speeding up transactions. In Q3 2023, this seamless experience drove a 39% YoY surge in loan disbursals. Partnerships like Housing.com and FinBox enable instant credit access, while ML models personalize offers, further accelerating housing finance adoption.

Market Challenges

- High Competition in Digital Real Estate Platforms: Rising customer acquisition costs (CAC) are a key challenge in India’s fintech and real estate advisory sectors. As digital platforms proliferate, competition for online visibility has intensified, driving up lead costs and lowering conversion rates. Sectors like residential and institutional real estate face saturated ad spaces. While select PropTech firms report CAC reductions through hyperlocal influencer campaigns, such outcomes remain rare.

- Difficulty in Managing Unstructured and Unsold Inventory: India’s unsold residential inventory is projected to reach 5.78 lakh units by CY’25, with a significant portion concentrated in the mid-income segment (INR 40–80 lakh). As of CY’24, over 5.08 lakh units remain stuck in under-construction or stalled projects. Despite interventions like the SWAMIH fund offering last-mile financing, developers continue to face pressure from sluggish absorption, capital lock-ins, and misaligned demand.

India Real Estate Brokerage, Advisory & Underwriting, and Loan Syndication Market Future Outlook

The future of the India real estate market appears promising, driven by urbanization and government initiatives. By 2030, the market is expected to witness a significant transformation, with increased investments in sustainable and smart city projects. The integration of technology in real estate transactions will enhance efficiency and transparency, attracting more investors. Additionally, the rise of co-working spaces and flexible office solutions will cater to evolving business needs, further stimulating market growth and diversification.

Market Opportunities

- Growth of Real Estate Investment Trusts (REITs): India’s REIT market is expanding rapidly, creating new opportunities for brokerage firms to offer investment facilitation and advisory services. As REITs gain traction among both institutional and retail investors, there is rising demand for diversified real estate portfolio management, enabling brokerages to play a key role in navigating asset selection, compliance, and yield optimization.

- Expansion of Digital Platforms for Brokerage Services: The digital transformation in real estate is creating opportunities for online brokerage platforms. By end of 2025, it is estimated that 40% of real estate transactions will occur through digital channels, allowing firms to reach a broader audience and streamline operations, enhancing customer experience and service delivery.

Scope of the Report

|

By Service Type |

Brokerage Advisory & Underwriting Loan Syndication |

|

By Client Type |

End Users NBFCs/Banks Developers |

|

By Region |

Metro Cities Tier 2/3 Cities |

Products

Key Target Audience

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., Ministry of Housing and Urban Affairs, Reserve Bank of India)

Real Estate Developers and Builders

Financial Institutions and Banks

Insurance Companies

Pension Funds and Institutional Investors

Real Estate Investment Trusts (REITs)

Property Management Firms

Companies

Players Mentioned in the Report:

- Knight FrankHomesfy Realty

- Anarock

- Investor Clinic

- Prop Mart

- Wealth Clinic

- Square Yards

- Knight Frank India

- JLL India

- CBRE India

- Savills India

Table of Contents

1. Global Macroeconomic Landscape

1.1. Global Economic Landscape

1.2. GDP Growth Rate of Key Regions – APAC, North America, MEA, & Europe

2. Indian Economic Outlook Landscape

2.1. Overview of Indian Economic Environment

2.2. Sectoral GDP Contribution including Real Estate & Financial Services

2.3. Inflation Scenario & Interest Rate Movement Impact on Credit Markets

2.4. Overview on Key Demographic Drivers

Overview of Household Construction in India

2.5. Personal Income Distribution by Classes – Lower, Middle, Upper Middle and Luxury

3. Market Analysis

3.1. Real Estate Primary Market Unit Supply, Construction & Housing Supply Trends

Real Estate Market Sectorial View – Supply, Vacancy Rate, Inventory Sold

3.2. India Real Estate Market Size by Transaction Value, FY’20 – FY’25 – FY’30F

3.3. Indian Real Estate Brokerage, Advisory & Underwriting, and Loan Syndication Market Size, FY’20–FY’25–FY’30F

3.4. Market Segmentation of Brokerage, Advisory & Underwriting, and Loan Syndication Market, FY’25 & FY’30F

By Service Line (FY’25 & FY’30F)

By Client Type (FY’25 & FY’30F)

By Geographical Segment (FY’25 & FY’30F)

India Real Estate Brokerage Market (FY’20–FY’25–FY’30F)

India Real Estate Luxury Brokerage Market (FY’20–FY’25–FY’30F)

Evolution of Real Estate Brokerage, Advisory & Underwriting, and Loan Syndication Market in India

Segment-wise Overview of Real Estate Brokerage Rate (%) and Life Cycle of Transactions in India

Outlook of Real Estate Investment in India

Consumer Journey in Real Estate Brokerage, Advisory & Underwriting, and Loan Syndication Market

4. Value Chain and Process Flow

5. Regulatory Landscape

5.1. RBI Guidelines on NBFC Lending for Real Estate Sector

5.2. SEBI & MCA Norms for Real Estate Investments, Distribution, and Compliance

5.3. Data Protection and Information Symmetry Key for Digital-First Housing Platforms

5.4. Scrutiny and Disclosure for Financial Intermediaries

6. Industry Analysis

6.1. Major Metro City Luxury Hotspot

6.2. Key Growth Drivers

6.3. Industry Challenges and Risks

7. Competition Landscape

7.1. Major Players in the Industry

7.2. Cross-Comparison of Peers in India Real Estate Brokerage, Advisory & Underwriting, and Loan Syndication Market

8. Conclusion – Way Forward

9. Research Methodology

9.1. Market Definitions

9.2. Abbreviations

9.3. Market Sizing and Modeling

Consolidated Research Approach

Limitations

Conclusion

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the India Real Estate Brokerage, Advisory & Underwriting, and Loan Syndication Market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we will compile and analyze historical data pertaining to the India Real Estate Brokerage, Advisory & Underwriting, and Loan Syndication Market. This includes assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics will be conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through computer-assisted telephone interviews (CATIS) with industry experts representing a diverse array of companies. These consultations will provide valuable operational and financial insights directly from industry practitioners, which will be instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction will serve to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the India Real Estate Brokerage, Advisory & Underwriting, and Loan Syndication Market.

Frequently Asked Questions

01. How big is the India Real Estate Brokerage, Advisory & Underwriting, and Loan Syndication Market?

The India Real Estate Brokerage, Advisory & Underwriting, and Loan Syndication Market is valued at INR 269 billion, driven by factors such as increasing demand, technological advancements, and supportive government initiatives.

02. What are the key challenges in the India Real Estate Brokerage, Advisory & Underwriting, and Loan Syndication Market?

Key challenges in the India Real Estate Brokerage, Advisory & Underwriting, and Loan Syndication Market include intense competition, regulatory complexities, and infrastructure limitations affecting market dynamics.

03. Who are the major players in the India Real Estate Brokerage, Advisory & Underwriting, and Loan Syndication Market?

Major players in the India Real Estate Brokerage, Advisory & Underwriting, and Loan Syndication Market are Homesfy Realty, Anarock, Investor Clinic, Prop Mart, Wealth Clinic, and Square Yards.

04. What are the growth drivers for the India Real Estate Brokerage, Advisory & Underwriting, and Loan Syndication Market?

The primary growth drivers for the India Real Estate Brokerage, Advisory & Underwriting, and Loan Syndication Market are Growing Incomes and Lifestyle Aspirations Encouraging Premium Housing, Surge in Institutional Funding for Residential Projects, and Embedded Fintech is Boosting Home Loan Access.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.