India Spice Market Outlook to 2030

Region:Asia

Author(s):Sanjeev

Product Code:KROD2099

November 2024

83

About the Report

India Spice Market Overview

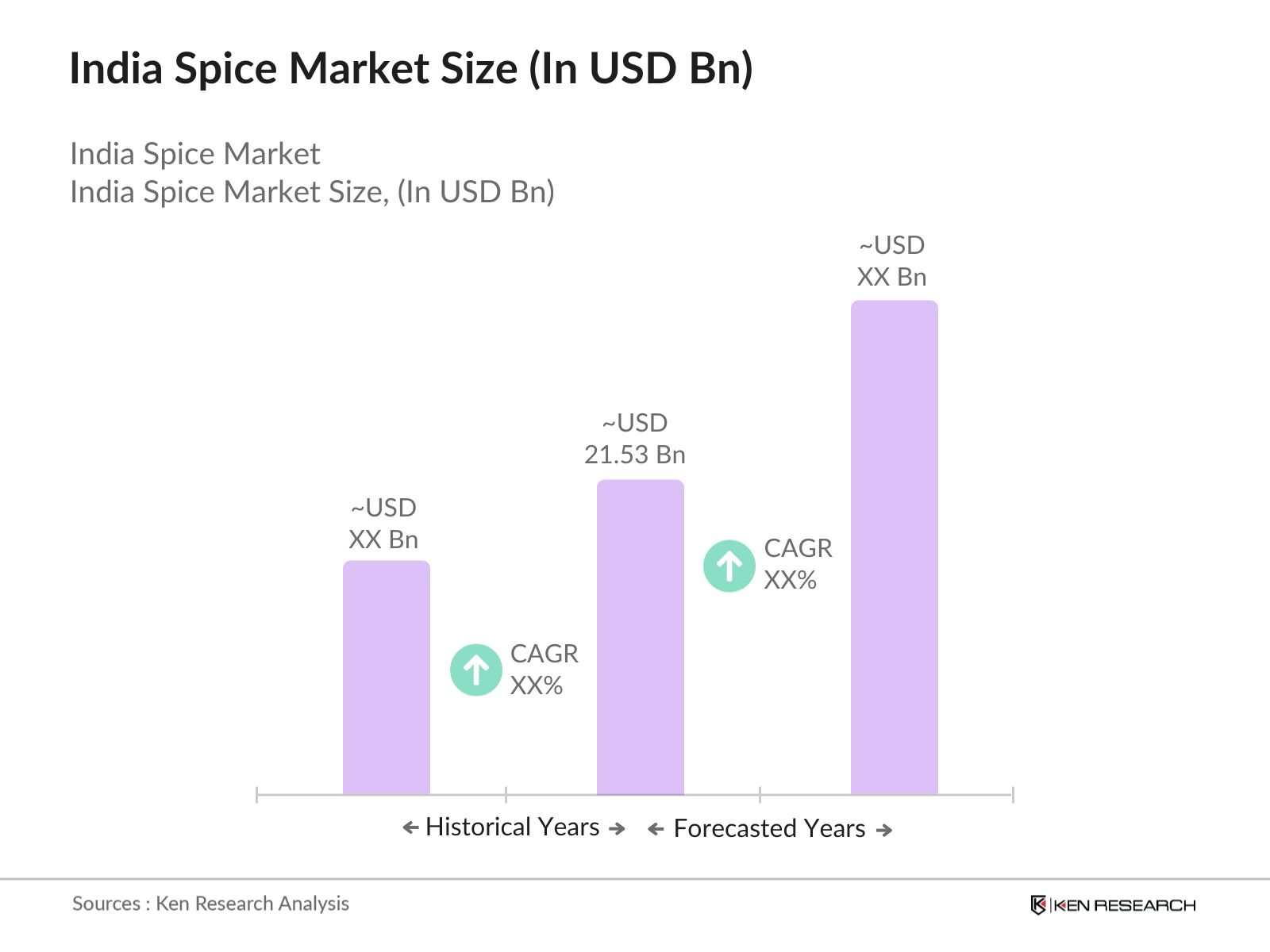

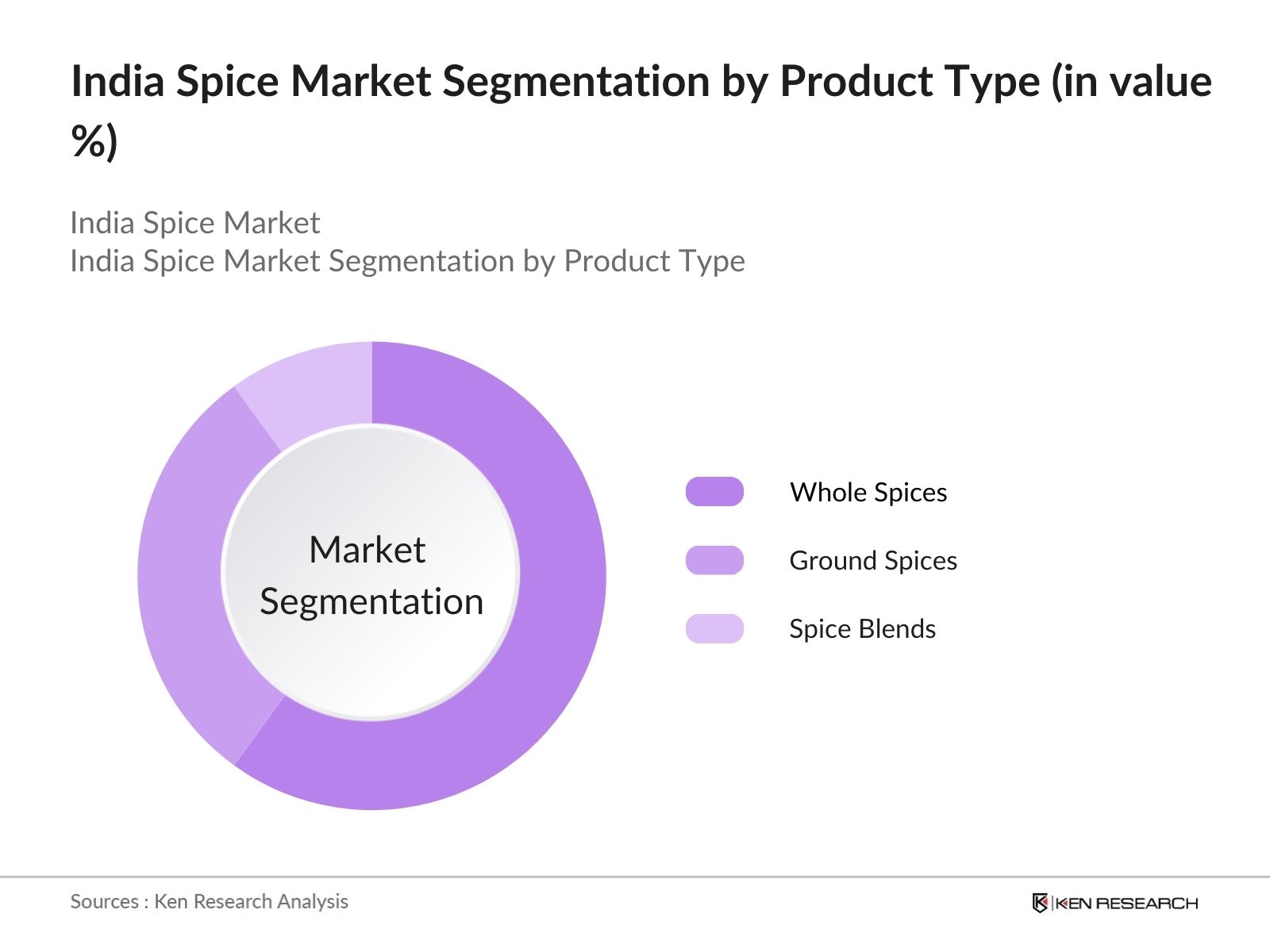

- The India Spice Market was valued at USD 21.53 billion, propelled by the increasing consumption of spices in both domestic and international cuisines, rising health awareness regarding the benefits of spices, and expanding applications in the pharmaceutical and cosmetic industries. The market is segmented into whole spices, ground spices, and spice blends, with whole spices holding the largest share due to their extended shelf life and traditional use in Indian cooking.

- The market is segmented into whole spices, ground spices, and spice blends, with whole spices holding the largest share due to their extended shelf life and traditional use in Indian cooking.

- Major players in the India Spice Market include MDH Spices, Everest Spices, Catch Spices, Aachi Spices, and Rajesh Masala. These companies are known for their extensive product ranges and emphasis on quality control and innovation. MDH Spices leads the market with its well-established brands, offering a wide variety of spices with a focus on purity and traditional taste.

- In 2023, MDH Spices introduced a new line of organic spices under its MDH Organic brand, aimed at health-conscious consumers seeking natural and chemical-free products. This launch reflects the growing trend towards organic and sustainable food products in India, in line with global health and wellness trends.

India Spice Market Segmentation

The India Spice Market can be segmented by product type, sales channel, and region:

- By Product Type: The market is segmented into whole spices, ground spices, and spice blends. In 2023, whole spices are the most dominant due to their traditional use and longer shelf life. However, ground spices and spice blends are gaining popularity for their convenience and diverse flavor profiles, particularly in urban areas.

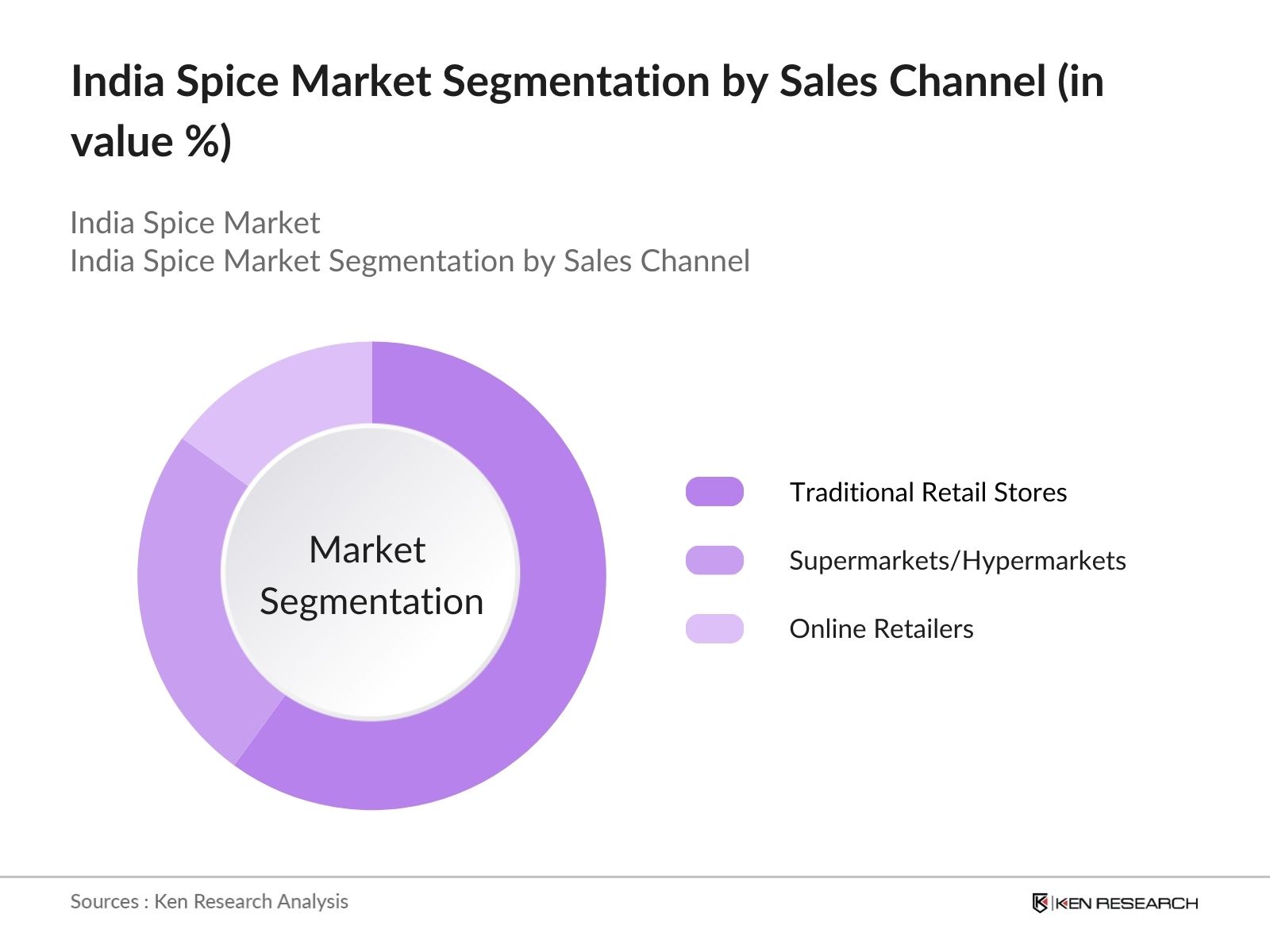

- By Sales Channel: The market is segmented by sales channel into supermarkets/hypermarkets, traditional retail stores, and online retailers. In 2023, traditional retail stores dominate the market due to their widespread presence and familiarity among consumers. However, online retailers are rapidly growing in market share, driven by the convenience of online shopping and a broader product selection.

- By Region: The Indian market is segmented regionally into North, South, East, and West. In 2023, North India leads the market due to its extensive use of spices in local cuisines and high production levels. Southern India also holds a significant share, driven by the high consumption of spices in regional dishes and a growing export market.

India Spice Market Competitive Landscape

|

Company |

Establishment Year |

Headquarters |

|

MDH Spices |

1919 |

Delhi, India |

|

Everest Spices |

1986 |

Mumbai, India |

|

Catch Spices |

1990 |

Mumbai, India |

|

Aachi Spices |

1995 |

Chennai, India |

|

Rajesh Masala |

1984 |

Kolkata, India |

- MDH Spices: In 2023, MDH Spices launched a new range of organic spice powders aimed at health-conscious consumers. This innovation reflects the company's commitment to maintaining high-quality standards and addressing the growing demand for natural and sustainable products.

- Everest Spices: In 2024, Everest Spices expanded its product line with the introduction of new spice blends designed for regional and international cuisines. This expansion aligns with the company's strategy to diversify its product offerings and cater to evolving consumer preferences.

India Spice Market Analysis

Market Growth Drivers:

- Increasing Consumption of Spices: The spice market benefits from the widespread use of spices in Indian cuisine and increasing international demand. In 2023, India exported over 1.4 million metric tons of spices, indicating strong global demand and consumption.

- Health Benefits of Spices: The growing awareness of the health benefits of spices, such as their anti-inflammatory and antioxidant properties, drives consumer interest. For instance, turmeric, a commonly used spice, has been widely recognized for its health benefits and is increasingly featured in wellness products.

- Innovation in Spice Products: The introduction of new spice blends and convenient packaging options contributes to market growth. In 2023, companies like MDH Spices launched new product lines, including organic spices and pre-mixed blends, catering to evolving consumer preferences for natural and convenient products.

Market Challenges:

- Supply Chain Disruptions: The spice market is susceptible to disruptions in the supply chain, including transportation delays, logistical challenges, and issues with sourcing raw materials. These disruptions can impact the availability and cost of spices.

- Competition from Imported Spices: The influx of imported spices at lower prices creates competition for domestic producers. Imported spices can sometimes undercut local prices, putting pressure on Indian spice manufacturers to maintain their market share.

- Counterfeit and Adulteration Issues: The presence of counterfeit or adulterated spices in the market poses a challenge to quality assurance and consumer trust. Ensuring the authenticity and purity of spices is a significant concern for both manufacturers and consumers.

Government Initiatives:

- Spices Board of India: The Spices Board of India, established under the Ministry of Commerce and Industry, is responsible for the promotion and development of the spice industry. Various programmes rolled out under the scheme 'Sustainability in Spice Sector through Progressive, Innovative and Collaborative Interventions for Export Development (SPICED)' will be implemented during the remaining period of the 15th Finance Commission cycle, till FY 2025-26, with a total approved outlay of Rs. 422.30 crore.

- Integrated Horticulture Development Scheme (IHDS): Under the IHDS, the government has provided subsidies for the cultivation of spices. For the financial year 2023-2024, INR 150 crore was allocated to support spice cultivation through subsidies and grants for improved farming practices and infrastructure.

India Spice Market Future Market Outlook

The India Spice Market is expected to experience steady growth, driven by increasing global demand, innovation in spice products, and expanding export opportunities.

Future Market Trends:

- Increased Focus on Export Markets: As global demand for Indian spices continues to grow, there will be a stronger focus on expanding export markets. Efforts will likely include exploring new trade agreements, enhancing export infrastructure, and leveraging international trade shows to increase market reach.

- Integration of Spices in Functional Foods and Beverages: The incorporation of spices into functional foods and beverages, such as health drinks and dietary supplements, is expected to rise. This trend reflects growing consumer interest in the health benefits of spices and their potential role in preventive healthcare and wellness.

- Growth of Spice Blends and Ready-to-Use Products: There is likely to be increased consumer preference for convenient, ready-to-use spice blends and pre-mixed products. Innovations in spice blends designed for specific cuisines or health benefits are expected to gain popularity, catering to busy lifestyles and diverse culinary preferences.

Scope of the Report

|

By Product Type |

Whole Spices Ground Spices Spice Blends |

|

By Sales Channel |

Supermarkets/Hypermarkets Traditional Retail Stores Online Retailers |

|

By Price Segment |

Economy Mid-range Premium |

|

By Region |

West East North South |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing to This Report:

Banks and Financial Institutions

Venture Capitalists

Government and Regulatory Bodies (FSSAI, SEPC)

Spice Manufacturers

Exporters and Importers

E-commerce Companies

Product Development Firms

Agricultural and Spice Cultivation Organizations

Time Period Captured in the Report:

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2028

Companies

Players Mentioned in the Report:

MDH Spices

Everest Spices

Catch Spices

Aachi Spices

Rajesh Masala

Eastern Condiments

Shan Foods

Badshah Masala

Priya Foods

Fortune Spices

Saptarishi Spices

Ruchi Soya

Kumar's Spices

Vellanki Foods

Ashoka Spices

Table of Contents

1. India Spice Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. India Spice Market Size (in USD Bn), 2018-2023

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. India Spice Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Consumption of Spices

3.1.2. Health Benefits of Spices

3.1.3. Innovation in Spice Products

3.1.4. Export Opportunities

3.2. Restraints

3.2.1. Supply Chain Disruptions

3.2.2. Competition from Imported Spices

3.2.3. Counterfeit and Adulteration Issues

3.3. Opportunities

3.3.1. Expansion into New Export Markets

3.3.2. Integration into Functional Foods and Beverages

3.3.3. Development of Convenient Spice Blends

3.4. Trends

3.4.1. Focus on Organic and Sustainable Products

3.4.2. Growth of E-commerce Channels

3.4.3. Innovation in Spice Blends

3.5. Government Initiatives

3.5.1. Spices Board of India

3.5.2. Integrated Horticulture Development Scheme (IHDS)

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Competition Ecosystem

4. India Spice Market Segmentation, 2023

4.1. By Product Type (in Value %)

4.1.1. Whole Spices

4.1.2. Ground Spices

4.1.3. Spice Blends

4.2. By Sales Channel (in Value %)

4.2.1. Supermarkets/Hypermarkets

4.2.2. Traditional Retail Stores

4.2.3. Online Retailers

4.3. By Region (in Value %)

4.3.1. North

4.3.2. South

4.3.3. East

4.3.4. West

5. India Spice Market Cross Comparison

5.1. Detailed Profiles of Major Companies

5.1.1. MDH Spices

5.1.2. Everest Spices

5.1.3. Catch Spices

5.1.4. Aachi Spices

5.1.5. Rajesh Masala

5.1.6. Eastern Condiments

5.1.7. Shan Foods

5.1.8. Badshah Masala

5.1.9. Priya Foods

5.1.10. Fortune Spices

5.1.11. Saptarishi Spices

5.1.12. Ruchi Soya

5.1.13. Kumar's Spices

5.1.14. Vellanki Foods

5.1.15. Ashoka Spices

5.2. Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue)

6. India Spice Market Competitive Landscape

6.1. Market Share Analysis

6.2. Strategic Initiatives

6.3. Mergers and Acquisitions

6.4. Investment Analysis

6.4.1. Venture Capital Funding

6.4.2. Government Grants

6.4.3. Private Equity Investments

7. India Spice Market Regulatory Framework

7.1. Industry Regulations

7.2. Compliance Requirements

7.3. Certification Processes

8. India Spice Market Future Market Size (in USD Bn), 2023-2028

8.1. Future Market Size Projections

8.2. Key Factors Driving Future Market Growth

9. India Spice Market Future Market Segmentation, 2028

9.1. By Product Type (in Value %)

9.2. By Sales Channel (in Value %)

9.3. By Region (in Value %)

10. India Spice Market Analysts Recommendations

10.1. TAM/SAM/SOM Analysis

10.2. Customer Cohort Analysis

10.3. Marketing Initiatives

10.4. White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step 1: Identifying Key Variables

We begin by referencing multiple secondary and proprietary databases to conduct desk research. This includes gathering industry-level information on market drivers, challenges, key players, consumer behavior, and usage trends related to spices. We also assess regulatory impacts and market dynamics specific to the Indian spice market.

Step 2: Market Building

We collect historical data on market size, growth rates, product segmentation (whole spices, ground spices, and spice blends), and the distribution of sales channels (supermarkets, traditional retail stores, and online retailers). We also analyze market share and revenue generated by leading brands, emerging trends in spice consumption, and consumer preferences to ensure accuracy and reliability in the data presented.

Step 3: Validating and Finalizing

We perform Computer-Assisted Telephone Interviews (CATIs) with industry experts, including representatives from leading spice manufacturers, distributors, and retailers. These interviews validate the statistics collected and provide insights into operational and financial aspects, such as pricing strategies, supply chain management, and consumer buying patterns.

Step 4: Research Output

Our team interacts with spice manufacturers, retailers, and market analysts to understand the dynamics of market segments, evolving consumer preferences, and sales trends. This process helps validate the derived statistics using a bottom-to-top approach, ensuring that the final data accurately reflects the actual market conditions.

Frequently Asked Questions

1. How large is the India Spice Market?

The India Spice Market was valued at USD 21.53 billion. The market's growth is driven by increasing consumption in domestic and international cuisines, rising health awareness regarding the benefits of spices, and expanding applications in various industries.

2. What are the challenges in the India Spice Market?

Challenges in the India Spice Market include volatility in raw material prices, which affects pricing and profit margins for manufacturers. Regulatory compliance issues and intense competition among established brands and local producers also pose significant challenges.

3. Who are the major players in the India Spice Market?

Major players in the India Spice Market include MDH Spices, Everest Spices, Catch Spices, Aachi Spices, and Rajesh Masala. These companies lead the market with extensive product ranges and a focus on quality control and innovation.

4. What are the growth drivers of the India Spice Market?

Key growth drivers include increasing spice consumption in both domestic and international cuisines, health benefits associated with spices, and innovations in spice products, such as organic options and new blends. Expanding export opportunities and evolving consumer preferences also contribute to market growth.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.