India Rheumatoid Arthritis Market Outlook to 2030

Region:Asia

Author(s):Shambhavi

Product Code:KROD3234

November 2024

82

About the Report

India Rheumatoid Arthritis Market Overview

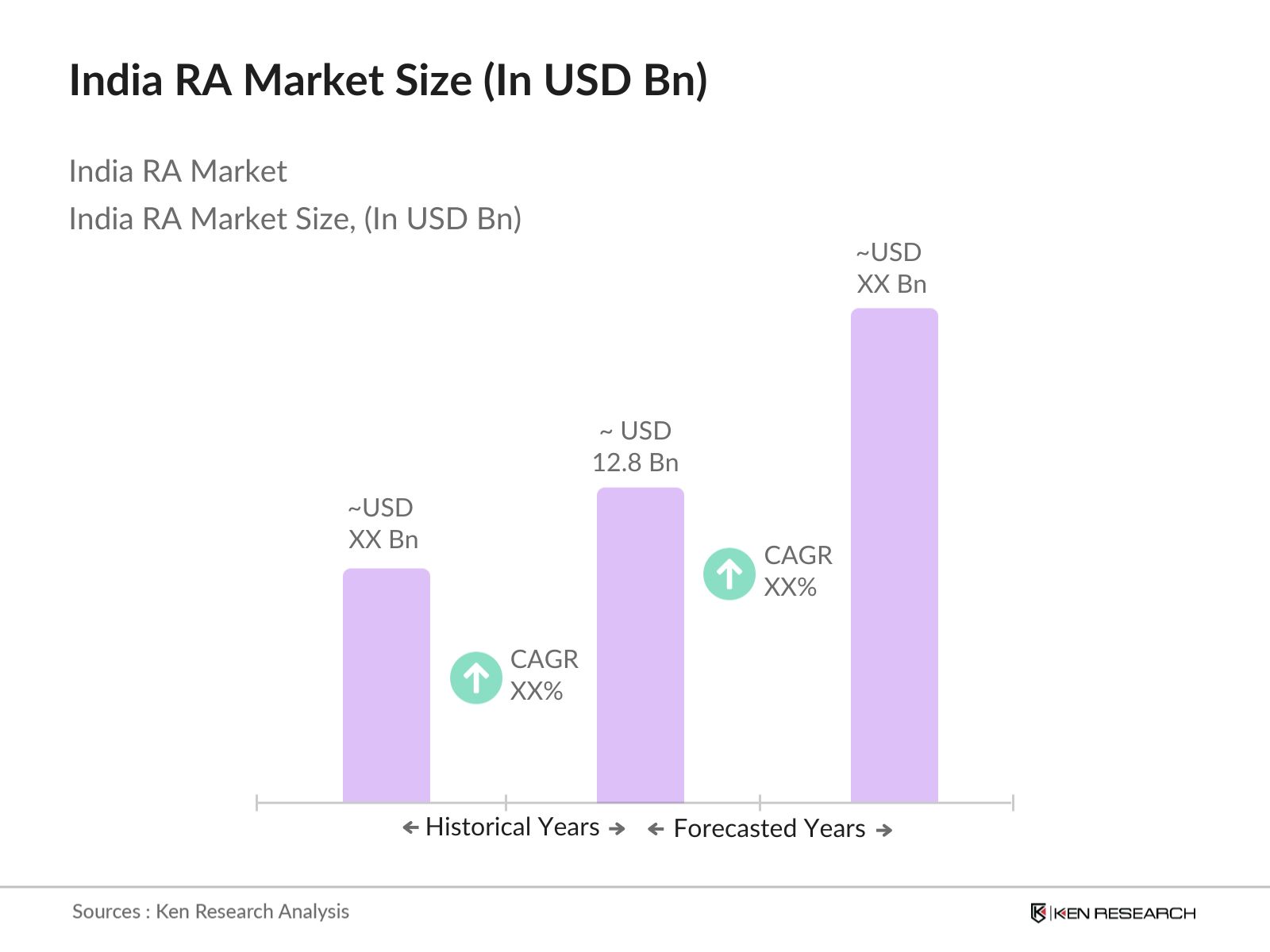

- The India Rheumatoid Arthritis market is valued at INR 12.8 billion, based on a five-year historical analysis. The market size is primarily driven by the increasing prevalence of Rheumatoid Arthritis among the aging population and growing awareness about early diagnosis and treatment options. Additionally, advancements in biologic therapies and government support through health schemes further push the markets growth trajectory.

- The Rheumatoid Arthritis market is dominated by cities like Mumbai, Delhi, and Bangalore due to their advanced healthcare infrastructure, availability of specialized rheumatology centers, and access to innovative treatments like biologics. These cities also benefit from a high concentration of specialists and well-established pharmaceutical supply chains, facilitating better treatment accessibility and delivery.

- The Indian governments initiatives, such as the National Programme for Prevention and Control of Cancer, Diabetes, Cardiovascular Diseases & Stroke (NPCDCS), are critical for managing chronic conditions like Rheumatoid Arthritis. In 2024, the program received USD 1.5 billion in funding, with a substantial portion dedicated to chronic disease management. This initiative has enabled better early diagnosis, preventive care, and management of Rheumatoid Arthritis in both urban and rural settings. Healthcare facilities under this scheme cater to millions of Rheumatoid Arthritis patients across the country.

India Rheumatoid Arthritis Market Segmentation

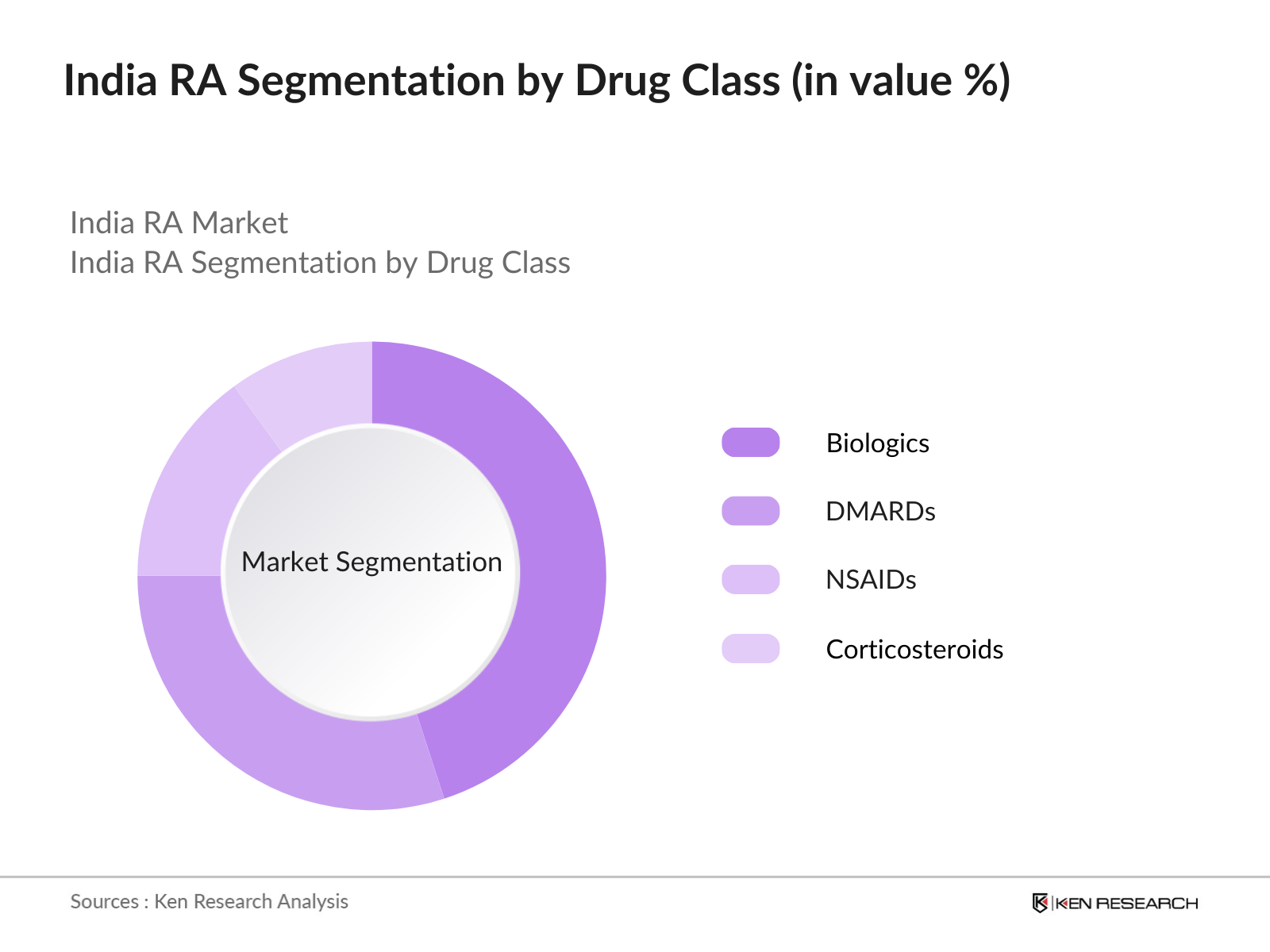

By Drug Class: The India Rheumatoid Arthritis market is segmented by drug class into biologics, DMARDs (Disease Modifying Anti-Rheumatic Drugs), NSAIDs, and corticosteroids. Among these, biologics have emerged as the dominant segment. The prominence of biologics in the Indian Rheumatoid Arthritis market stems from their targeted approach in inhibiting specific pathways involved in the disease process, leading to better patient outcomes. Moreover, the introduction of biosimilars, which offer cost-effective alternatives to expensive biologics, has contributed to their increased uptake across the country.

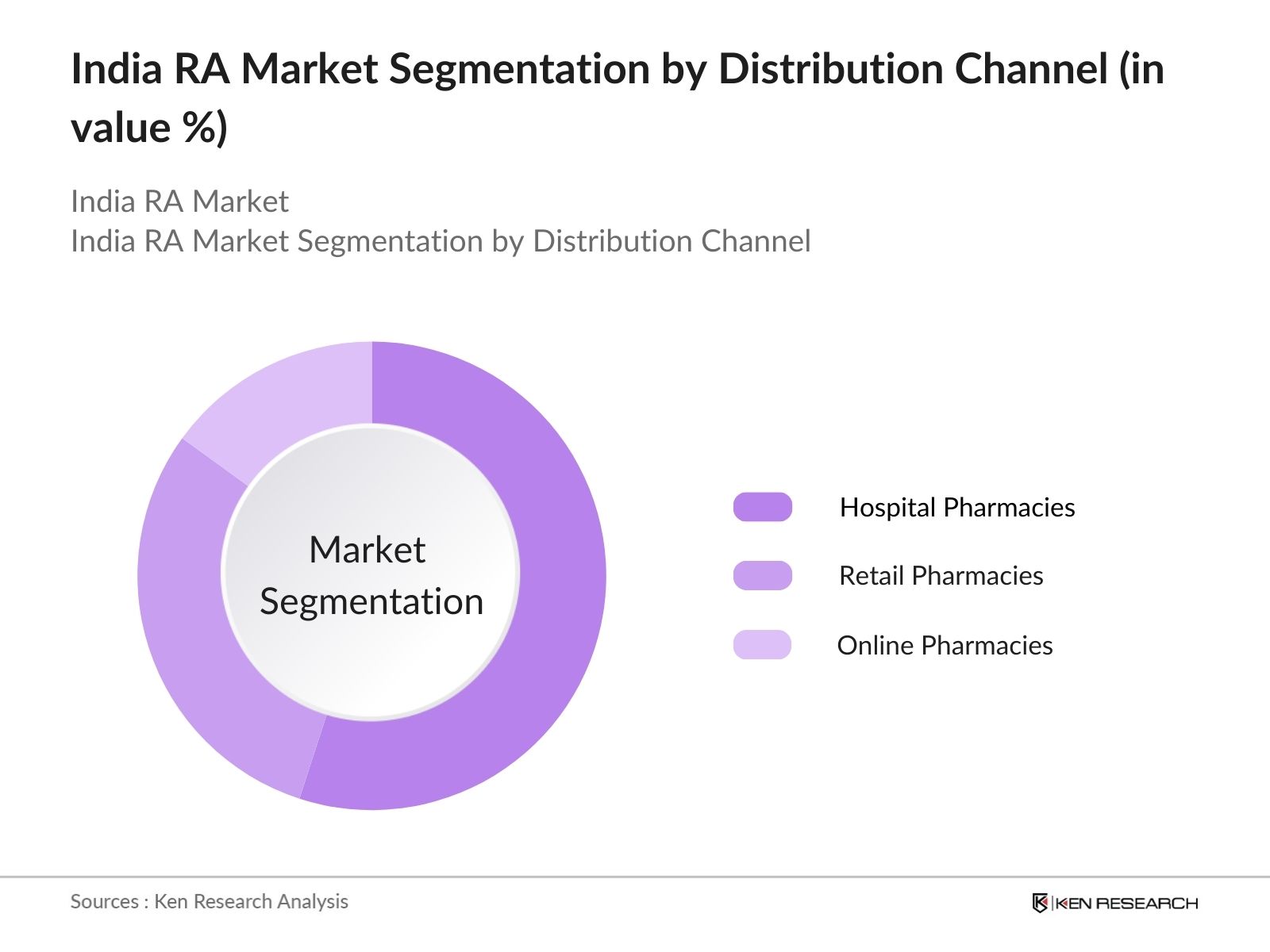

By Distribution Channel: The distribution of Rheumatoid Arthritis treatments is segmented into hospital pharmacies, retail pharmacies, and online pharmacies. Hospital pharmacies hold the dominant market share due to the complex nature of Rheumatoid Arthritis treatments, which often require specialized handling and administration. Additionally, biologic drugs, which are often injected, are commonly dispensed through hospital networks to ensure proper administration under medical supervision.

Competitive Landscape

The India Rheumatoid Arthritis market is consolidated with key pharmaceutical players dominating the market. The major companies leverage extensive distribution networks, strong research and development pipelines, and strategic partnerships with international brands. The India Rheumatoid Arthritis market is dominated by a few major players, including Sun Pharmaceuticals, Cipla, and Dr. Reddys Laboratories, which have strong research and development capabilities and broad distribution networks. Their dominance is further enhanced by their ability to navigate regulatory pathways efficiently and offer innovative treatment options such as biologics and biosimilars.

|

Company |

Year Established |

Headquarters |

Drug Portfolio |

Market Reach |

R&D Investments |

Regulatory Approvals |

Therapeutic Focus |

Collaborations |

|

Sun Pharmaceuticals |

1983 |

Mumbai, India |

||||||

|

Cipla Ltd. |

1935 |

Mumbai, India |

||||||

|

Lupin Limited |

1968 |

Mumbai, India |

||||||

|

Dr. Reddys Laboratories |

1984 |

Hyderabad, India |

||||||

|

Torrent Pharmaceuticals |

1959 |

Ahmedabad, India |

India Rheumatoid Arthritis Market Analysis

Growth Drivers

- Aging Population and Increased Incidence of Rheumatoid Arthritis: India's aging population is a significant driver for the rise in rheumatoid arthritis (Rheumatoid Arthritis). In 2024, approximately 139 million people in India are aged 60 or above, a demographic heavily prone to chronic conditions like Rheumatoid Arthritis. The prevalence of Rheumatoid Arthritis in India is around 0.75% of the total population, affecting nearly 10 million people. This has led to increased healthcare demands and challenges in managing chronic illnesses. The World Bank notes that India's population over 60 years is expected to grow by 41% by 2031, further stressing healthcare infrastructure.

- Increasing Healthcare Spending (Healthcare Expenditure % of GDP): Indias healthcare spending has been rising steadily, contributing to better Rheumatoid Arthritis care. In 2024, India is projected to spend approximately USD 88 billion on healthcare, with healthcare expenditure representing around 3.5% of the GDP. This increase supports the expansion of healthcare infrastructure, diagnosis, and treatment capabilities, especially for chronic diseases like Rheumatoid Arthritis. Government health schemes such as Ayushman Bharat also play a critical role in providing access to Rheumatoid Arthritis treatments across both urban and rural regions.

- Advancements in Biologics and Biosimilars (Biologics Market Contribution): India has witnessed a significant rise in the availability and use of biologics and biosimilars to treat Rheumatoid Arthritis. In 2024, biologics contribute over USD 1.2 billion to India's overall pharmaceuticals market. Several key biologics have received regulatory approval in India, enhancing treatment options for Rheumatoid Arthritis patients. The increase in biosimilar manufacturing capabilities in India, backed by government incentives for biotechnology research, ensures broader access to these advanced treatments, helping reduce the disease burden.

Market Challenges

- High Cost of Rheumatoid Arthritis Treatments (Cost Analysis): Rheumatoid Arthritis treatments, particularly biologics, are expensive, making them inaccessible to a large portion of the Indian population. The average annual cost of Rheumatoid Arthritis biologic treatment in India can range between INR 100,000 to INR 200,000 in 2024, depending on the severity and required medication. Although government schemes provide some relief, a vast majority of patients in rural areas remain underserved due to high out-of-pocket expenses. This high cost continues to be a significant barrier to widespread Rheumatoid Arthritis treatment access.

- Lack of Early Diagnosis (Patient Access to Diagnosis Rates): The lack of early diagnosis in Rheumatoid Arthritis remains a persistent challenge in India. In 2024, it is estimated that only 35% of Rheumatoid Arthritis patients receive a diagnosis within the first year of symptom onset, leading to delayed treatment and worsened outcomes. Diagnostic infrastructure, especially in rural areas, is insufficient, with less than 20% of rural patients having access to proper diagnostic facilities. The government has been working to improve access to diagnostic services, but it remains a slow process.

Future Outlook

Over the next few years, the India Rheumatoid Arthritis market is expected to experience substantial growth driven by a combination of factors, including the introduction of new biologic therapies, improved patient access to treatment, and a growing elderly population. Government initiatives to improve healthcare access in rural areas and advancements in personalized medicine are also set to fuel market expansion. The increasing prevalence of lifestyle diseases and autoimmune disorders, including rheumatoid arthritis, will necessitate ongoing innovation in drug development and delivery.

Market Opportunities

- Growth of Telemedicine for Rheumatoid Arthritis Care (Telemedicine Adoption Rate): Telemedicine has grown as a vital tool in Rheumatoid Arthritis care, especially in remote regions. In 2024, India recorded more than 150 million telemedicine consultations, driven by government initiatives and private healthcare platforms. Telemedicine allows Rheumatoid Arthritis patients in rural and semi-urban areas to access specialist consultations without the need to travel, helping bridge the healthcare accessibility gap. Government regulations on telemedicine, introduced in 2020, have accelerated the growth of this sector, creating opportunities for improved Rheumatoid Arthritis management across the country.

- Expansion of Private Health Insurance (Insurance Penetration): The expansion of private health insurance in India has created more opportunities for Rheumatoid Arthritis patients to access expensive treatments like biologics. In 2024, more than 520 million Indians are covered under private or government-backed health insurance schemes, a significant increase from 450 million in 2022. Private insurance plans are increasingly offering coverage for chronic diseases, including Rheumatoid Arthritis, which helps alleviate the financial burden of treatment. The growing insurance penetration is expected to boost access to Rheumatoid Arthritis care.

Scope of the Report

|

Segment |

Sub-segments |

|

By Treatment Type |

NSAIDs, DMARDs, Biologics, Corticosteroids |

|

By Route of Administration |

Oral, Injectable, Intravenous |

|

By End-User |

Hospitals, Specialty Clinics, Homecare Settings |

|

By Distribution Channel |

Hospital Pharmacies, Retail Pharmacies, Online Pharmacies |

|

By Region |

North India, South India, East India, West India |

Products

Key Target Audience

Pharmaceutical Manufacturers

Healthcare Providers (Hospitals, Specialty Clinics)

Biopharmaceutical Companies

Insurance Companies and Healthcare Payers

Investors and Venture Capitalist Firms

Rheumatology Research Institutes

Distribution Networks (Hospital Pharmacies, Retail Pharmacies)

Government and Regulatory Bodies (CDSCO, DCGI)

Companies

Major Players mentioned in the Report

Sun Pharmaceuticals

Cipla Ltd.

Lupin Limited

Dr. Reddys Laboratories

Torrent Pharmaceuticals

Zydus Cadila

Glenmark Pharmaceuticals

Biocon

Mylan N.V.

Pfizer India

Novartis India

Roche India

Sanofi India

AstraZeneca India

Johnson & Johnson India

Table of Contents

1. India RA Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. India RA Market Size (In INR Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. India RA Market Analysis

3.1. Growth Drivers

3.1.1. Aging Population and Increased Incidence of RA

3.1.2. Increasing Healthcare Spending (Healthcare Expenditure % of GDP)

3.1.3. Advancements in Biologics and Biosimilars (Biologics Market Contribution)

3.1.4. Government Initiatives for Chronic Disease Management (Healthcare Programs)

3.2. Market Challenges

3.2.1. High Cost of RA Treatments (Cost Analysis)

3.2.2. Lack of Early Diagnosis (Patient Access to Diagnosis Rates)

3.2.3. Limited Access to Biologics in Rural Areas (Healthcare Infrastructure)

3.2.4. Competition from Generic Drug Manufacturers (Market Penetration)

3.3. Opportunities

3.3.1. Growth of Telemedicine for RA Care (Telemedicine Adoption Rate)

3.3.2. Expansion of Private Health Insurance (Insurance Penetration)

3.3.3. Increasing Research into New Treatment Modalities (R&D Investment)

3.3.4. Global Clinical Trials in India (Trial Participation Rates)

3.4. Trends

3.4.1. Personalized Treatment for RA Patients (Genomic Applications)

3.4.2. Increasing Adoption of Biosimilars (Biosimilar Market Share)

3.4.3. Collaborations Between Hospitals and Pharma Companies (Partnership Deals)

3.4.4. Use of AI in RA Diagnostics (AI Implementation)

3.5. Government Regulations

3.5.1. Regulation of Biologics and Biosimilars (Approval Process)

3.5.2. Patent Laws Affecting RA Drug Manufacturers (Patent Expirations)

3.5.3. Government Subsidies for RA Drugs (Subsidy Allocation)

3.5.4. National Health Mission for Chronic Diseases (Program Scope)

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces

3.9. Competitive Ecosystem

4. India RA Market Segmentation

4.1. By Treatment Type (In Value %)

4.1.1. Non-Steroidal Anti-Inflammatory Drugs (NSAIDs)

4.1.2. Disease-Modifying Anti-Rheumatic Drugs (DMARDs)

4.1.3. Biologics and Biosimilars

4.1.4. Corticosteroids

4.2. By Route of Administration (In Value %)

4.2.1. Oral

4.2.2. Injectable

4.2.3. Intravenous

4.3. By End-User (In Value %)

4.3.1. Hospitals

4.3.2. Specialty Clinics

4.3.3. Homecare Settings

4.4. By Distribution Channel (In Value %)

4.4.1. Hospital Pharmacies

4.4.2. Retail Pharmacies

4.4.3. Online Pharmacies

4.5. By Region (In Value %)

4.5.1. North India

4.5.2. South India

4.5.3. East India

4.5.4. West India

5. India RA Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Cipla Ltd.

5.1.2. Sun Pharmaceutical Industries Ltd.

5.1.3. Lupin Limited

5.1.4. Dr. Reddys Laboratories Ltd.

5.1.5. Biocon Limited

5.1.6. Zydus Cadila

5.1.7. Torrent Pharmaceuticals

5.1.8. Glenmark Pharmaceuticals

5.1.9. Aurobindo Pharma

5.1.10. Intas Pharmaceuticals Ltd.

5.1.11. Pfizer Inc.

5.1.12. AbbVie Inc.

5.1.13. Amgen Inc.

5.1.14. Novartis AG

5.1.15. Roche Holding AG

5.2. Cross Comparison Parameters (Revenue, Market Presence, Drug Pipeline, R&D Investment, Geographic Reach, Treatment Portfolio, Strategic Initiatives, No. of Employees)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. India RA Market Regulatory Framework

6.1. Indian Drug Approval Process

6.2. Compliance and Regulatory Requirements

6.3. Certification and Licensing

6.4. Guidelines for Biosimilars

7. India RA Future Market Size (In INR Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. India RA Future Market Segmentation

8.1. By Treatment Type (In Value %)

8.2. By Route of Administration (In Value %)

8.3. By End-User (In Value %)

8.4. By Distribution Channel (In Value %)

8.5. By Region (In Value %)

9. India RA Market Analysts' Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

In this phase, we construct an ecosystem map of all key stakeholders in the India RA Market. This includes hospitals, pharmaceutical companies, healthcare providers, and regulatory bodies. We collect data from secondary sources, including industry reports and government publications, to identify critical market variables.

Step 2: Market Analysis and Construction

This phase involves analyzing historical data, focusing on key market drivers such as drug availability, the ratio of hospital admissions for RA patients, and treatment outcomes. The data provides a foundation for understanding market penetration and growth patterns.

Step 3: Hypothesis Validation and Expert Consultation

We validate our market hypotheses through interviews with industry experts, rheumatologists, and pharmaceutical executives. This allows us to refine the market data and gain insights into emerging trends and treatment adoption.

Step 4: Research Synthesis and Final Output

The final phase synthesizes all the collected data, including insights from manufacturers and healthcare providers, into a cohesive report. This phase ensures that the data is accurate and provides actionable insights for industry stakeholders.

Frequently Asked Questions

1. How big is the India RA Market?

The India RA market is valued at INR 12.8 billion, driven by increased awareness, rising prevalence of autoimmune diseases, and a focus on biologic drugs for advanced treatment.

2. What are the challenges in the India RA Market?

The key challenges in the India RA market include high treatment costs, limited access to biologic drugs in rural areas, and the regulatory complexities surrounding drug approvals.

3. Who are the major players in the India RA Market?

Key players in the market include Sun Pharmaceuticals, Cipla Ltd., Lupin Limited, and Dr. Reddys Laboratories. These companies have established strong footholds due to their extensive drug portfolios and distribution networks.

4. What are the growth drivers of the India RA Market?

The market is propelled by factors such as an aging population, the introduction of cost-effective biosimilars, and increased government initiatives to improve healthcare access, particularly in rural regions.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.