India Solvent Market Outlook to 2030

Region:Asia

Author(s):Abhinav kumar

Product Code:KROD6010

November 2024

89

About the Report

India Solvent Market Overview

- The India solvent market is valued at approximately USD 1.5 billion, based on a five-year historical analysis. This market is driven by growing demand from industries such as paints & coatings, pharmaceuticals, and adhesives. The expansion of industrial sectors and increasing urbanization have pushed the need for solvents as key intermediates in manufacturing processes. Furthermore, favorable government policies supporting the expansion of chemical industries have played a pivotal role in this market's growth trajectory.

- Key cities such as Mumbai, Chennai, and Pune, along with the industrial clusters in Gujarat, dominate the India solvent market. These regions benefit from well-established infrastructure, proximity to raw material sources, and high industrial activities. The chemical hubs in Gujarat and Maharashtra, with their high concentration of manufacturing facilities, contribute significantly to the demand for solvents, making these regions key players in the market.

- The adoption of bio-based solvents is increasingly gaining traction, driven by green chemistry initiatives and rising environmental awareness. The market for bio-based solvents in India was valued at $5 billion in 2023, reflecting a growing preference for sustainable alternatives in industries such as paints, coatings, and cleaning products. Government initiatives, including the National Policy on Biofuels, support this shift, aiming to promote biofuel and bio-based product usage. This trend is set to continue as industries strive to reduce their carbon footprint, creating significant growth opportunities for bio-based solvent manufacturers.

India Solvent Market Segmentation

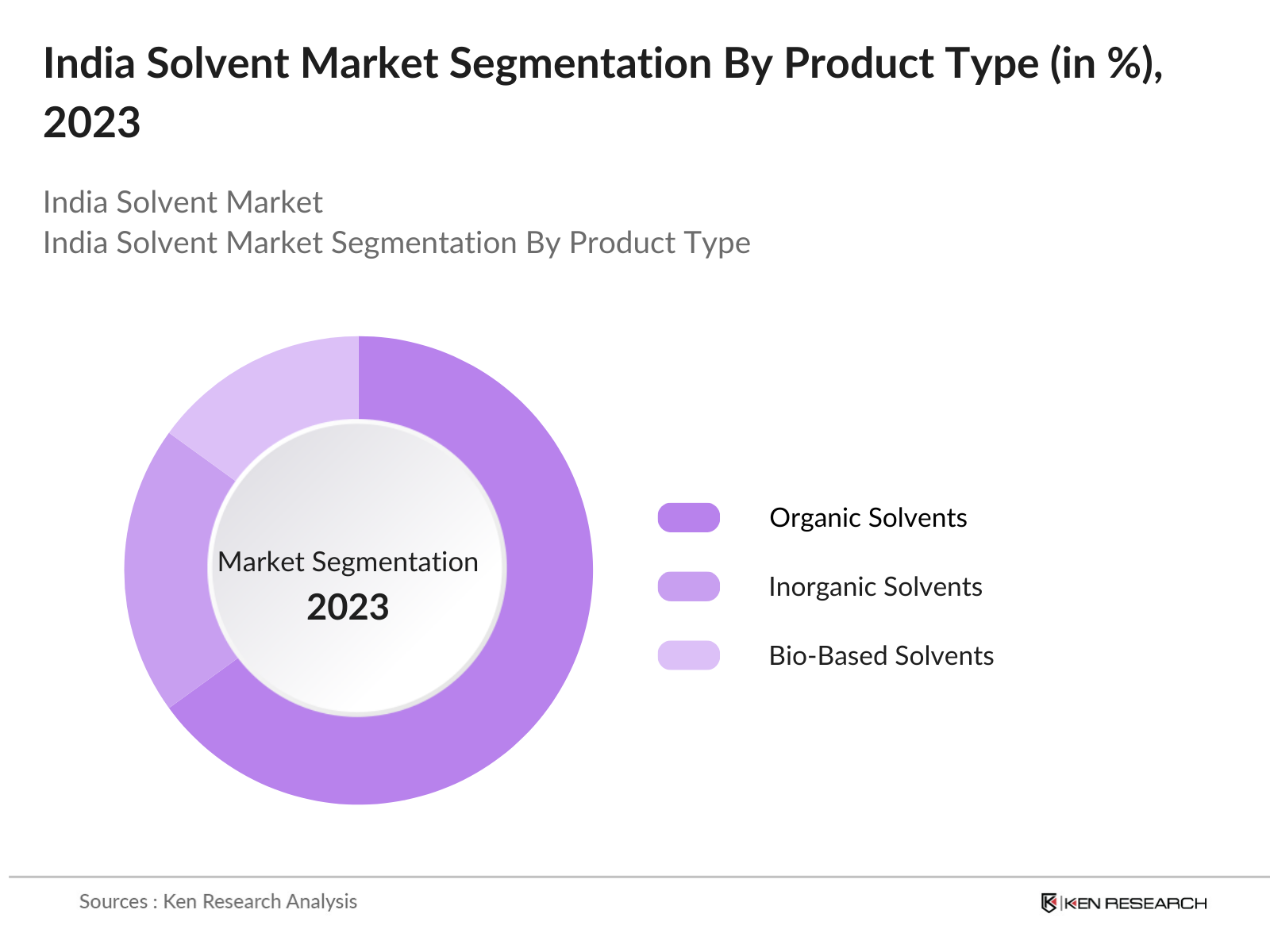

By Product Type: The India solvent market is segmented by product type into organic solvents, inorganic solvents, and bio-based solvents. Organic solvents, such as alcohols, hydrocarbons, and ketones, hold a dominant market share in India due to their widespread applications in industries like pharmaceuticals and paints & coatings. The ease of availability, along with their performance in multiple processes, makes organic solvents a preferred choice across industries. However, the increasing environmental concerns surrounding volatile organic compounds (VOC) emissions are driving a gradual shift toward greener alternatives.

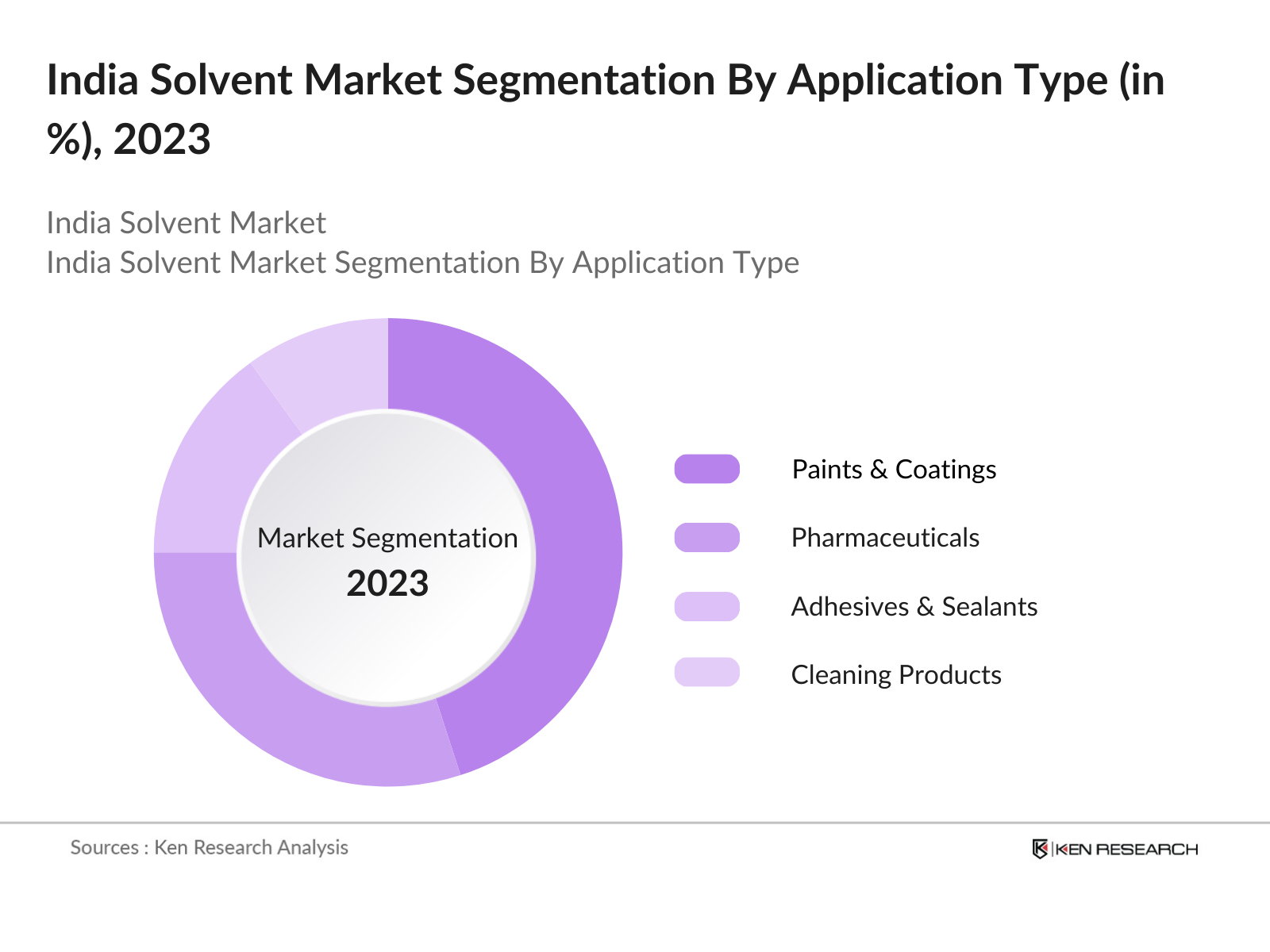

By Application: The India solvent market is further segmented by application into paints & coatings, pharmaceuticals, adhesives & sealants, and cleaning products. The paints & coatings industry commands the largest share of the solvent market, owing to the booming construction and automotive industries. Solvents are crucial in maintaining the fluidity and application properties of paints, making them indispensable in this sector. The pharmaceutical industry follows closely, driven by the need for solvents in the synthesis of active pharmaceutical ingredients (APIs) and drug formulations.

India Solvent Market Competitive Landscape

The India solvent market is dominated by several key players who have established strong operational networks across the country. These players have significant investments in R&D and production facilities, allowing them to cater to the evolving demands of industries like pharmaceuticals and automotive. The competitive landscape is shaped by both domestic and international companies vying for market dominance through innovation and strategic partnerships.

India Solvent Industry Analysis

Growth Drivers

- Increasing Industrial Applications: The Indian chemical industry is projected to reach $300 billion by 2025, driven by a surge in the demand for solvents across various sectors, including pharmaceuticals and paints. In 2022, the pharmaceuticals sector in India witnessed exports worth $24 billion, indicating a growing reliance on solvents for drug formulation and manufacturing. The paint and coatings industry is also expanding, expected to reach $18 billion by 2025, necessitating high-quality solvents for production. This robust industrial growth underpins the increasing application of solvents, reinforcing their critical role in the manufacturing processes across these sectors.

- Expanding End-User Industries: The automotive industry in India is anticipated to produce 30 million vehicles annually by 2026, leading to a higher demand for solvents in coatings and cleaning processes. The agricultural sector, contributing 17-18% to India's GDP, relies on solvents for pesticides and herbicides, with current agrochemical exports valued at $3 billion. The textiles industry, one of the largest in the world, is expected to reach $223 billion by 2025, requiring solvents for dyeing and finishing processes. This growth across key end-user industries significantly drives the solvent market forward, reflecting a dynamic industrial landscape.

- Favorable Government Regulations: The Indian government has introduced several initiatives to bolster the manufacturing sector, including the Production-Linked Incentive (PLI) scheme, which aims to attract investments worth $520 billion by 2025. Tax reforms have simplified the tax structure, enhancing ease of doing business and encouraging solvent manufacturers to invest in capacity expansion. Additionally, schemes like "Make in India" have incentivized local production, further supporting the growth of the solvent market. This favorable regulatory environment facilitates investment and innovation in the solvent industry, driving its overall development.

Market Challenges

- Fluctuating Crude Oil Prices: Crude oil prices have shown significant volatility, with Brent crude reaching $86 per barrel in early 2024, impacting the cost of petroleum-derived solvents. As the Indian solvent market is heavily dependent on crude oil for raw material sourcing, any fluctuations in oil prices can lead to instability in solvent pricing and availability. This reliance poses a challenge for manufacturers, who must navigate the risks associated with volatile raw material costs, potentially leading to reduced margins and operational challenges in maintaining supply chains.

- Stringent Environmental Regulations: India's commitment to reducing greenhouse gas emissions under the Paris Agreement necessitates stricter environmental regulations, impacting solvent production processes. The government has implemented stringent emission norms, with the National Clean Air Programme (NCAP) aiming for a 20-30% reduction in particulate matter levels by 2024. Furthermore, the Hazardous Waste Management Rules mandate comprehensive waste management strategies for solvents. Compliance with these regulations increases operational costs for manufacturers, posing a challenge to the industry's sustainability and profitability.

India Solvent Market Future Outlook

Over the next five years, the India solvent market is expected to show substantial growth driven by the increasing demand from the pharmaceutical and automotive industries. The shift towards bio-based and environmentally friendly solvents will also play a crucial role in shaping the future of the market. Advancements in solvent recovery technologies, coupled with government initiatives promoting green chemistry, will further accelerate the transition to sustainable solutions. Additionally, the rising need for specialty solvents in high-end industrial applications is likely to open new avenues for growth. The ongoing industrialization, expansion of infrastructure projects, and a growing emphasis on reducing VOC emissions will continue to propel the demand for solvents. With these factors in play, the market is well-positioned for steady expansion.

Opportunities

- Increasing Demand for Green Solvents: The demand for green solvents is witnessing significant growth as sustainability initiatives gain momentum. In 2023, the bio-based solvent market in India was estimated at $5 billion, with expectations of continued growth driven by government policies favoring eco-friendly solutions. The "National Biofuel Policy" aims to increase biofuel production to 20% by 2025, indirectly promoting the use of bio-based solvents in various applications. As industries prioritize sustainability, the shift towards green solvents presents a lucrative opportunity for manufacturers to innovate and capture market share in this burgeoning segment.

- Expanding Automotive Industry: The Indian automotive industry is experiencing a transformation, with the government targeting 30% electric vehicle adoption by 2030. This transition is expected to drive demand for specialized coatings and solvents used in electric vehicle manufacturing and maintenance. In 2022, the automotive coatings segment was valued at $2 billion, and with the anticipated growth in electric vehicles, this segment is expected to expand further. The rise of the automotive industry thus presents a critical opportunity for solvent manufacturers to align their products with evolving market needs.

Scope of the Report

|

By Product Type |

Organic Solvents Inorganic Solvents Green/Bio-Based Solvents |

|

By Application |

Paints & Coatings Pharmaceuticals Adhesives & Sealants Cleaning Products Others (Agrochemicals, Cosmetics) |

|

By End-Use Industry |

Chemical Industry Automotive Industry Pharmaceutical Industry Agriculture Others (Textiles, Electronics) |

|

By Technology |

Distillation Azeotropic Separation Extractive Distillation |

|

By Region |

Northern India Southern India |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Chemical Manufacturing Industries

Automotive Manufacturing Industries

Pharmaceutical Companies

Paints & Coatings Companies

Adhesives & Sealants Manufacturing Industries

Government and Regulatory Bodies (Ministry of Chemicals & Fertilizers, Central Pollution Control Board)

Investor and Venture Capitalist Firms

Industrial Cleaning Service Companies

Companies

Players Mentioned in the Report

Deepak Nitrite Ltd.

Balaji Amines Ltd.

BASF India Ltd.

Gujarat Alkalies & Chemicals Ltd.

Laxmi Organic Industries Ltd.

Jubilant Life Sciences Ltd.

Reliance Industries Ltd.

GAIL India Ltd.

Aarti Industries Ltd.

Tata Chemicals Ltd.

Table of Contents

1. India Solvent Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. India Solvent Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. India Solvent Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Industrial Applications

3.1.2. Expanding End-User Industries

3.1.3. Favorable Government Regulations

3.1.4. Rising Urbanization and Industrialization

3.2. Market Challenges

3.2.1. Fluctuating Crude Oil Prices 3.2.2. Stringent Environmental Regulations

3.2.3. Availability of Substitutes

3.2.4. Supply Chain Disruptions

3.3. Opportunities

3.3.1. Increasing Demand for Green Solvents

3.3.2. Expanding Automotive Industry

3.3.3. Rise in Pharma Sector Investments

3.3.4. Technological Advancements in Solvent Manufacturing

3.4. Trends

3.4.1. Growing Adoption of Bio-Based Solvents

3.4.2. Increased Focus on VOC Reduction

3.4.3. Rising Demand for Specialty Solvents

3.5. Government Regulation

3.5.1. India Solvent Control Guidelines

3.5.2. Environmental Clearance Norms

3.5.3. Tax Incentives for Solvent Producers

3.5.4. Compliance with Hazardous Waste Management Rules

3.6. SWOT Analysis

3.6.1. Strengths

3.6.2. Weaknesses

3.6.3. Opportunities

3.6.4. Threats

3.7. Stakeholder Ecosystem

3.7.1. Suppliers

3.7.2. Distributors

3.7.3. End-Users (Industries, Retailers)

3.8. Porters Five Forces Analysis

3.8.1. Bargaining Power of Suppliers

3.8.2. Bargaining Power of Buyers

3.8.3. Threat of New Entrants

3.8.4. Threat of Substitutes

3.8.5. Industry Rivalry

4. India Solvent Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Organic Solvents

4.1.2. Inorganic Solvents

4.1.3. Green/Bio-Based Solvents

4.2. By Application (In Value %)

4.2.1. Paints & Coatings

4.2.2. Pharmaceuticals

4.2.3. Adhesives & Sealants

4.2.4. Cleaning Products

4.2.5. Others (Agrochemicals, Cosmetics)

4.3. By End-Use Industry (In Value %)

4.3.1. Chemical Industry

4.3.2. Automotive Industry

4.3.3. Pharmaceutical Industry

4.3.4. Agriculture

4.3.5. Others (Textiles, Electronics)

4.4. By Technology (In Value %)

4.4.1. Distillation

4.4.2. Azeotropic Separation

4.4.3. Extractive Distillation

4.5. By Region (In Value %)

4.5.1. Northern India

4.5.2. Southern India

4.5.3. Eastern India

4.5.4. Western India

5. India Solvent Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Deepak Nitrite Ltd.

5.1.2. Balaji Amines Ltd.

5.1.3. BASF India Ltd.

5.1.4. India Glycols Ltd.

5.1.5. Gujarat Alkalies and Chemicals Ltd.

5.1.6. Jubilant Life Sciences Ltd.

5.1.7. GAIL India Ltd.

5.1.8. Reliance Industries Ltd.

5.1.9. Tata Chemicals Ltd.

5.1.10. Solvay India

5.1.11. Laxmi Organic Industries Ltd.

5.1.12. Aarti Industries Ltd.

5.1.13. Vinati Organics Ltd.

5.1.14. IOL Chemicals and Pharmaceuticals Ltd.

5.1.15. DFPCL (Deepak Fertilisers and Petrochemicals Corp.)

5.2. Cross Comparison Parameters

(Revenue, Market Share, Product Portfolio, R&D Investments, Geographic Presence, Environmental Initiatives, Number of Employees, Operational Efficiency)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Government Subsidies and Grants

5.8. Public-Private Partnerships

5.9. Private Equity and Venture Capital

6. India Solvent Market Regulatory Framework

6.1. Environmental Standards

6.2. Compliance Requirements

6.3. Certification and Licensing Processes

7. India Solvent Future Market Size (In USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. India Solvent Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Application (In Value %)

8.3. By End-Use Industry (In Value %)

8.4. By Technology (In Value %)

8.5. By Region (In Value %)

9. India Solvent Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The first step involves constructing an ecosystem map that includes all relevant stakeholders within the India solvent market. This is achieved through thorough desk research, using a combination of secondary sources and proprietary databases. The objective is to identify the critical variables influencing the market, including regulatory frameworks, key growth drivers, and challenges.

Step 2: Market Analysis and Construction

During this phase, historical data on market size, growth rates, and industry penetration are compiled and analyzed. We also assess the number of solvent producers and their output capacity, considering their impact on the overall market dynamics. The analysis is refined through statistical models to ensure accuracy.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses regarding market trends and growth opportunities are developed and validated through interviews with industry experts. These consultations provide valuable insights into operational challenges and the overall business environment, further enhancing the precision of our market data.

Step 4: Research Synthesis and Final Output

In the final step, the data is synthesized and cross-verified with additional primary research. Direct interviews with solvent manufacturers and end-users ensure the accuracy of the final report, which includes detailed market forecasts and actionable insights.

Frequently Asked Questions

01. How big is the India solvent market?

The India solvent market is valued at approximately USD 1.5 billion, driven by the increasing demand from industries such as paints & coatings, pharmaceuticals, and adhesives.

02. What are the key challenges in the India solvent market?

Challenges in the India solvent market include fluctuating raw material prices, particularly those linked to crude oil, and growing environmental concerns regarding VOC emissions.

03. Who are the major players in the India solvent market?

Key players in the India solvent market include Deepak Nitrite Ltd., Balaji Amines Ltd., BASF India Ltd., Gujarat Alkalies & Chemicals Ltd., and Laxmi Organic Industries Ltd.

04. What are the growth drivers of the India solvent market?

The India solvent market is driven by the expanding industrial base, particularly in the automotive and pharmaceutical sectors, as well as the shift towards environmentally friendly and bio-based solvents.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.