India Staffing and Recruitment Market Outlook to 2030

Region:Asia

Author(s):Sanjeev

Product Code:KROD4040

November 2024

98

About the Report

India Staffing and Recruitment Market Overview

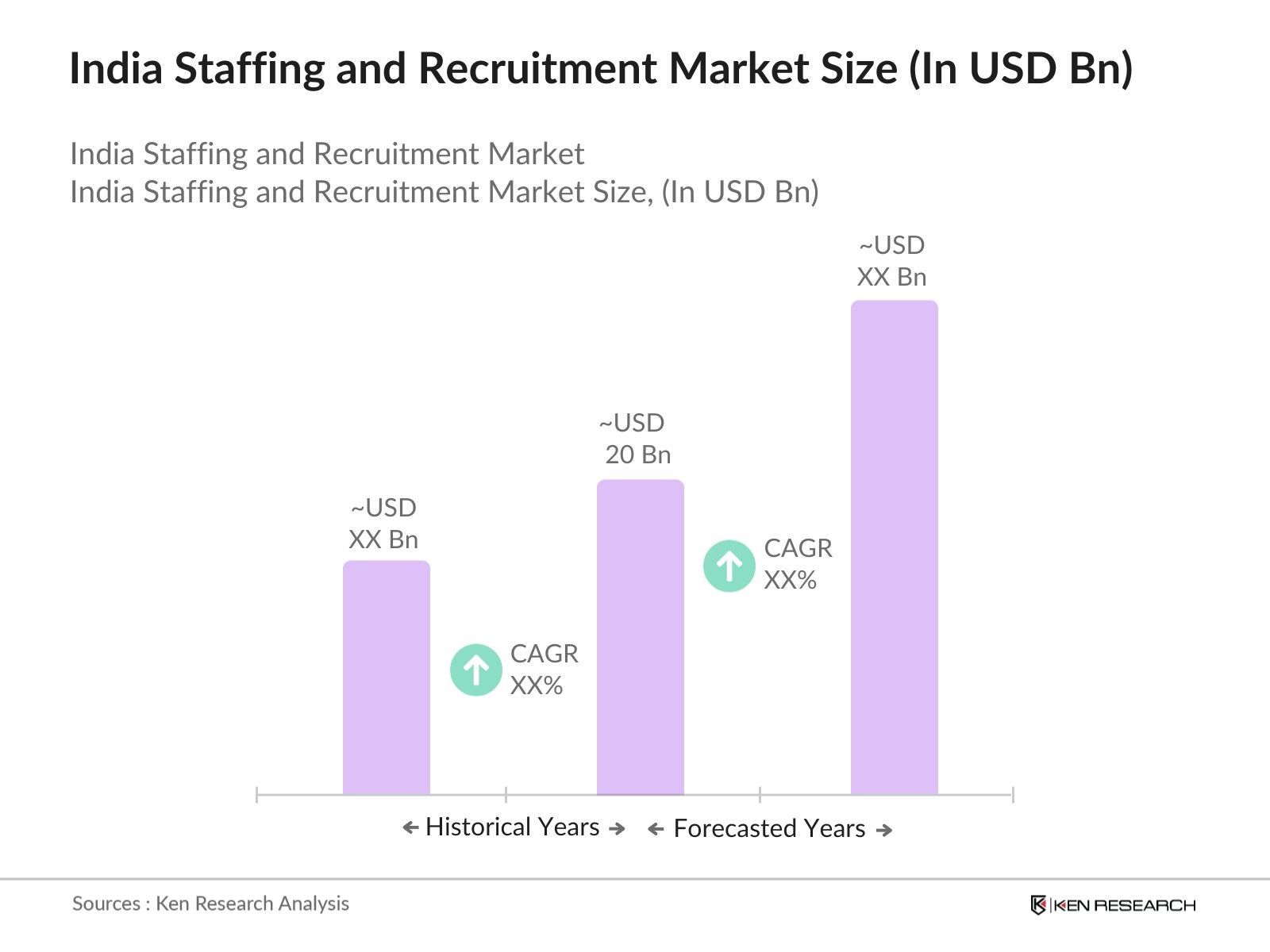

- The India staffing and recruitment market has experienced significant growth, reaching a valuation of USD 20 billion. This expansion is primarily driven by the country's robust economic development, a burgeoning youth population, and the increasing demand for skilled professionals across various sectors. The rise of industries such as Information Technology (IT), Banking, Financial Services, and Insurance (BFSI), and healthcare has further fueled the need for efficient staffing solutions to meet the evolving workforce requirements.

- Major metropolitan cities like Mumbai, Delhi, Bengaluru, and Hyderabad dominate the staffing and recruitment landscape in India. These urban centers serve as hubs for numerous multinational corporations, startups, and large domestic enterprises, leading to a higher concentration of job opportunities. The presence of diverse industries and a skilled talent pool in these cities contributes to their prominence in the staffing market.

- India has streamlined its labor laws, consolidating 29 central labor statutes into four labor codes: Wages, Industrial Relations, Occupational Safety, and Social Security. These reforms aim to simplify compliance for businesses and improve worker welfare. As of 2024, over 70 million workers have been registered on the e-Shram portal, an initiative to ensure social security for unorganized sector workers. This regulatory overhaul is expected to make hiring more flexible for employers while safeguarding workers rights.

India Staffing and Recruitment Market Segmentation

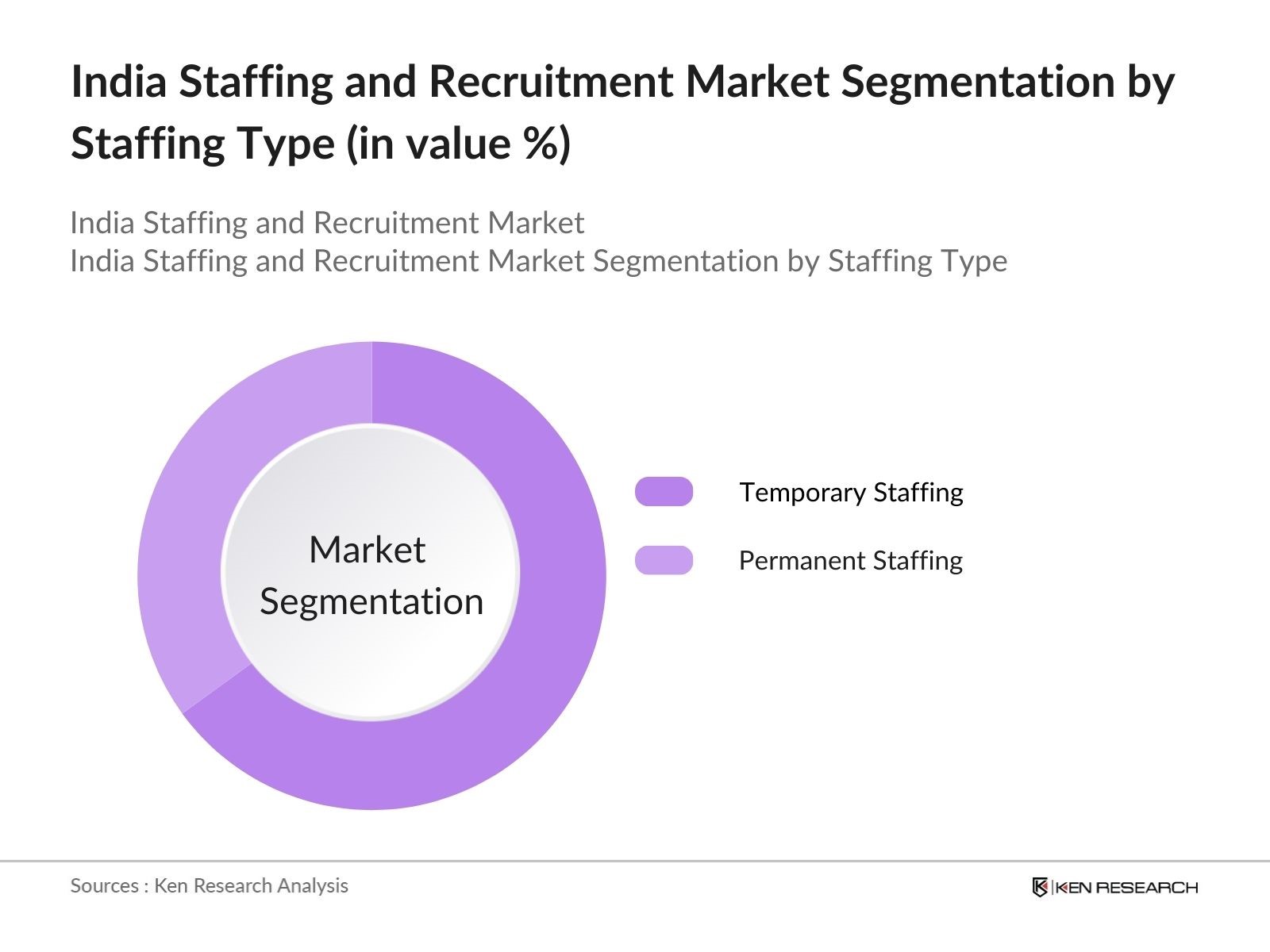

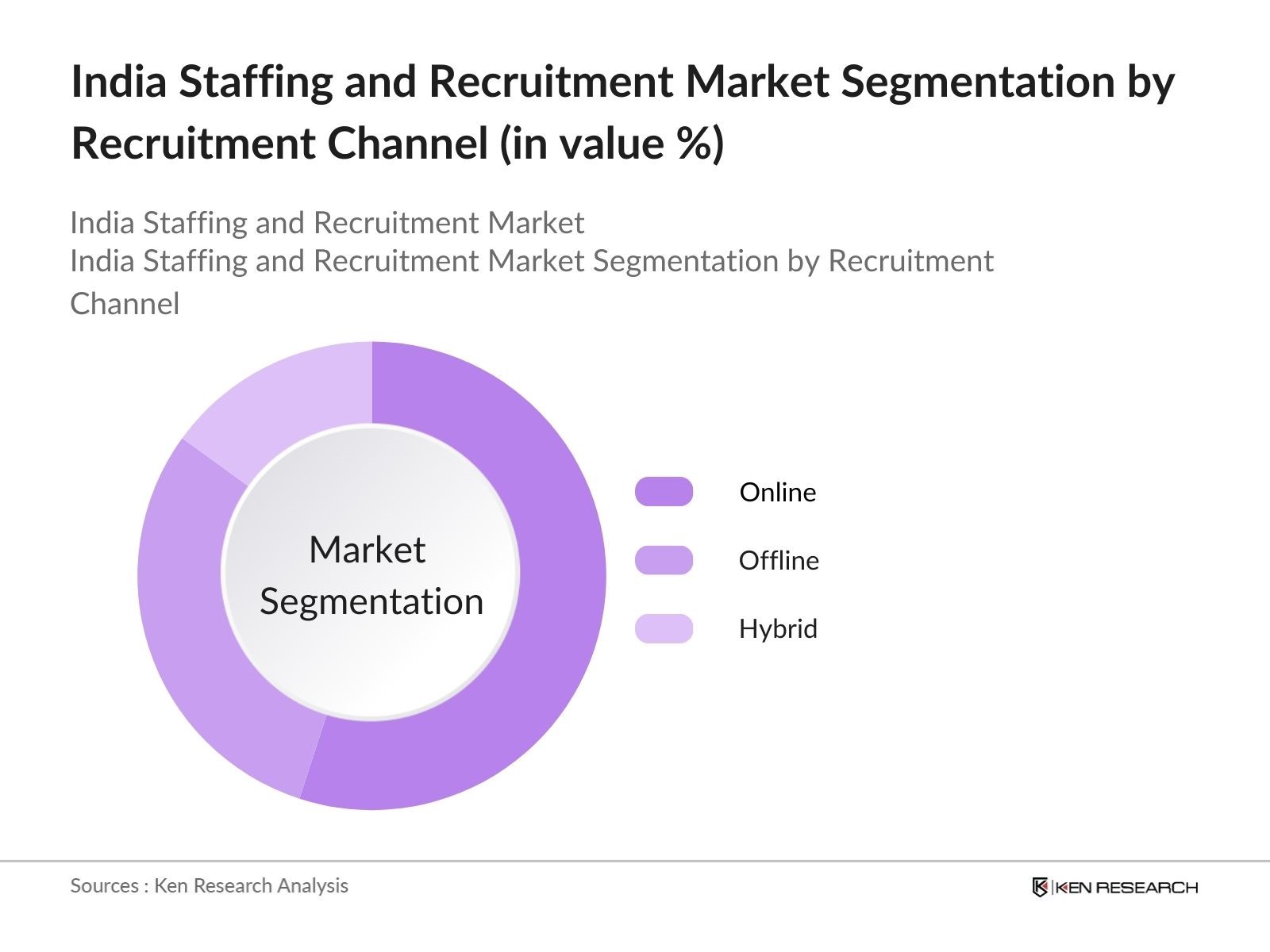

The Indian staffing market is segmented by staffing type and by recruitment channel.

By Staffing Type: The Indian staffing market is segmented into temporary and permanent staffing. Temporary staffing holds a dominant position due to its flexibility and cost-effectiveness, allowing companies to manage workforce needs efficiently without long-term commitments.

By Recruitment Channel: Recruitment channels are categorized into online, offline, and hybrid methods. Online recruitment has gained prominence with the proliferation of digital platforms, offering a wider reach and streamlined processes for both employers and job seekers.

India Staffing and Recruitment Market Competitive Landscape

The Indian staffing and recruitment market is characterized by the presence of both domestic and international players, contributing to a competitive environment. Key companies include:

India Staffing and Recruitment Market Analysis

Growth Drivers

- Economic Expansion: India's economy has demonstrated robust growth, with the World Bank reporting a GDP of $3.5 trillion in 2023, positioning it as the world's fifth-largest economy. This expansion is underpinned by strong domestic demand and significant public infrastructure investments. The World Bank projects India's GDP to reach $3.7 trillion in 2024, reflecting sustained economic momentum.

- Technological Advancements: The Indian technology sector has seen substantial growth, with the IT industry generating revenues of $227 billion in 2023. The government's Digital India initiative has facilitated the proliferation of internet users, reaching 900 million in 2023, thereby enhancing digital literacy and e-governance. The adoption of emerging technologies like artificial intelligence and blockchain is further propelling innovation across various sectors.

- Government Initiatives: The Indian government has implemented several initiatives to stimulate economic growth and employment. The Make in India campaign has attracted $50 billion in foreign direct investment in 2023, boosting manufacturing capabilities. Additionally, the Skill India program has trained over 10 million individuals in 2023, enhancing workforce competencies. These initiatives aim to create a conducive environment for business and employment generation.

Market Challenges

- Talent Shortages: Despite a large labor force, India faces a shortage of skilled professionals in sectors like information technology and healthcare. The unemployment rate in urban areas for individuals aged 15 years and above was 6.7% during January March 2024, indicating a mismatch between available jobs and skilled candidates. This gap underscores the need for targeted skill development programs.

- Regulatory Compliance: Navigating India's complex regulatory environment poses challenges for businesses. The World Bank's Ease of Doing Business report ranked India 63rd in 2023, highlighting areas for improvement in regulatory frameworks. Compliance with labor laws, taxation policies, and environmental regulations requires significant resources, potentially hindering business operations.

India Staffing and Recruitment Market Future Outlook

Over the next five years, the Indian staffing and recruitment market is poised for substantial growth, driven by continuous economic expansion, technological advancements, and evolving workforce dynamics. The increasing adoption of digital recruitment platforms and the rise of the gig economy are expected to reshape traditional staffing models. Additionally, government initiatives aimed at skill development and employment generation will further bolster market growth.

Market Opportunities

- Digital Transformation: The surge in internet users, reaching 900 million in 2023, presents significant opportunities for digital businesses. E-commerce platforms have experienced a 25% increase in transactions, and digital payment volumes have surpassed 70 billion transactions in 2023. Businesses can leverage this digital shift to expand their reach and enhance customer engagement.

- Sectoral Diversification: India's economy is diversifying, with sectors like renewable energy and pharmaceuticals witnessing growth. The renewable energy sector added 15 GW of capacity in 2023, and pharmaceutical exports reached $25 billion. Investing in these emerging sectors offers avenues for growth and resilience against sector-specific downturns.

Scope of the Report

|

By Staffing Type

|

Temporary Staffing |

|

By Recruitment Channel |

Online Recruitment |

|

By End User Industry

|

Information Technology (IT) and Telecom |

|

By Company Size

|

Small and Medium Enterprises (SMEs) |

|

By Region |

North East West South |

Products

Key Target Audience

Human Resource Departments of Corporations

Recruitment Agencies

Staffing Service Providers

Government and Regulatory Bodies (e.g., Ministry of Labor and Employment)

Industry Associations (e.g., Indian Staffing Federation)

Training and Skill Development Institutes

Technology Providers for Recruitment Solutions

Investment and Venture Capitalist Firms

Companies

Players Mention in the Report:

Quess Corp Limited

TeamLease Services Limited

Randstad India

Adecco India

ManpowerGroup India

ABC Consultants

Innovsource Services Pvt. Ltd.

Kelly Services India

Allegis Group India

GlobalHunt India Private Limited

Careernet Technologies Pvt. Ltd.

PeopleStrong Technologies Pvt. Ltd.

Uplers Solutions Private Limited

Focuse Management Consultants

BigLeap Technologies & Solutions Private Limited

Table of Contents

1. Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. Market Size (In USD Million)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. Market Analysis

3.1 Growth Drivers

3.1.1 Economic Expansion

3.1.2 Technological Advancements

3.1.3 Government Initiatives

3.1.4 Workforce Demographics

3.2 Market Challenges

3.2.1 Talent Shortages

3.2.2 Regulatory Compliance

3.2.3 Economic Fluctuations

3.3 Opportunities

3.3.1 Digital Transformation

3.3.2 Sectoral Diversification

3.3.3 Upskilling and Reskilling Initiatives

3.4 Trends

3.4.1 Gig Economy Growth

3.4.2 Remote Work Adoption

3.4.3 AI and Automation in Recruitment

3.5 Government Regulations

3.5.1 Labor Laws

3.5.2 Employment Standards

3.5.3 Taxation Policies

3.5.4 Foreign Direct Investment (FDI) Norms

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Porter's Five Forces Analysis

3.9 Competitive Landscape

4. Market Segmentation

4.1 By Staffing Type (In Value %)

4.1.1 Temporary Staffing

4.1.2 Permanent Staffing

4.2 By Recruitment Channel (In Value %)

4.2.1 Online Recruitment

4.2.2 Offline Recruitment

4.2.3 Hybrid Recruitment

4.3 By End User Industry (In Value %)

4.3.1 Information Technology (IT) and Telecom

4.3.2 Banking, Financial Services, and Insurance (BFSI)

4.3.3 Healthcare

4.3.4 Real Estate

4.3.5 Manufacturing

4.3.6 Retail and E-commerce

4.3.7 Others

4.4 By Company Size (In Value %)

4.4.1 Small and Medium Enterprises (SMEs)

4.4.2 Large Enterprises

4.5 By Region (In Value %)

4.5.1 North

4.5.2 South

4.5.3 East

4.5.4 West

5. Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Quess Corp Limited

5.1.2 TeamLease Services Limited

5.1.3 Randstad India

5.1.4 Adecco India

5.1.5 ManpowerGroup India

5.1.6 ABC Consultants

5.1.7 Innovsource Services Pvt. Ltd.

5.1.8 Kelly Services India

5.1.9 Allegis Group India

5.1.10 GlobalHunt India Private Limited

5.1.11 Careernet Technologies Pvt. Ltd.

5.1.12 PeopleStrong Technologies Pvt. Ltd.

5.1.13 Uplers Solutions Private Limited

5.1.14 Focuse Management Consultants

5.1.15 BigLeap Technologies & Solutions Private Limited

5.2 Cross Comparison Parameters (Number of Employees, Headquarters, Inception Year, Revenue, Service Portfolio, Geographic Presence, Client Base, Market Share)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.6.1 Venture Capital Funding

5.6.2 Government Grants

5.6.3 Private Equity Investments

6. Regulatory Framework

6.1 Labor Laws and Regulations

6.2 Compliance Requirements

6.3 Certification Processes

7. Future Market Size (In USD Million)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. Future Market Segmentation

8.1 By Staffing Type (In Value %)

8.2 By Recruitment Channel (In Value %)

8.3 By End User Industry (In Value %)

8.4 By Company Size (In Value %)

8.5 By Region (In Value %)

9. Market Analysts Recommendations

9.1 Total Addressable Market (TAM), Serviceable Available Market (SAM), and Serviceable Obtainable Market (SOM) Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the India Staffing and Recruitment Market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data pertaining to the India Staffing and Recruitment Market. This includes assessing market penetration, the ratio of staffing agencies to service providers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics is conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations provide valuable operational and financial insights directly from industry practitioners, which are instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple staffing and recruitment firms to acquire detailed insights into service segments, operational performance, client preferences, and other pertinent factors. This interaction serves to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the India Staffing and Recruitment market.

Frequently Asked Questions

01. How big is the India Staffing and Recruitment Market?

The India staffing and recruitment market is valued at USD 20 billion, driven by economic growth, a young workforce, and increasing demand across various industries.

02. What are the challenges in the India Staffing and Recruitment Market?

India staffing and recruitment Challenges include talent shortages, regulatory compliance complexities, and economic fluctuations that impact hiring trends and workforce stability.

03. Who are the major players in the India Staffing and Recruitment Market?

India staffing and recruitment Key players include Quess Corp Limited, TeamLease Services Limited, Randstad India, Adecco India, and ManpowerGroup India, dominating due to extensive service portfolios and widespread geographic presence.

04. What are the growth drivers of the India Staffing and Recruitment Market?

India staffing and recruitment Growth is propelled by economic expansion, technological advancements, government initiatives for skill development, and evolving workforce demographics favoring flexible employment models.

05. How is technology influencing the India Staffing and Recruitment Market?

Technology is reshaping the India staffing and recruitment through digital recruitment platforms, AI-driven candidate screening, and automation, enhancing efficiency and broadening reach for both employers and job seekers.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.