India Synthetic Leather Market Outlook to 2030

Region:Asia

Author(s):Vijay Kumar

Product Code:KROD7656

November 2024

99

About the Report

India Synthetic Leather Market Overview

- The India Synthetic Leather market is valued at USD 1.83 billion, based on a five-year historical analysis. This market is primarily driven by the growing demand for cost-effective, cruelty-free alternatives to genuine leather in key industries like footwear, automotive, and furniture. Additionally, increasing consumer preference for sustainable materials and the rising fashion industry have further contributed to market growth. The government's push for local manufacturing through initiatives like Make in India has also bolstered domestic production capabilities.

- The Indian synthetic leather market is primarily dominated by cities like Delhi, Mumbai, and Chennai, which are key manufacturing hubs for footwear and automotive upholstery. These cities host significant production facilities and are home to major players in the industry due to their access to raw materials, skilled labor, and proximity to major ports for both domestic and international distribution. Additionally, Indias large consumer base, increasing urbanization, and government support for local manufacturing drive dominance in these regions.

- The Indian government has implemented import duties on certain types of synthetic leather to protect domestic manufacturers while offering export incentives for leather goods. In 2024, the Ministry of Commerce introduced a 10% import duty on synthetic leather imports from non-FTA countries and provided a 5% export incentive for goods manufactured using eco-friendly materials. These policies are aimed at promoting domestic production while boosting exports.

India Synthetic Leather Market Segmentation

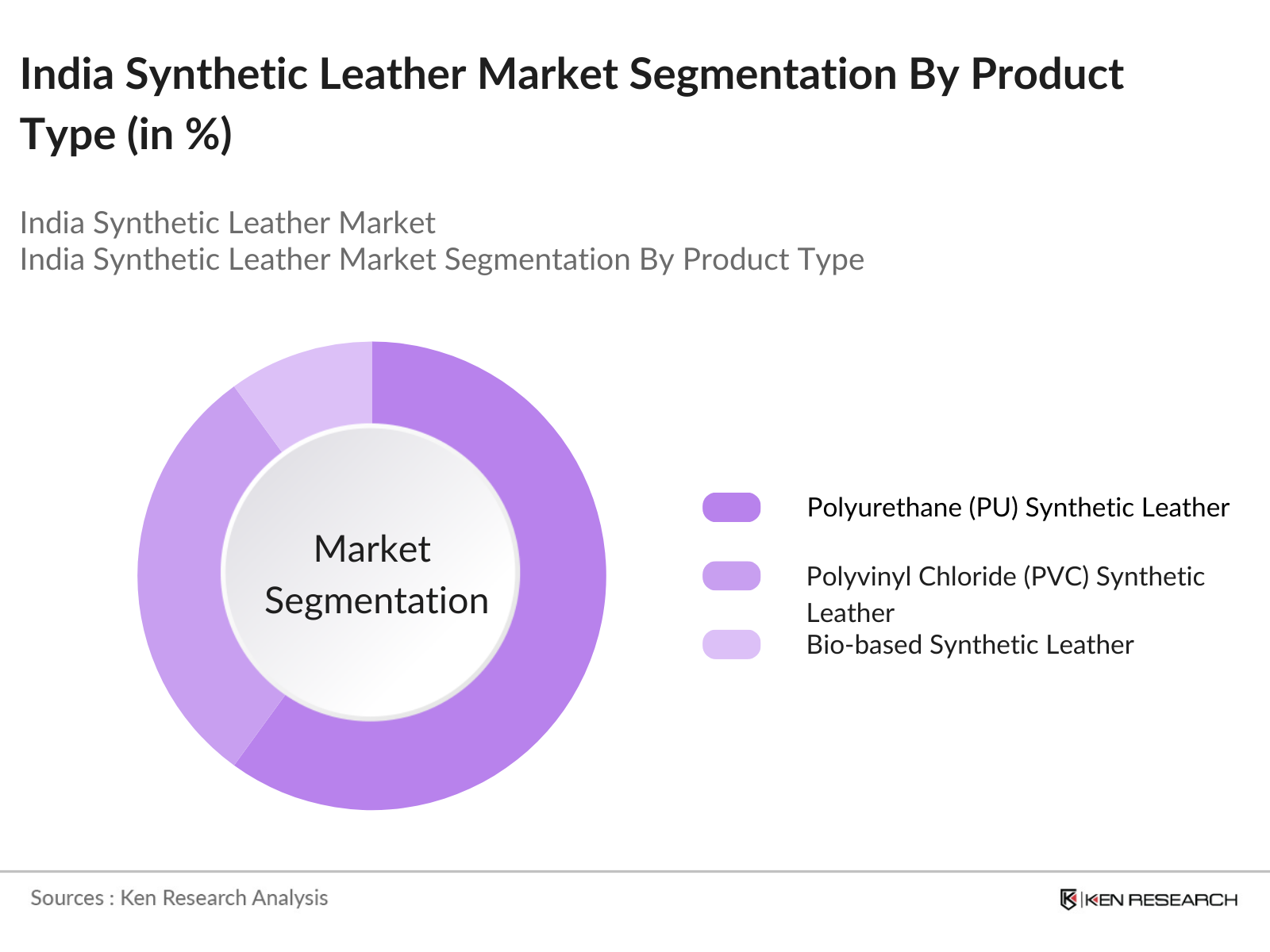

By Product Type: India's synthetic leather market is segmented by product type into Polyurethane (PU) synthetic leather, Polyvinyl Chloride (PVC) synthetic leather, and bio-based synthetic leather. PU synthetic leather dominates the market due to its superior aesthetic appeal, durability, and ease of manufacturing. PU is widely used in the footwear, automotive, and furniture industries, making it the most popular choice among manufacturers and consumers.

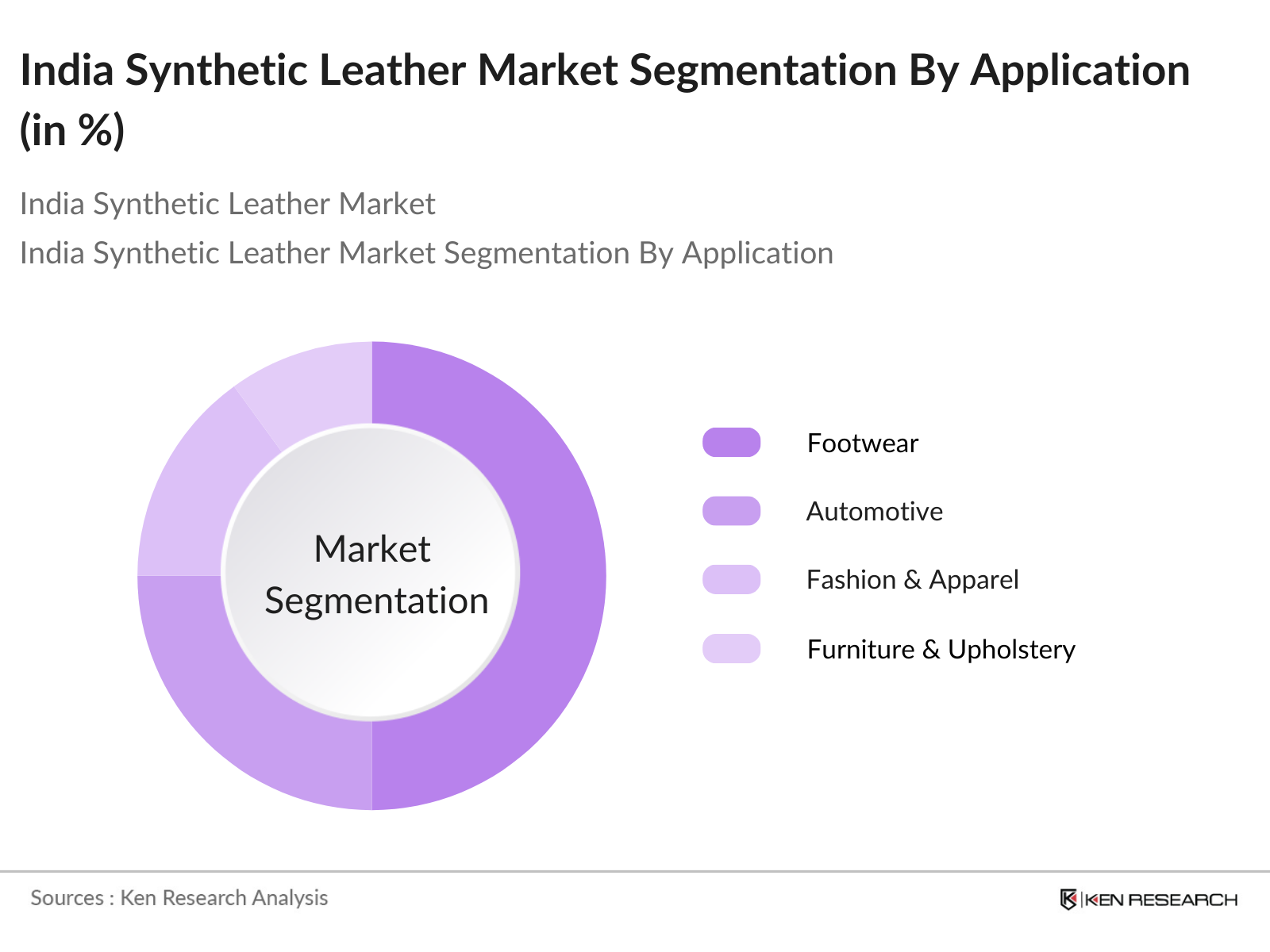

By Application: The synthetic leather market in India is segmented by application into footwear, automotive, fashion & apparel, furniture & upholstery, and others. Footwear has the dominant market share under the application segment due to the growing demand for affordable and durable footwear among India's large population. Synthetic leather offers a cost-effective solution for both casual and formal footwear, making it a popular material among manufacturers.

India Synthetic Leather Market Competitive Landscape

The India synthetic leather market is characterized by the presence of several key players with established reputations in the industry. These companies have established production bases, strong supply chain networks, and a focus on innovation in materials and production technologies. The competition is further fueled by government initiatives aimed at boosting domestic production and reducing reliance on imports.

India Synthetic Leather Industry Analysis

Growth Drivers

- Expansion in Footwear Industry: The footwear industry in India, one of the largest in the world, is experiencing rapid growth. The Government of India forecasts that the sector will grow significantly due to rising domestic demand and exports. As of 2024, India produced approximately 2.3 billion pairs of footwear annually, with synthetic leather accounting for a significant portion of this production due to its durability and cost-effectiveness.

- Increasing Automotive Upholstery Demand: Indias automotive sector is experiencing a boom, driven by increased consumer spending and the production of electric vehicles. As of 2024, India produced over 4 million cars, with synthetic leather being a preferred material for car upholstery due to its cost-efficiency and resistance to wear. With manufacturers focusing on affordable, durable, and eco-friendly materials, synthetic leather has become crucial for upholstery in mass-market vehicles.

- Rising Consumer Awareness of Animal Welfare: With increasing awareness of animal welfare and the environmental impact of genuine leather production, Indian consumers are shifting towards synthetic alternatives. The rise of veganism and animal rights campaigns, supported by organizations like PETA India, has increased demand for synthetic leather in various products, including footwear, accessories, and clothing. According to government data, synthetic leather alternatives have reduced the demand for traditional leather by over 12 million hides annually, reducing pressure on livestock farming for leather production.

Market Challenges

- Competition from Genuine Leather Genuine leather: continues to be a major competitor for synthetic leather, particularly in the premium segment. Despite synthetic leathers growing popularity, genuine leathers perceived luxury appeal keeps it competitive, especially in the high-end footwear and automotive industries. The Indian Leather Development Programme (ILDP) still sees substantial demand for genuine leather, as evidenced by Indias export of over 15 million square meters of leather in 2023.

- Fluctuation in Raw Material Prices (Polyurethane, PVC): Synthetic leather is primarily produced using materials such as polyurethane (PU) and polyvinyl chloride (PVC). Fluctuations in the global prices of these raw materials, which are derived from petroleum, pose a challenge for manufacturers. In 2024, the price of polyurethane increased by 18%, affecting production costs. This price volatility, driven by crude oil market dynamics and supply chain disruptions, impacts profit margins in the synthetic leather sector, making it less competitive against genuine leather in some markets.

India Synthetic Leather Market Future Outlook

Over the next five years, the Indian synthetic leather market is expected to experience substantial growth, driven by increased demand for cruelty-free, sustainable materials, and expanding applications in industries such as automotive, fashion, and footwear. The shift towards plant-based and bio-based alternatives, along with government regulations promoting sustainability, will further propel the market forward.

Market Opportunities

- Growth in Sustainable and Eco-friendly Products: The increasing global emphasis on sustainability has created a lucrative opportunity for bio-based synthetic leather. Consumers are demanding products that are not only free from animal products but also have a lower environmental impact. In response, several Indian manufacturers have started producing synthetic leather made from bio-based materials such as plant oils and waste materials. The Sustainable Leather Initiative, launched by the Ministry of Environment, supports the development of eco-friendly synthetic leather, with a target to increase production by 25% in 2025.

- Innovation in Bio-based Synthetic Leather: Innovation in bio-based synthetic leather technology is transforming the industry. Indian companies are investing in R&D to produce leather-like materials from natural fibers such as pineapple leaves and coconut husk. As of 2024, over 50 startups in India are involved in developing bio-based synthetic leather. These innovations align with government incentives to promote sustainable manufacturing, which includes a INR 200 crore fund for eco-friendly material research.

Scope of the Report

|

Product Type |

Polyurethane (PU) Synthetic Leather |

|

Application |

Footwear |

|

Distribution Channel |

B2B |

|

End-user Industry |

Footwear Manufacturers |

|

Region |

North India |

Products

Key Target Audience

Footwear Manufacturers

Automotive OEMs

Fashion Designers & Retailers

Furniture & Upholstery Producers

Material Science Researchers

Investments and Venture Capitalist Firms

Government and Regulatory Bodies (Ministry of Commerce & Industry, Bureau of Indian Standards)

Leather Industry Associations (Council for Leather Exports, Indian Leather Products Association)

Companies

Players Mentioned in the Report

Mayur Uniquoters Limited

Fenoplast Limited

Marvel Vinyls Limited

HR Polycoats Private Ltd

Nan Ya Plastics Corp.

Zhejiang Hexin Industry Group Co.

Toray Industries, Inc.

Teijin Limited

Kuraray Co., Ltd.

Zhejiang Yongfa Synthetic Leather Co.

Table of Contents

1. India Synthetic Leather Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. India Synthetic Leather Market Size (In INR Cr)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. India Synthetic Leather Market Analysis

3.1. Growth Drivers

3.1.1. Expansion in Footwear Industry

3.1.2. Increasing Automotive Upholstery Demand

3.1.3. Rising Consumer Awareness of Animal Welfare

3.1.4. Government Policies on Leather Industry

3.2. Market Challenges

3.2.1. Competition from Genuine Leather

3.2.2. Fluctuation in Raw Material Prices (Polyurethane, PVC)

3.2.3. Lack of High-Quality Production Facilities

3.3. Opportunities

3.3.1. Growth in Sustainable and Eco-friendly Products

3.3.2. Innovation in Bio-based Synthetic Leather

3.3.3. Expansion in Fashion and Apparel Industry

3.4. Trends

3.4.1. Shift Toward Plant-based Leather Alternatives

3.4.2. Adoption of Digital Printing Technology

3.4.3. Growing Online Retail for Leather Goods

3.5. Government Regulations

3.5.1. BIS Standards for Synthetic Leather Products

3.5.2. Import Duties and Export Incentives for Leather Goods

3.5.3. Eco-labeling Requirements for Synthetic Leather

3.5.4. National Skill Development Programs in Leather Industry

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis (Buyer Power, Supplier Power, Threat of Substitutes, Industry Rivalry, New Entrants)

3.9. Competitive Landscape

4. India Synthetic Leather Market Segmentation

4.1. By Product Type (In Value %):

4.1.1. Polyurethane (PU) Synthetic Leather

4.1.2. Polyvinyl Chloride (PVC) Synthetic Leather

4.1.3. Bio-based Synthetic Leather

4.2. By Application (In Value %):

4.2.1. Footwear

4.2.2. Automotive

4.2.3. Fashion & Apparel

4.2.4. Furniture & Upholstery

4.2.5. Other Applications (Sports, Electronics, etc.)

4.3. By Distribution Channel (In Value %):

4.3.1. B2B

4.3.2. B2C

4.4. By End-user Industry (In Value %):

4.4.1. Footwear Manufacturers

4.4.2. Automotive OEMs

4.4.3. Fashion Designers & Retailers

4.4.4. Furniture Makers

4.5. By Region (In Value %):

4.5.1. North India

4.5.2. South India

4.5.3. East India

4.5.4. West India

5. India Synthetic Leather Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Mayur Uniquoters Limited

5.1.2. Fenoplast Limited

5.1.3. Marvel Vinyls Limited

5.1.4. HR Polycoats Private Limited

5.1.5. San Fang Chemical Industry Co. Ltd.

5.1.6. Zhejiang Hexin Industry Group Co., Ltd.

5.1.7. Kuraray Co., Ltd.

5.1.8. Toray Industries, Inc.

5.1.9. Teijin Limited

5.1.10. Nan Ya Plastics Corporation

5.1.11. Filwel Co., Ltd.

5.1.12. Alfatex Italia SRL

5.1.13. Zhejiang Yongfa Synthetic Leather Co.

5.1.14. Xiefu Group

5.1.15. Ultrafabrics Holdings Co., Ltd.

5.2. Cross Comparison Parameters (No. of Employees, Headquarters, Production Capacity, Revenue, Market Share, Product Portfolio, R&D Spend, Sustainability Initiatives)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers & Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. India Synthetic Leather Market Regulatory Framework

6.1. Environmental Standards (VOC Emission, Hazardous Substance Restrictions)

6.2. Compliance Requirements (Certifications, Testing Standards)

6.3. Certification Processes (ISO, REACH Compliance, BIS)

7. India Synthetic Leather Future Market Size (In INR Cr)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. India Synthetic Leather Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Application (In Value %)

8.3. By Distribution Channel (In Value %)

8.4. By End-user Industry (In Value %)

8.5. By Region (In Value %)

9. India Synthetic Leather Market Analysts' Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The research process begins with identifying major stakeholders in the India synthetic leather market. This involves desk research using secondary and proprietary databases, with a focus on collecting industry-specific data such as production capacity, export volumes, and material innovations.

Step 2: Market Analysis and Construction

In this step, historical data related to market demand, production output, and market penetration across key industries such as footwear and automotive is compiled. The data is then analyzed to understand market trends and the competitive landscape.

Step 3: Hypothesis Validation and Expert Consultation

Key market hypotheses, such as the shift towards sustainable leather alternatives, are developed. These are validated through expert consultations with industry insiders from major companies and associations in the leather and synthetic material sectors.

Step 4: Research Synthesis and Final Output

The final stage involves combining quantitative data with qualitative insights from manufacturers and suppliers. This synthesis ensures a well-rounded analysis that reflects current market conditions and future opportunities in the India synthetic leather market.

Frequently Asked Questions

01. How big is the India Synthetic Leather Market?

The India Synthetic Leather market is valued at USD 1.83 billion, based on a five-year historical analysis. This market is primarily driven by the growing demand for cost-effective, cruelty-free alternatives to genuine leather in key industries like footwear, automotive, and furniture.

02. What are the challenges in the India Synthetic Leather Market?

Key challenges include competition from genuine leather, fluctuating raw material prices (especially polyurethane and PVC), and the lack of high-quality production facilities. Additionally, eco-friendly alternatives still face higher production costs.

03. Who are the major players in the India Synthetic Leather Market?

Major players include Mayur Uniquoters Limited, Fenoplast Limited, Marvel Vinyls Limited, HR Polycoats Private Ltd, and Nan Ya Plastics Corp. These companies dominate due to their large production capacities, advanced technologies, and strong distribution networks.

04. What are the growth drivers of the India Synthetic Leather Market?

Growth drivers include the expansion of the footwear and automotive sectors, consumer demand for affordable alternatives to genuine leather, and government support for local manufacturing. The rise of eco-friendly and bio-based synthetic leather products is also contributing to market growth.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.