India Titanium Dioxide Market Outlook to 2030

Region:Asia

Author(s):Yogita Sahu

Product Code:KROD10683

November 2024

95

About the Report

India Titanium Dioxide Market Overview

- The India Titanium Dioxide Market, is valued at USD 868 million. The market is driven by its extensive applications in the paints and coatings industry, as well as in plastics and cosmetics. Increased infrastructure spending and growing consumer demand for high-quality, durable products with aesthetic appeal fuel this demand. The sector has seen substantial investment in domestic production to meet rising needs across various industries.

- The Indian market sees major contributions from urban hubs like Mumbai and Chennai, as well as regions with concentrated industrial activity, including Gujarat and Maharashtra. These regions are dominant due to a strong manufacturing base, proximity to raw material suppliers, and established logistics networks, which collectively facilitate large-scale production and distribution of titanium dioxide.

- Under Indias Production-Linked Incentive (PLI) scheme, which allocated INR 50 billion specifically for specialty chemicals in 2024, titanium dioxide manufacturers are being incentivized to expand local production. This initiative has led to a 20% increase in production capacity investments, which aims to decrease import dependency and strengthen the domestic supply chain for key industries.

India Titanium Dioxide Market Segmentation

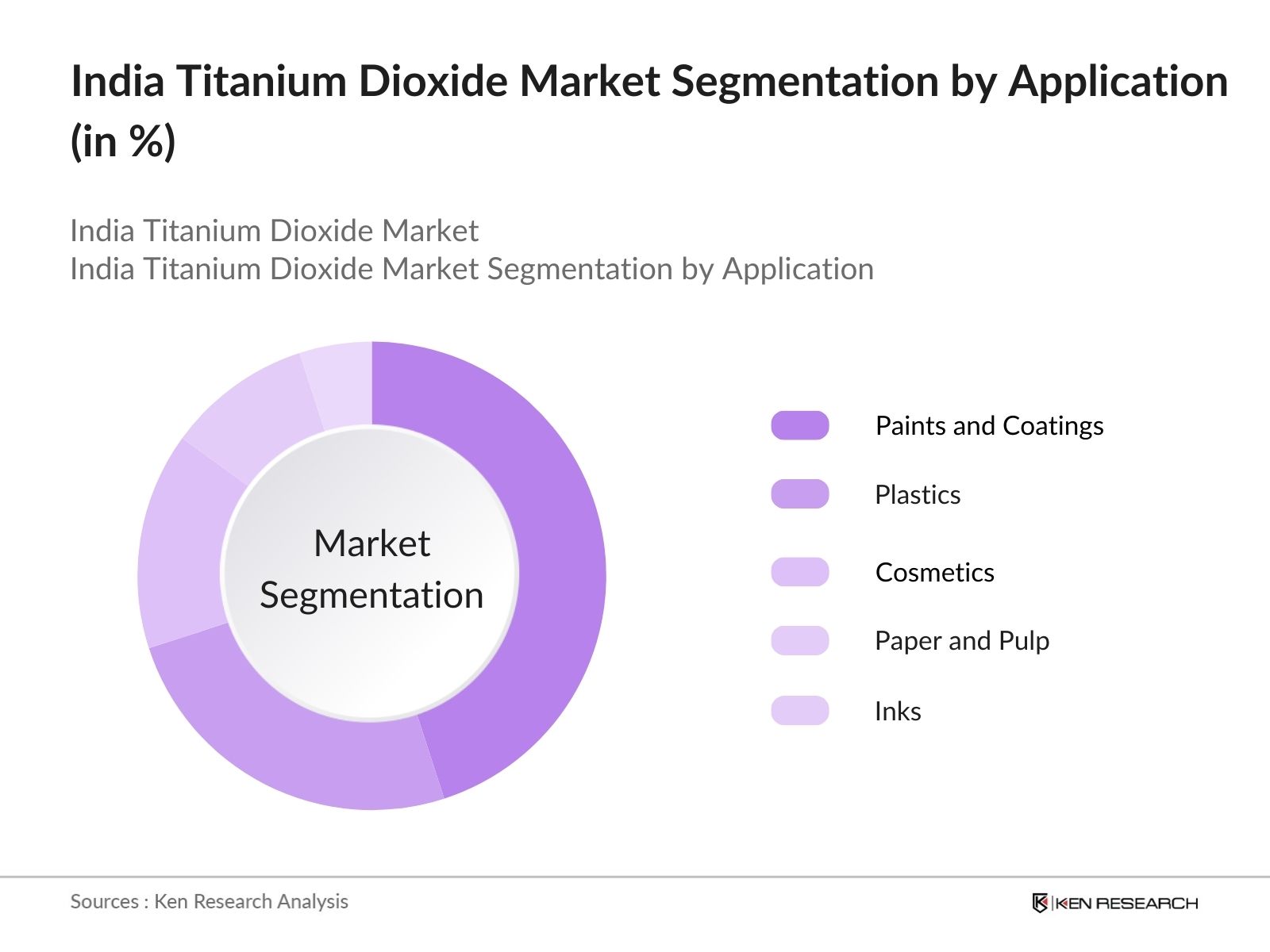

By Application: The market is segmented by application into Paints and Coatings, Plastics, Cosmetics, Paper and Pulp, and Inks. Recently, the Paints and Coatings segment has dominated this segmentation. Its strong performance is driven by increasing infrastructure developments and a consumer shift toward higher-quality paints with better durability and aesthetic qualities. Brands in this sector also promote innovative products with UV resistance, contributing to the sustained dominance of this segment.

By Production Process: The market is further segmented by production processes into the Sulfate Process and the Chloride Process. The Sulfate Process leads due to lower production costs and adaptability with various grades of titanium dioxide. This method is widely employed by smaller manufacturing plants catering to local demand, especially in sectors where high-grade titanium dioxide is less critical.

India Titanium Dioxide Market Competitive Landscape

The market is characterized by a mix of local and global players. Major companies focus on expanding production capacities, adopting sustainable manufacturing practices, and strengthening distribution networks.

India Titanium Dioxide Market Analysis

Market Growth Drivers

- Demand from Paints and Coatings Sector: The Indian paints and coatings industry, valued at INR 1.5 trillion in 2024, is a significant driver for titanium dioxide demand. This sector uses titanium dioxide for its opacity, brightness, and durability in paint formulations. The expanding infrastructure projects and construction boom in urban centers are propelling this industry's need for high-quality coatings, which has boosted titanium dioxide consumption by an additional 50,000 metric tons in the past year alone.

- Expanding Automotive Industry Needs: Indias automotive production reached over 4.4 million units in 2024, spurring increased demand for durable coatings that withstand environmental wear. Titanium dioxide's application in automotive paints is crucial, providing a growth avenue as manufacturers continue to produce vehicles requiring high-quality coatings. The anticipated addition of 2 million vehicles in the next five years will keep titanium dioxide demand strong.

- Rising Pharmaceutical and Cosmetic Applications: With the Indian pharmaceutical industry estimated to grow to INR 3 trillion in 2024, titanium dioxide usage in tablet coatings, sunscreens, and cosmetics has surged. The substance is highly valued for its non-toxicity and effectiveness in UV protection, spurring consumption in cosmetic products. The personal care industry, worth over INR 1.2 trillion, has seen a consistent increase in products containing titanium dioxide, which supports its continued demand in this sector.

Market Challenges

- Environmental Concerns and Regulations: Titanium dioxide production emits amounts of CO and other pollutants. Given Indias commitment to reducing emissions by 1 billion tons by 2030, manufacturers face regulatory hurdles. The costs of adopting cleaner technologies and complying with government-mandated reductions are affecting profitability and production efficiency, potentially impacting production capacity by up to 15%.

- Fluctuating Raw Material Costs: The cost of raw materials like ilmenite, a primary source of titanium dioxide, has increased by over INR 10,000 per ton due to import constraints and high global demand. This increase directly impacts production costs, limiting the competitive edge of domestic producers and affecting their margins. With India importing around 40% of its ilmenite, exchange rate fluctuations further exacerbate this challenge.

India Titanium Dioxide Market Future Outlook

Over the next five years, the India Titanium Dioxide industry is expected to witness steady growth, driven by increasing demand across construction, automotive, and packaging industries. With a focus on high-quality, durable products and sustainability, manufacturers are adopting eco-friendly practices in their production processes.

Future Market Opportunities

- Enhanced Use in Automotive and Industrial Coatings: Driven by increased automobile production and infrastructure projects, the demand for titanium dioxide in automotive and industrial coatings will rise. The industry will add over 3 million vehicles, and the anticipated growth in construction projects will require higher titanium dioxide use in coating solutions to meet durability standards in extreme climates.

- Sustainable Production Technologies: In response to growing environmental regulations, Indian titanium dioxide manufacturers will invest INR 5 billion over the next five years to implement greener production technologies. This shift will not only help meet regulatory standards but also attract environmentally conscious clients in the paints, coatings, and plastics sectors.

Scope of the Report

|

Application |

Paints and Coatings Plastics Cosmetics Paper and Pulp Inks |

|

Production Process |

Sulfate Process Chloride Process |

|

Grade |

Anatase Rutile |

|

End-Use Industry |

Automotive Construction Food and Beverage Medical and Pharmaceutical Renewable Energy |

|

Region |

North India South India East India West India |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Titanium dioxide manufacturers and processors

Paints and coatings companies

Plastics manufacturers

Cosmetics and personal care product manufacturers

Automotive industry suppliers

Government and regulatory bodies (Ministry of Chemicals and Fertilizers, Bureau of Indian Standards)

Investor and venture capitalist firms

Paper and pulp manufacturers

Companies

Tronox Holdings Plc

The Chemours Company

Venator Materials PLC

Lomon Billions Group

Ishihara Sangyo Kaisha Ltd.

Kronos Worldwide Inc.

Tayca Corporation

INEOS Group

Huntsman Corporation

Gujarat Narmada Valley Fertilizers & Chemicals Ltd.

Table of Contents

1. India Titanium Dioxide Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Key Market Dynamics

1.4. Market Segmentation Overview

2.India Titanium Dioxide Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Market Developments and Milestones

3. India Titanium Dioxide Market Analysis

3.1. Growth Drivers

3.1.1. Rising Demand in Paints and Coatings

3.1.2. Growth in Plastics Industry

3.1.3. Increasing Applications in Cosmetics and Personal Care

3.2. Market Challenges

3.2.1. Fluctuating Raw Material Prices

3.2.2. Stringent Environmental Regulations

3.2.3. Limited Domestic Production

3.3. Opportunities

3.3.1. Growth in Emerging Sectors (like Pharmaceuticals, Energy Storage)

3.3.2. Technological Advancements in Production Techniques

3.4. Trends

3.4.1. Shift Towards Sustainable Production

3.4.2. Rising Adoption in Nanotechnology

3.5. Regulatory Overview

3.5.1. BIS Standards

3.5.2. Environmental Compliance Requirements

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competition Ecosystem

4. India Titanium Dioxide Market Segmentation

4.1. By Application (In Value %)

4.1.1. Paints and Coatings

4.1.2. Plastics

4.1.3. Cosmetics

4.1.4. Paper and Pulp

4.1.5. Inks

4.2. By Production Process (In Value %)

4.2.1. Sulfate Process

4.2.2. Chloride Process

4.3. By Grade (In Value %)

4.3.1. Anatase

4.3.2. Rutile

4.4. By End-Use Industry (In Value %)

4.4.1. Automotive

4.4.2. Construction

4.4.3. Food and Beverage

4.4.4. Medical and Pharmaceutical

4.4.5. Renewable Energy

4.5. By Region (In Value %)

4.5.1. North India

4.5.2. South India

4.5.3. East India

4.5.4. West India

5. India Titanium Dioxide Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1. Tronox Holdings Plc

5.1.2. The Chemours Company

5.1.3. Venator Materials PLC

5.1.4. Lomon Billions Group

5.1.5. INEOS Group

5.1.6. Kronos Worldwide Inc.

5.1.7. Tayca Corporation

5.1.8. Ishihara Sangyo Kaisha Ltd.

5.1.9. Huntsman Corporation

5.1.10. Cinkarna Celje D.D.

5.1.11. Pangang Titanium Industry Co., Ltd.

5.1.12. Gujarat Narmada Valley Fertilizers & Chemicals Ltd.

5.1.13. Kerala Minerals and Metals Ltd.

5.1.14. SRL Titanium

5.1.15. Travancore Titanium Products Ltd.

5.2 Cross Comparison Parameters (Market Share, Production Capacity, Distribution Networks, Innovation Focus, Product Quality, Financial Strength, Pricing Strategies, Sustainability Initiatives)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital and Private Equity Funding

6. India Titanium Dioxide Market Regulatory Framework

6.1 National Environmental Standards

6.2 Industry Compliance Requirements

6.3 Certification Processes

7. India Titanium Dioxide Future Market Size (In USD Mn)

7.1. Projected Market Size

7.2. Key Growth Factors

8. India Titanium Dioxide Future Market Segmentation

8.1 By Application (In Value %)

8.2 By Production Process (In Value %)

8.3 By Grade (In Value %)

8.4 By End-Use Industry (In Value %)

8.5 By Region (In Value %)

9. India Titanium Dioxide Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Competitive Positioning and Differentiation

9.3 Market Expansion Strategies

9.4 White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

The research began with mapping critical industry stakeholders, using secondary and proprietary databases to outline the influencing variables within the India Titanium Dioxide Market. Key drivers, challenges, and trends were identified to understand overall market dynamics.

Step 2: Market Analysis and Construction

Historical data for the market was analyzed to estimate market penetration and revenue generation across different applications and production processes. Data on product performance and production techniques was cross-referenced with market needs for accuracy.

Step 3: Hypothesis Validation and Expert Consultation

Industry hypotheses were validated through computer-assisted interviews with industry specialists from major titanium dioxide companies. These consultations helped verify operational insights and refine market estimates.

Step 4: Research Synthesis and Final Output

In the final phase, primary data was obtained directly from manufacturing companies to understand consumer trends, segment performances, and projected demand. This data was consolidated with secondary sources to ensure a comprehensive market analysis.

Frequently Asked Questions

01. How big is the India Titanium Dioxide Market?

The India Titanium Dioxide Market, valued at USD 868 million, is driven by extensive applications across various industries, including paints, coatings, plastics, and cosmetics.

02. What are the challenges in the India Titanium Dioxide Market?

Challenges in the India Titanium Dioxide Market include fluctuating raw material costs, strict environmental regulations, and limited domestic production capacity, which impact the overall market profitability.

03. Who are the major players in the India Titanium Dioxide Market?

Key players in the India Titanium Dioxide Market include Tronox Holdings Plc, The Chemours Company, Venator Materials PLC, and Lomon Billions Group. These companies dominate due to their high production capacities, technological advancements, and strong distribution networks.

04. What drives growth in the India Titanium Dioxide Market?

Growth in the India Titanium Dioxide Market is driven by increasing demand in paints and coatings for infrastructure projects, the rising use of high-quality plastics in packaging, and a shift towards durable consumer products.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.