India Software Defined Radio Market Outlook to 2030

Region:Asia

Author(s):Paribhasha Tiwari

Product Code:KROD9223

December 2024

83

About the Report

India Software Defined Radio Market Overview

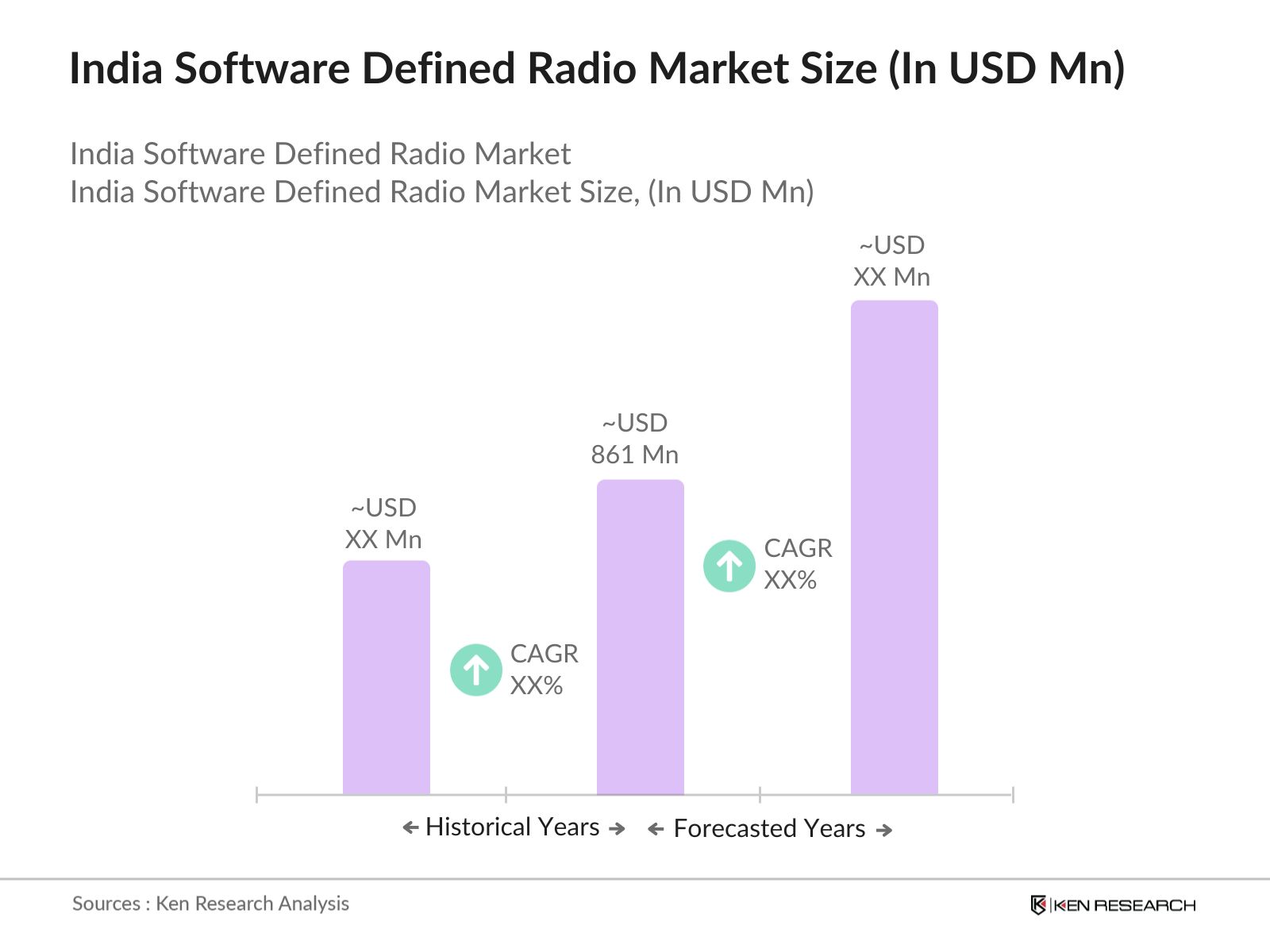

- The India Software Defined Radio market is valued at USD 861 million, supported by a five-year historical analysis. The market is propelled by increasing investments in defense modernization, growing demand for secure and flexible communication systems, and advancements in wireless communication technologies. The expansion of SDR applications into commercial and civil sectors is further augmenting its growth, while government initiatives to boost indigenous manufacturing strengthen the markets foundation.

- Metropolitan cities like Bengaluru and Hyderabad dominate the SDR market due to their concentration of defense research organizations, tech hubs, and skilled workforce. These cities are home to major public and private sector projects, benefiting from proximity to advanced manufacturing facilities and collaborative ecosystems that foster innovation in SDR technologies.

- The Indian Ministry of Defence (MoD) has accelerated the development of SDR technology, emphasizing its importance for modern military communications. Notably, in March 2023, the MoD awarded a contract to Bharat Electronics Limited (BEL) for the supply of 1,265 indigenously developed SDR portables for the Indian Navy. These radios are designed to support multi-band and multi-channel operations, crucial for network-centric warfare.

India Software Defined Radio Market Segmentation

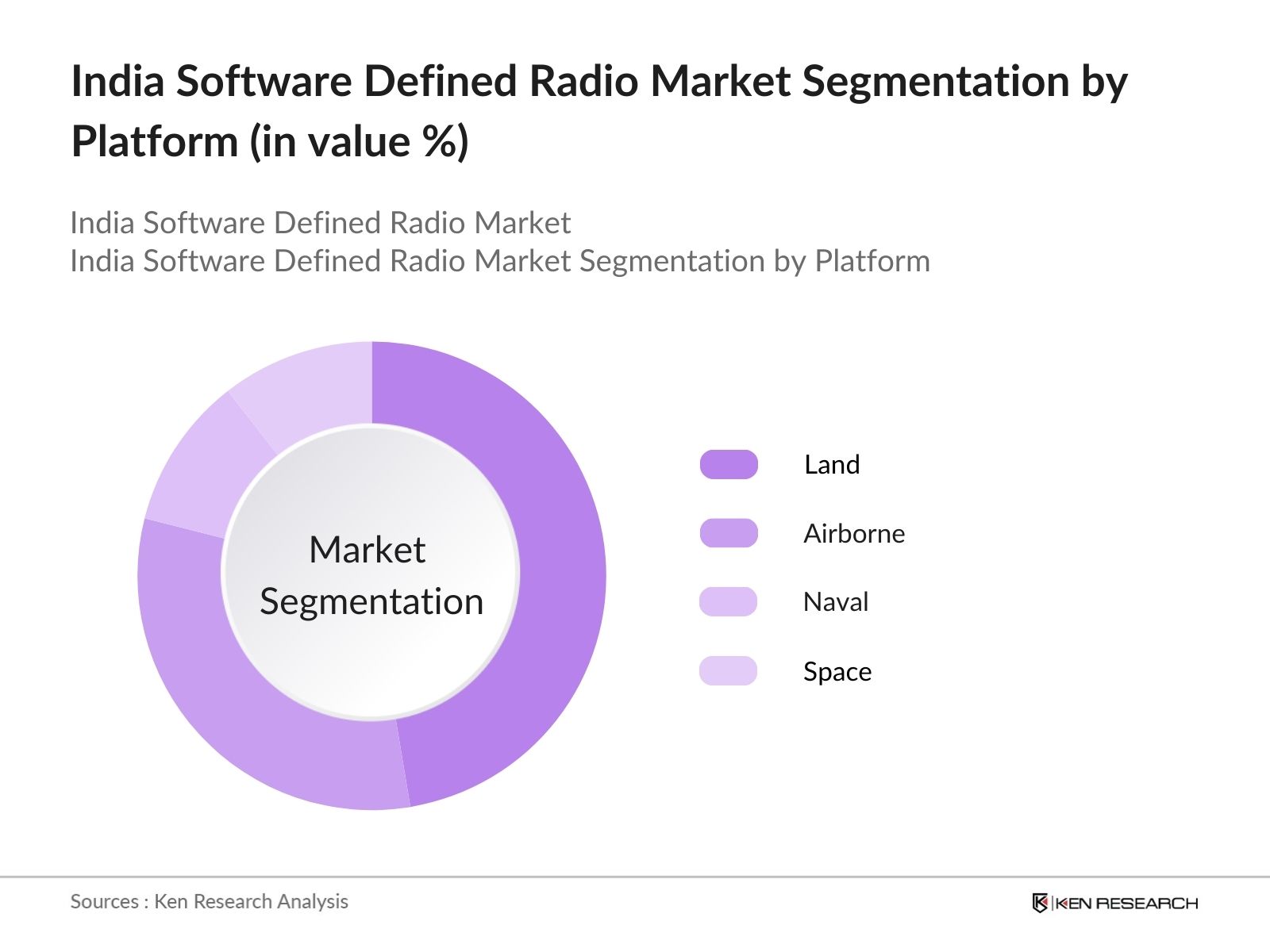

By Platform: The India SDR market is segmented by platform into land, airborne, naval, and space platforms. Land platforms dominate the market due to extensive usage in military communications and disaster management systems. These platforms ensure seamless communication across various terrains and scenarios, a critical factor for Indias vast and diverse geography. The demand for secure and interoperable communication systems by defense forces underpins the segments dominance.

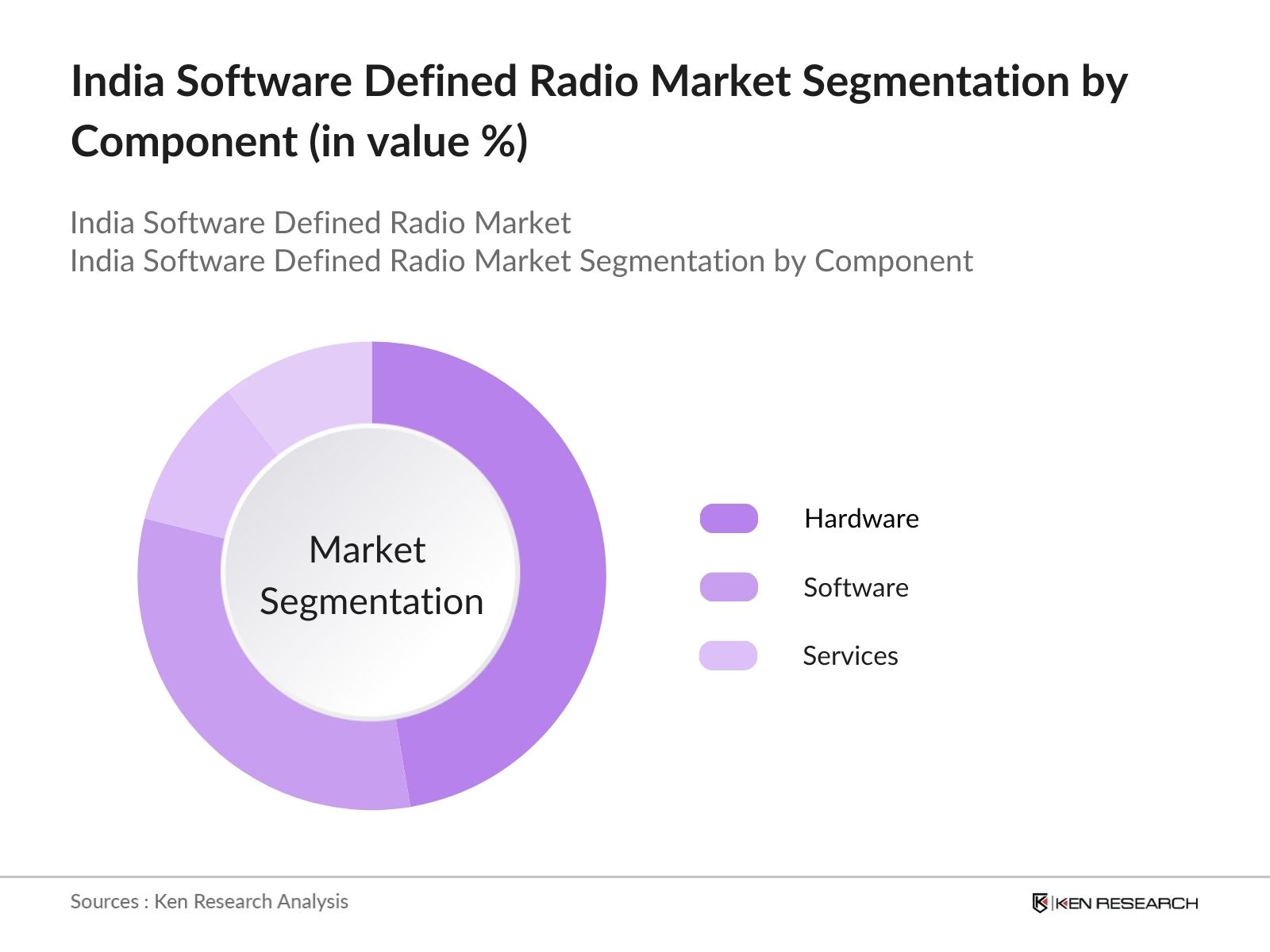

By Component: The India SDR market is segmented by component into hardware, software, and services. Hardware holds the largest share in this segment due to the high cost and demand for sophisticated transmitters, receivers, and auxiliary systems. Advanced technologies like field-programmable gate arrays (FPGAs) and digital signal processors (DSPs) are widely used, contributing to its market leadership.

India Software Defined Radio Market Competitive Landscape

The India SDR market is dominated by both domestic players and international companies, indicating a competitive and collaborative ecosystem. Companies like Bharat Electronics Limited (BEL) and Tata Power SED lead the market due to their strong ties with government projects and R&D capabilities.

India Software Defined Radio Market Analysis

Growth Drivers

- Defense Modernization Initiatives: The U.S. Department of Defense's budget for FY2025 has reached $849.8 billion, significantly allocating funds for modernizing communication technologies essential for advanced military operations. Such investments aim to integrate cutting-edge communication systems to enhance national defense capabilities.

- Advancements in Wireless Communication Technologies: The adoption of 5G technologies in military operations is rapidly expanding, with $430 million allocated by the U.S. government to integrate 5G into military and dual-use systems, improving secure and high-speed communication for defense applications.

- Increasing Demand for Interoperable Communication Systems: The implementation of the Joint All-Domain Command and Control (JADC2) framework is a primary focus for the U.S. military, ensuring that communication systems across all military branches operate seamlessly to optimize real-time strategic decision-making.

Market Challenges

- High Development and Implementation Costs: Developing advanced military communication systems, such as 5G-enabled networks and encrypted systems, often requires investments exceeding $1 billion, presenting financial constraints for large-scale implementation.

- Technical Complexities in Integration: Ensuring compatibility between legacy systems and new communication technologies like software-defined radios (SDRs) often requires extensive engineering, leading to delays and higher costs in deployment.

India Software Defined Radio Market Future Outlook

Over the next five years, the India SDR market is expected to experience robust growth driven by increasing defense expenditures, demand for secure communication systems, and advancements in SDR technologies. The government's focus on indigenization and collaboration with global manufacturers is expected to enhance market opportunities further. Key areas such as cognitive radio and space-based SDR systems are likely to gain prominence, aligning with India's strategic initiatives.

Market Opportunities

- Expansion into Commercial and Civil Sectors: The rise of dual-use technologies enables military-grade communication systems to be utilized in civil and commercial applications, creating an avenue for revenue growth while enhancing global infrastructure.

- Development of Indigenous SDR Technologies: Nations like India are actively investing in indigenous Software-Defined Radios, with defense contracts worth over $1 billion focused on reducing reliance on imports and strengthening domestic capabilities.

Scope of the Report

|

By Type |

Joint Tactical Radio System (JTRS) Cognitive Radio General Purpose Radio Terrestrial Trunked Radio (TETRA) Others |

|

By Application |

Aerospace and Defense Commercial Telecommunication Others |

|

By Component |

Transmitter Receiver Auxiliary System Software |

|

By Platform |

Land Airborne Naval Space |

|

By Frequency Band |

High Frequency (HF) Very High Frequency (VHF) Ultra-High Frequency (UHF) Others |

Products

Key Target Audience

Defense Ministries and Agencies

Public Safety Departments

Private Aerospace Manufacturers

Telecommunication Service Providers

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., Department of Telecommunications)

Technology Integrators

Space Research Organizations

Companies

Players Mentioned in the Report:

Bharat Electronics Limited (BEL)

Tata Power SED

Larsen & Toubro (L&T)

Harris Corporation

Thales Group

Raytheon Technologies Corporation

BAE Systems plc

Rohde & Schwarz GmbH

Leonardo S.p.A.

FlexRadio Systems

Table of Contents

1. India Software Defined Radio Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. India Software Defined Radio Market Size (In USD Billion)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. India Software Defined Radio Market Analysis

3.1. Growth Drivers

3.1.1. Defense Modernization Initiatives

3.1.2. Advancements in Wireless Communication Technologies

3.1.3. Increasing Demand for Interoperable Communication Systems

3.1.4. Government Investments in Communication Infrastructure

3.2. Market Challenges

3.2.1. High Development and Implementation Costs

3.2.2. Technical Complexities in Integration

3.2.3. Regulatory and Spectrum Allocation Issues

3.3. Opportunities

3.3.1. Expansion into Commercial and Civil Sectors

3.3.2. Development of Indigenous SDR Technologies

3.3.3. Collaborations with International Defense Contractors

3.4. Trends

3.4.1. Adoption of Cognitive Radio Technologies

3.4.2. Integration with Internet of Things (IoT) Applications

3.4.3. Miniaturization and Portability Enhancements

3.5. Government Regulations

3.5.1. Defense Procurement Policies

3.5.2. Spectrum Management and Licensing

3.5.3. Standards for Communication Security

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competitive Landscape

4. India Software Defined Radio Market Segmentation

4.1. By Type (In Value %)

4.1.1. Joint Tactical Radio System (JTRS)

4.1.2. Cognitive Radio

4.1.3. General Purpose Radio

4.1.4. Terrestrial Trunked Radio (TETRA)

4.1.5. Others

4.2. By Application (In Value %)

4.2.1. Aerospace and Defense

4.2.2. Commercial

4.2.3. Telecommunication

4.2.4. Others

4.3. By Component (In Value %)

4.3.1. Transmitter

4.3.2. Receiver

4.3.3. Auxiliary System

4.3.4. Software

4.4. By Platform (In Value %)

4.4.1. Land

4.4.2. Airborne

4.4.3. Naval

4.4.4. Space

4.5. By Frequency Band (In Value %)

4.5.1. High Frequency (HF)

4.5.2. Very High Frequency (VHF)

4.5.3. Ultra-High Frequency (UHF)

4.5.4. Others

5. India Software Defined Radio Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Bharat Electronics Limited (BEL)

5.1.2. Tata Power SED

5.1.3. Larsen & Toubro (L&T)

5.1.4. Elbit Systems Ltd.

5.1.5. L3Harris Technologies Inc.

5.1.6. Thales Group

5.1.7. Raytheon Technologies Corporation

5.1.8. Collins Aerospace

5.1.9. General Dynamics Corporation

5.1.10. Leonardo S.p.A.

5.1.11. BAE Systems plc

5.1.12. Rohde & Schwarz GmbH & Co. KG

5.1.13. Indra Sistemas S.A.

5.1.14. Huawei Technologies Co. Ltd.

5.1.15. Ultra Electronics Holdings

5.2. Cross Comparison Parameters

5.2.1. Revenue

5.2.2. Market Share

5.2.3. Product Portfolio

5.2.4. R&D Investment

5.2.5. Regional Presence

5.2.6. Strategic Initiatives

5.2.7. Partnerships and Collaborations

5.2.8. Technological Innovations

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.6.1. Venture Capital Funding

5.6.2. Government Grants

5.6.3. Private Equity Investments

6. India Software Defined Radio Market Regulatory Framework

6.1. Defense Communication Standards

6.2. Spectrum Allocation Policies

6.3. Compliance and Certification Processes

7. India Software Defined Radio Future Market Size (In USD Billion)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. India Software Defined Radio Future Market Segmentation

8.1. By Type (In Value %)

8.2. By Application (In Value %)

8.3. By Component (In Value %)

8.4. By Platform (In Value %)

8.5. By Frequency Band (In Value %)

9. India Software Defined Radio Market Analysts Recommendations

9.1. Total Addressable Market (TAM), Serviceable Available Market (SAM), and Serviceable Obtainable Market (SOM) Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The research begins by mapping all major stakeholders in the India SDR market. Extensive desk research and data extraction from credible proprietary databases are conducted to identify variables like defense communication policies, technology adoption rates, and procurement budgets.

Step 2: Market Analysis and Construction

Historical data is compiled to evaluate market dynamics, including hardware and software integration trends. A detailed assessment of the interplay between government projects and private sector contributions is also conducted.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are validated through structured interviews with industry experts and SDR manufacturers. Insights into product performance, technological advancements, and competitive positioning are collected to ensure data reliability.

Step 4: Research Synthesis and Final Output

Comprehensive insights are synthesized through a bottom-up approach, validating segmentation data and cross-referencing it with primary findings. The result is a validated, data-driven report tailored for business professionals in the SDR industry.

Frequently Asked Questions

01. How big is the India Software Defined Radio Market?

The India Software Defined Radio Market is valued at USD 861 million, primarily driven by defense modernization, demand for secure communication systems, and technological advancements in wireless communication.

02. What are the challenges in the India SDR Market?

Challenges in the India Software Defined Radio Market include high initial costs of development, regulatory and spectrum allocation hurdles, and integration complexities due to diverse application requirements.

03. Who are the major players in the India SDR Market?

Key players in the India Software Defined Radio Market include Bharat Electronics Limited, Tata Power SED, Larsen & Toubro, Harris Corporation, and Thales Group, known for their advanced technologies and strategic collaborations.

04. What drives growth in the India SDR Market?

The India Software Defined Radio Market is driven by defense modernization, demand for interoperable communication systems, and government initiatives to boost domestic manufacturing.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.