India Refrigerator Market Outlook to 2030

Region:Asia

Author(s):Meenakshi

Product Code:KROD4499

October 2024

85

About the Report

India Refrigerator Market Overview

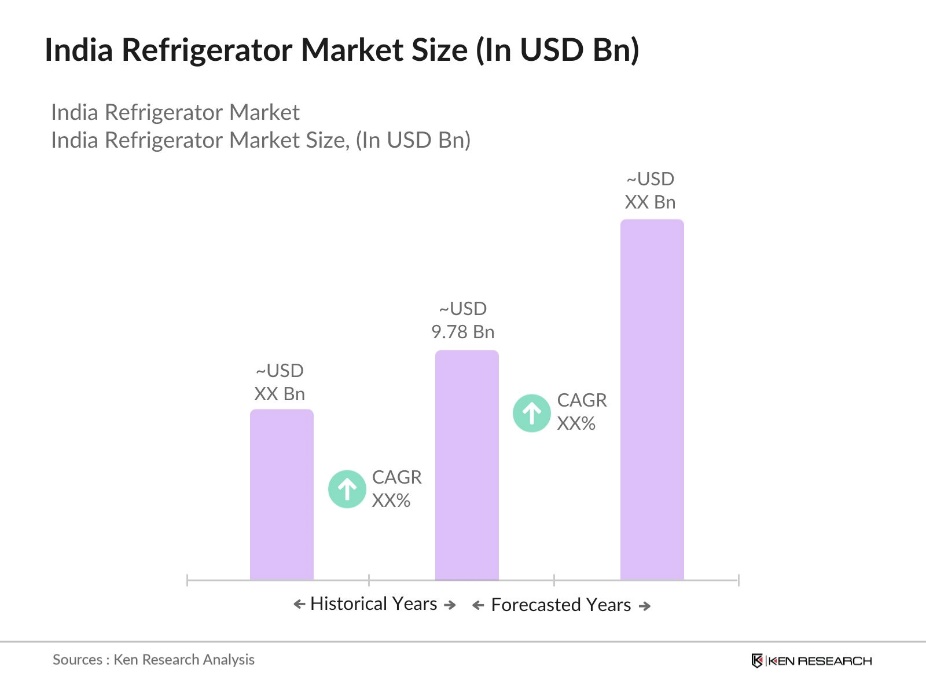

- The India Refrigerator Market is valued at USD 9.78 billion, driven by increasing disposable incomes, urbanization, and a growing consumer base seeking advanced home appliances. The rising penetration of energy-efficient and inverter-based refrigerators has further propelled market growth. Additionally, expanding e-commerce platforms and the demand for smart appliances, such as refrigerators integrated with IoT technology, contribute to the markets expanding footprint, as supported by credible data from industry reports and consumer surveys.

- Dominant regions in the refrigerator market include metropolitan cities like Mumbai, Delhi, and Bangalore, which exhibit a high demand for premium appliances. These cities have large urban populations, higher disposable incomes, and a growing middle-class population. Additionally, states like Maharashtra, Tamil Nadu, and Gujarat are key players in the market due to the presence of significant manufacturing bases and robust retail distribution networks.

- The Bureau of Energy Efficiency (BEE) introduced updated norms for refrigerators in India starting January 1, 2023. These include revised energy consumption limits and the requirement for a minimum 1-star energy rating for direct cool refrigerators. The new standards aim to enhance energy efficiency in refrigeration units, reduce electricity consumption, and promote environmentally sustainable products. Manufacturers must comply with these regulations to meet the standards set for energy-efficient appliances.

India Refrigerator Market Segmentation

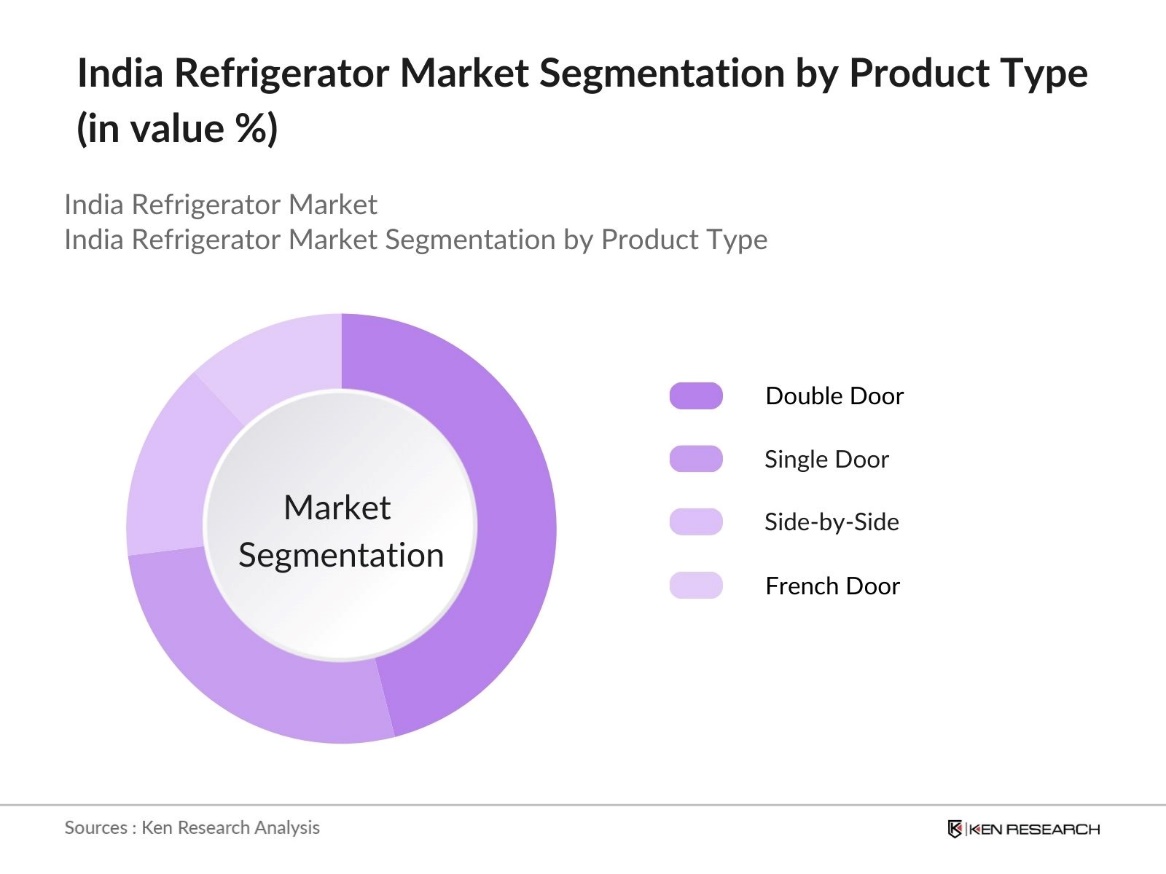

By Product Type: The India Refrigerator market is segmented by product type into Single Door, Double Door, Side-by-Side, and French Door refrigerators. Currently, the Double Door segment dominates the market due to its enhanced storage capacity, multi-compartment design, and increasing demand for premium products among the middle-income population. Leading brands such as LG and Samsung have solidified their position in this segment by launching energy-efficient, inverter-based models. Furthermore, Double Door refrigerators appeal to consumers because of their blend of affordability, advanced features, and durability.

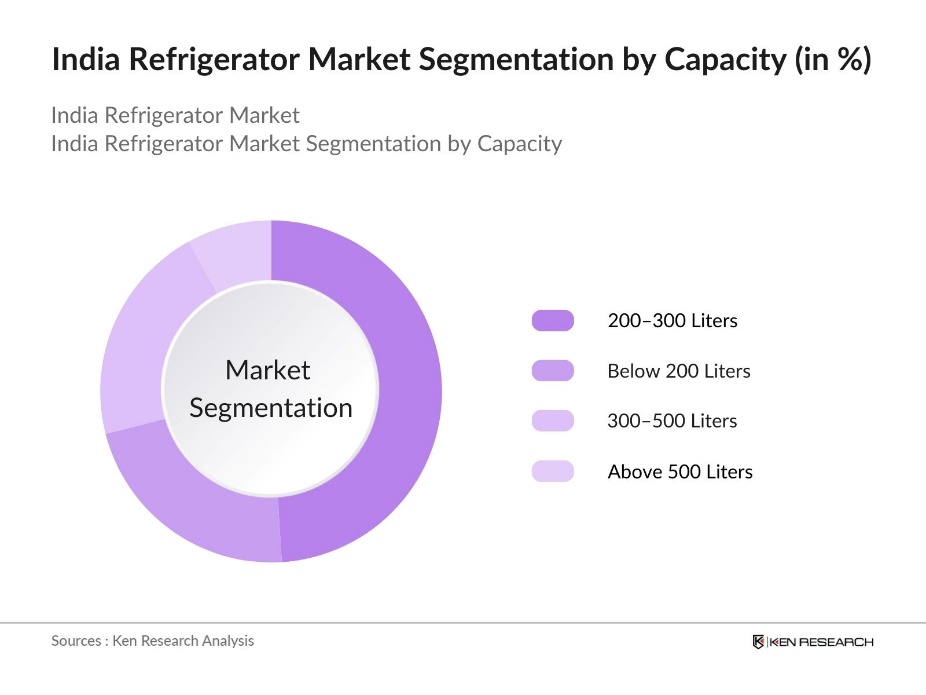

By Capacity: The India Refrigerator market is segmented by capacity into Below 200 Liters, 200300 Liters, 300500 Liters, and Above 500 Liters. The 200300 Liters segment has a dominant market share, primarily driven by nuclear families and urban dwellers looking for compact yet efficient solutions. The strong presence of this sub-segment is due to its balance between affordability and functionality, making it suitable for both residential and commercial usage. Key brands like Whirlpool and Godrej have targeted this segment with high-performing, eco-friendly models, which align with government energy conservation programs.

India Refrigerator Market Competitive Landscape

The India Refrigerator market is highly competitive, with leading brands holding significant shares due to their established manufacturing bases, product innovation, and distribution networks. The market is dominated by both international and domestic players, all vying for a larger consumer base through enhanced product offerings.

|

Company |

Establishment Year |

Headquarters |

No. of Employees |

Revenue (USD Bn) |

Product Portfolio |

R&D Investments |

Distribution Network |

Market Share |

|

LG Electronics |

1958 |

Seoul, South Korea |

||||||

|

Samsung Electronics |

1969 |

Suwon, South Korea |

||||||

|

Whirlpool Corporation |

1911 |

Michigan, USA |

||||||

|

Godrej Appliances |

1897 |

Mumbai, India |

||||||

|

Haier Group |

1984 |

Qingdao, China |

India Refrigerator Industry Analysis

Growth Drivers

- Urbanization and Rising Disposable Income: India's rapid urbanization is a major factor driving refrigerator demand. As of 2024, over 35% of India's population resides in urban areas, a significant increase from previous years and this urban shift has resulted in higher disposable incomes. These income gains have led to a surge in demand for refrigerators as more households can afford durable consumer goods.

- Expanding Retail and E-commerce Channels: Indias expanding retail and e-commerce sectors have been critical in boosting refrigerator sales. The India e-commerce market with refrigerators being one of the fastest-growing categories in the consumer appliances segment. Retail giants like Reliance and online platforms such as Amazon and Flipkart are enhancing the reach of refrigerators in tier-2 and tier-3 cities. With over 700 million internet users, e-commerce has become a vital distribution channel for home appliances, creating easy accessibility and competitive pricing.

- Technological Advancements (Inverter Technology, Smart Refrigerators): Technological innovations such as inverter technology and smart refrigerators are transforming India's refrigerator market. These advancements offer better energy efficiency, performance, and convenience to consumers. Inverter technology optimizes energy use, leading to lower electricity consumption, while smart refrigerators allow connectivity and integration with other smart home devices. Government initiatives are also encouraging the adoption of such advanced technologies.

Market Challenges

- High Initial Costs of Advanced Refrigerators: The high cost of advanced refrigerators presents a significant challenge in the Indian market. While technological innovations like inverter technology and smart features offer long-term benefits such as energy efficiency and enhanced functionality, the initial investment required for these models is considerably higher than traditional refrigerators. For price-sensitive consumers, this upfront cost often outweighs the potential savings on energy bills, limiting the wider adoption of advanced models.

- Intense Competition Among Brands: India's refrigerator market is characterized by intense competition among established and emerging brands. Leading players face significant pressure from both international and domestic companies entering the market, resulting in aggressive marketing strategies and price wars. This high level of competition forces companies to focus on product differentiation, promotional offers, and innovation to retain their market share.

India Refrigerator Market Future Outlook

Over the next five years, the India Refrigerator market is expected to experience robust growth, driven by factors such as increasing consumer demand for energy-efficient appliances, rising disposable incomes, and a shift towards premium products. Advancements in inverter and cooling technology, as well as government regulations promoting energy conservation, will significantly influence the market trajectory.

Market Opportunities

- Increased Penetration in Rural Areas: Rural India offers significant growth opportunities for refrigerator manufacturers. With a large portion of the population residing in rural regions, the penetration of refrigerators remains relatively low compared to urban areas. Government initiatives aimed at improving rural infrastructure, such as housing and electrification projects, are creating the conditions for increased demand in these areas. As rural households gain better access to electricity and improved living standards, the demand for basic household appliances, including refrigerators, is expected to rise, offering brands the opportunity to expand their market presence beyond urban centers.

- Government Energy Conservation Programs: The Indian government has been actively promoting energy conservation through various programs that encourage the use of energy-efficient appliances, including refrigerators. The Bureau of Energy Efficiency (BEE) plays a key role by setting standards for energy consumption and updating the star rating system for appliances. These programs not only aim to reduce electricity consumption but also incentivize manufacturers to design and produce more efficient products.

Scope of the Report

|

Product Type |

Single Door Double Door Side-by-Side French Door |

|

Capacity |

Below 200 Liters 200300 Liters 300500 Liters Above 500 Liters |

|

Distribution Channel |

Offline (Specialty Stores, Multi-brand Outlets) Online (E-commerce) |

|

End-User |

Residential Commercial (Hotels, Restaurants, Retail Stores) |

|

Region |

North South West East |

Products

Key Target Audience

Hospitality Industry

Energy Utility Companies

Technology Integration Companies

Refrigerator Recycling and Waste Management Companies

Government Agencies (Ministry of Consumer Affairs)

Investment and Venture Capitalist Firms

Banks and Financial Institutions

Companies

Major Players

LG Electronics

Samsung Electronics

Whirlpool Corporation

Godrej Appliances

Haier Group

Bosch Siemens Home Appliances (BSH)

Panasonic Corporation

Hitachi Home Appliances

Electrolux

Voltas Ltd.

Blue Star Ltd.

IFB Industries

Midea Group

Videocon Industries

Siemens

Table of Contents

1. India Refrigerator Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. India Refrigerator Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. India Refrigerator Market Analysis

3.1. Growth Drivers

3.1.1. Urbanization and Rising Disposable Income

3.1.2. Technological Advancements (Inverter Technology, Smart Refrigerators)

3.1.3. Rising Demand for Energy-efficient Appliances (Energy Star Rating)

3.1.4. Expanding Retail and E-commerce Channels

3.2. Market Challenges

3.2.1. High Initial Costs of Advanced Refrigerators

3.2.2. Intense Competition Among Brands

3.2.3. Import Dependency for Raw Materials

3.3. Opportunities

3.3.1. Increased Penetration in Rural Areas

3.3.2. Government Energy Conservation Programs (Bureau of Energy Efficiency Standards)

3.3.3. Growth in Demand for Compact and Single Door Refrigerators

3.4. Trends

3.4.1. Smart Refrigerator Integration with IoT

3.4.2. Use of Green Refrigerants (Hydrocarbon-based Refrigerants)

3.4.3. Frost-free and Convertible Technology

3.5. Government Regulation

3.5.1. Bureau of Indian Standards (BIS) Certification

3.5.2. Energy Efficiency Labeling (Energy Star Ratings)

3.5.3. Make in India Initiative for Domestic Manufacturing

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. India Refrigerator Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Single Door Refrigerators

4.1.2. Double Door Refrigerators

4.1.3. Side-by-Side Refrigerators

4.1.4. French Door Refrigerators

4.2. By Capacity (In Value %)

4.2.1. Below 200 Liters

4.2.2. 200300 Liters

4.2.3. 300500 Liters

4.2.4. Above 500 Liters

4.3. By Distribution Channel (In Value %)

4.3.1. Offline (Specialty Stores, Multi-brand Outlets)

4.3.2. Online (E-commerce)

4.4. By End-User (In Value %)

4.4.1. Residential

4.4.2. Commercial (Hotels, Restaurants, Retail Stores)

4.5. By Region (In Value %)

4.5.1. North India

4.5.2. South India

4.5.3. West India

4.5.4. East India

5. India Refrigerator Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1. LG Electronics

5.1.2. Samsung Electronics

5.1.3. Whirlpool Corporation

5.1.4. Haier Group

5.1.5. Panasonic Corporation

5.1.6. Godrej Appliances

5.1.7. Bosch Siemens Home Appliances (BSH)

5.1.8. Voltas Ltd.

5.1.9. Hitachi Home Appliances

5.1.10. Blue Star Ltd.

5.1.11. IFB Industries

5.1.12. Videocon Industries

5.1.13. Midea Group

5.1.14. Electrolux

5.1.15. Siemens

5.2 Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue, Market Share, Product Portfolio, R&D Investments, Distribution Network)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. India Refrigerator Market Regulatory Framework

6.1. Environmental Standards (Energy Efficiency, Green Refrigerants)

6.2. Compliance Requirements

6.3. Certification Processes (BIS, Energy Labeling, BEE Certification)

7. India Refrigerator Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. India Refrigerator Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Capacity (In Value %)

8.3. By Distribution Channel (In Value %)

8.4. By End-User (In Value %)

8.5. By Region (In Value %)

9. India Refrigerator Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial step involves creating a comprehensive ecosystem map for the India Refrigerator Market. Extensive desk research and a combination of proprietary databases are utilized to identify critical variables influencing market dynamics, such as consumer preferences, production capacities, and the role of energy conservation programs.

Step 2: Market Analysis and Construction

In this phase, historical data on refrigerator sales, penetration in urban and rural areas, and market trends will be compiled and analyzed. The market is assessed by considering the revenue generation from various product segments and by evaluating the competitive landscape.

Step 3: Hypothesis Validation and Expert Consultation

Industry experts are consulted to validate the key market hypotheses through computer-assisted telephone interviews (CATIs). These interviews provide financial and operational insights from industry players, offering a practical understanding of the market trends.

Step 4: Research Synthesis and Final Output

The final stage includes direct engagement with major refrigerator manufacturers to obtain insights into their sales performance, product lines, and future market strategies. This bottom-up approach will ensure an accurate and comprehensive analysis of the India Refrigerator Market.

Frequently Asked Questions

01 How big is the India Refrigerator Market?

The India Refrigerator Market is valued at USD 9.78 billion, driven by growing disposable incomes, increased demand for energy-efficient appliances, and a well-established retail distribution network.

02 What are the challenges in the India Refrigerator Market?

Challenges in India Refrigerator Market include high competition among global and domestic brands, fluctuating raw material costs, and compliance with energy efficiency regulations. The demand for eco-friendly refrigerants adds complexity to manufacturing processes.

03 Who are the major players in the India Refrigerator Market?

Key players in India Refrigerator Market include LG Electronics, Samsung Electronics, Whirlpool Corporation, Godrej Appliances, and Haier Group. These companies dominate the market due to their product innovation, strong manufacturing capabilities, and widespread distribution networks.

04 What are the growth drivers of the India Refrigerator Market?

Key growth drivers in India Refrigerator Market include increasing disposable incomes, urbanization, a growing middle-class population, and the demand for energy-efficient and smart appliances. Government programs promoting energy conservation also contribute to market expansion.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.