India Steel Market Outlook to 2030

Region:Asia

Author(s):shreya

Product Code:KROD2881

November 2024

99

About the Report

India Steel Market Overview

The India steel market was valued at 103 million metric tons in volume based on the historical data of past five years. The market's growth is driven primarily by robust demand from sectors like construction, automotive, and infrastructure development, fueled by increased government spending on mega projects such as highways and housing. Steel's critical role in infrastructure development, along with urbanization, continues to drive the market forward.

Some of the leading players in the India steel market include Tata Steel, JSW Steel, Steel Authority of India Limited (SAIL), Jindal Steel & Power, and Bhushan Steel. These companies dominate the domestic market with a wide range of products catering to both domestic and international demand. Their extensive production capacities and strategic investments in modernizing steel plants have helped them maintain leadership positions in the market.

In 2024, Tata Steel announced plans to expand its Kalinganagar plant by 5 million tons per year, with a total investment of INR 23,500 crore (around USD 2.83 billion). The expansion is part of Tata Steel's strategy to meet the growing demand for high-grade steel, particularly in sectors such as automotive and infrastructure, which aligns with your statement about catering to increasing demand.

The state of Odisha is the dominant player in Indias steel production in 2023. This dominance is due to its rich iron ore reserves, estimated at one third of Indias total, and the presence of major steel players like Tata Steel and Jindal Steel. In 2023, Odisha produced over 70 million tons of steel, benefiting from favorable policies and infrastructure development by the state government.

India Steel Market Segmentation

The India Steel market is segmented into various factors such as product type, End User Industry and Region etc.

By Product Type: The market is segmented by product type into flat steel, long steel, and tubular steel. Flat steel held a dominant market share, primarily due to its widespread use in the automotive and construction industries. The rising demand for electric vehicles (EVs) and lightweight materials further boosted the growth of flat steel, driven by the increasing number of infrastructure projects across the country.

|

Product Type |

Market Share (2023) |

|---|---|

|

Flat Steel |

55% |

|

Long Steel |

35% |

|

Tubular Steel |

10% |

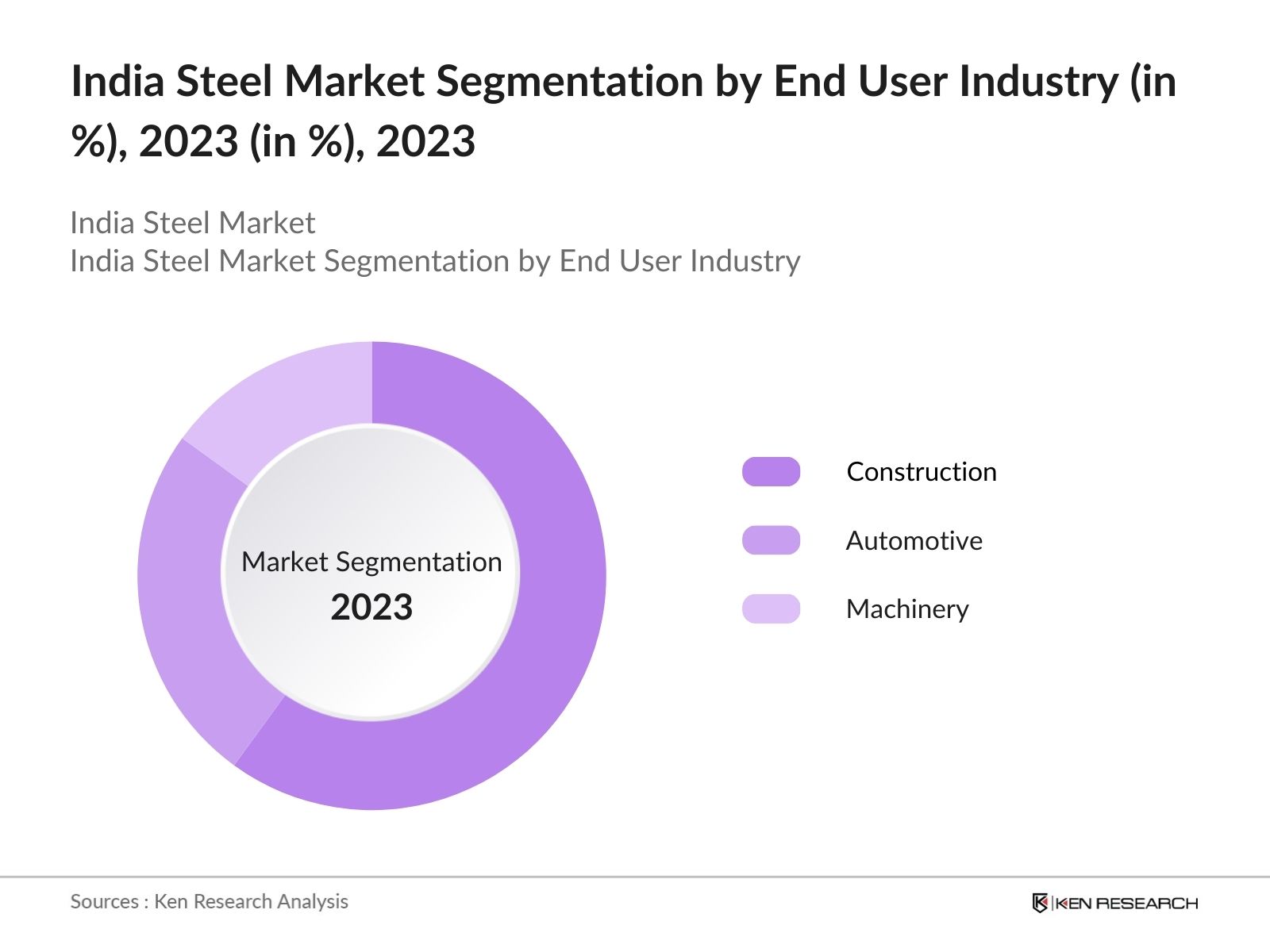

By End-User Industry: The market is segmented by end-user industry into construction, automotive, and machinery manufacturing. The construction sector dominated the market share, fueled by the governments Smart Cities Mission and other large-scale infrastructure projects, driven by increasing demand for steel in electric vehicle production.

|

End-User Industry |

Market Share (2023) |

|---|---|

|

Construction |

60% |

|

Automotive |

25% |

|

Machinery |

15% |

By Region: The steel market in India is geographically segmented into North, South, East, and West.

The Eastern region dominated the market share. This is attributed to the regions proximity to major raw material sources such as iron ore and coal mines, especially in states like Odisha and Jharkhand, with contributions from construction and manufacturing activities.

|

Region |

Market Share (2023) |

|---|---|

|

East |

40% |

|

West |

30% |

|

North |

15% |

|

South |

15% |

India Steel Market Competitive Landscape

|

Company |

Established |

Headquarters |

|---|---|---|

|

Tata Steel |

1907 |

Mumbai, India |

|

JSW Steel |

1982 |

Mumbai, India |

|

SAIL |

1954 |

New Delhi, India |

|

Jindal Steel & Power |

1979 |

Hisar, India |

|

Bhushan Steel |

1987 |

New Delhi, India |

- JSW Steels Sustainability Initiatives

JSW Steel plans to invest INR 15 billion to achieve a 25% reduction in carbon emissions by 2027. The company is set to implement hydrogen as a reducing agent in steel production. They have partnered with JSW Energy to establish a green hydrogen plant with a capacity of 3,800 tonnes per annum at their Vijayanagar facility, expected to be operational within 18-24 months - SAILs Modernization Drive: In 2023, SAIL initiated a modernization and expansion plan, which is part of its broader strategy to enhance productivity and reduce operational costs across its facilities. The modernization project at the Bhilai Steel Plant is part of a larger investment plan of INR 70,000 crore aimed at increasing its overall crude steel production capacity to 50 million tonnes per annum (MTPA) in the coming years.

India Steel Industry Analysis

Growth Drivers

- Rising Infrastructure Investments: In 2024, the Indian government allocated INR 10 trillion for infrastructure projects, including highways, railways, and ports. This substantial investment is expected to drive steel demand by increasing the consumption of long and flat steel products for construction purposes. The National Infrastructure Pipeline (NIP), aimed at completing 7,400 projects by 2025, will boost steel demand as many of these projects require significant amounts of steel.

- Increasing Automotive Production: In 2024, the production of vehicles in India is projected to cross 35 million units, driving the demand for steel in the automotive sector. The increased production of electric vehicles (EVs), which are lighter and require high-strength steel, is expected to boost the steel industry, especially for flat steel products used in vehicle bodies and parts. Leading automobile manufacturers have already increased their steel procurement to cater to the rising consumer demand.

- Renewable Energy Expansion: The expansion of renewable energy projects, particularly wind and solar, is projected to consume more than 5 million tons of steel annually by 2025. Steel is a key material in the construction of wind turbines, solar panels, and transmission towers. The governments plan to achieve 500 GW of renewable energy capacity by 2030 will further drive demand for steel products required in green energy projects.

Challenges

- Rising Input Costs

The cost of raw materials, particularly iron ore and coking coal is increasing steel production costs. Additionally, global disruptions in the supply of coking coal from Australia and South Africa have further inflated prices, directly affecting the profitability of steel producers. Securing a stable supply of raw materials remains a significant challenge for the industry. - Logistics and Transportation Issues

Inefficiencies in logistics and transportation have increased the cost of moving steel products within India. In 2024, it was estimated that the logistics cost in India was around 14% of GDP, which is significantly higher than the global average. Delays in rail and port infrastructure projects have compounded transportation issues, making it challenging for steel manufacturers to deliver products efficiently.

Government Initiatives

- National Steel Policy 2017: The National Steel Policy sets a production target of 300 million tons of steel by 2030, with a focus on increasing domestic capacity and reducing carbon emissions. In 2024, the government announced crucial investment to upgrade outdated steel plants with energy-efficient technologies. This policy encourages sustainable production practices and aims to position India as a global leader in steel production.

- Gati Shakti Plan: The PM Gati Shakti National Master Plan was launched by the Prime Minister in October 2021 as a digital platform to bring 16 Ministries together for integrated planning including highways, railways, and urban infrastructure. This initiative is expected to increase steel consumption and coordinated implementation of infrastructure connectivity projects.The plan aims to provide multi-modal connectivity for the movement of people, goods and services, facilitate last mile connectivity, and reduce travel time.

India Steel Market Future Outlook

The India steel market is expected to grow exponentially, driven by continued growth in construction, real estate, and heavy industries. With an investment in greenfield projects and the increasing emphasis on renewable energy, steel will continue to be a critical material. Furthermore, initiatives like the National Steel Policy, which targets humongous production by 2030, will significantly contribute to market expansion.

Future Trends

- Increased Investment in Automation: Indian steel manufacturers are expected to invest heavily in automation technologies to increase operational efficiency and reduce labor costs. By 2027, it is projected that more than one third of steel plants in India will implement AI-driven systems to monitor and optimize production processes, leading to enhanced productivity and reduced energy consumption.

- Expansion of Specialty Steel Production: The specialty steel market is expected to grow substantially in the next five years, driven by demand from sectors such as defense, aerospace, and renewable energy. Indias production of specialty steel is projected to increase, supported by government incentives and technological advancements that enable the production of high-performance steel for critical industries.

Scope of the Report

|

By Product Type |

Flat Steel Long Steel Tubular Steel |

|

By End User Industry |

Construction Automotive Machinery Manufacturing |

|

By Region |

North South East West |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Steel Manufacturers

Construction Companies

Automotive Manufacturers

Machinery and Equipment Manufacturers

Public and Private Infrastructure Developers

Raw Material Suppliers

Ministry of Heavy Industries

Ministry of Steel, Government of India

Investors and VC Firms

Banks and Financial Institutions

Time Period Captured in the Report:

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2028

Step: 1 Identifying Key Variables:

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry level information.

Step: 2 Market Building:

Collating statistics on India Steel market over the years, penetration of marketplaces and service providers ratio to compute revenue generated for India Steel market. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.

Step: 3 Validating and Finalizing:

Building market hypothesis and conducting CATIs with industry experts belonging to different steel companies to validate statistics and seek operational and financial information from company representatives.

Step: 4 Research Output:

Our team will approach multiple steel manufacturers and understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from Steel companies.

Companies

Players Mentioned in the Report:

Tata Steel

JSW Steel

SAIL

Jindal Steel & Power

Bhushan Steel

Essar Steel

Rashtriya Ispat Nigam

ArcelorMittal Nippon Steel

Electrosteel Castings

Lloyds Steel Industries

Kalyani Steel

Mukand Ltd

Uttam Galva Steels

Vardhman Special Steels

APL Apollo Tubes

Table of Contents

1.India Steel Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2.India Steel Market Size (in Metric Tons), 2018-2023

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

3.India Steel Market Analysis

3.1. Growth Drivers

3.1.1. Infrastructure Investments

3.1.2. Automotive Production Growth

3.1.3. Renewable Energy Projects

3.1.4. Real Estate Development

3.2. Restraints

3.2.1. Rising Raw Material Costs

3.2.2. Energy Consumption and Emissions Regulations

3.2.3. Trade Barriers and Tariffs

3.2.4. Logistical and Transportation Challenges

3.3. Opportunities

3.3.1. Adoption of Green Steel Technologies

3.3.2. Expansion of Specialty Steel Production

3.3.3. Strategic Partnerships and Collaborations

3.3.4. Digitalization and Automation in Steel Plants

3.4. Trends

3.4.1. Rise in Demand for High-Strength Steel

3.4.2. Shift Toward Sustainable and Green Steel

3.4.3. Increasing Use of Steel in Electric Vehicles

3.4.4. Investment in Energy-Efficient Steelmaking Technologies

3.5. Government Regulations

3.5.1. National Steel Policy 2017

3.5.2. Production Linked Incentive (PLI) Scheme

3.5.3. Steel Scrap Recycling Policy

3.5.4. Gati Shakti Initiative

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Competition Ecosystem

4.India Steel Market Segmentation, 2023

4.1. By Product Type (in Value %)

4.1.1. Flat Steel

4.1.2. Long Steel

4.1.3. Tubular Steel

4.2. By End-User Industry (in Value %)

4.2.1. Construction

4.2.2. Automotive

4.2.3. Machinery Manufacturing

4.3. By Region (in Value %)

4.3.1. North

4.3.2. South

4.3.3. East

4.3.4. West

5.India Steel Market Cross Comparison

5.1 Detailed Profiles of Major Companies

5.1.1. Tata Steel

5.1.2. JSW Steel

5.1.3. SAIL

5.1.4. Jindal Steel & Power

5.1.5. Bhushan Steel

5.2 Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue)

6.India Steel Market Competitive Landscape

6.1. Market Share Analysis

6.2. Strategic Initiatives

6.3. Mergers and Acquisitions

6.4. Investment Analysis

6.4.1. Venture Capital Funding

6.4.2. Government Grants

6.4.3. Private Equity Investments

7.India Steel Market Regulatory Framework

7.1. Environmental Standards

7.2. Compliance Requirements

7.3. Certification Processes

8.India Steel Market Future Size Projections (in Metric Tons), 2023-2028

8.1. Future Market Size Projections

8.2. Key Factors Driving Future Market Growth

9.India Steel Market Future Segmentation, 2028

9.1. By Product Type (in Value %)

9.2. By End-User Industry (in Value %)

9.3. By Region (in Value %)

10.India Steel Market Analysts Recommendations

10.1. TAM/SAM/SOM Analysis

10.2. Customer Cohort Analysis

10.3. Marketing Initiatives

10.4. White Space Opportunity Analysis

Disclaimer

Contact Us

Frequently Asked Questions

How big is India Steel Market?

The India steel market, valued at 103 million metric tons in volume, is driven by infrastructure development, automotive production, and government initiatives aimed at increasing steel output.

What are the challenges in India Steel Market?

Challenges in the India steel market include rising input costs such as iron ore and coking coal, logistical inefficiencies, strict environmental regulations, and global trade barriers that limit export opportunities.

Who are the major players in the India Steel Market?

Key players in the India steel market include Tata Steel, JSW Steel, Steel Authority of India Limited (SAIL), Jindal Steel & Power, and Bhushan Steel. These companies lead the market due to their production capacities and strategic investments.

What are the growth drivers of India Steel Market?

The India steel market is driven by increasing infrastructure investments, growing automotive production, expansion of renewable energy projects, and the rising demand from the real estate sector for steel in construction.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.