India Veterinary Eye Care Market Outlook to 2030

Region:Asia

Author(s):Meenakshi

Product Code:KROD5090

October 2024

95

About the Report

India Veterinary Eye Care Market Overview

- The India Veterinary Eye Care Market is valued at USD 208 million, according to recent studies and data from industry sources. The markets growth is driven by increasing pet ownership, rising awareness of pet healthcare, and technological advancements in veterinary ophthalmology. These factors have led to a surge in demand for treatments, diagnostics, and eye surgeries specifically for animals. Additionally, the growing inclination towards specialized pet care is pushing veterinarians to adopt advanced technologies for ophthalmic treatments.

- In terms of regional dominance, major metropolitan areas such as Mumbai, Delhi, and Bengaluru lead the veterinary eye care market. The dominance of these cities can be attributed to higher pet ownership rates, a concentration of veterinary specialists, and greater disposable income that allows for more premium veterinary services. Additionally, these regions house a growing number of veterinary clinics equipped with advanced ophthalmic devices, contributing to the regional dominance.

- The Indian government is being urged to pass the Prevention of Cruelty to Animals (Amendment) Bill,2022, which aims to strengthen penalties for animal cruelty and introduce five fundamental freedoms for animals, such as freedom from hunger, pain, and discomfort. The bill would replace outdated fines under the 1960 law and introduce stricter regulations for animal welfare. This initiative could significantly enhance veterinary care and protection, benefiting sectors like veterinary ophthalmology.

India Veterinary Eye Care Market Segmentation

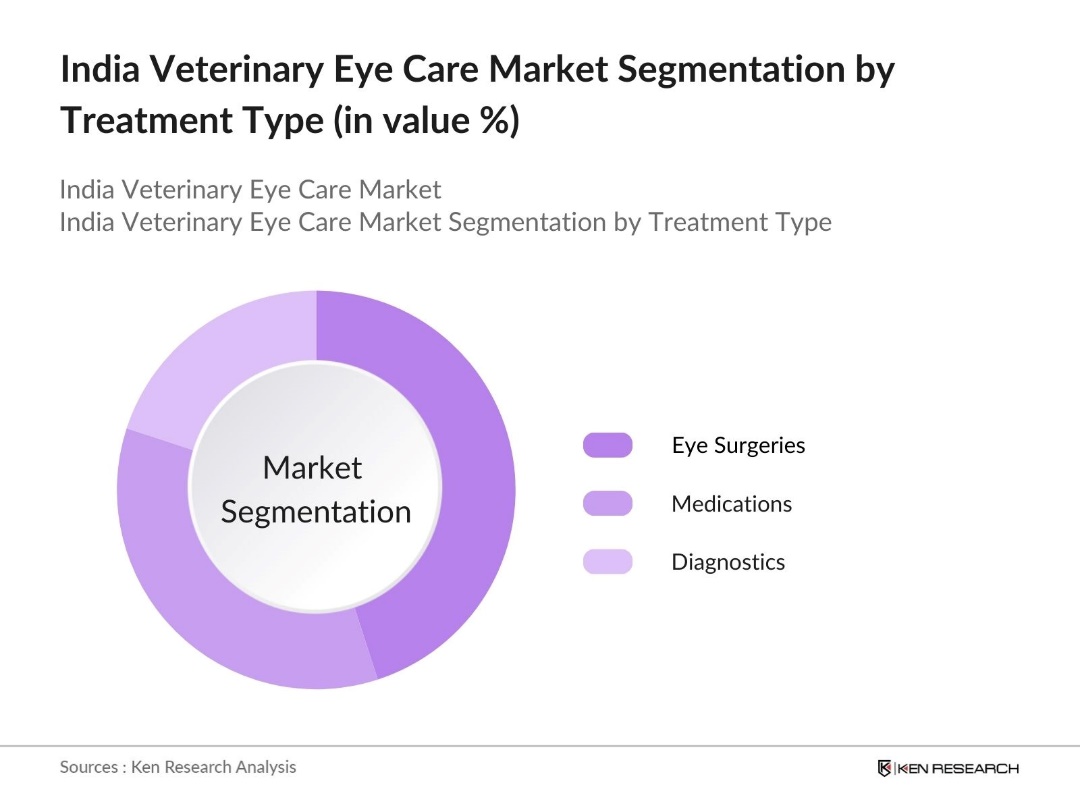

By Treatment Type: The India Veterinary Eye Care market is segmented by treatment type into eye surgeries, medications, and diagnostics. Eye surgeries have recently gained a dominant market share under this segmentation. This is due to the increasing availability of advanced ophthalmic surgical procedures for conditions such as cataracts and glaucoma in companion animals. Additionally, the growing demand for specialized surgical interventions in veterinary care is driving the segments prominence.

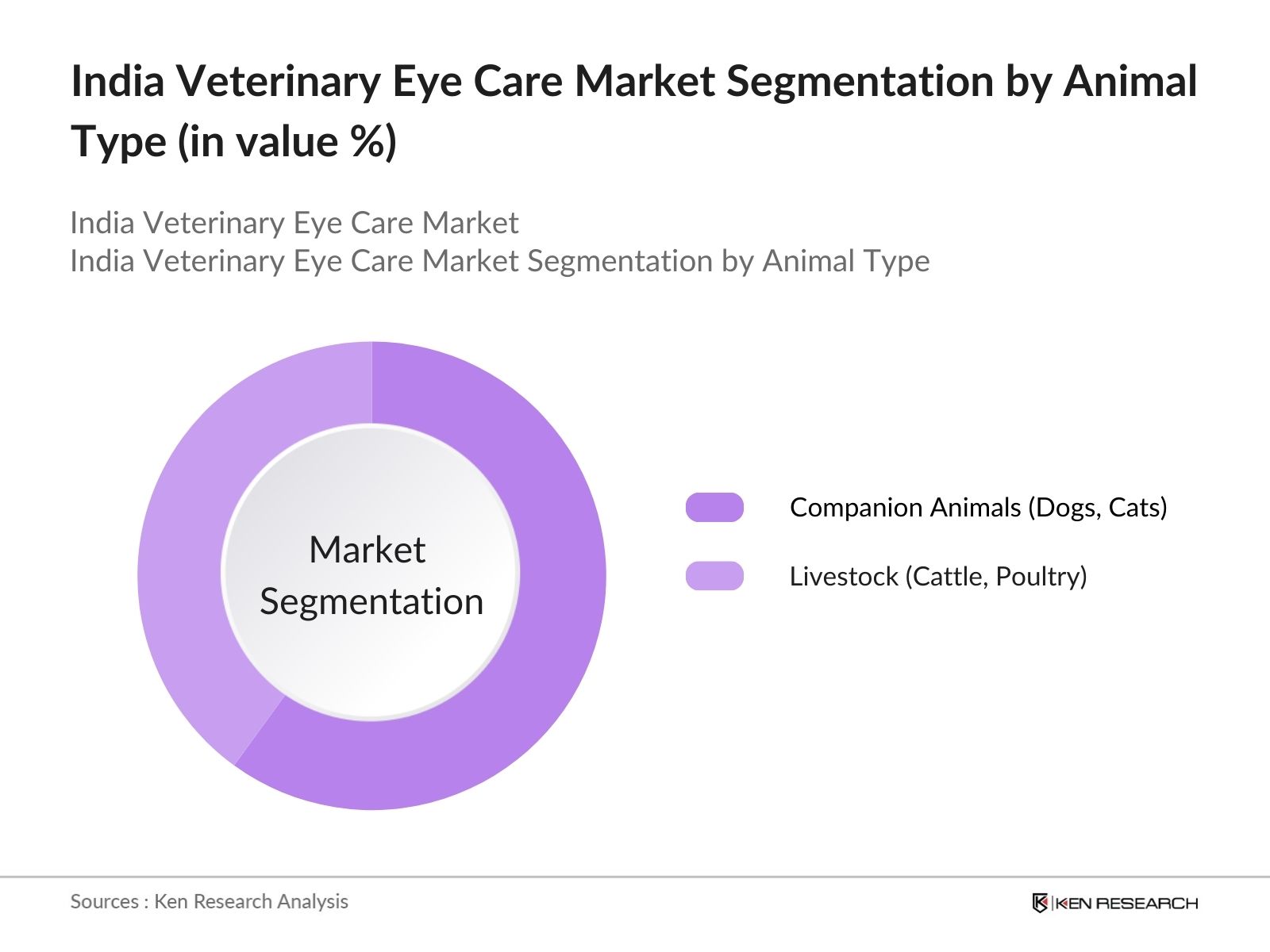

By Animal Type: The India Veterinary Eye Care market is further segmented by animal type into companion animals (dogs, cats) and livestock (cattle, poultry). The companion animals segment holds a dominant position in the market due to the rising rates of pet adoption, especially in urban areas. Pets, particularly dogs and cats, are increasingly viewed as family members, and pet owners are more willing to invest in their health, including specialized treatments like eye care.

India Veterinary Eye Care Market Competitive Landscape

The market is characterized by a mix of domestic and international players who dominate the industry with innovative products, services, and technological advancements. The competitive landscape in India is growing more consolidated, with a handful of major players holding a significant market share due to their strong product portfolios, established distribution networks, and deep market penetration.

|

Company |

Establishment Year |

Headquarters |

No. of Products |

R&D Investment (INR Bn) |

Employee Strength |

Revenue (INR Bn) |

No. of Clinics |

Market Reach |

|

Vetoquinol India Animal Health |

1995 |

Mumbai |

||||||

|

Virbac India |

1996 |

Hyderabad |

||||||

|

Zoetis India Limited |

1952 |

Bengaluru |

||||||

|

Cipla Vet |

1998 |

Pune |

||||||

|

Intas Pharmaceuticals |

1985 |

Ahmedabad |

India Veterinary Eye Care Industry Analysis

Growth Drivers

- Increasing Pet Ownership: India has witnessed a substantial rise in pet ownership, especially in urban areas. The growing affection for pets has led to an increase in healthcare spending on animals, including veterinary eye care. For instance, in July 2022, the Union Minister for Fisheries, Animal Husbandry, and Dairy, Shri Parshottam Rupala, recommended that the cooperative movement in the livestock industry be strengthened. In addition, there has been the implementation of various programs and schemes in India in the favor of veterinary health.

- Expanding Veterinary Clinic Networks: India has experienced a increase in veterinary clinics. This expansion, particularly in urban and semi-urban areas, is supported by initiatives from the Department of Animal Husbandry, which aims to increase veterinary infrastructure through public-private partnerships. For instance, in August 2022, DCC (Dogs Cats & Companions) Animal Hospital, one of India's leading multi-specialty state-of-the-art pet care chains expanded with a new full-service medical and grooming center in New Delhi, India.

- Advancements in Veterinary Ophthalmic Devices and Diagnostics: The veterinary medical device market, particularly in ophthalmic equipment, has experienced notable innovations. Many veterinary clinics, especially in metropolitan areas, have adopted advanced diagnostic tools like digital fundus cameras and slit lamps, enhancing the precision and quality of eye care diagnostics. These developments are supported by regulatory approvals for modern ophthalmic devices, which have facilitated their wider deployment across clinics.

Market Challenges

- High Costs of Veterinary Eye Surgeries: The cost of veterinary eye surgeries remains a significant challenge for many pet owners, limiting access to necessary treatments. Eye surgeries, such as cataract removal, can be expensive, especially for middle-income families. While there is growing demand for veterinary eye care, these high costs prevent a larger portion of pet owners from seeking specialized treatments for their animals. Government programs aimed at subsidizing veterinary services are still in development, and only a small percentage of clinics currently offer affordable options for eye surgeries.

- Lack of Specialized Veterinary Ophthalmologists: India faces a shortage of specialized veterinary ophthalmologists, which presents a major challenge for pet owners seeking expert eye care. Very few veterinarians choose to specialize in ophthalmology, leaving a gap in the availability of advanced eye care services. This shortage is more pronounced in rural and semi-urban areas, where general veterinarians often manage eye conditions without specialized training. As a result, access to high-quality veterinary eye care is limited, particularly outside major urban centers.

India Veterinary Eye Care Market Future Outlook

Over the next few years, the India Veterinary Eye Care market is expected to witness significant growth, driven by an increasing awareness of animal healthcare, the rising pet population, and the introduction of advanced ophthalmic treatments. The expansion of veterinary clinics in Tier II and III cities is also projected to fuel growth, making eye care treatments more accessible to a broader population.

Market Opportunities

- Technological Innovations in Diagnostics (AI in diagnostics, telemedicine): The integration of artificial intelligence (AI) in veterinary diagnostics is transforming the field of eye care. AI-assisted diagnostic tools are being increasingly used for early detection of retinal and other eye diseases, providing more accurate and efficient results. Additionally, telemedicine platforms are expanding to include veterinary eye consultations, making specialized care more accessible to pet owners, especially those in remote areas. This growing reliance on technology is enhancing the ability of veterinarians to diagnose and treat eye conditions with greater precision and convenience.

- Growing Demand for Pet Insurance Coverage for Eye Treatments: There has been a steady increase in the availability of pet insurance policies that cover eye treatments and surgeries. More pet owners are now opting for insurance plans that provide coverage for specialized veterinary eye care, allowing them to afford advanced treatments for conditions such as cataracts and glaucoma. This rise in pet insurance coverage is driving demand for veterinary ophthalmic services, as more pet owners seek out specialized care to address their animals' eye health needs.

Scope of the Report

|

By Treatment Type |

Eye Surgeries Medications Diagnostics |

|

By Animal Type |

Companion Animals Livestock |

|

By Distribution Channel |

Veterinary Clinics Online Retail Pharmacies Hospitals |

|

By End-User |

Pet Owners Veterinary Practitioners Government Animal Healthcare Providers |

|

By Region |

North South East West |

Products

Key Target Audience

Veterinary Clinics

Animal Health Manufacturers

Veterinary Ophthalmic Equipment Suppliers

Pet Insurance Companies

Pet Hospitals and Diagnostic Centers

Investment and Venture Capitalist Firms

Government Animal Healthcare Providers (Animal Welfare Board of India, Veterinary Council of India)

Government and Regulatory Bodies (Ministry of Animal Husbandry and Dairying)

Companies

Major Players

Vetoquinol India Animal Health Pvt. Ltd.

Virbac India

Zoetis India Limited

Cipla Vet

Intas Pharmaceuticals Ltd. (Animal Health Division)

Merck Animal Health

Bayer Animal Health

Savavet

Dechra Pharmaceuticals

Abbott Animal Health

Himalaya Animal Health

Pet Mankind

Elanco Animal Health

Sava Vetcare

Boehringer Ingelheim

Table of Contents

1. India Veterinary Eye Care Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate (Market-specific growth rates based on treatment innovations, diagnostics, and demand for pet healthcare)

1.4. Market Segmentation Overview

2. India Veterinary Eye Care Market Size (In INR Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones (Veterinary clinic expansions, new drug approvals, and technological advancements)

3. India Veterinary Eye Care Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Pet Ownership

3.1.2. Rising Awareness of Animal Healthcare

3.1.3. Advancements in Veterinary Ophthalmic Devices and Diagnostics

3.1.4. Expanding Veterinary Clinic Networks

3.2. Market Challenges

3.2.1. High Costs of Veterinary Eye Surgeries

3.2.2. Lack of Specialized Veterinary Ophthalmologists

3.2.3. Limited Access to Veterinary Eye Care in Rural Areas

3.3. Opportunities

3.3.1. Technological Innovations in Diagnostics (AI in diagnostics, telemedicine)

3.3.2. Growing Demand for Pet Insurance Coverage for Eye Treatments

3.3.3. Expansion into Tier II and III Cities

3.4. Trends

3.4.1. Integration of AI and Robotics in Veterinary Eye Surgeries

3.4.2. Use of Digital Eye Diagnostic Tools

3.4.3. Telehealth Services for Post-operative Eye Care

3.5. Government Regulation

3.5.1. Animal Welfare Board Regulations

3.5.2. Licensing and Certification of Veterinary Clinics

3.5.3. Regulations on Importation of Veterinary Ophthalmic Drugs

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. India Veterinary Eye Care Market Segmentation

4.1. By Treatment Type (In Value %)

4.1.1. Eye Surgeries (Cataract, Glaucoma, Retinal Disorders)

4.1.2. Medications (Topical, Oral, Injectables)

4.1.3. Diagnostics (Ophthalmic Examination, Imaging Techniques)

4.2. By Animal Type (In Value %)

4.2.1. Companion Animals (Dogs, Cats)

4.2.2. Livestock (Cattle, Poultry)

4.3. By Distribution Channel (In Value %)

4.3.1. Veterinary Clinics

4.3.2. Online Retail Pharmacies

4.3.3. Hospitals

4.4. By End-User (In Value %)

4.4.1. Pet Owners

4.4.2. Veterinary Practitioners

4.4.3. Government Animal Healthcare Providers

4.5. By Region (In Value %)

4.5.1. North India

4.5.2. South India

4.5.3. East India

4.5.4. West India

5. India Veterinary Eye Care Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1. Vetoquinol India Animal Health Pvt. Ltd.

5.1.2. Virbac India

5.1.3. Zoetis India Limited

5.1.4. Intas Pharmaceuticals Ltd. (Animal Health Division)

5.1.5. Cipla Vet

5.1.6. Merck Animal Health

5.1.7. Bayer Animal Health

5.1.8. Boehringer Ingelheim

5.1.9. Savavet

5.1.10. Dechra Pharmaceuticals

5.1.11. Abbott Animal Health

5.1.12. Himalaya Animal Health

5.1.13. Pet Mankind

5.1.14. Elanco Animal Health

5.1.15. Sava Vetcare

5.2. Cross Comparison Parameters

(Headquarters Location, Revenue, Employee Strength, Product Portfolio, Market Share, No. of Product Launches, Distribution Reach, Clinical Trials)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. India Veterinary Eye Care Market Regulatory Framework

6.1. Regulations on Veterinary Drugs

6.2. Licensing Requirements for Veterinary Clinics

6.3. Veterinary Medical Devices Certification

7. India Veterinary Eye Care Future Market Size (In INR Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. India Veterinary Eye Care Future Market Segmentation

8.1. By Treatment Type (In Value %)

8.2. By Animal Type (In Value %)

8.3. By Distribution Channel (In Value %)

8.4. By End-User (In Value %)

8.5. By Region (In Value %)

9. India Veterinary Eye Care Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

In this step, an ecosystem map of the India Veterinary Eye Care Market was created by identifying all major stakeholders, including veterinary clinics, hospitals, manufacturers, and diagnostic centers. This involved extensive secondary research using databases and industry-specific reports to gather comprehensive data.

Step 2: Market Analysis and Construction

Historical data was collected and analyzed to determine the market size, revenue generation, and the adoption rate of veterinary ophthalmic services across India. This step ensured the reliability of the market estimates through the cross-referencing of data sources.

Step 3: Hypothesis Validation and Expert Consultation

Key market assumptions were validated through structured interviews with industry experts, including veterinary professionals and clinic owners, to obtain first-hand insights. This helped refine the final market figures and confirmed the trends observed.

Step 4: Research Synthesis and Final Output

The data gathered from secondary sources was synthesized with expert inputs to prepare a robust and validated market analysis. This final report was then reviewed for accuracy and completeness, ensuring a detailed and factual representation of the India Veterinary Eye Care Market.

Frequently Asked Questions

01. How big is the India Veterinary Eye Care Market?

The India Veterinary Eye Care Market is valued at USD 208 million, driven by increasing pet ownership, a rising demand for specialized animal healthcare, and technological advancements in diagnostics and treatments.

02. What are the challenges in the India Veterinary Eye Care Market?

Challenges in this India Veterinary Eye Care Market include the high cost of eye surgeries, a shortage of specialized veterinary ophthalmologists, and limited access to advanced veterinary services in rural areas.

03. Who are the major players in the India Veterinary Eye Care Market?

Key players in India Veterinary Eye Care Market include Vetoquinol India Animal Health Pvt. Ltd., Virbac India, Zoetis India Limited, Cipla Vet, and Intas Pharmaceuticals. These companies dominate the market with their extensive product portfolios and strong distribution networks.

04. What are the growth drivers of the India Veterinary Eye Care Market?

The India Veterinary Eye Care Market is propelled by rising pet adoption rates, growing awareness of pet healthcare, and advancements in veterinary ophthalmic technologies. The increasing number of specialized veterinary clinics also supports market expansion.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.