India Skincare Market Outlook to 2030

Region:Asia

Author(s):Sanjeev

Product Code:KROD10098

December 2024

91

About the Report

India Skincare Market Overview

- The India skincare market is valued at USD 3 billion, reflecting robust growth driven by rising disposable incomes, increasing consumer awareness, and a burgeoning middle class. The demand for skincare products has surged, fueled by the influence of social media, which promotes beauty and skincare trends, and the expansion of e-commerce platforms that enhance product accessibility. Additionally, a shift towards organic and natural products has contributed significantly to market dynamics, catering to a growing segment of health-conscious consumers.

- Major cities such as Mumbai, Delhi, and Bangalore dominate the skincare market due to their high population density, urban lifestyle, and increasing consumer expenditure on beauty products. These urban centers are also hubs for major skincare brands, which have established a strong foothold through extensive retail networks and marketing strategies. Furthermore, these cities experience diverse demographics, leading to a high demand for tailored skincare solutions, thereby driving market growth in these regions.

- The regulatory framework governing cosmetic products in India is robust, with the Bureau of Indian Standards (BIS) overseeing product safety and quality. As of 2022, the BIS had established over 70 standards specific to cosmetics, ensuring compliance with safety and efficacy requirements (BIS). These regulations protect consumers from harmful products while promoting industry credibility. Brands must adhere to these standards to ensure market access and maintain consumer trust, making compliance a critical aspect of product development and marketing strategies.

India Skincare Market Segmentation

The India skincare market is segmented by product type and by application.

- By Product Type: The India skincare market is segmented by product type into facial care, body care, sun care, hair care, and others. Among these, facial care holds a dominant market share, driven by the increasing emphasis on personal grooming and skincare routines. Products such as moisturizers, cleansers, and serums are witnessing significant demand as consumers prioritize skin health and appearance. The rise of beauty influencers and skincare enthusiasts on social media platforms has also intensified the focus on facial products, resulting in a broader acceptance and desire for premium and specialized formulations.

- By Application: The market is also segmented by application into retail, e-commerce, and salon and spa. The e-commerce segment has seen exponential growth and currently dominates the market, largely due to the convenience it offers and the increasing trend of online shopping among consumers. Platforms like Amazon, Flipkart, and niche beauty sites have made it easier for consumers to access a wide variety of products and brands, often at competitive prices. This shift towards digital shopping is also supported by aggressive marketing strategies and the ability of e-commerce platforms to cater to consumer preferences through personalized recommendations.

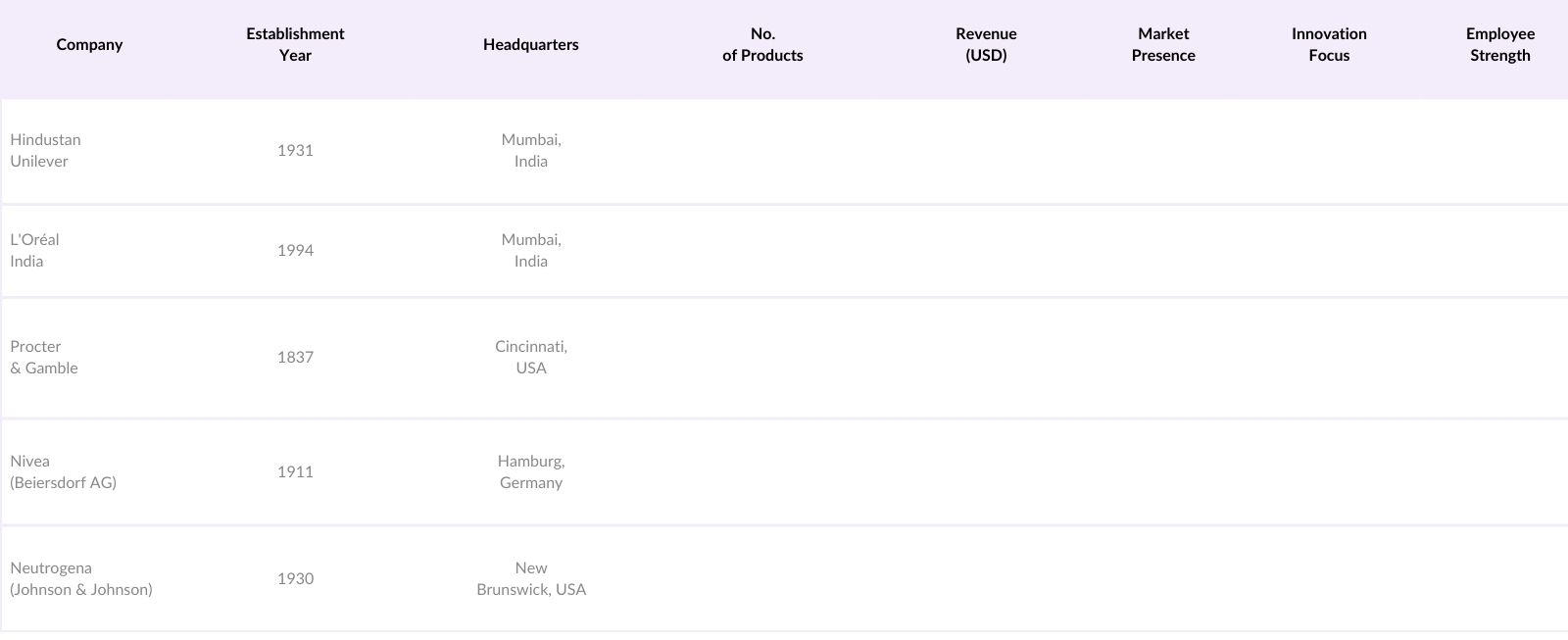

India Skincare Market Competitive Landscape

The India skincare market is characterized by the presence of both established global brands and emerging local players. The competitive landscape is dominated by major players, including Hindustan Unilever, L'Oral India, and Procter & Gamble, who continuously innovate to meet consumer demands. This consolidation highlights the significant influence of these key companies, as they leverage extensive distribution networks, brand loyalty, and diverse product offerings to maintain their competitive edge.

India Skincare Industry Analysis

Growth Drivers

- Rising Disposable Income: India's economy has witnessed substantial growth, leading to an increase in disposable income. In 2022, the average per capita income in India was approximately $2,256, reflecting a significant rise from $1,850 in 2021 (World Bank). As disposable income rises, consumers are more likely to invest in skincare products, which are often perceived as luxury items. The World Bank projects a continued increase in household income, with expectations that the middle class will expand significantly. This growth translates to higher expenditure on personal care products, contributing to the skincare market's expansion.

- Increased Awareness of Skincare Products: Consumer awareness regarding skincare benefits has surged, fueled by educational campaigns and digital media. According to the National Sample Survey Office (NSSO), over 70% of urban respondents reported an increased awareness of skincare benefits in 2022. This has led to greater investment in skincare regimens, with spending on beauty and personal care increasing significantly. The rise in health consciousness post-pandemic has also driven consumers to seek out products that promote skin health, resulting in a burgeoning market for skincare brands.

- Growth of E-commerce Channels: The rapid growth of e-commerce has transformed how consumers access skincare products in India. As of 2023, the e-commerce market in India was valued at $74 billion, with projections suggesting it will reach $110 billion by 2025 (India Brand Equity Foundation). This digital transformation allows consumers to easily explore a diverse range of skincare products, driving online sales and brand loyalty. With increasing internet penetration, which reached 60% in 2022, consumers are more inclined to shop for skincare products online, facilitating the expansion of both established and emerging brands in the digital space.

Market Challenges

- Intense Competition: The Indian skincare market is characterized by intense competition, with numerous brands vying for market share. In 2022, the number of registered cosmetic companies in India reached approximately 1,200, highlighting a saturated market landscape (Central Drugs Standard Control Organization). This competition has led to price wars and aggressive marketing strategies, which can strain profitability for smaller players. As new entrants continue to emerge, established brands must innovate continually to maintain their market position amidst evolving consumer preferences.

- Regulatory Hurdles: Navigating the regulatory landscape poses challenges for skincare companies in India. The Drug and Cosmetic Act mandates stringent guidelines for product safety and efficacy. In 2022, the regulatory body issued over 500 notices to companies for non-compliance with safety standards (Ministry of Health and Family Welfare). These regulatory hurdles can delay product launches and increase operational costs, particularly for new entrants unfamiliar with compliance protocols. Adhering to these regulations is essential for maintaining consumer trust and avoiding legal repercussions in the market.

India Skincare Market Future Outlook

Over the next five years, the India skincare market is expected to witness substantial growth, propelled by increasing consumer awareness about skin health and the rising popularity of e-commerce channels. The trend toward organic and natural skincare products is likely to continue, driven by consumer preferences for sustainable and ethically sourced ingredients. Additionally, advancements in technology will facilitate personalized skincare solutions, enhancing customer experiences and driving market expansion.

Market Opportunities

- Expansion of Organic and Natural Products: The demand for organic and natural skincare products is on the rise, driven by consumer preference for clean beauty. In 2022, sales of organic personal care products in India reached $1.2 billion, a significant jump from previous years (Nielsen). This trend is fueled by growing awareness of the harmful effects of synthetic ingredients, with consumers actively seeking products that are environmentally friendly and sustainable. The market presents an opportunity for brands to innovate and expand their portfolios to include organic offerings, capitalizing on this consumer shift toward healthier alternatives.

- Emergence of Male Grooming Products: The male grooming segment is experiencing rapid growth as societal norms evolve and more men invest in skincare. In 2022, the male grooming market in India was valued at $1.2 billion, with expectations of steady growth driven by increasing awareness and availability of men's skincare products (Statista). This segment presents a significant opportunity for brands to create targeted marketing campaigns and product lines catering specifically to male consumers, including skincare, haircare, and grooming essentials.

Scope of the Report

Products

Key Target Audience

Retailers and Distributors

E-commerce Platforms

Manufacturers of Skincare Products

Beauty Salons and Spas

Investments and Venture Capitalist Firms

Government and Regulatory Bodies (Central Drugs Standard Control Organization)

Cosmetic Industry Associations

Importers and Exporters of Skincare Products

Companies

Players Mention in the Report:

Hindustan Unilever

L'Oral India

Procter & Gamble

Nivea (Beiersdorf AG)

Neutrogena (Johnson & Johnson)

Dabur India Ltd.

Emami Ltd.

The Himalaya Drug Company

Kama Ayurveda

Lotus Herbals

Biotique

Mamaearth

Plum Goodness

FabIndia

Unilever (Simple, Dove)

Table of Contents

01. India Skincare Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

02. India Skincare Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

03. India Skincare Market Analysis

3.1. Growth Drivers

3.1.1. Rising Disposable Income

3.1.2. Increased Awareness of Skincare Products

3.1.3. Growth of E-commerce Channels

3.1.4. Influence of Social Media and Celebrities

3.2. Market Challenges

3.2.1. Intense Competition

3.2.2. Regulatory Hurdles

3.2.3. Counterfeit Products

3.3. Opportunities

3.3.1. Expansion of Organic and Natural Products

3.3.2. Emergence of Male Grooming Products

3.3.3. Innovation in Packaging

3.4. Trends

3.4.1. Customization of Products

3.4.2. Rise of Sustainable Brands

3.4.3. Incorporation of Technology in Skincare

3.5. Government Regulations

3.5.1. Cosmetic Product Standards

3.5.2. Import Regulations

3.5.3. Certification and Testing Requirements

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces

3.9. Competition Ecosystem

04. India Skincare Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Facial Care

4.1.2. Body Care

4.1.3. Sun Care

4.1.4. Hair Care

4.1.5. Others

4.2. By Application (In Value %)

4.2.1. Retail

4.2.2. E-commerce

4.2.3. Salon and Spa

4.3. By Skin Type (In Value %)

4.3.1. Dry Skin

4.3.2. Oily Skin

4.3.3. Combination Skin

4.3.4. Sensitive Skin

4.4. By Distribution Channel (In Value %)

4.4.1. Offline

4.4.2. Online

4.5. By Region (In Value %)

4.5.1. North India

4.5.2. South India

4.5.3. East India

4.5.4. West India

05. India Skincare Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Hindustan Unilever

5.1.2. Procter & Gamble

5.1.3. L'Oral India

5.1.4. Nivea (Beiersdorf AG)

5.1.5. Neutrogena (Johnson & Johnson)

5.1.6. Dabur India Ltd.

5.1.7. Emami Ltd.

5.1.8. The Himalaya Drug Company

5.1.9. Kama Ayurveda

5.1.10. Lotus Herbals

5.1.11. Biotique

5.1.12. Mamaearth

5.1.13. Plum Goodness

5.1.14. FabIndia

5.1.15. Unilever (Simple, Dove)

5.2. Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. India Skincare Market Regulatory Framework

6.1. Cosmetic Regulations

6.2. Labeling Requirements

6.3. Compliance and Safety Standards

7. India Skincare Market Future Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. India Skincare Market Future Segmentation

8.1. By Product Type (In Value %)

8.2. By Application (In Value %)

8.3. By Skin Type (In Value %)

8.4. By Distribution Channel (In Value %)

8.5. By Region (In Value %)

9. India Skincare Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the India skincare market. This step relies on extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data pertaining to the India skincare market. This includes assessing market penetration, evaluating the distribution channels, and analyzing revenue generation trends. Furthermore, a detailed evaluation of service quality metrics will be conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and subsequently validated through structured interviews with industry experts representing a diverse array of companies in the skincare sector. These consultations provide valuable operational and financial insights directly from industry practitioners, instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple skincare manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction serves to verify and complement the statistics derived from the bottom-up approach, ensuring a comprehensive, accurate, and validated analysis of the India skincare market.

Frequently Asked Questions

01. How big is the India skincare market?

The India skincare market is valued at USD 3 billion, driven by increasing disposable incomes, consumer awareness, and a shift towards organic products.

02. What are the challenges in the India skincare market?

India skincare market Challenges include high competition among brands, regulatory hurdles, and a rise in counterfeit products that undermine market integrity.

03. Who are the major players in the India skincare market?

India skincare market Key players include Hindustan Unilever, L'Oral India, and Procter & Gamble, which dominate due to extensive distribution networks and strong brand loyalty.

04. What are the growth drivers of the India skincare market?

The India skincare market is propelled by increased internet penetration, the rise of e-commerce, and growing consumer demand for premium skincare solutions.

05. What trends are shaping the India skincare market?

India skincare market Trends include the rise of natural and organic products, personalized skincare solutions, and the increasing influence of beauty influencers on social media.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.