India Silk Market Outlook to 2030

Region:Asia

Author(s):Shambhavi

Product Code:KROD1310

December 2024

96

About the Report

India Silk Market Overview

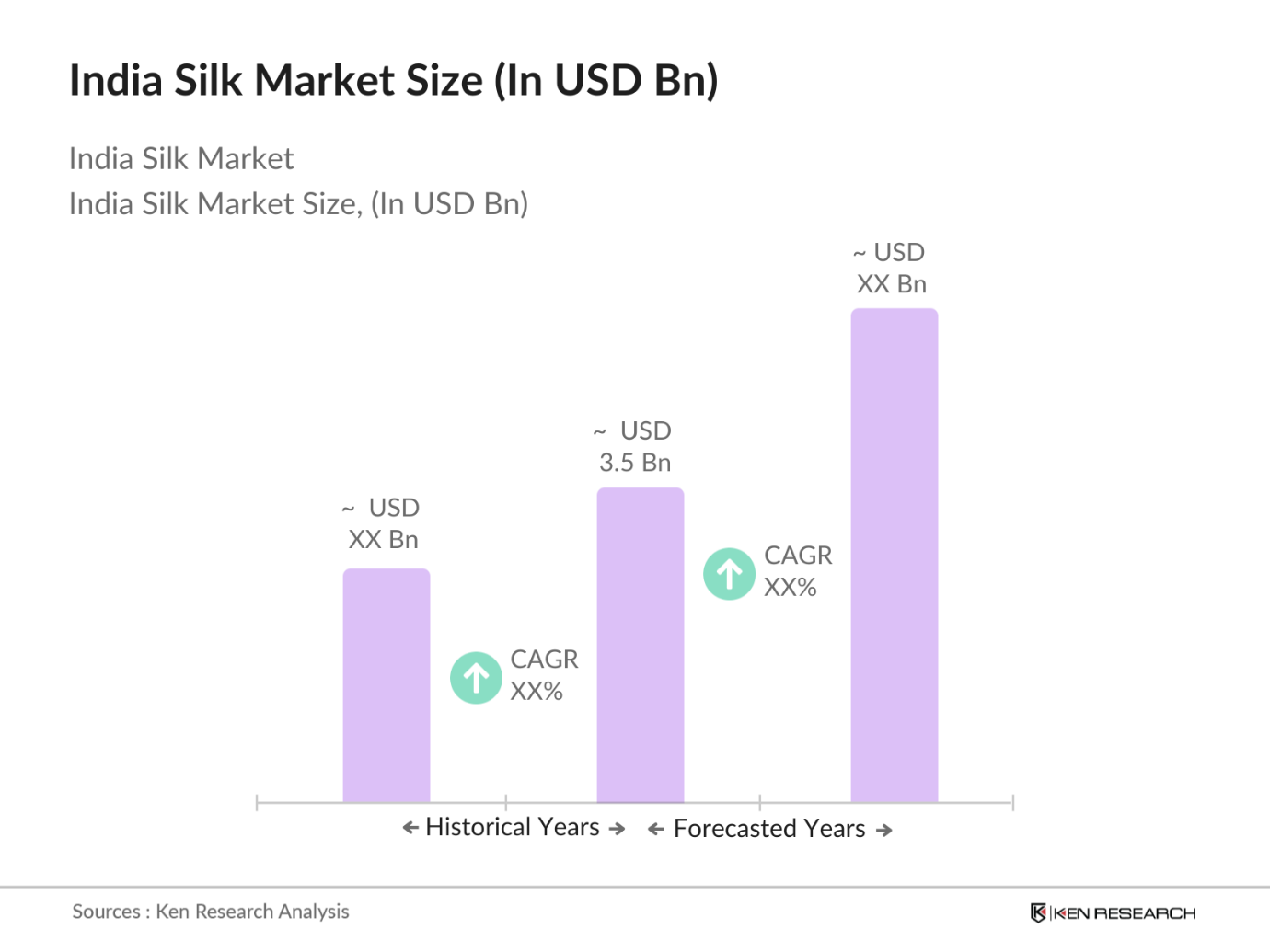

- In 2023, the India Silk Market is estimated to be valued at USD 3.5 billion, driven by both domestic demand and robust export activities. India's dominance in silk production, particularly in mulberry silk, is underpinned by favorable climatic conditions and a long-standing tradition of sericulture. The growing demand for sustainable and luxurious textiles globally has further bolstered the market. Key export destinations such as the USA, Europe, and the Middle East have contributed significantly to this market size, driven by the demand for high-quality Indian silk products.

- Key players in the India Silk Market include prominent entities such as Khadi and Village Industries Commission (KVIC), Central Silk Board (CSB), Fabindia, and Raymond Group. These organizations are at the forefront of production, processing, and retailing of silk products. KVIC and CSB are government-backed bodies that play a crucial role in promoting sericulture and ensuring quality control, while Fabindia and Raymond Group are major private sector players with significant market share due to their extensive distribution networks and strong brand equity.

- The Production Linked Incentive (PLI) Scheme for Textiles, backed by an approved outlay of 10,683 crore, is a strategic government initiative to boost the production of man-made fiber apparel, fabrics, and technical textiles in India. The scheme aims to expand the textile sectors size and scale, making it globally competitive by encouraging domestic manufacturing and reducing reliance on imports. By offering financial incentives, the PLI scheme seeks to attract large investments, foster innovation, and create employment opportunities. As of August 2024, 73 companies have been selected under this scheme, marking significant progress toward transforming Indias textile industry.

- The cities of Bengaluru, Mysuru, and Kanchipuram are the dominant hubs in the India Silk Market. Bengaluru and Mysuru in Karnataka are renowned for their high-quality mulberry silk production, supported by favourable agro-climatic conditions and government initiatives. Kanchipuram in Tamil Nadu is famous for its traditional silk sarees, which command premium prices in both domestic and international markets. These cities have well-established silk industries, contributing significantly to the overall market revenue.

India Silk Market Segmentation

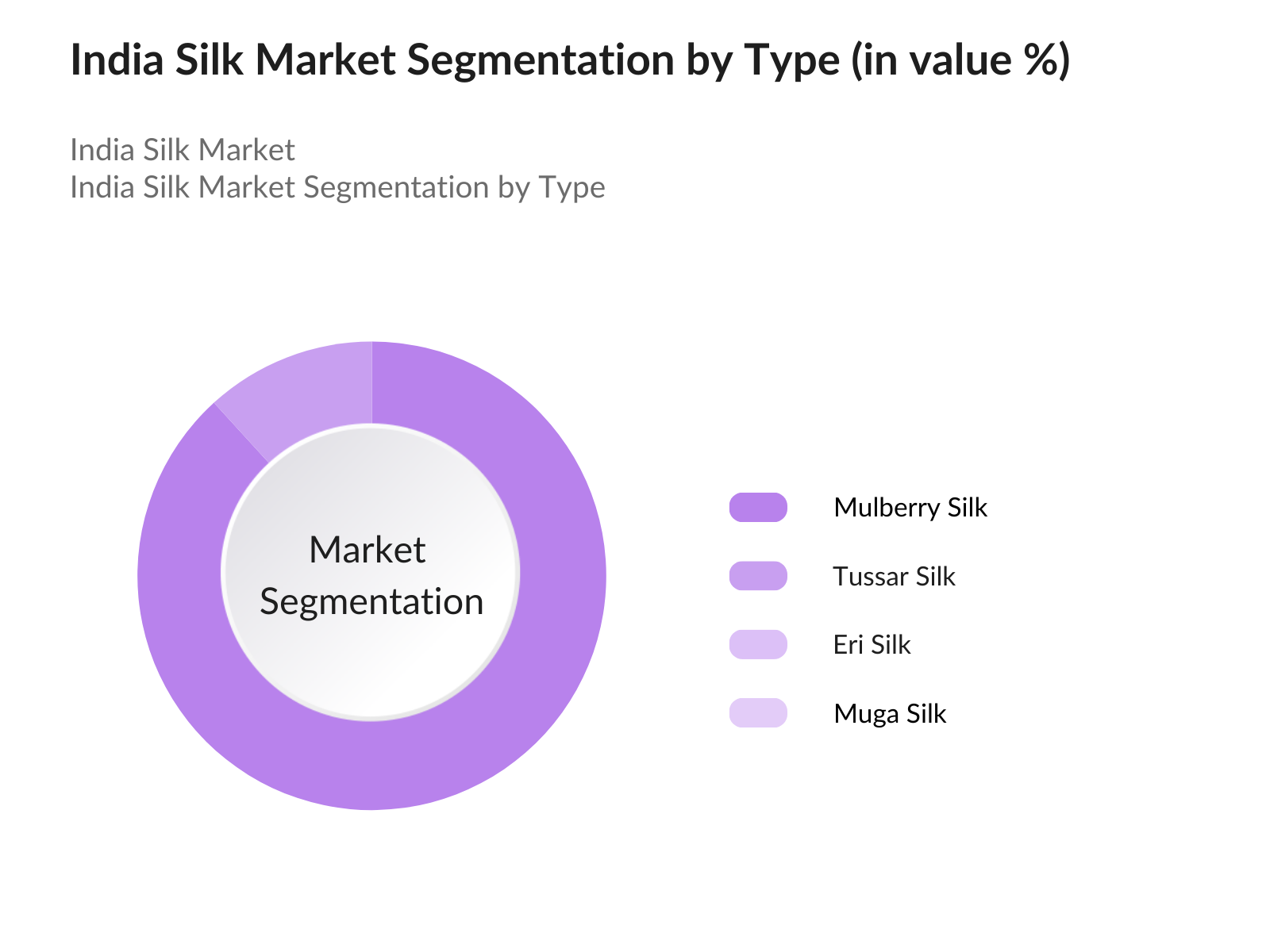

- By Type: India's silk market is segmented by type into mulberry silk, tussar silk, eri silk, and muga silk. In 2023, mulberry silk held the dominant market share due to its widespread use in the textile industry and its superior quality compared to other types of silk. Mulberry silk is primarily produced in Karnataka, Tamil Nadu, and West Bengal, where it is favored for its soft texture, strength, and ability to hold dye well, making it the preferred choice for luxury garments.

- By Region: The India Silk Market is segmented into North, South, East and West. In 2023, South held the largest market share due to its favourable climatic conditions for sericulture and the presence of established silk industries in Karnataka, Tamil Nadu, and Andhra Pradesh. South India is the leading producer of mulberry silk, which accounts for the majority of India's silk production. The region's well-developed infrastructure and strong government support also contribute to its dominance.

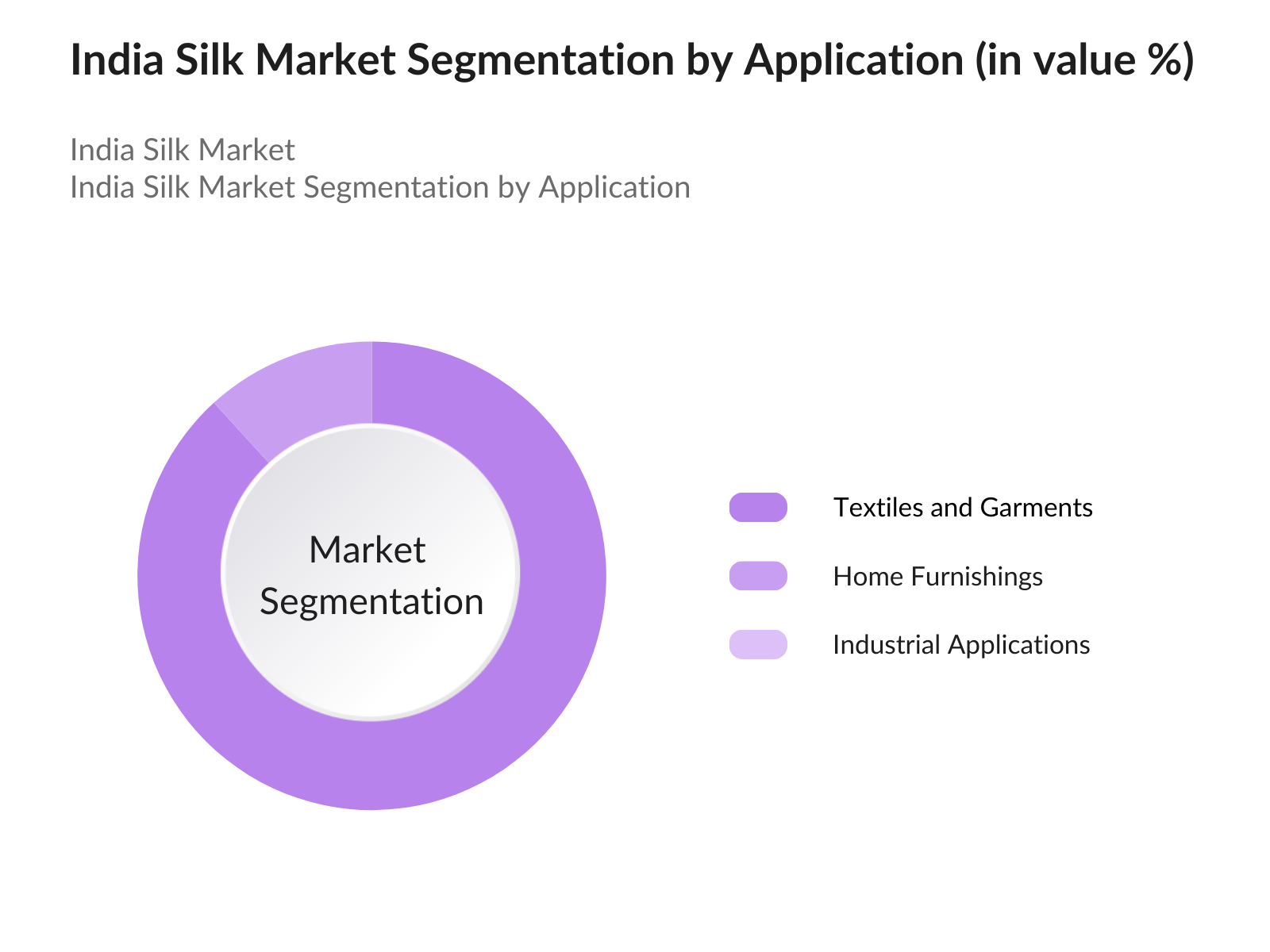

- By Application: India's silk market is also segmented by application into textiles and garments, home furnishings, and industrial applications. In 2023, textiles and garments dominated the market due to the high demand for silk sarees, ethnic wear, and luxury garments both within India and in export markets. The cultural significance of silk in Indian weddings and festivals drives consistent demand, while international markets continue to favour Indian silk for its quality and craftsmanship, particularly in high-end fashion.

India Silk Market Competitive Landscape

|

Company |

Establishment Year |

Headquarters |

|

Khadi and Village Industries Commission |

1956 |

New Delhi, India |

|

Central Silk Board |

1948 |

Bengaluru, India |

|

Fabindia |

1960 |

New Delhi, India |

|

Raymond Group |

1925 |

Mumbai, India |

|

Grasim Industries Ltd. |

1947 |

Mumbai, India |

- Khadi and Village Industries Commission (KVIC): In 2023, KVIC introduced an innovative initiative to boost silk production through the "Silk Mark Expo," which promoted pure silk products across India. This initiative was part of KVICs broader strategy to increase awareness and sales of genuine silk products, with a focus on promoting rural artisans and boosting the local economy.

- Grasim Industries: Introduction of Eco-Friendly Silk Blends Grasim Industries, a leading player in the Indian textile market, introduced a new range of eco-friendly silk blends in 2023. The new product line, which combines silk with sustainable fibres like Tencel and organic cotton, has been well received in the market, particularly among environmentally conscious consumers. Grasim has committed to expanding this product line by 30% by 2025, with a focus on capturing the growing demand for sustainable textiles.

India Silk Market Analysis

India Silk Market Growth Drivers

- Rising Demand for High-Quality Silk Products in Global Markets: The India Silk Market is experiencing robust growth due to increasing global demand for high-quality silk products, particularly from luxury fashion brands in the USA, Europe, and the Middle East. In 2022, India exported silk worth USD 300 million to these regions, with a significant portion of the demand coming from luxury apparel and home furnishing sectors. The Indian governments focus on promoting "Make in India" has further bolstered this demand, leading to increased production capacity and improved export figures in 2023.

- Government Support and Investment in Sericulture: The Sericulture Development in North-Eastern States (NERTPS) initiative, led by the Indian government, focuses on the revival, expansion, and diversification of sericulture across the North-Eastern region. This program places special emphasis on Eri and Muga silks, which are indigenous to the area and hold cultural and economic importance. NERTPS aims to increase silk production through improved infrastructure, technological interventions, and training for local farmers.

- Growing Consumer Preference for Organic Silk There has been a marked increase in consumer preference for organic and sustainable silk products, particularly in urban centres and international markets. The organic silk segment has witnessed significant growth, supported by government subsidies for organic farming practices and increasing certifications under the Silk Mark Certification Scheme.

India Silk Market Challenges

- High Production Costs and Price Volatility: One of the major challenges facing the India Silk Market is the high cost of production, primarily due to the intensive labour required for sericulture and the high cost of inputs such as fertilizers and pesticides. In India, the price of raw mulberry silk was reported to be over 4,500 Indian rupees per kilogram in fiscal year 2023, which is approximately USD 54 at current exchange rates.

- Competition from Synthetic Alternatives: The India Silk Market faces stiff competition from synthetic fibres, which are cheaper and more readily available. In 2022, synthetic fibres accounted for more than half of the global textile market share, with polyester being the most popular alternative to silk. The lower cost and similar aesthetic appeal of synthetic fabrics have led to a decline in silk's market share, particularly in mass-market applications.

India Silk Market Government Initiatives

- National Silk Mission (2023-2024): The Indian government launched the National Silk Mission in 2023 with a focus on increasing silk production and enhancing the quality of Indian silk to meet global standards. The mission has a budget allocation of USD 1 billion and includes various components such as the establishment of new silk production units, technology upgrades for existing units, and support for research and development in sericulture.

- Subsidy Scheme for Sericulture Farmers: In 2024, the Indian government introduced a new subsidy scheme under the "Silk Samagra 2" initiative, specifically targeting small-scale sericulture farmers. The subsidy covers up to 50% of the total cost, with a maximum cap of USD 10,000 per farmer. This initiative is expected to increase silk production by 20% by 2025, particularly in states like Karnataka, Tamil Nadu, and Assam.

India Silk Market Future Outlook

The India Silk Market is poised for significant growth over the next five years, driven by expanding exports, increased adoption of advanced sericulture techniques, and rising demand for sustainable, organic silk. Government initiatives and technological advancements will further enhance production capacity, positioning India as a global leader in high-quality silk products.

Future Trends

- Expansion Driven by Export Growth: The India Silk Market is expected to experience significant growth over the next five years, driven by the expansion of exports to key markets such as the USA, Europe, and China. The Silk Samagra 2 initiative, coupled with targeted marketing efforts, will help Indian silk capture a larger share of the global luxury textile market.

- Increased Adoption of Advanced Sericulture Techniques: The future of the India Silk Market will be shaped by the adoption of advanced sericulture techniques, such as genetically modified silkworms and precision farming. This technological advancement will help India maintain its competitive edge in the global silk market, ensuring a steady supply of high-quality silk.

Scope of the Report

|

By Type |

Mulberry Silk Tussar Silk Eri Silk Muga Silk |

|

By Application |

Textiles and Garments Home Furnishings Industrial Applications |

|

By Region |

North India South India East India West India |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Silk Manufacturers

Textile and Garment Manufacturers

Retail Chains and E-commerce Platforms

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (MOT, CSB etc.)

Sericulture Farmers and Cooperatives

Fashion Designers and Brands

Home Furnishing Companies

Time Period Captured in the Report:

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2028

Companies

Players Mentioned in the Report:

Khadi and Village Industries Commission (KVIC)

Central Silk Board (CSB)

Fabindia

Raymond Group

Grasim Industries Ltd.

Indian Silk House Agencies

Nalli Silk Sarees

RmKV Silks

Mysore Silk Udyog

Pothys

Chennai Silks

Reliance Industries

Garden Silk Mills Ltd.

Arvind Limited

Vardhman Textiles Ltd.

Table of Contents

1. India Silk Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. India Silk Market Size (in USD Bn), 2018-2023

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. India Silk Market Analysis

3.1. Growth Drivers

3.1.1. Rising Demand for Sustainable Fashion

3.1.2. Increasing Exports

3.1.3. Government Initiatives Supporting Sericulture

3.1.4. Rising Disposable Income

3.2. Restraints

3.2.1. High Production Costs

3.2.2. Vulnerability to Environmental Changes

3.2.3. Competition from Synthetic Fibers

3.3. Opportunities

3.3.1. Expansion into Niche Markets

3.3.2. Technological Innovations in Silk Production

3.3.3. Increasing Awareness of Ethical Fashion

3.4. Trends

3.4.1. Growth in Organic Silk Production

3.4.2. Integration of Silk in Luxury Fashion

3.4.3. Development of Silk Blends with Other Fibers

3.5. Government Regulation

3.5.1. Silk Mark Certification Scheme

3.5.2. Subsidies for Sericulture

3.5.3. Quality Control Measures

3.5.4. Export Incentives

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Competition Ecosystem

4. India Silk Market Segmentation, 2023

4.1. By Type (in Value %)

4.1.1. Mulberry Silk

4.1.2. Tussar Silk

4.1.3. Eri Silk

4.1.4. Muga Silk

4.2. By Application (in Value %)

4.2.1. Textiles and Garments

4.2.2. Home Furnishings

4.2.3. Industrial Applications

4.3. By Region (in Value %)

4.3.1. North India

4.3.2. South India

4.3.3. East India

4.3.4. West India

5. India Silk Market Cross Comparison

5.1. Detailed Profiles of Major Companies

5.1.1. Khadi and Village Industries Commission (KVIC)

5.1.2. Central Silk Board (CSB)

5.1.3. Fabindia

5.1.4. Raymond Group

5.1.5. Grasim Industries Ltd.

5.2. Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue)

6. India Silk Market Competitive Landscape

6.1. Market Share Analysis

6.2. Strategic Initiatives

6.3. Mergers and Acquisitions

6.4. Investment Analysis

6.4.1. Venture Capital Funding

6.4.2. Government Grants

6.4.3. Private Equity Investments

7. India Silk Market Regulatory Framework

7.1. Quality Standards

7.2. Compliance Requirements

7.3. Certification Processes

8. India Silk Future Market Size (in USD Bn), 2023-2028

8.1. Future Market Size Projections

8.2. Key Factors Driving Future Market Growth

9. India Silk Future Market Segmentation, 2028

9.1. By Type (in Value %)

9.2. By Application (in Value %)

9.3. By Region (in Value %)

10. India Silk Market Analysts Recommendations

10.1. TAM/SAM/SOM Analysis

10.2. Customer Cohort Analysis

10.3. Marketing Initiatives

10.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 01 Identifying Key Variables:

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry level information.

Step 02 Market Building:

Collating statistics on India Silk Market over the years, penetration of marketplaces and service providers ratio to compute revenue generated in India Silk Market. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.

Step 03 Validating and Finalizing:

Building market hypothesis and conducting CATIs with industry experts belonging to different companies to validate statistics and seek operational and financial information from company representatives.

Step 04 Research Output:

Our team will approach multiple India Silk Market companies and understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from Silk Market companies.

Frequently Asked Questions

01. How big is the India Silk Market?

The India Silk Market was valued at USD 3.5 billion in 2023, driven by the country's strong sericulture tradition, robust export demand, and growing consumer preference for luxury silk products both domestically and internationally.

02. What are the challenges in the India Silk Market?

Challenges in the India Silk Market include high production costs due to labor-intensive processes, competition from synthetic fibers, and the impact of environmental factors like climate change on sericulture. These challenges can affect the profitability and sustainability of silk production in India.

03. Who are the major players in the India Silk Market?

Key players in the India Silk Market include Khadi and Village Industries Commission (KVIC), Central Silk Board (CSB), Fabindia, Raymond Group, and Grasim Industries Ltd. These entities are leaders due to their extensive production capabilities, strong market presence, and focus on quality.

04. What are the growth drivers of the India Silk Market?

The growth of the India Silk Market is driven by increasing global demand for high-quality silk products, government support through initiatives like Silk Samagra 2, and the rising consumer preference for organic and sustainable silk products, especially in urban centers.

05. What are the recent trends in the India Silk Market?

Recent trends in the India Silk Market include the growing adoption of digital platforms for silk trade, an increase in the production of silk-blended fabrics, and a heightened focus on sustainable and organic silk production, which is gaining popularity among environmentally conscious consumers.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.