India Surgical Sutures Market Outlook 2030

Region:Global

Author(s):Shivani Mehra

Product Code:KROD11415

December 2024

94

About the Report

India Surgical Sutures Market Overview

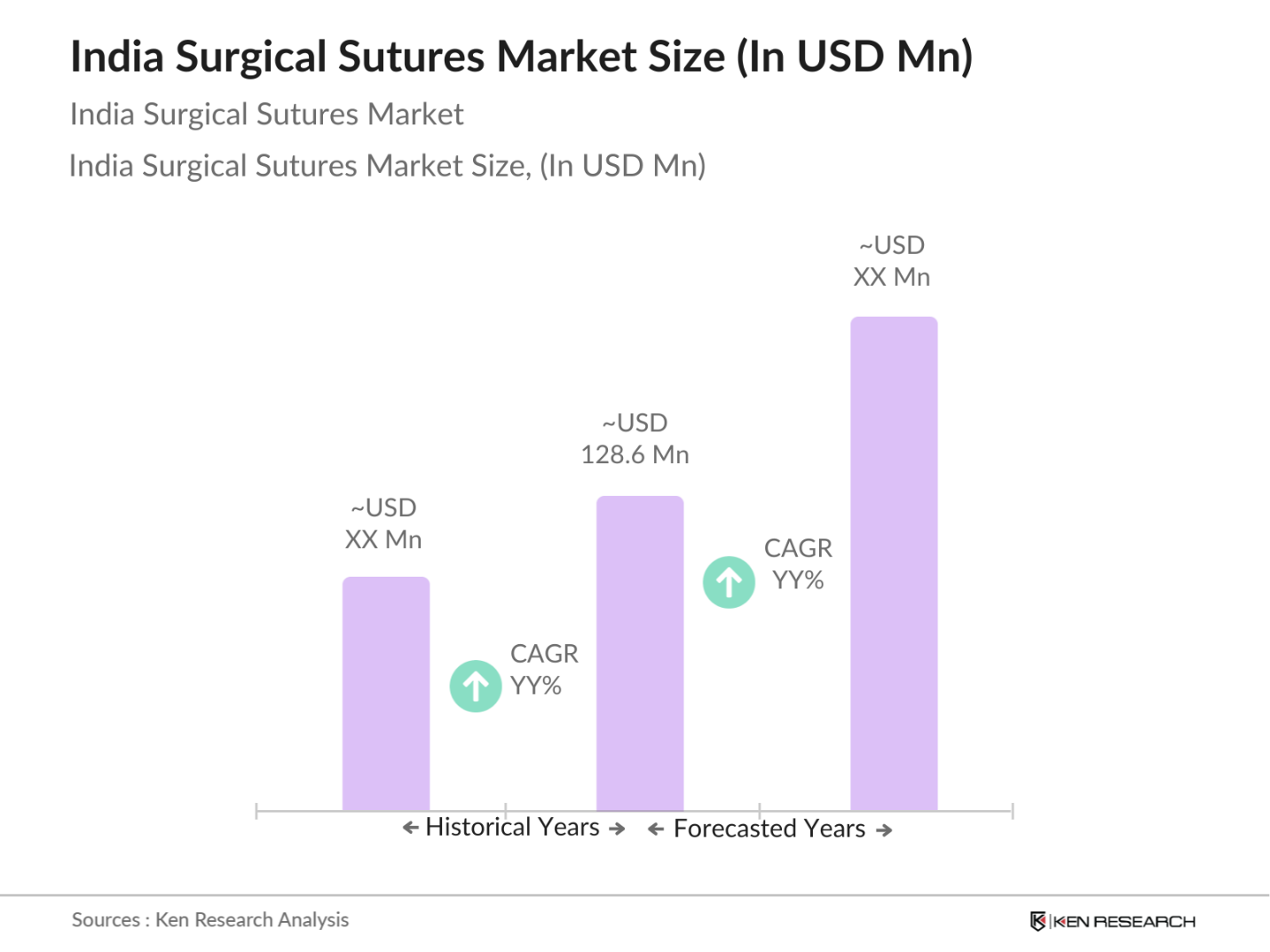

- The India Surgical Sutures market is valued at USD 128.6 million, reflecting robust growth driven by the issncreasing volume of surgical procedures and a rise in healthcare spending. The demand for advanced surgical techniques and the growing preference for minimally invasive surgeries are key factors propelling market expansion. The market is also influenced by innovations in suture technology, including the development of absorbable sutures and antimicrobial options, which enhance patient safety and recovery times.

- Key cities such as Mumbai, Delhi, and Bangalore dominate the surgical sutures market due to their advanced healthcare infrastructure, high population density, and concentration of leading hospitals and surgical centers. Additionally, these regions host a significant number of healthcare professionals and specialists, facilitating the adoption of new surgical techniques and products. The increasing number of healthcare facilities in these urban areas further supports the growth of the surgical sutures market.

- Government regulations regarding medical devices, particularly surgical sutures, are becoming increasingly stringent to ensure patient safety and product efficacy. The CDSCO has implemented comprehensive guidelines for the classification, testing, and approval of medical devices. As of 2023, all medical devices, including surgical sutures, must comply with ISO 13485 standards, which mandate quality management systems. These regulations are designed to minimize risks associated with surgical procedures, fostering greater trust in the safety and effectiveness of suturing solutions available in the market.

India Surgical Sutures Market Segmentation

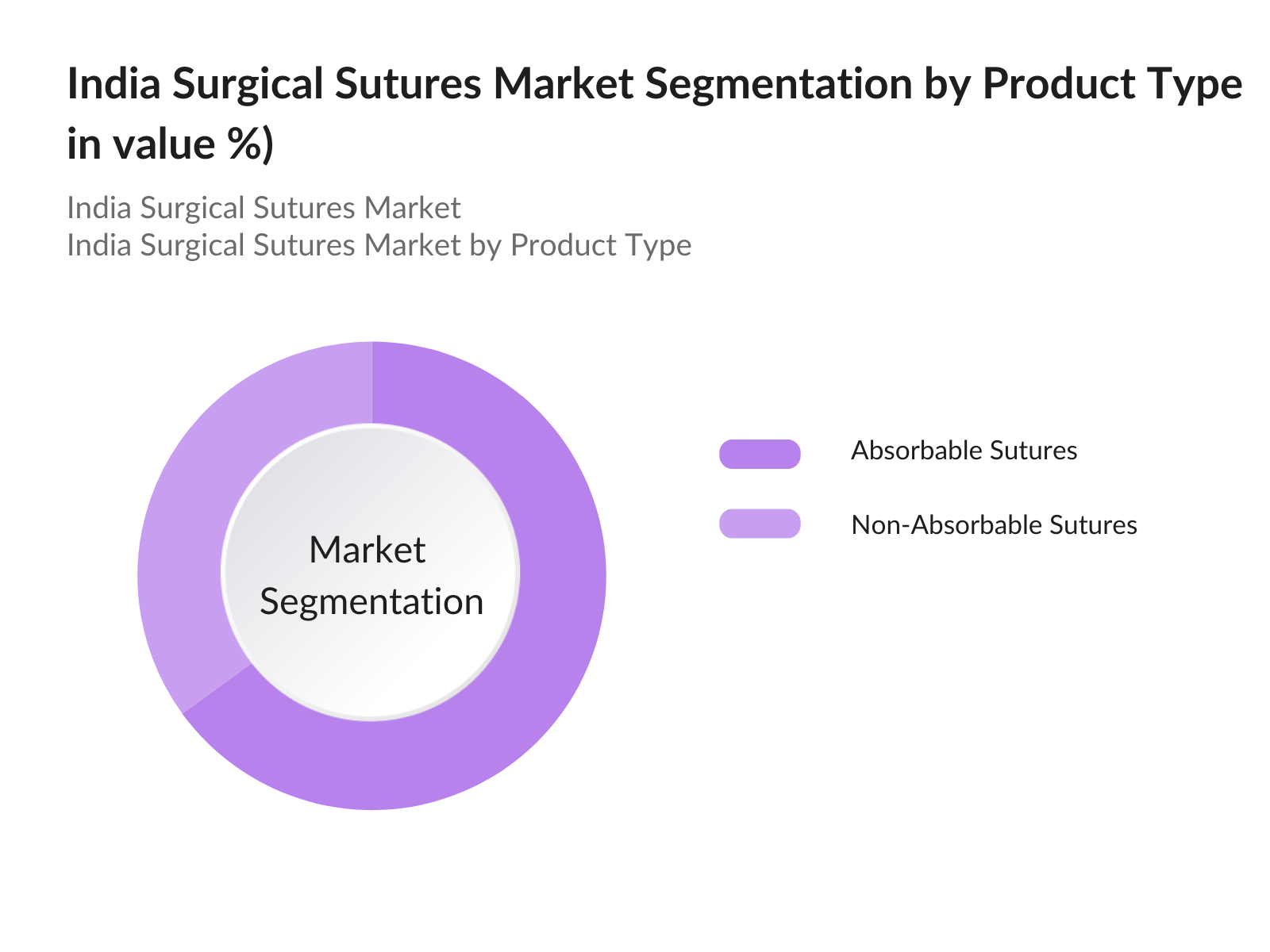

By Product Type: The India Surgical Sutures market is segmented by product type into absorbable sutures and non-absorbable sutures. Currently, absorbable sutures hold a dominant market share due to their increasing use in various surgical procedures. These sutures are designed to dissolve naturally in the body over time, eliminating the need for suture removal and thereby reducing patient discomfort and hospital visits. The rising preference among surgeons for absorbable sutures is attributed to advancements in material technology, making these sutures more reliable and effective.

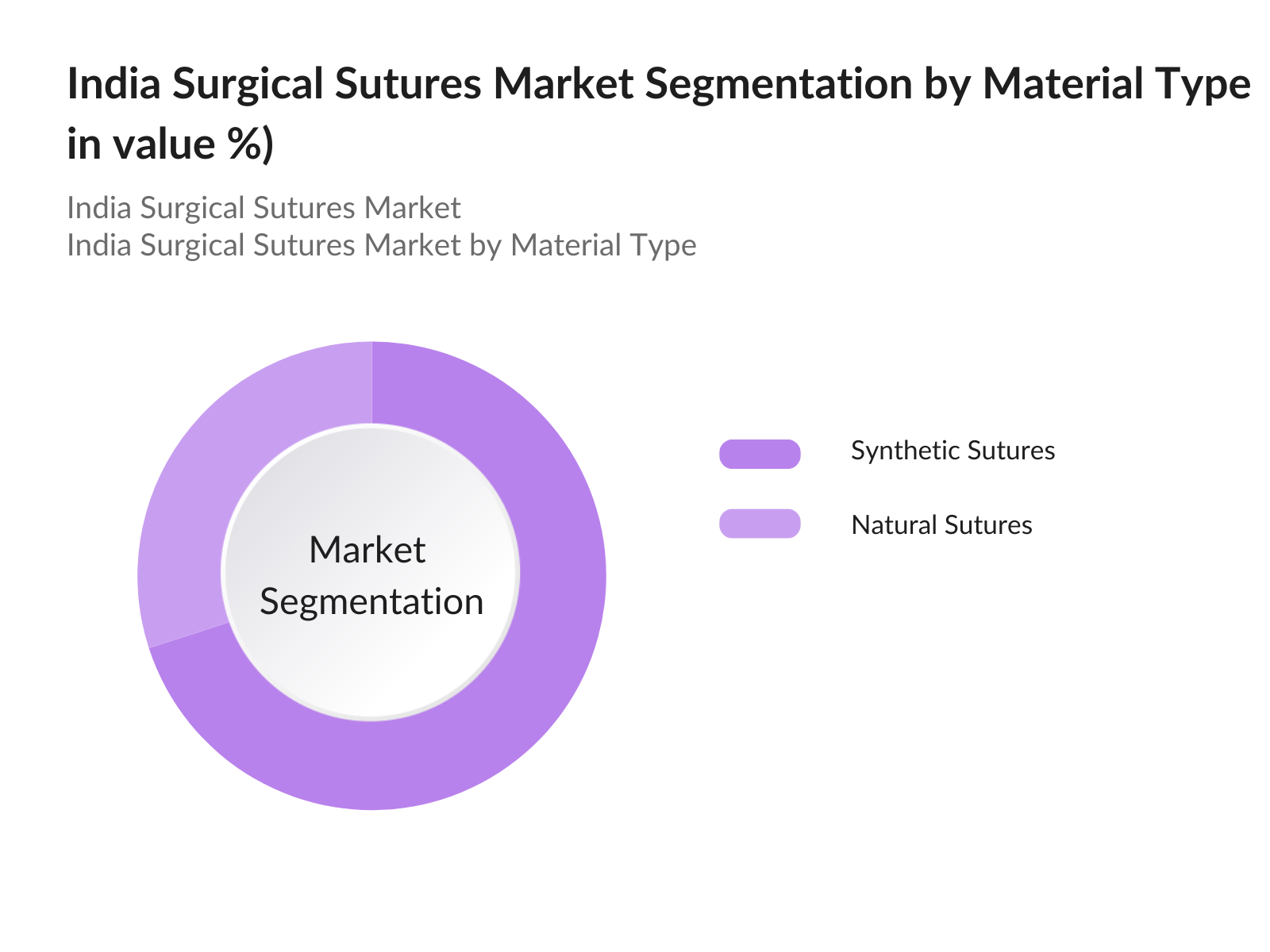

By Material Type: The market is further segmented by material type into natural sutures and synthetic sutures. Synthetic sutures dominate the market due to their favorable properties, such as increased strength, reduced tissue reactivity, and varied absorption rates. They are commonly used in a wide array of surgical procedures, including cardiovascular, orthopedic, and plastic surgeries. The ability to tailor synthetic sutures for specific applications, combined with ongoing innovations in material science, continues to enhance their market position.

India Surgical Sutures Market Competitive Landscape

The India Surgical Sutures market is dominated by several key players, including both local manufacturers and international brands. The competitive landscape is characterized by continuous innovation and strategic partnerships aimed at enhancing product offerings and expanding market reach.

|

Company Name |

Establishment Year |

Headquarters |

Market Presence |

Product Range |

R&D Investment |

Distribution Network |

Customer Base |

|

Johnson & Johnson |

1886 |

New Brunswick, USA |

|||||

|

Medtronic |

1949 |

Dublin, Ireland |

|||||

|

B. Braun Melsungen AG |

1839 |

Melsungen, Germany |

|||||

|

Ethicon, Inc. |

1903 |

Somerville, USA |

|||||

|

Smith & Nephew |

1856 |

London, UK |

India Surgical Sutures Market Analysis

Market Growth Drivers

- Increasing Surgical Procedures: The number of surgical procedures in India is on the rise, with over 28 million surgeries performed annually as of 2023. Factors contributing to this growth include increasing incidences of chronic diseases such as cardiovascular diseases, which affect approximately 63 million individuals in India. The World Health Organization (WHO) emphasizes the importance of surgical interventions in treating these conditions. Moreover, advancements in surgical techniques and the availability of better healthcare facilities have led to a surge in elective surgeries. This trend significantly boosts the demand for surgical sutures, ensuring their pivotal role in healthcare.

- Rising Healthcare Expenditure: India's healthcare expenditure is projected to reach approximately USD 200 billion by 2024, driven by a growing middle class and increased government spending on health infrastructure. The government allocated INR 2.23 trillion for healthcare in the 2023 budget, reflecting a significant commitment to enhancing healthcare access and quality. This increase in spending is leading to improved surgical facilities and resources, thereby amplifying the demand for surgical sutures. Additionally, with higher disposable incomes, patients are opting for advanced surgical procedures, which require specialized sutures, further stimulating market growth.

- Growing Geriatric Population: India's geriatric population is projected to exceed 300 million by 2025, making it a significant driver for surgical sutures. Older adults are more susceptible to chronic illnesses that often require surgical interventions, which in turn increases the demand for effective suturing solutions. According to the Ministry of Statistics and Programme Implementation, a considerable number of elderly individuals suffer from chronic conditions, necessitating surgical procedures. This demographic trend underscores a persistent need for reliable surgical sutures to facilitate recovery and improve surgical outcomes among the elderly, reflecting the market's critical role in addressing the healthcare needs of this growing population.

Market Challenges:

- Stringent Regulatory Policies: India's healthcare industry faces stringent regulatory policies governing the approval and use of medical devices, including surgical sutures. The Central Drugs Standard Control Organization (CDSCO) enforces rigorous testing and compliance standards, which can delay product launches and increase costs. The approval process can take several months, hampering the speed at which new suturing technologies can reach the market. For example, as of 2023, it can take up to 18 months for sutures to receive regulatory approval, impacting the ability of manufacturers to respond to market demands promptly.

- Risk of Infections: Infections related to surgical procedures remain a critical concern, with hospital-acquired infections (HAIs) impacting surgical patients in India as of 2023. The use of non-sterile or substandard sutures can significantly increase the risk of complications post-surgery. The Indian Council of Medical Research (ICMR) emphasizes the need for stringent infection control measures in surgical settings to mitigate these risks. This concern affects patient outcomes and can lead to increased healthcare costs, thereby impacting the demand for high-quality sutures that ensure patient safety and efficacy in surgical interventions.

India Surgical Sutures Market Future Outlook

Over the next five years, the India Surgical Sutures market is expected to witness significant growth, driven by an increase in surgical procedures, technological advancements in suture materials, and heightened healthcare investments. The ongoing focus on improving surgical outcomes and patient safety will propel demand for innovative suture solutions. Furthermore, government initiatives aimed at enhancing healthcare infrastructure will facilitate market expansion, providing opportunities for both established and emerging players in the industry.

Market Opportunities:

- Expansion in Emerging Markets: The expansion of surgical facilities in emerging markets presents a significant growth opportunity for the surgical sutures market. With over 1,200 new hospitals projected to open across tier 2 and tier 3 cities in India by 2025, access to surgical care is set to improve dramatically. This expansion necessitates an increased supply of surgical sutures, as these facilities will require reliable and advanced suturing solutions. Additionally, the government's initiative to improve healthcare infrastructure in rural areas is expected to enhance surgical service availability, further driving demand for sutures.

- Technological Innovations in Sutures: Technological advancements are paving the way for innovative suturing solutions, including smart sutures that can monitor healing and detect infections. As of 2023, companies investing in R&D for advanced sutures are expected to grow, with funding reaching USD 300 million. These innovations not only improve patient outcomes but also create a new market segment, enhancing the overall demand for surgical sutures. The integration of technology in sutures signifies a pivotal shift towards personalized and effective surgical care, providing ample growth potential in the coming years.

Scope of the Report

|

By Product Type |

Absorbable Sutures Non-Absorbable Sutures |

|

By Material Type |

Natural Sutures Synthetic Sutures |

|

By Application |

Cardiovascular Surgery Orthopedic Surgery Plastic Surgery |

|

By End-User |

Hospitals Ambulatory Surgical Centers Clinics |

|

By Region |

North-East Midwest West Coast Southern States |

Products

Key Target Audience

Hospitals

Surgical Centers

Healthcare Professionals

Investments and Venture Capitalist Firms

Government and Regulatory Bodies (Ministry of Health and Family Welfare, FDA India)

Medical Device Distributors

Surgical Equipment Suppliers

Healthcare Consultants

Companies

Players Mention in the Report

Johnson & Johnson

Medtronic

B. Braun Melsungen AG

Ethicon, Inc.

Smith & Nephew

Boston Scientific

Stryker Corporation

ConvaTec Group

Integra LifeSciences

Acelity

Milliken & Company

Surgical Specialties Corporation

Assut Medical

Medline Industries

Aesculap

Table of Contents

01. India Surgical Sutures Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

02. India Surgical Sutures Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

03. India Surgical Sutures Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Surgical Procedures

3.1.2. Advancements in Medical Technologies

3.1.3. Rising Healthcare Expenditure

3.1.4. Growing Geriatric Population

3.2. Market Challenges

3.2.1. Stringent Regulatory Policies

3.2.2. High Cost of Raw Materials

3.2.3. Risk of Infections

3.3. Opportunities

3.3.1. Expansion in Emerging Markets

3.3.2. Technological Innovations in Sutures

3.3.3. Increasing Demand for Minimally Invasive Surgeries

3.4. Trends

3.4.1. Shift Towards Biodegradable Sutures

3.4.2. Integration of Smart Technologies

3.4.3. Personalized Surgical Solutions

3.5. Government Regulation

3.5.1. Medical Device Regulations

3.5.2. Quality Assurance Standards

3.5.3. Approval Processes for Surgical Products

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Porters Five Forces

3.9. Competition Ecosystem

04. India Surgical Sutures Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Absorbable Sutures

4.1.2. Non-Absorbable Sutures

4.2. By Material Type (In Value %)

4.2.1. Natural Sutures

4.2.2. Synthetic Sutures

4.3. By Application (In Value %)

4.3.1. Cardiovascular Surgery

4.3.2. Orthopedic Surgery

4.3.3. Plastic Surgery

4.4. By End User (In Value %)

4.4.1. Hospitals

4.4.2. Ambulatory Surgical Centers

4.4.3. Clinics

4.5. By Region (In Value %)

4.5.1. North India

4.5.2. South India

4.5.3. East India

4.5.4. West India

05. India Surgical Sutures Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1. Johnson & Johnson

5.1.2. Medtronic

5.1.3. Boston Scientific

5.1.4. Smith & Nephew

5.1.5. Stryker Corporation

5.1.6. B. Braun Melsungen AG

5.1.7. Ethicon, Inc.

5.1.8. ConvaTec Group

5.1.9. Integra LifeSciences

5.1.10. Acelity

5.1.11. Milliken & Company

5.1.12. Surgical Specialties Corporation

5.1.13. Assut Medical

5.1.14. Medline Industries

5.1.15. Aesculap

5.2 Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue, Product Portfolio, Geographic Presence, Market Share, R&D Investment)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers And Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

06. India Surgical Sutures Market Regulatory Framework

6.1. Environmental Standards

6.2. Compliance Requirements

6.3. Certification Processes

07. India Surgical Sutures Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

08. India Surgical Sutures Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Material Type (In Value %)

8.3. By Application (In Value %)

8.4. By End User (In Value %)

8.5. By Region (In Value %)

09. India Surgical Sutures Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the India Surgical Sutures market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we will compile and analyze historical data pertaining to the India Surgical Sutures market. This includes assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics will be conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through computer-assisted telephone interviews (CATI) with industry experts representing a diverse array of companies. These consultations will provide valuable operational and financial insights directly from industry practitioners, which will be instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple surgical suture manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction will serve to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the India Surgical Sutures market.

Frequently Asked Questions

01. How big is the India Surgical Sutures market?

The India Surgical Sutures market is valued at USD 128.6 million, driven by the increasing volume of surgical procedures and advancements in suture technology.

02. What are the challenges in the India Surgical Sutures market?

Challenges include stringent regulatory policies, high costs of raw materials, and risks of infection associated with surgical procedures.

03. Who are the major players in the India Surgical Sutures market?

Key players include Johnson & Johnson, Medtronic, and B. Braun Melsungen AG. These companies dominate due to their extensive product offerings and strong distribution networks.

04. What are the growth drivers of the India Surgical Sutures market?

The market is propelled by increasing healthcare expenditure, the growing geriatric population, and rising demand for minimally invasive surgical options.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.