India Structured Cabling Market Outlook to 2030

Region:Asia

Author(s):Naman Rohilla

Product Code:KROD1934

November 2024

92

About the Report

India Structured Cabling Market Overview

- The India Structured Cabling Market was valued at USD 704 million. The increasing demand for high-speed data transfer, the proliferation of data centres, and the rising adoption of digital transformation initiatives across industries primarily drive this growth.

- The key players in the India Structured Cabling Market include Sterlite Technologies, Finolex Cables, TE Connectivity, Nexans India Pvt. Ltd., and Belden India. These companies have leveraged their advanced technological capabilities and robust distribution networks to develop high-quality structured cabling solutions that meet the growing demand for faster and more efficient data transmission.

- Sterlite Technologies Limited (STL) has secured around Rs 900 crore worth of fiberization orders from private telecom companies in FY24, covering over 15,000 km across 20 states in India. The orders form about 10% of STL's total order book of Rs 9,000-10,000 crore.

- The Western region of India led the Structured Cabling Market in 2023, driven by its rapid industrial growth, expansion of IT hubs, and favourable government policies supporting the digital economy. The region's dominance is also attributed to the growing number of smart city projects and the increasing demand for broadband connectivity.

India Structured Cabling Market Segmentation

The India Structured Cabling Market is segmented by solution type, application type, and region.

- By Solution Type: The market is segmented into hardware, software, and services. In 2023, the hardware segment dominated the market due to the rising demand for high-performance cabling infrastructure in large enterprises and data centers.

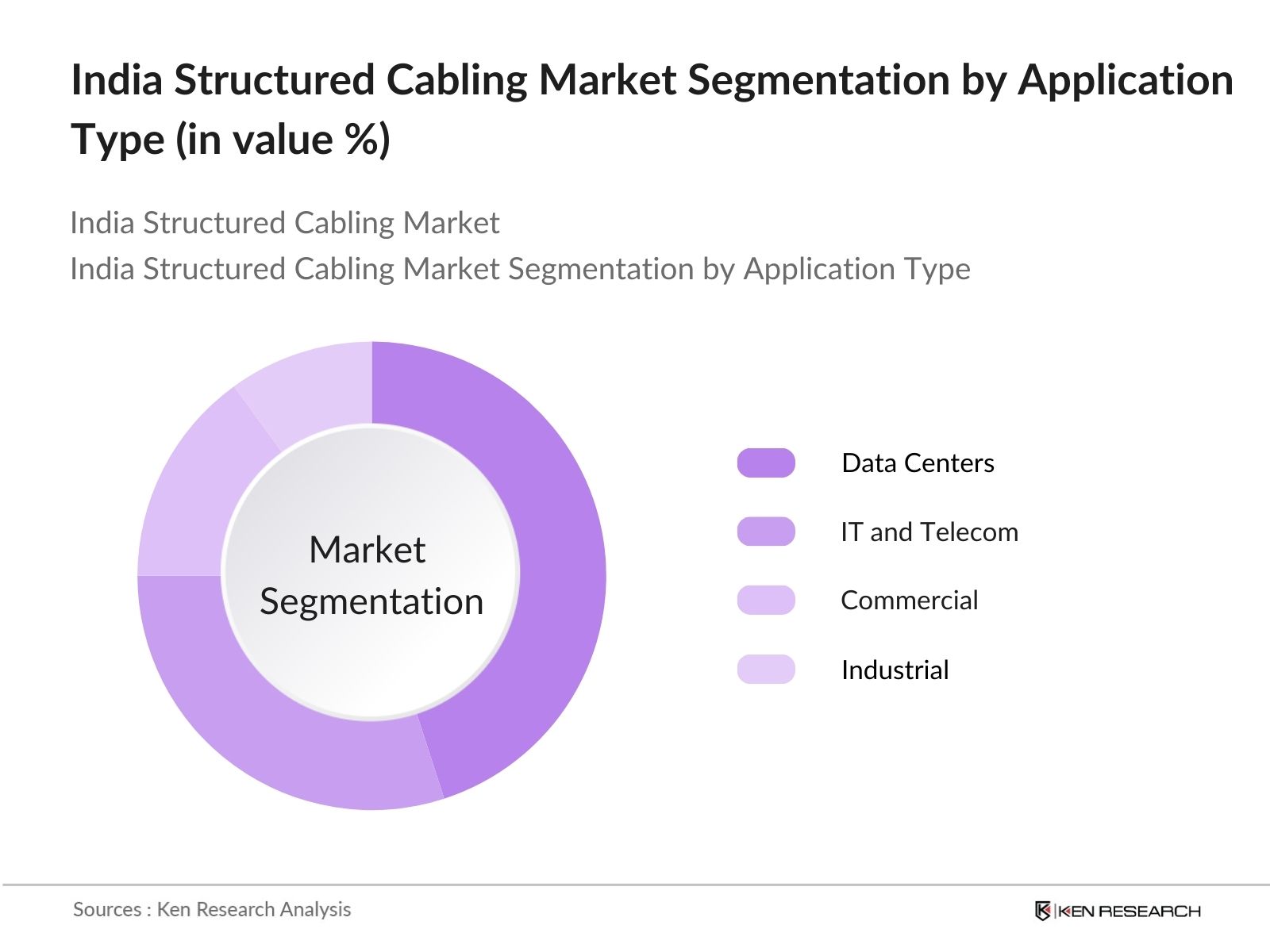

- By Application Type: The market is also segmented into data centers, IT and telecom, commercial, and industrial. Data centers held the largest market share in 2023, driven by the rapid growth of cloud computing and the increasing need for efficient data management solutions.

- By Region: The market is segmented into North, South, East, and West. In 2023, the Western region dominated the market, with cities like Mumbai and Pune leading in the deployment of structured cabling solutions, owing to the high concentration of IT firms and data centers.

India Structured Cabling Market Competitive Landscape

|

Company |

Establishment Year |

Headquarters |

|

Sterlite Technologies |

2000 |

Pune, Maharashtra |

|

Finolex Cables |

1958 |

Mumbai, Maharashtra |

|

TE Connectivity |

1941 |

Bengaluru, Karnataka |

|

Nexans India Pvt. Ltd. |

2004 |

Gurugram, Haryana |

|

Belden India |

1902 |

Mumbai, Maharashtra |

- Finolex Cables: Finolex Cables has launched a new range of LAN passive components, including patch cords and faceplates, aimed at enhancing data transmission in high-density environments like data centers and offices. This move aligns with India's digital transformation and the increasing demand for structured cabling solutions amid urbanization and smart city initiatives.

- TE Connectivity: TE Connectivity is set to showcase its innovative copper solutions aimed at enhancing AI systems at DesignCon 2024. The company will present its 224G products and PCIe Gen 6 technologies, addressing signal integrity challenges and demonstrating advanced thermal solutions and smart power connectors to support next-generation data centers and AI applications.

India Structured Cabling Market Analysis

India Structured Cabling Market Growth Drivers:

- Surging Adoption of IoT: India currently has 759 million active internet users, expected to grow to 900 million by 2025. This surge in IoT device integration across sectors necessitates robust structured cabling infrastructure to support seamless communication and efficient data transfer among an increasing number of connected devices.

- Expansion of Data Centers: India is set to see over 45 new data centers developed by 2025, totaling 13 million square feet and 1,015 MW of capacity. This growth in cloud computing and digitalization significantly increases the demand for structured cabling to manage high data traffic effectively.

- Rise of 5G Networks: With the deployment of 5G technology, India is projected to lead global data consumption, reaching 62GB per user monthly by 2028. This dramatic increase in data usage compels telecom operators to upgrade their cabling infrastructure, driving demand for structured cabling solutions.

India Structured Cabling Market Challenges:

- Fluctuations in Raw Material Prices: Fluctuating raw material prices, particularly for copper and fiber optic components, directly impact the production costs of structured cabling solutions. Increased material costs can lead to higher prices for consumers, market volatility, supply chain disruptions, and reduced profit margins for manufacturers, ultimately affecting demand and project implementation in the industry.

- Lack of Skilled Workforce: The structured cabling market in India faces a significant shortage of skilled technicians, with over 50% of industry professionals citing it as a major challenge. Currently, approximately 672,000 technicians are employed, but an additional 250,000 are needed to meet growing demand in the sector.

India Structured Cabling Market Government Initiatives:

- Digital India Campaign: Launched in 2015, the Digital India initiative aims to enhance internet connectivity, with internet penetration reaching 67% and 916.77 million subscribers as of March 2024. The government allocated 14,903 crore for its expansion from 2021 to 2026, promoting digital inclusiveness.

- BharatNet Project: The BharatNet initiative aims to provide high-speed broadband connectivity to rural areas, having connected over 1.5 lakh gram panchayats as of early 2024. The project seeks to connect all 2.5 lakh gram panchayats by 2025, significantly improving digital access in underserved regions.

India Structured Cabling Market Future Market Outlook

The India Structured Cabling Market is expected to grow substantially in the coming years. The market is anticipated to shift towards more advanced and future-proof solutions, with a focus on fiber optic cables and smart building cabling systems.

Future Market Trends:

- Increased Adoption of Fiber Optic Cables: As internet speeds and data traffic continue to grow, fiber optic cables are increasingly favoured over traditional copper cables. The demand for higher bandwidth, driven by high-definition streaming and online gaming, supports this trend, as fiber optics can transmit data faster and more reliably than copper cables.

- Growth of Smart Buildings: The rising focus on smart buildings and IoT applications is indeed driving demand for structured cabling systems. These systems enable seamless connectivity across various devices and platforms, essential for the integration of smart technologies and efficient building management.

Scope of the Report

|

By Solution Type |

Hardware Software Services |

|

By Application Type |

Data Centers IT and Telecom Commercial Industrial |

|

By Cable Type |

Copper Cabling Fiber Optic Cabling |

|

By Region |

North South East West |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Government and Regulatory Bodies

Banks and Financial Institutes

Investors and Venture Capitalists

IT Infrastructure Companies

Data Center Companies

Telecommunication Companies

Structured Cabling Manufacturers

Time-Period Captured in the Report

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2028

Companies

Players Mentioned in the Report:

Sterlite Technologies

Finolex Cables

TE Connectivity

Nexans India Pvt. Ltd.

Belden India

CommScope India

D-Link India Ltd.

Schneider Electric India

Legrand India Pvt. Ltd.

AMP Netconnect India Pvt. Ltd.

Corning India

Molex India

Panduit India Pvt. Ltd.

R&M India

Havells India Ltd.

Table of Contents

1. India Structured Cabling Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate (CAGR, market trends)

1.4 Market Segmentation Overview (solution type, application type, region)

2. India Structured Cabling Market Size (in USD Billion)

2.1 Historical Market Size

2.2 Year-on-Year Growth Analysis

2.3 Key Market Developments and Milestones (data centers growth, IoT adoption, digital transformation initiatives)

3. India Structured Cabling Market Analysis

3.1 Growth Drivers

3.1.1 Surging IoT Adoption (Impact of IoT on cabling infrastructure demand)

3.1.2 Expansion of Data Centers (Role of cloud computing in structured cabling)

3.1.3 Rise of 5G Networks (5Gs influence on structured cabling needs)

3.1.4 Government Digital Initiatives (Digital India, BharatNet project)

3.2 Restraints

3.2.1 Fluctuations in Raw Material Prices (Impact of copper and fiber optic prices)

3.2.2 Lack of Skilled Workforce (Shortage of technicians and skilled engineers)

3.2.3 Supply Chain Disruptions (Impact of global and local disruptions)

3.3 Opportunities

3.3.1 Increased Fiber Optic Deployment (Growing preference for fibre over copper)

3.3.2 Expansion of Smart Cities Projects (Impact of smart cities on structured cabling demand)

3.3.3 Technological Advancements in Cabling Solutions (High-density cabling systems, AI-enhanced solutions)

3.4 Trends

3.4.1 Growth of Smart Buildings and IoT (Structured cabling enabling smart building ecosystems)

3.4.2 Innovations in Fiber Optic Cables (Future-proof solutions for higher bandwidth requirements)

3.4.3 Increased Demand for Data Center Optimization (High-performance cabling systems for large-scale data management)

3.5 Government Regulations

3.5.1 BharatNet Initiative (Broadband connectivity expansion in rural areas)

3.5.2 Digital India Initiative (Internet penetration, digital inclusiveness)

3.5.3 Telecom Infrastructure Regulations (Impact of 5G deployment regulations on structured cabling)

3.6 SWOT Analysis

3.6.1 Strengths (Technological capabilities, government support)

3.6.2 Weaknesses (Raw material price fluctuations, lack of workforce)

3.6.3 Opportunities (IoT adoption, smart city projects)

3.6.4 Threats (Supply chain disruptions, global competition)

3.7 Stakeholder Ecosystem (Cabling manufacturers, data center operators, IT infrastructure providers)

3.8 Competition Ecosystem (Key players, market consolidation, strategic partnerships)

4. India Structured Cabling Market Segmentation (2023)

4.1 By Solution Type (in Value %)

4.1.1 Hardware (Cabling, patch panels, racks)

4.1.2 Software (Cabling management software, network management)

4.1.3 Services (Installation, maintenance, consulting)

4.2 By Application Type (in Value %)

4.2.1 Data Centers (High-performance cabling solutions)

4.2.2 IT and Telecom (Telecommunication infrastructure, 5G readiness)

4.2.3 Commercial (Office buildings, smart workspaces)

4.2.4 Industrial (Manufacturing facilities, automation systems)

4.3 By Cable Type (in Value %)

4.3.1 Copper Cabling

4.3.2 Fiber Optic Cabling (Single-mode, multimode)

4.4 By Region (in Value %)

4.4.1 North

4.4.2 South

4.4.3 East

4.4.4 West

5. India Structured Cabling Market Cross Comparison

5.1 Detailed Profiles of Major Companies

5.1.1 Sterlite Technologies

5.1.2 Finolex Cables

5.1.3 TE Connectivity

5.1.4 Nexans India Pvt. Ltd.

5.1.5 Belden India

5.1.6 CommScope India

5.1.7 D-Link India Ltd.

5.1.8 Schneider Electric India

5.1.9 Legrand India Pvt. Ltd.

5.1.10 AMP Netconnect India Pvt. Ltd.

5.1.11 Corning India

5.1.12 Molex India

5.1.13 Panduit India Pvt. Ltd.

5.1.14 R&M India

5.1.15 Havells India Ltd.

5.2 Cross Comparison Parameters

5.2.1 Headquarters

5.2.2 Inception Year

5.2.3 Revenue

5.2.4 Market Share

5.2.5 Employee Count

6. India Structured Cabling Market Competitive Landscape

6.1 Market Share Analysis

6.2 Strategic Initiatives

6.3 Mergers and Acquisitions (Analysis of key M&A activities)

6.4 Investment Analysis

6.4.1 Venture Capital Funding (Role of private equity in market growth)

6.4.2 Government Grants and Incentives

6.4.3 Private Equity Investments (Impact on market consolidation)

7. India Structured Cabling Market Regulatory Framework

7.1 Environmental Standards (E-waste management, eco-friendly cabling)

7.2 Compliance Requirements (Telecom regulations, safety standards)

7.3 Certification Processes (ISO certifications, cabling standards compliance)

8. India Structured Cabling Future Market Size (in USD Billion)

8.1 Future Market Size Projections (Based on CAGR)

8.2 Key Factors Driving Future Market Growth (5G adoption, digital transformation, data center expansion)

9. India Structured Cabling Future Market Segmentation (2028)

9.1 By Solution Type (in Value %)

9.2 By Application Type (in Value %)

9.3 By Cable Type (in Value %)

9.4 By Region (in Value %)

10. India Structured Cabling Market Analysts Recommendations

10.1 TAM/SAM/SOM Analysis (Total Addressable Market, Serviceable Available Market, Serviceable Obtainable Market)

10.2 Customer Cohort Analysis (Enterprise segments, service providers, government)

10.3 Marketing Initiatives (Brand awareness strategies, digital marketing)

10.4 White Space Opportunity Analysis (Potential growth areas, underserved markets)

Research Methodology

Step: 1 Identifying Key Variables

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around the market to collate market-level information.

Step: 2 Market Building

Collating statistics on the India Structured Cabling market over the years and analyzing the penetration of products as well as the ratio of suppliers to compute the revenue generated for the market. We will also review product quality statistics to ensure accuracy behind the data points shared.

Step: 3 Validating and Finalizing

Building market hypotheses and conducting CATIs with market experts from different companies to validate statistics and seek operational and financial information from company representatives.

Step: 4 Research Output

Our research team approaches multiple cabling manufacturers, data center operators, and IT infrastructure providers to understand product segments, sales trends, consumer preferences, and other parameters. This supports us in validating the statistics derived from the bottom-up approach of these cabling manufacturers, data center operators, and IT infrastructure providers.

Frequently Asked Questions

01. How big is the India Structured Cabling Market?

The India Structured Cabling Market was valued at USD 704 million in 2023. This growth is driven by increasing digitalization, expansion of data centers, and government initiatives like "Digital India."

02. Who are the major players in the India Structured Cabling market?

The major players in the India Structured Cabling Market include Sterlite Technologies, Finolex Cables, TE Connectivity, Nexans India Pvt. Ltd., and Belden India. These companies dominate the market with advanced technological capabilities and robust distribution networks.

03. What are the growth drivers of the India Structured Cabling market?

The growth drivers of the India Structured Cabling Market include increasing digital transformation initiatives, expansion of data centers, and the rise of 5G networks, which are fueling demand for high-performance cabling infrastructure.

04. What are the India Structured Cabling market challenges?

The India Structured Cabling Market faces challenges including fluctuations in raw material prices, particularly copper and fibre optic materials, and a lack of skilled workforce, which may delay project implementations.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.