India Sleep Apnea Devices Market Outlook to 2030

Region:Asia

Author(s):Yogita Sahu

Product Code:KROD4188

October 2024

96

About the Report

India Sleep Apnea Devices Market Overview

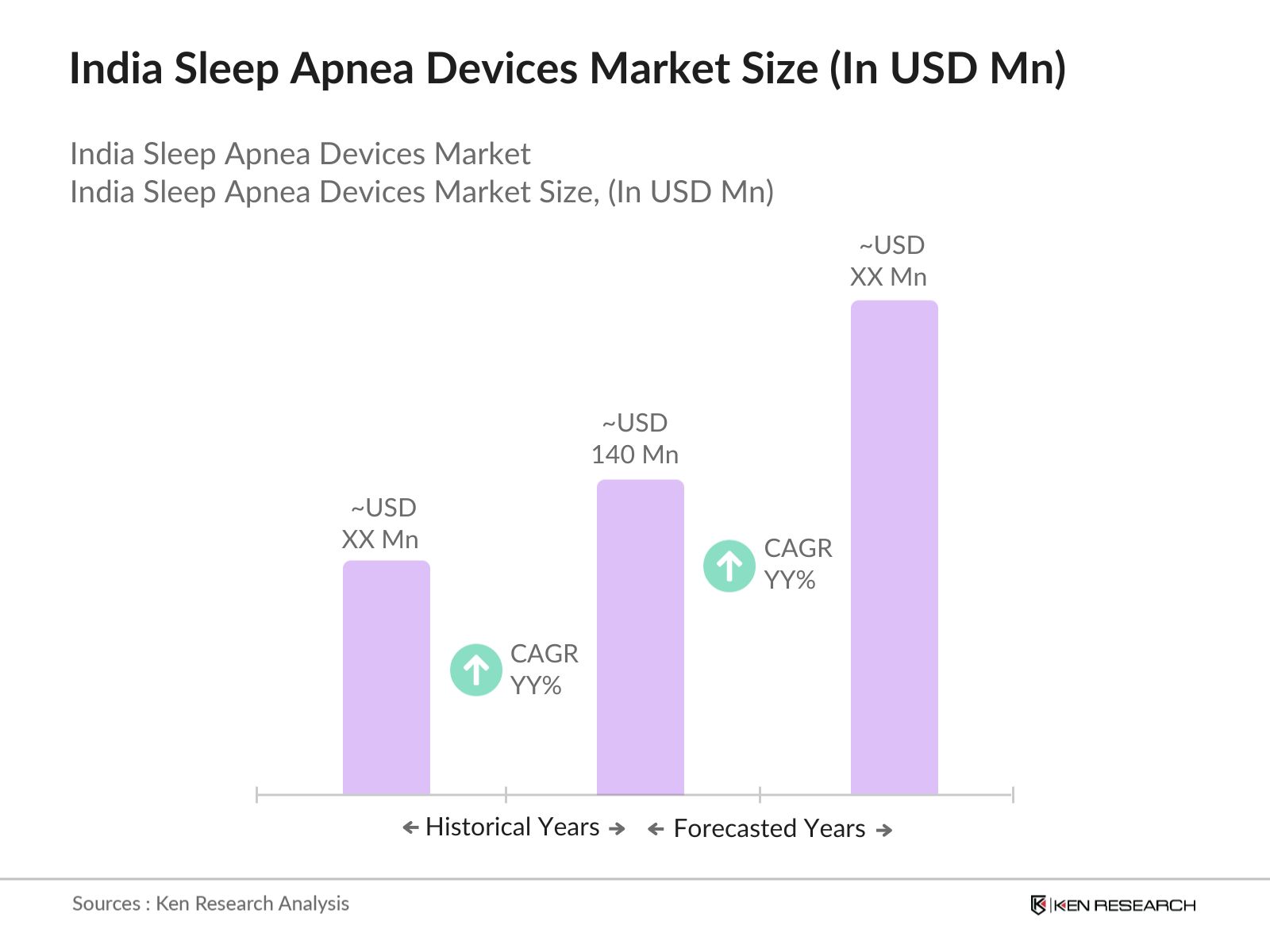

- The India Sleep Apnea Devices Market is valued at USD 140 million, driven by the increasing awareness of sleep disorders and the rising prevalence of conditions like obstructive sleep apnea (OSA). With advancements in technology and healthcare, many urban centers in India are seeing a surge in diagnostic sleep studies, further propelling the demand for sleep apnea devices. In addition, the growing focus on early diagnosis and treatment of sleep disorders, along with increasing disposable incomes, has led to an upsurge in the acquisition of these devices.

- The market is dominated by cities like Delhi, Mumbai, and Bengaluru, primarily due to their advanced healthcare infrastructure, growing urbanization, and increasing awareness about sleep disorders. These cities have a higher concentration of sleep clinics and hospitals equipped with modern diagnostic and therapeutic devices, making them key areas for growth.

- The Indian government is enhancing sleep apnea management through initiatives like theAyushman Bharat Health Infrastructure Mission, which allocated 4,200 crore for 2023-24, a 123% increase from the previous year towards healthcare infrastructure development, focusing on improving access to diagnostic tools and therapeutic devices for managing chronic diseases. The policy also supports the growth of Indias medical devices industry, which is instrumental in increasing the availability of sleep apnea devices in the country.

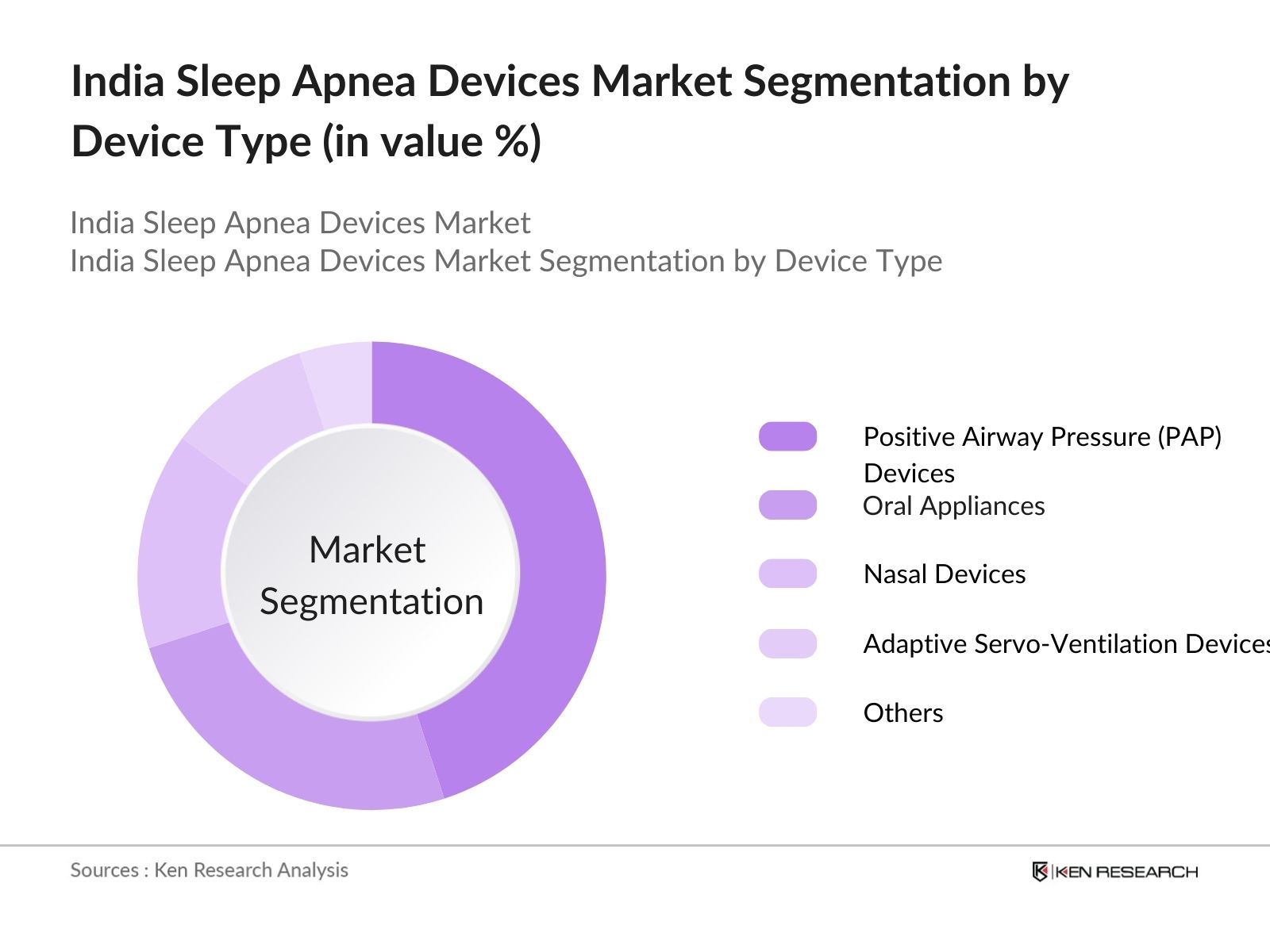

India Sleep Apnea Devices Market Segmentation

By Device Type: The market is segmented by device type into Positive Airway Pressure (PAP) Devices, Oral Appliances, Nasal Devices, Adaptive Servo-Ventilation Devices, and others. Positive Airway Pressure (PAP) Devices hold the dominant market share. PAP devices are considered the gold standard for the treatment of obstructive sleep apnea, offering a non-invasive solution that maintains continuous airflow. This dominance is attributed to their high efficacy in managing severe sleep apnea, along with widespread adoption by healthcare professionals.

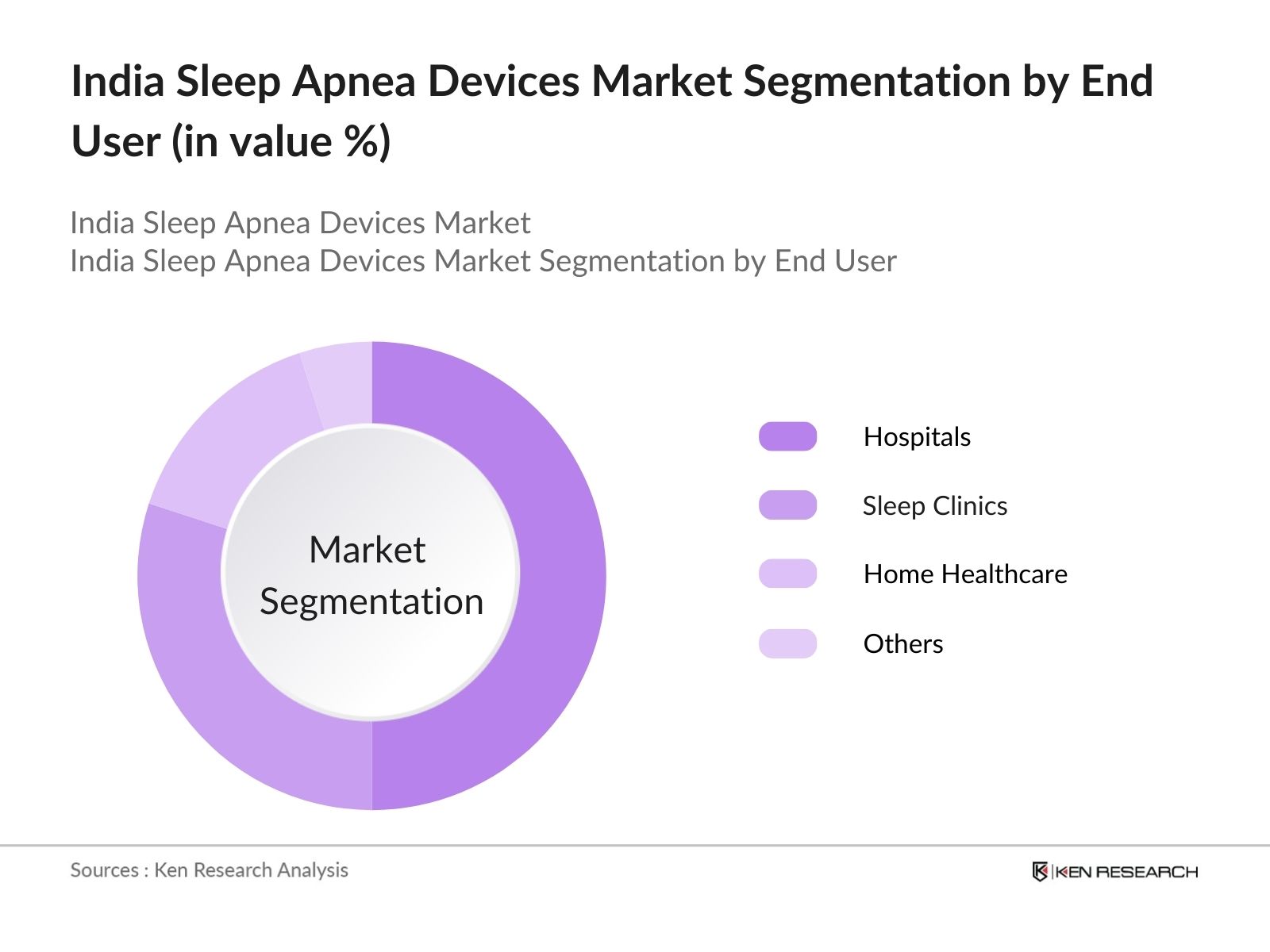

By End User: The market is further segmented by end user into Hospitals, Sleep Clinics, Home Healthcare, and Others. Hospitals dominate this segment due to their superior infrastructure, trained medical personnel, and access to comprehensive diagnostic tools for sleep disorders. Hospitals provide immediate access to specialized sleep apnea treatments and are often the first point of care for patients diagnosed with the condition. Moreover, hospitals tend to adopt the latest advancements in medical devices, ensuring better treatment options for patients with severe sleep apnea.

India Sleep Apnea Devices Market Competitive Landscape

The market is dominated by a combination of international and domestic players who provide a range of innovative products. The market is concentrated, with companies investing heavily in R&D to offer improved diagnostic and therapeutic solutions for sleep apnea. Key players focus on product differentiation, partnerships with healthcare institutions, and expansion into untapped regions.

|

Company |

Establishment Year |

Headquarters |

Revenue (USD) |

No. of Employees |

Product Portfolio |

R&D Investments |

Geographic Presence |

Recent Initiatives |

|

ResMed |

1989 |

San Diego, USA |

||||||

|

Philips Respironics |

1985 |

Amsterdam, Netherlands |

||||||

|

Fisher & Paykel Healthcare |

1934 |

Auckland, New Zealand |

||||||

|

DeVilbiss Healthcare |

1888 |

Somerset, USA |

||||||

|

Apex Medical |

1990 |

Taipei, Taiwan |

India Sleep Apnea Devices Market Analysis

Market Growth Drivers

- Increasing Prevalence of Sleep Apnea in India: The rising incidence of sleep apnea across India is driving the demand for sleep apnea devices. In 2023, the Indian Ministry of Health recorded approximately 30 million individuals suffering from obstructive sleep apnea (OSA), a condition often underdiagnosed. Lifestyle changes, air pollution, and rising cases of obesity have contributed to the growing number of cases. Medical institutions are increasing their focus on sleep disorders, with over 200 sleep clinics opening across major cities in the last two years.

- Growth of the Medical Devices Industry: India's medical devices industry is growing rapidly, bolstered by government policies like the "Make in India" initiative. In 2023, the Ministry of Commerce reported an investment of 27,000 crore in medical device manufacturing, which included sleep apnea devices. This policy supports local production, reducing dependency on imported devices and making sleep apnea treatments more accessible and affordable.

- Expansion of Healthcare Infrastructure: Indias ongoing healthcare infrastructure development, particularly in Tier-2 and Tier-3 cities, has enhanced access to sleep apnea treatments. By 2024, the Indian government plans the Pradhan Mantri Swasthya Suraksha Yojana (PMSSY) to improve healthcare facilities. The increasing number of hospitals and sleep clinics is expected to boost the adoption of CPAP machines and other apnea-related devices in smaller towns, driving market growth. This expansion also facilitates early diagnosis, contributing to better treatment outcomes.

Market Challenges

- Limited Access to Diagnostic Facilities: India faces a shortage of sleep clinics and diagnostic centers, particularly in rural areas. The Indian Society for Sleep Research (ISSR) reports that less than 10% of the population suffering from sleep apnea have access to proper diagnosis due to the lack of medical infrastructure. In 2023, India had fewer than 300 certified sleep clinics, primarily concentrated in urban centers. This shortage limits early diagnosis and proper management of sleep apnea, especially in remote regions.

- Insufficient Skilled Workforce: The Indian healthcare system lacks adequately trained professionals to diagnose and treat sleep apnea. As of 2023, there were only around 1,200 certified sleep specialists in India, according to the Indian Association of Sleep Medicine (IASM). This shortage of skilled professionals, especially in smaller cities and towns, has led to delayed diagnoses and suboptimal treatment. The lack of specialized training in sleep medicine also restricts the market's ability to address the growing number of patients effectively.

India Sleep Apnea Devices Market Future Outlook

Over the next five years, the India Sleep Apnea Devices industry is expected to see steady growth driven by increasing awareness of sleep disorders, technological advancements in treatment devices, and favorable government healthcare initiatives. As urbanization continues to rise, more people will seek diagnosis and treatment for sleep apnea, leading to higher adoption rates of both diagnostic and therapeutic devices.

Future Market Opportunities

- Expansion of Telehealth Services: Over the next five years, the market is expected to see growth due to the continued expansion of telemedicine and digital health platforms. The Indian governments push for digital healthcare infrastructure, supported by the Ayushman Bharat Digital Mission (ABDM), will enhance access to sleep disorder treatments via online consultations.

- Integration with Artificial Intelligence (AI): The future of sleep apnea management in India will increasingly involve AI-powered diagnostic and therapeutic devices. By 2028, AI integration in CPAP machines and other sleep apnea devices will allow for personalized treatment plans based on real-time data analysis. AI-enabled devices will help predict sleep apnea events and provide feedback to both patients and healthcare providers, improving overall treatment outcomes.

Scope of the Report

|

Device Type |

Positive Airway Pressure (PAP) Devices |

|

Oral Appliances |

|

|

Nasal Devices |

|

|

Adaptive Servo-Ventilation Devices |

|

|

Others |

|

|

End User |

Hospitals |

|

Sleep Clinics |

|

|

Home Healthcare |

|

|

Others |

|

|

Distribution Channel |

Direct Sales |

|

Online Retail |

|

|

Specialty Stores |

|

|

Pharmacy Chains |

|

|

Patient Age Group |

Pediatric Patients |

|

Adult Patients |

|

|

Geriatric Patients |

|

|

Region |

North |

|

South |

|

|

East |

|

|

West |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Home Healthcare Providers

Medical Device Manufacturers

Government and Regulatory Bodies (Indian FDA, National Health Mission)

Investments and Venture Capitalist Firms

Public and Private Insurance Providers

Banks and Financial Institutions

Companies

Players Mentioned in the Report:

ResMed

Philips Respironics

Fisher & Paykel Healthcare

DeVilbiss Healthcare

Apex Medical

Itamar Medical

BMC Medical Co.

Lwenstein Medical

SomnoMed

Compumedics

Curative Medical

Braebon Medical Corporation

Teleflex Inc.

Oventus Medical

Drive DeVilbiss Healthcare

Table of Contents

1. India Sleep Apnea Devices Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. India Sleep Apnea Devices Market Size (In USD Mn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. India Sleep Apnea Devices Market Analysis

3.1 Growth Drivers

3.1.1 Rising Prevalence of Sleep Disorders

3.1.2 Growing Awareness of Sleep Apnea Treatment Options

3.1.3 Technological Advancements in Sleep Apnea Devices

3.1.4 Government Initiatives and Healthcare Support Programs

3.2 Market Challenges

3.2.1 High Cost of Sleep Apnea Devices

3.2.2 Limited Access to Treatment in Rural Areas

3.2.3 Patient Adherence to Treatment

3.2.4 Lack of Awareness in Certain Demographics

3.3 Opportunities

3.3.1 Increasing Focus on Home Healthcare Solutions

3.3.2 Expansion in Untapped Rural and Tier-2 Cities

3.3.3 Partnerships with Telemedicine Providers

3.3.4 Integration with IoT and Connected Health Devices

3.4 Trends

3.4.1 Adoption of Wearable Sleep Apnea Monitoring Devices

3.4.2 Growing Preference for Non-Invasive Solutions

3.4.3 Advancements in AI-Driven Diagnosis

3.4.4 Increasing Number of FDA Approvals for Innovative Devices

3.5 Government Regulation

3.5.1 National Health Mission Policies

3.5.2 Medical Device Regulations and Standards

3.5.3 Reimbursement Policies

3.5.4 Import and Export Regulations for Sleep Apnea Devices

3.6 SWOT Analysis

3.7 Stake Ecosystem

3.8 Porters Five Forces

3.9 Competition Ecosystem

4. India Sleep Apnea Devices Market Segmentation

4.1 By Device Type (In Value %)

4.1.1 Positive Airway Pressure (PAP) Devices

4.1.2 Oral Appliances

4.1.3 Nasal Devices

4.1.4 Adaptive Servo-Ventilation Devices

4.1.5 Others (Therapeutic Devices)

4.2 By End User (In Value %)

4.2.1 Hospitals

4.2.2 Sleep Clinics

4.2.3 Home Healthcare

4.2.4 Others

4.3 By Distribution Channel (In Value %)

4.3.1 Direct Sales

4.3.2 Online Retail

4.3.3 Specialty Stores

4.3.4 Pharmacy Chains

4.4 By Patient Age Group (In Value %)

4.4.1 Pediatric Patients

4.4.2 Adult Patients

4.4.3 Geriatric Patients

4.5 By Region (In Value %)

4.5.1 North India

4.5.2 South India

4.5.3 East India

4.5.4 West India

5. India Sleep Apnea Devices Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 ResMed

5.1.2 Philips Respironics

5.1.3 Fisher & Paykel Healthcare

5.1.4 DeVilbiss Healthcare

5.1.5 Apex Medical

5.1.6 Itamar Medical

5.1.7 BMC Medical Co.

5.1.8 Lwenstein Medical

5.1.9 SomnoMed

5.1.10 Compumedics

5.1.11 Curative Medical

5.1.12 Braebon Medical Corporation

5.1.13 Teleflex Inc.

5.1.14 Oventus Medical

5.1.15 Drive DeVilbiss Healthcare

5.2 Cross Comparison Parameters (No. of Employees, Headquarters, Revenue, Product Portfolio, R&D Investment, Market Presence, Strategic Partnerships, Innovation Index)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers And Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Grants

5.9 Private Equity Investments

6. India Sleep Apnea Devices Market Regulatory Framework

6.1 Medical Device Certification Requirements

6.2 Compliance with Indian FDA Guidelines

6.3 Import-Export Regulations for Medical Devices

6.4 Environmental Standards and Disposal Guidelines

7. India Sleep Apnea Devices Future Market Size (In USD Mn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. India Sleep Apnea Devices Future Market Segmentation

8.1 By Device Type (In Value %)

8.2 By End User (In Value %)

8.3 By Distribution Channel (In Value %)

8.4 By Patient Age Group (In Value %)

8.5 By Region (In Value %)

9. India Sleep Apnea Devices Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

In this step, we created a comprehensive overview of all stakeholders in the India Sleep Apnea Devices Market. Desk research was conducted utilizing databases such as FactSet and Hoovers to gather key insights into market dynamics and stakeholder involvement.

Step 2: Market Analysis and Construction

This phase focused on compiling historical data on market penetration, device adoption rates, and service revenue generation in the Indian sleep apnea device sector. The gathered data was analyzed to ensure accuracy in estimating device sales and service offerings.

Step 3: Hypothesis Validation and Expert Consultation

We conducted interviews with industry experts from leading companies like ResMed and Fisher & Paykel to validate our hypotheses and acquire deeper insights into market trends and operational practices. These consultations helped us refine our projections and market insights.

Step 4: Research Synthesis and Final Output

The final stage involved aggregating data from multiple sources, ensuring comprehensive market analysis. This synthesis of information, coupled with primary insights, led to the creation of the final output, ensuring accuracy and reliability in the report.

Frequently Asked Questions

01. How big is the India Sleep Apnea Devices Market?

The India Sleep Apnea Devices Market is valued at USD 140 million, driven by the rising prevalence of sleep disorders and growing awareness about the importance of early diagnosis and treatment.

02. What are the challenges in the India Sleep Apnea Devices Market?

Challenges in the India Sleep Apnea Devices Market include the high cost of devices, limited access to sleep clinics in rural areas, and lack of awareness about sleep disorders in certain demographics, making it difficult to reach a broader audience.

03. Who are the major players in the India Sleep Apnea Devices Market?

Key players in the India Sleep Apnea Devices Market include ResMed, Philips Respironics, Fisher & Paykel Healthcare, DeVilbiss Healthcare, and Apex Medical. These companies have strong market penetration due to their extensive distribution networks and product portfolios.

04. What are the growth drivers of the India Sleep Apnea Devices Market?

Growth drivers in the India Sleep Apnea Devices Market include rising awareness of sleep apnea, advancements in diagnostic technologies, increasing healthcare spending, and the growing focus on non-invasive home healthcare solutions.

05. What is the future outlook of the India Sleep Apnea Devices Market?

The India Sleep Apnea Devices Market is expected to see steady growth, driven by technological advancements, expanding urbanization, and government initiatives to improve healthcare infrastructure, especially in rural regions.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.