India Sodium Silicate Market Outlook to 2030

Region:Asia

Author(s):Shreya Garg

Product Code:KROD3297

December 2024

83

About the Report

India Sodium Silicate Market Overview

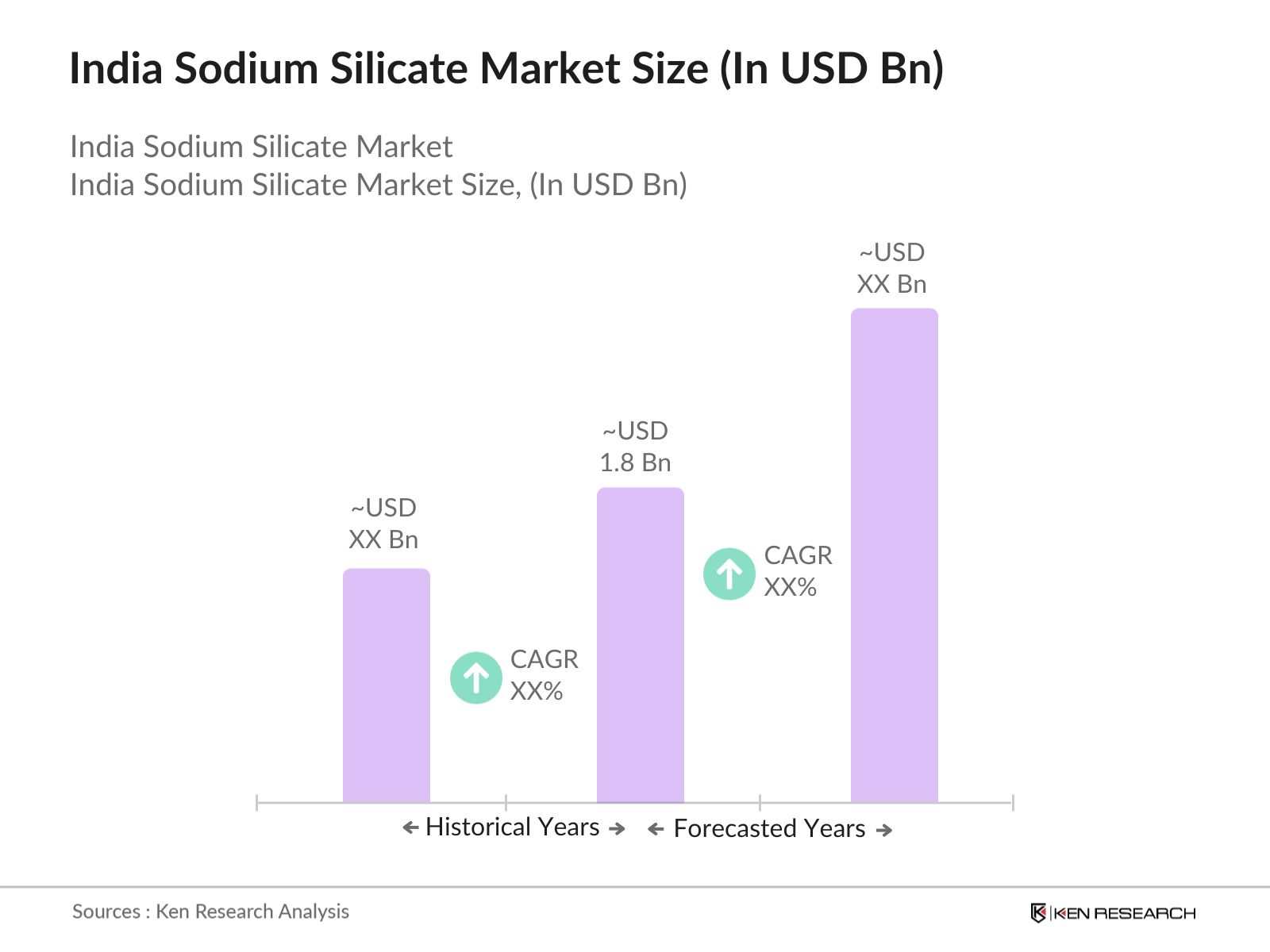

- The India Sodium Silicate market is valued at USD 1.8 billion, driven primarily by its extensive use in various industries such as construction, detergents, and water treatment. The market has expanded significantly over the past five years, owing to increased demand from industrial applications, particularly in construction, due to its use in concrete hardening and soil stabilization. Furthermore, rising awareness about environmental protection has fueled the demand for sodium silicate in water treatment plants, enhancing its market position.

- Cities like Mumbai, Delhi, and Chennai dominate the India Sodium Silicate market due to their industrial concentration and infrastructure development. These cities host a large number of manufacturing plants and construction projects, which directly contribute to the demand for sodium silicate. Additionally, Gujarat stands out as a key region because of its chemical manufacturing base and easy access to raw materials, making it a prime location for sodium silicate production.

- The Government of Indias "Make in India" initiative, which aims to promote local manufacturing and reduce import dependency, has provided significant impetus to the domestic production of chemicals, including sodium silicate. In 2024, the campaign continues to support the expansion of chemical manufacturing clusters, with new investment opportunities of over INR 50,000 crore ($6 billion) in chemical zones across various states. This initiative has driven investment in production capacity and infrastructure for sodium silicate manufacturing.

India Sodium Silicate Market Segmentation

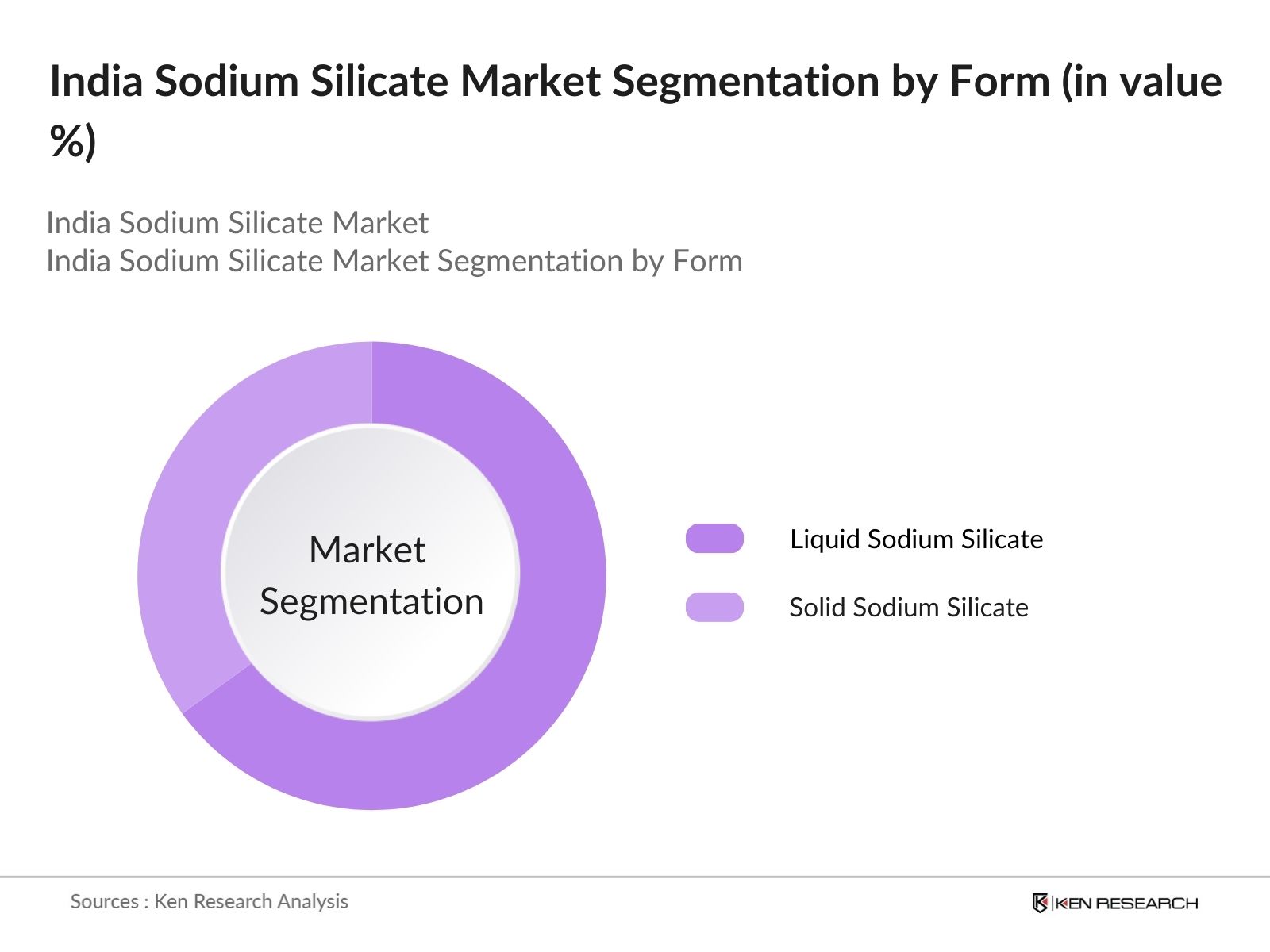

By Form: Indias Sodium Silicate market is segmented by form into liquid and solid sodium silicate. Liquid sodium silicate holds a dominant share in the market. This is attributed to its widespread application in the detergents and adhesives industries due to its ease of integration into formulations and its ability to enhance product effectiveness. Furthermore, the water treatment sector has driven the demand for liquid sodium silicate because of its efficient use in coagulation and flocculation processes.

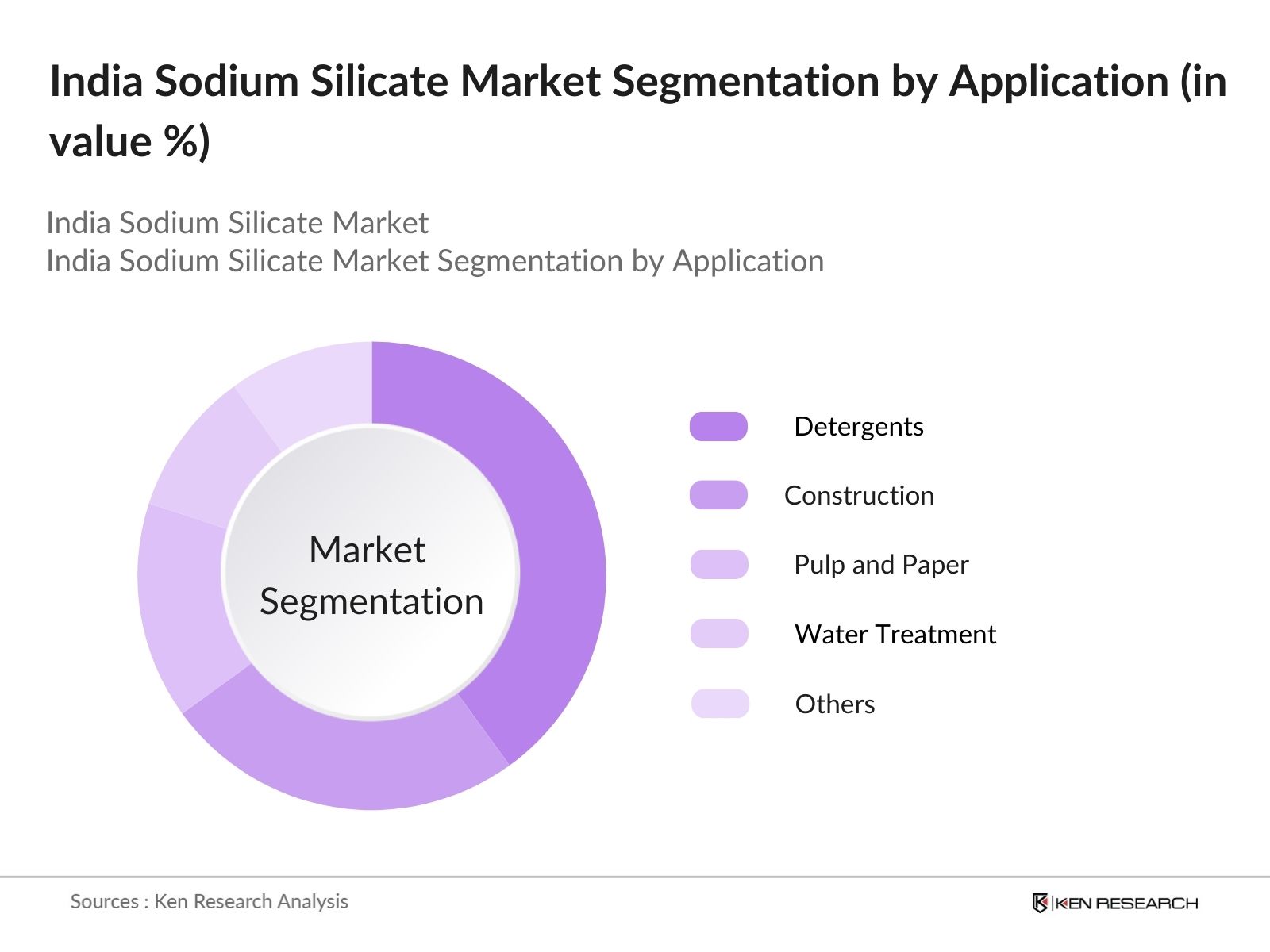

By Application: Indias Sodium Silicate market is also segmented by application into detergents, construction, pulp and paper, water treatment, and others. Detergents hold the largest share of the application segment due to the extensive use of sodium silicate as a builder in laundry detergents. The growing consumption of detergents in urban and rural areas has sustained this segments dominance. Additionally, its anti-corrosion properties and cost-effectiveness make it a preferred choice in detergent formulations.

India Sodium Silicate Market Competitive Landscape

The India Sodium Silicate market is moderately consolidated, with a few major players leading the industry. The market sees competition in terms of product innovation, expansion of production facilities, and partnerships with key industry sectors.

The India Sodium Silicate market is dominated by both global and local players, including PQ Corporation, BASF SE, and Kiran Global Chem Limited. These companies lead the market through extensive production capacities, strong distribution networks, and continued focus on R&D. The competition landscape is shaped by partnerships with key industries such as construction and chemicals, driving product innovations and expansion strategies.

|

Company Name |

Establishment Year |

Headquarters |

Key Parameters |

R&D Investment |

Production Capacity |

Distribution Network |

Market Focus |

|

PQ Corporation |

1831 |

Pennsylvania, USA |

|||||

|

BASF SE |

1865 |

Ludwigshafen, Germany |

|||||

|

Kiran Global Chem Limited |

1979 |

Chennai, India |

|||||

|

Solvay S.A. |

1863 |

Brussels, Belgium |

|||||

|

Shanti Chemical Works |

1978 |

Gujarat, India |

India Sodium Silicate Market Analysis

Growth Drivers

- Increasing Demand from the Construction Industry: The demand for sodium silicate in India has been rising steadily due to its extensive use in the construction industry for waterproofing, concrete hardening, and as a bonding agent. In 2024, the Indian government is projected to continue large-scale infrastructure projects, with an allocation of over INR 10 lakh crore ($120 billion) for urban development and housing initiatives. The construction industry heavily relies on materials like sodium silicate for durable and cost-effective solutions, driving further demand in the coming years.

- Rising Adoption in Detergents and Cleaners Manufacturing: Sodium silicates role as a builder and a pH regulator makes it a key component in the production of detergents and cleaning agents.With India's household cleaning products sectors increasing urbanization and hygiene awareness have significantly expanded the need for effective cleaning solutions. This growing demand has resulted in a surge in sodium silicate consumption by manufacturers, especially in large metropolitan areas, driving its use in various detergent formulations.

- Government Policies on Environmental Protection (Government Initiatives): The Indian governments environmental regulations, including the Clean India Mission and various water treatment mandates, have incentivized industries to adopt eco-friendly raw materials like sodium silicate. With India facing water scarcity issues affecting over 600 million people, treatment plants using sodium silicate as a coagulant for wastewater and effluent treatment are gaining prominence. In 2024, over 100 new water treatment plants are expected to be established, further boosting sodium silicate demand in the water management and treatment sectors.

Market Challenges

- Fluctuating Raw Material Prices: The prices of raw materials required for sodium silicate production, such as soda ash and silica, are subject to frequent fluctuations in the global market. In 2024, India imports over 1 million tons of soda ash annually, primarily from countries like the USA and Turkey. Fluctuations in global demand and currency exchange rates contribute to cost volatility, increasing manufacturing expenses. Such uncertainty in raw material costs poses a significant challenge for sodium silicate producers, affecting pricing and profitability in the domestic market.

- Stringent Environmental Regulations (Compliance Issues): As part of Indias commitment to reducing industrial pollution and carbon emissions, environmental agencies have enforced stringent regulations on the manufacturing processes of chemicals, including sodium silicate. In 2024, the Central Pollution Control Board (CPCB) continues to impose stricter norms on emissions from chemical factories. Compliance with these regulations often requires significant investment in cleaner technologies and processes, putting additional financial pressure on manufacturers and potentially slowing down production rates.

India Sodium Silicate Market Future Outlook

Over the next five years, the India Sodium Silicate market is expected to witness significant growth driven by increasing demand from the construction and detergents industries. The rising focus on water treatment and environmental protection initiatives by the government will further boost market demand. Key market players are anticipated to invest in product innovations, expanding applications in the automotive and electronics industries, which will create new growth avenues for the sodium silicate market. Additionally, the rising investments in infrastructure projects across India will bolster the demand for sodium silicate in construction.

Future Market Opportunities

- Growth of Indias Infrastructure Sector: Indias infrastructure sector, which is expected to witness investments of over INR 100 lakh crore ($1.2 trillion) by 2024, presents vast opportunities for sodium silicate manufacturers. The materials extensive applications in concrete, coatings, and adhesives make it indispensable in the development of highways, smart cities, and housing projects. This surge in infrastructure growth, especially with projects like Bharatmala and the Smart Cities Mission, is projected to significantly boost demand for sodium silicate in various construction applications.

- Increasing R&D in New Applications of Sodium Silicate (Product Innovation): With increased investment in R&D, sodium silicate is finding innovative applications beyond traditional sectors. In 2024, several Indian companies are exploring its use in advanced battery technologies and eco-friendly packaging materials. Research institutions, funded by government grants totaling over INR 5,000 crore ($600 million) for green chemistry and material sciences, are working on developing more sustainable applications for sodium silicate, opening up new avenues for growth in the coming years.

Scope of the Report

|

By Form |

Liquid Sodium Silicate Solid Sodium Silicate |

|

By Application |

Detergents Construction Pulp and Paper Water Treatment Others |

|

By Manufacturing Process |

Hydrothermal Process Furnace Process |

|

By End-Use Industry |

Chemicals Adhesives Refractories |

|

By Region |

North South East West |

Products

Key Target Audience

Sodium Silicate Manufacturers

Sodium Silicate Suppliers and Distributors

Detergent Manufacturers

Construction Industry Stakeholders

Government and Regulatory Bodies (Central Pollution Control Board, Ministry of Environment, Forest and Climate Change)

Water Treatment Plant Operators

Investors and Venture Capitalist Firms

Pulp and Paper Manufacturers

Companies

Major Players

PQ Corporation

BASF SE

Solvay S.A.

Kiran Global Chem Limited

Shanti Chemical Works

Gujarat Multi Gas Base Chemicals Pvt. Ltd.

W.R. Grace & Co.

Patalia Chem Industries

Evonik Industries AG

VanBaerle Group

Table of Contents

India Sodium Silicate Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

India Sodium Silicate Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

India Sodium Silicate Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Demand from the Construction Industry

3.1.2. Rising Adoption in Detergents and Cleaners Manufacturing

3.1.3. Government Policies on Environmental Protection (Government Initiatives)

3.1.4. Expanding Use in the Paper and Pulp Industry (Product Diversification)

3.2. Market Challenges

3.2.1. Fluctuating Raw Material Prices

3.2.2. Stringent Environmental Regulations (Compliance Issues)

3.2.3. Availability of Alternatives (Market Penetration of Substitutes)

3.3. Opportunities

3.3.1. Growth of Indias Infrastructure Sector

3.3.2. Increasing R&D in New Applications of Sodium Silicate (Product Innovation)

3.3.3. Expanding Application in Automotive Industry (Automotive Sector Growth)

3.4. Trends

3.4.1. Increasing Preference for Green Chemicals (Sustainability)

3.4.2. Advancements in Sodium Silicate Production Technologies

3.4.3. Growing Demand for Eco-friendly Packaging Materials

3.5. Government Regulations

3.5.1. Pollution Control Policies (Environmental Compliance)

3.5.2. Licensing and Certification Requirements

3.5.3. Standards for Safe Use of Sodium Silicate in Manufacturing

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competition Ecosystem

India Sodium Silicate Market Segmentation

4.1. By Form (In Value %)

4.1.1. Liquid Sodium Silicate

4.1.2. Solid Sodium Silicate

4.2. By Application (In Value %)

4.2.1. Detergents

4.2.2. Construction

4.2.3. Pulp and Paper

4.2.4. Water Treatment

4.2.5. Others

4.3. By Manufacturing Process (In Value %)

4.3.1. Hydrothermal Process

4.3.2. Furnace Process

4.4. By End-Use Industry (In Value %)

4.4.1. Chemicals

4.4.2. Adhesives

4.4.3. Ceramics and Refractories

4.5. By Region (In Value %)

4.5.1. Northern India

4.5.2. Southern India

4.5.3. Eastern India

4.5.4. Western India

India Sodium Silicate Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. PQ Corporation

5.1.2. BASF SE

5.1.3. Solvay S.A.

5.1.4. CIECH Group

5.1.5. Kiran Global Chem Limited

5.1.6. Shanti Chemical Works

5.1.7. Gujarat Multi Gas Base Chemicals Pvt. Ltd.

5.1.8. PPG Industries, Inc.

5.1.9. W. R. Grace & Co.

5.1.10. Oriental Silicas Corporation

5.1.11. Evonik Industries AG

5.1.12. Patalia Chem Industries

5.1.13. Silmaco N.V.

5.1.14. VanBaerle Group

5.1.15. IQE Group

5.2. Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue, Product Diversification, Market Share, R&D Investments, Manufacturing Facilities)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

India Sodium Silicate Market Regulatory Framework

6.1. Environmental Standards

6.2. Compliance Requirements

6.3. Certification Processes

India Sodium Silicate Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

India Sodium Silicate Future Market Segmentation

8.1. By Form (In Value %)

8.2. By Application (In Value %)

8.3. By Manufacturing Process (In Value %)

8.4. By End-Use Industry (In Value %)

8.5. By Region (In Value %)

India Sodium Silicate Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

In this phase, a detailed mapping of the India Sodium Silicate market is constructed, involving all stakeholders, including manufacturers, suppliers, and end-users. Desk research is conducted utilizing secondary databases to identify market drivers, challenges, and growth opportunities.

Step 2: Market Analysis and Construction

Historical data from industry sources and government reports is compiled to assess market growth and penetration. The data analysis also includes an evaluation of key revenue-generating sectors, particularly focusing on construction and detergent applications.

Step 3: Hypothesis Validation and Expert Consultation

To ensure the accuracy of our findings, we engaged with industry experts through direct interviews. These experts provided valuable insights into sodium silicate production trends, new product developments, and demand forecasts.

Step 4: Research Synthesis and Final Output

After validating the data, the final synthesis involved creating a comprehensive report that integrates market segmentation, competitive analysis, and future outlook. This phase ensures that the report offers actionable insights for stakeholders.

Frequently Asked Questions

01 How big is the India Sodium Silicate market?

The India Sodium Silicate market is valued at USD 1.8 billion, primarily driven by its demand in the construction and detergent industries.

02 What are the challenges in the India Sodium Silicate market?

The India Sodium Silicate market faces challenges related to fluctuating raw material prices and stringent environmental regulations. These factors impact production costs and compliance requirements.

03 Who are the major players in the India Sodium Silicate market?

Key players in the India Sodium Silicate market include PQ Corporation, BASF SE, Kiran Global Chem Limited, Solvay S.A., and Shanti Chemical Works. These companies dominate the market due to their large production capacities and strong distribution networks.

04 What are the growth drivers of the India Sodium Silicate market?

The growth drivers for the India Sodium Silicate market include increasing demand from the construction and detergent industries, along with government initiatives supporting water treatment projects.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.