India Real Estate Software Market Outlook 2030

Global Methacrylate Butadiene Styrene Market Outlook 2028

Region:Global

Author(s):Shivani Mehra

Product Code:KROD5929

December 2024

96

About the Report

India Real Estate Software Market Overview

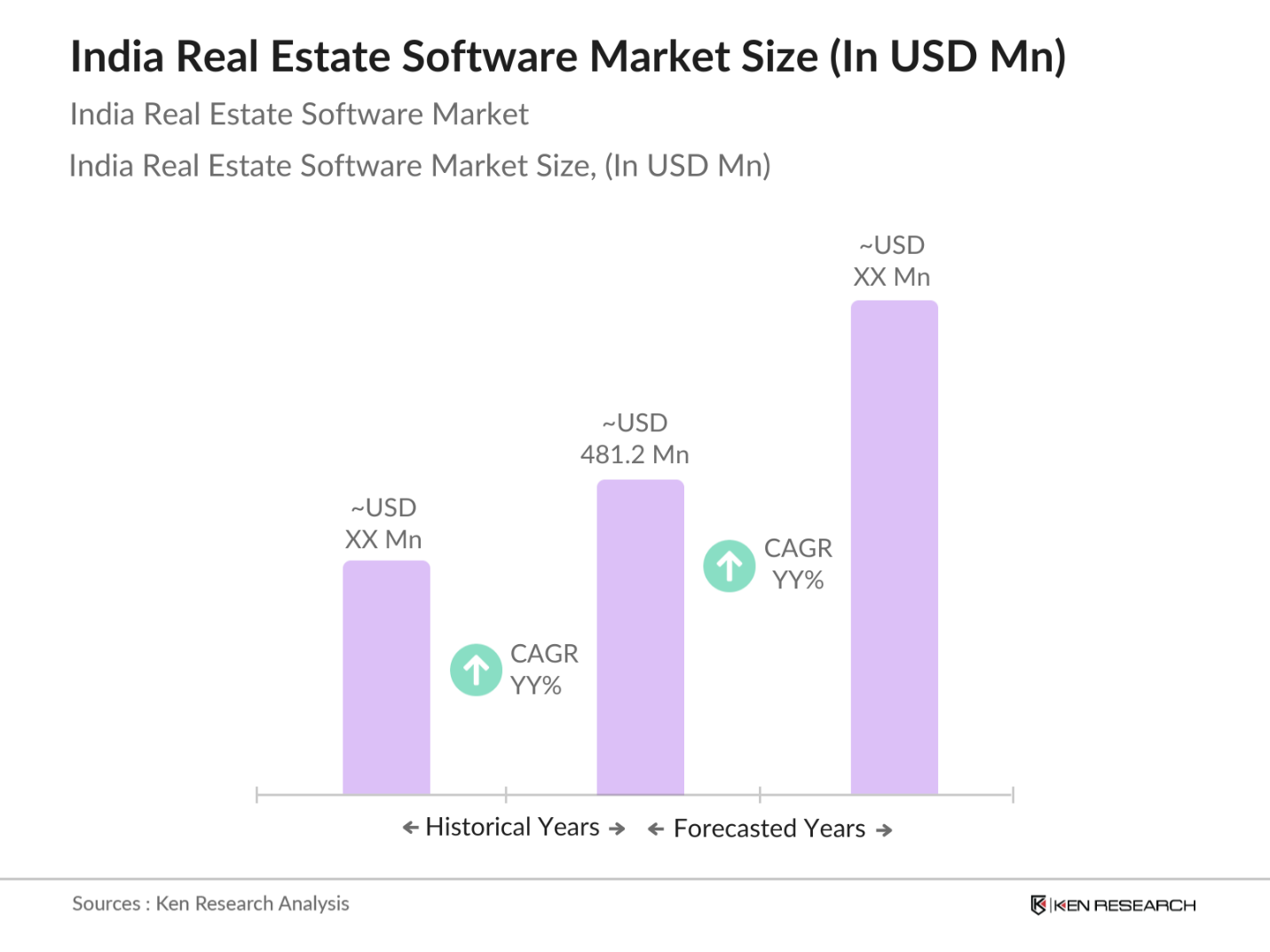

- The India real estate software market is valued at USD 481.2 million, driven by the increasing demand for digital solutions in property management and real estate operations. The rise in urbanization, coupled with government-led initiatives like Smart Cities and the Real Estate Regulatory Authority (RERA), is propelling the adoption of real estate software in both residential and commercial segments.

- Cities such as Mumbai, Delhi, and Bengaluru dominate the real estate software market due to their robust real estate activities and a high concentration of commercial and residential projects. These cities are at the forefront of adopting innovative software solutions, such as cloud-based property management systems and CRM platforms, to streamline operations and enhance customer experiences.

- The Government of Indias Smart City Mission aims to develop 100 smart cities with a focus on sustainable urban infrastructure and technology-driven solutions. Under this initiative, the real estate sector benefits from the integration of smart technologies such as IoT, cloud computing, and AI to create more efficient, sustainable buildings. The mission has allocated over 200,000 crore for urban infrastructure projects, including the development of smart housing and real estate management systems that rely on digital technologies to improve livability, safety, and resource management.

India Real Estate Software Market Segmentation

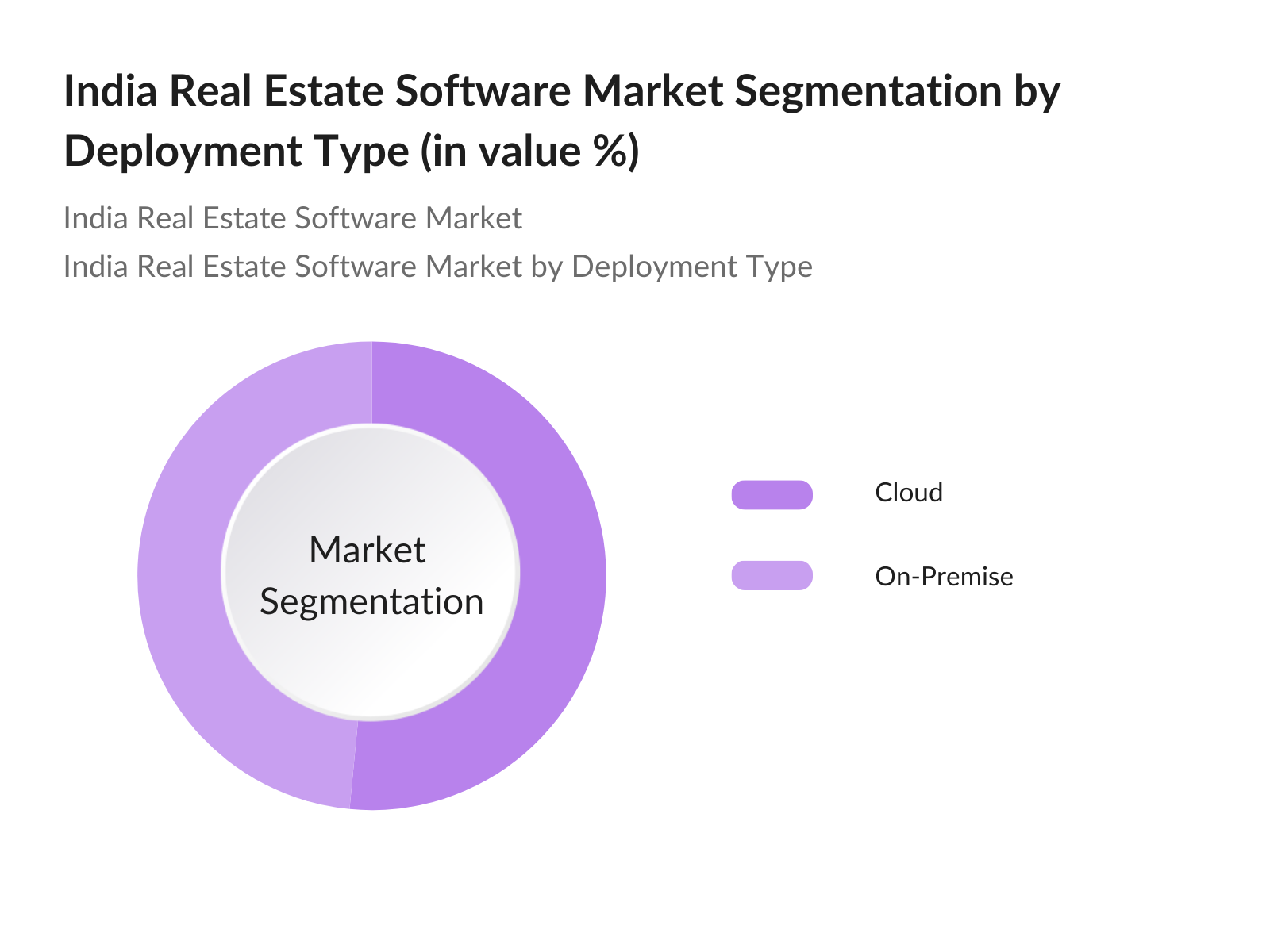

By Deployment Type: Indias real estate software market is segmented by deployment type into Cloud and On-Premise. Cloud-based real estate software dominates the market due to its scalability, cost-effectiveness, and accessibility. Businesses, particularly large real estate firms, favor cloud deployment for its ability to streamline operations across multiple locations and provide real-time data access.

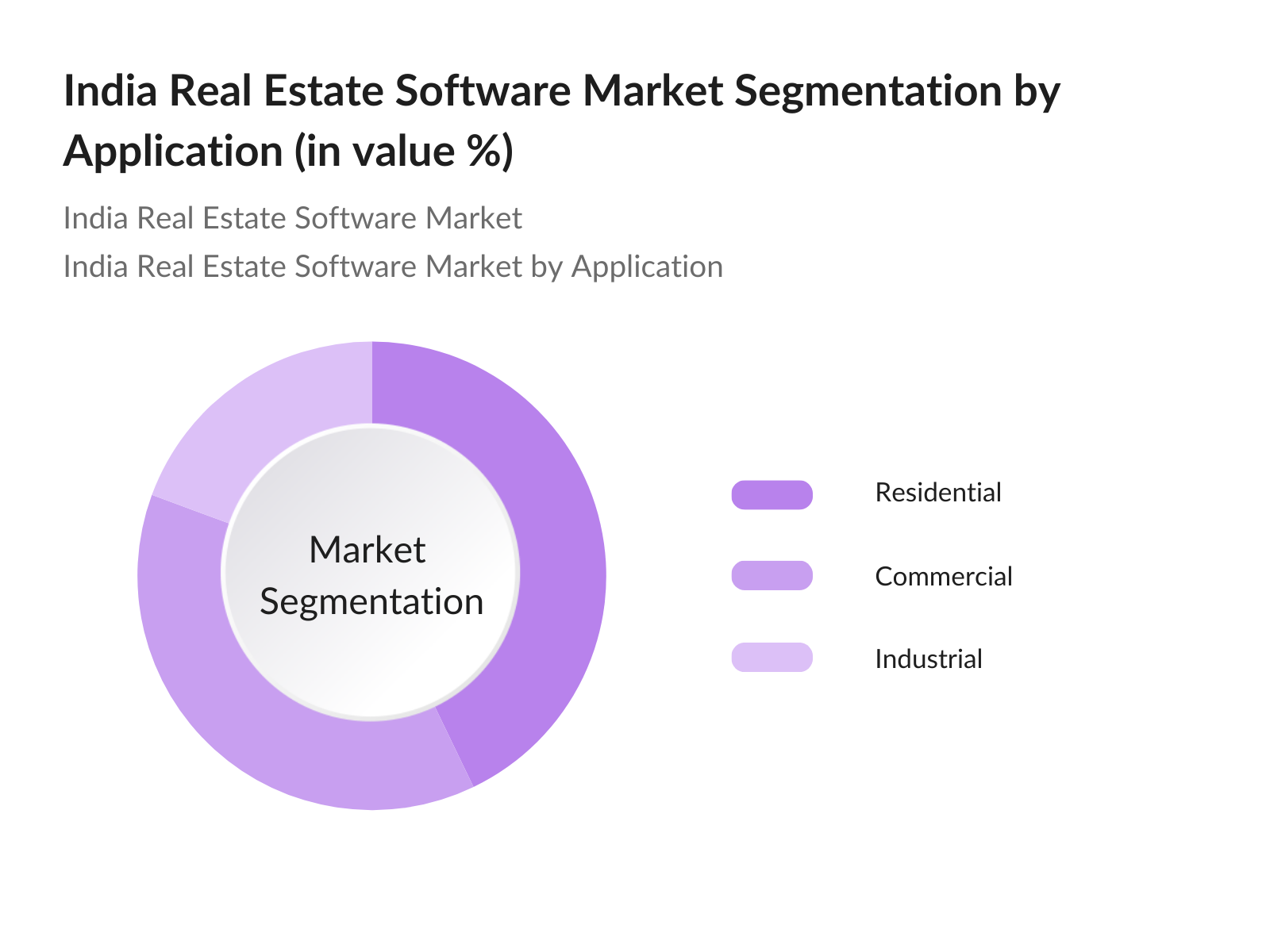

By Application: The market is also segmented by application into Residential, Commercial, and Industrial sectors. The Residential segment holds a dominant market share in India, driven by the growing demand for organized housing, government initiatives promoting affordable housing, and the digital transformation of property management. Real estate software solutions are increasingly used for managing leasing, maintenance, and tenant communication in residential buildings.

India Real Estate Software Market Competitive Landscape

The India real estate software market is highly competitive, with major players offering a range of software solutions catering to various real estate needs. The market is dominated by key players such as Yardi Systems, MRI Software, and Altus Group, known for their comprehensive solutions in property management and real estate analytics. These companies have maintained a competitive edge through continuous innovation, strategic partnerships, and expanding their market presence in India.

|

Company Name |

Established |

Headquarters |

Revenue (USD) |

Market Penetration |

Software Portfolio |

R&D Investment |

Global Presence |

Strategic Initiatives |

|

Yardi Systems |

1984 |

Santa Barbara, USA |

1.1 billion |

- |

- |

- |

- |

- |

|

MRI Software |

1971 |

Solon, USA |

500 million |

- |

- |

- |

- |

- |

|

Altus Group |

2005 |

Toronto, Canada |

561 million |

- |

- |

- |

- |

- |

|

RealPage Inc. |

1998 |

Texas, USA |

1.2 billion |

- |

- |

- |

- |

- |

|

Microsoft Corporation |

1975 |

Redmond, USA |

168 billion |

- |

- |

- |

- |

- |

India Real Estate Software Market Analysis

Market Growth Drivers

- Increasing Urbanization: Indias urban population is expanding rapidly, with over 480 million people living in urban areas in 2023. This figure represents a consistent annual increase, driven by rural-to-urban migration and government policies encouraging urban growth. As cities expand, the demand for real estate projects rises, necessitating advanced real estate software solutions to manage properties, streamline transactions, and improve efficiency. According to the World Bank, Indias urbanization rate continues to accelerate, driving a significant need for technology-driven real estate management solutions.

- Rising Adoption of Cloud Technologies: Cloud technology adoption in India has seen significant growth, with cloud spending expected to reach $8 billion in 2023. The real estate sector has increasingly integrated cloud-based systems to manage property portfolios, enhance customer relationship management (CRM), and automate processes. This trend is further bolstered by India's push toward digital transformation, enabling real estate companies to scale operations, offer real-time data analytics, and improve operational flexibility. Cloud-based solutions also support the development of mobile applications for real estate transactions.

- Government Digital Initiatives (Smart City Mission, RERA Act): Indias Smart City Mission and the Real Estate Regulatory Authority (RERA) Act have accelerated the digitalization of the real estate sector. Over 100 cities are being developed under the Smart City Mission, with over 200,000 crore allocated for infrastructure and technology development by 2024. RERA has also streamlined real estate regulations, promoting transparency and encouraging the adoption of digital platforms for project management and compliance. These government initiatives are driving the demand for advanced real estate software, particularly for compliance, reporting, and smart infrastructure integration.

Market Challenges:

- High Cost of Transitioning to New Technologies: The cost of adopting new real estate technologies remains a challenge, particularly for small and medium-sized enterprises. Transitioning from traditional systems to cloud-based platforms, automation tools, or AI-driven software can cost up to 5 crore annually for mid-sized developers. Despite the operational efficiency gained, the upfront investment in technology infrastructure, training, and maintenance deters many companies. According to government data, digital infrastructure costs continue to rise, making it harder for smaller firms to integrate advanced software systems into their workflows.

- Lack of Skilled Workforce in Real Estate Tech: The real estate industry in India is facing a significant shortage of professionals skilled in real estate technology. This gap has hindered the adoption of advanced software solutions, as companies struggle to find IT specialists familiar with real estate-specific technologies like property management systems (PMS), CRM tools, and blockchain for property transactions. Despite government-backed training initiatives and efforts to upskill the workforce, the slow pace of digital education in this sector continues to be a major challenge. This shortage affects the ability of firms to fully leverage digital transformation for efficient operations.

India Real Estate Software Market Future Outlook

Over the next five years, the India real estate software market is poised for significant growth, driven by the increasing adoption of cloud-based technologies, the government's push for smart city infrastructure, and the rising demand for seamless property management solutions. The integration of artificial intelligence (AI), machine learning (ML), and blockchain technology into real estate software is expected to enhance automation, data security, and operational efficiency, thereby creating new growth avenues in the market.

Market Opportunities:

- Real-Time Data and Analytics Adoption: Real-time data and analytics have become crucial in transforming how real estate portfolios are managed in India. Developers are increasingly leveraging these tools to make informed decisions based on market trends, consumer behavior, and demand forecasts. These analytics platforms allow real estate firms to optimize marketing strategies, identify prime investment locations, and enhance the overall management of assets. By providing insights into operational efficiency, real-time data also helps businesses streamline their operations, reduce costs, and increase profitability, contributing to a more data-driven approach in the industry.

- Growth of Virtual Tours and Augmented Reality in Property Sales: Virtual tours and augmented reality (AR) tools have become essential in property sales in India, particularly in the post-pandemic environment. These technologies allow real estate firms to showcase properties virtually, providing an immersive experience for potential buyers. This has streamlined the sales process by reducing the need for physical site visits. Additionally, AR tools enable developers to offer customizable property views, allowing buyers to visualize modifications or upgrades. This trend is gaining momentum in metropolitan areas, where time constraints and geographical limitations often impact property transactions.

Scope of the Report

|

By Deployment |

Cloud On-Premise |

|

By Application |

Residential Commercial Industrial |

|

By Software Type |

Property Management CRM ERP |

|

By Enterprise Size |

Large Enterprises Medium Enterprises Small Enterprises |

|

By Region |

North-East Midwest West Coast Southern States |

Products

Key Target Audience

Real Estate Developers

Property Management Companies

Software Vendors

Government and Regulatory Bodies (e.g., RERA, Smart City Mission)

Large Enterprises

Real Estate Investors

Technology Solution Providers

Venture Capital and Investment Firms

Companies

Players Mention in the Report

Yardi Systems

MRI Software

Altus Group

RealPage Inc.

Microsoft Corporation

Oracle Corporation

SAP SE

Trimble Inc.

CoStar Group

Autodesk Inc.

Propertybase

Fortive Corporation

NuScale Power

SMR Group

Accruent

Table of Contents

01. India Real Estate Software Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Structure

1.4 Key Stakeholders

02. India Real Estate Software Market Size (In USD Million)

2.1 Historical Market Size

2.2 Market Growth Rate (CAGR)

2.3 Key Milestones and Developments

03. India Real Estate Software Market Dynamics

3.1 Growth Drivers

3.1.1 Increasing Urbanization

3.1.2 Rising Adoption of Cloud Technologies

3.1.3 Government Digital Initiatives (Smart City Mission, RERA Act)

3.1.4 Real Estate Digitization (Automation, CRM Solutions)

3.2 Market Challenges

3.2.1 High Cost of Transitioning to New Technologies

3.2.2 Lack of Skilled Workforce in Real Estate Tech

3.3 Opportunities

3.3.1 Demand for Custom Real Estate Software Solutions

3.3.2 Integration of AI and Blockchain for Enhanced Security

3.4 Trends

3.4.1 Real-Time Data and Analytics Adoption

3.4.2 Growth of Virtual Tours and Augmented Reality in Property Sales

3.5 SWOT Analysis

3.6 Porters Five Forces

3.6.1 Bargaining Power of Buyers

3.6.2 Bargaining Power of Suppliers

3.6.3 Threat of New Entrants

3.6.4 Threat of Substitutes

3.6.5 Competitive Rivalry

04. India Real Estate Software Market Segmentation (By Value %)

4.1 By Deployment Type

4.1.1 Cloud

4.1.2 On-Premise

4.2 By Application

4.2.1 Residential

4.2.2 Commercial

4.2.3 Industrial

4.3 By Software Type

4.3.1 Property Management Software

4.3.2 CRM Solutions

4.3.3 ERP Systems

4.4 By Enterprise Size

4.4.1 Large Enterprises

4.4.2 Medium Enterprises

4.4.3 Small Enterprises

4.5 By Region

4.5.1 North India

4.5.2 South India

4.5.3 West India

4.5.4 East India

05. India Real Estate Software Competitive Landscape

5.1 Market Share Analysis

5.2 Detailed Profiles of Major Companies (By Revenue, Market Penetration, and Product Innovation)

5.2.1 Yardi Systems

5.2.2 RealPage Inc.

5.2.3 MRI Software LLC

5.2.4 Microsoft Corporation

5.2.5 Altus Group Limited

5.2.6 SAP SE

5.2.7 Oracle Corporation

5.2.8 Accruent

5.2.9 Autodesk Inc.

5.2.10 CoStar Group

5.2.11 Trimble Inc.

5.2.12 Propertybase

5.2.13 Fortive Corporation

5.2.14 NuScale Power

5.2.15 SMR Group

5.3 Cross Comparison Parameters (No. of Employees, Revenue, Software Portfolio, Regional Presence, Mergers and Acquisitions, Innovations, Customer Satisfaction)

5.4 Strategic Initiatives

5.4.1 Partnerships and Collaborations

5.4.2 Product Launches and Enhancements

5.5 Investment Analysis

5.5.1 Venture Capital Funding

5.5.2 Government Grants

06. India Real Estate Software Market Regulatory Framework

6.1 Data Security and Privacy Regulations

6.2 Compliance and Certification Standards

6.3 Government Digital Real Estate Initiatives

07. India Real Estate Software Future Market Size (In USD Million)

7.1 Market Projections

7.2 Key Factors Driving Future Growth

08. India Real Estate Software Future Market Segmentation

8.1 By Deployment Type

8.2 By Application

8.3 By Software Type

8.4 By Enterprise Size

8.5 By Region

09. India Real Estate Software Market Analyst Recommendations

9.1 Go-To-Market Strategies

9.2 Investment Pockets

9.3 Technology Integration Recommendations

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

This phase involves a comprehensive desk research process, where we gather data from secondary databases and proprietary sources. We identify key stakeholders, technological trends, and other variables influencing the India Real Estate Software Market.

Step 2: Market Analysis and Construction

In this step, we analyze historical data and market penetration rates to assess the markets current state. This includes analyzing the impact of cloud-based solutions and the revenue generated from different market segments.

Step 3: Hypothesis Validation and Expert Consultation

We conduct interviews with industry experts to validate our market hypotheses. These consultations provide insights into operational strategies, market challenges, and technological trends that influence market growth.

Step 4: Research Synthesis and Final Output

The final stage involves synthesizing all collected data, validating it through bottom-up analysis, and producing a comprehensive report on the India Real Estate Software Market.

Frequently Asked Questions

01. How big is the India Real Estate Software Market?

The India real estate software market is valued at USD 481.2 million, driven by the increased demand for digital solutions in property and facility management.

02. What are the challenges in the India Real Estate Software Market?

Challenges include the high cost of transitioning to cloud-based solutions, data security concerns, and the lack of technical expertise among real estate professionals.

03. Who are the major players in the India Real Estate Software Market?

Major players include Yardi Systems, MRI Software, Altus Group, RealPage Inc., and Microsoft Corporation, who dominate through comprehensive software offerings and strategic investments.

04. What are the growth drivers of the India Real Estate Software Market?

The market is driven by increasing urbanization, government initiatives like RERA, and the adoption of cloud technologies to streamline real estate operations.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.