India Smart Furniture Market Outlook to 2030

Region:Asia

Author(s):Naman Rohilla

Product Code:KROD7641

December 2024

91

About the Report

India Smart Furniture Market Overview

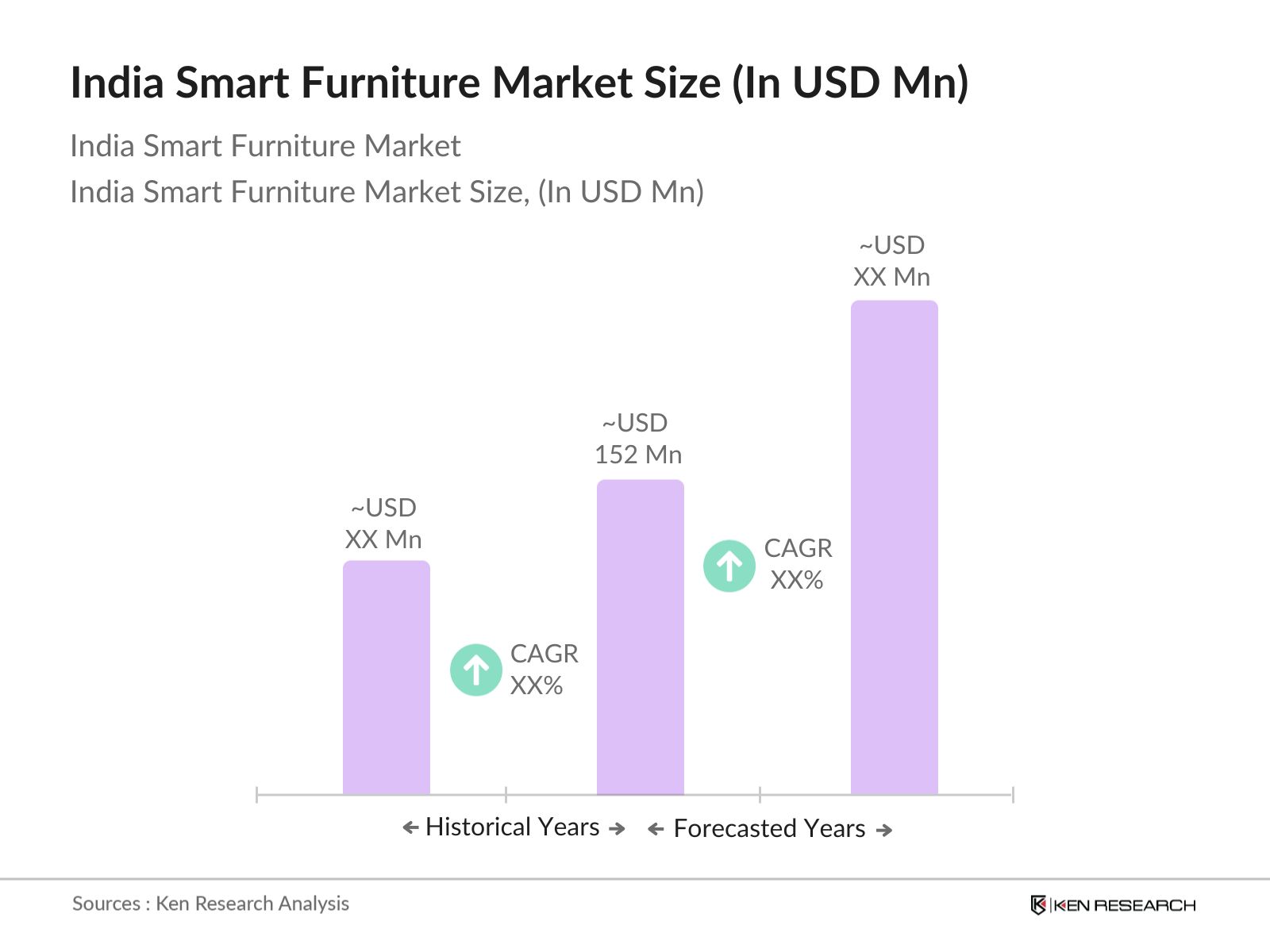

- The India smart furniture market is valued at USD 152 million, driven by rapid urbanization, technological advancements, and the increasing demand for smart homes. Factors such as rising disposable incomes and a growing tech-savvy middle class have contributed to this markets growth. With smart city initiatives gaining momentum across key metropolitan areas, the adoption of IoT-integrated smart furniture is witnessing a steady rise. Additionally, consumers are gravitating towards energy-efficient and multifunctional furniture options that blend technology with convenience.

- Dominant cities driving the smart furniture market include Mumbai, Bengaluru, and Delhi. These cities dominate due to their rapid urbanization, high real estate development, and the increasing demand for modern, tech-savvy home solutions. The rising number of tech hubs and the populations shift towards a smart and sustainable lifestyle in these metropolitan areas position them as leaders in the smart furniture market. Additionally, the smart city programs initiated in these regions are also contributing to the dominance of these cities in this market.

- The Indian governments "100 Smart Cities Mission" has been a driving force behind smart furniture adoption. In 2024, the program received 6,450 crores ($780 million) in funding to develop tech-driven urban infrastructure, including residential spaces designed for smart furniture integration. The initiative promotes IoT and AI technologies in urban development, aligning with the growing demand for smart, connected living spaces

India Smart Furniture Market Segmentation

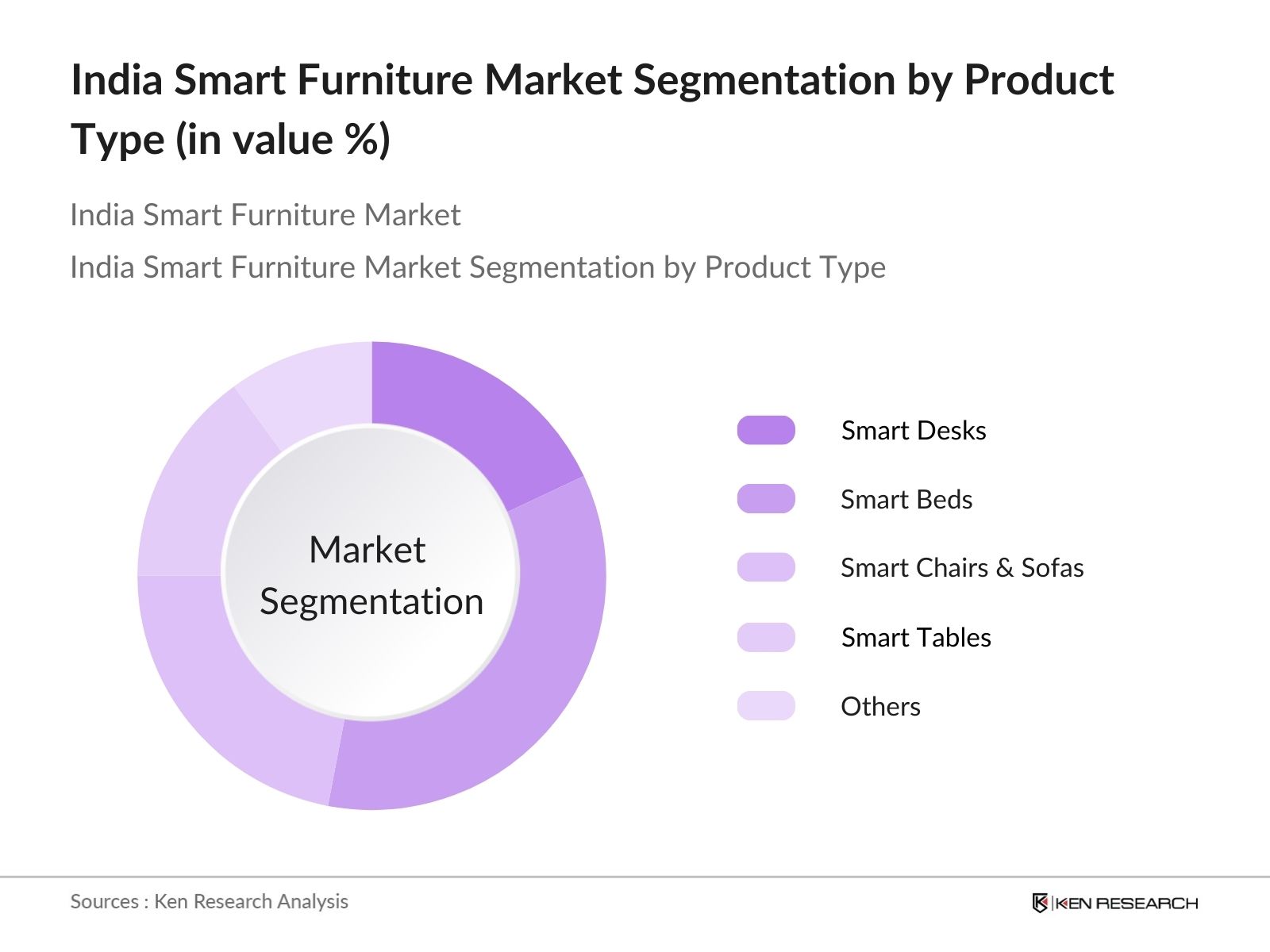

- By Product Type: India's smart furniture market is segmented by product type into smart desks, smart beds, smart chairs and sofas, smart tables, and others (storage units, lighting-integrated furniture). Smart beds dominate the product type segmentation, mainly due to their popularity among urban consumers who seek tech-enabled solutions for better comfort and convenience. Features such as app-controlled adjustments, sleep tracking, and temperature control make smart beds highly desirable in the growing tech-savvy consumer market. Their multifunctionality and convenience cater to the evolving needs of Indias urban population.

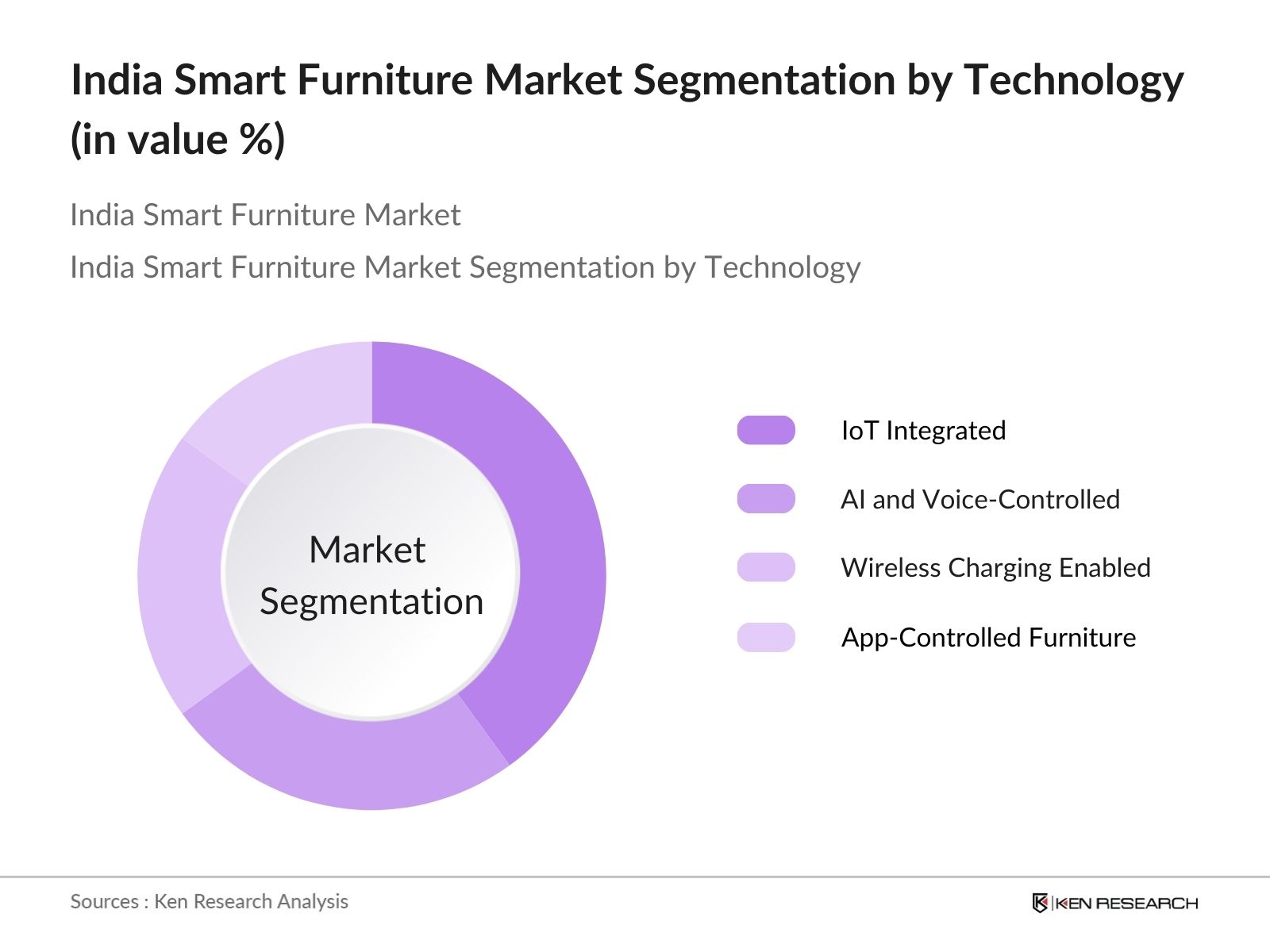

- By Technology: In the India smart furniture market, technology is a critical segmentation criterion, with categories including IoT-integrated furniture, AI and voice-controlled furniture, wireless charging-enabled furniture, and app-controlled furniture. IoT-integrated furniture leads this segment due to the increased adoption of connected devices within homes. Consumers prefer furniture that can seamlessly connect with other smart home devices, such as lighting systems, HVAC units, and security solutions, offering a holistic smart home experience. The growing popularity of home automation systems further reinforces this segments dominance.

India Smart Furniture Market Competitive Landscape

The India smart furniture market is characterized by a mix of local and international players, with brands offering diverse products that cater to a wide range of consumer needs. Companies such as Godrej Interio and Featherlite dominate the market due to their strong local presence and long-standing reputation in the furniture industry. Meanwhile, global brands like IKEA India and Steelcase have carved out shares by offering innovative smart furniture solutions that resonate with tech-savvy consumers. The consolidation of these players highlights the competitive nature of the market.

Company | Establishment Year | Headquarters | Revenue | Product Innovation | Regional Presence | Sustainability Initiatives | Smart Furniture Range | R&D Investments |

Godrej Interio | 1897 | Mumbai, India | - | - | - | - | - | - |

Featherlite | 1965 | Bengaluru, India | - | - | - | - | - | - |

IKEA India | 1943 | Hyderabad, India | - | - | - | - | - | - |

Pepperfry | 2012 | Mumbai, India | - | - | - | - | - | - |

Steelcase India | 1912 | Gurgaon, India | - | - | - | - | - | - |

India Smart Furniture Market Analysis

India Smart Furniture Market Growth Drivers

- Rise in Real Estate and Smart Homes Demand: Indias real estate sector is projected to touch $1 trillion by 2030, boosting demand for smart homes. Smart homes, equipped with AI-driven appliances and furniture, are becoming a preferred choice in urban areas. Currently, nearly 40 million Indian households use some form of smart technology in their homes. The surge in demand for connected living spaces is accelerating the adoption of smart furniture designed to enhance space efficiency and automation.

- Technological Advancements: Advancements in technology, particularly IoT integration, are transforming the Indian furniture market. By 2024, over 2.4 billion IoT devices are projected to be active in India, with many used in residential settings. AI-powered smart furniture, such as automated desks and sensor-driven recliners, is becoming mainstream, enabling users to control their environment through apps and voice commands. This rise in IoT devices enhances the market for smart furniture, catering to urban populations focused on high-tech home solutions.

- Consumer Shift Towards Sustainability: Consumers in India are increasingly shifting towards sustainable products, with 48% of Indian consumers preferring eco-friendly alternatives in 2024. This trend is also reflected in the smart furniture market, where energy-efficient solutions are in demand. Solar-powered desks, low-energy smart lighting integrated into furniture, and materials sourced from sustainable practices are driving growth. With government incentives for energy-efficient products, like tax rebates, the demand for such smart furniture is on the rise.

India Smart Furniture Market Challenges

- High Initial Costs and Maintenance: The high cost of production and technological integration in smart furniture remains a barrier, with an average smart sofa priced at 80,000 to 1.5 lakh ($960 to $1,800) in 2024. Furthermore, the maintenance costs for such tech-embedded furniture can be prohibitive for middle-income households, limiting its adoption to urban affluent regions. This cost factor remains a critical challenge for manufacturers aiming to expand into middle-class markets.

- Lack of Consumer Awareness in Tier-2/3 Cities: While smart furniture is gaining traction in metropolitan cities, there remains a lack of awareness in Tier-2 and Tier-3 cities, where approximately 70% of India's population resides. A survey conducted by the Ministry of Electronics & IT in 2023 showed that only 18% of consumers in these regions were familiar with smart home technology, limiting market penetration. Bridging this awareness gap is essential for the expansion of smart furniture into these cities.

India Smart Furniture Market Future Outlook

Over the next five years, the India smart furniture market is expected to experience substantial growth, propelled by the ongoing development of smart city projects, increased consumer awareness, and a growing preference for tech-enabled home solutions. The convergence of smart home technology with energy-efficient furniture is expected to create opportunities for both domestic and international players. The markets future will also be shaped by advancements in AI, IoT, and wireless technology, allowing for more personalized and interconnected furniture solutions.

India Smart Furniture Market Opportunities

- Expansion into Tier-2 and Tier-3 Cities: The rising disposable income in Tier-2 and Tier-3 cities presents a growth opportunity for smart furniture manufacturers. In 2023, these cities contributed 45% of Indias consumption growth, as per the NITI Aayog. With real estate developments expanding into these areas, there is potential for market expansion. Initiatives like the Housing for All mission, which targets affordable housing in smaller cities, also create opportunities for smart furniture adoption in these regions.

- Integration with Work-from-Home Ecosystems: With over 21 million employees in India expected to work remotely by 2025, according to the Ministry of Labour and Employment, the demand for home office furniture has surged. Smart workstations that enhance productivity and comfort, such as height-adjustable desks and ergonomically designed smart chairs, are becoming essential for home-based professionals. This growing work-from-home ecosystem is driving innovation and demand for smart furniture specifically designed for home offices.

Scope of the Report

Product Type | Smart Desks Smart Beds Smart Chairs Smart Tables Others |

Technology | IoT Integrated AI and Voice-Controlled Wireless Charging App-Controlled |

Application | Residential Commercial Industrial |

Material Type | Wood Metal Plastic Hybrid Materials |

Region | North India South India East India West India |

Products

Key Target Audience

Furniture Manufacturers

Smart Home Product Providers

Technology Integrators

Real Estate Developers

Investors and Venture Capitalist Firms

Banks and Financial Institutions

Government and Regulatory Bodies (Bureau of Indian Standards, Ministry of Housing and Urban Affairs)

Interior Designers and Architects

Retail Chains and E-Commerce Platforms

Companies

Players Mentioned in the Report

Godrej Interio

Featherlite

Nilkamal Furniture

IKEA India

Urban Ladder

Pepperfry

Durian

Wipro Furniture

Bose Smart Furniture

Steelcase India

Table of Contents

1. India Smart Furniture Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. India Smart Furniture Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis (Growth Rate %, Units Sold)

2.3. Key Market Developments and Milestones

3. India Smart Furniture Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Urbanization and Smart City Initiatives

3.1.2. Rise in Real Estate and Smart Homes Demand

3.1.3. Technological Advancements (Integration with IoT, AI-powered furniture)

3.1.4. Consumer Shift Towards Sustainability (Smart energy-efficient furniture)

3.2. Market Challenges

3.2.1. High Initial Costs and Maintenance

3.2.2. Lack of Consumer Awareness in Tier-2/3 Cities

3.2.3. Regulatory Barriers (Import Duties on Smart Furniture Components)

3.3. Opportunities

3.3.1. Expansion into Tier-2 and Tier-3 Cities

3.3.2. Integration with Work-from-Home Ecosystems

3.3.3. Collaboration with Real Estate Developers and Interior Designers

3.4. Trends

3.4.1. Customization and Personalization of Smart Furniture

3.4.2. Emergence of Voice-Controlled and AI-Driven Furniture

3.4.3. Use of Sustainable Materials in Smart Furniture Production

3.5. Government Regulation

3.5.1. Smart City Initiatives by Government

3.5.2. Incentives for Energy-Efficient Products

3.5.3. Guidelines on Wireless Connectivity and Data Privacy

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis (Supplier Power, Buyer Power, Threat of New Entrants, Threat of Substitutes, Competitive Rivalry)

3.9. Competitive Ecosystem (Smart Furniture Players, IoT Providers, Furniture Manufacturers)

4. India Smart Furniture Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Smart Desks

4.1.2. Smart Beds

4.1.3. Smart Chairs and Sofas

4.1.4. Smart Tables

4.1.5. Others (Storage Units, Lighting Integrated Furniture)

4.2. By Technology (In Value %)

4.2.1. IoT Integrated

4.2.2. AI and Voice-Controlled

4.2.3. Wireless Charging Enabled

4.2.4. App-Controlled Furniture

4.3. By Application (In Value %)

4.3.1. Residential

4.3.2. Commercial (Offices, Retail, Hospitality)

4.3.3. Industrial (Workstations, Meeting Rooms)

4.4. By Material Type (In Value %)

4.4.1. Wood

4.4.2. Metal

4.4.3. Plastic

4.4.4. Hybrid Materials

4.5. By Region (In Value %)

4.5.1. North India

4.5.2. South India

4.5.3. East India

4.5.4. West India

5. India Smart Furniture Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Godrej Interio

5.1.2. Featherlite

5.1.3. Nilkamal Furniture

5.1.4. IKEA India

5.1.5. Urban Ladder

5.1.6. Pepperfry

5.1.7. Durian

5.1.8. Wipro Furniture

5.1.9. Bose Smart Furniture

5.1.10. Steelcase India

5.1.11. Snapdeal Smart Furniture

5.1.12. Sleek International

5.1.13. Manglam Timbers

5.1.14. Zuari Furniture

5.1.15. Spacewood

5.2. Cross Comparison Parameters (Revenue, Product Innovation, Sustainability Practices, Regional Presence, IoT Integration, Technological Investments, Product Range, Market Share)

5.3. Market Share Analysis (Top 15 Players)

5.4. Strategic Initiatives (Mergers & Acquisitions, Partnerships, New Product Launches)

5.5. Investment Analysis

5.6. Private Equity and Venture Capital Funding

5.7. Technology Integration Trends (AI, IoT, Smart Assistants)

6. India Smart Furniture Market Regulatory Framework

6.1. Smart City Program Policies

6.2. Energy Efficiency Guidelines

6.3. Wireless and IoT Integration Compliance

6.4. Data Privacy Laws (Concerning Smart Devices)

7. India Smart Furniture Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. India Smart Furniture Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Technology (In Value %)

8.3. By Application (In Value %)

8.4. By Material Type (In Value %)

8.5. By Region (In Value %)

9. India Smart Furniture Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

DisclaimerContact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the India Smart Furniture Market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, historical data on the India Smart Furniture Market is compiled and analyzed. This includes assessing market penetration, the ratio of smart home adoption, and the resultant revenue generation. Furthermore, service quality statistics are evaluated to ensure the accuracy of revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and validated through expert consultations with professionals from the smart furniture and technology industries. These consultations provide operational and financial insights from practitioners, which are instrumental in refining the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple smart furniture manufacturers to acquire insights into product segments, sales performance, and consumer preferences. This interaction verifies and complements the bottom-up approach statistics, ensuring a comprehensive and validated analysis of the India Smart Furniture market.

Frequently Asked Questions

01. How big is the India Smart Furniture Market?

The India smart furniture market is valued at USD 152 million, driven by increasing urbanization, technological advancements, and growing consumer interest in smart homes.

02. What are the challenges in the India Smart Furniture Market?

Challenges in the India smart furniture market include high initial costs of smart furniture, lack of consumer awareness in Tier-2 and Tier-3 cities, and regulatory hurdles related to data privacy and wireless connectivity in smart homes.

03. Who are the major players in the India Smart Furniture Market?

Key players in the India smart furniture market include Godrej Interio, Featherlite, IKEA India, Pepperfry, and Steelcase India. These companies dominate the market due to their established brand presence, strong distribution networks, and innovative product offerings.

04. What are the growth drivers of the India Smart Furniture Market?

The market is driven by rapid urbanization, growing demand for smart homes, technological advancements in IoT and AI, and the increasing focus on energy-efficient and multifunctional furniture solutions.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.