India Toys and Games Market Outlook to 2030

Region:Asia

Author(s):Shreya Garg

Product Code:KROD924

July 2024

100

About the Report

India Toys and Games Market Overview

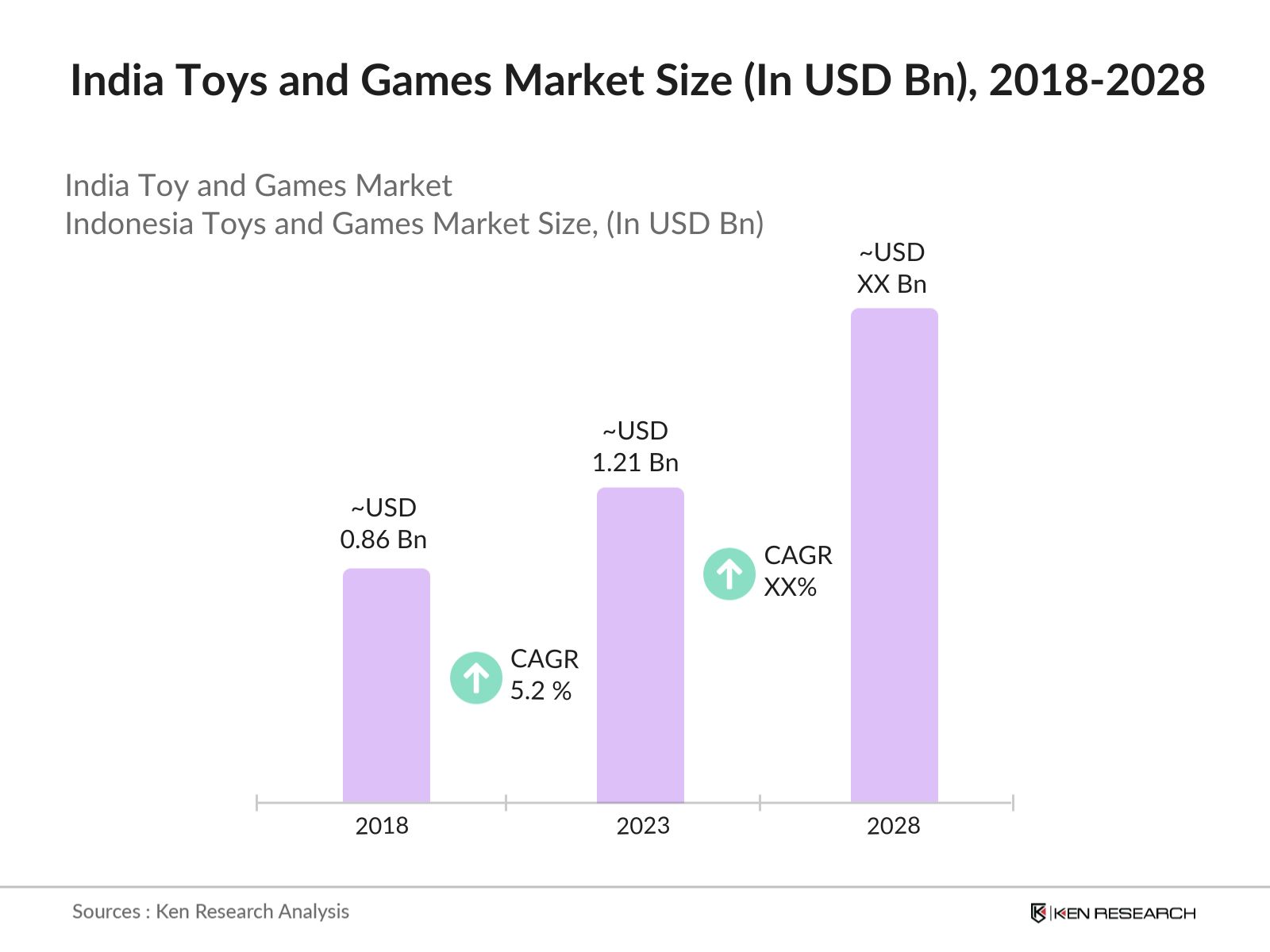

- The India toys and games market was valued at USD 1.21 billion in 2023. In 2018, the market has shown the market size of 860 million, grown at a CAGR of 5.02% between 2018-23. This growth is powered by technological advancements, the influence of digital media, and the expansion of organized retail.

- Key players in the market include Mattel Inc., LEGO Group, Hasbro Inc., Funskool India Ltd., and Simba Toys India Pvt. Ltd. These companies are focusing on expanding their product portfolios and increasing their market presence through strategic partnerships and acquisitions.

- Reflecting its commitment to sustainability, Lego launched a series of eco-friendly toys made from recycled materials in 2023, aligning with global environmental goals and catering to the increasing consumer preference for sustainable products. Lego's move is part of a broader strategy to achieve zero waste in operations by 2030.

India Toys and Games Current Market Analysis

- The Indian toy market is flourishing, with consumer spending on children's entertainment and educational products reaching all-time high in 2023. E-commerce platforms like Amazon and Flipkart have seen significant growth, driven by their wide product range and convenience.

- Parents are increasingly preferring educational and interactive toys that contribute to their children’s learning and development. There is also a rising demand for safe, non-toxic, and durable toys. Sales through e-commerce platforms are witnessing rapid growth, with a significant increase in online toy purchases.

- Northern India, particularly Delhi-NCR, dominate the market due to higher purchasing power and greater exposure to global toy trends also their high consumer spending power and the presence of numerous retail outlets.

India Toys and Games Market Segmentation

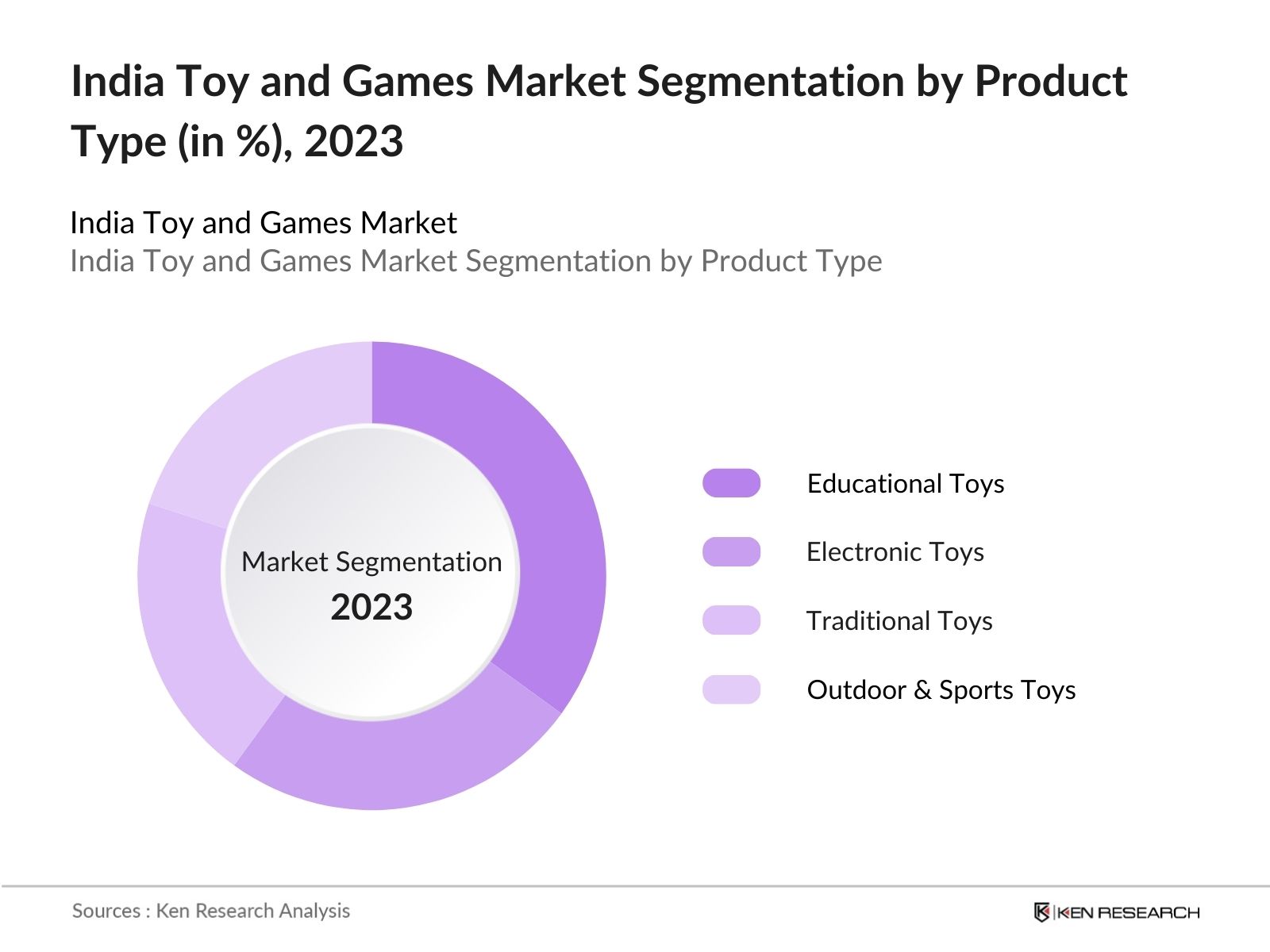

By Product Type: In 2023, the India Toy and Games is segmented by Product Type into Educational Toy, Traditional Toy, Electronic Toy and Sports Toys. Educational toys dominate due to their focus on learning and development, making them highly popular among parents who prioritize their children's cognitive and skill development.

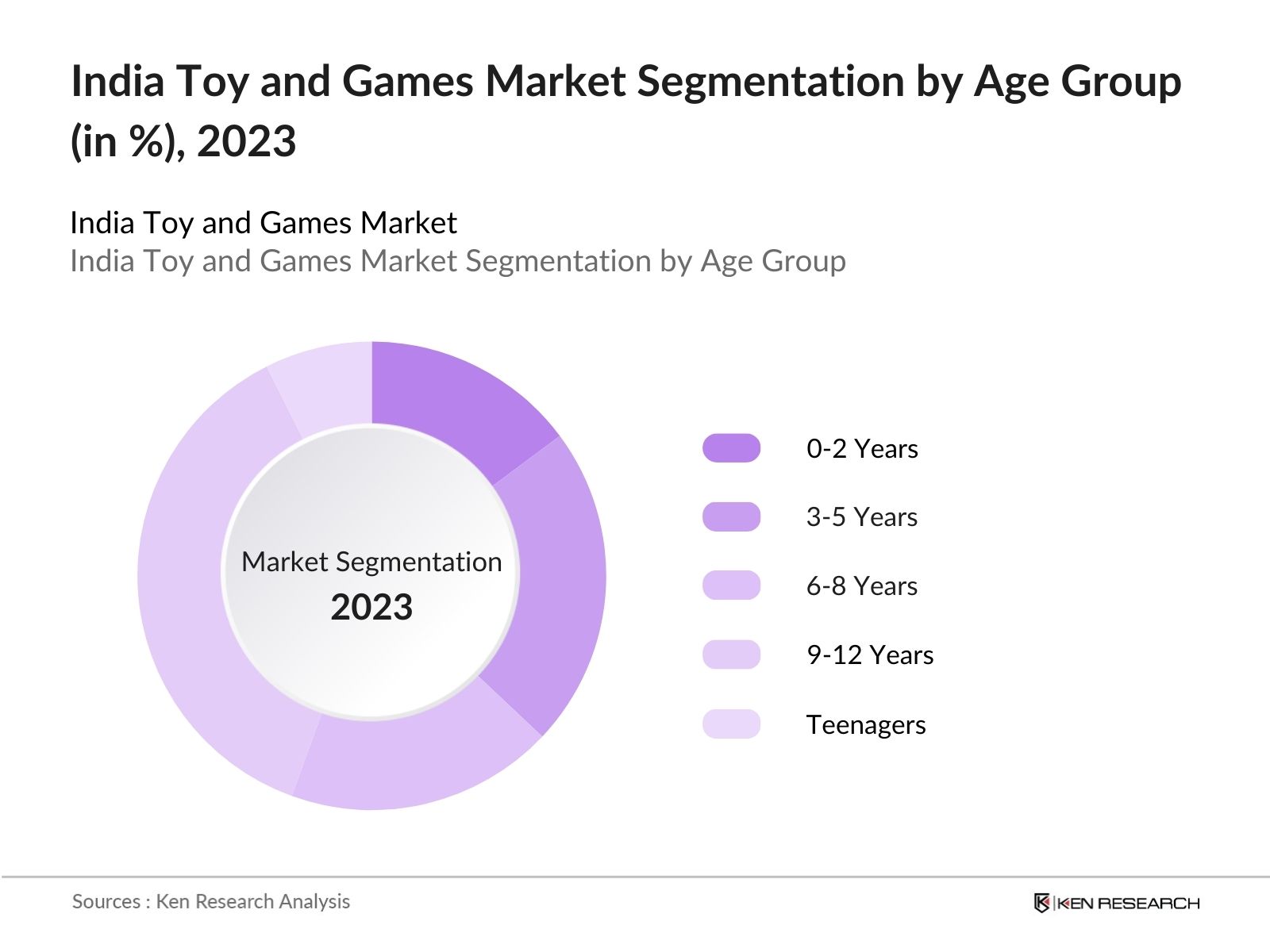

By Age Group: In 2023, the India Toy and Games is segmented by Age Group into Infants, 3-5 Years, 6-8 Years, 9-12 Years and Teenagers. Toys for infants and toddlers focus on sensory development and safety, attracting a significant share of new parents. While 3-5 years age group children’s parent sees high demand for educational and interactive toys that aid in early learning and development.

By Region: In 2023, the India Toy and Games is segmented by region into northern, Southern, Western and Eastern India. Northern India dominates the Indian toy and games market primarily due to its high disposable income levels and urban density. The region's extensive retail infrastructure and significant consumer spending power in cities like Delhi-NCR further amplify its market share.

India Toys and Games Market Competitive Landscape

|

Player |

Establishment Year |

Headquarters |

|

Funskool |

1987 |

Chennai, India |

|

Reliance Toys |

2007 |

Mumbai, India |

|

Mattel |

1945 |

California, USA |

|

Hasbro |

1923 |

Rhode Island, USA |

|

Lego |

1932 |

Billund, Denmark |

- Funskool Factory Expansion: Funskool, the Indian toy manufacturing company, has announced the expansion of its facility at Ranipet in Tamil Nadu in 2024. The expansion has added more than 1.6 lakh sq ft (160,000 sq ft) to the existing facility, which doubles the manufacturing capacity. This expansion is aimed at meeting the growing consumer base and reducing reliance on imports by increasing domestic production.

- Mattel's Eco-Friendly Range: In 2023, Mattel introduced an eco-friendly line of toys, marking a significant shift towards sustainability within the industry. This new range, which has experienced a 15% increase in sales, includes toys made from bio-based plastics and recycled materials.

- Acquisition of Channapatna Toy Manufacturer: In 2022, a leading Indian toy company acquired a Channapatna toy manufacturer, renowned for its traditional wooden toys. This acquisition aims to diversify the company's product portfolio, integrate traditional craftsmanship with modern design, and promote indigenous toy-making techniques.

India Toys and Games Industry Analysis

India Toys and Games Market Growth Drivers

- Educational Focus: The demand for educational toys has seen a substantial rise, with retailers like Hamleys reporting an increase in the sale of STEM kits. Parents are increasingly opting for toys that aid in their children's cognitive and motor skills development, reflecting a shift towards value-based purchasing decisions.

- Expansion of E-commerce: The growth of e-commerce platforms has made toys more accessible, with Amazon India and Flipkart collectively selling over 15 million toys annually in 2023. The extensive product variety, competitive pricing, and convenience offered by these platforms have driven consumer preference towards online purchases.

- Cultural Shift Towards Play-Based Learning: Schools and parents are increasingly incorporating educational toys into curriculums and home activities, driving a market demand of over 1 million units annually for educational and play-based learning toys.

India Toys and Games Market Challenges

- Counterfeit Products: The Indian toy market is significantly impacted by counterfeit products, these fake toys lead to an annual revenue loss which make up 30% of the market. These products not only reduce the revenue of legitimate businesses but also pose safety risks.

- High Import Dependence: A large portion of toys sold in India are imported, leading to price volatility and supply chain disruptions. Import restrictions and increased tariffs have led to a rise in toy prices, making it challenging for local retailers to maintain competitive pricing.

- Limited Rural Penetration: Despite urban market growth, rural areas, which house 890 million people, remain underpenetrated due to lower purchasing power and limited retail infrastructure. However, given that the internet penetration in the rural areas has reached a significant 442 million in 2024, there is lot of untapped potential yet to be discovered.

India Toys and Games Market Government Initiatives

- Toyathon Initiative: The 'Toyathon' initiative, launched in 2021, has significantly impacted the domestic toy industry by fostering innovation and supporting over 200 startups. In 2023, these startups collectively produced toys in exponential quantity, showcasing a substantial increase in domestic production capabilities and contributing to employment generation in the sector.

- Quality Control Order: The 2020 Quality Control Order mandating BIS certification for all toys has markedly improved product safety and quality. By 2023, compliance rates among manufacturers surged, with many new companies obtaining certification, ensuring that toys meet stringent safety standards and enhancing consumer trust in domestically produced toys.

- PLI Scheme for Toy Manufacturing: The Indian government is developing an INR 3,500-crore Production Linked Incentive (PLI) scheme to promote the domestic manufacturing of toys that comply with Bureau of Indian Standards (BIS) norms, leading to the establishment of new manufacturing units and boosting the industry's overall capacity and output.

India Toys and Games Market Future Outlook

By 2028, the market is projected to reach higher, growth is anticipated to be driven by the continual rise in young demographics, an increase in online sales, and innovations in product offerings integrating technology with traditional toys.

Future Market Trends

- Sustainability in Toys: By 2025, the demand for eco-friendly toys is projected to exceed, driven by increasing consumer awareness and preference for environmentally friendly products. This shift is supported by global sustainability initiatives and the rising availability of toys made from sustainable materials.

- Integration of Technology: Technologically advanced toys, such as interactive robots and augmented reality games, are expected to see substantial growth, as kids are preferring smart toys and parents seek educational toys with technology integration. These products cater to the tech-savvy younger generation, integrating daily technological advancements into playtime.

- Customization and Personalization: The market for personalized toys is anticipated to grow significantly, with demand projected to surpass 5 million custom action figures and name-engraved puzzles annually by 2025. This trend caters to consumers seeking unique and personalized products for their children, aligning with broader consumer preferences for customization.

Scope of the Report

|

By Product Type |

Educational Toys Traditional Toys Electronic Toys Outdoor and Sports Toys |

|

By Age Group |

Infants 3 to 5 Years 6-8 Years 9-12 Years Teenagers |

|

By Region |

North South East West |

Products

Key Target Audience – Organizations and Entities who can benefit by Subscribing this Report:

Toy Manufacturers and Suppliers

Toy and Games Retailers and Distributors

Investors and Financial Institutions

Toy Association of India

Bureau of Indian Standards

Toy Importers and Exporters

Banking and Financial Institutions

Time Period Captured in the Report:

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2028

Companies

Players Mentioned in the Report: Â

Mattel Inc.

LEGO Group

Hasbro Inc.

Funskool India Ltd.

Simba Toys India Pvt. Ltd.

Fisher-Price

Hot Wheels

Toy Kraft

Green Gold Animation Pvt. Ltd.

Hamleys

Chicco

FirstCry

Hamleys India

Spin Master

BANDAI NAMCO Holdings Inc.

Giggles

VTech

Marvel Toys Pvt. Ltd.

Sunbaby

IMC Toys

Table of Contents

1. India Toys and Games Market Overview

1.1 India Toys and Games Market TaxonomyÂ

2. India Toys and Games Market Size (in USD Bn), 2018-2023

3. India Toys and Games Market Analysis

3.1 India Toys and Games Market Growth DriversÂ

3.2 India Toys and Games Market Challenges and IssuesÂ

3.3 India Toys and Games Market Trends and DevelopmentÂ

3.4 India Toys and Games Market Government RegulationÂ

3.5 India Toys and Games Market SWOT AnalysisÂ

3.6 India Toys and Games Market Stake EcosystemÂ

3.7 India Toys and Games Market Competition EcosystemÂ

4. India Toys and Games Market Segmentation, 2023

4.1 India Toys and Games Market Segmentation by Type (in value %), 2023Â

4.2 India Toys and Games Market Segmentation by Age Group (in value %), 2023Â

4.3 India Toys and Games Market Segmentation by Region (in value %), 2023Â

5. India Toys and Games Market Competition Benchmarking

5.1 India Toys and Games Market Cross-Comparison (no. of employees, company overview, business strategy, USP, recent development, operational parameters, financial parameters and advanced analytics)Â

6. India Toys and Games Future Market Size (in USD Bn), 2023-2028

7. India Toys and Games Market Segmentation, 2028Â

7.1 India Toys and Games Market Segmentation by Type (in value %), 2028Â

7.2 India Toys and Games Market Segmentation by Age Group (in value %), 2028Â

7.3 India Toys and Games Market Segmentation by Region (in value %), 2028Â

8. India Toys and Games Market Analysts’ Recommendations

8.1 India Toys and Games Market TAM/SAM/SOM AnalysisÂ

8.2 India Toys and Games Market Customer Cohort AnalysisÂ

8.3 India Toys and Games Marketing InitiativesÂ

8.4 India Toys and Games Market White Space Opportunity AnalysisÂ

DisclaimerÂ

Contact Us Â

Research Methodology

Step 1 Identifying Key Variables:

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry level information. Â

Step 2 Market Building:

Collating statistics on India Toys and Games Market over the years, penetration of marketplaces and service providers ratio to compute revenue generated for India Toys and Games Market. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared. Â

Step 3 Validating and Finalizing:

Building market hypothesis and conducting CATIs with industry experts belonging to different companies to validate statistics and seek operational and financial information from company representatives. Â

Step 4 Research output:

Our team will approach multiple Toy and Games companies and understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from Toy Manufacturers and Retailers.

Frequently Asked Questions

01 How big is the India Toy and Games Market?

The India toys and games market was valued at USD 1.24 billion in 2023, which was growing at a CAGR of 5.02% between 2018-23. This growth is driven by increase in demand of technological advanced toys, the influence of digital media, and the expansion of organized retail.

02 What is the future of India Toy and Games Market?

By 2028, the India Toy and Games Market is projected to reach around $1.5 billion. The expected future demand is anticipated to be driven by the continual rise in young demographics, an increase in online sales, and innovations in product offerings integrating technology with traditional toys.

03 Who are the major players of India Toy and Games Market?

Prominent players in India Toy and Games Market include Funskool, Reliance Trends, and international brands like Mattel and Hasbro. These companies dominate due to their wide range of product offerings, extensive distribution networks, and strong brand recognition.

04 What are the emerging trends in India Toy and Games Market?

India Toy and Games Market is projected to reach higher in 2028, driven by the continual rise in young demographics, an increase in online sales, and innovations in product offerings integrating technology with traditional toys.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.