India Senior Living Market Outlook to 2030

Region:Asia

Author(s):Naman Rohilla

Product Code:KROD10718

December 2024

91

About the Report

India Senior Living Market Overview

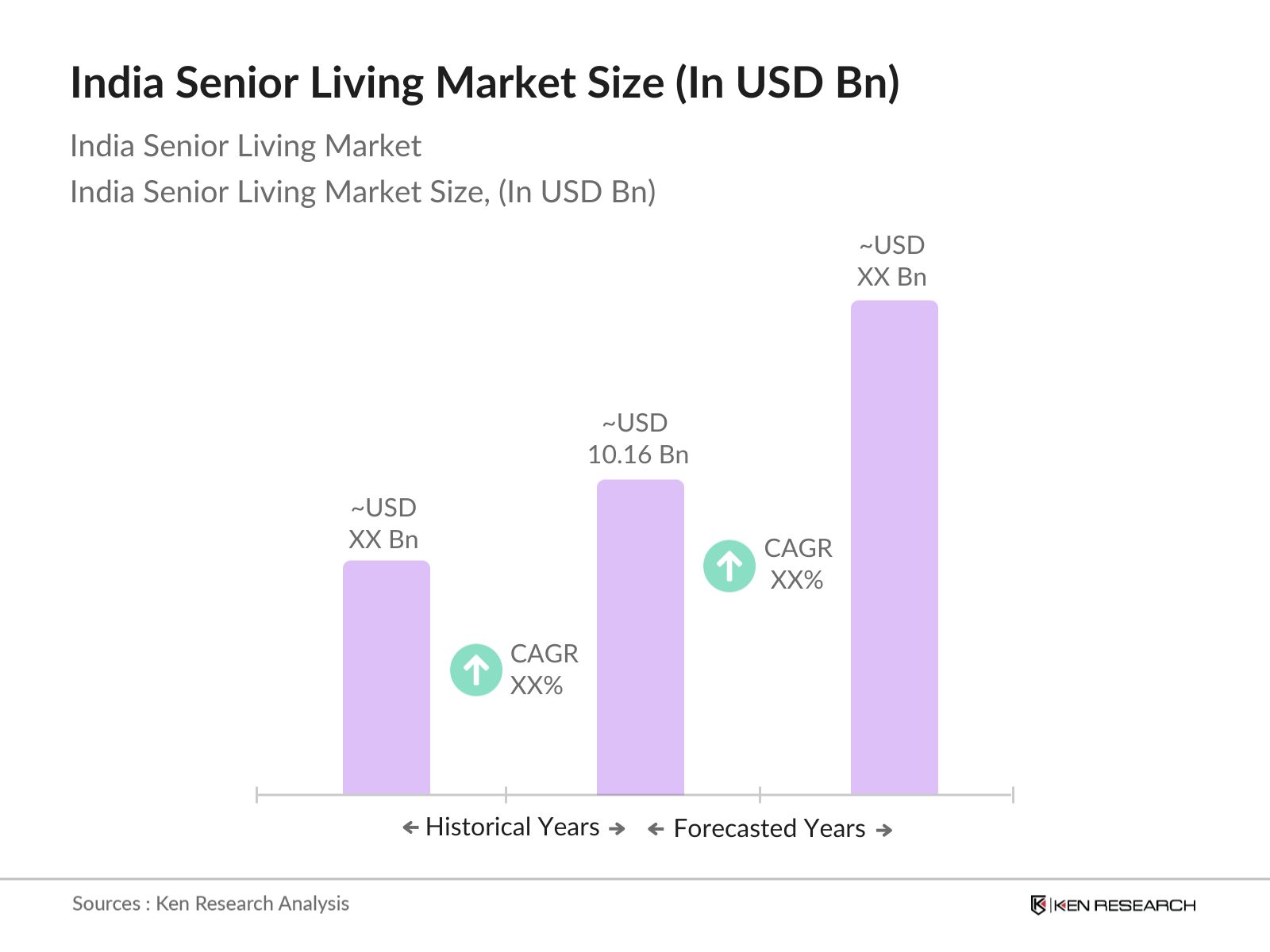

- The India senior living market is valued at USD 10.16 billion, supported by a growing aging population and an increasing shift toward nuclear family structures. This market is primarily driven by the rising demand for specialized housing solutions that cater to the unique needs of senior citizens, including healthcare services, community engagement, and enhanced living conditions. Additionally, advancements in healthcare technology and increasing investments in senior living facilities are expected to propel the market further.

- Key cities such as Bengaluru, Chennai, and Mumbai dominate the senior living market in India due to their developed infrastructure, better healthcare facilities, and a growing number of affluent retirees. These cities are experiencing a surge in demand for senior living solutions, fueled by favourable climate conditions, high quality of life, and active community involvement. Moreover, regions in South India are particularly attractive for senior living projects, given their robust healthcare systems and cultural acceptance of specialized senior housing.

- The Integrated Programme for Senior Citizens is a government initiative aimed at enhancing the welfare of seniors across India. In 2023, the program received a budget allocation of INR 400 crores, aimed at providing various services, including health care, financial support, and recreational activities. The focus on senior citizens in government policy illustrates the commitment to improving living conditions for the elderly. Such regulations and support systems encourage private investment in senior living projects, aligning the market's growth with government priorities.

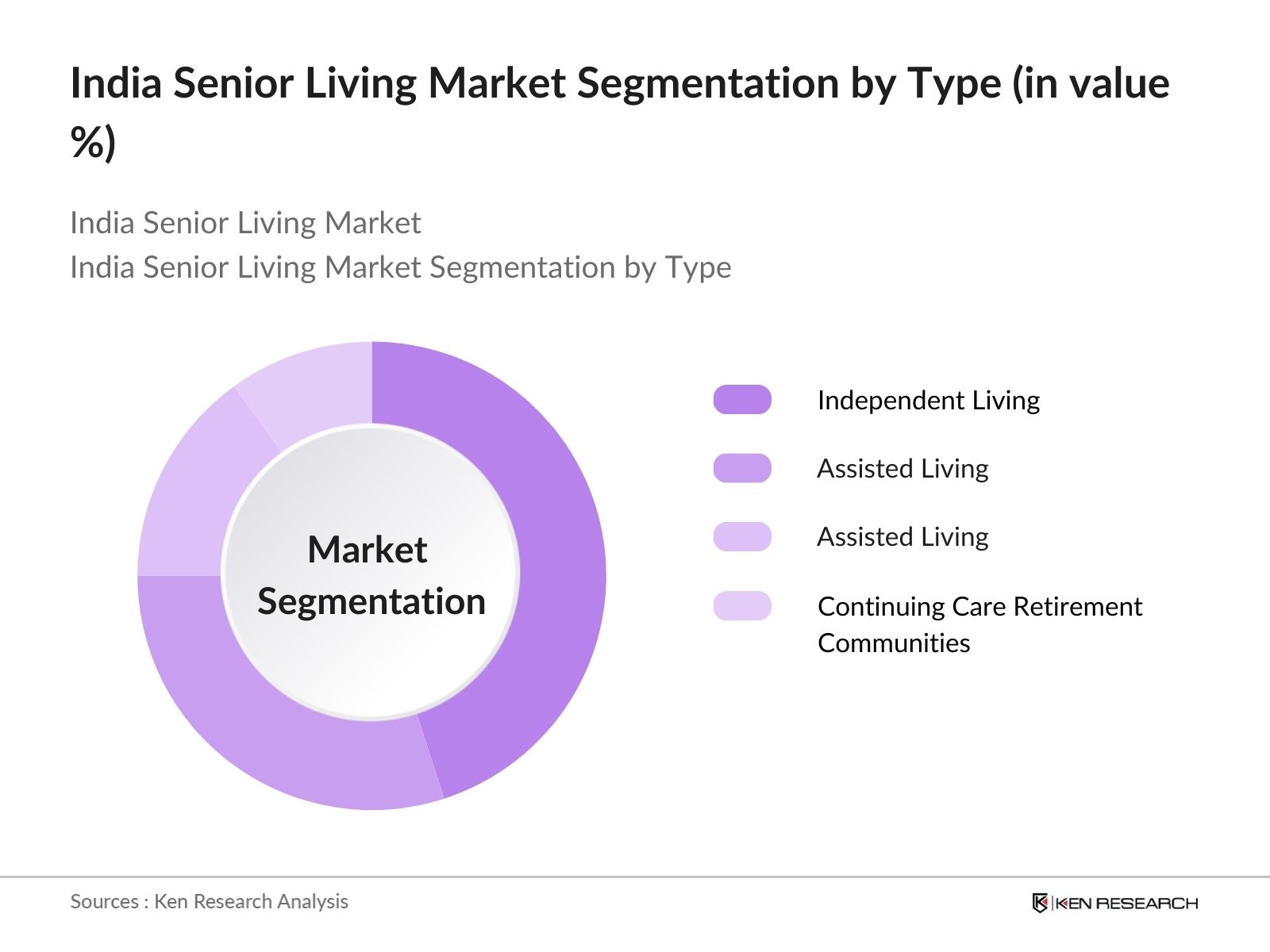

India Senior Living Market Segmentation

- By Type: The market is segmented by type into Independent Living, Assisted Living, Nursing Care, and Continuing Care Retirement Communities (CCRCs). The Independent Living segment currently holds a dominant market share due to the preference of seniors for autonomous living arrangements that still offer access to communal facilities and support services. Many older adults favor independent living because it allows them to maintain their lifestyle while having access to various amenities and healthcare options.

- By Facility Size: The market is also segmented by facility size, classified into Small-Scale Facilities and Large-Scale Developments. Large-scale developments dominate the market share as they often provide a comprehensive range of services and amenities, appealing to a larger demographic of seniors. These facilities typically offer extensive recreational options, healthcare services, and social activities, which are highly sought after by retirees looking for an engaging community. The economies of scale achieved by larger facilities allow for better service delivery and cost efficiency, thereby enhancing their attractiveness in the market.

India Senior Living Market Competitive Landscape

The India senior living market is characterized by a few major players, including Columbia Pacific Communities, Ashiana Housing Ltd., and AntaraSeniorCare. This consolidation highlights the significant influence of these key companies in shaping market trends and driving innovation. These organizations focus on creating tailored living environments that cater to the evolving needs of senior citizens, ensuring a competitive edge through superior service offerings and comprehensive care solutions.

India Senior Living Market Analysis

Market Growth Drivers

- Increased Longevity: India's life expectancy has seen growth, reaching about 70.42 years in 2022, a marked increase from previous decades. The rise in longevity is driven by advancements in healthcare, improved nutrition, and better living standards. According to the World Health Organization, the number of individuals aged 60 and above in India is projected to reach 300 million by 2030, underscoring the growing demand for senior living solutions tailored to this demographic. As longevity increases, the need for supportive living environments is critical, paving the way for a robust senior living market.

- Rise in Nuclear Families: The traditional joint family structure in India has shifted towards nuclear families, with about 70% of households now categorized as nuclear. This trend is a result of urban migration, changing societal norms, and economic factors, leading to more independent living situations. The 2021 Census reported that around 25% of Indian families consist of single individuals or couples, which enhances the demand for senior living facilities that offer community support and services. This demographic shift is expected to drive the growth of the senior living market as these families seek quality care options for aging relatives.

- Affluent Retiree Segment Growth: The affluent retiree segment in India is expanding, with over 1.5 million individuals classified as high net worth (HNW) seniors in 2022, a number projected to grow due to rising income levels and savings. The increasing wealth among retirees has led to a demand for premium senior living options that provide luxury amenities and services. Additionally, the growth in disposable income among seniors encourages investments in quality living spaces that cater to their lifestyle preferences. This affluent segment is driving the development of upscale retirement communities, fostering further investment in the senior living market.

Market Challenges

- Cultural Perceptions: In India, cultural perceptions around aging influence the senior living market. Many seniors prefer to stay with their families, with over 70% of older adults expressing a desire to live in their own homes. This deep-rooted cultural value presents a challenge for senior living facilities as they compete against traditional living arrangements. Additionally, the stigma associated with moving to a senior living community persists, often viewed as a last resort. As families grapple with caregiving responsibilities, changing these perceptions will be crucial for market growth and acceptance of senior living solutions.

- Financial Constraints: Financial barriers remain a critical challenge in the senior living market in India. A notable portion of the elderly population relies on pensions and savings, with about 60% of seniors living on less than INR 10,000 monthly. This financial limitation makes it difficult for many to afford premium senior living facilities, which often come with substantial costs. Furthermore, the lack of comprehensive financial planning services for seniors exacerbates the issue, hindering their ability to invest in suitable living environments. Addressing these financial constraints is vital for the growth and accessibility of the senior living market.

India Senior Living Market Future Outlook

Over the next five years, the India senior living market is expected to experience growth driven by an increasing aging population, urbanization, and a growing preference for specialized housing solutions. The continuous support from government initiatives aimed at improving senior care, combined with innovations in healthcare technology, will further enhance the appeal of senior living facilities. Additionally, the rising disposable income among seniors and an increasing number of affluent retirees returning to India will boost demand for high-quality senior living options.

Market Opportunities

- Technological Integration: The integration of technology into senior living is a substantial opportunity for market growth. As of 2022, about 50% of seniors are using smartphones, and 38% have access to the internet, facilitating the adoption of digital health solutions. Technologies such as telemedicine, health monitoring devices, and smart home features enhance the quality of care and independence for seniors. With the increasing emphasis on health tech, there is a growing demand for senior living facilities that incorporate these innovations, providing a competitive edge in the market. This trend is likely to drive investment in tech-enabled senior living options. Source

- Expansion in Tier II Cities: The expansion of senior living facilities into Tier II cities represents a significant opportunity for market growth. With increasing urbanization and improving infrastructure, cities like Jaipur and Nagpur are experiencing a rise in middle-class families seeking quality retirement options. As of 2022, about 60% of Indias elderly population resides in urban areas, indicating a growing demand for senior living solutions beyond metropolitan cities. This trend is supported by the rising disposable income in these regions, making them ideal for developers to invest in senior living projects catering to this demographic.

Scope of the Report

|

Segment |

Sub-Segments |

|

Type |

Independent Living Assisted Living Nursing Care Others |

|

Facility Size |

Small-Scale Facilities Large-Scale Developments |

|

Price Segment |

Economy Mid-Range Luxury |

|

Region |

North India South India, East West India |

|

Ownership |

Privately Owned, Government Funded |

Products

Key Target Audience

Investor and Venture Capitalist Firms

Government and Regulatory Bodies (Ministry of Social Justice and Empowerment)

Healthcare Providers and Institutions

Real Estate Developers

Senior Care Service Providers

Retirement Planning Agencies

Insurance Companies

NGOs focused on elder care

Companies

Players Mentioned in the Report

Columbia Pacific Communities

Ashiana Housing Ltd.

AntaraSeniorCare

Primus Senior Living

Covai Property Centre

Brigade Group

Tata Housing Development Company

Max India Ltd.

Rustomjee

Silverglades Group

Table of Contents

1. India Senior Living Market Overview

1.1 Definition and Scope

1.2 Market Evolution and Current Dynamics

1.3 Regulatory and Economic Background

2. India Senior Living Market Size (In INR Cr)

2.1 Historical Market Size

2.2 Current Market Valuation

2.3 Projected Market Growth

3. India Senior Living Market Analysis

3.1 Market Growth Drivers

3.1.1 Increased Longevity

3.1.2 Rise in Nuclear Families

3.1.3 Affluent Retiree Segment Growth

3.2 Market Challenges

3.2.1 Cultural Perceptions

3.2.2 Financial Constraints

3.2.3 Land Acquisition Issues

3.3 Market Opportunities

3.3.1 Technological Integration

3.3.2 Government Initiatives (Integrated Programme for Senior Citizens)

3.3.3 Expansion in Tier II Cities

3.4 Trends

3.4.1 Rise of Community Living Spaces

3.4.2 Digital Health Tech Adoption

3.4.3 Development of CCRCs (Continuing Care Retirement Communities)

3.5 Government Regulations

3.5.1 Integrated Programme for Senior Citizens

3.5.2 Senior Citizen Welfare Schemes

3.5.3 Compliance Standards for Senior Living Facilities

3.6 SWOT Analysis

3.7 Value Chain Analysis

3.8 Porters Five Forces Analysis

3.9 Competitive Landscape

4. India Senior Living Market Segmentation

4.1 By Type (In Value %)

4.1.1 Independent Living

4.1.2 Assisted Living

4.1.3 Nursing Care

4.1.4 Others

4.2 By Facility Size (In Value %)

4.2.1 Small-Scale Facilities

4.2.2 Large-Scale Developments

4.3 By Price Segment (In Value %)

4.3.1 Economy

4.3.2 Mid-Range

4.3.3 Luxury

4.4 By Region (In Value %)

4.4.1 North India

4.4.2 South India

4.4.3 East India

4.4.4 West India

4.5 By Ownership (In Value %)

4.5.1 Privately Owned

4.5.2 Government Funded

5. India Senior Living Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 AntaraSeniorCare

5.1.2 Columbia Pacific Communities

5.1.3 Ashiana Housing Ltd.

5.1.4 Paranjape Schemes (Construction) Ltd.

5.1.5 Covai Property Centre (I) Pvt. Ltd.

5.1.6 Primus Senior Living

5.1.7 Brigade Group

5.1.8 Tata Housing Development Company

5.1.9 Silverglades Group

5.1.10 Max India Ltd.

5.1.11 Rustomjee

5.1.12 Gagan Properties

5.1.13 Seniority Pvt. Ltd.

5.1.14 Aamoksh One Eighty

5.1.15 Heritage Eldercare Services

5.2 Cross Comparison Parameters (Region Presence, Number of Units, Ownership Type, Pricing Segment, Services Offered, Revenue, Facilities, Market Entry Year)

5.3 Market Share Analysis

5.4 Strategic Initiatives (Mergers, Acquisitions, Expansions)

5.5 Investment Patterns (Venture Capital, Private Equity)

5.6 Government Grants and Subsidies

6. India Senior Living Market Regulatory Framework

6.1 Overview of Senior Living Regulations

6.2 Compliance Standards

6.3 Certification and Licensing Requirements

7. India Senior Living Future Market Size (In INR Cr)

7.1 Projected Market Growth

7.2 Future Demand Drivers

8. India Senior Living Future Market Segmentation

8.1 By Type (Independent Living, Assisted Living, Nursing Care)

8.2 By Facility Size (Small-Scale, Large-Scale)

8.3 By Price Segment (Economy, Mid-Range, Luxury)

8.4 By Region (North, South, East, West)

8.5 By Ownership (Private, Government)

9. India Senior Living Market Analysts Recommendations

9.1 Market Entry Strategy Analysis (TAM/SAM/SOM)

9.2 White Space Opportunity Analysis

9.3 Customer Cohort Analysis

9.4 Marketing and Positioning Strategy

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the India senior living market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data pertaining to the India senior living market. This includes assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics will be conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through consultations with industry experts representing a diverse array of companies. These consultations will provide valuable operational and financial insights directly from industry practitioners, which will be instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple senior living facility operators to acquire detailed insights into product segments, occupancy rates, consumer preferences, and other pertinent factors. This interaction will serve to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the India senior living market.

Frequently Asked Questions

01. How big is the India Senior Living Market?

The India senior living market is valued at USD 10.16 billion, driven by a growing aging population and increasing demand for specialized housing solutions tailored for senior citizens.

02. What are the challenges in the India Senior Living Market?

Challenges include cultural perceptions regarding aging, financial constraints among seniors, and regulatory hurdles that may hinder the development and acceptance of senior living facilities.

03. Who are the major players in the India Senior Living Market?

Key players include Columbia Pacific Communities, Ashiana Housing Ltd., AntaraSeniorCare, and Primus Senior Living, who dominate the market due to their extensive service offerings and strong market presence.

04. What are the growth drivers of the India Senior Living Market?

The market is propelled by factors such as an increasing aging population, urbanization, a rise in nuclear families, and growing disposable incomes among retirees seeking high-quality living environments.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.