India Solar Energy Market Outlook to 2030

Region:Asia

Author(s):Shreya Garg

Product Code:KROD9542

December 2024

88

About the Report

India Solar Energy Market Overview

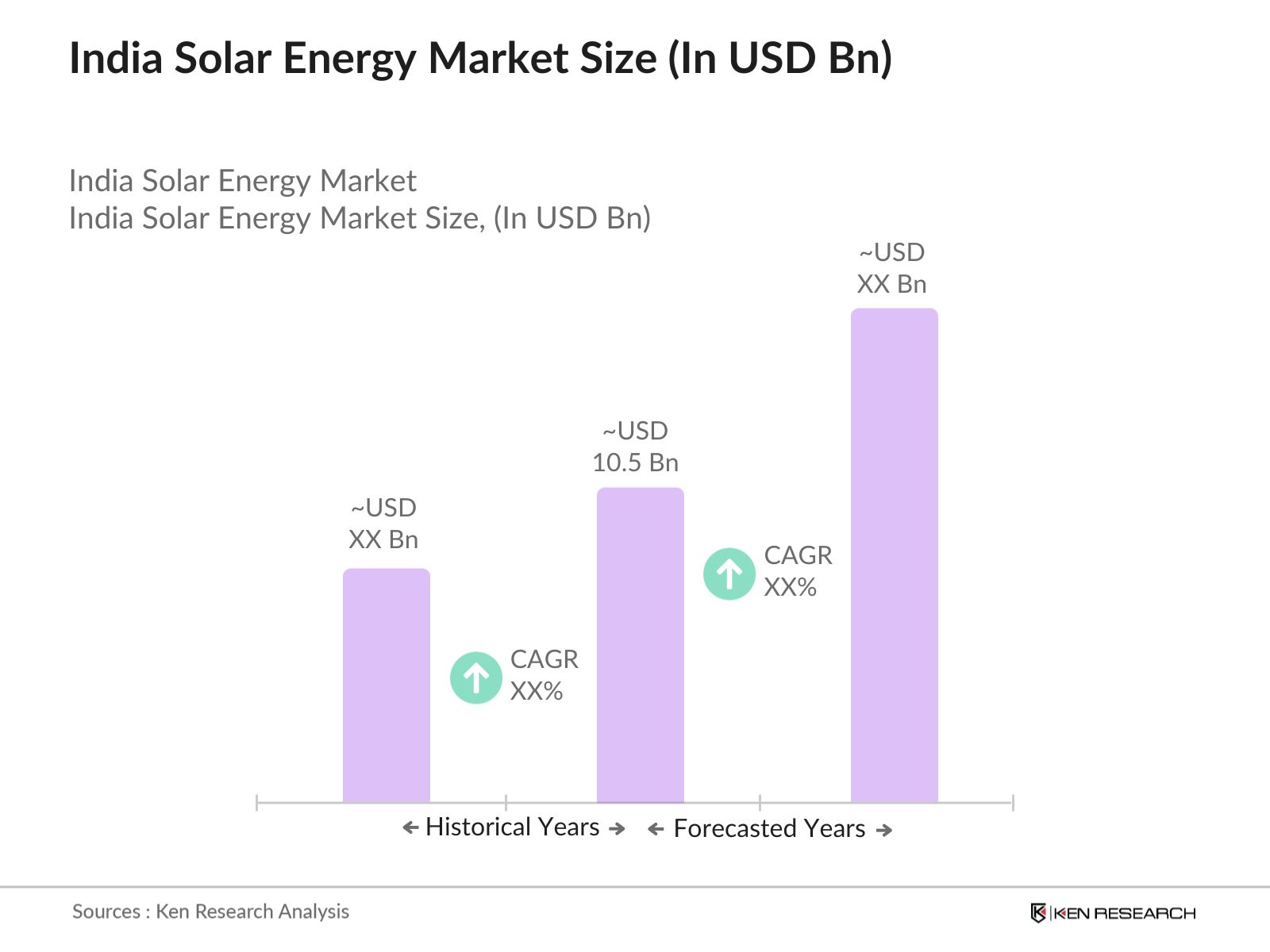

- The India solar energy market is valued at USD 10.5 billion, driven by a combination of favorable government policies, cost reductions in solar technologies, and the increasing need for clean, renewable energy sources. India's commitment to increasing solar capacity through initiatives like the National Solar Mission has helped propel this growth. Additionally, declining costs of photovoltaic (PV) cells, availability of vast solar potential due to the country's geographical position, and supportive financing options for solar power developers have collectively supported the expansion of the market. This figure is backed by data from the Ministry of New and Renewable Energy (MNRE) and other governmental bodies.

- The India solar energy market is largely dominated by regions like Gujarat, Rajasthan, and Tamil Nadu due to their higher solar irradiance levels and the availability of vast land banks. Gujarat leads with its proactive state government policies, while Rajasthan has the largest solar park in the world. Tamil Nadus solar dominance is driven by strong infrastructure and industrial demand. These states also benefit from clear state-level policy frameworks and investment incentives, encouraging significant private sector involvement.

- The Indian government mandates that distribution companies (DISCOMs) must source a certain percentage of their energy from renewable sources, including solar. In 2024, the RPO for solar stands at 10.5%, encouraging states and private players to ramp up their solar investments. Non-compliance with RPO targets can result in penalties, making this regulation a key driver of solar energy demand.

India Solar Energy Market Segmentation

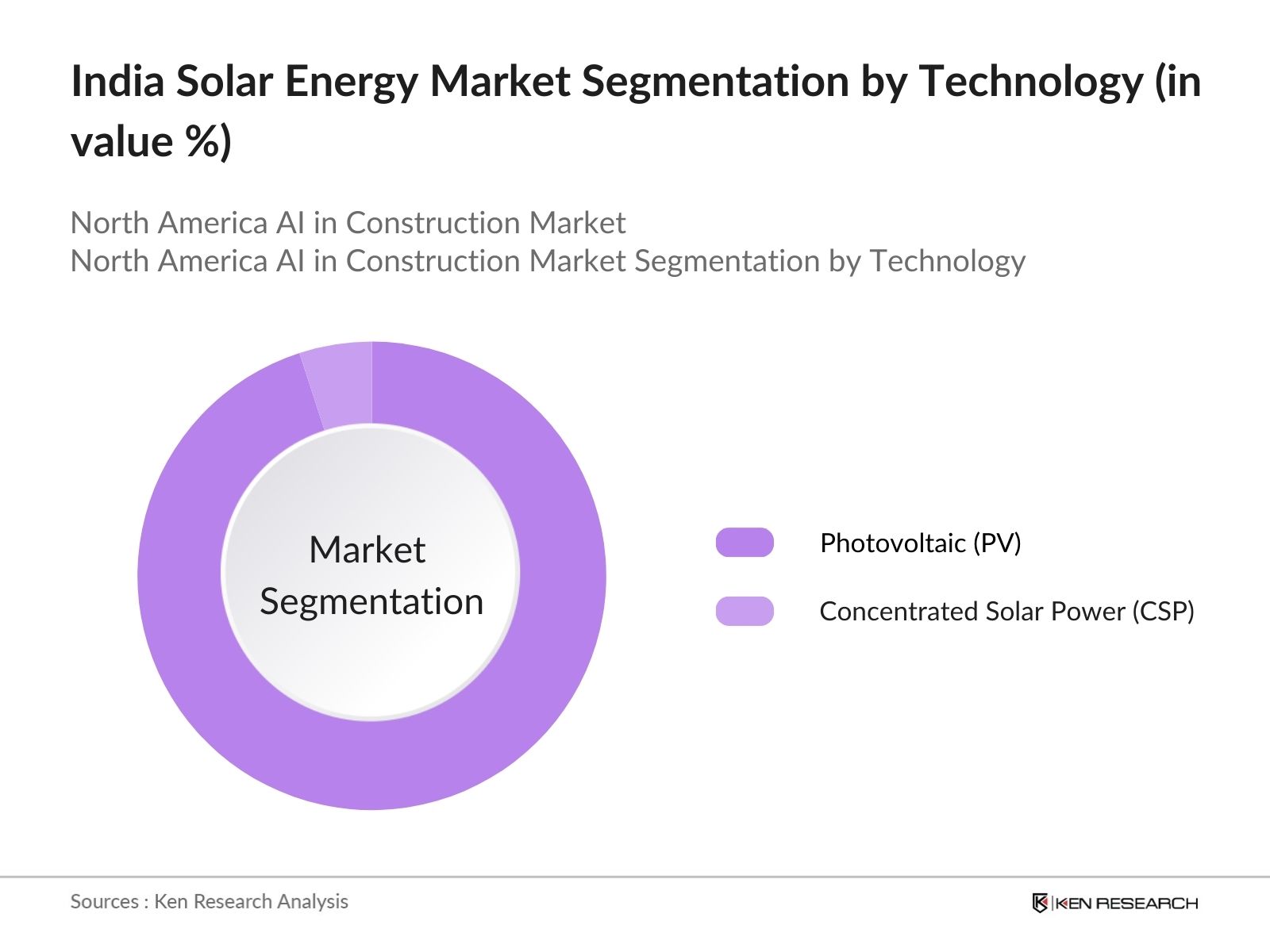

By Technology: The market is segmented by technology into Photovoltaic (PV) and Concentrated Solar Power (CSP). The dominant segment in the India solar energy market is PV technology, which holds approximately 95% of the market share in 2023. PV's dominance is driven by its lower cost, scalability, and the ease with which it can be deployed in both utility-scale and rooftop solar projects. Additionally, PV systems have witnessed rapid technological advancements, contributing to their growing adoption.

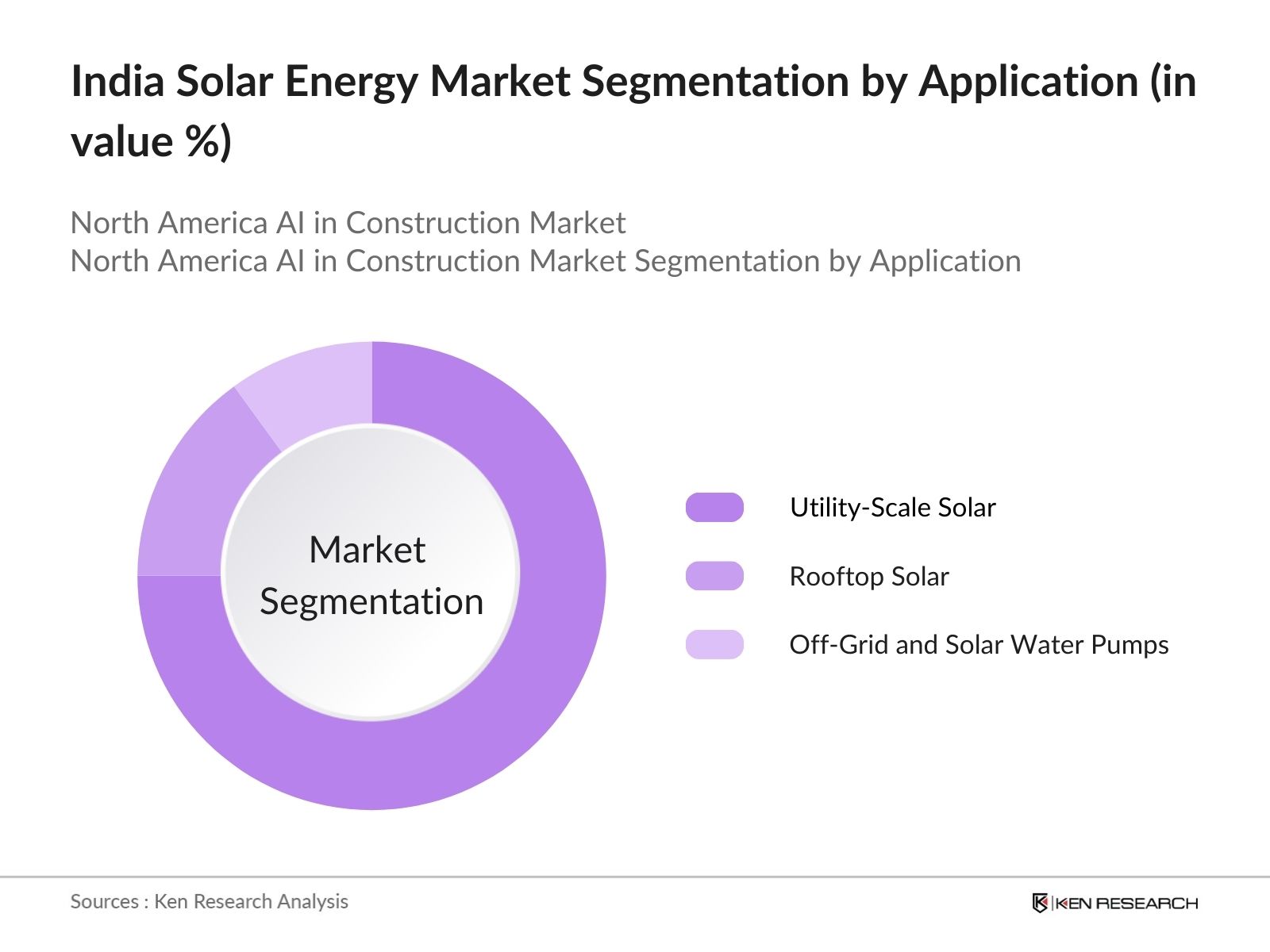

By Application: The market in India can be segmented by application into utility-scale solar power, rooftop solar power, off-grid solar, and solar water pumps. Utility-scale solar is the most significant application, holding around 75% of the market share in 2023. This segment's dominance is driven by large solar parks such as the Bhadla Solar Park in Rajasthan. The utility-scale segment benefits from government-backed auctions and long-term Power Purchase Agreements (PPAs) with DISCOMs, which secure stable revenue streams for developers.

India Solar Energy Market Competitive Landscape

The India solar energy market is dominated by several large players who are responsible for a significant portion of installed solar capacity. These companies range from domestic players to international companies that have entered the Indian market through partnerships or direct investments. The market is characterized by significant competition, primarily driven by price-sensitive bidding processes and the rapid pace of solar technology advancements. The consolidation of the market is evident, with the top five companies controlling a significant portion of the market.

|

Company |

Year Established |

Headquarters |

Installed Capacity |

Key Projects |

Revenue (INR Cr) |

No. of Employees |

Global Operations |

Recent Acquisitions |

|

Tata Power Solar Systems |

1989 |

Mumbai, India |

||||||

|

Adani Green Energy |

2015 |

Ahmedabad, India |

||||||

|

ReNew Power |

2011 |

Gurugram, India |

||||||

|

Vikram Solar |

2006 |

Kolkata, India |

||||||

|

Azure Power |

2008 |

New Delhi, India |

India Solar Energy Industry Analysis

Growth Drivers

- Government Initiatives: The National Solar Mission (NSM) has been a key driver for solar energy growth in India. As of 2024, the Indian government, through the Ministry of New and Renewable Energy (MNRE), has achieved an installed solar capacity of over 70 GW, with a target of reaching 100 GW by 2025. This mission has seen significant investment from both domestic and international sources, pushing India to become the fifth-largest solar power producer globally. These initiatives also align with India's broader goals of generating 500 GW of renewable energy by 2030.

- Reduction in Solar Power Costs: The cost of solar energy in India has dropped significantly, with solar tariffs as low as 1.99 per kWh in 2022, making it one of the most competitive energy sources. Government subsidies and incentives like the Production Linked Incentive (PLI) scheme have reduced the cost of solar energy equipment, fostering further adoption. India has also implemented various state-level policies to encourage solar park development and rooftop solar projects, making solar energy affordable for both residential and industrial users.

- Increasing Energy Demand: India's growing economy and rapid urbanization have led to a surge in energy demand, projected to be over 1,400 TWh in 2024. Solar energy, with its vast potential, is seen as a critical component in meeting this demand. Additionally, coal dependency is being phased out, with renewable energy making up over 25% of the countrys energy mix by 2024. Solar energy, given its scalability and decreasing costs, is set to become a major contributor to the energy supply. CEA Source

Market Challenges

- High Land Acquisition Costs: Land acquisition remains a significant barrier for large-scale solar projects in India. In states like Gujarat and Rajasthan, prime locations for solar farms, land prices have surged to 30-40 lakhs per hectare in 2024. This cost increase hampers project viability, especially in rural areas where land conversion laws and compensation delays further add to the financial burden on developers.

- Policy and Regulatory Uncertainty: Frequent changes in government policies and state-level regulatory frameworks present challenges to the solar industry. For instance, changes in Renewable Purchase Obligations (RPOs) and delays in tariff approvals by State Electricity Regulatory Commissions (SERCs) create uncertainty for investors and developers. Despite central government efforts to streamline policies, inconsistent implementation across states continues to hinder market expansion.

India Solar Energy Market Future Outlook

Over the next five years, the India solar energy market is expected to see substantial growth, driven by sustained government support, declining costs of solar panels, and increasing demand for clean energy. India's ambitious goal of achieving 100 GW of solar capacity will further catalyze market expansion. The country is also likely to witness an increase in rooftop solar installations, supported by net metering policies and financial incentives. Investments in advanced solar technologies, such as bifacial PV modules and solar-plus-storage solutions, are expected to play a pivotal role in shaping the market's future.

Future Market Opportunities

- Rooftop Solar Growth Potential: Rooftop solar installations in India reached 8.2 GW by 2024, but the potential remains far higher, especially in urban and semi-urban areas. Government schemes like the Grid-Connected Rooftop Solar Program have provided financial assistance, pushing growth. With the target of 40 GW rooftop solar by 2025, there is ample opportunity for residential and commercial sectors to tap into this energy source, offering immediate savings on electricity bills and reducing grid dependence.

- Rural Electrification: Solar energy is playing a transformative role in rural electrification. The Saubhagya Scheme has provided solar-powered electricity connections to over 27 million households in rural India by 2024. Standalone solar installations are proving viable for remote areas, reducing the need for grid infrastructure. Furthermore, the solar mini-grid market is growing in villages where grid access remains limited. These solutions are critical for achieving India's universal electrification targets.

Scope of the Report

|

By Technology |

Photovoltaic (PV) Concentrated Solar Power (CSP) |

|

By Application |

Utility-Scale Solar Rooftop Solar Off-Grid Solar Solar Water Pumps |

|

By Installation |

Ground-Mounted Rooftop Floating Solar |

|

By End-User |

Residential Commercial Industrial Agricultural |

|

By Region |

North India South India East India West India |

Products

Key Target Audience

Government and Regulatory Bodies (Ministry of New and Renewable Energy, Solar Energy Corporation of India)

Solar Power Developers and Contractors

Solar Module Manufacturers

Investors and Venture Capitalist Firms

EPC (Engineering, Procurement, and Construction) Companies

Renewable Energy Financing Institutions

Industrial and Commercial Consumers of Solar Power

Utilities and Power Distribution Companies

Companies

Major Players

Adani Green Energy Limited

ReNew Power

Vikram Solar

Azure Power

NTPC Renewable Energy Ltd.

ACME Solar

Sterling & Wilson Solar Ltd.

Waaree Energies Ltd.

First Solar India

JinkoSolar India

Mahindra Susten

Hero Future Energies

Suzlon Energy Limited

Canadian Solar

Table of Contents

India Solar Energy Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

India Solar Energy Market Size (in INR Billion)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones (e.g., Installed Capacity, Tariff Developments, Financing Models)

India Solar Energy Market Analysis

3.1. Growth Drivers

3.1.1. Government Initiatives (e.g., National Solar Mission)

3.1.2. Reduction in Solar Power Costs

3.1.3. Increasing Energy Demand

3.1.4. Favorable Financing Options

3.2. Market Challenges

3.2.1. High Land Acquisition Costs

3.2.2. Policy and Regulatory Uncertainty

3.2.3. Grid Integration and Stability Issues

3.3. Opportunities

3.3.1. Rooftop Solar Growth Potential

3.3.2. Rural Electrification

3.3.3. International Investments and Collaborations (World Bank, IFC, etc.)

3.4. Trends

3.4.1. Hybrid Renewable Projects (Solar-Wind, Solar-Storage)

3.4.2. Growth of Floating Solar Power Projects

3.4.3. Technology Advancements (e.g., Bifacial Modules, Perovskite Solar Cells)

3.5. Government Regulation

3.5.1. Renewable Purchase Obligations (RPOs)

3.5.2. Tariff Determination by CERC/SERCs

3.5.3. Grid Connection Regulations

3.5.4. Solar Park Policy

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem (Developers, EPC Contractors, Financial Institutions, Technology Providers)

3.8. Porters Five Forces (Bargaining Power of Suppliers, Buyers, New Entrants, Substitutes, Competitive Rivalry)

3.9. Competition Ecosystem (Market Share, Key Players)

India Solar Energy Market Segmentation

4.1. By Technology (in Value %)

4.1.1. Photovoltaic (PV)

4.1.2. Concentrated Solar Power (CSP)

4.2. By Application (in Value %)

4.2.1. Utility-Scale Solar Power

4.2.2. Rooftop Solar Power

4.2.3. Off-Grid Solar

4.2.4. Solar Water Pumps

4.3. By Installation (in Value %)

4.3.1. Ground-Mounted

4.3.2. Rooftop

4.3.3. Floating Solar

4.4. By End-User (in Value %)

4.4.1. Residential

4.4.2. Commercial

4.4.3. Industrial

4.4.4. Agricultural

4.5. By Region (in Value %)

4.5.1. North India

4.5.2. South India

4.5.3. East India

4.5.4. West India

India Solar Energy Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Tata Power Solar Systems Ltd.

5.1.2. Azure Power

5.1.3. Adani Green Energy Limited

5.1.4. ReNew Power

5.1.5. Vikram Solar

5.1.6. Sterling & Wilson Solar

5.1.7. ACME Solar

5.1.8. Suzlon Energy Limited

5.1.9. Waaree Energies Ltd.

5.1.10. Mahindra Susten

5.1.11. First Solar India

5.1.12. JinkoSolar India

5.1.13. Canadian Solar

5.1.14. NTPC Limited (Renewables Division)

5.1.15. KEC International

5.2. Cross Comparison Parameters (Installed Capacity, Revenue, Market Share, Operational Solar Projects, Total Employees)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Government Grants and Incentives

5.8. Venture Capital and Private Equity Investments

India Solar Energy Market Regulatory Framework

6.1. Ministry of New and Renewable Energy (MNRE) Guidelines

6.2. Solar Energy Corporation of India (SECI) Bidding Process

6.3. Central and State-Level Renewable Energy Policies

6.4. Net Metering and Grid Connection Standards

India Solar Energy Future Market Size (in INR Billion)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth (Government Targets, International Agreements, Decreasing Cost of Solar Energy)

India Solar Energy Future Market Segmentation

8.1. By Technology

8.2. By Application

8.3. By Installation

8.4. By End-User

8.5. By Region

India Solar Energy Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Strategic Expansion Opportunities (e.g., Regional Focus, Technological Innovation)

9.3. Investment Roadmap

9.4. Emerging Market Opportunities (e.g., Solar Storage Integration, EV Charging Infrastructure)

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

We begin by mapping the solar energy market ecosystem, identifying critical variables such as installed capacity, technological adoption, and regulatory frameworks. This is accomplished through desk research and engagement with key stakeholders in the Indian solar industry.

Step 2: Market Analysis and Construction

Historical data related to solar power capacity additions, investment patterns, and market penetration are compiled. We utilize government databases such as MNRE and SECI to construct a detailed analysis of the market structure, focusing on state-wise data and technology adoption trends.

Step 3: Hypothesis Validation and Expert Consultation

Interviews are conducted with solar developers, EPC contractors, and financial institutions to validate our hypotheses regarding market growth, challenges, and opportunities. These insights are integrated into the report to ensure the accuracy of market forecasts and trends.

Step 4: Research Synthesis and Final Output

The final stage involves synthesizing all gathered data and insights into a comprehensive market report. This includes a top-down and bottom-up approach to estimate market size, market shares, and growth opportunities, ensuring a reliable output for stakeholders.

Frequently Asked Questions

01. How big is the India solar energy market?

The India solar energy market is valued at USD 10.5 billion, driven by government initiatives like the National Solar Mission and increasing private sector involvement.

02. What are the challenges in the India solar energy market?

Challenges in the India solar energy market include high land acquisition costs, policy and regulatory uncertainty, and grid integration issues, which hinder the seamless expansion of solar projects.

03. Who are the major players in the India solar energy market?

Key players in the India solar energy market include Tata Power Solar Systems, Adani Green Energy, ReNew Power, Vikram Solar, and Azure Power. These companies dominate due to their extensive project portfolios and strong market presence.

04. What are the growth drivers of the India solar energy market?

Growth in the India solar energy market is driven by government support through policies like the National Solar Mission, declining costs of PV technology, and the increasing demand for clean energy.

05. Which regions dominate the India solar energy market?

North India, particularly Rajasthan and Gujarat, dominates the India solar energy market due to favorable geographical conditions, high solar irradiance, and supportive state policies.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.