India Super Absorbent Polymer Market Outlook to 2030

Region:Asia

Author(s):Meenakshi Bisht

Product Code:KROD1894

December 2024

82

About the Report

India Super Absorbent Polymer Market Overview

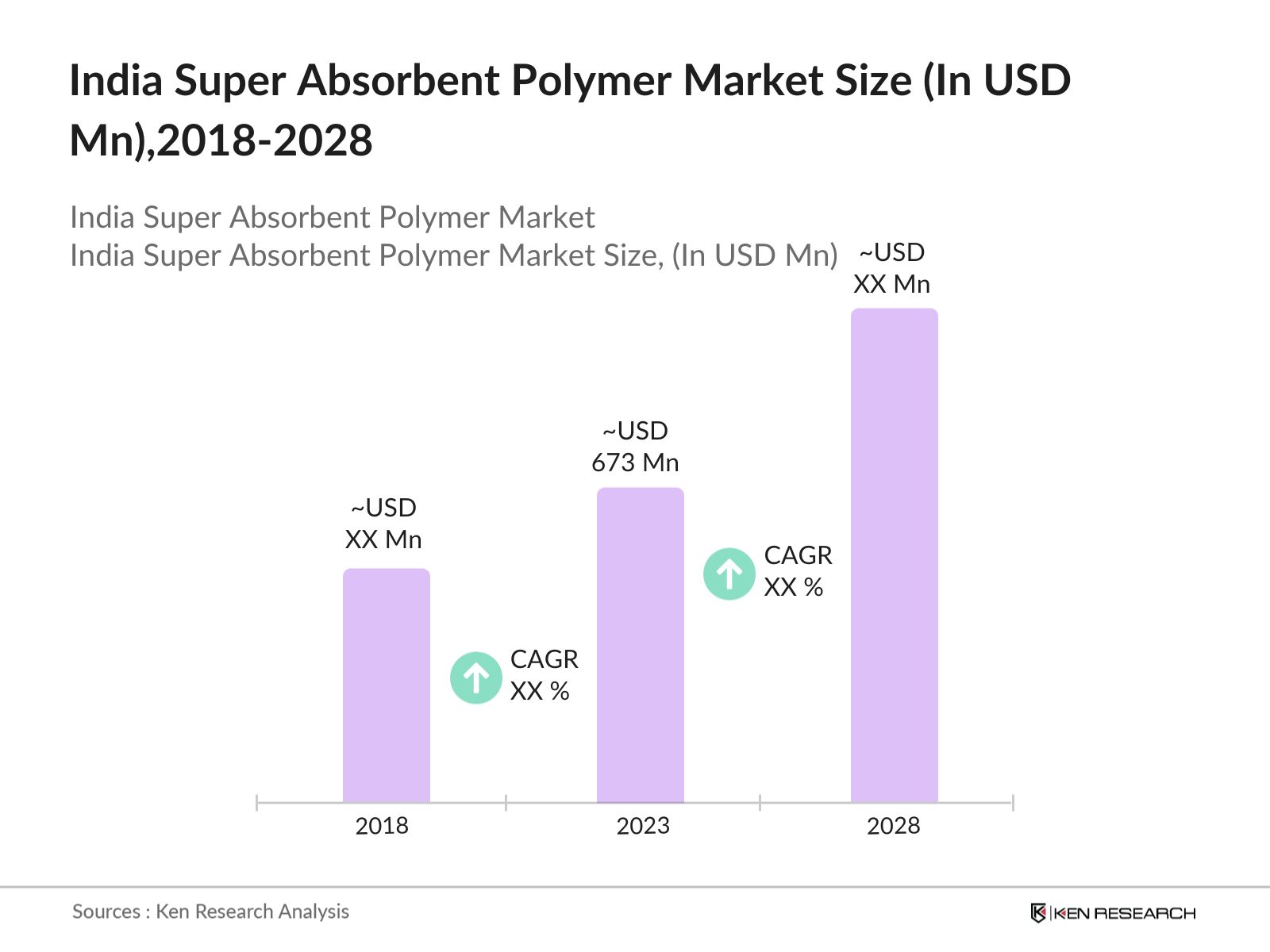

- The India Super Absorbent Polymer (SAP) Market was valued at USD 673 million in 2023. The market is expected to continue its upward trajectory, driven by increased demand from the hygiene products segment, including baby diapers, adult incontinence products, and feminine hygiene products.

- Key players in this market include companies like BASF SE, LG Chem Ltd., Evonik Industries AG, and Sumitomo Seika Chemicals Co., Ltd. These companies have established strong footholds in the market through continuous innovation and by expanding their product portfolios to meet the growing demand in various application sectors, such as hygiene, agriculture, and packaging.

- InFebruary 2024, the company announced the introduction ofCcycled, a line of sustainable materials produced using advanced recycling technology called ChemCycling. This initiative is part of BASF's strategy to incorporate more sustainable practices in its operations, aligning with global trends towards eco-friendly products.

- Maharashtra is the leading state in this market, due to its large population base, high urbanization rate, and the presence of major manufacturing hubs. The state's well-developed infrastructure and favorable business environment also make it a preferred location for SAP manufacturers and distributors.

India Super Absorbent Polymer Market Segmentation

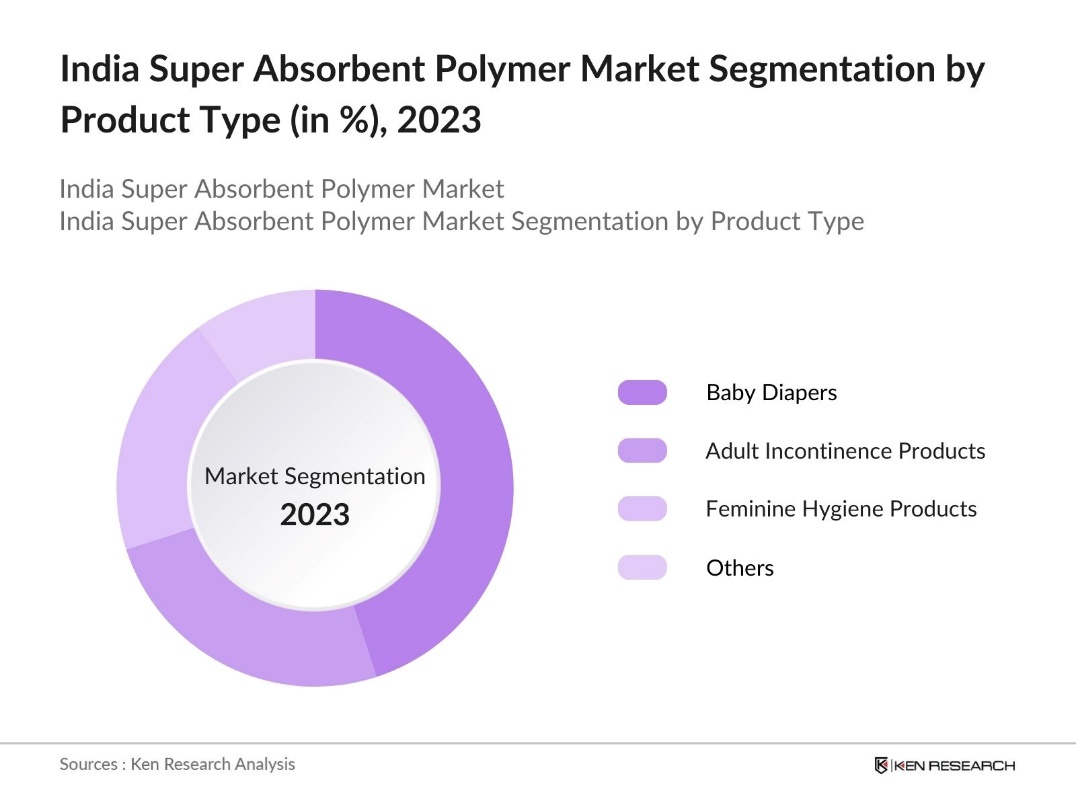

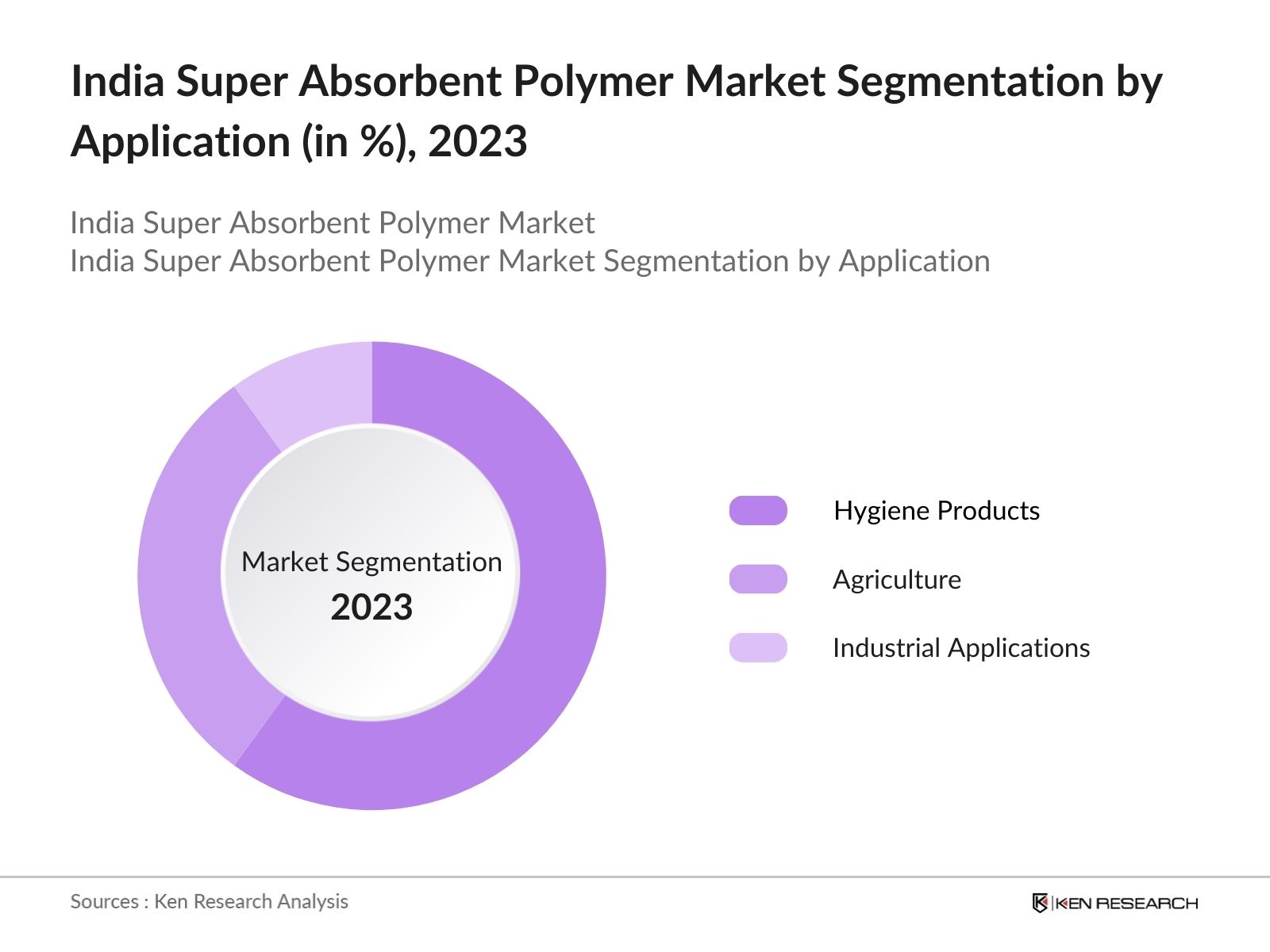

The India Super Absorbent Polymer Market is segmented into different factors like by product type, by application and region.

By Product Type: The market is segmented by product type into baby diapers, adult incontinence products, feminine hygiene products, and others. In 2023, baby diapers held the dominant market share, due to the growing infant population, increased disposable income, and heightened awareness of baby hygiene among parents. Additionally, government initiatives to promote child health and hygiene further bolster this segment's growth.

By Application: The market is segmented by application into hygiene products, agriculture, and industrial applications. Hygiene products dominate the market share in 2023. This dominance is driven by the high demand for disposable hygiene products, such as diapers and sanitary napkins, in both urban and rural areas. The increasing focus on personal hygiene and the adoption of SAP in various hygiene products is expected to maintain this segment's dominance in the coming years.

By Region: The market is segmented by region into north, south, east, and west. In 2023, the Western region was dominating the market due to the concentration of manufacturing facilities, higher urbanization rates, and better access to infrastructure. The region's proximity to raw material suppliers and major consumer markets also contributes to its leading position in the SAP market.

India Super Absorbent Polymer Market Competitive Landscape

|

Company Name |

Establishment Year |

Headquarters |

|---|---|---|

|

BASF SE |

1865 |

Ludwigshafen, Germany |

|

LG Chem Ltd. |

1947 |

Seoul, South Korea |

|

Evonik Industries AG |

2007 |

Essen, Germany |

|

Sumitomo Seika Chemicals Co. |

1944 |

Osaka, Japan |

|

Sanyo Chemical Industries Ltd. |

1949 |

Kyoto, Japan |

- Evonik Industries AG: On April 23, 2024, Evonik inaugurated a new office and research hub in Thane, India. This facility spans 100,000 square feet and includes eight application technology labs and a dedicated research and development area. The hub is designed to foster collaboration and innovation, catering to various industries, including pharmaceuticals, personal care, and agriculture. This development underscores Evonik's commitment to sustainability and creating products tailored to the Indian market's specific needs.

- Sanyo Chemical Industries Ltd.: In April 2024, Sanyo Chemical Industries Ltd. entered into a collaboration with Econic Technologies Ltd. to advance CO2-based polyols for sustainable polyurethane production. This partnership aims to reduce the carbon footprint of polyol production by 30% using Econic's innovative technology, which incorporates CO2 into polyols. The development aligns with Sanyo Chemical's commitment to carbon neutrality and enhancing the sustainability of the polyurethane market.

India Super Absorbent Polymer Market Analysis

Growth Drivers

- Growing Geriatric Population: The ageing population in India, projected to reach 347 million by 2050, drives the growth of the Super Absorbent Polymer (SAP) market. This rise increases demand for healthcare products, especially in adult incontinence and hygiene sectors. India's initiatives in geriatric care and expanding elderly demographics underscore the need for products addressing health and comfort, boosting SAP usage across various applications tailored to the elderly population.

- Adoption of SAPs in Agriculture: The use of SAPs in Indian agriculture is gaining momentum, especially in drought-prone areas where water retention is critical. SAP adoption remains a major advancement in agricultural activities due to rising government initiatives promoting water-efficient technologies are encouraging wider use. These efforts support farmers in managing scarce water resources more effectively, making SAPs increasingly essential in regions facing water scarcity.

- Increasing Demand for Hygiene Products: The demand for super absorbent polymers in India is largely driven by the growing consumption of hygiene products such as baby diapers, adult incontinence products, and feminine hygiene items. This trend is fueled by increasing awareness of health and hygiene, especially in rural areas, where government initiatives are promoting improved menstrual hygiene. The expanding population and rising health consciousness further contribute to the growing demand for these products.

Challenges

- Regulatory Hurdles: The industry in India is under increasing pressure from stringent regulations related to product safety and environmental impact. Recent regulatory changes have imposed stricter safety and environmental guidelines, including the need to reduce volatile organic compounds (VOCs) in SAP production. These regulations have led to higher production costs, particularly affecting smaller manufacturers who may find it challenging to comply with the new requirements.

- Competition from Alternatives: The market in India is facing growing competition from alternative absorbent materials, particularly cellulose-based products that are gaining traction due to their biodegradable properties. Many manufacturers are shifting towards these alternatives to meet the rising consumer demand for sustainable products. This shift presents a significant challenge for SAP manufacturers, who need to innovate and adapt to stay competitive in the evolving market.

Government Initiatives

- BPCL: BPCL has set up a demonstration plant with a capacity of 200 tons per annum at the Kochi refinery, which is expected to be followed by a commercial plant with an annual capacity of 50,000 tons by FY 2026. This initiative aims to significantly reduce dependency on imports and enhance domestic production capabilities in India.

- Innovative Biodegradable SAPs: In June 2023, researchers at IIT Delhi developed Celligo BioSAP, a biodegradable super absorbent polymer designed for use in sanitary pads. This innovation aims to address environmental concerns associated with traditional non-biodegradable products and promote sustainable menstruation practices nationwide

India Super Absorbent Polymer Market Future Outlook

The India SAP Market is projected to grow exponentially by 2028, driven by continued growth in the hygiene products sector and the expansion of SAP applications in agriculture and industrial sectors. The market is expected to witness increased competition, with more local players entering the market, thereby driving innovation and potentially lowering costs. Additionally, advancements in biodegradable SAPs are likely to gain traction, aligning with global sustainability trends.

Future Market Trends

- Growth in Hygiene Product Consumption: By 2028, the consumption of hygiene products in India is expected to grow significantly over the next five years, driving the demand for SAPs. This growth will be fueled by increasing awareness of hygiene, government initiatives, and the expansion of distribution networks into rural areas. The market for baby diapers and adult incontinence products is likely to see substantial expansion as these factors converge.

- Expansion of SAP Applications in Agriculture: The use of SAPs in agriculture is anticipated to expand further, with more farmland likely to adopt this technology by 2028. This growth will be driven by the increasing need for water conservation in drought-prone regions, supported by government subsidies and initiatives. The adoption of SAPs in agriculture is expected to play a critical role in improving crop yields and ensuring sustainable farming practices.

Scope of the Report

|

By Product Type |

Baby Diapers Adult Incontinence Products Feminine Hygiene Products Others |

|

By Application |

Hygiene Products Agriculture Industrial Applications |

|

By Region |

North South East West |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Agricultural technology companies

Industrial water management companies

Packaging industry

Polymer and chemical Companies

Baby care product manufacturers

Sanitary napkin manufacturers

Adult incontinence product manufacturers

Investment and financial institutions

Investors and VC Firms

Banks and Financial Institution

Government Agencies (Ministry of Health and Family Welfare (MoHFW), Ministry of Agriculture & Farmers Welfare)

Time Period Captured in the Report:

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2028

Companies

Players Mentioned in the Report:

BASF SE

LG Chem Ltd.

Evonik Industries AG

Sumitomo Seika Chemicals Co., Ltd.

Sanyo Chemical Industries Ltd.

Nippon Shokubai Co., Ltd.

Formosa Plastics Corporation

Kao Corporation

Yixing Danson Technology

SDP Global Co., Ltd.

Zhejiang Satellite Petrochemical Co., Ltd.

Archer Daniels Midland Company

Ashland Global Holdings Inc.

The Dow Chemical Company

San-Dia Polymers Co., Ltd.

Table of Contents

1. India Super Absorbent Polymer Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. India Super Absorbent Polymer Market Size (in USD Mn), 2018-2023

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. India Super Absorbent Polymer Market Analysis

3.1. Growth Drivers

3.1.1. Growing Geriatric Population

3.1.2. Adoption of SAPs in Agriculture

3.1.3. Increasing Demand for Hygiene Products

3.1.4. Expansion of Manufacturing Capabilities

3.2. Challenges

3.2.1. Regulatory Hurdles

3.2.2. Competition from Alternatives

3.2.3. Environmental Impact Concerns

3.2.4. Volatility in Raw Material Prices

3.3. Government Initiatives

3.3.1. BPCL

3.3.2. Swachh Bharat Abhiyan

3.3.3. Innovative Biodegradable SAPs

3.3.4. National Policy on Biodegradable Polymers

3.4. Recent Developments

3.4.1. BASF SEs Ccycled Initiative

3.4.2. Evonik Industries AGs New Research Hub in India

3.4.3. Sanyo Chemicals Collaboration with Econic Technologies

3.4.4. LG Chem Ltd.s Expansion of SAP Production in Gujarat

3.5. SWOT Analysis

3.6. Stake Ecosystem

3.7. Competition Ecosystem

4. India Super Absorbent Polymer Market Segmentation, 2023

4.1. By Product Type (in Value)

4.1.1. Baby Diapers

4.1.2. Adult Incontinence Products

4.1.3. Feminine Hygiene Products

4.1.4. Others

4.2. By Application (in Value)

4.2.1. Hygiene Products

4.2.2. Agriculture

4.2.3. Industrial Applications

4.3. By Region (in Value)

4.3.1. North

4.3.2. South

4.3.3. East

4.3.4. West

4.4. By End-User Industry (in Value)

4.4.1. Healthcare

4.4.2. Agriculture

4.4.3. Packaging

4.4.4. Industrial

4.5. By Distribution Channel (in Value)

4.5.1. Direct Sales

4.5.2. Online Channels

4.5.3. Distributors

4.5.4. Retail Stores

5. India Super Absorbent Polymer Market Cross Comparison

5.1. Detailed Profiles of Major Companies

5.1.1. BASF SE

5.1.2. LG Chem Ltd.

5.1.3. Evonik Industries AG

5.1.4. Sumitomo Seika Chemicals Co.

5.1.5. Sanyo Chemical Industries Ltd.

5.2. Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue)

6. India Super Absorbent Polymer Market Competitive Landscape

6.1. Market Share Analysis

6.2. Strategic Initiatives

6.3. Mergers and Acquisitions

6.4. Investment Analysis

6.4.1. Venture Capital Funding

6.4.2. Government Grants

6.4.3. Private Equity Investments

7. India Super Absorbent Polymer Market Regulatory Framework

7.1. Environmental Standards

7.2. Compliance Requirements

7.3. Certification Processes

8. India Super Absorbent Polymer Market Future Market Size (in USD Mn), 2023-2028

8.1. Future Market Size Projections

8.2. Key Factors Driving Future Market Growth

9. India Super Absorbent Polymer Market Future Market Segmentation, 2028

9.1. By Product Type (in Value)

9.2. By Application (in Value)

9.3. By Region (in Value)

9.4. By End-User Industry (in Value)

9.5. By Distribution Channel (in Value)

10. India Super Absorbent Polymer Market Analysts Recommendations

10.1. TAM/SAM/SOM Analysis

10.2. Customer Cohort Analysis

10.3. Marketing Initiatives

10.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step: 1 Identifying Key Variables:

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry level information.

Step: 2 Market Building:

Collating statistics on India Super Absorbent Polymer Market over the years, penetration of marketplaces and service providers ratio to compute revenue generated for India Super Absorbent Polymer Industry. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.

Step: 3 Validating and Finalizing:

Building market hypothesis and conducting CATIs with industry experts belonging to different companies to validate statistics and seek operational and financial information from company representatives.

Step: 4 Research Output:

Our team will approach multiple chemical companies and understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from chemical companies.

Frequently Asked Questions

01 How big is India Super Absorbent Polymer Market?

The India Super Absorbent Polymer (SAP) Market was valued at USD 673 million in 2023, driven by increased demand from the hygiene products segment, including baby diapers, adult incontinence products, and feminine hygiene products.

02 What are the challenges in India Super Absorbent Polymer Market?

Challenges in India Super Absorbent Polymer include regulatory hurdles related to product safety and environmental impact, competition from alternative absorbent materials, volatility in raw material prices, and the need for continuous innovation to meet market demands.

03 Who are the major players in the India Super Absorbent Polymer Market?

Key players in the India Super Absorbent Polymer include BASF SE, LG Chem Ltd., Evonik Industries AG, Sumitomo Seika Chemicals Co., Ltd., and Sanyo Chemical Industries Ltd. These companies dominate due to their strong footholds, continuous innovation, and expanding product portfolios.

04 What are the growth drivers of India Super Absorbent Polymer Market?

The India Super Absorbent Polymer Market is propelled by factors such as the growing geriatric population, increasing demand for hygiene products, adoption of SAPs in agriculture, and government initiatives promoting water-efficient technologies and improved hygiene practices.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.