India Remote Health Wearable Tech Market to Outlook 2030

Region:Global

Author(s):Shivani Mehra

Product Code:KROD3931

December 2024

96

About the Report

India Remote Health Wearable Tech Market Overview

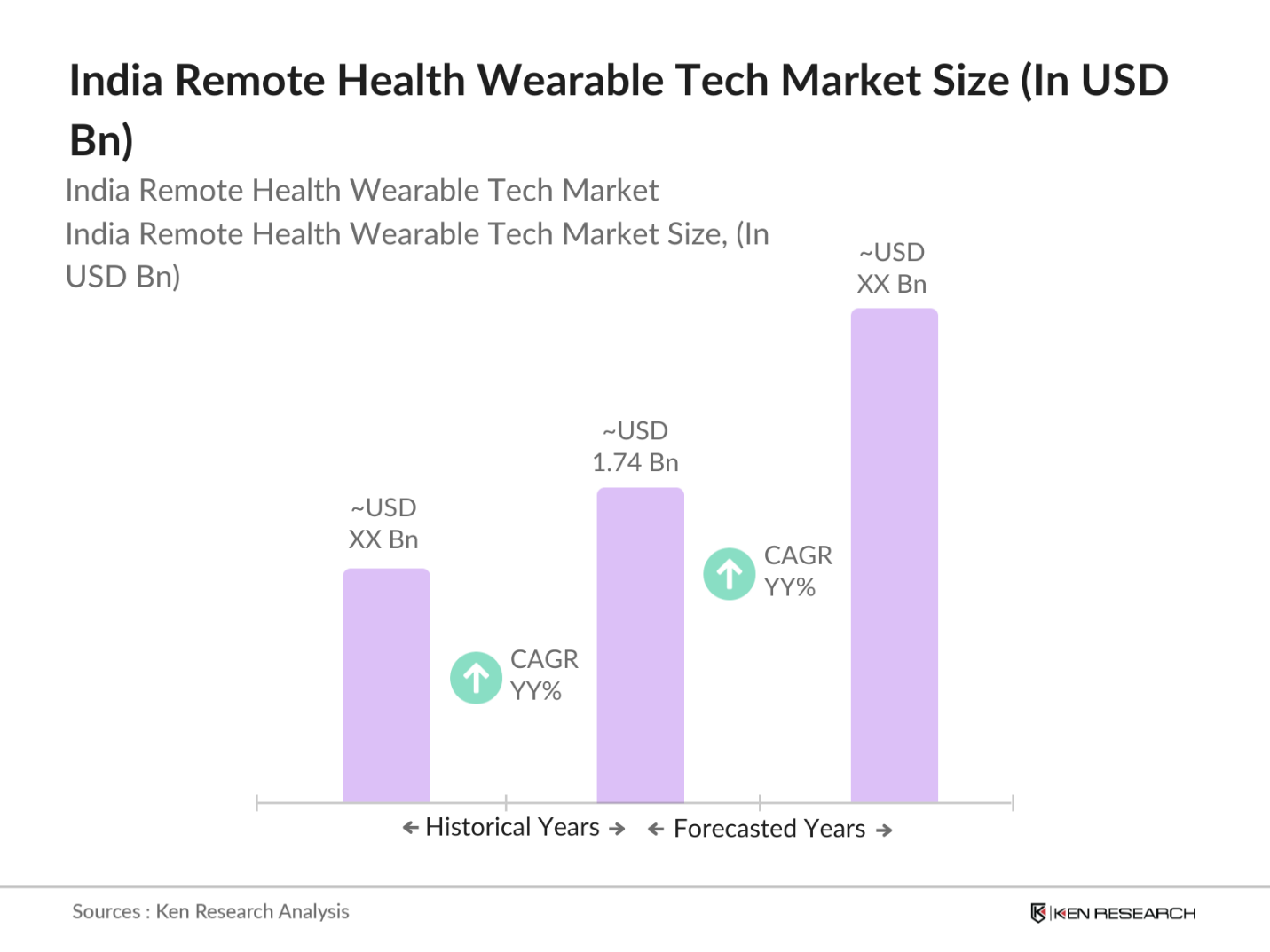

- The India Remote Health Wearable Tech Market is valued at USD 1.74 billion, driven by growing health awareness and increased digital adoption. Factors such as the high penetration of smartphones, government support for digital health, and an aging population contribute to market growth. The surge in chronic diseases and demand for continuous health monitoring further bolster the expansion of wearable health tech.

- Major cities like Delhi, Mumbai, and Bangalore lead this market due to higher income levels, greater tech awareness, and access to healthcare infrastructure. These cities witness early adoption of wearable devices for fitness tracking, heart rate monitoring, and telemedicine compatibility, which cater to health-conscious consumers.

- India is strengthening its health data privacy laws to protect citizens' sensitive health information. In 2023, the Indian government is expected to implement more robust regulations under the Personal Data Protection Bill (PDPB), which mandates secure handling of personal data, including health data collected by wearables. These regulations are creating both opportunities and challenges for wearable tech companies, as they must ensure that their devices and platforms comply with these laws while maintaining data security and user privacy.

India Remote Health Wearable Tech Market Segmentation

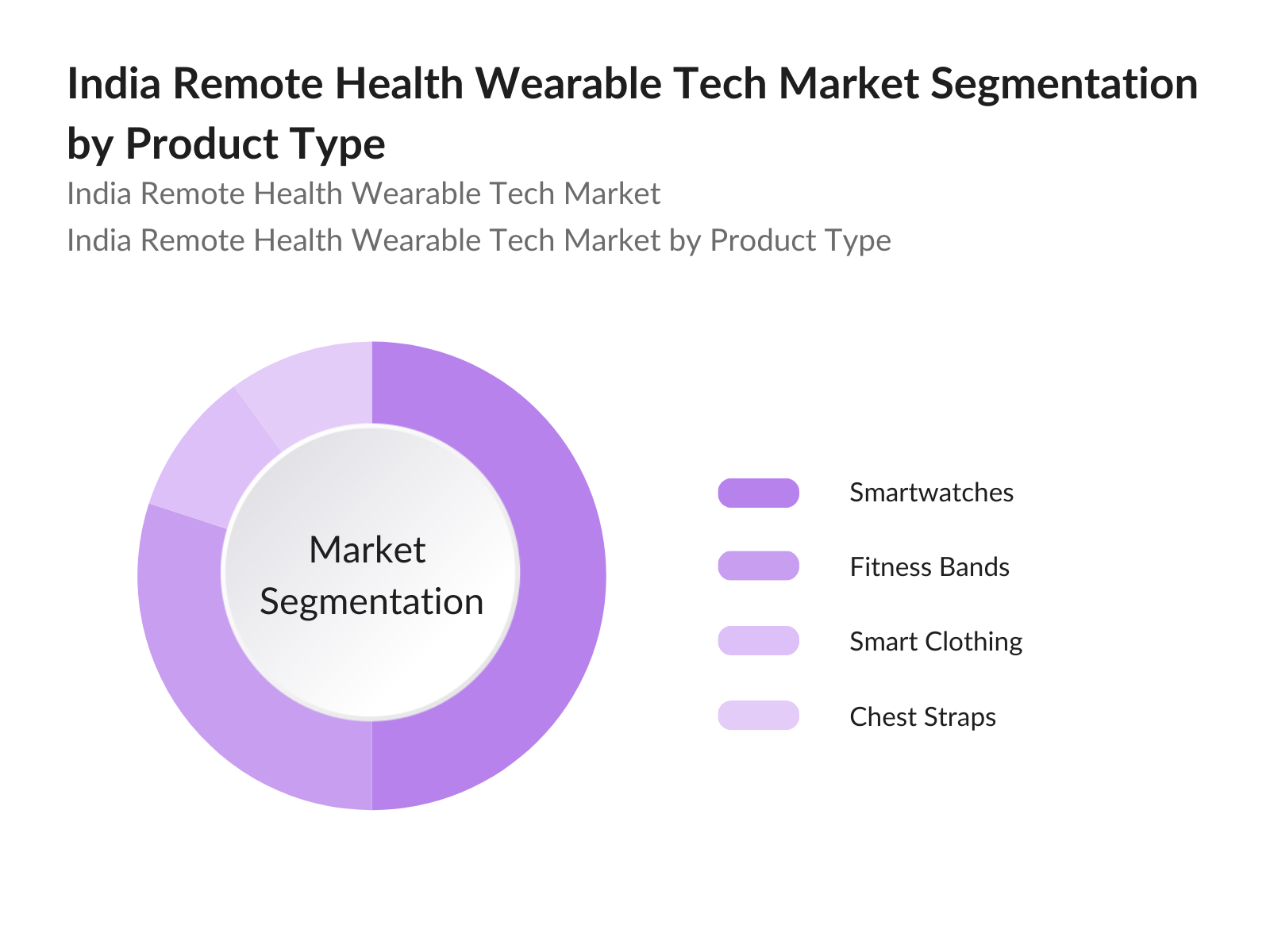

By Product Type: The market segmentation by product type includes smartwatches, fitness bands, smart clothing, and chest straps. Smartwatches hold the dominant market share due to their versatile functionality, appealing aesthetics, and health monitoring capabilities. The convenience and continuous data tracking offered by smartwatches make them popular among consumers looking for comprehensive health tracking.

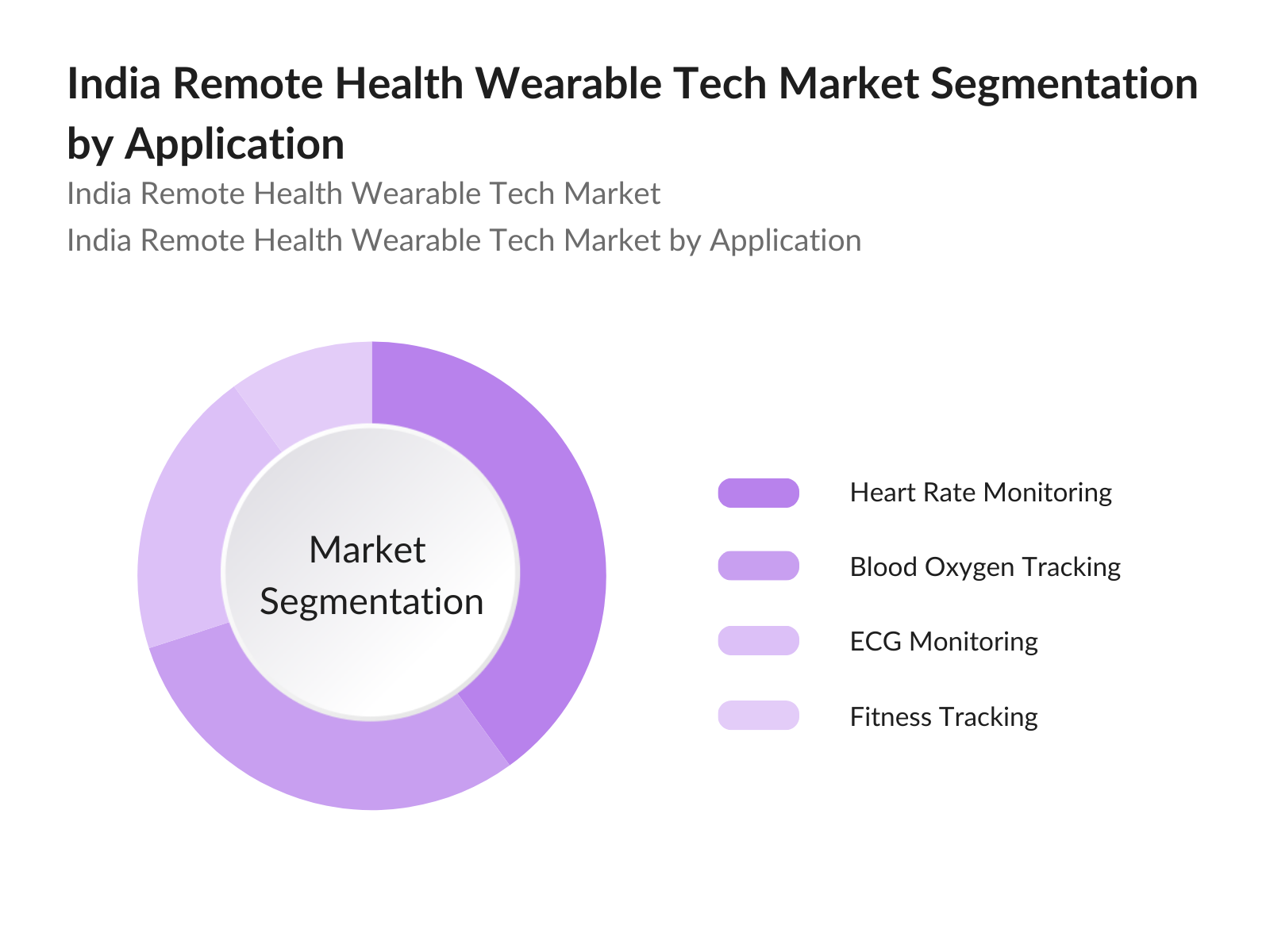

By Application: The application-based segmentation includes heart rate monitoring, blood oxygen tracking, ECG monitoring, and fitness and activity tracking. Heart rate monitoring leads in market share as cardiovascular awareness increases. Devices with accurate heart rate monitoring capabilities are in demand, with users tracking metrics in real-time for preventive health.

India Remote Health Wearable Tech Market Competitive Landscape

The India Remote Health Wearable Tech Market features prominent players like Fitbit, Apple, and Samsung, alongside local competitors such as Noise and Goqii. These companies leverage innovation in design, compatibility with smartphone ecosystems, and advancements in data accuracy to secure market positions.

|

Company |

Establishment Year |

Headquarters |

Revenue ($ Mn) |

Wearable Devices |

Data Certifications |

Product Innovation |

Partnerships |

|

Fitbit (Google) |

2007 |

San Francisco, USA |

|||||

|

Apple Inc. |

1976 |

Cupertino, USA |

|||||

|

Samsung Electronics |

1969 |

Seoul, South Korea |

|||||

|

Noise |

2018 |

Gurgaon, India |

|||||

|

Goqii |

2014 |

Mumbai, India |

India Remote Health Wearable Tech Market Analysis

Market Growth Drivers

- Rising Health Awareness: Rising health awareness in India is driving the adoption of remote health wearable technologies. With increasing concern over lifestyle diseases, heart conditions, and diabetes, consumers are more inclined to monitor their health. In 2023 of Indian adults are aware of the importance of regular health checkups, with wearable devices becoming a common tool for health management. Health-conscious individuals are turning to devices that track fitness metrics, heart rate, sleep patterns, and blood oxygen levels, fueling the demand for wearables. This trend is supported by the growing availability of affordable wearable tech for health monitoring.

- Increasing Smartphone Penetration: The growth of smartphone penetration in India is a major factor driving the remote health wearable tech market. As of 2024, smartphone penetration in India is approaching, with over 1.2 billion mobile connections in use. The integration of smartphones with health wearables allows users to track health metrics via mobile apps, providing real-time insights. Smartphones serve as the hub for data processing and communication with healthcare providers, enhancing the appeal of wearable health devices, especially among tech-savvy and urban consumers. The expanding smartphone user base is a key enabler of the wearables market growth in India.

- Government Initiatives in Digital Health: Indias government is supporting the adoption of digital health technologies, including remote health wearables, through various initiatives. In 2023, the government launched the National Digital Health Mission (NDHM), aiming to provide health records digitally and ensure accessibility of healthcare services across the country. This initiative encourages the use of health tracking devices and wearables, as they are essential for continuous health data collection. Government backing not only raises awareness but also ensures that digital health solutions, including wearables, are integrated into the broader healthcare system, further driving their adoption.

Market Challenges:

- High Device Costs: The high cost of health wearables remains a major challenge to widespread adoption in India, particularly in rural areas. In 2023, the average cost of a health wearable device in India is approximately 10,00015,000, which can be prohibitive for lower-income individuals, particularly in smaller towns and rural regions. While prices have decreased over the years, the affordability of such devices remains a concern, limiting their accessibility. Manufacturers are working on making wearables more affordable by reducing production costs and offering entry-level devices, but cost remains a significant barrier for mass adoption.

- Data Privacy and Security Concerns: Data privacy and security are significant challenges in the remote health wearable tech market in India. Health data, especially sensitive information like heart rate, blood pressure, and sleep patterns, is a prime target for cyber threats. In 2023, India is introducing stricter regulations regarding the protection of personal health data, but concerns over data breaches persist. Wearable device manufacturers and app developers need to ensure compliance with privacy laws, implement robust encryption methods, and educate users on securing their health data, which poses an ongoing challenge for the market.

India Remote Health Wearable Tech Market Future Outlook

Over the next five years, the India Remote Health Wearable Tech Market is expected to grow significantly due to increased health awareness, advancements in wearable technology, and wider adoption across demographics. Rural market penetration and partnerships with healthcare providers are likely to drive further growth in this segment.

Market Opportunities:

- Integration with AI and IoT: The integration of Artificial Intelligence (AI) and the Internet of Things (IoT) with remote health wearables presents significant opportunities in the Indian market. By 2023, of health wearables are expected to incorporate AI-driven features such as predictive health insights and real-time health analysis. IoT integration allows devices to collect and transmit data seamlessly to healthcare providers, enabling remote monitoring and intervention. This integration enhances the functionality of wearables, making them smarter and more useful for proactive health management, especially for chronic disease management, offering a strong growth opportunity.

- Expansion in Rural Markets: The rural market in India represents a significant opportunity for the expansion of remote health wearable technologies. While urban areas are seeing higher adoption rates, rural areas remain largely untapped due to infrastructure challenges and affordability concerns. However, initiatives like the governments Digital India program and increasing mobile connectivity are opening up opportunities for health wearables to reach rural populations. In 2023, the governments focus on rural healthcare through digital platforms is expected to drive awareness and adoption of wearables, presenting a huge opportunity for manufacturers to expand into these underserved markets.

Scope of the Report

|

By Product Type |

Smartwatches |

|

By Application |

Heart Rate Monitoring |

|

By Distribution Channel |

Online Retailers |

|

By End-User |

Individuals |

|

By Region |

North-East Midwest West Coast Southern States |

Products

Key Target Audience

Hospitals and Health Clinics

Elderly Care Facilities

Government and Regulatory Bodies(e.g., Ministry of Health and Family Welfare, India)

Insurance Companies

Investments and Venture Capital Firms

Smartphone and Tech Manufacturers

Retail Chains and E-commerce Platforms

Fitness and Health Training Centers

Companies

Players Mention in the Report

Fitbit (Google)

Apple Inc.

Samsung Electronics

Xiaomi

Huawei Technologies

Garmin Ltd.

Noise

Goqii

Titan Company Limited

boAt

Oppo

OnePlus

Realme

Fossil Group, Inc.

Sony Corporation

Table of Contents

01. India Remote Health Wearable Tech Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

02. India Remote Health Wearable Tech Market Size (In USD Million)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

03. India Remote Health Wearable Tech Market Analysis

3.1. Growth Drivers

3.1.1. Rising Health Awareness

3.1.2. Increasing Smartphone Penetration

3.1.3. Government Initiatives in Digital Health

3.1.4. Growing Aging Population

3.2. Market Challenges

3.2.1. High Device Costs

3.2.2. Data Privacy and Security Concerns

3.2.3. Lack of Skilled Workforce in Health Tech

3.3. Opportunities

3.3.1. Integration with AI and IoT

3.3.2. Expansion in Rural Markets

3.3.3. Partnerships with Health Providers

3.4. Trends

3.4.1. Shift Towards Continuous Health Monitoring

3.4.2. Increased Demand for Smart Wearables

3.4.3. Rise of Telemedicine Compatibility

3.5. Government Regulation

3.5.1. Health Data Privacy Laws

3.5.2. Medical Device Certifications

3.5.3. Subsidies for Digital Health Devices

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces

3.9. Competition Ecosystem

04. India Remote Health Wearable Tech Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Smartwatches

4.1.2. Fitness Bands

4.1.3. Smart Clothing

4.1.4. Chest Straps

4.2. By Application (In Value %)

4.2.1. Heart Rate Monitoring

4.2.2. Blood Oxygen Tracking

4.2.3. ECG Monitoring

4.2.4. Fitness and Activity Tracking

4.3. By Distribution Channel (In Value %)

4.3.1. Online Retailers

4.3.2. Offline Retail Stores

4.3.3. Direct Sales

4.4. By End-User (In Value %)

4.4.1. Individuals

4.4.2. Hospitals

4.4.3. Clinics

4.4.4. Homecare Settings

4.5. By Region (In Value %)

4.5.1. North India

4.5.2. South India

4.5.3. East India

4.5.4. West India

05. India Remote Health Wearable Tech Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Fitbit (Google)

5.1.2. Apple Inc.

5.1.3. Samsung Electronics

5.1.4. Xiaomi

5.1.5. Huawei Technologies

5.1.6. Garmin Ltd.

5.1.7. Goqii

5.1.8. Noise

5.1.9. boAt

5.1.10. Titan Company Limited

5.1.11. OnePlus

5.1.12. Realme

5.1.13. Fossil Group, Inc.

5.1.14. Sony Corporation

5.1.15. Oppo

5.2. Cross Comparison Parameters (Revenue, Headquarters, Year of Establishment, Patents, Data Security Certifications, Smart Wearables Portfolio, Market Share, Strategic Partnerships)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

06. India Remote Health Wearable Tech Regulatory Framework

6.1. Medical Device Approval Standards

6.2. Compliance with Health Data Privacy Laws

6.3. Certification Processes for Wearable Devices

07. India Remote Health Wearable Tech Future Market Size (In USD Million)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Growth

08. India Remote Health Wearable Tech Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Application (In Value %)

8.3. By Distribution Channel (In Value %)

8.4. By End-User (In Value %)

8.5. By Region (In Value %)

09. India Remote Health Wearable Tech Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Product Innovation and Differentiation

9.3. Go-To-Market Strategies

9.4. White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves defining the ecosystem of stakeholders and identifying significant market drivers in the India Remote Health Wearable Tech Market using proprietary databases and extensive desk research.

Step 2: Market Analysis and Construction

Analyzing historical data on wearable adoption, revenue generation, and device usage trends to understand segmentation and market trends.

Step 3: Hypothesis Validation and Expert Consultation

Engaging with industry experts to validate data, gain insights into technological advancements, and gather perspectives on competitive strategies.

Step 4: Research Synthesis and Final Output

Integrating verified insights and data to generate a comprehensive, validated analysis of the India Remote Health Wearable Tech Market.

Frequently Asked Questions

01. How big is the India Remote Health Wearable Tech Market?

The India Remote Health Wearable Tech Market is valued at USD 1.74 billion, supported by health-conscious consumers and increasing digital adoption across the country.

02. What are the challenges in the India Remote Health Wearable Tech Market?

Challenges include data privacy issues, high costs of advanced wearables, and limited consumer awareness in rural regions.

03. Who are the major players in the India Remote Health Wearable Tech Market?

Key players include Fitbit (Google), Apple, Samsung, Noise, and Goqii, leveraging technology and brand loyalty to secure their positions.

04. What drives the India Remote Health Wearable Tech Market?

Growth is driven by increasing health awareness, government support for digital health, and rising incidence of chronic diseases requiring continuous health monitoring.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.