India Soy Protein Market Outlook to 2030

Region:Asia

Author(s):Samanyu

Product Code:KROD4189

November 2024

96

About the Report

India Soy Protein Market Overview

- The India Soy Protein market is valued at USD 550 million, based on a five-year historical analysis. This market is driven by the rising health consciousness among consumers, a growing vegan population, and the increasing demand for plant-based protein in the food and beverage sector. The surge in functional foods and dietary supplements incorporating soy protein has bolstered the market's growth. In addition, soy protein is widely accepted in the animal feed and pharmaceutical sectors due to its high protein content, affordability, and nutritional benefits.

- The major cities driving the soy protein market in India include Mumbai, Delhi, and Bengaluru, which have seen significant demand due to their large population, urbanization, and higher consumer awareness of health and wellness. Additionally, these cities are home to a growing number of food manufacturers and health-conscious consumers. Globally, China and the USA also dominate the soy protein market due to their large-scale production of soybeans and growing consumption of plant-based products.

- The demand for organic soy protein is on the rise as consumers become more conscious about food sourcing and sustainability. The Agricultural and Processed Food Products Export Development Authority (APEDA) reported a 25% increase in organic food consumption in India between 2022 and 2023, driven by health-conscious millennials. Organic soy protein, free from synthetic pesticides and genetically modified organisms (GMOs), is increasingly preferred by consumers who seek clean-label products. This trend is creating opportunities for soy protein producers to cater to niche markets that prioritize organic and sustainably produced foods.

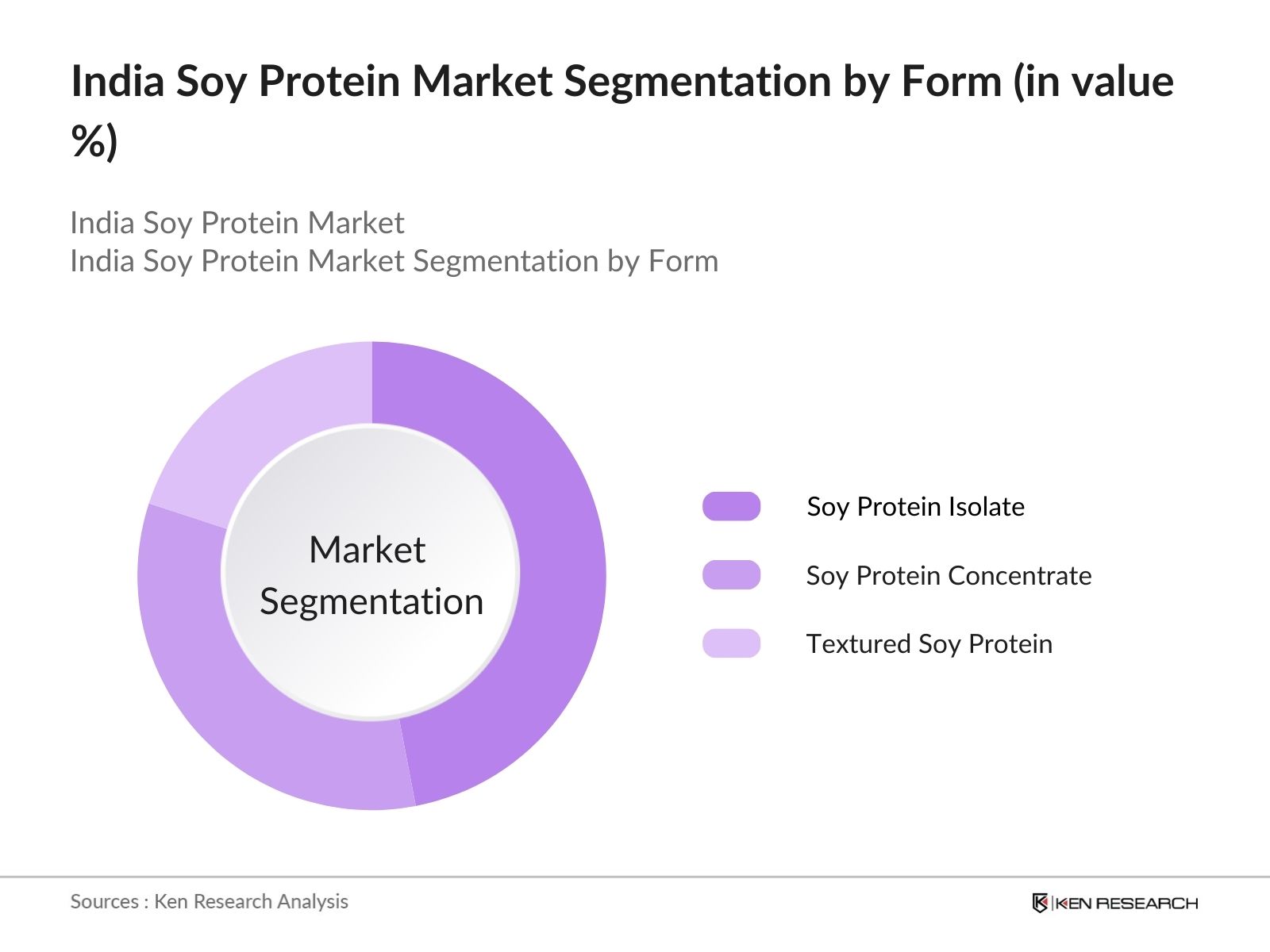

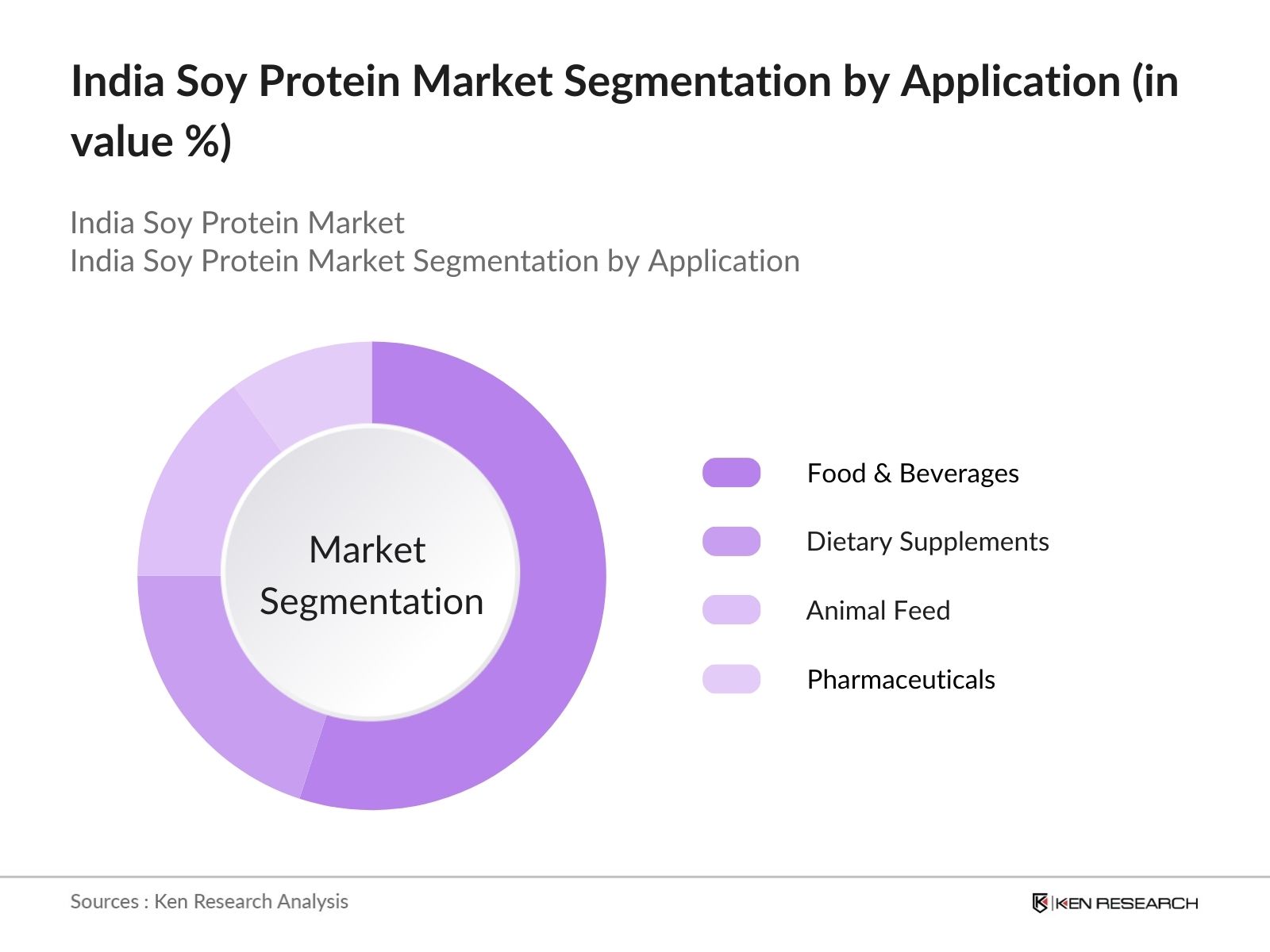

India Soy Protein Market Segmentation

By Form: The market is segmented by form into soy protein isolate, soy protein concentrate, and textured soy protein. Recently, soy protein isolate holds the dominant market share in this segment. This is largely due to its higher protein content (up to 90%), making it a popular choice in high-protein foods, dietary supplements, and fortified beverages. Its versatility in various applications, such as protein powders, meat alternatives, and sports nutrition, contributes to its market dominance.

By Application: The market is also segmented by application into food & beverages, dietary supplements, animal feed, and pharmaceuticals. The food & beverages sector dominates the application segment, thanks to the growing consumer demand for meat alternatives and plant-based foods. Increasing health consciousness and the shift toward vegetarian and vegan diets in urban areas have significantly boosted the consumption of soy protein in this sector.

India Soy Protein Market Competitive Landscape

The Indian soy protein market is highly consolidated, with a few dominant players shaping the competitive landscape. These key companies are involved in the production, processing, and distribution of soy protein products across various industries, including food & beverages, pharmaceuticals, and animal feed. Local companies and international players are competing to capture a larger share of the market by introducing innovative products, expanding their geographic reach, and investing in R&D.

|

Company Name |

Establishment Year |

Headquarters |

Revenue (2023) |

Employees |

Product Portfolio |

Market Presence |

R&D Investment |

Partnerships |

|

ADM |

1902 |

Chicago, USA |

||||||

|

Cargill |

1865 |

Minneapolis, USA |

||||||

|

DuPont |

1802 |

Wilmington, USA |

||||||

|

Wilmar International |

1991 |

Singapore |

||||||

|

Sonic Biochem |

1992 |

Indore, India |

India Soy Protein Industry Analysis

Growth Drivers

- Increasing Vegan Population: In India, the growing vegan population is contributing to the increased demand for plant-based protein sources like soy. According to government data from 2024, approximately 9% of India's population now follows a vegetarian or vegan diet. Soy protein has become a critical part of these diets due to its rich amino acid profile. The shift towards healthier lifestyles and dietary changes is evident in urban areas like Delhi, Mumbai, and Bengaluru, where vegan food product sales, including soy-based products, have risen by 20% year-over-year since 2022, according to industry reports.

- Health Consciousness: With a growing awareness of health issues such as diabetes and obesity, there has been an increased preference for protein-rich diets. Soy protein, being low in fat and cholesterol-free, appeals to health-conscious consumers. According to the National Health Profile of India, lifestyle-related disorders have increased by 11% in the last decade, driving demand for healthier protein alternatives. Indias per capita protein consumption in 2024 is estimated at 60 grams daily, with soy protein contributing significantly to this figure, supported by government campaigns promoting balanced diets.

- Government Initiatives: The Indian government has been actively supporting agricultural advancements that boost soy production. The Ministry of Agriculture reported that 12 million tons of soybeans were produced in 2023. Additionally, the government has incentivized exports of soy products to global markets through schemes like the Merchandise Exports from India Scheme (MEIS), which provides financial support to exporters. This has led to an increase in soy protein exports, which reached 1.8 million tons by the first quarter of 2024, helping India emerge as a key player in the global soy protein trade.

Market Challenges

- Allergen Concerns: One significant restraint to the growth of soy protein consumption is the allergen concern. According to the Indian Council of Medical Research (ICMR), approximately 1% of the Indian population is allergic to soy products. This is a small but impactful portion of the population that limits the market penetration of soy-based foods. With increasing health consciousness, consumers are becoming more cautious about allergens, limiting soy proteins reach despite its health benefits. This issue is particularly relevant for food processors, who need to consider allergen-free alternatives to maintain product inclusivity.

- Availability of Alternatives: Despite its benefits, soy protein faces stiff competition from other plant and animal-based protein sources such as pea, rice, and whey protein. The Ministry of Agriculture estimates that India produced 7 million tons of pulses in 2023, which are increasingly being processed into alternative protein powders. Consumers often prefer these alternatives due to dietary preferences or perceived health benefits. The availability of these alternatives presents a challenge to the soy protein market, as consumers have a wider choice of protein options, reducing dependency on soy-based products.

India Soy Protein Market Future Outlook

Over the next five years, the India soy protein market is expected to experience steady growth driven by rising consumer demand for plant-based protein alternatives and increased awareness of the health benefits of soy protein. Innovations in soy protein extraction and product formulations, combined with increasing penetration in rural areas, are expected to enhance market opportunities. The growing trend of veganism and the preference for organic, non-GMO soy protein products will also contribute to market expansion.

Future Market Opportunities

- Expanding Applications in Functional Foods: The functional foods segment, including soy protein-based snacks and beverages, is experiencing robust growth in India. According to the Food Processing Ministry, functional food consumption in India increased by 30% between 2022 and 2024. Soy protein is finding new applications in this segment, including energy bars, protein shakes, and meat alternatives. The demand for high-protein snacks and beverages is driven by the fitness industry, which has grown significantly due to increased health awareness. This expansion provides significant opportunities for soy protein manufacturers to capitalize on new product development in functional foods.

- Export Potential: Indias soy protein market holds considerable potential for exports due to growing global demand. Data from the Ministry of Commerce shows that Indias soy protein exports reached a record 1.8 million tons in the first quarter of 2024. Export opportunities are particularly significant in Southeast Asia, Europe, and North America, where the vegan and plant-based food movement is growing rapidly. With Indian soy protein products being more cost-competitive than those from other major producers like the U.S. and Brazil, there is ample room for Indian exporters to expand their footprint globally.

Scope of the Report

|

By Form |

Soy Protein Isolate Soy Protein Concentrate Textured Soy Protein |

|

By Application |

Food & Beverages Dietary Supplements Animal Feed Pharmaceuticals |

|

By Functionality |

Emulsification Water Binding Gelation Solubility |

|

By End-User |

Food Manufacturers Nutraceutical Companies Animal Feed Producers Pharmaceutical Companies |

|

By Region |

North India South India West India East India |

Products

Key Target Audience

Soy Protein Manufacturers

Food & Beverage Companies

Dietary Supplement Producers

Animal Feed Manufacturers

Pharmaceutical Companies

Government and Regulatory Bodies (FSSAI)

Investors and Venture Capital Firms

Banks and Financial Institutes

Export and Import Agencies

Companies

Major Players

ADM

Cargill

DuPont

Wilmar International

Sonic Biochem

Shandong Yuwang Ecological Food

CHS Inc.

Axiom Foods

SunOpta

Kerry Group

Royal Ingredients Group

Farbest Brands

Gushen Group

Shandong Wonderful Industrial Group

Soyfoods Pvt. Ltd.

Table of Contents

1. India Soy Protein Market Overview

1.1. Definition and Scope (Definition of soy protein, Scope of application across industries like food & beverages, dietary supplements, pharmaceuticals, and animal feed)

1.2. Market Taxonomy (Detailed classification of soy protein market: isolate, concentrate, textured soy protein, etc.)

1.3. Market Growth Rate (Current CAGR of soy protein in India across industry applications, forecasted growth rate)

1.4. Market Segmentation Overview (Segmentation based on form, application, end-user, functionality, and region)

2. India Soy Protein Market Size (In USD Mn)

2.1. Historical Market Size (Market size over the past five years in volume and value terms)

2.2. Year-On-Year Growth Analysis (Yearly analysis of growth in demand for soy protein across sectors)

2.3. Key Market Developments and Milestones (Major developments in soy protein production, product launches, and regulatory approvals)

3. India Soy Protein Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Vegan Population (Rising demand for plant-based protein)

3.1.2. Health Consciousness (Increased preference for protein-rich diets)

3.1.3. Government Initiatives (Support for agricultural advancements and exports)

3.1.4. Cost Competitiveness (Price advantage over other protein sources)

3.2. Restraints

3.2.1. Allergen Concerns (Soy as a potential allergen)

3.2.2. Availability of Alternatives (Competing plant and animal protein sources)

3.2.3. Fluctuations in Raw Material Prices (Impact of soybean price volatility)

3.2.4. Consumer Misconceptions (Misinformation about soy and hormonal impacts)

3.3. Opportunities

3.3.1. Expanding Applications in Functional Foods (Nutritional snacks, beverages)

3.3.2. Export Potential (Rising demand in international markets)

3.3.3. Research & Development (Innovations in protein extraction and formulation)

3.3.4. Growth of E-Commerce (Increasing direct-to-consumer sales channels)

3.4. Trends

3.4.1. Shift Towards Organic Soy Protein (Growing consumer preference for organic)

3.4.2. Clean Label Products (Transparency in sourcing and ingredients)

3.4.3. Blending of Proteins (Combination of soy with pea, rice, or other proteins)

3.5. Government Regulation

3.5.1. FSSAI Guidelines (Compliance with Food Safety Standards)

3.5.2. Export Policies (Government incentives for soy protein exports)

3.5.3. Sustainability Policies (Regulations on environmentally friendly production practices)

3.6. SWOT Analysis

3.6.1. Strengths

3.6.2. Weaknesses

3.6.3. Opportunities

3.6.4. Threats

3.7. Stakeholder Ecosystem (Key stakeholders including manufacturers, distributors, suppliers, and regulatory bodies)

3.8. Porters Five Forces Analysis (Competitive landscape, bargaining power of buyers and suppliers, threat of substitutes, new entrants, and competitive rivalry)

3.9. Competitive Ecosystem (Overview of market competition and product differentiation)

4. India Soy Protein Market Segmentation

4.1. By Form (In Value %)

4.1.1. Soy Protein Isolate

4.1.2. Soy Protein Concentrate

4.1.3. Textured Soy Protein

4.2. By Application (In Value %)

4.2.1. Food & Beverages (Bakery, meat alternatives, dairy alternatives)

4.2.2. Dietary Supplements (Protein powders, bars)

4.2.3. Animal Feed

4.2.4. Pharmaceuticals (Protein fortification)

4.3. By Functionality (In Value %)

4.3.1. Emulsification

4.3.2. Water Binding

4.3.3. Gelation

4.3.4. Solubility

4.4. By End-User (In Value %)

4.4.1. Food Manufacturers

4.4.2. Nutraceutical Companies

4.4.3. Animal Feed Producers

4.4.4. Pharmaceutical Companies

4.5. By Region (In Value %)

4.5.1. North India

4.5.2. South India

4.5.3. West India

4.5.4. East India

5. India Soy Protein Market Competitive Analysis

5.1. Detailed Profiles of Major Competitors

5.1.1. ADM

5.1.2. Cargill

5.1.3. DuPont

5.1.4. Wilmar International

5.1.5. Royal Ingredients Group

5.1.6. Shandong Yuwang Ecological Food

5.1.7. CHS Inc.

5.1.8. Sonic Biochem

5.1.9. Axiom Foods

5.1.10. SunOpta

5.1.11. Kerry Group

5.1.12. Farbest Brands

5.1.13. Gushen Group

5.1.14. Shandong Wonderful Industrial Group

5.1.15. Soyfoods Pvt. Ltd.

5.2. Cross Comparison Parameters (No. of Employees, Headquarters, Revenue, Product Offerings, Market Share)

5.3. Market Share Analysis

5.4. Strategic Initiatives (New Product Launches, Partnerships, Acquisitions)

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Private Equity Investments

5.9. Government Grants and Subsidies

6. India Soy Protein Market Regulatory Framework

6.1. FSSAI Standards

6.2. Export Compliance

6.3. Environmental Regulations (Sustainable farming and production practices)

6.4. Labeling Requirements (Nutrition labeling, allergen warnings)

7. India Soy Protein Future Market Size (In USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. India Soy Protein Future Market Segmentation

8.1. By Form (In Value %)

8.2. By Application (In Value %)

8.3. By Functionality (In Value %)

8.4. By End-User (In Value %)

8.5. By Region (In Value %)

9. India Soy Protein Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial step involves identifying key variables that influence the India soy protein market. This includes gathering data from secondary sources like industry reports and government publications, as well as proprietary databases. The goal is to map all relevant stakeholders, from manufacturers to end-users, across various market segments.

Step 2: Market Analysis and Construction

In this phase, historical market data is analyzed to assess growth trends and market dynamics. We study the penetration of soy protein in different sectors, revenue generation, and the distribution network of major players. This helps in building a reliable market size estimate for the base year and projected growth for future years.

Step 3: Hypothesis Validation and Expert Consultation

A set of market hypotheses are developed based on initial data analysis and market trends. These hypotheses are validated through direct consultations with industry experts, including manufacturers, distributors, and regulatory authorities, to ensure accuracy and comprehensiveness.

Step 4: Research Synthesis and Final Output

The final step synthesizes all gathered information into a comprehensive report. Data is validated using a bottom-up approach, which ensures that all projections and analyses are grounded in real-world market conditions. Additional insights are gathered through surveys and direct interviews with major industry players.

Frequently Asked Questions

01 How big is the India Soy Protein Market?

The India soy protein market is valued at USD 550 Mn and is driven by increasing consumer demand for plant-based proteins, particularly in food & beverage applications.

02 What are the challenges in the India Soy Protein Market?

Challenges in India soy protein market include fluctuations in soybean prices, consumer misconceptions about soy's health effects, and competition from alternative plant-based protein sources like pea and rice proteins.

03 Who are the major players in the India Soy Protein Market?

Major players in India soy protein market include ADM, Cargill, DuPont, Wilmar International, and Sonic Biochem, who have established a strong foothold in the market due to their extensive product portfolios and strategic partnerships.

04 What are the growth drivers of the India Soy Protein Market?

Growth in India soy protein market is driven by rising health consciousness, an increasing vegan population, and the expanding application of soy protein in functional foods, dietary supplements, and animal feed.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.