India Sports Nutrition Market Outlook to 2030

Region:Asia

Author(s):Paribhasha Tiwari

Product Code:KROD2263

December 2024

87

About the Report

India Sports Nutrition Market Overview

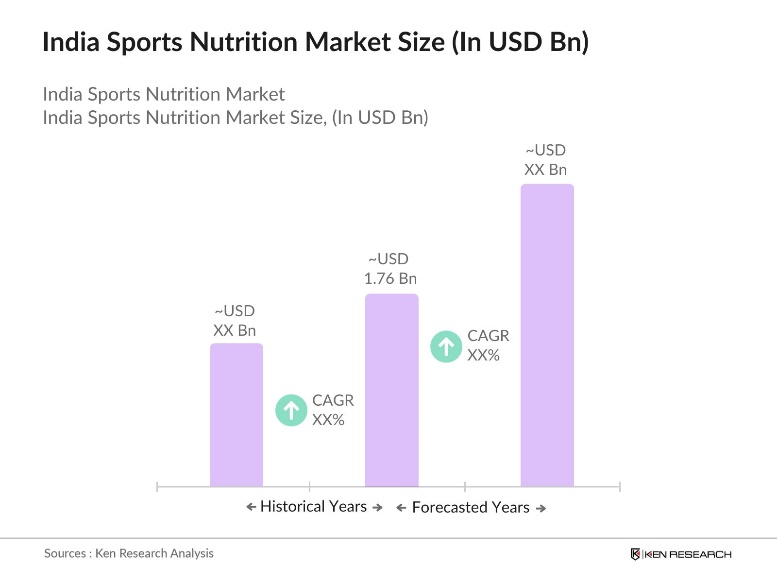

- In 2023, the India sports nutrition market reached a size of USD 1.76 Billion, driven by the rising health consciousness and fitness trends among urban consumers. This growth was significantly influenced by the surge in gym memberships, sporting activities, and increased disposable incomes. Moreover, the popularity of e-commerce has made sports nutrition products more accessible across Tier I and Tier II cities. The rising participation in fitness programs, such as marathons and sports leagues, has also contributed to this robust market expansion.

- The sports nutrition market in India is dominated by several key players, including domestic brands like MuscleBlaze and Fast&Up, as well as international giants like Optimum Nutrition, MyProtein, and GNC. These brands have established a strong presence due to their wide range of products tailored for Indian consumers. They leverage e-commerce platforms and partnerships with fitness centers to reach a broader audience, helping them maintain a significant share in this rapidly growing market.

- The Indian government's Union Budget for FY 2023-24 allocated a record INR 3,397.32 crore to the sports sector, marking the highest-ever funding increase of INR 723.97 crore from the previous year. This initiative aims to support preparations for major global events, such as the Asian Games and the 2024 Paris Olympics, and will contribute to the growth of the sports nutrition market as athletes receive greater support and funding for their nutritional needs.

- In 2023, metropolitan cities like Mumbai, Delhi, and Bengaluru dominated the sports nutrition market due to their dense population of fitness enthusiasts, athletes, and bodybuilders. These cities boast high numbers of gyms, health clubs, and sporting events, which fuel the demand for sports nutrition products. Additionally, these urban centers have a high concentration of affluent consumers willing to spend on premium sports supplements, driving the market in these regions.

India Sports Nutrition Market Segmentation

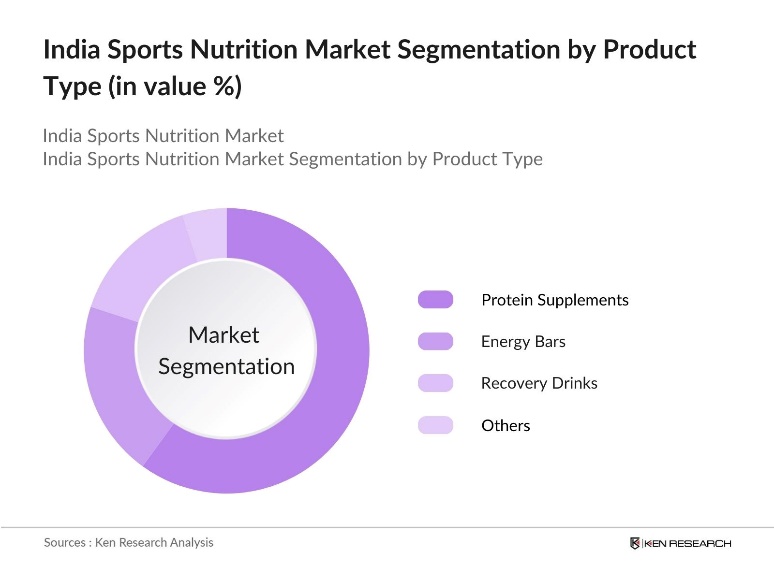

By Product Type: Indias sports nutrition market is segmented by product type into protein supplements, energy bars, and recovery drinks. In 2023, protein supplements accounted for the largest share. The dominance of this segment is due to the increasing demand from fitness enthusiasts, athletes, and bodybuilders. Brands like Optimum Nutrition and MuscleBlaze are popular in this category due to their wide range of whey protein products, which are seen as essential for muscle building and recovery post-workout.

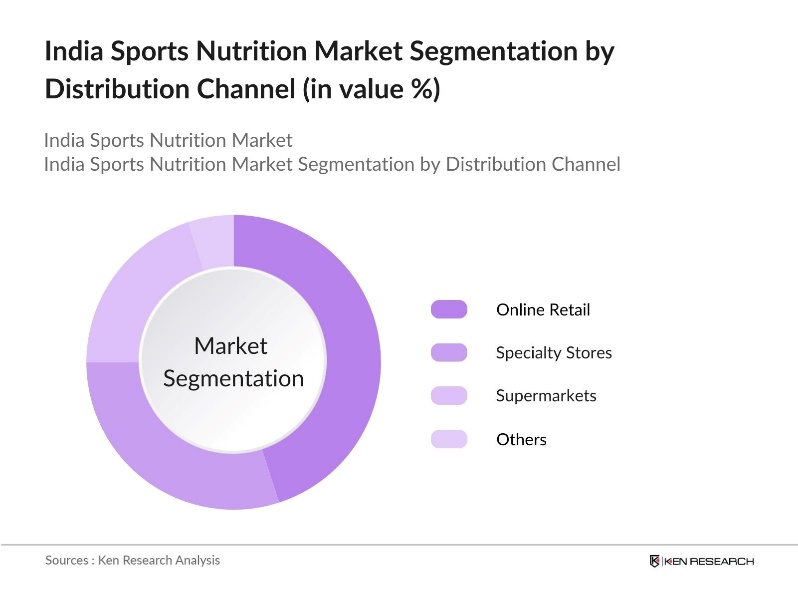

By Distribution Channel: The distribution of sports nutrition products is segmented into online retail, specialty stores, and supermarkets. Online retail dominated the market with in 2023, driven by the convenience of home delivery and attractive discounts. Platforms like Amazon and Flipkart, along with specialized online stores such as HealthKart, have made it easy for consumers to access a variety of sports nutrition products, particularly in Tier II and Tier III cities, where offline retail is limited.

By Region: The Indian sports nutrition market is divided into North, South, East, and West regions. In 2023, the North region led the market where fitness and wellness awareness is significantly high. The presence of major sports events, gyms, and fitness centers, along with a growing population of health-conscious millennials, has spurred the demand for sports nutrition products in this region.

India Sports Nutrition Market Competitive Landscape

|

Company Name |

Year of Establishment |

Headquarters |

|---|---|---|

|

MuscleBlaze |

2012 |

Gurgaon, India |

|

Optimum Nutrition |

1986 |

Chicago, USA |

|

Fast&Up |

2015 |

Mumbai, India |

|

MyProtein |

2004 |

Manchester, UK |

|

GNC |

1935 |

Pittsburgh, USA |

- MuscleBlaze: In 2023, MuscleBlaze expanded its product portfolio by introducing a new series of vegan protein supplements. Priced competitively at INR 2,200 per kilogram, the brand targeted the growing vegan consumer base in India. MuscleBlaze saw a 25% increase in annual sales due to its focus on product innovation and the growing fitness culture in India. This development reflects the brands success in capturing the demand for high-quality sports nutrition products, particularly among gym-goers and athletes.

- Optimum Nutrition: In 2021, Optimum Nutrition began manufacturing in India to meet the growing demand for sports nutrition products in the country. This local manufacturing initiative is aimed at reducing import dependency, ensuring quicker delivery times, and providing cost-effective products. The new facility supports Optimum Nutritions efforts to expand its footprint in the Indian market, particularly for products like whey protein, catering to the increasing fitness-conscious population.

India Sports Nutrition Market Analysis

Growth Drivers

- Increased Awareness of Fitness and Health in Urban Centers: The growth of the Indian sports nutrition market is fueled by increasing gym memberships and a surge in fitness awareness. With over 6 million gym-goers in India by 2023, demand for supplements has skyrocketed. This trend is driven by athletes and fitness enthusiasts seeking better performance and recovery solutions, propelling the market toward rapid expansion.

- Rising Participation of Indian Athletes in Global Sports: With over 70 medals won in international events in recent years, many athletes rely on supplements to boost their performance. The sports nutrition industry in India has been bolstered by the exceptional performances of Indian athletes at international events like the Olympics, Asian Games, and Commonwealth Games. Many athletes rely on nutritional supplements to enhance their performance, inspiring aspiring sportspeople and fitness enthusiasts to follow their regimen. This has led to a growing demand for similar supplements as individuals seek to emulate the diets and fitness routines of these successful athletes to achieve similar results in their own fitness journeys.

- Growing Popularity of E-Commerce Platforms

E-commerce has played a pivotal role in making sports nutrition products more accessible to consumers across India. These platforms offer discounts, subscription models, and easy access to a wide variety of products. The growing reach of e-commerce into smaller towns and cities has made it easier for consumers to purchase authentic products, boosting the markets growth.

Market Challenges

- High Cost of Premium Products: One of the biggest challenges facing the sports nutrition market in India is the high cost of premium products, which limits their accessibility to a wider audience. The high cost is primarily due to import duties, supply chain inefficiencies, and the lack of local production facilities. As a result, price-sensitive consumers often opt for cheaper, low-quality alternatives, impacting the growth of the premium segment.

- Lack of Regulatory Oversight: Another challenge in the Indian sports nutrition market is the lack of stringent regulatory oversight. The Food Safety and Standards Authority of India (FSSAI) has set guidelines for dietary supplements, but many counterfeit products still enter the market. This has eroded consumer trust, especially among those concerned about the safety and authenticity of products.

Government Initiative

- Fit India Movement and Khelo India Scheme: The government's initiatives, such as the Fit India and Khelo India campaigns, have raised awareness about the importance of fitness in daily life and contributed to the revival of the sports culture in India. These campaigns, alongside increased investments in sports infrastructure over the past few years, have played a significant role in promoting active lifestyles and fostering the growth of the sports nutrition market.

- Increasing Fund for sports: The Indian government has expanded opportunities for athletes by supporting professional sports leagues, providing a platform for emerging talent. Additionally, various civil society organizations are stepping up to fund athletes and strengthen Indias position as a sporting powerhouse. These efforts align with the growing sports culture in the country, making it an opportune time to invest in the sports nutrition market.

India Sports Nutrition Market Future Outlook

Market Trends

- Increasing Focus on Functional Foods and Nutritional Beverages: By 2028, the Indian sports nutrition market will see a strong shift towards functional foods and nutritional beverages. As consumers become more aware of the benefits of all-in-one solutions, products like protein-rich energy drinks and meal replacement shakes will dominate the market. Brands are expected to innovate and introduce more such products, appealing to time-pressed urban consumers who seek convenience without compromising on nutrition.

- Growth in Demand for Personalized Nutrition Solutions: Over the next five years, the demand for personalized nutrition solutions will rise significantly. With the advancement of AI and machine learning, sports nutrition brands will increasingly offer tailored nutrition plans and supplements based on genetic profiling and lifestyle choices.

Scope of the Report

|

By Product Type |

Protein Supplements Energy Bars Recovery Drinks |

|

By Distribution Channel |

Online Retail Specialty Stores Supermarkets |

|

By Region |

North South East West |

|

By End-User |

Professional Athletes Fitness Enthusiasts Bodybuilders |

|

By Ingredient |

Animal-Based Ingredients Plant-Based Ingredients Additives |

Products

Key Target Audience

Health and fitness clubs

Fitness trainers and influencers

Gym chains and fitness centers

Hospitals and healthcare providers

Supplements and nutrition stores

E-commerce platforms

Government and regulatory bodies (Ministry of Youth Affairs and Sports)

Investments and venture capitalist firms

Companies

Players Mentioned in the Report:

MuscleBlaze

Optimum Nutrition

Fast&Up

MyProtein

GNC

HealthKart

Ultimate Nutrition

BigMuscles Nutrition

Labrada Nutrition

Scitec Nutrition

Proburst

Herbalife

Universal Nutrition

Naturyz

Ronnie Coleman

Table of Contents

1. India Sports Nutrition Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate (Y-o-Y)

1.4. Market Segmentation Overview

2. India Sports Nutrition Market Size (USD Mn)

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. India Sports Nutrition Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Fitness and Health Awareness

3.1.2. Growing Participation of Indian Athletes

3.1.3. Expansion of E-commerce Platforms

3.2. Market Challenges

3.2.1. High Cost of Premium Products

3.2.2. Lack of Regulatory Oversight

3.2.3. Limited Awareness in Rural Areas

3.3. Opportunities

3.3.1. Rise of Plant-Based Proteins

3.3.2. Untapped Potential in Tier II and III Cities

3.3.3. Collaborations with Fitness Influencers

3.4. Trends

3.4.1. Clean-Label Products

3.4.2. Personalized Nutrition Plans

3.4.3. Social Media Marketing

3.5. Government Regulation

3.5.1. FSSAI Guidelines

3.5.2. Import Regulations

3.5.3. Compliance Requirements

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Competition Ecosystem

4. India Sports Nutrition Market Segmentation

4.1. By Product Type (in value %)

4.1.1. Protein Supplements

4.1.2. Energy Bars

4.1.3. Recovery Drinks

4.2. By Distribution Channel (in value %)

4.2.1. Online Retail

4.2.2. Specialty Stores

4.2.3. Supermarkets

4.3. By End-User (in value %)

4.3.1. Professional Athletes

4.3.2. Fitness Enthusiasts

4.3.3. Bodybuilders

4.4. By Ingredient (in value %)

4.4.1. Animal-Based Ingredients

4.4.2. Plant-Based Ingredients

4.4.3. Additives

4.5. By Region (in value %)

4.5.1. North India

4.5.2. South India

4.5.3. West India

4.5.4. East India

5. India Sports Nutrition Market Cross Comparison

5.1. Detailed Profiles of Major Companies

5.1.1. MuscleBlaze

5.1.2. Optimum Nutrition

5.1.3. Fast&Up

5.1.4. GNC

5.1.5. MyProtein

5.1.6. HealthKart

5.1.7. BigMuscles Nutrition

5.1.8. Ultimate Nutrition

5.1.9. Labrada Nutrition

5.1.10. Scitec Nutrition

5.1.11. Proburst

5.1.12. Herbalife

5.1.13. Universal Nutrition

5.1.14. Naturyz

5.1.15. Ronnie Coleman Signature Series

5.2. Cross-Comparison Parameters

5.2.1. No. of Employees

5.2.2. Headquarters

5.2.3. Inception Year

5.2.4. Revenue

6. India Sports Nutrition Market Competitive Landscape

6.1. Market Share Analysis

6.2. Strategic Initiatives

6.3. Mergers and Acquisitions

6.4. Investment Analysis

6.4.1. Venture Capital Funding

6.4.2. Government Grants

6.4.3. Private Equity Investments

7. India Sports Nutrition Market Regulatory Framework

7.1. Government Regulations

7.2. Compliance Requirements

7.3. Tax and Import Duty Regulations

8. India Sports Nutrition Future Market Projections

8.1. Future Market Size Projections

8.2. Key Factors Driving Future Market Growth

9. India Sports Nutrition Future Market Segmentation

9.1. By Product Type (in value %)

9.2. By Distribution Channel (in value %)

9.3. By End-User (in value %)

9.4. By Region (in value %)

10. India Sports Nutrition Market Analysts Recommendations

10.1. TAM/SAM/SOM Analysis

10.2. Customer Cohort Analysis

10.3. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial phase focuses on mapping key stakeholders and identifying influential variables within the India Sports Nutrition Market. This step utilizes desk research, drawing from proprietary and secondary databases to establish a comprehensive understanding of market dynamics.

Step 2: Market Analysis and Construction

This phase involves compiling and analyzing historical data on the India Sports Nutrition Market, including assessing the health and nutrition requirement of athletes. Additionally, service quality metrics are reviewed to ensure reliable revenue estimations.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses are developed and validated through industry expert interviews, which provide insights into operational and technological trends. These consultations reinforce market data accuracy and align findings with real-world applications.

Step 4: Research Synthesis and Final Output

The concluding phase engages directly with industry stakeholders to verify and supplement bottom-up data, ensuring a validated, comprehensive analysis of the India Sports Nutrition Market. This step synthesizes data from all phases, resulting in a precise market report.

Frequently Asked Questions

1. How big is the India sports nutrition market?

The India sports nutrition market was valued at USD 1.76 Billion in 2023, driven by the rising fitness culture, increasing participation in sports, and a growing consumer base focused on health and wellness.

2. What are the challenges in the India sports nutrition market?

Challenges in the India sports nutrition market include high prices of premium products, the presence of counterfeit supplements, and limited awareness of sports nutrition products in rural areas, which restrict market growth.

3. Who are the major players in the India sports nutrition market?

Key players in the India sports nutrition market include MuscleBlaze, Optimum Nutrition, GNC, Fast&Up, and MyProtein. These brands dominate due to their wide product range, strong e-commerce presence, and partnerships with gyms and fitness influencers.

4. What are the growth drivers of the India sports nutrition market?

The growth of the India sports nutrition market is driven by the rise in fitness awareness, increased participation in professional sports, and the growing trend of online retail, which has made sports supplements more accessible to consumers nationwide.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.