India Sustainable Packaging Market Outlook to 2030

Region:Asia

Author(s):Paribhasha Tiwari

Product Code:KROD3022

October 2024

94

About the Report

India Sustainable Packaging Market Overview

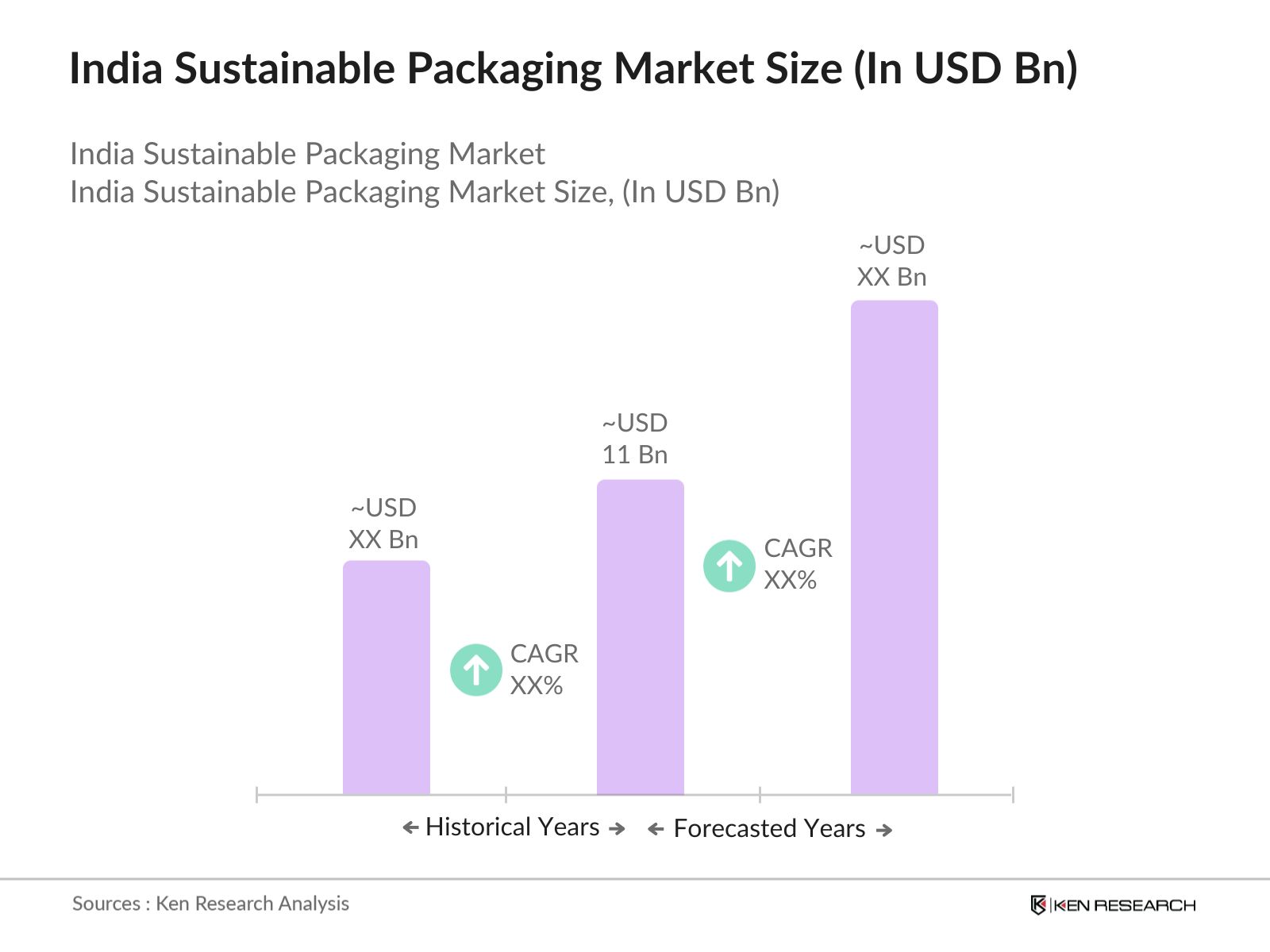

- The India sustainable packaging market is currently valued at USD 11 billion, based on a five-year historical analysis. This market is driven by the increasing demand for environmentally friendly packaging solutions, particularly from industries such as food and beverage, pharmaceuticals, and e-commerce. A growing awareness of the harmful effects of plastic on the environment, coupled with government initiatives to promote sustainable materials, has spurred demand. The emphasis on reducing plastic waste and the introduction of Extended Producer Responsibility (EPR) policies have also contributed to the markets steady growth.

- Major cities such as Mumbai, Delhi, and Bangalore dominate the sustainable packaging market in India due to their rapid industrialization, high consumption patterns, and established manufacturing sectors. These cities are home to many FMCG and pharmaceutical companies, which are leading the transition towards sustainable packaging solutions. Their dominance is further bolstered by government regulations enforcing stricter packaging waste management in metropolitan areas.

- Innovations in biodegradable and recyclable materials, driven by regulatory pressures and shifting consumer preferences have been taking place often recently. For example, companies in the fast-moving consumer goods (FMCG) and beverage industries are adopting packaging made from polylactic acid (PLA) and aluminum, which have lower carbon footprints and are highly recyclable. Collaboration between industries and regulatory bodies has increased, aiming to reduce plastic waste and implement circular economy practices, improving sustainability and reducing environmental impact.

India Sustainable Packaging Market Segmentation

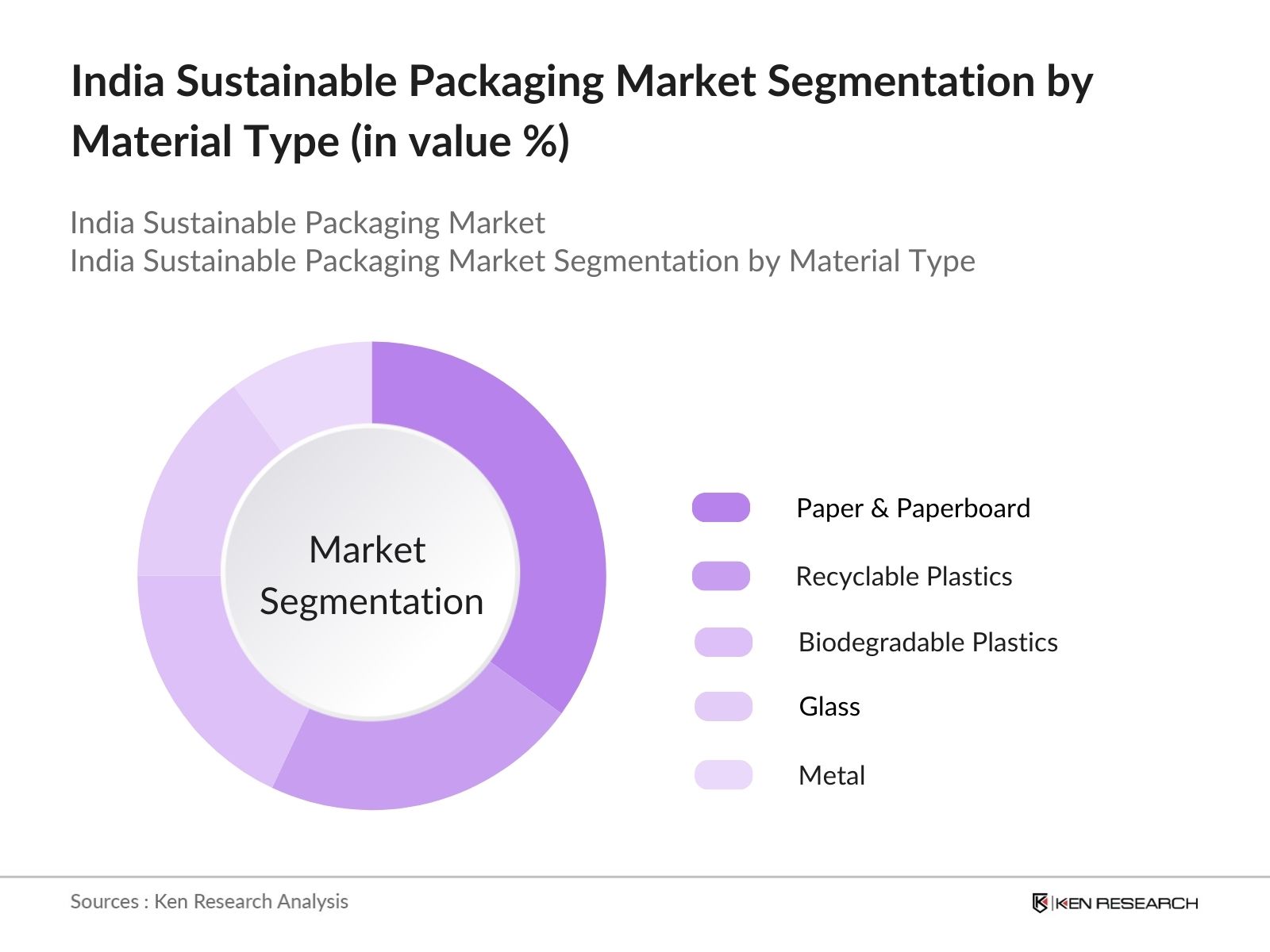

By Material Type: The India sustainable packaging market is segmented by material type into recyclable plastics, biodegradable plastics, paper & paperboard, glass, and metal. Recently, paper & paperboard have dominated the market under this segmentation due to their high recyclability and biodegradability, aligning with consumer preferences for eco-friendly packaging. Many companies have shifted to using paperboard for packaging as it provides a balance between cost and sustainability, especially in the food and beverage sector. Additionally, the Indian governments policies on reducing plastic consumption have made paper-based packaging a viable alternative.

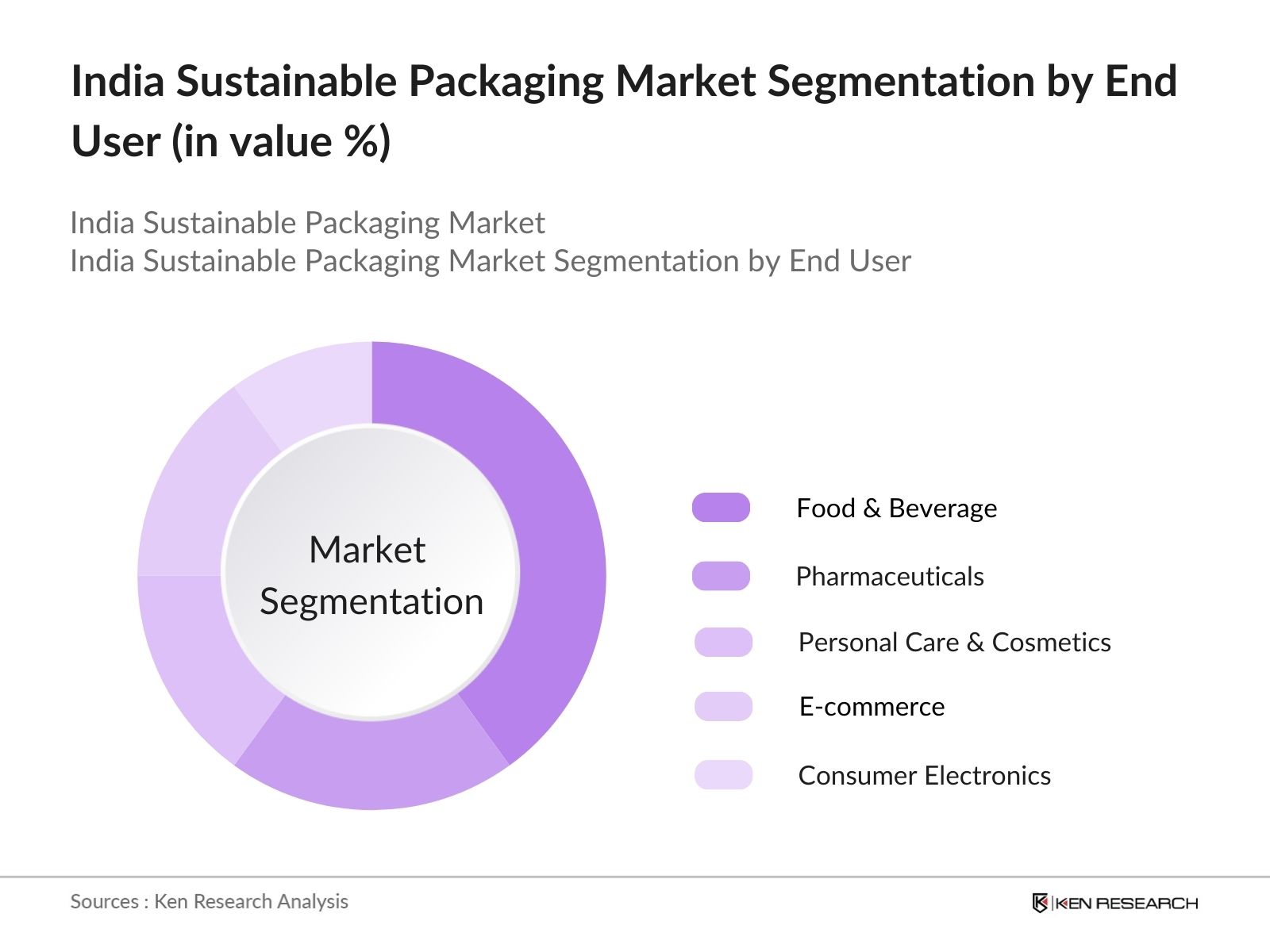

By End-User Industry: The market is also segmented by end-user industry into food & beverage, pharmaceuticals, personal care & cosmetics, consumer electronics, and e-commerce. The food & beverage segment dominates the market due to the growing demand for eco-friendly packaging to address consumer concerns about food safety and environmental impact. The industry is progressively adopting sustainable materials such as biodegradable plastics and paperboard, spurred by government regulations that promote food safety and sustainability.

India Sustainable Packaging Market Competitive Landscape

The India sustainable packaging market is dominated by a few key players, including global giants and local manufacturers. The presence of established players such as Amcor Ltd., Uflex Limited, and Huhtamaki India Ltd. indicates that the market is highly competitive. These companies are expanding their sustainable product portfolios and investing in innovative materials to stay ahead. The consolidation of key companies, driven by mergers and acquisitions, also plays a significant role in shaping the competitive landscape of the market.

Competitive Landscape Table

|

Company Name |

Established |

Headquarters |

Key Products |

Revenue (2023) |

Number of Employees |

Sustainability Initiatives |

R&D Investment |

Company Name |

Established |

|

Amcor Ltd. |

1860 |

Zurich, Switzerland |

|||||||

|

Uflex Limited |

1985 |

Noida, India |

|||||||

|

Huhtamaki India Ltd. |

1920 |

Espoo, Finland |

|||||||

|

Tetra Pak International S.A. |

1951 |

Lausanne, Switzerland |

|||||||

|

Constantia Flexibles Group |

2009 |

Vienna, Austria |

India Sustainable Packaging Market Analysis

Growth Drivers

- Consumer Demand for Eco-Friendly Packaging: The rising consumer preference for eco-friendly packaging in India is fueled by increasing awareness about the environmental impact of plastic waste. In 2023, India produced over 3.4 million tonnes of plastic waste, as reported by the Central Pollution Control Board (CPCB), driving the need for sustainable alternatives. This shift in consumer preference has led to a substantial increase in the demand for biodegradable and recyclable materials. The World Banks 2022 report on Indias urban population highlights the rapid growth in urban centers, pushing companies to innovate packaging solutions that appeal to environmentally conscious consumers.

- Government Regulations on Plastic Waste (Plastic Waste Management Rules, Extended Producer Responsibility): India's government has implemented strict regulations to reduce plastic waste, particularly through the Plastic Waste Management Rules, 2016, amended in 2022. These regulations mandate businesses to adopt Extended Producer Responsibility (EPR) and ensure waste management across the packaging lifecycle. According to the Ministry of Environment, Forest and Climate Change, these rules aim to manage the 3.5 million tonnes of plastic waste generated annually in India. EPR encourages collaboration between manufacturers and recyclers, promoting sustainable packaging initiatives across the industry.

- Expansion of E-commerce (Sustainability Trends in Packaging): E-commerce expansion in India has transformed the packaging landscape, with online retail expected to ship over 8 billion parcels in 2024, according to the Indian Ministry of Commerce. This surge drives the need for sustainable packaging to reduce waste from single-use plastics. Major e-commerce platforms like Flipkart and Amazon India are incorporating eco-friendly packaging materials, such as recycled paper and biodegradable alternatives, aligning with sustainability trends. Such shifts are supported by consumer pressure and government regulations, creating a solid foundation for sustainable packaging solutions.

Challenges

- High Production Costs of Sustainable Packaging: Despite consumer demand, the cost of producing sustainable packaging in India remains high. According to a 2024 report by the Ministry of Commerce and Industry, materials like biodegradable plastics can cost up to 40% more than conventional plastics. This is due to limited local manufacturing capabilities and the import dependency on raw materials like polylactic acid (PLA). This significant cost barrier makes it challenging for small and medium enterprises (SMEs) to adopt sustainable alternatives at scale, despite regulatory pressures.

- Lack of Recycling Infrastructure: Indias recycling infrastructure lags behind the growing demand for sustainable packaging solutions. In 2023, the Central Pollution Control Board (CPCB) reported that only 60% of plastic waste is recycled annually, leaving a substantial amount unmanaged. The lack of a cohesive national recycling framework complicates efforts to manage post-consumer waste from sustainable packaging. Although initiatives like Swachh Bharat Mission promote waste segregation, the infrastructure needed to process biodegradable or recycled packaging materials is still in its infancy. This gap limits the scalability of sustainable packaging solutions.

India Sustainable Packaging Market Future Outlook

Over the next five years, the India sustainable packaging market is expected to witness steady growth, driven by rising consumer demand for eco-friendly products and strong government regulations promoting sustainable waste management. Additionally, advancements in biodegradable and recyclable materials will create new opportunities for growth within the market. Companies are also expected to focus more on integrating circular economy principles, such as closed-loop recycling systems, into their packaging processes, further contributing to market expansion.

Market Opportunities

- Innovations in Biodegradable Materials: Technological advancements in biodegradable materials present a significant opportunity for the sustainable packaging market in India. The Indian Institute of Technology (IIT) is developing plant-based polymers that can replace conventional plastic. These innovations could reduce Indias reliance on imported raw materials, such as PLA, and promote local manufacturing. In 2023, IIT researchers reported progress on creating packaging materials that decompose within 180 days, which could revolutionize food and beverage packaging. These materials not only reduce plastic waste but also align with government regulations on sustainability.

- Circular Economy Initiatives: The Indian government's push towards a circular economy has opened new avenues for sustainable packaging. The National Resource Efficiency Policy, 2023, encourages businesses to adopt closed-loop systems that reuse packaging materials. This initiative has gained traction in the fast-moving consumer goods (FMCG) sector, where companies are collaborating with recycling firms to develop reusable packaging solutions. According to the Ministry of Environment, India could save up to 2 million tonnes of plastic waste annually by transitioning to a circular packaging economy, offering significant environmental and economic benefits.

Scope of the Report

|

Segment |

Sub-segments |

|

By Material Type |

Recyclable Plastics Biodegradable Plastics Paper & Paperboard Glass Metal |

|

By Packaging Type |

Flexible Packaging Rigid Packaging Cartons Bags & Pouches Bottles & Jars |

|

By End-User Industry |

Food & Beverage Pharmaceuticals Personal Care & Cosmetics Consumer Electronics E-commerce |

|

By Distribution Channel |

Direct Sales Indirect Sales (Retail, Online) |

|

By Region |

North South West East |

Products

Key Target Audience

Packaging Manufacturers

FMCG Companies

Pharmaceutical Companies

Food & Beverage Industry

E-commerce Firms

Investments and Venture Capital Firms

Government and Regulatory Bodies (Ministry of Environment, Forest and Climate Change, Central Pollution Control Board)

Retailers and Distributors

Companies

Players mentioned in the report:

Amcor Ltd.

Uflex Limited

Huhtamaki India Ltd.

Tetra Pak International S.A.

Constantia Flexibles Group

Berry Global Inc.

DS Smith Plc

Sealed Air Corporation

Mondi Group

WestRock Company

Smurfit Kappa Group

Ball Corporation

Crown Holdings, Inc.

Essel Propack Limited

Plastindia International

Table of Contents

1. India Sustainable Packaging Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. India Sustainable Packaging Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. India Sustainable Packaging Market Analysis

3.1. Growth Drivers

3.1.1. Consumer Demand for Eco-Friendly Packaging

3.1.2. Government Regulations on Plastic Waste (Plastic Waste Management Rules, Extended Producer Responsibility)

3.1.3. Expansion of E-commerce (Sustainability Trends in Packaging)

3.1.4. Rise in Global Sustainability Standards

3.2. Market Challenges

3.2.1. High Production Costs of Sustainable Packaging

3.2.2. Lack of Recycling Infrastructure

3.2.3. Consumer Misconceptions about Sustainable Packaging

3.2.4. Supply Chain Disruptions

3.3. Opportunities

3.3.1. Innovations in Biodegradable Materials

3.3.2. Circular Economy Initiatives

3.3.3. Collaboration with FMCG Companies for Green Packaging

3.3.4. Expansion in Tier-2 and Tier-3 Cities

3.4. Trends

3.4.1. Adoption of Recyclable Packaging Materials (Plant-Based Plastics, Paper-Based Packaging)

3.4.2. Increased Focus on Compostable Packaging

3.4.3. Smart Packaging Solutions (QR Codes for Sustainability Transparency)

3.4.4. Shift Towards Minimalist Packaging Designs

3.5. Government Regulation

3.5.1. Plastic Waste Management Rules

3.5.2. Ban on Single-Use Plastics

3.5.3. Green Packaging Certification Programs

3.5.4. Subsidies for Sustainable Packaging Technologies

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. India Sustainable Packaging Market Segmentation

4.1. By Material Type (In Value %)

4.1.1. Recyclable Plastics

4.1.2. Biodegradable Plastics

4.1.3. Paper & Paperboard

4.1.4. Glass

4.1.5. Metal

4.2. By Packaging Type (In Value %)

4.2.1. Flexible Packaging

4.2.2. Rigid Packaging

4.2.3. Cartons

4.2.4. Bags & Pouches

4.2.5. Bottles & Jars

4.3. By End-User Industry (In Value %)

4.3.1. Food & Beverage

4.3.2. Pharmaceuticals

4.3.3. Personal Care & Cosmetics

4.3.4. Consumer Electronics

4.3.5. E-commerce

4.4. By Distribution Channel (In Value %)

4.4.1. Direct Sales

4.4.2. Indirect Sales (Retail, Online)

4.5. By Region (In Value %)

4.5.1. North India

4.5.2. South India

4.5.3. West India

4.5.4. East India

5. India Sustainable Packaging Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Amcor Ltd.

5.1.2. Mondi Group

5.1.3. Tetra Pak International S.A.

5.1.4. Uflex Limited

5.1.5. Huhtamaki India Ltd.

5.1.6. Essel Propack Limited

5.1.7. Constantia Flexibles Group GmbH

5.1.8. Berry Global Inc.

5.1.9. DS Smith Plc

5.1.10. Smurfit Kappa Group

5.1.11. WestRock Company

5.1.12. Sealed Air Corporation

5.1.13. Ball Corporation

5.1.14. Crown Holdings, Inc.

5.1.15. Plastindia International

5.2. Cross Comparison Parameters (Number of Employees, Headquarters, Revenue, Sustainability Initiatives, Market Penetration, Key Products, Production Facilities, Mergers and Acquisitions)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. India Sustainable Packaging Market Regulatory Framework

6.1. Plastic Waste Management Rules

6.2. Extended Producer Responsibility (EPR)

6.3. Sustainable Packaging Certifications (FSC, BPI Certification)

6.4. Environmental Impact Assessment for Packaging

7. India Sustainable Packaging Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. India Sustainable Packaging Future Market Segmentation

8.1. By Material Type (In Value %)

8.2. By Packaging Type (In Value %)

8.3. By End-User Industry (In Value %)

8.4. By Distribution Channel (In Value %)

8.5. By Region (In Value %)

9. India Sustainable Packaging Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

The first step involves identifying the key variables that influence the India Sustainable Packaging Market, which includes factors like consumer demand, government regulations, and technological innovations. Extensive desk research and analysis of secondary data sources, including industry reports and proprietary databases, were utilized to establish the key metrics.

Step 2: Market Analysis and Construction

In this phase, historical data on market performance and product segmentation were compiled and analyzed. The assessment included metrics on material types, end-user industries, and sustainability initiatives within the market. This data was further corroborated through multiple internal and external data sources.

Step 3: Hypothesis Validation and Expert Consultation

The market assumptions and growth hypotheses were validated through interviews with experts from the packaging industry. These consultations provided a deeper understanding of industry dynamics, production methods, and challenges, ensuring the accuracy of the analysis.

Step 4: Research Synthesis and Final Output

The final stage involved synthesizing the data and producing the report, which included market size estimates, segmentation, and key player analysis. The report is cross-validated using bottom-up and top-down approaches to provide a comprehensive market overview.

Frequently Asked Questions

01. How big is the India Sustainable Packaging Market?

The India sustainable packaging market is valued at USD 11 billion, driven by increasing demand for eco-friendly materials and government regulations aimed at reducing plastic waste.

02.What are the challenges in the India Sustainable Packaging Market?

Challenges in the India Sustainable Packaging Market include high production costs for sustainable materials, lack of adequate recycling infrastructure, and supply chain disruptions, particularly for biodegradable packaging.

03.Who are the major players in the India Sustainable Packaging Market?

Major players in the India Sustainable Packaging Market include Amcor Ltd., Uflex Limited, Huhtamaki India Ltd., Tetra Pak International S.A., and Constantia Flexibles Group. These companies dominate due to their innovative product lines and strong market presence.

04.What are the growth drivers of the India Sustainable Packaging Market?

Growth drivers in the India Sustainable Packaging Market include increasing consumer demand for eco-friendly products, government initiatives to reduce plastic waste, and the adoption of sustainable packaging by key industries such as food & beverage and pharmaceuticals.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.