India Sexual Wellness Market Outlook to 2030

Region:Asia

Author(s):Sanjeev

Product Code:KROD8511

November 2024

93

About the Report

India Sexual Wellness Market Overview

- The India sexual wellness market is valued at USD 1.5 billion, driven by growing awareness around sexual health and wellness, the increasing prevalence of e-commerce platforms, and the adoption of digital media to promote conversations around sexual well-being. The market is influenced by factors like rising income levels, urbanization, and improved access to a diverse range of sexual wellness products, particularly among younger demographics. This surge is also supported by advancements in product offerings such as organic and vegan alternatives, further enhancing the overall market demand.

- Cities like Mumbai, Delhi, and Bengaluru dominate the market due to their high population density, progressive attitudes toward sexual wellness, and higher internet penetration rates, which facilitate online purchases of sexual wellness products. These cities are also known for their openness to modern lifestyle changes, making them ideal for the introduction of new products and innovations in the sexual wellness space. Additionally, e-commerce platforms and major retailers have solidified their presence in these urban centers, providing easy access to various sexual wellness products.

- Sexual wellness products in India are regulated by the Drug Controller General of India (DCGI), which ensures product safety and efficacy. In 2023, the DCGI introduced updated guidelines requiring detailed labeling and ingredient disclosure for products like lubricants and contraceptives. This move is part of broader efforts to enhance consumer safety and confidence in the wellness sector. Businesses are required to meet strict quality standards, and non-compliance can result in penalties or product recalls.

India Sexual Wellness Market Segmentation

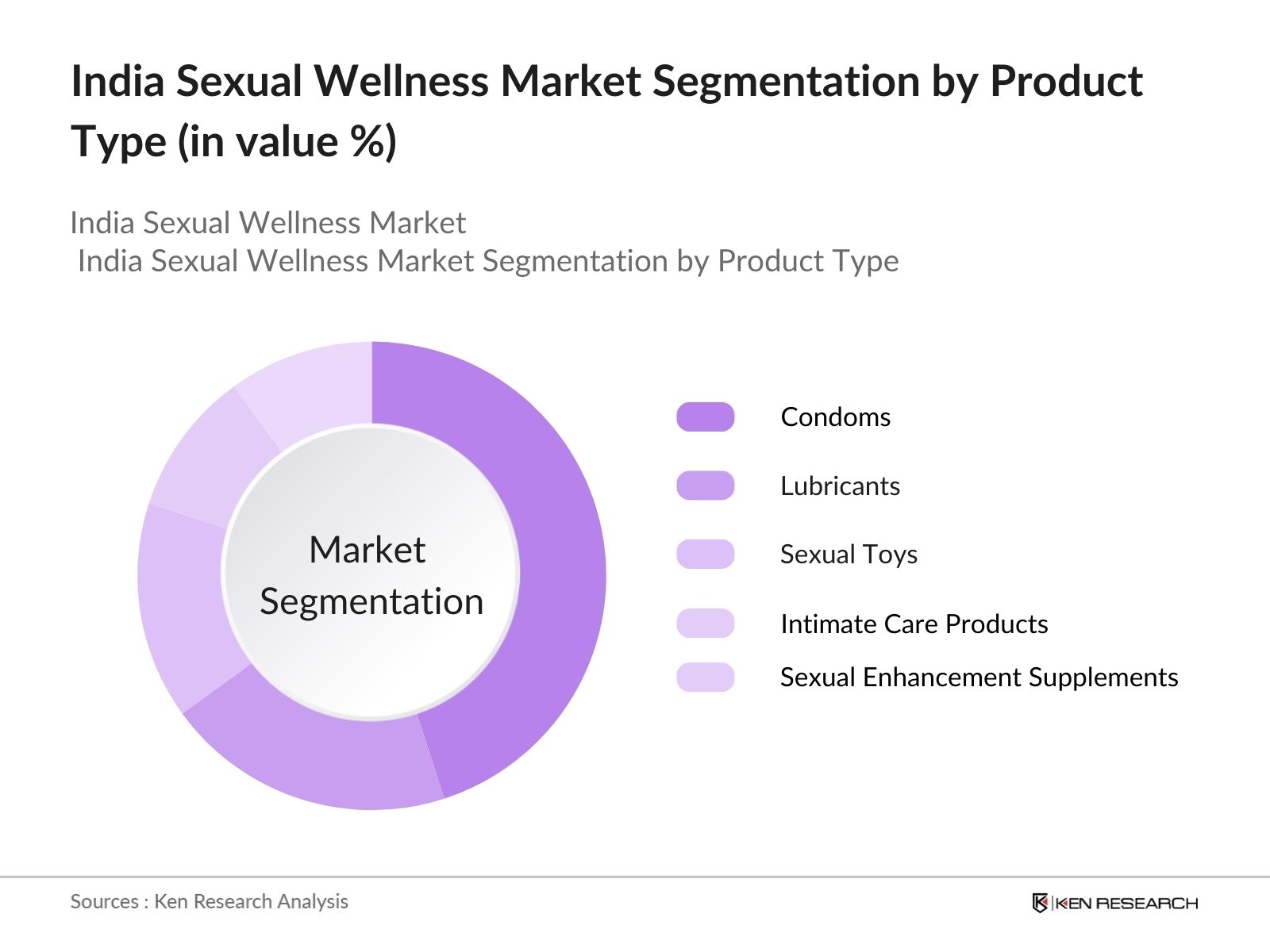

The Indian sexual wellness market is segmented by product type and segmented by distribution channels.

- By Product Type: The market is segmented by product type into condoms, lubricants, sexual toys, intimate care products, and sexual enhancement supplements. Recently, condoms have held a dominant market share within this segment, largely due to the widespread adoption of family planning initiatives, increased public health awareness, and strong government support for promoting contraceptive use. Furthermore, brands such as Durex and Skore have established substantial market penetration through aggressive marketing strategies and collaborations with public health campaigns, making condoms the leading sub-segment in the product type category.

- By Distribution Channel: The market is also segmented by distribution channels into offline and online platforms. Among these, the online segment has seen remarkable growth, driven by increasing smartphone penetration and consumer preference for discreet purchasing experiences. The rise of platforms like Amazon and Flipkart, along with niche sexual wellness sites such as Lovetreats and Thatspersonal, has made purchasing sexual wellness products more accessible and private. This shift toward e-commerce has been accelerated by consumer comfort in making sensitive purchases online.

India Sexual Wellness Market Competitive Landscape

The India sexual wellness market is dominated by both domestic and international players. The market is highly competitive, with brands such as Durex and Skore leading the charge due to their strong product portfolios and effective marketing campaigns. Other key players, such as Manforce and Kamasutra, maintain significant market shares through partnerships with healthcare providers and online platforms. In addition, many companies are focusing on product innovations and the introduction of organic and sustainable options to cater to evolving consumer preferences.

|

Company Name |

Established |

Headquarters |

Product Portfolio |

Marketing Strategy |

Online Presence |

Sustainability Initiatives |

Market Penetration |

Revenue Growth |

|

Durex (Reckitt) |

1929 |

Slough, UK |

||||||

|

Skore (TTK) |

1928 |

Chennai, India |

||||||

|

Manforce (Mankind) |

1995 |

Delhi, India |

||||||

|

Kamasutra (Raymond) |

1991 |

Mumbai, India |

||||||

|

Lovetreats |

2015 |

Bengaluru, India |

India Sexual Wellness Market Analysis

Market Growth Drivers

- Rising Consumer Awareness: Consumer awareness regarding sexual wellness in India has seen substantial growth, driven by campaigns promoting sexual health education and the role of the internet in spreading information. According to data from the Ministry of Health and Family Welfare, nearly 30 million people accessed sexual health information online in 2023. Government initiatives such as the National Health Mission are raising awareness about reproductive health, contributing to an increased demand for sexual wellness products. Indias rapid urbanization, where over 35% of the population now resides in cities, further facilitates access to such information and products.

- Increasing Adoption of E-commerce: The e-commerce sector in India continues to thrive, with over 200 million online shoppers recorded in 2023, according to data from the Ministry of Commerce and Industry. This growth has significantly impacted the sexual wellness market, where consumers prefer the privacy and convenience of buying products online. Major platforms like Flipkart and Amazon have expanded their product lines in sexual wellness categories, providing consumers with easy access. With the government's "Digital India" initiative, internet penetration reached 700 million users in 2023, boosting online shopping trends for wellness products.

- Changing Societal Norms: Social attitudes toward sexual wellness in India have evolved due to increased exposure to global media and education. The 2022 National Family Health Survey found that urban youths are more open to discussing sexual health issues, contributing to a greater acceptance of sexual wellness products. India's millennial and Gen Z populations, constituting over 65% of the workforce, are more likely to adopt progressive views on sexual health. This demographic shift drives market growth, as younger consumers actively seek out products related to sexual health and wellness.

Market Challenges

- Cultural Taboos: Despite evolving societal norms, deep-rooted cultural taboos still hinder the widespread acceptance of sexual wellness products. According to the 2022 National Family Health Survey, only 22% of adults in rural areas feel comfortable discussing sexual health openly. This cultural barrier limits the adoption of wellness products outside of urban areas. Moreover, religious and cultural organizations continue to oppose the open sale of these products, especially in conservative regions, which constrains market growth. Source.

- Lack of Proper Distribution Channels: A significant challenge in the Indian sexual wellness market is the limited availability of formal distribution channels, especially in rural regions. Only about 60% of India's population has easy access to such products, with many smaller towns and rural areas lacking retail presence. The Ministry of Rural Development's data indicates that 65% of Indias population resides in rural areas, making it difficult to distribute wellness products widely. This gap in distribution limits the market's reach to potential consumers in underserved areas.

India Sexual Wellness Market Future Outlook

The India sexual wellness market is expected to experience robust growth, driven by increasing consumer awareness, rising disposable incomes, and an expanding e-commerce sector. The market will also be shaped by a growing openness to conversations about sexual health and wellness, coupled with government-led initiatives aimed at improving sexual health education and access to contraceptives.

Future Market Opportunities

- Technological Advancements in Product Development: Advancements in medical technology are fueling the development of innovative sexual wellness products. Companies are increasingly investing in non-invasive solutions like smart devices for sexual health monitoring. In 2023, the Indian startup scene saw over 50 new companies in the health tech space, with a significant focus on sexual wellness products. This innovation is largely supported by Indias robust tech ecosystem, which saw a total of $12 billion in venture capital investment during 2023. Such technology-driven products are expected to bridge gaps in sexual health management.

- Rise of Digital Platforms and Sexual Health Apps: Digital platforms offering sexual health services are on the rise, providing anonymous consultations, access to experts, and product recommendations. The Indian telemedicine market, estimated to have 60 million users in 2023, has been instrumental in reducing stigma by providing a discreet platform for sexual health inquiries. Apps such as Practo and 1mg are increasingly integrating sexual wellness features, enhancing user engagement. The proliferation of smartphones, with over 800 million users in 2023, facilitates the growing popularity of such platforms.

Scope of the Report

Products

Key Target Audience

Sexual Wellness Product Manufacturers

E-commerce Platforms

Pharmaceuticals Companies

Retail Chains and Pharmacies

Government and Regulatory Bodies (Ministry of Health and Family Welfare, FSSAI)

Healthcare Providers and Sexual Health Clinics

Venture Capital and Investment Firms

NGOs and Non-profit Organizations

Banks and Financial Institutes

Companies

Players Mention in the Report:

Reckitt Benckiser Group

Mankind Pharma

TTK Healthcare

HLL Lifecare

Cipla Ltd.

Ansell Ltd.

Beiersdorf AG

Church & Dwight Co.

Durex (Reckitt)

Skore (TTK)

Unilever Plc

K-Y (Johnson & Johnson)

Sliquid

Fun Factory GmbH

WOW Life Science

Table of Contents

1. India Sexual Wellness Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate (Awareness Programs, E-commerce Penetration, Gender Inclusivity)

1.4. Market Segmentation Overview

2. India Sexual Wellness Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones (Product Launches, Consumer Behavior Trends)

3. India Sexual Wellness Market Analysis

3.1. Growth Drivers

3.1.1. Rising Consumer Awareness

3.1.2. Increasing Adoption of E-commerce

3.1.3. Changing Societal Norms

3.1.4. Government Initiatives and Policy Support

3.2. Market Challenges

3.2.1. Cultural Taboos

3.2.2. Lack of Proper Distribution Channels

3.2.3. Regulatory Barriers

3.3. Opportunities

3.3.1. Technological Advancements in Product Development

3.3.2. Rise of Digital Platforms and Sexual Health Apps

3.3.3. Untapped Rural Market Potential

3.4. Trends

3.4.1. Growing Demand for Organic and Sustainable Products

3.4.2. Sexual Health Supplements and Innovations

3.4.3. Influencer Marketing in Sexual Wellness

3.5. Government Regulation

3.5.1. Regulatory Guidelines on Sexual Wellness Products

3.5.2. Advertising Regulations

3.5.3. Policy Initiatives to Promote Sexual Health

3.5.4. Online Marketplace Compliance

3.6. SWOT Analysis

3.7. Stake Ecosystem (Suppliers, Distributors, Retailers, E-commerce Platforms)

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. India Sexual Wellness Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Condoms

4.1.2. Lubricants

4.1.3. Sexual Toys

4.1.4. Intimate Care Products

4.1.5. Sexual Enhancement Supplements

4.2. By Distribution Channel (In Value %)

4.2.1. Offline (Pharmacies, Specialty Stores, Hypermarkets)

4.2.2. Online (E-commerce Websites, Sexual Wellness Platforms)

4.2.3. Direct to Consumer (D2C)

4.3. By Gender (In Value %)

4.3.1. Male

4.3.2. Female

4.3.3. Others

4.4. By Age Group (In Value %)

4.4.1. 18-24

4.4.2. 25-34

4.4.3. 35-44

4.4.4. 45+

4.5. By Region (In Value %)

4.5.1. North India

4.5.2. South India

4.5.3. East India

4.5.4. West India

5. India Sexual Wellness Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1. Reckitt Benckiser Group

5.1.2. Mankind Pharma

5.1.3. TTK Healthcare

5.1.4. HLL Lifecare

5.1.5. Cipla Ltd.

5.1.6. Ansell Ltd.

5.1.7. Beiersdorf AG

5.1.8. Church & Dwight Co.

5.1.9. Durex (Reckitt)

5.1.10. Skore (TTK)

5.1.11. Unilever Plc

5.1.12. K-Y (Johnson & Johnson)

5.1.13. Sliquid

5.1.14. Fun Factory GmbH

5.1.15. WOW Life Science

5.2 Cross Comparison Parameters (Revenue, Market Share, Product Portfolio, Innovation Index, Product Development Initiatives, Distribution Network, Target Demographics, Sustainability Initiatives)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Grants

5.9 Private Equity Investments

6. India Sexual Wellness Market Regulatory Framework

6.1. Product Approval Processes

6.2. Advertising and Promotional Regulations

6.3. Labeling and Packaging Requirements

6.4. Compliance with Health and Safety Standards

7. India Sexual Wellness Market Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. India Sexual Wellness Market Future Segmentation

8.1. By Product Type (In Value %)

8.2. By Distribution Channel (In Value %)

8.3. By Gender (In Value %)

8.4. By Age Group (In Value %)

8.5. By Region (In Value %)

9. India Sexual Wellness Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Consumer Sentiment Analysis

9.3. Product Innovation Opportunities

9.4. Strategic Partnerships and Collaborations

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The research began by identifying key factors influencing the India sexual wellness market. This involved building an industry ecosystem map, which included manufacturers, distributors, retailers, and regulatory bodies. Secondary research from industry reports, company filings, and government data helped map the relevant market variables.

Step 2: Market Analysis and Construction

Historical data for the India sexual wellness market was compiled and analyzed, focusing on product penetration, channel preferences, and demographic behavior. Revenue data and volume sales were scrutinized to develop accurate market projections and assess segment performance.

Step 3: Hypothesis Validation and Expert Consultation

A series of interviews with market experts, including retailers, product manufacturers, and online platform managers, were conducted. These interviews provided real-time insights into consumer behavior and market challenges, validating initial hypotheses.

Step 4: Research Synthesis and Final Output

The final stage of the research involved synthesizing data from primary and secondary sources, followed by a bottom-up approach to ensure accuracy. The research output was further refined to provide a comprehensive view of the India sexual wellness market.

Frequently Asked Questions

01. How big is the India Sexual Wellness Market?

The India sexual wellness market is valued at USD 1.5 billion, driven by increased consumer awareness, rising disposable incomes, and e-commerce penetration. Major cities like Mumbai and Bengaluru are key contributors to market growth due to their urban demographic and higher acceptance of sexual wellness products.

02. What are the challenges in the India Sexual Wellness Market?

Challenges in India sexual wellness market include cultural taboos, limited product access in rural areas, and a lack of comprehensive sex education. These factors inhibit market growth, particularly in smaller towns and conservative communities.

03. Who are the major players in the India Sexual Wellness Market?

Key players in the India sexual wellness market include Reckitt (Durex), Mankind (Manforce), and TTK (Skore), which dominate due to their strong product portfolios and extensive distribution networks.

04. What are the growth drivers of the India Sexual Wellness Market?

The India sexual wellness market is propelled by increased internet penetration, rising income levels, and a growing openness to conversations around sexual health. Additionally, government initiatives promoting contraception have spurred market growth.

05. What trends are shaping the India Sexual Wellness Market?

Current trends in India sexual wellness market include a shift towards organic and eco-friendly products, increasing use of digital platforms for discreet purchasing, and growing acceptance of sexual wellness products among millennials.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.