India Shampoo Market Outlook to 2030

Region:Asia

Author(s):Paribhasha Tiwari

Product Code:KROD4561

December 2024

90

About the Report

India Shampoo Market Overview

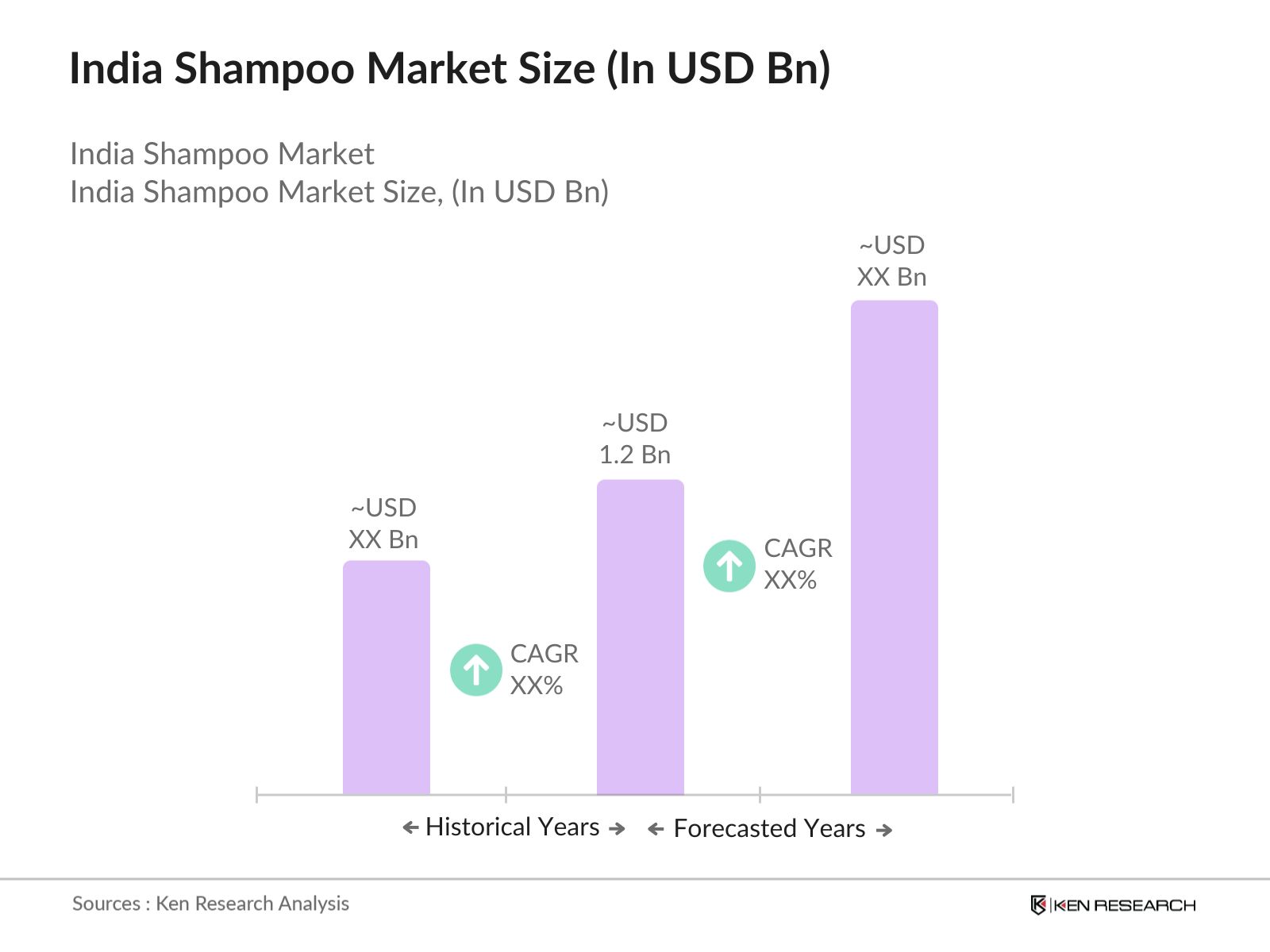

- The India shampoo market is valued at USD 1.2 billion, based on a comprehensive five-year historical analysis. The market's growth is predominantly driven by increased disposable incomes and heightened consumer awareness regarding personal grooming and hygiene. The rise in urbanization and the expansion of the middle class have further boosted the market, as these groups increasingly seek specialized hair care products, including anti-dandruff, herbal, and medicated shampoos. Product innovations, particularly in organic and ayurvedic shampoos, have also played a crucial role in expanding the markets offerings.

- Cities such as Delhi, Mumbai, and Bengaluru dominate the shampoo market in India. These cities are economic hubs with a high concentration of consumers who are more aware of and have access to a variety of shampoo brands. Additionally, these cities have a strong presence of multinational and domestic brands, which drives consumer choices through extensive marketing campaigns and promotions. The significant purchasing power and growing demand for premium hair care products in these regions solidify their market dominance.

- The Swachh Bharat Abhiyan campaign has played a crucial role in promoting hygiene and cleanliness in India. In 2024, the government allocated over INR 60 billion to expand this campaign, which has driven demand for personal care products, including shampoos. The program, aimed at improving sanitation and cleanliness in both urban and rural areas, has directly impacted consumer behavior, encouraging the use of personal hygiene products.

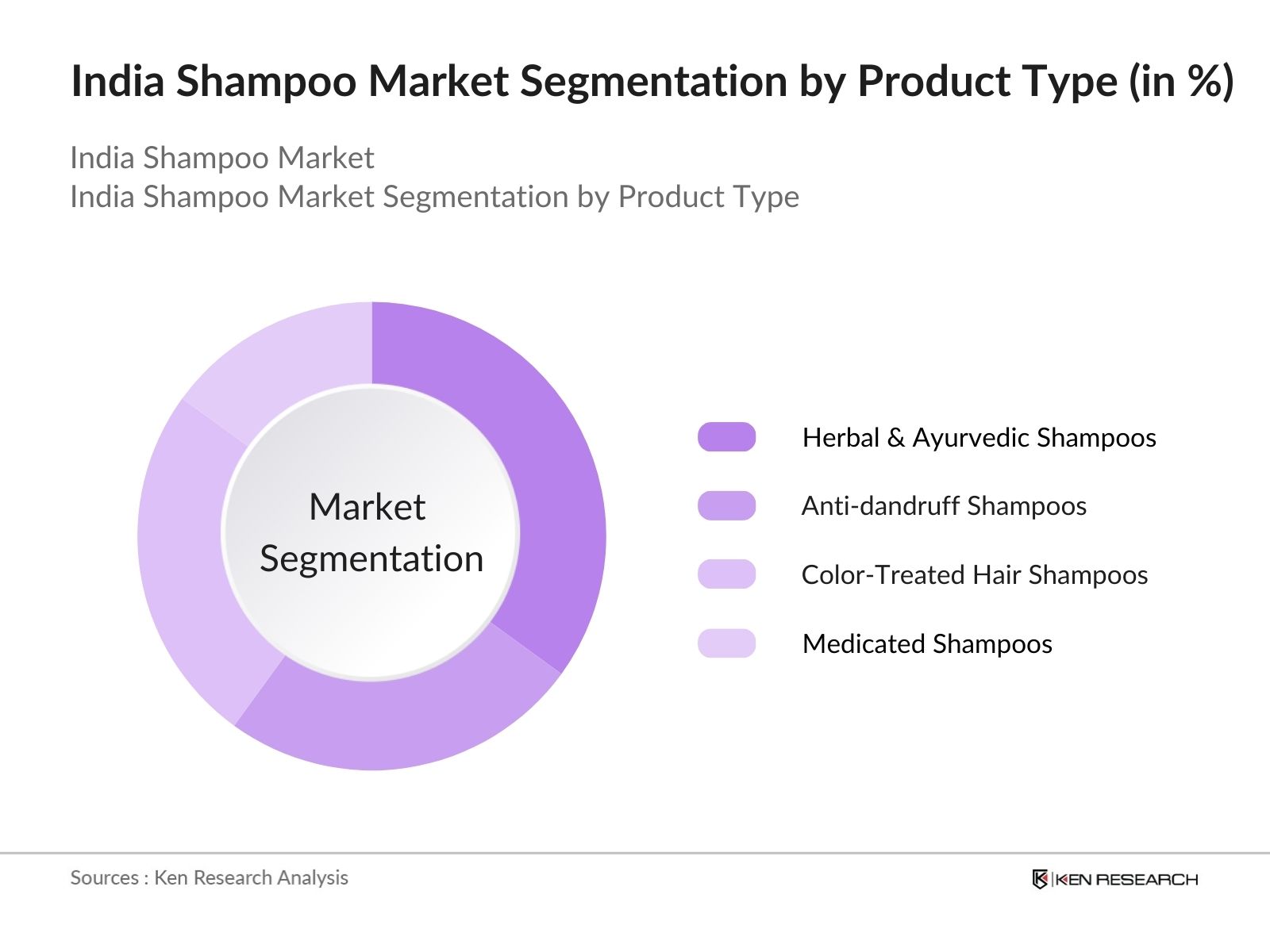

India Shampoo Market Segmentation

By Product Type: The India shampoo market is segmented by product type into anti-dandruff shampoos, herbal & ayurvedic shampoos, medicated shampoos, and color-treated hair shampoos. Herbal & ayurvedic shampoos dominate the product type segment, owing to the rising consumer preference for natural and organic ingredients. These shampoos are considered safer for long-term use, as they contain fewer synthetic chemicals and are closely aligned with traditional Indian beauty practices. The popularity of herbal brands such as Patanjali and Dabur, along with international interest in natural products, has further bolstered this sub-segment's share.

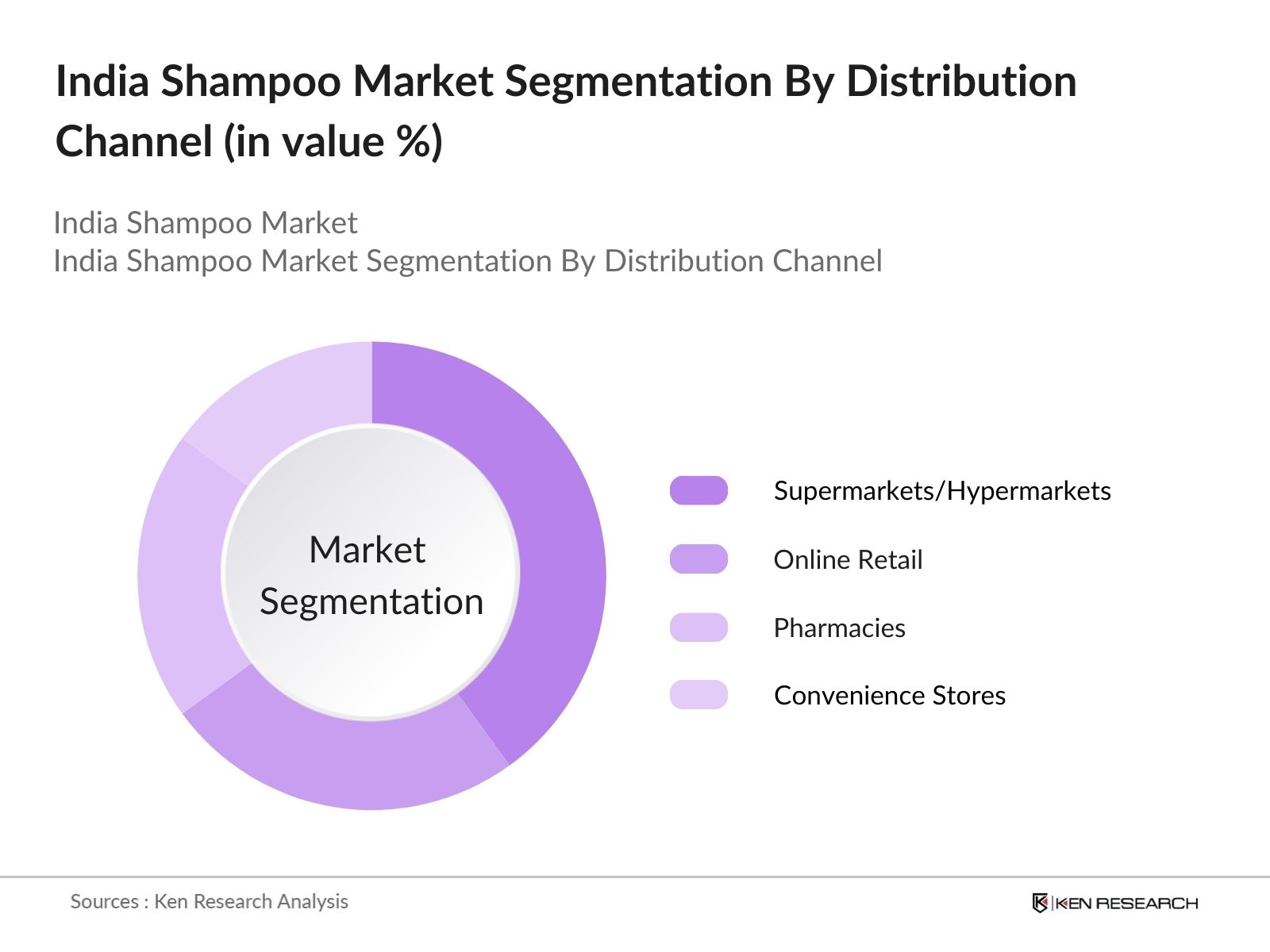

By Distribution Channel: Indias shampoo market is also segmented by distribution channel into supermarkets/hypermarkets, online retail, pharmacies, and convenience stores. Supermarkets and hypermarkets dominate the distribution channel in terms of market share. This is largely due to their widespread presence in urban and semi-urban areas, offering a broad range of product choices. Consumers often prefer to physically assess the quality and variety of shampoos before purchasing, making these channels a convenient option. Moreover, these outlets frequently offer discounts, which attracts cost-conscious shoppers.

India Shampoo Market Competitive Landscape

The India shampoo market is dominated by a mixture of multinational and domestic players, each vying for a larger consumer base. Major companies, such as Hindustan Unilever Limited, Dabur India Ltd., and Procter & Gamble Co., lead the market due to their extensive distribution networks, strong brand equity, and consistent innovation in product offerings. The local players, with a strong focus on ayurvedic and herbal products, have carved out significant niches, challenging the dominance of established global brands. The competition has intensified with the entry of smaller startups that are focusing on sustainable, organic, and personalized shampoo products.

|

Company Name |

Established |

Headquarters |

Product Portfolio |

R&D Investment |

Sustainability Initiatives |

Distribution Network |

Brand Awareness |

|

Hindustan Unilever Limited |

1931 |

Mumbai, India |

- | - | - | - | - |

|

Dabur India Ltd. |

1884 |

Ghaziabad, India |

- | - | - | - | - |

|

Procter & Gamble Co. |

1837 |

Cincinnati, USA |

- | - | - | - | - |

|

L'Oral India |

1957 |

Mumbai, India |

- | - | - | - | - |

|

Patanjali Ayurved Limited |

2006 |

Haridwar, India |

- | - | - | - | - |

India Shampoo Market Analysis

Growth Drivers

- Increased Personal Hygiene Awareness: Increased awareness of personal hygiene, bolstered by initiatives like the Indian government's Swachh Bharat Abhiyan, has driven the demand for personal care products, including shampoos. The government invested INR 60 billion in 2023-2024 to promote health and hygiene across the nation, which indirectly boosted shampoo consumption in rural and urban areas. Additionally, hygiene products are gaining importance due to the post-pandemic health consciousness, creating a larger customer base for shampoo brands across different socioeconomic groups.

- Product Diversification and Innovation: The shift towards natural and herbal products is a significant driver in the Indian shampoo market. In 2024, over 250 million consumers in urban and rural areas are actively seeking out herbal alternatives over chemical-based products. This trend is supported by the growing popularity of Ayurveda, which has encouraged brands to innovate with plant-based ingredients like neem, amla, and hibiscus. Herbal shampoos now constitute nearly 40% of new product launches in the market, reflecting changing consumer preferences toward sustainable and chemical-free alternatives.

- Rise in Organized Retail Sector: In 2024, Indias organized retail sector has grown to approximately 12 million square feet of modern retail space, up from 10 million in 2022. This increase in retail infrastructure, especially in Tier 2 and Tier 3 cities, has expanded the availability and accessibility of premium hair care products. The presence of modern trade outlets and supermarket chains has made it easier for shampoo brands to cater to the growing demand for premium and customized hair care solutions, enhancing the growth of the shampoo market.

Market Challenges

- High Input Costs for Natural Ingredients: The increasing demand for natural and herbal shampoos has escalated the costs of raw materials such as aloe vera, neem, and essential oils. In 2024, the cost of neem and aloe vera extracts increased by 25% and 30% respectively, largely due to higher demand and limited cultivation. These rising input costs strain manufacturers who need to maintain competitive pricing while offering quality products. As a result, profit margins are shrinking, especially for small and medium-sized companies that rely heavily on natural ingredients.

- Supply Chain Disruptions: Although India has largely recovered from the COVID-19 pandemic, logistical challenges continue to affect the shampoo industry. In 2024, fuel costs increased by INR 3 per liter due to geopolitical tensions, increasing transportation costs for FMCG companies. Additionally, the global shortage of shipping containers has delayed the import of key ingredients and packaging materials. These supply chain disruptions, coupled with inflationary pressures, have led to sporadic shortages and distribution bottlenecks in certain regions, particularly rural areas.

India Shampoo Market Future Outlook

The India shampoo market is expected to experience significant growth over the next five years, driven by rising consumer demand for premium and natural hair care products. The increasing penetration of e-commerce platforms, coupled with growing consumer awareness around ingredient safety and environmental sustainability, will further drive growth. Furthermore, rural expansion efforts by both multinational and local brands are expected to significantly contribute to market size in the coming years.

Market Opportunities

- Growing Demand for Premium Hair Care Products: As income levels rise, particularly in urban India, consumers are increasingly seeking premium hair care products that cater to specific needs such as dandruff control, color protection, and hair regrowth. The premium segment has grown significantly, with over 45 million consumers opting for specialized shampoos in 2024. The rising demand for premium, value-added hair care solutions presents opportunities for brands to expand their product portfolios and tap into a more affluent customer base.

- Customization and Personalization in Shampoo Products: There is a growing trend toward personalized hair care solutions, with AI-powered technologies enabling brands to offer custom-made shampoos based on individual hair types and concerns. In 2024, over 5 million urban consumers have adopted personalized hair care regimes, indicating a shift towards more customized solutions. This presents an opportunity for shampoo brands to invest in AI and machine learning technologies to cater to the personalized care needs of their consumers.

Scope of the Report

|

By Product Type |

Anti-dandruff Shampoos Herbal & Ayurvedic Shampoos Medicated Shampoos Dry Shampoos Color-Treated Hair Shampoos |

|

By Hair Type |

Normal Hair Oily Hair Dry & Damaged Hair Curly Hair Color-Treated Hair |

|

By Distribution Channel |

Supermarkets/Hypermarkets Convenience Stores Online Retail Pharmacies, Salons |

|

By Packaging Type |

Bottles Sachets Tubes |

|

By Region |

North South East West |

Products

Key Target Audience

FMCG Companies

Hair Care Product Manufacturers

Retailers (Supermarkets, Hypermarkets, Online Stores)

Distributors and Wholesalers

Investments and Venture Capitalist Firms

Government and Regulatory Bodies (FDA, Bureau of Indian Standards)

E-commerce Platforms

Personal Care Brands

Companies

Players Mentioned in the Report:

Hindustan Unilever Limited

Procter & Gamble Co.

Dabur India Ltd.

L'Oral India

Patanjali Ayurved Limited

ITC Limited

Johnson & Johnson Pvt. Ltd.

Marico Limited

Emami Ltd.

Himalaya Wellness Company

Table of Contents

1. India Shampoo Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. India Shampoo Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. India Shampoo Market Analysis

3.1. Growth Drivers

3.1.1. Rising Disposable Income (Per Capita Income Growth, Middle-Class Expansion)

3.1.2. Increased Personal Hygiene Awareness (Government Campaigns, FMCG Penetration)

3.1.3. Product Innovation (Herbal, Anti-Hair Fall, Color-Treated Hair Specific)

3.1.4. Urbanization (Migration to Cities, Western Beauty Standards Influence)

3.2. Market Challenges

3.2.1. High Competition (Local vs. International Brands)

3.2.2. Rising Raw Material Costs (Chemical Ingredients, Natural Extracts)

3.2.3. Supply Chain Disruptions (Logistics, Pandemic Impact)

3.2.4. Distribution Bottlenecks (Rural India, Unorganized Sector Penetration)

3.3. Opportunities

3.3.1. Growth of Online Retail (E-Commerce Adoption, D2C Models)

3.3.2. Expansion in Tier 2 & Tier 3 Cities (Increased Affordability, Improved Distribution)

3.3.3. Organic & Sustainable Products Demand (Eco-friendly Packaging, Clean Labels)

3.3.4. Customization & Personalization (AI-based Hair Care Recommendations, Subscription Models)

3.4. Trends

3.4.1. Shift to Organic & Natural Products (Ayurvedic, Plant-based Ingredients)

3.4.2. Gender-Specific Shampoos (Men's Grooming, Female-Specific Hair Care)

3.4.3. Eco-friendly Packaging (Recyclable, Zero-Waste Packaging)

3.4.4. Salon Professional Shampoos (Premiumization, Salon Partnerships)

3.5. Government Regulation

3.5.1. FDA Regulations for Cosmetic Products (Certification for Herbal Products)

3.5.2. Import Tariffs on Ingredients (Impact on Imported Raw Materials)

3.5.3. CSR Initiatives by Companies (Sustainable Sourcing, Social Impact)

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Porters Five Forces

3.8.1. Bargaining Power of Suppliers

3.8.2. Bargaining Power of Buyers

3.8.3. Threat of New Entrants

3.8.4. Threat of Substitutes

3.8.5. Competitive Rivalry

3.9. Competition Ecosystem

3.9.1. Local vs. International Brands (Brand Equity, Consumer Preferences)

3.9.2. Entry Barriers (Investment in R&D, Regulatory Approvals)

3.9.3. Innovation Drivers (R&D, Ingredient Sourcing, Technology Adoption)

4. India Shampoo Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Anti-dandruff Shampoos

4.1.2. Herbal & Ayurvedic Shampoos

4.1.3. Medicated Shampoos

4.1.4. Dry Shampoos

4.1.5. Color-Treated Hair Shampoos

4.2. By Hair Type (In Value %)

4.2.1. Normal Hair

4.2.2. Oily Hair

4.2.3. Dry & Damaged Hair

4.2.4. Curly Hair

4.2.5. Color-Treated Hair

4.3. By Distribution Channel (In Value %)

4.3.1. Supermarkets/Hypermarkets

4.3.2. Convenience Stores

4.3.3. Online Retail

4.3.4. Pharmacies

4.3.5. Salons

4.4. By Packaging Type (In Value %)

4.4.1. Bottles

4.4.2. Sachets

4.4.3. Tubes

4.5. By Region (In Value %)

4.5.1. North India

4.5.2. South India

4.5.3. East India

4.5.4. West India

5. India Shampoo Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Hindustan Unilever Limited

5.1.2. Procter & Gamble Co.

5.1.3. L'Oral India

5.1.4. Dabur India Ltd.

5.1.5. ITC Limited

5.1.6. Patanjali Ayurved Limited

5.1.7. Marico Limited

5.1.8. Emami Ltd.

5.1.9. Godrej Consumer Products Limited

5.1.10. Johnson & Johnson Pvt. Ltd.

5.1.11. Himalaya Wellness Company

5.1.12. Colgate-Palmolive India

5.1.13. Parachute

5.1.14. Nivea India Pvt. Ltd.

5.1.15. Garnier (India)

5.2. Cross Comparison Parameters (Market Share %, Distribution Network, Sales Growth %, Innovation Capability, Product Portfolio Size, Sustainability Initiatives, Advertisement Spend %, Price Competitiveness)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers And Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. India Shampoo Market Regulatory Framework

6.1. FDA Approval Process

6.2. BIS Standards for Cosmetic Products

6.3. Labeling Regulations (Ingredients, Expiry Dates)

7. India Shampoo Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. India Shampoo Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Hair Type (In Value %)

8.3. By Distribution Channel (In Value %)

8.4. By Packaging Type (In Value %)

8.5. By Region (In Value %)

9. India Shampoo Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

In this step, we map the shampoo ecosystem in India by identifying major stakeholders, including manufacturers, retailers, and consumers. Extensive desk research using secondary and proprietary databases helps outline the critical market variables that affect growth, such as consumer preferences, distribution channels, and pricing strategies.

Step 2: Market Analysis and Construction

This phase involves compiling historical data on the shampoo market in India, focusing on penetration levels across urban and rural sectors. We analyze revenue trends and consumer preferences, comparing this data against industry standards to ensure its accuracy and reliability.

Step 3: Hypothesis Validation and Expert Consultation

Our research hypotheses are validated through CATIs with industry experts from FMCG companies and market analysts. These interviews provide valuable insights into market trends, consumer behavior, and company strategies, enabling us to refine our analysis.

Step 4: Research Synthesis and Final Output

We engage with key market players to gain detailed insights into product segmentation, sales performance, and customer feedback. This step helps corroborate our data and ensure that the final report provides an accurate, comprehensive analysis of the India shampoo market.

Frequently Asked Questions

01. How big is the India Shampoo Market?

The India shampoo market is valued at USD 1.2 billion, driven by increased demand for personal care products, rising disposable incomes, and greater consumer awareness of grooming and hygiene.

02. What are the challenges in the India Shampoo Market?

Challenges in the India shampoo market include rising competition, increasing raw material costs, and supply chain disruptions. In addition, penetrating rural markets and addressing the demands for sustainability are key obstacles for companies.

03. Who are the major players in the India Shampoo Market?

Key players in the India shampoo market include Hindustan Unilever Limited, Dabur India Ltd., Procter & Gamble Co., Patanjali Ayurved Limited, and L'Oral India, driven by their strong distribution networks and innovative product lines.

04. What are the growth drivers of the India Shampoo Market?

Growth of India shampoo market is fueled by factors such as urbanization, rising disposable incomes, and the demand for natural and organic products. Additionally, the expansion of e-commerce platforms has contributed to the ease of product availability.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.