India Staffing and Recruiting Market Outlook to 2030

Region:Asia

Author(s):Shreya Garg

Product Code:KROD10562

December 2024

99

About the Report

India Staffing and Recruiting Market Overview

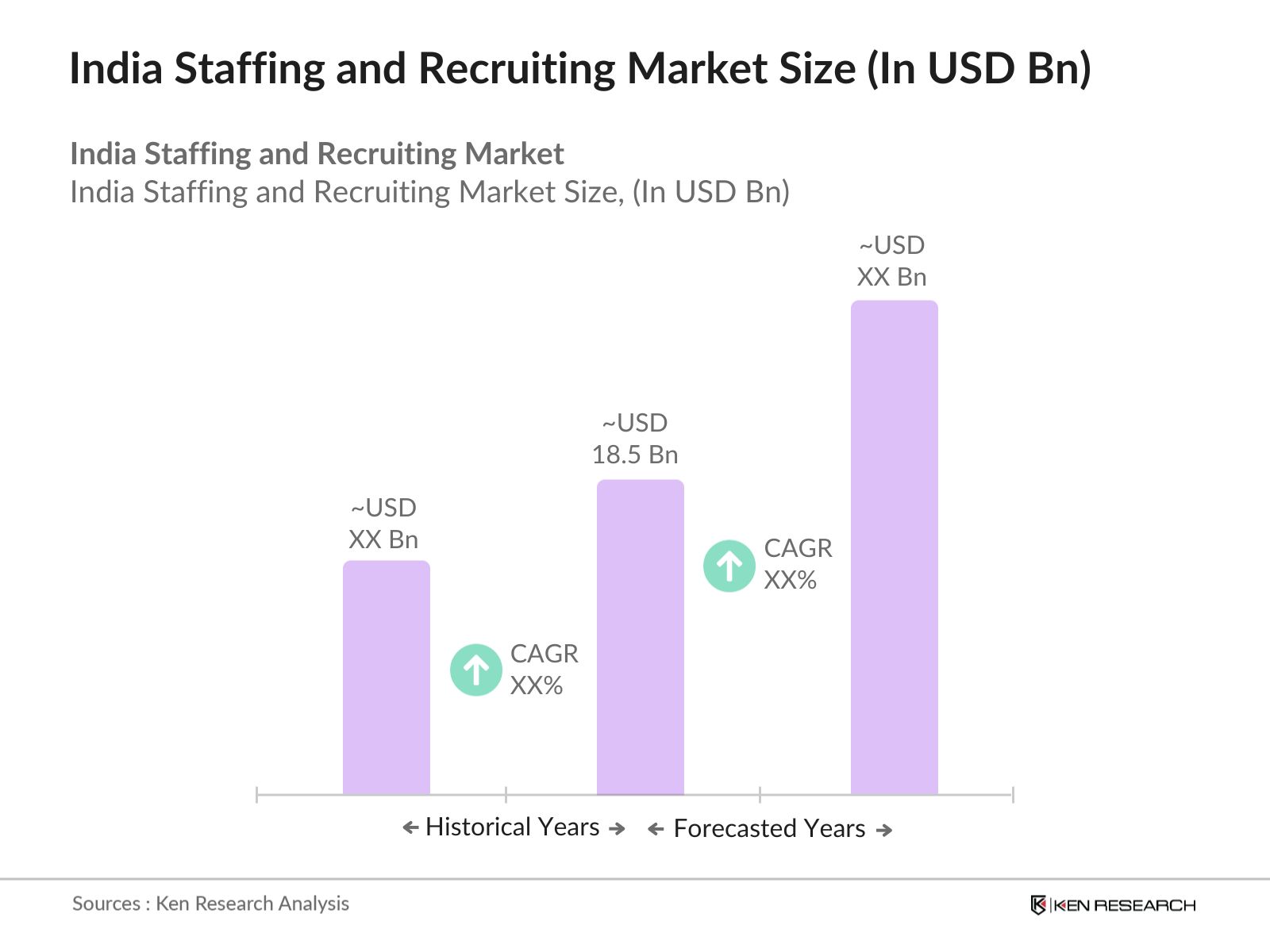

- The India Staffing and Recruiting market is valued at USD 18.5 Billion, based on a five-year historical analysis. This growth is driven by the increasing demand for flexible staffing solutions across various industries, including IT, manufacturing, and BFSI. The market's expansion is supported by the rise in digital recruitment technologies and a growing preference for temporary staffing due to evolving business needs and project-based requirements, making it a pivotal component of Indias workforce management ecosystem.

- Indias leading cities in staffing and recruitment include Bangalore, Mumbai, and Delhi-NCR. These cities dominate the market due to their concentration of IT and ITES companies, robust industrial bases, and financial institutions. Bangalore's strong presence in the tech industry and start-up ecosystem makes it a hub for IT recruitment, while Mumbai's role as a financial capital drives demand for staffing in BFSI and manufacturing sectors. Delhi-NCR serves as a focal point for government and multinational recruitment, owing to its strategic location and business infrastructure.

- The implementation of India's new Wage Code has had a significant impact on the staffing industry, mandating revised salary structures and benefits. In 2023, the Ministry of Labour and Employment reported over 50 million workers under the new wage norms, affecting payroll management and statutory compliance for staffing agencies. The Wage Code aims to standardize definitions and ensure minimum wages across all sectors, making it crucial for recruitment firms to adapt their processes. This regulatory shift ensures fair compensation practices, which can aid in talent attraction and retention for businesses.

India Staffing and Recruiting Market Segmentation

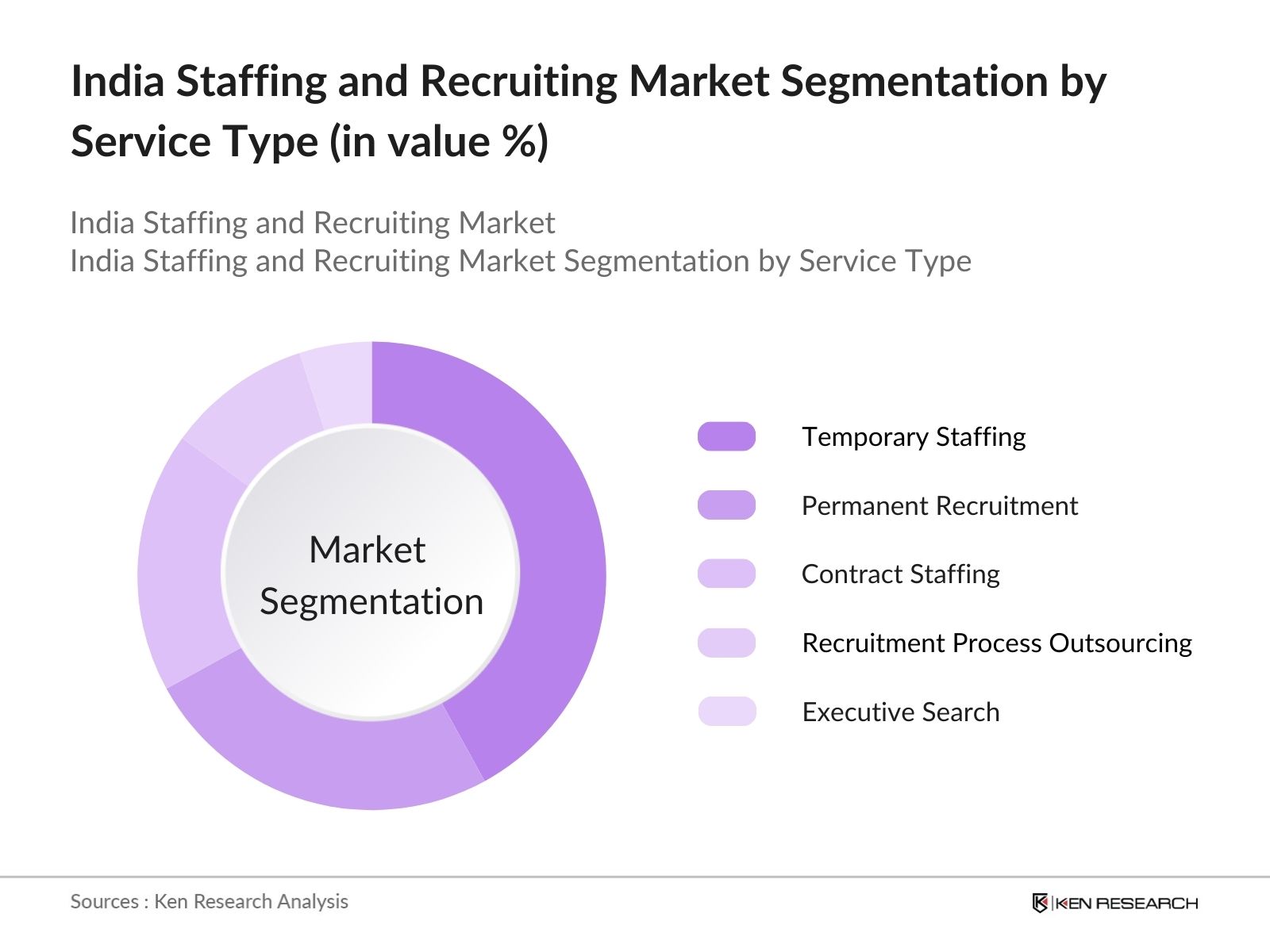

By Service Type: The India Staffing and Recruiting market is segmented by service type into temporary staffing, permanent recruitment, contract staffing, recruitment process outsourcing (RPO), and executive search. Recently, temporary staffing has a dominant market share in India under the service type segmentation. This is attributed to the growing preference of companies for flexible staffing models that help manage workforce needs without long-term commitments. The temporary staffing model provides cost efficiency and flexibility, especially in sectors like IT and manufacturing where project-based work is prevalent.

By Industry Vertical: The market is also segmented by industry vertical into IT & ITES, BFSI, manufacturing, healthcare, and retail & e-commerce. IT & ITES holds a dominant share within this segmentation, primarily because of the high demand for specialized technical skills, including software development, data analytics, and IT infrastructure management. The rapid growth of India's digital economy and increasing investments in cloud computing and cybersecurity have further bolstered recruitment in this sector, driving continuous demand for skilled IT professionals.

India Staffing and Recruiting Market Competitive Landscape

The India Staffing and Recruiting market is dominated by key players, including both local giants and multinational corporations. Companies like TeamLease Services and Randstad India hold significant influence due to their extensive network and robust technological integration. The presence of strong regional players in key cities adds to the competitive nature of the market.

|

Company |

Establishment Year |

Headquarters |

Revenue (INR Cr) |

Geographic Reach |

Technology Integration |

Service Diversification |

Client Retention Rate |

Market Focus |

Employee Strength |

|

TeamLease Services Ltd. |

2002 |

Bangalore, India |

|||||||

|

Randstad India |

1992 |

Chennai, India |

|||||||

|

Quess Corp Ltd. |

2007 |

Bangalore, India |

|||||||

|

Adecco India |

1996 |

Bangalore, India |

|||||||

|

ManpowerGroup India |

1997 |

Gurgaon, India |

India Staffing and Recruiting Industry Analysis

Growth Drivers

- Rise in Contractual Workforce: The demand for contractual and project-based hiring in India has increased significantly, driven by businesses adapting to changing market conditions. According to the Ministry of Labour and Employment, India had around 100 million contractual workers in 2023, showing a growing preference for flexible work arrangements. This trend is particularly evident in industries like manufacturing and IT services, where project-specific hiring helps manage workload fluctuations. Contract durations often range from 3 to 12 months, offering companies the agility to scale workforce quickly. The flexibility in hiring also aligns with India's focus on boosting job creation through MSME sector growth.

- Digital Transformation in Recruitment Processes: Digital transformation has become pivotal in India's staffing market, with over 70,000 businesses adopting Applicant Tracking Systems (ATS) by 2023, according to NASSCOM data. This adoption streamlines recruitment by automating CV parsing and scheduling interviews, reducing the time to hire by 30% on average. The surge in virtual interview platforms, especially during remote work conditions, supports more than 50 million interviews annually, providing seamless hiring experiences across geographical boundaries. This shift not only improves the efficiency of recruitment but also aligns with India's growing digital economy, which is expected to reach INR 10 trillion in revenue by 2025.

- Increased Demand for Skilled Professionals: Indias demand for skilled professionals has been rising, driven by the digital economy's rapid growth. A report by the National Skill Development Corporation (NSDC) highlighted that India faced a skill gap of 35 million in sectors like IT, healthcare, and data analytics in 2023. This gap presents opportunities for recruitment firms specializing in sourcing professionals with emerging skill sets such as cloud computing, AI, and cybersecurity. Companies are actively seeking to fill roles that align with industry 4.0 requirements, driving staffing firms to focus on specialized recruitment.

Market Challenges

- High Attrition Rates: High attrition rates have been a challenge for India's staffing industry, particularly in sectors like IT and BPO, where turnover ratios often exceed 25 per 100 employees annually. According to the Ministry of Labour and Employment, approximately 10 million workers switched jobs in 2023, highlighting retention issues across industries. Staffing firms are thus required to implement effective retention strategies, such as offering competitive employee benefits and continuous skill development programs, to mitigate attrition and maintain a stable workforce.

- Competition from Freelance Platforms: The rise of freelance platforms has intensified competition for traditional staffing firms in India. Data from the Ministry of Electronics and IT indicates that over 15 million freelancers were active on various digital platforms in 2023, providing employers with access to a vast pool of independent talent. This shift toward gig work has been prominent in fields such as software development, content creation, and digital marketing, where freelancers offer cost-effective solutions for short-term projects. As a result, staffing firms need to offer value-added services to retain clients and remain competitive.

India Staffing and Recruiting Market Future Outlook

Over the next five years, the India Staffing and Recruiting market is expected to demonstrate substantial growth, driven by the rising demand for flexible staffing models and the increasing adoption of digital recruitment technologies. The shift towards remote work and hybrid work models will continue to influence recruitment dynamics, while investments in automation and AI-based recruitment solutions are likely to streamline hiring processes further. Additionally, government initiatives focusing on skill development and employment generation will play a crucial role in sustaining market growth.

Future Market Opportunities

- Expansion into Tier-2 and Tier-3 Cities: The expansion of businesses into Tier-2 and Tier-3 cities is driving growth in regional staffing markets. As per data from the Reserve Bank of India, non-metro cities accounted for over 40% of new job postings in 2023. Companies are increasingly adopting localization strategies to tap into the talent pools of cities like Coimbatore, Indore, and Bhubaneswar, where the cost of living is lower, and employee retention rates are higher. This trend offers staffing firms an opportunity to expand their reach, catering to the demand for skilled professionals beyond traditional metropolitan areas.

- Recruitment Process Outsourcing: Recruitment Process Outsourcing (RPO) is gaining traction in India, as businesses look for efficient ways to streamline their hiring processes. In 2023, RPO engagements contributed to over 10% of recruitment activities in sectors like IT, healthcare, and manufacturing, according to NITI Aayog. This model allows companies to leverage expertise in sourcing, screening, and onboarding talent, often involving offshore hiring solutions. RPO is particularly attractive to multinational corporations expanding their footprint in India, creating a lucrative avenue for staffing agencies to offer comprehensive recruitment solutions.

Scope of the Report

|

Service Type |

Temporary Staffing Permanent Recruitment Contract Staffing RPO Executive Search |

|

Industry Vertical |

IT & ITES BFSI Manufacturing Healthcare Retail & E-commerce |

|

Application |

Blue-Collar Workforce White-Collar Workforce Managerial and Executive Roles |

|

Recruitment Method |

Traditional Agency Hiring Online Job Portals Campus Recruitment Internal Referrals Freelance Platforms |

|

Region |

North South West East |

Products

Key Target Audience

Large Enterprises (IT, BFSI, Manufacturing)

Small and Medium Enterprises (SMEs)

Government and Regulatory Bodies (Ministry of Labor and Employment)

Human Resource Directors and Managers

Talent Acquisition Teams

Recruitment Process Outsourcing (RPO) Providers

Investor and Venture Capitalist Firms

Start-ups and Emerging Businesses

Companies

Major Players

TeamLease Services Ltd.

Randstad India

Quess Corp Ltd.

Adecco India

ManpowerGroup India

Kelly Services India

CIEL HR Services

ABC Consultants

Innovsource

Michael Page India

Genius Consultants Ltd.

Ikya Human Capital Solutions

GlobalHunt India

Monster.com India

Naukri.com

Table of Contents

1. India Staffing and Recruiting Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy (Staffing Models, Recruitment Solutions, Industry Focus)

1.3. Market Growth Rate (Placement Ratios, Billing Cycles)

1.4. Market Segmentation Overview (By Type, By Application, By End-User)

2. India Staffing and Recruiting Market Size (In INR Cr)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. India Staffing and Recruiting Market Analysis

3.1. Growth Drivers

3.1.1. Rise in Contractual Workforce (Contract Duration, Project-Based Hiring)

3.1.2. Digital Transformation in Recruitment Processes (ATS Adoption, Virtual Interview Platforms)

3.1.3. Government Policies and Employment Schemes (MSME Schemes, National Apprenticeship Programs)

3.1.4. Increased Demand for Skilled Professionals (Skill Gap Analysis, Emerging Skillsets)

3.2. Market Challenges

3.2.1. High Attrition Rates (Turnover Ratios, Retention Strategies)

3.2.2. Compliance with Labor Laws (Labor Code Adaptation, EPFO Regulations)

3.2.3. Competition from Freelance Platforms (Freelancer Market Penetration)

3.3. Opportunities

3.3.1. Growth in IT and ITES Recruitment (IT Services, Data Analytics Roles)

3.3.2. Expansion into Tier-2 and Tier-3 Cities (Regional Job Growth, Localization Strategies)

3.3.3. Recruitment Process Outsourcing (RPO Models, Offshore Hiring)

3.4. Trends

3.4.1. AI-Based Screening Tools (AI Integration in HR, Automation in CV Parsing)

3.4.2. Rise of Remote Work Models (Hybrid Recruitment, Virtual Onboarding)

3.4.3. Focus on Diversity and Inclusion (D&I Hiring Policies, Equal Opportunity Metrics)

3.5. Government Regulation

3.5.1. New Wage Code Implementation

3.5.2. Employment Schemes for Youth (Skill India, Pradhan Mantri Kaushal Vikas Yojana)

3.5.3. Tax Incentives for Employment Generation (Income Tax Benefits, Startup India)

3.5.4. Labor Market Digitalization Initiatives

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competition Ecosystem

4. India Staffing and Recruiting Market Segmentation

4.1. By Service Type (In Value %)

4.1.1. Temporary Staffing

4.1.2. Permanent Recruitment

4.1.3. Contract Staffing

4.1.4. Recruitment Process Outsourcing (RPO)

4.1.5. Executive Search

4.2. By Industry Vertical (In Value %)

4.2.1. IT & ITES

4.2.2. BFSI (Banking, Financial Services, and Insurance)

4.2.3. Manufacturing

4.2.4. Healthcare

4.2.5. Retail & E-commerce

4.3. By Application (In Value %)

4.3.1. Blue-Collar Workforce

4.3.2. White-Collar Workforce

4.3.3. Managerial and Executive Roles

4.4. By Recruitment Method (In Value %)

4.4.1. Traditional Agency Hiring

4.4.2. Online Job Portals

4.4.3. Campus Recruitment

4.4.4. Internal Referrals

4.4.5. Freelance Platforms

4.5. By Region (In Value %)

4.5.1. North India

4.5.2. South India

4.5.3. West India

4.5.4. East India

5. India Staffing and Recruiting Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. TeamLease Services Ltd.

5.1.2. Quess Corp Ltd.

5.1.3. Randstad India

5.1.4. Adecco India

5.1.5. ManpowerGroup India

5.1.6. Kelly Services India

5.1.7. CIEL HR Services

5.1.8. ABC Consultants

5.1.9. Innovsource

5.1.10. Michael Page India

5.1.11. Genius Consultants Ltd.

5.1.12. Ikya Human Capital Solutions

5.1.13. GlobalHunt India

5.1.14. Monster.com India

5.1.15. Naukri.com

5.2. Cross Comparison Parameters (Revenue, Placement Success Rate, Geographic Presence, Industry Focus, Client Retention Rate, Technology Integration, Service Diversification, Workforce Size)

5.3. Market Share Analysis

5.4. Strategic Initiatives (Mergers, Acquisitions, Partnerships)

5.5. Investment Analysis (Venture Capital, Private Equity)

5.6. Service Innovation and New Product Launches

5.7. Company SWOT Analysis

5.8. Strategic Focus and Growth Strategies

6. India Staffing and Recruiting Market Regulatory Framework

6.1. Labor Law Compliance (Minimum Wages Act, Contract Labor Act)

6.2. Regulatory Bodies and Licensing (Ministry of Labor and Employment, Staffing Industry Compliance)

6.3. Certification Processes (ISO Certification, NASSCOM Membership)

6.4. Policies Affecting Recruitment Agencies (GST Impact, Income Tax Benefits)

7. India Staffing and Recruiting Future Market Size (In INR Cr)

7.1. Market Size Projections

7.2. Key Factors Influencing Future Growth

7.3. Impact of Emerging Technologies on Market Dynamics

8. India Staffing and Recruiting Market Analysts Recommendations

8.1. Market Entry Strategies

8.2. Talent Acquisition Strategies

8.3. Value Proposition Enhancement

8.4. Strategic Partnerships and Alliances

8.5. Expansion into High-Growth Sectors

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the India Staffing and Recruiting Market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we will compile and analyze historical data pertaining to the India Staffing and Recruiting Market. This includes assessing market penetration, the ratio of recruitment firms to service providers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics will be conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations will provide valuable operational and financial insights directly from industry practitioners, which will be instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple recruitment agencies to acquire detailed insights into service segments, sales performance, client preferences, and other pertinent factors. This interaction will serve to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the India Staffing and Recruiting Market.

Frequently Asked Questions

01. How big is the India Staffing and Recruiting Market?

The India Staffing and Recruiting market is valued at USD 18.5 Billion, driven by the rising demand for flexible staffing solutions across diverse sectors like IT, BFSI, and manufacturing.

02. What are the challenges in the India Staffing and Recruiting Market?

Challenges in the India Staffing and Recruiting market include high attrition rates, adapting to new labor laws, and the growing competition from freelance platforms. The market also faces difficulties in meeting compliance requirements for staffing and labor regulations.

03. Who are the major players in the India Staffing and Recruiting Market?

Key players in the India Staffing and Recruiting market include TeamLease Services, Randstad India, Quess Corp Ltd., Adecco India, and ManpowerGroup India. These companies hold a significant presence due to their extensive networks and technological integration.

04. What are the growth drivers of the India Staffing and Recruiting Market?

Growth in the India Staffing and Recruiting market is propelled by the increasing adoption of digital recruitment solutions, the rise in contractual staffing needs, and government initiatives aimed at skill development and employment generation.

05. What are the key industry verticals in the India Staffing and Recruiting Market?

The primary industry verticals include IT & ITES, BFSI, manufacturing, healthcare, and retail & e-commerce, with IT & ITES being the largest segment due to the high demand for tech talent in the India Staffing and Recruiting market.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.