India Supermarket Industry Outlook to 2030

Region:Asia

Author(s):Shubham Kashyap

Product Code:KROD929

July 2024

99

About the Report

India Supermarket Industry Overview

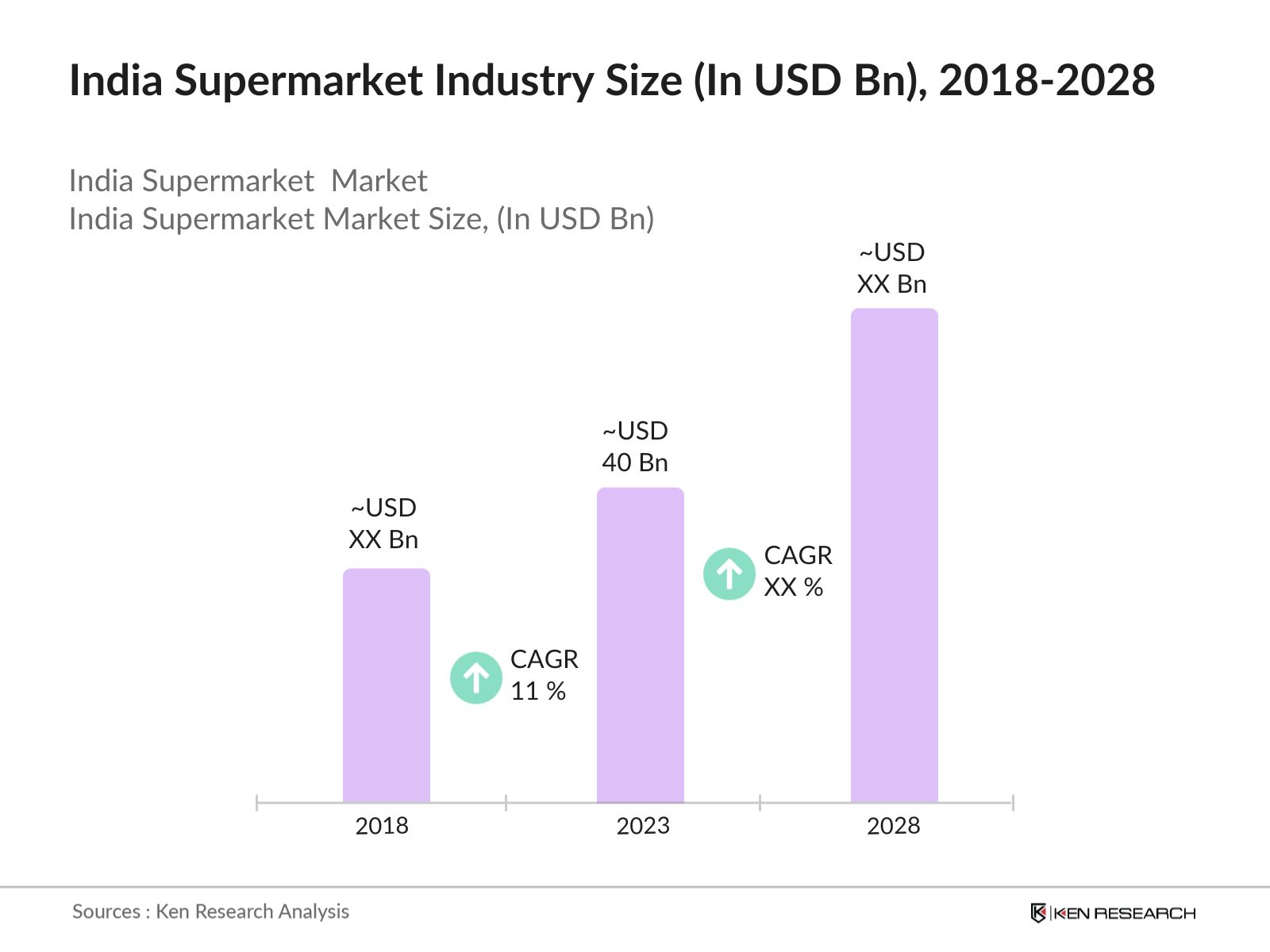

- The India supermarket industry is valued at USD 40 billion in 2023 growing at a CAGR of 11% between 2018-2023 driven by increasing urbanization, rising disposable incomes, and changing consumer preferences.

- Key players in the market include Reliance Retail, Avenue Supermarkets (DMart), Spencer's Retail, and Amazon India. The Indian supermarket industry is characterized as fragmented as it comprises a vast number of players, ranging from large national chains to numerous regional and local players.

- In 2023, Reliance Retail was the largest supermarket chain in the country with over 12,000 stores across India, providing extensive reach and convenience to customers. This widespread presence ensures consistent footfall and higher sales volumes, supporting economies of scale and more efficient logistics.

India Supermarket Current Market Analysis

- The expansion of the supermarket sector in India has notably influenced various markets. The supermarket industry has had a profound impact on the Indian retail landscape. It has revolutionized the way consumers shop by offering a one-stop solution for groceries, household items, and personal care products.

- The Indian supermarket industry is predominantly dominated by urban regions, with significant contributions from metropolitan cities. Mumbai, as one of the largest cities in India hosts a variety of supermarkets and hypermarkets. DMart, Reliance Fresh, and Big Bazaar have a strong presence in this region.

- India is experiencing rapid urbanization, with a significant shift of the population from rural to urban areas. According to the World Bank, the urban population in India increased from 31.16% in 2011 to 34.93% in 2020, and it is projected to reach 40% by 2030.

India Supermarket Industry Segmentation

The India Supermarket Industry is segmented based on various factors such as Product, Distribution Channel, and Region.

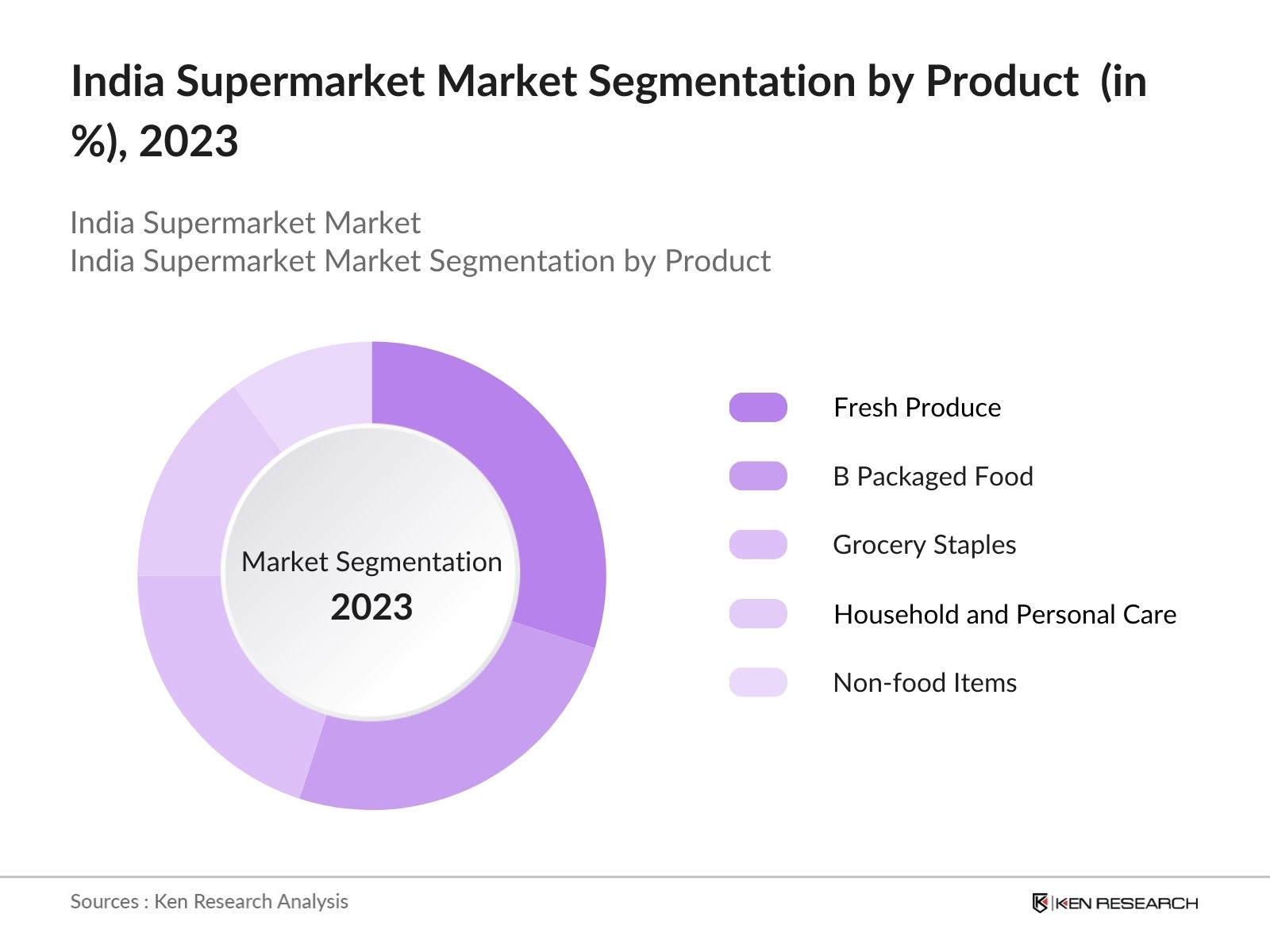

By Product: The India Supermarket Industry is segmented by products into Fresh Produce, Packaged Food, Grocery Staples, Household and Personal Care, and Non-food Items. In 2023, the grocery segment holds the highest market share as it includes essential items that are frequently purchased by consumers. Supermarkets offer a wide variety of grocery products, catering to daily needs. The consistent demand for groceries ensures regular footfall in stores and stable revenue.

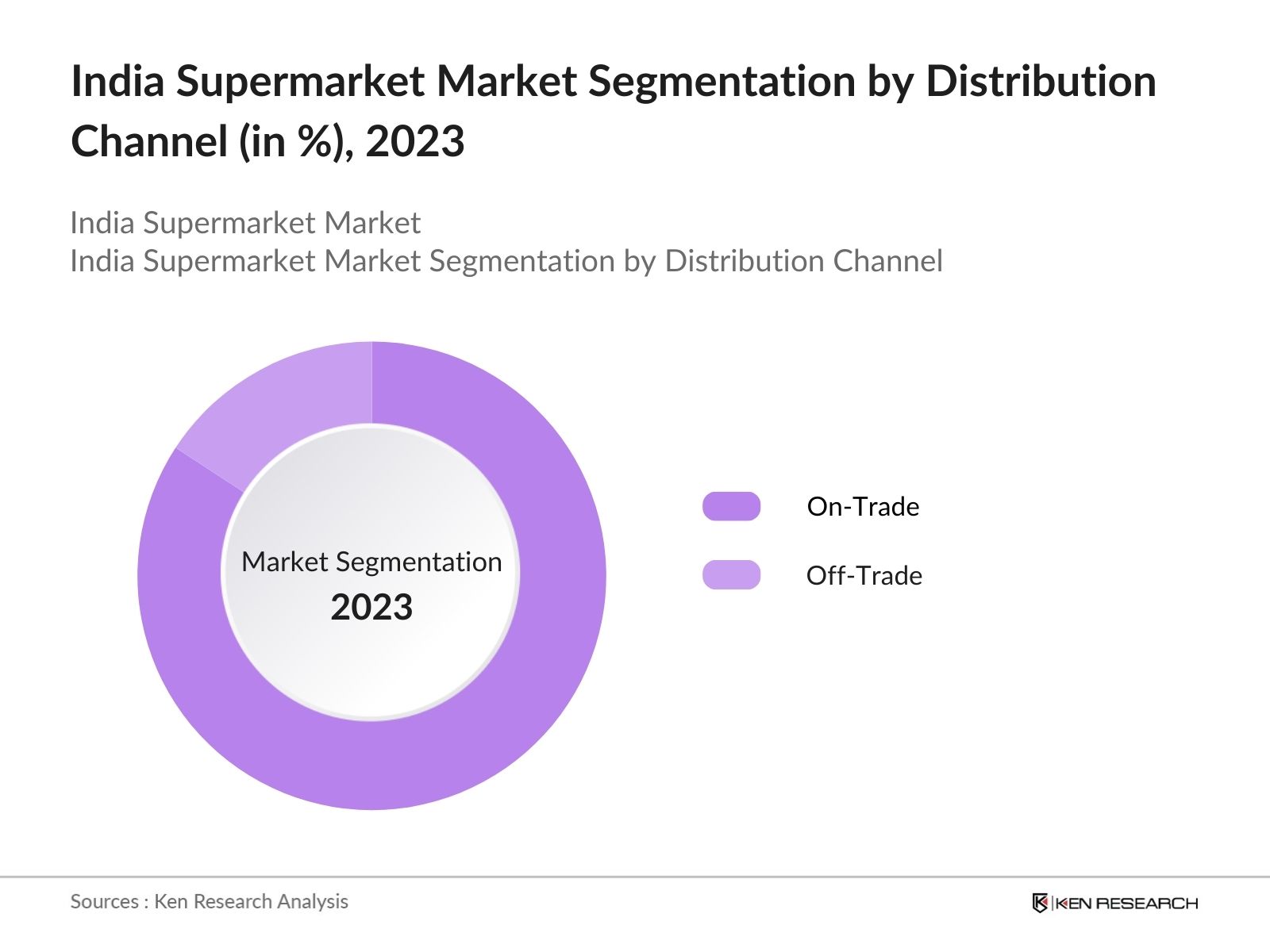

By Distribution Channel: The India Supermarket Industry is segmented by distribution channel into Offline Channels and Online Channel. In 2023, Hypermarkets dominate due to their ability to offer a vast range of products at competitive prices. They provide a one-stop shopping experience, which is highly valued by consumers. Their large format stores can accommodate extensive inventories, enabling bulk purchases and discounts, which attract cost-conscious shoppers.

By Region: The India Supermarket Industry is segmented into North, South, East, and West. West India stands out as the dominant region in the Indian Supermarket Industry due to its high level of urbanization and economic development. The region hosts the headquarters and numerous outlets of major supermarket chains like DMart and Reliance Fresh making it a central hub for the Supermarket Industry.

India Supermarket Industry Competitive Landscape

Reliance Fresh: Reliance Retail, one of India's largest retail companies, continues to make significant strides to expand and innovate. In 2023, Reliance Industries announced its intention to sell an 8-10% stake in Reliance Retail Ventures Ltd (RRVL) to fund further expansion, retire debt, and prepare for the IPO of its retail business.

DMart: DMart, operated by Avenue Supermarts Ltd, has been aggressively expanding its store network across India with over 350 stores across the country. In 2024, DMart has planned to open 40 new stores in several urban and semi-urban locations, enhancing its footprint significantly.

Spencer’s Retail: Spencer’s Retail has been integrating advanced technologies like AI-powered recommendation engine to enhance customer experience and operational efficiency. The company has adopted innovative solutions such as self-checkout systems, online shopping platforms, and personalized offers to stay competitive in the evolving retail landscape.

India Supermarket Industry Analysis

India Supermarket Industry Growth Drivers

- Urbanization and Growing Middle Class: The rapid urbanization in India has significantly increased the demand for supermarkets in the country. According to the Census of India, the urban population is projected to rise from 377 million in 2011 to 600 million by 2031. This urban shift is accompanied by the rise of a middle class with increasing disposable incomes, which leads to higher spending on groceries and household goods available in supermarkets. The rising disposable income among India's middle class has resulted in increased spending on supermarkets. World Bank data indicates that India's GDP per capita grew from $2,045 in 2018 to $2,202 in 2023.

- Technological Advancements and E-commerce Integration: The integration of technology in retail, such as the use of digital payment systems, self-checkout kiosks, and e-commerce platforms, is a major growth driver. The penetration of smartphones and the Internet in urban and rural areas has facilitated the growth of online grocery shopping. The number of online shoppers is expected to reach 500 million by 2030 from 150 million in 2020.

India Supermarket Industry Challenges

- Supply Chain Inefficiencies: The lack of cold storage facilities and poor logistics infrastructure leads to high levels of food wastage. According to the Ministry of Food Processing Industries, around approximately 30% of fruits and vegetables produced in India are wasted annually due to inadequate supply chain management.

- High Real Estate Costs: The cost of acquiring and maintaining retail space in prime urban locations is a considerable barrier. Real estate costs in major cities like Mumbai and Delhi are among the highest in the world. According to JLL India, retail real estate prices in these cities have increased by 9% annually, which affects the profitability of supermarket chains.

- Competition from Unorganized Retail: The Indian retail market is still largely dominated by unorganized retail, which includes local kirana stores and street vendors. These unorganized retailers have strong relationships with local consumers and operate with lower overhead costs. As a result, they often offer competitive prices that supermarkets find challenging to match.

India Supermarket Industry Government Initiatives

- 100% FDI in Single-Brand Retail: The Indian government has allowed 100% foreign direct investment in single-brand retail under the automatic route. This policy has encouraged global retailers to enter the Indian market, leading to increased competition and better services for consumers. As of 2023, several global retail giants have announced plans to expand in India due to this policy.

- Pradhan Mantri Kisan SAMPADA Yojana:This scheme aims to create modern infrastructure for the food processing sector, which directly benefits supermarkets by ensuring a steady supply of high-quality processed foods. The scheme has an outlay of Rs. 6,000 crore and is expected to benefit 20 lakh farmers and create 5 lakh jobs by 2025.

- Digital India Initiative: The Digital India campaign promotes digital payment systems, which are widely adopted by supermarkets for seamless transactions. The initiative has led to a significant increase in digital transactions, with UPI transactions reaching Rs. 17.39 lakh crore in November 2023.

India Supermarket Industry Future Outlook

The future outlook for the Indian Supermarket Industry is promising key factors and trends such as Continued Urbanization and Population Growth, Technological Integration and E-commerce Growth, and Government Initiatives and Policy Support.

Future Market Trends

- Omnichannel Retailing: Supermarkets will increasingly adopt an omnichannel approach to reach customers through multiple touchpoints. This will include integrating online and offline channels to provide a seamless shopping experience. Retailers using omnichannel strategies will see higher customer lifetime value compared to those using a single channel.

- Sustainability and Eco-friendly Practices: There will be a growing trend towards sustainability in the supermarket sector. As consumers become more aware of environmental issues, they will prefer retailers who adopt eco-friendly practices. Supermarkets will respond by reducing plastic usage, sourcing sustainable products, and implementing energy-efficient practices.

Scope of the Report

|

By Product |

Fresh Produce Packaged Food Grocery Staples Household and Personal Care Non-food Items |

|

By Distribution Channel |

Offline Channels Online Channel |

|

By Region |

North South East West |

Products

Key Target Audience – Organizations and Entities Who Can Benefit by Subscribing This Report

Retail Chains and Supermarkets

Real Estate Developers

FMCG Companies

E-commerce Platforms

Government Bodies and Policy Makers (Ministry of Consumer Affairs, Food and Public Distribution)

All India Retail Traders Association (AIRTA)

Supply Chain and Logistics Companies

Time Period Captured in the Report

- Historical Period: 2018-2023

- Base Year: 2023

- Forecast Period: 2023-2028

Companies

Players Mentioned in the Report:Â

Reliance Retail

Avenue Supermarts (DMart)

Spencer's Retail

Amazon India

More Retail

Walmart India

Spar Hypermarkets

Star Bazaar

Godrej Nature's Basket

Nilgiris

HyperCity

Patanjali Ayurved

Trent Hypermarket

Aditya Birla Retail (More)

Metro Cash & Carry

Ratnadeep Super Market

Vishal Mega Mart

Flipkart Groceries

Table of Contents

1. India Supermarket Industry Overview

1.1 India Supermarket Industry Taxonomy

2. India Supermarket Industry Size (in USD Bn), 2018-2023

3. India Supermarket Industry Analysis

3.1 India Supermarket Industry Growth Drivers

3.2 India Supermarket Industry Challenges and Issues

3.3 India Supermarket Industry Trends and Development

3.4 India Supermarket Industry Government Regulation

3.5 India Supermarket Industry SWOT Analysis

3.6 India Supermarket Industry Stake Ecosystem

3.7 India Supermarket Industry Competition Ecosystem

4. India Supermarket Industry Segmentation, 2023

4.1 India Supermarket Industry Segmentation by Product (in %), 2023

4.2 India Supermarket Industry Segmentation by Distribution Channel (in %), 2023

4.3 India Supermarket Industry Segmentation by Region (in %), 2023

5. India Supermarket Industry Competition Benchmarking

5.1 India Supermarket Industry Cross-Comparison (no. of employees, company overview, business strategy, USP, recent development, operational parameters, financial parameters and advanced analytics)

6. India Supermarket Industry Future Market Size (in USD Bn), 2023-2028

7. India Supermarket Industry Future Market Segmentation, 2028

7.1 India Supermarket Industry Segmentation by Product (in %), 2028

7.2 India Supermarket Industry Segmentation by Distribution Channel (in %), 2028

7.3 India Supermarket Industry Segmentation by Region (in %), 2028

8. India Supermarket Industry Analysts’ Recommendations

8.1 India Supermarket Industry TAM/SAM/SOM Analysis

8.2 India Supermarket Industry Customer Cohort Analysis

8.3 India Supermarket Industry Marketing Initiatives

8.4 India Supermarket Industry White Space Opportunity Analysis

9. Disclaimer

10. Contact Us

Research Methodology

Step 1 Identifying Key Variables:

Â

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry level information.Â

Â

Step 2 Market Building:

Â

Collating statistics on India Supermarket Industry over the years, penetration of marketplaces and service providers ratio to compute revenue generated for India Supermarket Industry. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.Â

Â

Step 3 Validating and Finalizing:

Â

Building market hypothesis and conducting CATIs with industry experts belonging to different companies to validate statistics and seek operational and financial information from company representatives.Â

Â

Step 4 Research output:

Â

Our team will approach multiple retail companies and understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from Supermarket companies.Â

Frequently Asked Questions

01 How big is India Supermarket Industry?

The India Supermarket market was valued at USD 40 billion in 2023, demonstrating significant growth driven by Urbanization and Rising Middle Class, Shift in Consumer Preferences, and Technological Advancements and E-commerce Integration

02 Who are the major players in the India Supermarket Industry?

Some of the major players in the market include Reliance Retail, Future Group, Avenue Supermarts (DMart), Spencer's Retail, and Amazon India which dominates the market owing to their extensive distribution networks, strong brand presence, and diverse product portfolios.

03 What are the growth drivers for India Supermarket Industry?

Some of the major growth drivers in the India Supermarket Industry include Urbanization and Rising Middle Class, Shift in Consumer Preferences, and Technological Advancements and E-commerce Integration.

04 What are the challenges in the India Supermarket Industry?

Some of the key challenges in the India Supermarket Industry include competition from Supply Chain Inefficiencies, High Real Estate Cost, Competition from Unorganized Retail.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.