India Reusable Water Bottle Market Outlook to 2030

Region:Asia

Author(s):Meenakshi

Product Code:KROD4387

October 2024

81

About the Report

India Reusable Water Bottle Market Overview

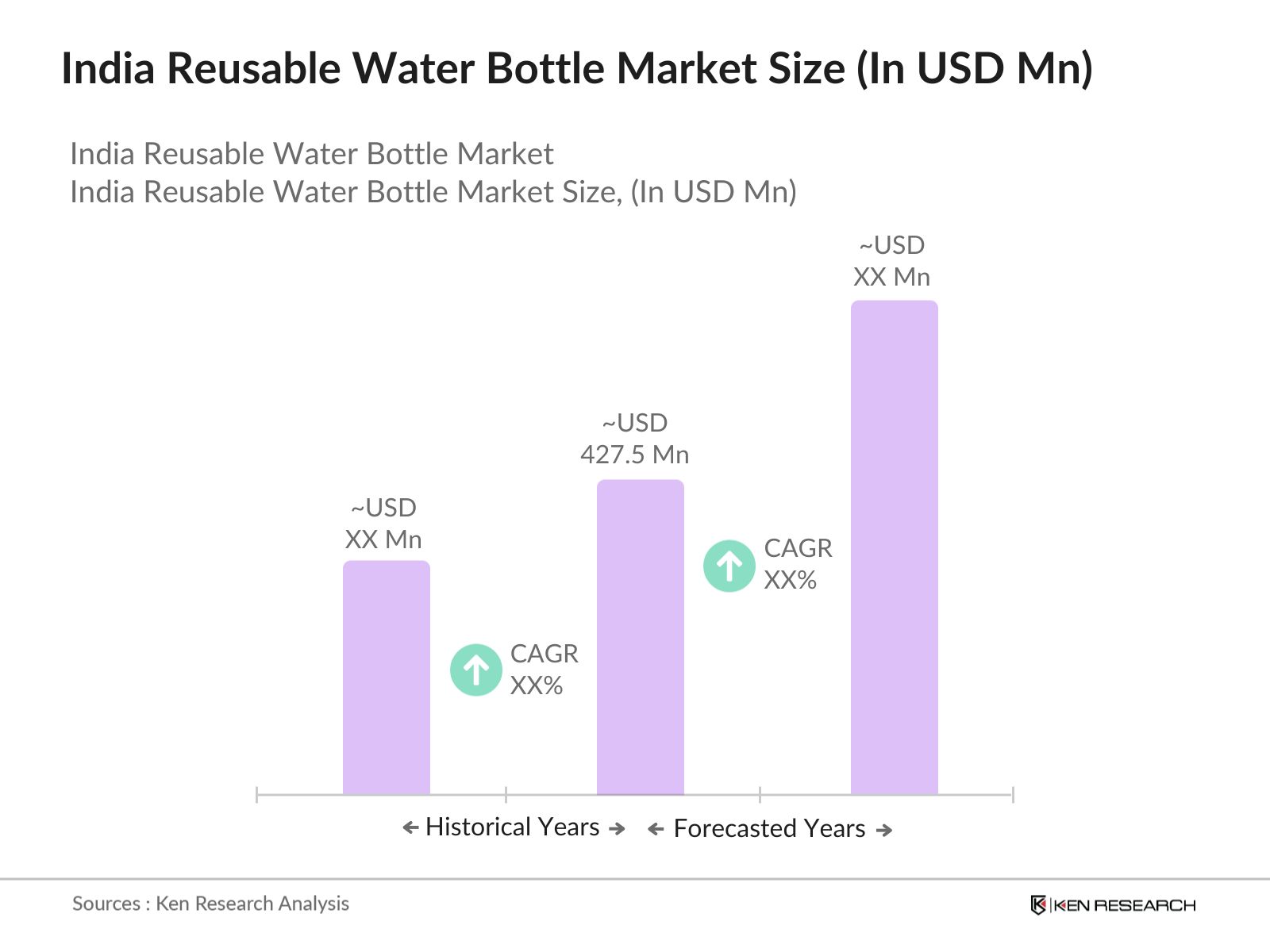

- The India Reusable Water Bottle Market is valued at USD 427.5 million, is driven by increasing awareness of environmental sustainability, government regulations banning single-use plastic, and a rise in health consciousness among consumers. With growing concerns over plastic pollution, consumers are shifting toward reusable alternatives, contributing to the steady growth of this market. Urbanization and changing lifestyle habits further push the demand for convenient and eco-friendly hydration solutions, making reusable water bottles a popular choice across age groups.

- The market is dominated by major urban cities such as Delhi, Mumbai, and Bangalore, where environmental consciousness and purchasing power are high. These cities witness significant demand due to heightened awareness regarding sustainability and strong disposable incomes, enabling the purchase of premium and branded water bottles. Additionally, the presence of robust retail and e-commerce networks in these regions facilitates product accessibility, further boosting market growth.

- The Indian governments Green Building initiatives are demonstrated through the country's third-place ranking in the U.S. Green Building Councils global list for 2023. India certified 248 projects covering 7.23 million gross square meters (GSM) of green buildings under the LEED (Leadership in Energy and Environmental Design) program. This commitment to sustainable construction is part of broader government efforts to promote green buildings and eco-friendly infrastructure.

India Reusable Water Bottle Market Segmentation

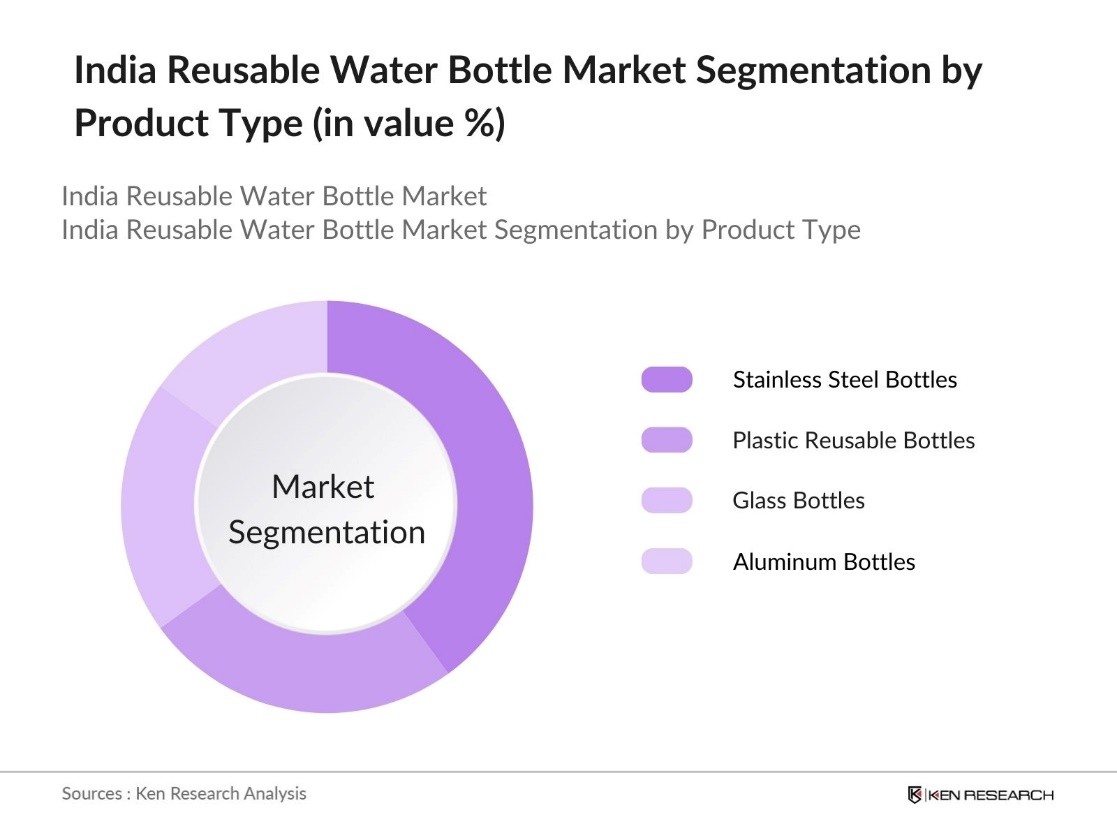

By Product Type: The India reusable water bottle market is segmented by product type into plastic reusable bottles, stainless steel bottles, glass bottles, and aluminum bottles. Among these, stainless steel bottles have garnered a dominant market share. The growing preference for stainless steel is attributed to its durability, safety, and aesthetic appeal. It is considered an ideal choice for consumers seeking long-lasting, BPA-free options that offer superior insulation properties. Additionally, increased awareness regarding the health hazards associated with plastic bottles has further shifted consumer preferences toward stainless steel bottles.

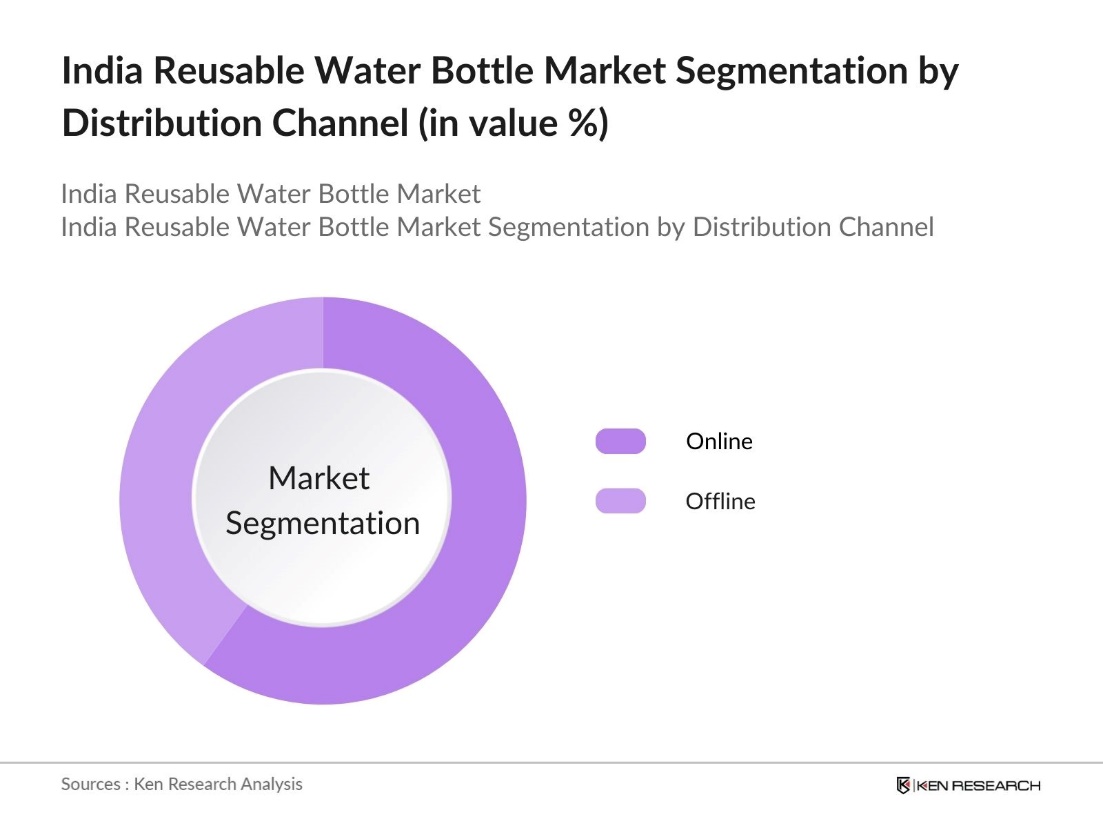

By Distribution Channel: In terms of distribution channels, the market is segmented into offline and online channels. The online segment is rapidly dominating the market due to the rise of e-commerce platforms and direct-to-consumer models. Consumers are increasingly choosing to purchase products online, driven by the convenience of home delivery, discounts, and the ability to compare multiple brands. E-commerce giants like Amazon, Flipkart, and specialty platforms have expanded their portfolios, offering various types of reusable water bottles, thus making it the preferred channel for urban buyers.

India Reusable Water Bottle Market Competitive Landscape

The India reusable water bottle market is characterized by the presence of both domestic and international players, competing on innovation, design, sustainability, and pricing strategies. The market's competitive landscape is marked by well-established brands alongside emerging eco-friendly startups that cater to environmentally conscious consumers. Additionally, companies are adopting digital marketing strategies and influencer campaigns to capture consumer attention, further intensifying competition.

|

Company |

Establishment Year |

Headquarters |

Sustainability Certifications |

Revenue (2023) |

Product Range |

Distribution Channels |

BPA-Free Initiative |

Customer Segments |

|

Tupperware India |

1946 |

Delhi |

||||||

|

Milton |

1972 |

Mumbai |

||||||

|

Cello World |

1974 |

Mumbai |

||||||

|

EcoRight |

2018 |

Ahmedabad |

||||||

|

Borosil |

1962 |

Mumbai |

India Reusable Water Bottle Industry Analysis

Growth Drivers

- Expanding Urbanization (Urban Consumer Trends): According to the World Bank, by 2036, India's urban population is projected to reach 600 million, which will account for approximately 40% of the total population, according to the World Bank. This rise in urban population contributes to the increased demand for convenient, eco-friendly lifestyle products like reusable water bottles. Additionally, with cities like Delhi, Mumbai, and Bangalore leading the charge in lifestyle shifts, indicating an evolving consumer trend that aligns with the demand for sustainable water bottles.

- Increasing Consumer Awareness on Sustainability (Eco-friendly Trends): Increased consumer awareness around sustainability is leading to higher demand for eco-friendly products, including reusable water bottles. In India specifically, a survey conducted by the Ministry of Commerce in 2023 highlighted that 27 million urban consumers actively choose eco-friendly products. This aligns with a broader trend where two-thirds of urban Indian consumers prioritize environmentally responsible actions from businesses, such as using eco-friendly materials and reducing carbon footprints.

- Rise in Health Consciousness (Health & Lifestyle Impact): India is experiencing a growing trend of health consciousness, leading to an increasing focus on healthy lifestyle choices such as the use of reusable water bottles. Consumers are now more aware of the benefits of hydration and are actively seeking health-centric products. This shift towards healthier habits has contributed to the rising demand for reusable water bottles, as they align with a sustainable and health-conscious lifestyle, promoting regular hydration while avoiding the environmental impact of single-use plastics.

Market Challenges

- Competition with Single-Use Bottles (Price Sensitivity): Despite a growing shift towards sustainability, reusable water bottles face substantial competition from cheaper, single-use plastic bottles. These single-use options are more affordable for many consumers, particularly in rural and semi-urban areas where price sensitivity is higher. The cost disparity between reusable and disposable bottles poses a significant challenge, as many consumers still prefer the low upfront cost of single-use bottles, slowing the adoption of reusable alternatives.

- Limited Penetration in Rural Areas (Geographical Barriers): The adoption of reusable water bottles remains limited in rural areas due to a combination of lower awareness and reduced accessibility. Rural regions, which comprise a large portion of the population, often have less exposure to eco-friendly products. Additionally, the lack of infrastructure and distribution channels to deliver sustainable alternatives, coupled with traditional consumption habits, creates a significant barrier for reusable water bottle manufacturers aiming to penetrate these markets.

India Reusable Water Bottle Market Future Outlook

The India reusable water bottle market is expected to witness significant growth in the coming years, driven by several factors. Increasing consumer awareness regarding the harmful effects of plastic waste and the introduction of government regulations banning single-use plastic products are key drivers. Additionally, as environmental sustainability continues to be a central theme for consumers, demand for reusable water bottles is likely to rise.

Market Opportunities

- Growth in E-Commerce Channels (Online Retail Expansion): The rise of e-commerce has become a vital avenue for the growth of reusable water bottles in India. Online retail platforms, such as Amazon and Flipkart, prominently feature eco-friendly products, increasing visibility and sales for reusable bottles. The growing trend of online shopping has created substantial opportunities for market players to tap into India's expanding e-commerce market, offering convenient access to sustainable alternatives for consumers across different regions.

- Demand for Customizable Bottles (Personalization Trends): Customizable and personalized reusable water bottles are becoming increasingly popular, especially among younger consumers. People seek products that reflect their individual preferences, such as unique designs and color schemes, encouraging manufacturers to offer more customizable options. This growing demand presents a valuable opportunity for businesses to cater to personalization trends, positioning themselves in a market focused on individuality and sustainability.

Scope of the Report

|

Product Type |

Plastic Stainless Steel Glass Aluminum |

|

Distribution Channel |

Offline (Retail Stores, Supermarkets) Online (E-Commerce, D2C) |

|

End-User |

Residential, Commercial Institutional |

|

Material Type |

BPA-free Plastic Stainless Steel Tritan Glass |

|

Region |

North South West East |

Products

Key Target Audience

Reusable Bottle Manufacturers

Eco-conscious Consumers

Retailers and Wholesalers

E-commerce Platforms

Corporate and Institutional Buyers

Investors and Venture Capital Firms

Government and Regulatory Bodies (Ministry of Environment, Forest and Climate Change, Government of India)

Companies

Major Players

Tupperware India

Milton

Cello World

Borosil

Signoraware

Pigeon

Himalayan Water

EcoRight

Steelbird

Camelbak

Thermos India

Klean Kanteen

Nirlon

Aquafina

Vaya India

Table of Contents

1. India Reusable Water Bottle Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate (Annual Growth Rate %)

1.4. Market Segmentation Overview

2. India Reusable Water Bottle Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. India Reusable Water Bottle Market Analysis

3.1. Growth Drivers

3.1.1. Rise in Health Consciousness (Health & Lifestyle Impact)

3.1.2. Government Initiatives on Plastic Reduction (Environmental Regulations)

3.1.3. Increasing Consumer Awareness on Sustainability (Eco-friendly Trends)

3.1.4. Expanding Urbanization (Urban Consumer Trends)

3.2. Market Challenges

3.2.1. Competition with Single-Use Bottles (Price Sensitivity)

3.2.2. Limited Penetration in Rural Areas (Geographical Barriers)

3.2.3. High Cost of Branded Bottles (Price Competitiveness)

3.3. Opportunities

3.3.1. Growth in E-Commerce Channels (Online Retail Expansion)

3.3.2. Demand for Customizable Bottles (Personalization Trends)

3.3.3. Increasing Corporate and Institutional Adoption (B2B Market Demand)

3.4. Trends

3.4.1. Use of Advanced Materials (BPA-free, Stainless Steel, Glass)

3.4.2. Adoption of Smart Water Bottles (IoT-enabled)

3.4.3. Shift Toward Premium Products (Luxury & Lifestyle Bottles)

3.5. Government Regulations

3.5.1. Plastic Waste Management Rules (Ban on Single-Use Plastics)

3.5.2. Green Certification Programs (Sustainability Certifications)

3.5.3. Import Duties on Raw Materials (Pricing Influence)

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. India Reusable Water Bottle Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Plastic Reusable Bottles

4.1.2. Stainless Steel Bottles

4.1.3. Glass Reusable Bottles

4.1.4. Aluminum Bottles

4.2. By Distribution Channel (In Value %)

4.2.1. Offline (Retail Stores, Supermarkets)

4.2.2. Online (E-Commerce, Direct-to-Consumer)

4.3. By End-User (In Value %)

4.3.1. Residential

4.3.2. Commercial

4.3.3. Institutional

4.4. By Material Type (In Value %)

4.4.1. BPA-free Plastic

4.4.2. Stainless Steel

4.4.3. Tritan

4.4.4. Glass

4.5. By Region (In Value %)

4.5.1. North

4.5.2. South

4.5.3. West

4.5.4. East

5. India Reusable Water Bottle Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1. Tupperware India

5.1.2. Milton

5.1.3. Cello World

5.1.4. Nirlon

5.1.5. Borosil

5.1.6. Signoraware

5.1.7. Pigeon

5.1.8. Aquafina

5.1.9. Himalayan Water

5.1.10. Thermos India

5.1.11. Camelbak

5.1.12. Klean Kanteen

5.1.13. Vaya India

5.1.14. EcoRight

5.1.15. Steelbird

5.2 Cross Comparison Parameters (Revenue, Product Range, Sustainability Initiatives, Distribution Reach, Market Share, No. of Employees, Headquarters, Inception Year)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. India Reusable Water Bottle Market Regulatory Framework

6.1. Environmental Standards

6.2. Compliance Requirements

6.3. Certification Processes

7. India Reusable Water Bottle Future Market Size (In USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. India Reusable Water Bottle Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Distribution Channel (In Value %)

8.3. By End-User (In Value %)

8.4. By Material Type (In Value %)

8.5. By Region (In Value %)

9. India Reusable Water Bottle Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The first step involves mapping the entire India Reusable Water Bottle Market ecosystem, identifying major stakeholders like manufacturers, retailers, and customers. This phase relies on extensive desk research from secondary sources and proprietary databases to gather comprehensive data on market trends, consumer preferences, and competitive dynamics.

Step 2: Market Analysis and Construction

In this step, historical data related to the India Reusable Water Bottle Market is gathered and analyzed, focusing on factors like consumer behavior, brand loyalty, and geographical market penetration. This data helps estimate current and future revenue generation and the competitive position of key players.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses related to market growth drivers, challenges, and consumer trends are developed. These are validated through interviews with industry experts, enabling a better understanding of market dynamics. Consultations provide first-hand insights into product demand, competition, and market growth.

Step 4: Research Synthesis and Final Output

In the final stage, insights from manufacturers and retailers are compiled to refine and validate the market analysis. The information gathered from multiple stakeholders ensures a well-rounded, accurate view of the reusable water bottle market, making it highly credible for business professionals.

Frequently Asked Questions

01 How big is the India Reusable Water Bottle Market?

The India Reusable Water Bottle Market is valued at USD 427.5 million, driven by increasing consumer demand for sustainable products and government initiatives promoting environmental awareness.

02 What are the challenges in the India Reusable Water Bottle Market?

Challenges in India Reusable Water Bottle Market include competition from low-cost plastic bottles, high pricing of premium reusable bottles, and limited penetration in rural areas. However, increasing environmental awareness continues to mitigate these barriers.

03 Who are the major players in the India Reusable Water Bottle Market?

Key players in India Reusable Water Bottle Market include Tupperware India, Milton, Cello World, EcoRight, and Borosil. These brands dominate due to their wide product ranges, strong distribution networks, and focus on sustainability.

04 What drives growth in the India Reusable Water Bottle Market?

The India Reusable Water Bottle Market is driven by increasing consumer awareness of plastic pollution, government regulations banning single-use plastics, and growing demand for eco-friendly products. The rise in health consciousness is also a key growth driver.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.