India Vending Machine Market Outlook to 2030

Region:Asia

Author(s):Yogita Sahu

Product Code:KROD3302

October 2024

83

About the Report

India Vending Machine Market Overview

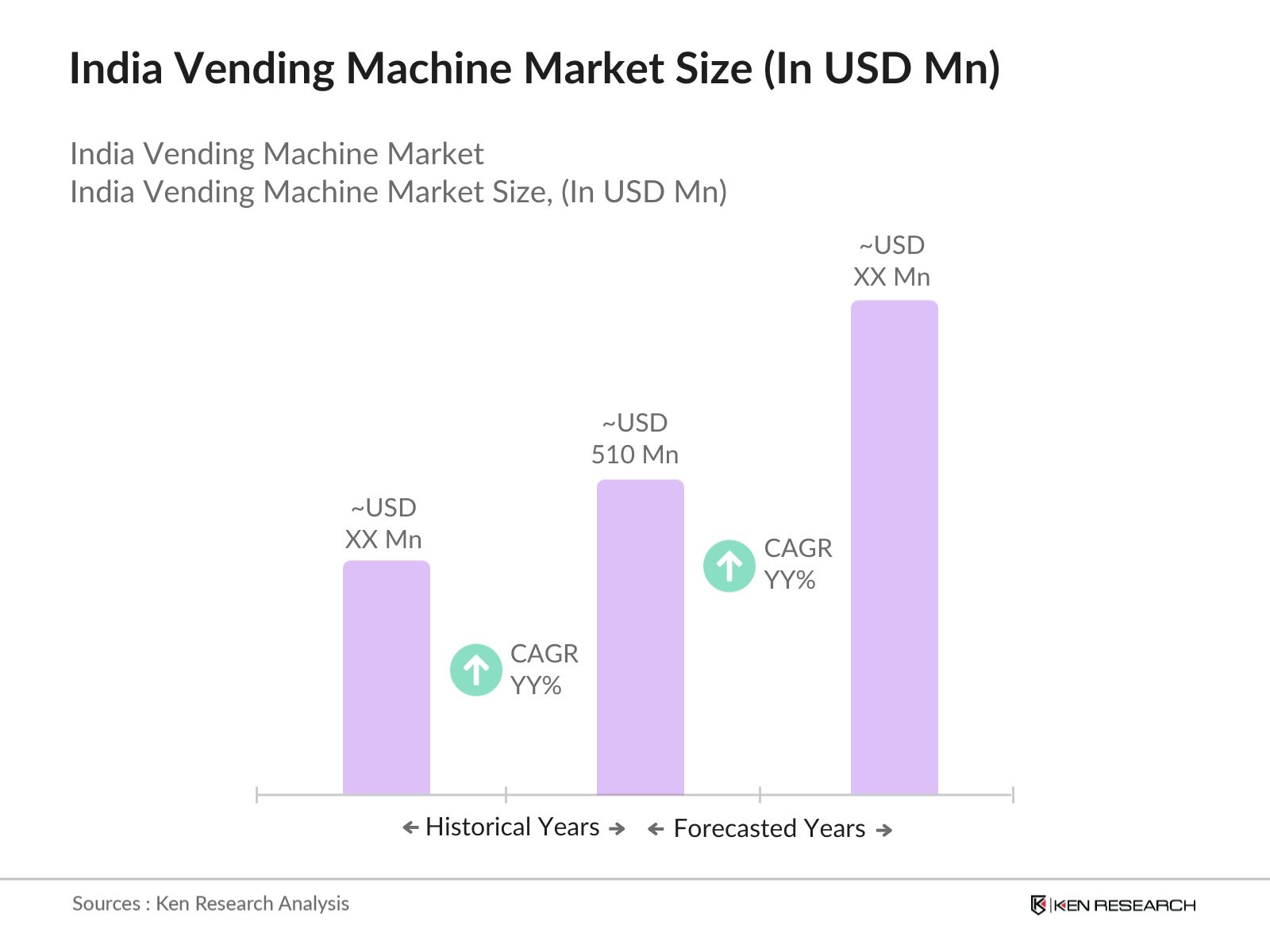

- The India vending machine market is valued at USD 510 million, based on a five-year historical analysis. The market is driven by rapid urbanization, the expansion of corporate offices, and increased adoption of automation in retail. Growing consumer preference for convenience, coupled with advancements in cashless payment systems like UPI and mobile wallets, has further propelled the adoption of vending machines across key cities in India.

- The dominance of metropolitan cities such as Delhi, Bengaluru, and Mumbai in the vending machine market is attributed to their higher levels of urbanization, a larger population of working professionals, and the rapid expansion of tech-enabled retail formats. These cities have seen strong demand for vending machines in corporate parks, educational institutions, and public areas, driven by consumer convenience and the trend of contactless payments.

- The Indian governments Digital India initiative promotes cashless payments, fostering growth in vending machine adoption. According to the Ministry of Electronics and Information Technology, digital transactions reached 114 billion in 2023, creating a strong foundation for vending machines equipped with cashless payment systems. In 2024, this initiative is expected to further boost vending machine adoption in urban and semi-urban areas, particularly in sectors like transportation, retail, and healthcare, where digital payments are becoming the norm.

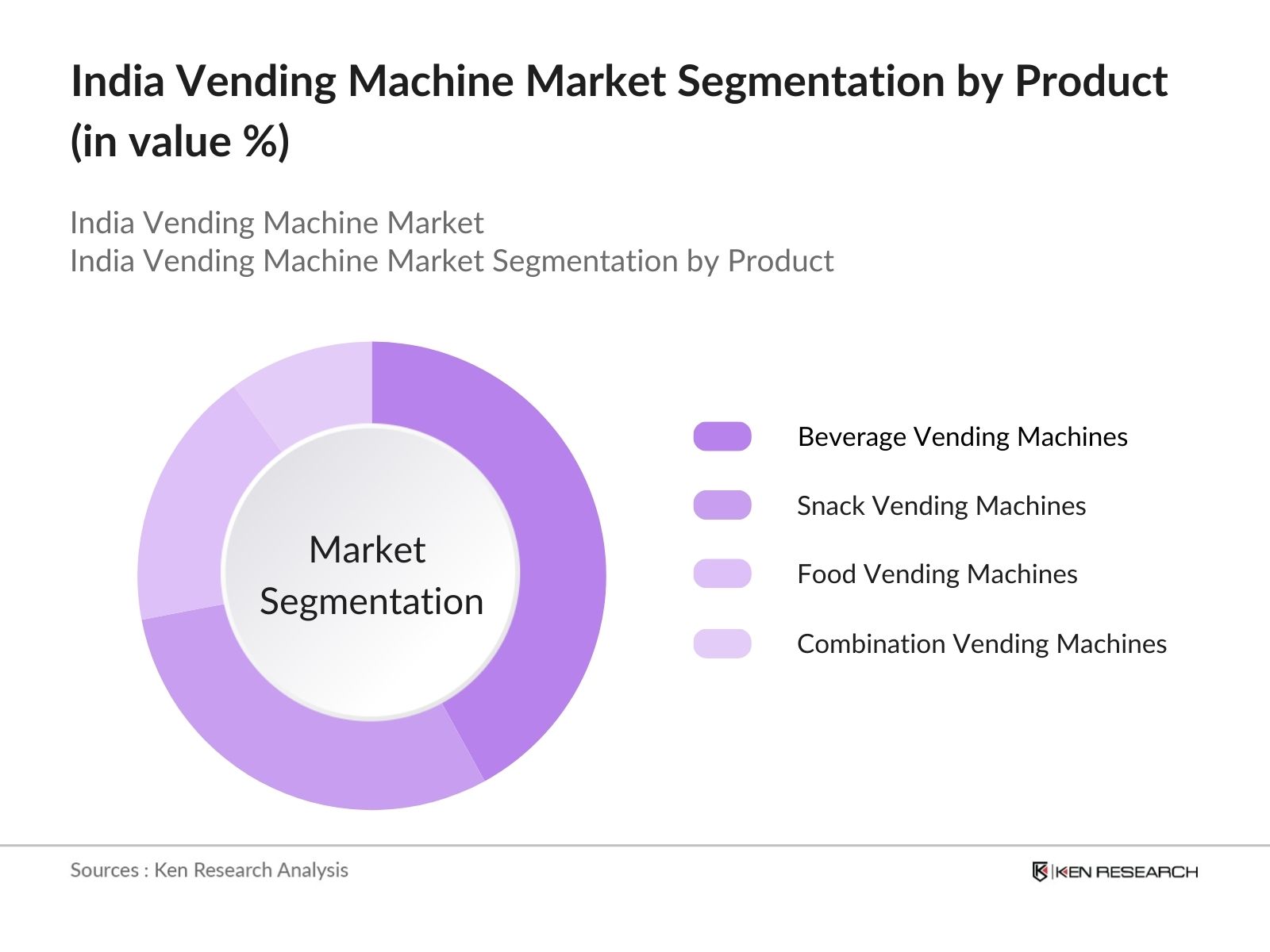

India Vending Machine Market Segmentation

By Product Type: The market is segmented by product type into beverage vending machines, snack vending machines, food vending machines, and combination vending machines. Beverage vending machines hold a dominant market share due to the high demand for on-the-go drinks in metro cities. This segment thrives in high-traffic areas such as airports, railway stations, and malls, where consumers often look for quick refreshment options.

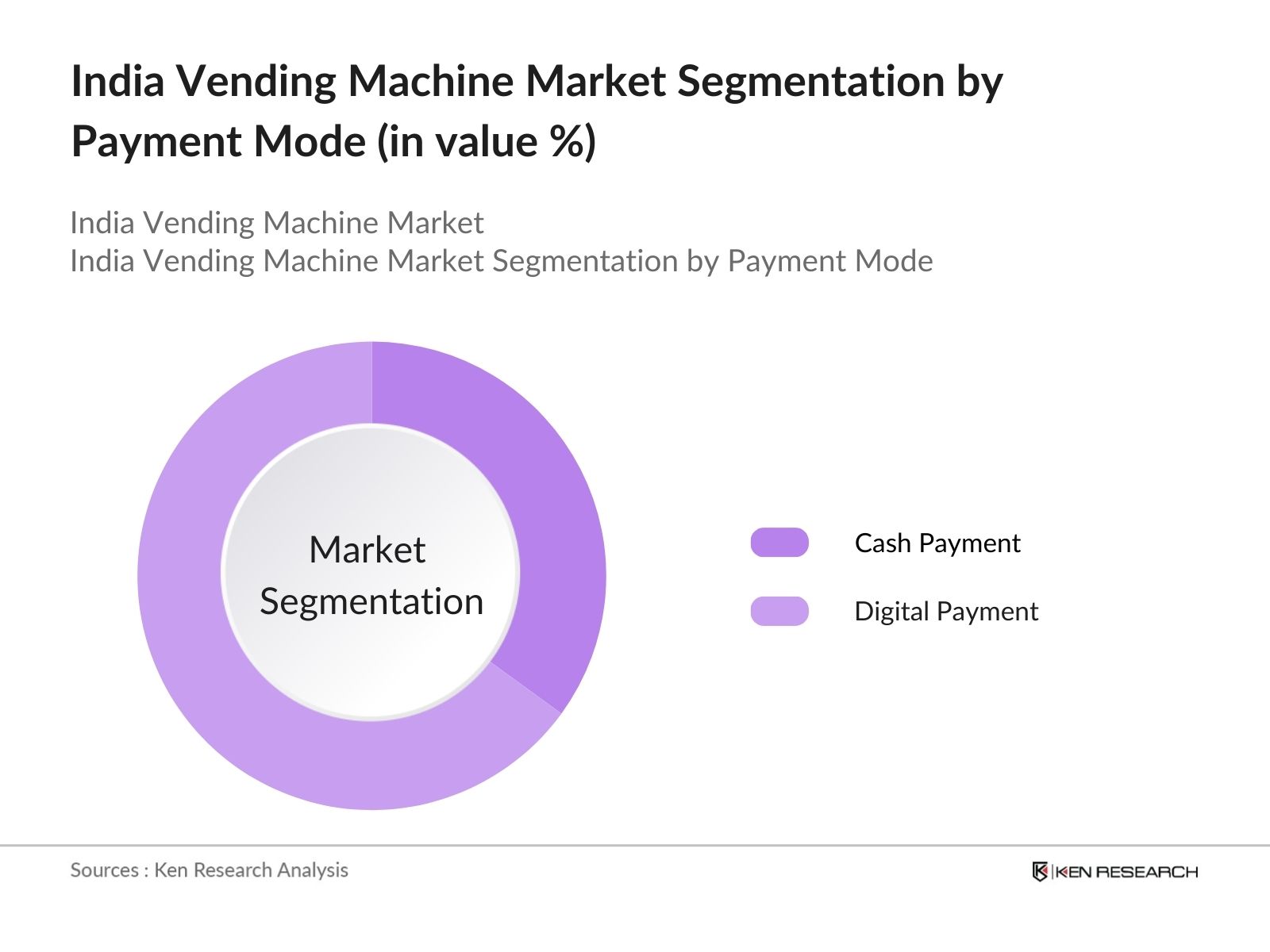

By Payment Mode: The market is also segmented by payment mode into cash payments and digital payments (UPI, cards, mobile wallets). Digital payments account for the largest share due to the widespread use of UPI and mobile wallets, driven by Indias government initiatives promoting a cashless economy. Consumers in urban centers, especially in corporate offices and educational institutions, prefer the convenience and speed of digital payments, which has led to higher transaction volumes through vending machines using these modes.

India Vending Machine Market Competitive Landscape

The market is dominated by a mix of domestic and international players, offering a range of product types and solutions. The market is highly consolidated, with key players leveraging advancements in technology and payment systems to gain competitive advantage. Companies are also focused on strategic partnerships with public institutions, corporate offices, and malls to expand their market presence.

|

Company Name |

Year of Establishment |

Headquarters |

Market Presence |

Product Portfolio |

No. of Employees |

Revenue (INR Bn) |

R&D Investment |

Customer Base |

|

Godrej Vending |

2002 |

Mumbai, India |

||||||

|

Fuji Electric |

1923 |

Tokyo, Japan |

||||||

|

Selecta Group |

1957 |

Cham, Switzerland |

||||||

|

Crane Merchandising Systems |

1917 |

Connecticut, USA |

||||||

|

Automatic Food Machines Pvt Ltd |

1995 |

Pune, India |

India Vending Machine Market Analysis

Market Growth Drivers

- Rising Cashless Transactions: The Reserve Bank of India reported that over 500 crore in digital transactions occurred daily in 2023, reflecting Indias transition towards a cashless economy. Vending machines equipped with digital payment systems are well-aligned with this trend, offering customers a seamless purchase experience without the need for cash. This increasing preference for digital payments is expected to drive vending machine adoption in public spaces, educational institutions, and corporate offices throughout 2024.

- Expansion of Public Transportation Networks: The Ministry of Road Transport and Highways reported an investment of 59,650 crore in public transportation infrastructure projects in 2023. Vending machines have become an integral part of modern transportation hubs like metro stations and bus terminals, providing refreshments and other essentials. As the public transportation network expands in 2024, the demand for vending machines in these areas is expected to rise, particularly in metro cities like Delhi and Bengaluru.

- Healthcare Sector Integration: Hospitals and healthcare facilities are incorporating vending machines to offer easy access to personal protective equipment (PPE), sanitizers, and hygiene-related products. The trend is expected to expand into Tier II cities by 2024 as hospitals continue to look for convenient ways to provide patients and staff with necessary supplies.

Market Challenges

- Inconsistent Power Supply: Despite Indias advancements in the power sector, power outages remain a concern in several states. The Ministry of Power reported that rural areas experienced an average of 6 hours of power outages per day in 2023. This challenge hinders the growth of the vending machine market in rural regions, where machines rely heavily on uninterrupted power supply for functionality.

- Limited Rural Penetration: According to the Ministry of Rural Development, rural regions saw only minimal adoption of vending machines in 2023 due to low footfall and limited purchasing power. Rural penetration is difficult, with machines often concentrated in metropolitan or semi-urban areas. The trend of low adoption rates in rural India is expected to continue in 2024 as rural markets remain less viable for vending machine operators due to logistical and financial challenges.

India Vending Machine Market Future Outlook

Over the next five years, the India vending machine industry is expected to see significant growth driven by increasing urbanization, growing consumer demand for convenience, and the expansion of corporate offices and retail outlets. The introduction of advanced payment systems like UPI and mobile wallets, combined with the government's focus on promoting digital transactions, will further accelerate the markets growth.

Future Market Opportunities

- Growth of Solar-Powered Vending Machines: By 2025, solar-powered vending machines will become a critical part of the market, particularly in regions facing inconsistent electricity supply. In 2023, the Ministry of New and Renewable Energy reported the successful pilot of 200 solar-powered vending machines in rural areas. As sustainability efforts gain traction, the adoption of solar-powered machines will rise, providing a cost-effective solution for remote regions.

- Expansion into Rural Markets: Over the next five years, the vending machine market will increasingly target rural areas, driven by improved infrastructure and government schemes such as the Pradhan Mantri Gram Sadak Yojana. In 2024, over 10,000 rural locations are expected to adopt vending machines offering essential goods, reducing reliance on traditional retail stores. This trend will support the expansion of automated retail into previously untapped markets.

Scope of the Report

|

By Product Type |

Beverage Vending Machines |

|

Snack Vending Machines |

|

|

Food Vending Machines |

|

|

Combination Vending Machines |

|

|

By Payment Mode |

Cash Payment |

|

Digital Payment |

|

|

By End-User |

Corporate Offices |

|

Retail Outlets |

|

|

Educational Institutions |

|

|

Healthcare Facilities |

|

|

By Installation Site |

Indoor Locations |

|

Outdoor Locations |

|

|

By Region |

North |

|

South |

|

|

East |

|

|

West |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Healthcare Companies

Investments and Venture Capitalist Firms

Government and Regulatory Bodies (FSSAI, Ministry of Commerce)

Hospitality and Tourism Industry

Hotels and Hospitality Chains

Private Equity Firms

Companies

Players Mentioned in the Report:

Godrej Vending

Fuji Electric

Selecta Group

Crane Merchandising Systems

Automatic Food Machines Pvt Ltd

Evoca Group

Azkoyen Group

Bianchi Vending Group

N&W Global Vending

Orasesta S.p.A

Fas International S.p.A

Saeco Vending

Sanden Vendo

Jofemar Corporation

Seaga Manufacturing

Table of Contents

1. India Vending Machine Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. India Vending Machine Market Size (In USD Million)

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. India Vending Machine Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Urbanization (Urbanization Rate, Consumer Demand Shift)

3.1.2. Technological Integration (IoT Integration, Contactless Payment Adoption)

3.1.3. Expansion of Retail Sector (Retail Growth, Store Automation)

3.1.4. Health and Wellness Trends (Health-Conscious Product Offerings)

3.2. Market Challenges

3.2.1. High Initial Investment (Setup Costs, Technology Costs)

3.2.2. Low Consumer Awareness (Penetration in Tier-II and Tier-III Cities)

3.2.3. Maintenance and Supply Chain Issues (Restocking Challenges, Technical Support)

3.3. Opportunities

3.3.1. Rising Demand for Cashless Payment Solutions (Digital Payment Trends, UPIIntegration)

3.3.2. Customization of Vending Machines (Smart Features, Personalized UserExperience)

3.3.3. Expanding Product Range (Healthy Snacks, Beverages, Ready-to-Eat Meals)

3.4. Trends

3.4.1. Adoption of Smart Vending Machines (IoT, AI, and Data Analytics)

3.4.2. Sustainability and Eco-friendly Machines (Green Vending Solutions)

3.4.3. Integration with Mobile Applications (User Interface, Rewards Program)

3.5. Government Initiatives

3.5.1. Digital India Initiative (Boosting Cashless Payments)

3.5.2. Start-up India Initiative (Supporting Small-Scale Manufacturers)

3.5.3. Smart Cities Mission (Promoting Technological Advancements in Retail)

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competitive Landscape

4. India Vending Machine Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Beverage Vending Machines

4.1.2. Snack Vending Machines

4.1.3. Food Vending Machines

4.1.4. Combination Vending Machines

4.2. By Payment Mode (In Value %)

4.2.1. Cash Payment

4.2.2. Digital Payment (UPI, Cards, Mobile Wallets)

4.3. By End-User (In Value %)

4.3.1. Corporate Offices

4.3.2. Retail Outlets

4.3.3. Educational Institutions

4.3.4. Healthcare Facilities

4.4. By Installation Site (In Value %)

4.4.1. Indoor Locations (Offices, Malls, Institutions)

4.4.2. Outdoor Locations (Railway Stations, Public Places)

4.5. By Region (In Value %)

4.5.1. North

4.5.2. South

4.5.3. East

4.5.4. West

5. India Vending Machine Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1. Godrej Vending

5.1.2. Fuji Electric

5.1.3. Automatic Food Machines Pvt Ltd

5.1.4. Selecta Group

5.1.5. Crane Merchandising Systems

5.1.6. Evoca Group

5.1.7. Azkoyen Group

5.1.8. Bianchi Vending Group

5.1.9. N&W Global Vending

5.1.10. Orasesta S.p.A

5.1.11. Fas International S.p.A

5.1.12. Saeco Vending

5.1.13. Sanden Vendo

5.1.14. Jofemar Corporation

5.1.15. Seaga Manufacturing

5.2 Cross Comparison Parameters (Headquarters, Market Presence, Product Portfolio, Employee Strength, Revenue, R&D Expenditure, Customer Base, Distribution Network)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Government Grants

5.8. Private Equity Investments

6. India Vending Machine Market Regulatory Framework

6.1. FSSAI Compliance

6.2. Licensing and Permits for Installation

6.3. Food and Beverage Safety Regulations

6.4. Environmental Regulations for Machine Disposal

7. India Vending Machine Future Market Size (In USD Million)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. India Vending Machine Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Payment Mode (In Value %)

8.3. By End-User (In Value %)

8.4. By Installation Site (In Value %)

8.5. By Region (In Value %)

9. India Vending Machine Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involved developing a detailed market map encompassing all major stakeholders in the India vending machine market. Extensive secondary research was conducted using proprietary databases and industry reports to identify the key variables impacting the market, such as payment modes, product offerings, and customer preferences.

Step 2: Market Analysis and Construction

In this step, we compiled historical market data to analyze market penetration and revenue generation. This included evaluating data from industry reports and financial statements of key players to provide accurate insights into market size and growth trends.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses were validated through interviews with industry experts, including vending machine manufacturers, corporate office managers, and retail operators. These interviews helped refine the data and validate the accuracy of the market projections.

Step 4: Research Synthesis and Final Output

In the final phase, direct consultations with key manufacturers helped gather insights on product segments, sales performance, and customer preferences. This validated the findings and provided a comprehensive analysis of the India vending machine market, ensuring the final report is both accurate and actionable.

Frequently Asked Questions

01. How big is the India Vending Machine Market?

The India vending machine market is valued at USD 510 million, driven by increasing demand for automated retail solutions and the widespread adoption of cashless payments through UPI and mobile wallets.

02. What are the challenges in the India Vending Machine Market?

The India vending machine market faces challenges such as high initial costs for vending machine installation and maintenance, as well as logistical issues in restocking machines in remote or low-traffic areas.

03. Who are the major players in the India Vending Machine Market?

Key players in the India vending machine market include Godrej Vending, Fuji Electric, Selecta Group, and Crane Merchandising Systems. These companies dominate due to their strong product portfolios, strategic partnerships, and advanced technology offerings.

04. What are the growth drivers of the India Vending Machine Market?

The India vending machine market is driven by increasing consumer demand for convenience, the expansion of digital payment systems, and the growing number of corporate offices and retail outlets. Additionally, government initiatives promoting cashless transactions are boosting the adoption of vending machines.

05. What trends are shaping the India Vending Machine Market?

Key trends in the India vending machine market include the integration of IoT and AI in vending machines, enabling smarter and more personalized customer experiences, as well as the rise in demand for healthier food and beverage options in vending machines.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.