India Road Freight Market Outlook to 2024

Driven by BS VI Norms, revision in Existing Axle Norms by the Government and Technological Advancements

Region:Asia

Author(s):Apoorva Narula

Product Code:KR994

June 2020

53

About the Report

The report titled “India Road Freight Market Outlook to 2024 – Driven by BS VI Norms, revision in Existing Axle Norms by the Government and Technological Advancements” provides a comprehensive analysis on the . The report covers various aspects including the current logistics scenario in India, its components viz, freight transportation, warehousing, CEP and VAS. The report specially focuses on Road freight market highlighting its issues and challenges, major growth drivers, investment in infrastructure, tech disruptions and innovations, and competition benchmarking. The report concludes with market projections for future of the Road freight market including forecasted industry size by Revenue.

India Logistics Market Overview and Size

India Logistics Sector has witnessed a robust CAGR with highest share to freight forwarding Market followed by Warehousing, Courier parcel and Express market and VAS Market. Road freight is the dominant mode with transportation to Domestic Flow corridors and international Neighboring Countries also. Many real estate developers such as Indospace, Logos India, ESR and many more are making constant investments in warehousing market in Gurgaon, Chennai and Mumbai. E commerce sector is becoming extremely popular with introduction of online payments such as Amazon Pay, Paytm, Gpay and new popular delivery apps.

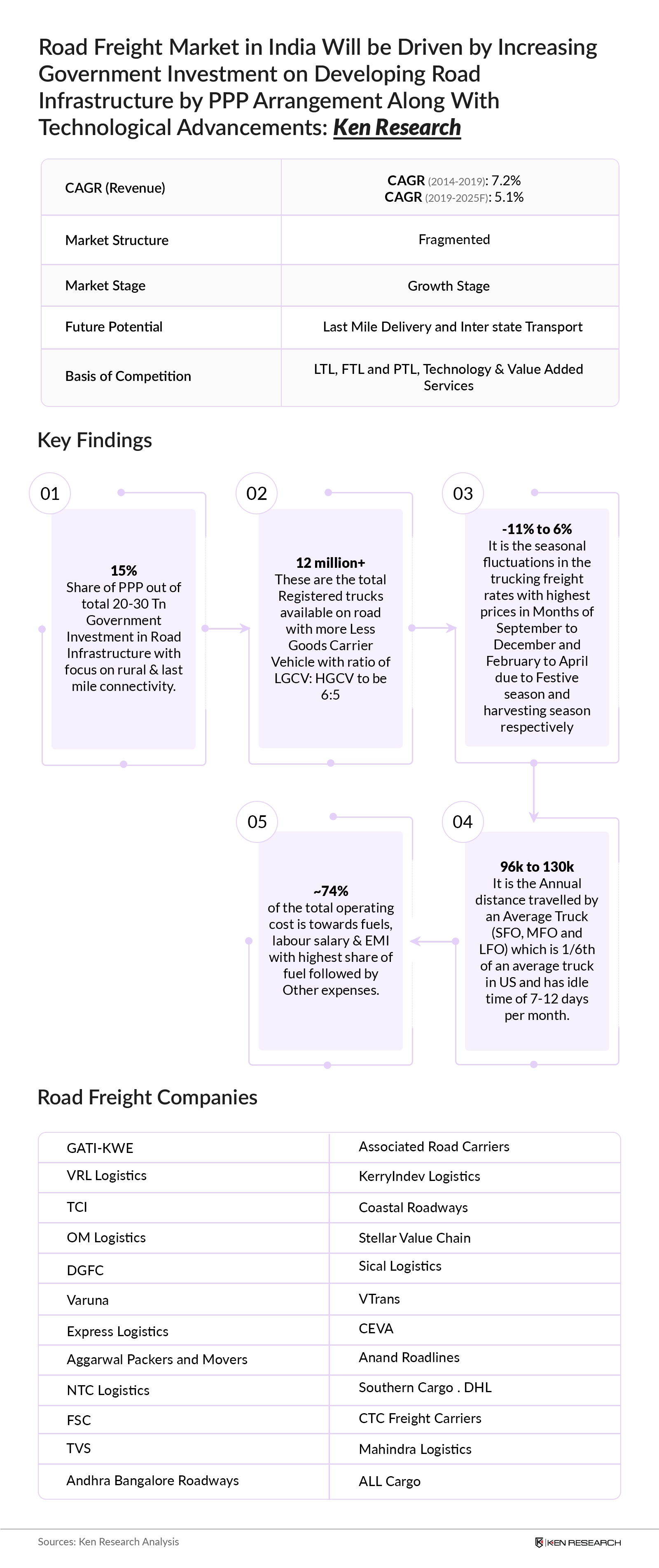

India Road Freight Market Overview and Size

Small fleet owners dominated industry (70% of all fleet) operating at a margin of 8-12% and average transaction days of 12-15 per month. SFOs primarily operating on Spot bookings while MFOs and LFOs working on LHAs. India Road Freight Market has witnessed an average CAGR during 2014-19 due to revision in BF VI Norms, Scrappage Policy, GST and new axle norms from the Government with rise in Average highway construction of Roads. The developments of Bhratamala Pariyojana and the Sagarmala projects and the Eastern and Western Dedicated Freight Corridors, Developments of ports along with Public Private partnership Projects has stimulated the growth in the market. On the front of assessing seasonality fluctuations in demand, Freight rates usually high during festive season in September-December with WAFC being ₹ 2.58/tonnes/km in 2019.

India Road Freight Market Segmentation

Road Freight Market Segmentation by LTL and FTL: The Road freight market is dominated by FTL by revenues and by Volume. The average freight cost charged for LTL is higher than FTL due to additional risk in carrying multiple loads, higher insurance cost and more.

Road Freight Market Segmentation by type of trucks: There are 12 million+ trucksin India, with net additions of over 6 lakh trucks in the market annuallyand there exist 40+ variants of trucks in the market.The Country is dominated by Light Goods Carrier Vehicles in comparison to High Goods Carrier Vehicles. The ratio of LCGV to HGCV is around 6:5. The LCGVs are expected to remain the dominant category in India Trucking Market.

Competitive Landscape of Major Players Operating in the India Road Frieght Market

The trucking Industry in India are extremely fragmented in nature. The trucking Industry is dominated by local domestic players who have large number of fleets and providing competitive prices. Big Companies such as Mahindra and All Cargo are moving towards Asset Light Model, subcontracting with local transport vendors and provide Value added services such as Kitting, Assembling, packing and other which are very important in road freight market. Online platforms such as Blackbuck, TruckOla, rivigo and many more are disrupting the logistics space. The major players in the India Road freight market include GATI, VRL logistics, TCI, Om Express, DGFC, Varuna, Express logistics and many more.

India Road Freight Market Future Outlook & Projections:

The Trucking Industry in India will be impacted by COVID in the country and is expected to revive back in 2021 with faster growth rate. The truckers who have bought trucks with 50-100% institutional finance will see a tough time and need to maintain 90% capacity utilisation for upcoming EMIs, Insurance premiums & Permit with same freight cost in spite of high diesel cost. This is due to disturbed production- consumption cycle with only 30% of trucks operating with cut throat competition for loads. Increasing Demand of e commerce products, growing Reefer trucks, technical innovations such as E vehicles, Fleet Management Software and more are disrupting the competition space.

Key Topics Covered in the Report

- India Logistics and Warehousing Market Introduction

- Logistics Infrastructure

- Cross Comparison of Logistics Performance in Different Countries (Germany, US, India, Australia, China, Vietnam, Philippines)

- India Logistics and Warehousing Market Size

- India Logistics and Warehousing Market Segmentation

- India Logistics and Warehousing Market Future Outlook

- India Logistics and Warehousing Market Future Segmentation

- India Freight Market Size

- India Freight Market Segmentation

- India Freight Market Future Outlook

- India Freight Market Future Segmentation

- India Trucking Market size

- India Trucking Ecosystem

- India Trucking Market Segmentation

- India Trucking Market Future Outlook

- India Trucking Market Future Segmentation

- Innovations in Transportation Market

- Investment Model on Road freight transportation

- Regulatory Environment

- Issues and Challenges

Products

Key Target Audience

Freight Forwarding Companies

E Commerce Logistics Companies

3PL Companies

Consultancy Companies

Logistics/Warehousing Companies

Time Period Captured in the Report:-

Historical Period – FY14-FY19

Forecast Period – FY20-FY24

Companies

Key Segments Covered

Freight Forwarding Market

By Mode of Transportation

Road Freight (Fleets, Volume, FTK, Price/ton/km and Revenue)

Sea Freight (Volume, Price/ton/km, Revenue and Inland Coastal Shipping Price/ton/km)

Air Freight (Volume, Price/ton/km and Revenue)

By Road transportation

Less than Truck load ( Revenue)

Full truck load (Revenue)

By Type of Fleets ( Number of Fleets)

Less Goods Carrier Vehicles

High Goods Carrier Vehicles

Companies Covered

GATI-KWE

VRL Logistics

TCI

OM Logistics

DGFC

Varuna

Express Logistics

Aggarwal Packers and Movers

NTC Logistics

FSC

Associated Road Carriers

KerryIndev Logistics

Coastal Roadways

Stellar Value Chain

Sical Logistics

VTrans

CEVA

Anand Roadlines

Southern Cargo

Andhra Bangalore Roadways

DHL

CTC Freight Carriers

Mahindra Logistics

ALL Cargo

TVS

Table of Contents

1. India Overview and Logistics Market

India Overview (Major Industries, Major Imports and Importers, Exports and Exporters, logistics cost as % of GDP)

Logistics Infrastructure: Road and Rail (Major Flow corridors by road and rail)

Logistics Infrastructure: Major Seaports and Airports, Coastal Shipping (Capacity, Throughput, Capacity Utilization, Import Share, Reefer Plugs for Air)

India Logistics Current and Future Market Size (Freight forwarding, warehousing, CEP, VAS), FY19-FY24

Indian Logistics International Benchmarking (Cross Comparison between Germany, US, China, Australia, Veitnam, India, India on the basis of LPI), FY19-FY24

Tax Regime in India: GST on Warehousing Services, Road Transport Services and Tax Liability of Parties

Tax Regime in India: Corporate Tax

2. Indian Freight Transportation Market

Pain points of Trucking Industry

Road Freight Market Supply ecosystem (Small, medium and large fleet operators)

Seasonality factors

Government Norms Creating a New Normal for Road Freight Showcasing GST, Scrappage Policy and Revision in Axle Load Norms

New Axle Load Norms: Impact on Truck Performance and Freight

BS VI Norms: Impact on Auto Industry

Target Audience (Beverages, Soft drinks, Consumer appliances, Consumer Electronics, Beauty/ Personal care, Hygeine, tobacco, Apparel and others)

Indian Freight forwarding market size (Market size, freight cost per ton per km for Air, sea, inland shipping, Road and Rail with Key trends)

How Indian Freight Market is Currently Positioned

Road freight Market size (Revenue, volume, FTK, Average distance travelled)

Challenges in Road freight market

Cross Comparison of major Road freight Companies in India (Parameters are trucks, Clientele, Industries, Technology, Certifications and more)

Cost component – pie composition, absolute terms assumption (32ft multi axle) (Fuel, Driver, EMI, Toll, Tire, Insurance, Maintenance, Overheads)

Innovations in Road freight market (FMS, digital aggregators, Platooning and more)

Future Market Size (Revenue by All modes of transport)

COVID Impact on Indian Trucking

3. Research Methodology

Market Definitions

Abbreviations Used

Market Sizing Approach

Consolidated Research Approach

Sample Size Inclusion

Primary Research Approach

Research Limitations and Future Conclusions

Disclaimer

Contact Us

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.