India Special Steel Market Outlook to 2030

Region:Asia

Author(s):Sanjeev

Product Code:KROD10154

November 2024

90

About the Report

India Special Steel Market Overview

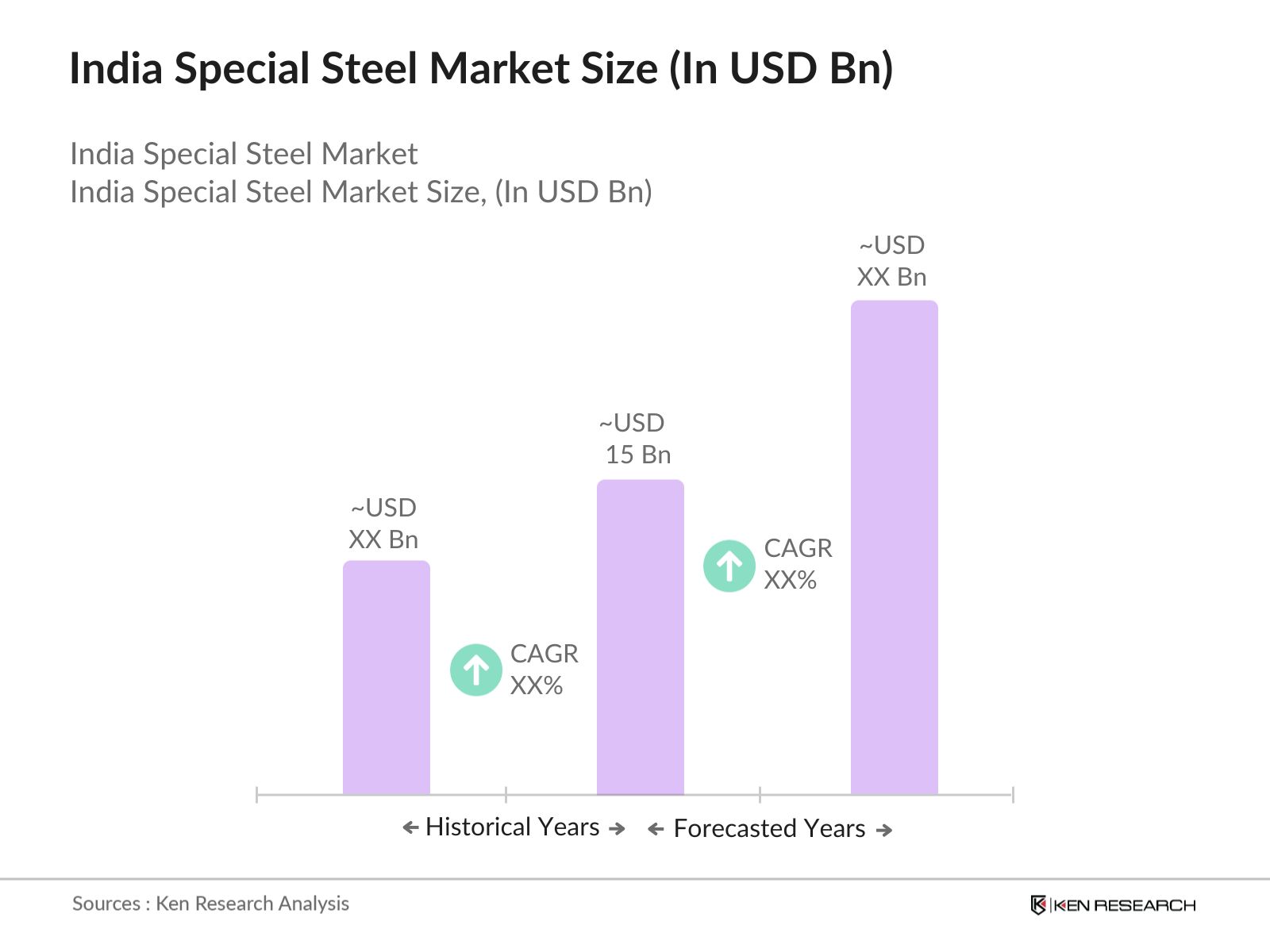

- The India Special Steel Market is valued at USD 15 billion, based on a five-year historical analysis. The growth of this market is driven by increasing demand from various end-user industries such as automotive, construction, and aerospace, which require high-quality steel for manufacturing components and structures. The ongoing urbanization and infrastructure development in India are significantly contributing to the rise in demand for special steel products.

- Key cities such as Mumbai, Pune, and Chennai dominate the India Special Steel Market due to their robust industrial bases and infrastructure projects. Mumbai, as a financial hub, attracts significant investments in manufacturing and construction, while Pune has a thriving automotive industry that requires specialized steel products. Chennais position as an automotive and manufacturing center further enhances its importance in this market.

- The National Steel Policy aims to enhance the competitiveness of the Indian steel sector and promote sustainable growth. Launched in 2017, the policy sets a target of reaching 300 million metric tons of steel production capacity by 2030. It emphasizes the need for quality enhancement, technological upgrades, and the promotion of domestic production. By focusing on these areas, the policy aims to increase the market's global competitiveness and support the growth of the special steel sector.

India Special Steel Market Segmentation

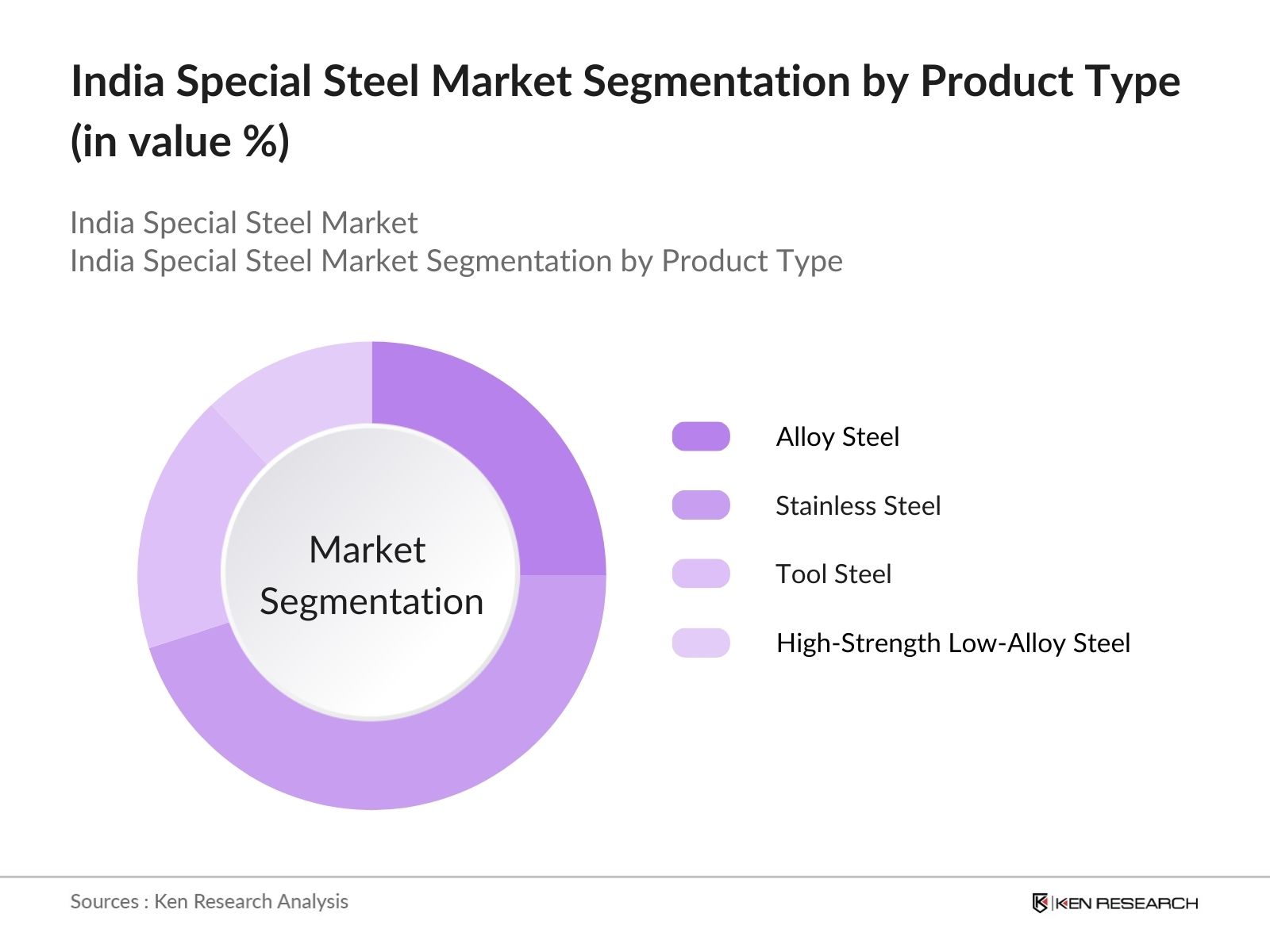

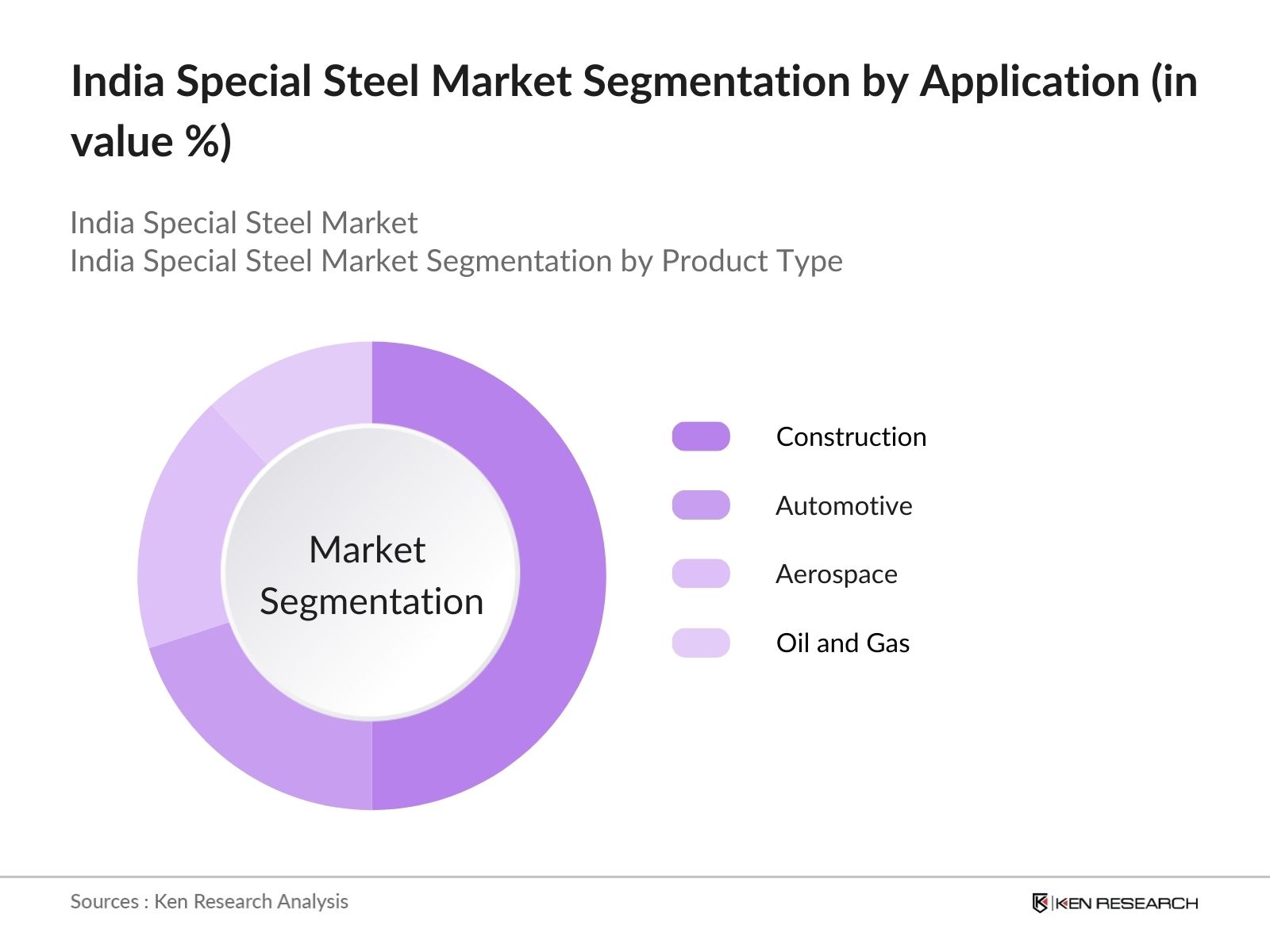

The India Special Steel Market is segmented by product type into and by application.

- By Product Type: The India Special Steel Market is segmented by product type into alloy steel, stainless steel, tool steel, and high-strength low-alloy steel. Among these, stainless steel holds a dominant market share due to its corrosion resistance, strength, and aesthetic appeal. It is extensively used in various applications ranging from kitchenware to construction. The growing preference for stainless steel in the food processing and healthcare sectors, owing to its hygienic properties, further solidifies its market position.

- By Application: The market is also segmented by application, which includes construction, automotive, aerospace, and oil and gas. The construction sector dominates the market due to the increasing investments in infrastructure development across India. Special steel is essential for building structures, bridges, and other facilities, providing durability and strength. The government's focus on housing and urban development initiatives significantly boosts the demand for special steel in this sector.

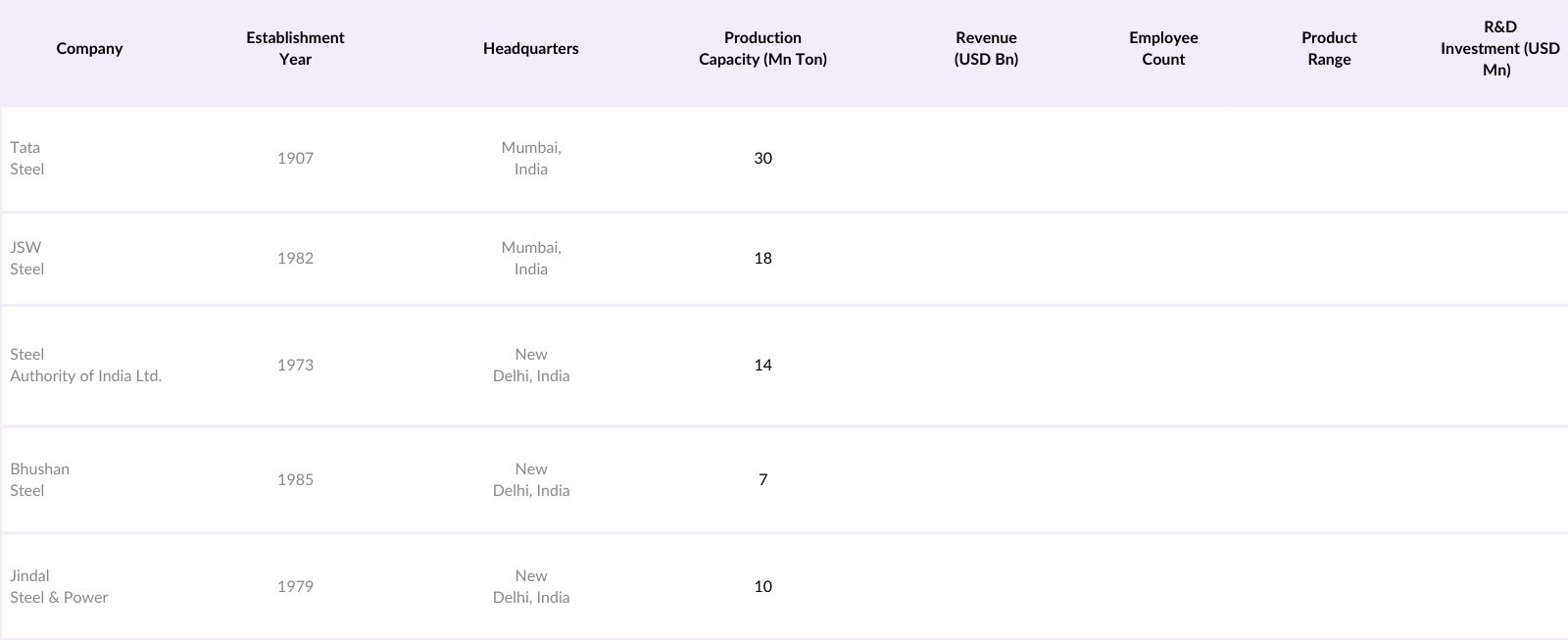

India Special Steel Market Competitive Landscape

India Special Steel Market Competitive Landscape

The India Special Steel Market is characterized by the presence of several major players, including Tata Steel, JSW Steel, and Steel Authority of India Ltd. (SAIL). These companies hold a significant market share due to their extensive production capabilities and strong brand recognition. The competition among these key players is intense, highlighting their strategic importance in shaping the industry landscape.

India Special Steel Industry Analysis

Growth Drivers

- Infrastructure Development: Infrastructure development in India is a critical growth driver for the special steel market, with government investments significantly boosting demand. The Indian government allocated 10 trillion (approximately $135 billion) for infrastructure development in 2023-2024, focusing on roads, railways, and urban development projects. The National Infrastructure Pipeline aims to invest 111 trillion (around $1.48 trillion) in infrastructure from 2020 to 2025, further increasing the demand for high-quality special steel. This growth in infrastructure will not only create immediate demand but also support long-term market expansion.

- Automotive Industry Demand: The Indian automotive industry is experiencing robust growth, with a production volume expected to reach 33 million vehicles by 2024, including passenger vehicles, commercial vehicles, and two-wheelers. This growth drives the demand for special steel, which is crucial in manufacturing durable automotive components. Additionally, the governments push for electric vehicles (EVs) is expected to result in the production of over 1 million EVs by 2025. This shift towards more advanced automotive technology will likely increase the consumption of high-strength and lightweight steel.

- Energy Sector Growth: The energy sector's expansion, particularly in renewable energy, significantly impacts the special steel market. India aims to achieve 500 GW of renewable energy capacity by 2030, with investments in solar, wind, and hydroelectric projects. The government has allocated 1.5 trillion (approximately $20 billion) for the National Solar Mission to enhance solar energy production. This transition requires high-quality steel for the construction of renewable energy plants and infrastructure, bolstering the special steel market.

Market Challenges

- Raw Material Price Volatility: Volatility in raw material prices poses a significant challenge to the special steel market in India. In 2022, the price of iron ore surged to 6,000 per metric ton (approximately $80), reflecting a 40% increase compared to 2021 due to global supply chain disruptions. The fluctuation in prices of key materials like nickel and chromium, which are essential for producing high-quality special steel, complicates production planning and profitability for manufacturers. This volatility can hinder investments and slow market growth.

- Stringent Environmental Regulations: The special steel industry faces challenges due to increasingly stringent environmental regulations aimed at reducing carbon emissions and promoting sustainable practices. The Indian governments push towards achieving net-zero emissions by 2070 includes regulations that impact steel production processes. Compliance with these regulations requires investments in cleaner technologies, which can be cost-prohibitive for many manufacturers. The need to balance compliance and production costs poses a challenge to the growth of the special steel market.

India Special Steel Market Future Outlook

Over the next five years, the India Special Steel Market is expected to show significant growth driven by continuous government support for infrastructure development, rising investments in the automotive sector, and advancements in steel manufacturing technologies. The demand for high-quality steel is anticipated to surge as industries focus on enhancing the performance and sustainability of their products.

Market Opportunities

- Technological Innovations: Technological innovations present significant opportunities for the special steel market in India. Advancements in manufacturing processes, such as the use of automation and Industry 4.0 technologies, are enhancing production efficiency. The implementation of smart manufacturing technologies could improve productivity by 30% by 2025, allowing manufacturers to produce high-quality steel at lower costs. Additionally, innovations in metallurgy are leading to the development of new alloys that meet stringent industry specifications, fostering market growth.

- Export Potential: India's special steel market has considerable export potential, particularly as global demand for high-quality steel continues to rise. In 2022, India's steel exports reached 1.2 trillion (approximately $16 billion), marking a 20% increase from the previous year. The government's initiatives to enhance production capabilities and quality standards are positioning India as a key player in the global steel market. As countries seek reliable suppliers amid geopolitical uncertainties, India could become a preferred destination for steel imports, driving market growth.

Scope of the Report

Products

Key Target Audience

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (Ministry of Steel, Bureau of Indian Standards)

Manufacturers of Special Steel Products

Construction and Infrastructure Development Companies

Automotive Manufacturers

Aerospace Companies

Oil and Gas Sector Players

Industry Associations

Companies

Players Mention in the Report:

Tata Steel

JSW Steel

Steel Authority of India Ltd. (SAIL)

Bhushan Steel

Jindal Steel & Power

Essar Steel

Hindalco Industries

Kalyani Steels

Rathi Steel

Gerdau Long Steel North America

Mahindra Susten

ArcelorMittal

Usha Martin

APL Apollo Tubes

Aichi Steel Corporation

Table of Contents

1. India Special Steel Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate (CAGR)

1.4. Market Segmentation Overview

2. India Special Steel Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. India Special Steel Market Analysis

3.1. Growth Drivers

3.1.1. Infrastructure Development

3.1.2. Automotive Industry Demand

3.1.3. Energy Sector Growth

3.1.4. Aerospace and Defense Expansion

3.2. Market Challenges

3.2.1. Raw Material Price Volatility

3.2.2. Stringent Environmental Regulations

3.2.3. Competition from Substitute Materials

3.3. Opportunities

3.3.1. Technological Innovations

3.3.2. Export Potential

3.3.3. Government Initiatives for Make in India

3.4. Trends

3.4.1. Adoption of Advanced Manufacturing Technologies

3.4.2. Shift Towards Sustainable Practices

3.4.3. Increasing Use of High-Strength Steel

3.5. Government Regulation

3.5.1. National Steel Policy

3.5.2. Quality Standards and Certifications

3.5.3. Import Duties and Tariffs

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competitive Landscape

4. India Special Steel Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Alloy Steel

4.1.2. Stainless Steel

4.1.3. Tool Steel

4.1.4. High-Strength Low-Alloy Steel

4.1.5. Others

4.2. By Application (In Value %)

4.2.1. Construction

4.2.2. Automotive

4.2.3. Aerospace

4.2.4. Oil and Gas

4.2.5. Others

4.3. By End-Use Industry (In Value %)

4.3.1. Manufacturing

4.3.2. Energy

4.3.3. Transportation

4.3.4. Healthcare

4.3.5. Others

4.4. By Region (In Value %)

4.4.1. North India

4.4.2. South India

4.4.3. East India

4.4.4. West India

4.4.5. Central India

5. India Special Steel Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Tata Steel

5.1.2. JSW Steel

5.1.3. Steel Authority of India Ltd. (SAIL)

5.1.4. Bhushan Steel

5.1.5. Jindal Steel & Power

5.1.6. Essar Steel

5.1.7. Hindalco Industries

5.1.8. Kalyani Steels

5.1.9. Rathi Steel

5.1.10. Gerdau Long Steel North America

5.1.11. Mahindra Susten

5.1.12. ArcelorMittal

5.1.13. Usha Martin

5.1.14. APL Apollo Tubes

5.1.15. Aichi Steel Corporation

5.2. Cross Comparison Parameters (Market Share, Revenue, Employee Strength, Geographic Reach, Product Portfolio, Research & Development Capability, Customer Base, Sustainability Practices)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. India Special Steel Market Regulatory Framework

6.1. Environmental Standards

6.2. Compliance Requirements

6.3. Certification Processes

7. India Special Steel Market Future Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. India Special Steel Market Future Segmentation

8.1. By Product Type (In Value %)

8.2. By Application (In Value %)

8.3. By End-Use Industry (In Value %)

8.4. By Region (In Value %)

8.5. By Technology (In Value %)

9. India Special Steel Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the India Special Steel Market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data pertaining to the India Special Steel Market. This includes assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics will be conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations will provide valuable operational and financial insights directly from industry practitioners, which will be instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple special steel manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction will serve to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the India Special Steel Market.

Frequently Asked Questions

01. How big is the India Special Steel Market?

The India Special Steel Market is valued at USD 15 billion, driven by increasing demand from the automotive, construction, and aerospace sectors, which require high-quality steel for manufacturing.

02. What are the challenges in the India Special Steel Market?

India Special Steel Market Challenges include fluctuating raw material prices, stringent environmental regulations, and competition from substitute materials, which pose threats to profitability and market stability.

03. Who are the major players in the India Special Steel Market?

India Special Steel Market Key players include Tata Steel, JSW Steel, and Steel Authority of India Ltd. (SAIL). These companies dominate due to their extensive production capabilities and strong brand recognition.

04. What are the growth drivers of the India Special Steel Market?

The India Special Steel Market is propelled by infrastructure development, rising automotive demand, and advancements in manufacturing technologies, which drive the need for specialized steel products.

05. What are the future prospects for the India Special Steel Market?

The India Special Steel Market is expected to experience significant growth driven by government support for infrastructure initiatives, increased automotive investments, and innovations in steel manufacturing technologies.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.