India Sports Apparel Market Outlook to 2030

Region:Asia

Author(s):Abhinav kumar

Product Code:KROD4134

December 2024

88

About the Report

India Sports Apparel Market Overview

- The India sports apparel market is valued at approximately USD 706 million, driven by growing health consciousness, increased participation in sports activities, and the rising trend of athleisure. Over the past five years, the market has experienced significant growth due to the increasing demand for performance-enhancing, durable, and fashionable sportswear. The expanding middle class, coupled with the rise in disposable income, has further fueled market growth as consumers increasingly invest in quality sportswear that blends fashion with function.

- The market is largely dominated by metropolitan cities like Mumbai, Delhi, and Bangalore. These cities have seen high levels of urbanization and have a culture deeply ingrained in fitness and sports, with access to premium brands. Additionally, these cities host numerous sporting events and marathons, further boosting the demand for high-performance sports apparel. The penetration of international brands and the growing presence of e-commerce platforms have also contributed to the dominance of these urban centers.

- The Indian government has established a policy framework to promote the sportswear industry, focusing on textile innovation and quality standards. In 2023, the Ministry of Textiles announced a grant of INR 200 crore for research and development in performance textiles. This initiative supports the growth of the domestic sportswear market by ensuring that locally produced sportswear meets international quality benchmarks.

India Sports Apparel Market Segmentation

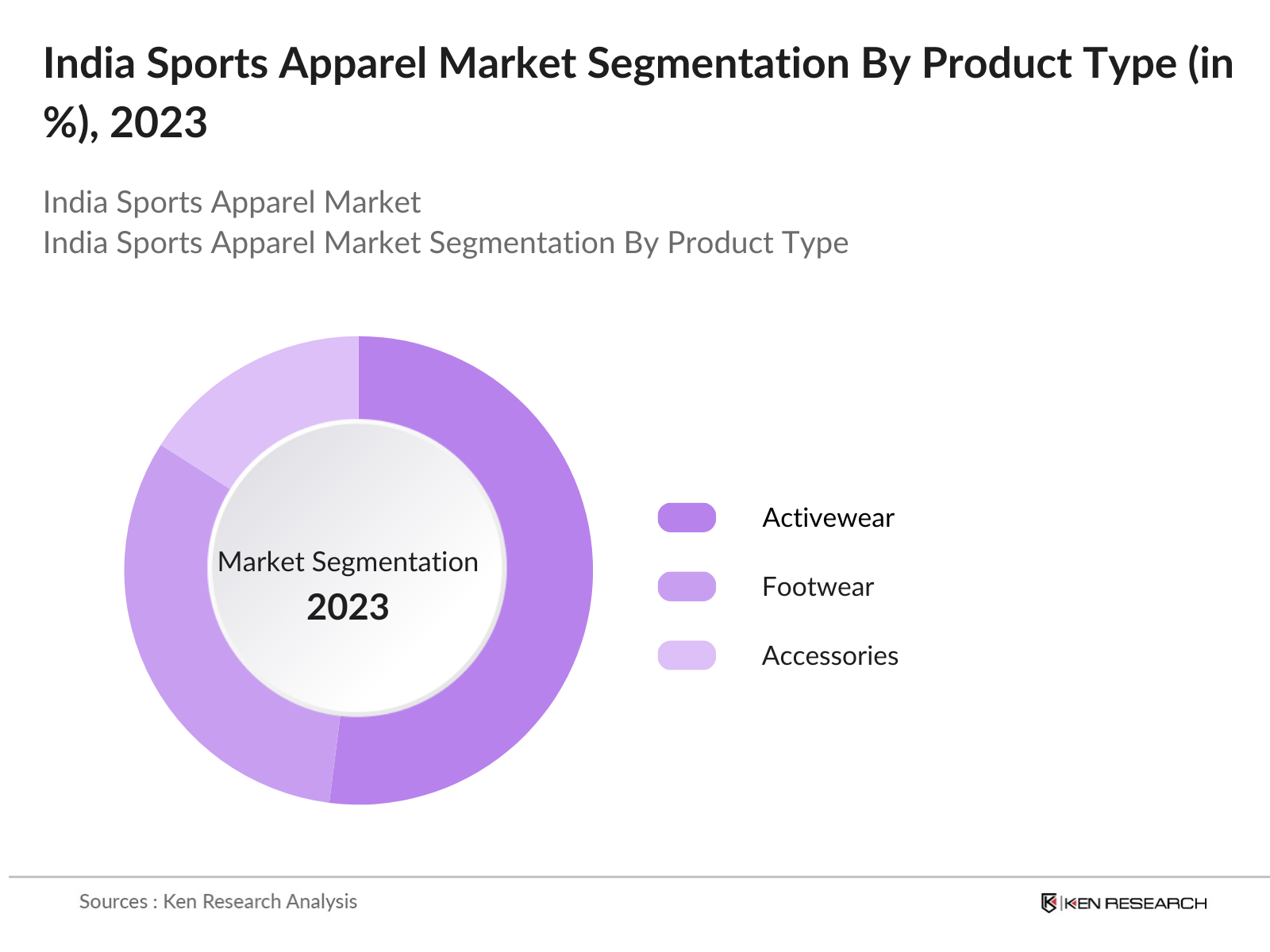

By Product Type: The India sports apparel market is segmented by product type into activewear, footwear, and accessories. Among these, activewear holds the largest market share due to the increasing trend of athleisure, where consumers are blending sportswear with casual wear. Brands like Nike, Adidas, and Puma have established a strong foothold in this category with products that focus on performance enhancement and style. The rise in gym memberships, home workout culture, and outdoor sports activities post-pandemic has further accelerated the growth of this segment.

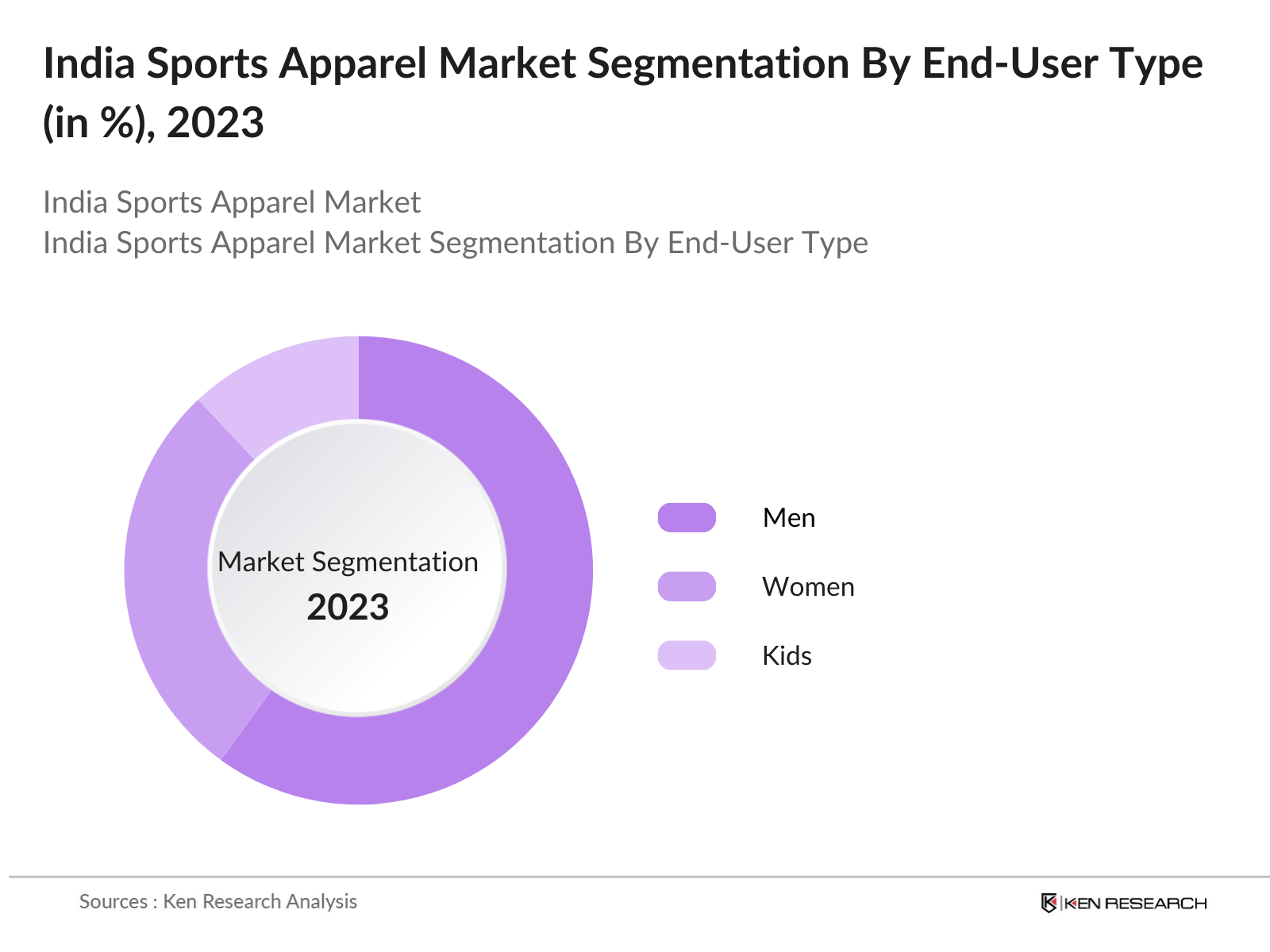

By End User: The market is also segmented by end user into men, women, and kids. The mens segment dominates the market, as sports apparel is traditionally marketed towards male consumers, especially for performance sports like football, cricket, and running. However, the womens segment is growing at a faster pace due to increasing awareness of fitness among women and the growing influence of women athletes and fitness influencers. The demand for sports bras, leggings, and other female-specific sportswear products has seen a sharp rise.

India Sports Apparel Market Competitive Landscape

The India sports apparel market is highly competitive, with the presence of both international and domestic players. Leading brands continue to innovate with performance-enhancing materials and expand their product lines. Local manufacturers are also gaining prominence by offering affordable and functional sportswear for the mass market. The market consolidation among top brands is evident due to strong brand loyalty and deep-rooted distribution networks.

|

Company Name |

Establishment Year |

Headquarters |

Revenue (USD Bn) |

No. of Stores |

Market Share (%) |

Brand Penetration |

Sustainability Initiatives |

|

Nike Inc. |

1964 |

Oregon, USA |

_ |

_ |

_ |

_ |

_ |

|

Adidas AG |

1949 |

Herzogenaurach, Germany |

_ |

_ |

_ |

_ |

_ |

|

Puma SE |

1948 |

Herzogenaurach, Germany |

_ |

_ |

_ |

_ |

_ |

|

Reebok International |

1958 |

Boston, USA |

_ |

_ |

_ |

_ |

_ |

|

Decathlon Group |

1976 |

Villeneuve, France |

_ |

_ |

_ |

_ |

_ |

India Sports Apparel Industry Analysis

Growth Drivers

- Rising Health and Fitness Awareness: In India, the increasing focus on health and fitness has significantly contributed to the demand for sports apparel. With a growing number of gyms, fitness centers, and outdoor exercise activities across major cities, the fitness industry has boomed. According to the World Bank, in 2024, Indias life expectancy reached 70.4 years, while health expenditure per capita increased to $63.5, reflecting the increased focus on personal well-being. Furthermore, government campaigns like Fit India Movement are promoting healthy lifestyles, creating more demand for fitness-related apparel. The surge in gym memberships and outdoor sports has further driven this growth.

- Increased Participation in Sports Events: Sports participation in India has risen, driven by events like the Indian Premier League (IPL) and the Pro Kabaddi League (PKL). Government data from the Ministry of Youth Affairs and Sports indicated that over 2,000 sporting events were held nationally in 2023. Additionally, sports education programs and school-level competitions have grown significantly, promoting grassroots sports engagement. This rising interest in sporting events has led to an increase in demand for sports apparel, particularly among youth. By 2024, sports participation in urban areas had increased by 15 million individuals compared to 2022.

- Expansion of Athleisure Trend: The athleisure trend, a combination of athletic and casual wear, has expanded significantly in India. As per data from the Indian Ministry of Textiles, the growth of this trend has led to a 12% rise in sales of athleisure products between 2022 and 2024. The increasing preference for comfortable, multi-purpose clothing is driven by changing consumer lifestyles, with more people opting for casual and fitness-oriented apparel even in non-sporting contexts. This shift in fashion, supported by rapid urbanization and the influence of global styles, continues to drive demand for sports apparel.

Market Challenges

- High Competition from International Brands: Indias sports apparel market faces stiff competition from international brands like Nike, Adidas, and Puma, which dominate the market with their established global presence. Data from the Indian Retailers Association shows that over 70% of premium sportswear sold in India in 2024 was from international brands. Domestic brands struggle to match the global marketing and product quality standards set by these companies, making it challenging to capture market share.

- Fluctuations in Raw Material Prices: The volatility in raw material prices, particularly for synthetic fibers like polyester and nylon used in sportswear, poses a challenge for manufacturers. In 2023, raw material costs surged by 8%, according to data from the Indian Ministry of Textiles, due to fluctuations in global oil prices and supply chain disruptions. This unpredictability has made it difficult for manufacturers to maintain stable pricing and profit margins, especially for smaller, local companies.

India Sports Apparel Market Future Outlook

Over the next five years, the India sports apparel market is expected to witness continuous growth, driven by evolving fitness trends, the rise in health consciousness, and the growing importance of sports in schools and institutions. As more consumers adopt active lifestyles, the demand for functional, high-performance, and fashionable sportswear will continue to grow. Additionally, government initiatives promoting sports and the increase in disposable incomes across Tier 2 and Tier 3 cities will likely open up new growth avenues for brands.

Opportunities

- Expansion into Tier 2 and Tier 3 Cities: As Tier 2 and Tier 3 cities in India experience economic growth, the demand for sports apparel has expanded beyond metropolitan regions. According to data from the Reserve Bank of India (RBI), per capita income in Tier 2 cities reached INR 1.2 lakh in 2024, encouraging greater discretionary spending on non-essential items like sportswear. Brands that target these emerging markets stand to benefit from a growing consumer base that values fitness and fashion.

- Technological Advancements in Fabrics: The development of advanced fabrics, such as moisture-wicking and temperature-regulating materials, presents an opportunity for sportswear manufacturers. In 2024, the Ministry of Science and Technology reported that Indian textile companies had invested INR 500 crore in research and development of high-performance fabrics. These innovations appeal to athletes and fitness enthusiasts who require functional and comfortable sportswear, offering a competitive edge for companies focusing on technologically enhanced products.

Scope of the Report

|

By Product Type |

Activewear Footwear Headgear Accessories |

|

By End User |

Men Women Kids |

|

By Sports Type |

Cricket Football Running Other Sports |

|

By Distribution Channel |

Online Offline |

|

By Region |

North India South India East India West India |

Products

Key Target Audience

Sportswear Companies

Online E-Commerce Companies

Fashion Design Industries

Government and Regulatory Bodies (Ministry of Youth Affairs and Sports, Government of India)

Professional Athletes and Sports Associations

Investors and Venture Capitalist Firms

Sports Sponsorship and Advertising Companies

Companies

Major Players in the Market

Nike Inc.

Adidas AG

Puma SE

Reebok International Ltd.

Decathlon Group

Under Armour Inc.

Skechers USA, Inc.

FILA Holdings Corp.

ASICS Corporation

New Balance Athletics Inc.

Bata India Limited

HRX by Hrithik Roshan

Nivia Sports

Shiv-Naresh Sports Pvt Ltd.

Wildcraft India

Table of Contents

1. India Sports Apparel Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. India Sports Apparel Market Size (In INR Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. India Sports Apparel Market Analysis

3.1. Growth Drivers

3.1.1. Rising Health and Fitness Awareness

3.1.2. Increased Participation in Sports Events

3.1.3. Expansion of Athleisure Trend

3.1.4. Government Initiatives for Sports Promotion

3.1.5. Growth in E-Commerce

3.2. Market Challenges

3.2.1. High Competition from International Brands

3.2.2. Fluctuations in Raw Material Prices

3.2.3. Counterfeit Sports Apparel Market

3.2.4. Supply Chain Disruptions

3.3. Opportunities

3.3.1. Expansion into Tier 2 and Tier 3 Cities

3.3.2. Technological Advancements in Fabrics

3.3.3. Increased Womens Participation in Sports

3.3.4. Sustainability and Eco-Friendly Initiatives

3.4. Trends

3.4.1. Emergence of Smart Sports Apparel

3.4.2. Customization and Personalization of Sports Apparel

3.4.3. Collaborations with Sports Celebrities and Influencers

3.4.4. Shift Towards Sustainable Fabrics

3.5. Government Regulations

3.5.1. Sportswear Industry Policy Framework

3.5.2. Textile Industry Regulations

3.5.3. Export-Import Regulations on Sports Apparel

3.5.4. GST on Sports Apparel

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. India Sports Apparel Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Activewear

4.1.2. Footwear

4.1.3. Headgear and Accessories

4.2. By End User (In Value %)

4.2.1. Men

4.2.2. Women

4.2.3. Kids

4.3. By Sports Type (In Value %)

4.3.1. Cricket

4.3.2. Football

4.3.3. Running and Gym Wear

4.3.4. Other Sports

4.4. By Distribution Channel (In Value %)

4.4.1. Online

4.4.2. Offline (Sports Retailers, Hypermarkets, Brand Outlets)

4.5. By Region (In Value %)

4.5.1. North India

4.5.2. South India

4.5.3. East India

4.5.4. West India

5. India Sports Apparel Market Competitive Analysis

5.1. Detailed Profiles of Major Competitors

5.1.1. Nike Inc.

5.1.2. Adidas AG

5.1.3. Puma SE

5.1.4. Reebok International Ltd.

5.1.5. Under Armour Inc.

5.1.6. Decathlon Group

5.1.7. ASICS Corporation

5.1.8. Skechers USA, Inc.

5.1.9. New Balance Athletics Inc.

5.1.10. FILA Holdings Corp.

5.1.11. Bata India Limited

5.1.12. HRX by Hrithik Roshan

5.1.13. Shiv-Naresh Sports Pvt Ltd.

5.1.14. Wildcraft India

5.1.15. Nivia Sports

5.2. Cross Comparison Parameters (No. of Employees, Revenue, Market Share, Headquarters, Inception Year, Distribution Network, Brand Value, Consumer Loyalty Index)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. India Sports Apparel Market Regulatory Framework

6.1. Textile and Apparel Industry Regulations

6.2. Sports and Fitness Promotion Schemes

6.3. Customs and Import Tariffs on Sports Apparel

6.4. Environmental Compliance for Sportswear Manufacturers

7. India Sports Apparel Market Analysts' Recommendations

7.1. TAM/SAM/SOM Analysis

7.2. Customer Cohort Analysis

7.3. Retail Expansion Strategy

7.4. Marketing and Branding Initiatives

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves mapping key stakeholders across the India sports apparel market. Through extensive desk research and secondary databases, critical variables such as product demand, market penetration, and emerging trends are identified, ensuring a comprehensive understanding of market dynamics.

Step 2: Market Analysis and Construction

This step involves collecting and analyzing historical data on product categories, market size, and distribution channels. The data is cross-verified using reliable government sources and company financial reports, ensuring accurate and insightful projections.

Step 3: Hypothesis Validation and Expert Consultation

Interviews with industry experts, such as product managers and supply chain professionals, provide qualitative insights that validate the initial hypotheses. These consultations also offer a perspective on operational challenges and strategic opportunities.

Step 4: Research Synthesis and Final Output

After consolidating qualitative and quantitative data, a thorough analysis is conducted to finalize the market findings. The synthesis ensures an accurate depiction of the competitive landscape, market trends, and consumer preferences, culminating in actionable insights.

Frequently Asked Questions

01. How big is the India Sports Apparel Market?

The India sports apparel market is valued at approximately USD 706 million, driven by rising health awareness, the athleisure trend, and an expanding middle class. Leading international brands dominate the market due to their established reputation.

02. What are the challenges in the India Sports Apparel Market?

Challenges include intense competition from global brands, fluctuating raw material prices, and the growing counterfeit sportswear market. Additionally, supply chain disruptions during the pandemic created operational challenges.

03. Who are the major players in the India Sports Apparel Market?

Key players in the market include Nike, Adidas, Puma, Reebok, and Decathlon. These brands dominate the market due to strong brand loyalty, extensive distribution networks, and a focus on sustainability.

04. What are the growth drivers of the India Sports Apparel Market?

The market is driven by factors such as the increasing participation in sports, rising health and fitness awareness, and the growing trend of athleisure. Furthermore, the expanding middle class and increasing disposable incomes boost market growth.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.