India Veterinary Industry Outlook to 2030

Region:Asia

Author(s):Paribhasha Tiwari

Product Code:KROD5110

December 2024

89

About the Report

India Veterinary Industry Market Overview

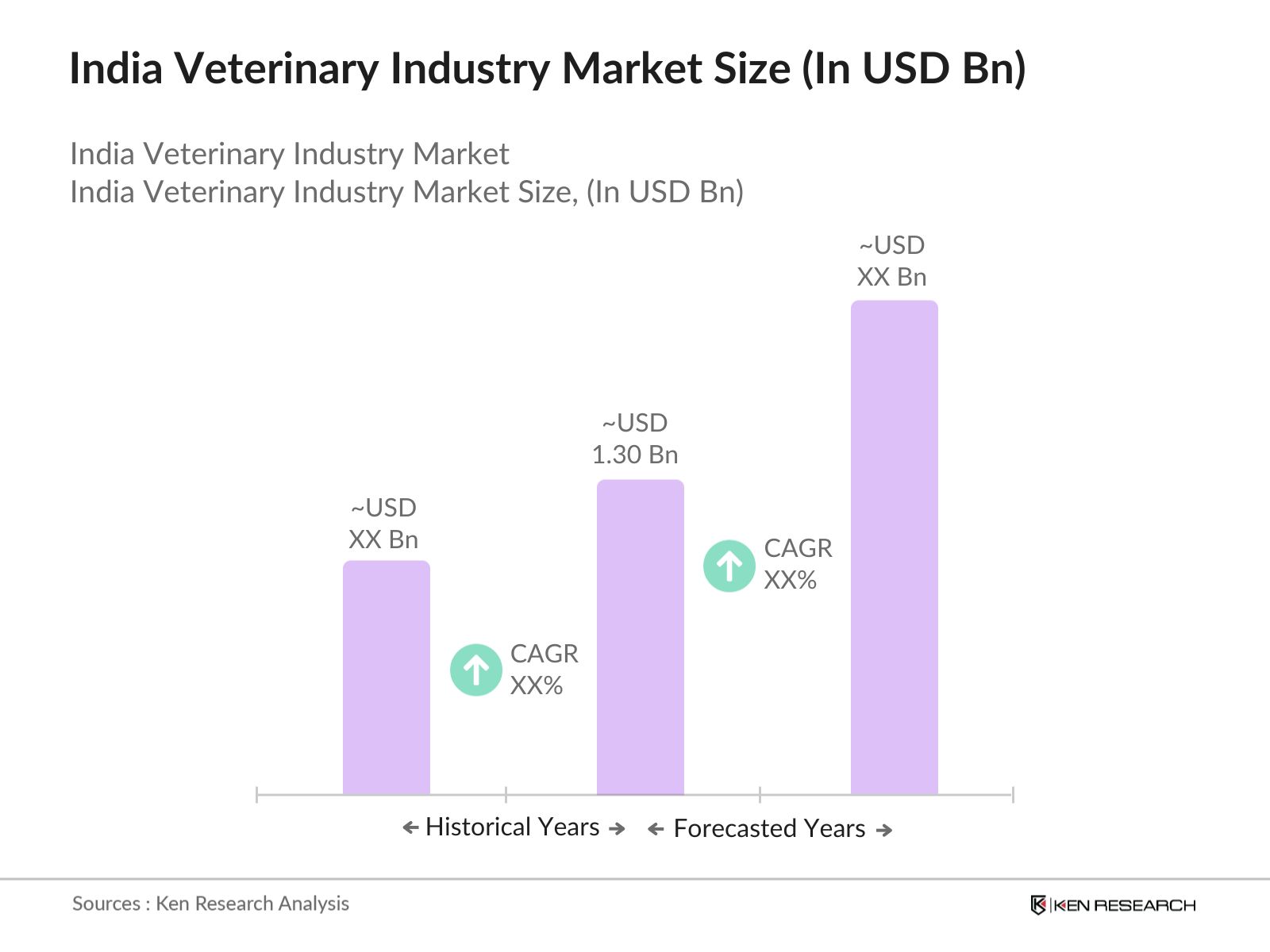

- The India Veterinary Industry is valued at USD 1.30 billion, based on a five-year historical analysis. The market is primarily driven by increasing pet ownership, livestock health awareness, and government initiatives aimed at improving animal healthcare standards. The growing demand for advanced veterinary pharmaceuticals, diagnostics, and vaccines is further fueling market growth, with significant contributions from rural as well as urban areas. Technological advancements in veterinary care, such as telemedicine and veterinary diagnostics, are also playing a vital role in driving market expansion.

- Key regions such as North and South India dominate the India veterinary market due to their large livestock populations and increasing pet ownership, particularly in metropolitan areas like Delhi, Mumbai, and Bengaluru. These cities benefit from a concentration of veterinary hospitals and clinics, as well as a robust infrastructure supporting animal healthcare services. The presence of top veterinary pharmaceutical manufacturers and the increasing consumer focus on companion animal health further bolster the market's strength in these regions.

- The National Animal Disease Control Program (NADCP) was launched with a budget of INR 13,343 crores to vaccinate 500 million livestock annually. The program focuses on controlling and eradicating diseases such as Foot and Mouth Disease (FMD) and Brucellosis. This initiative significantly boosts demand for veterinary services across India, creating opportunities for veterinarians, healthcare providers, and pharmaceutical companies.

India Veterinary Industry Market Segmentation

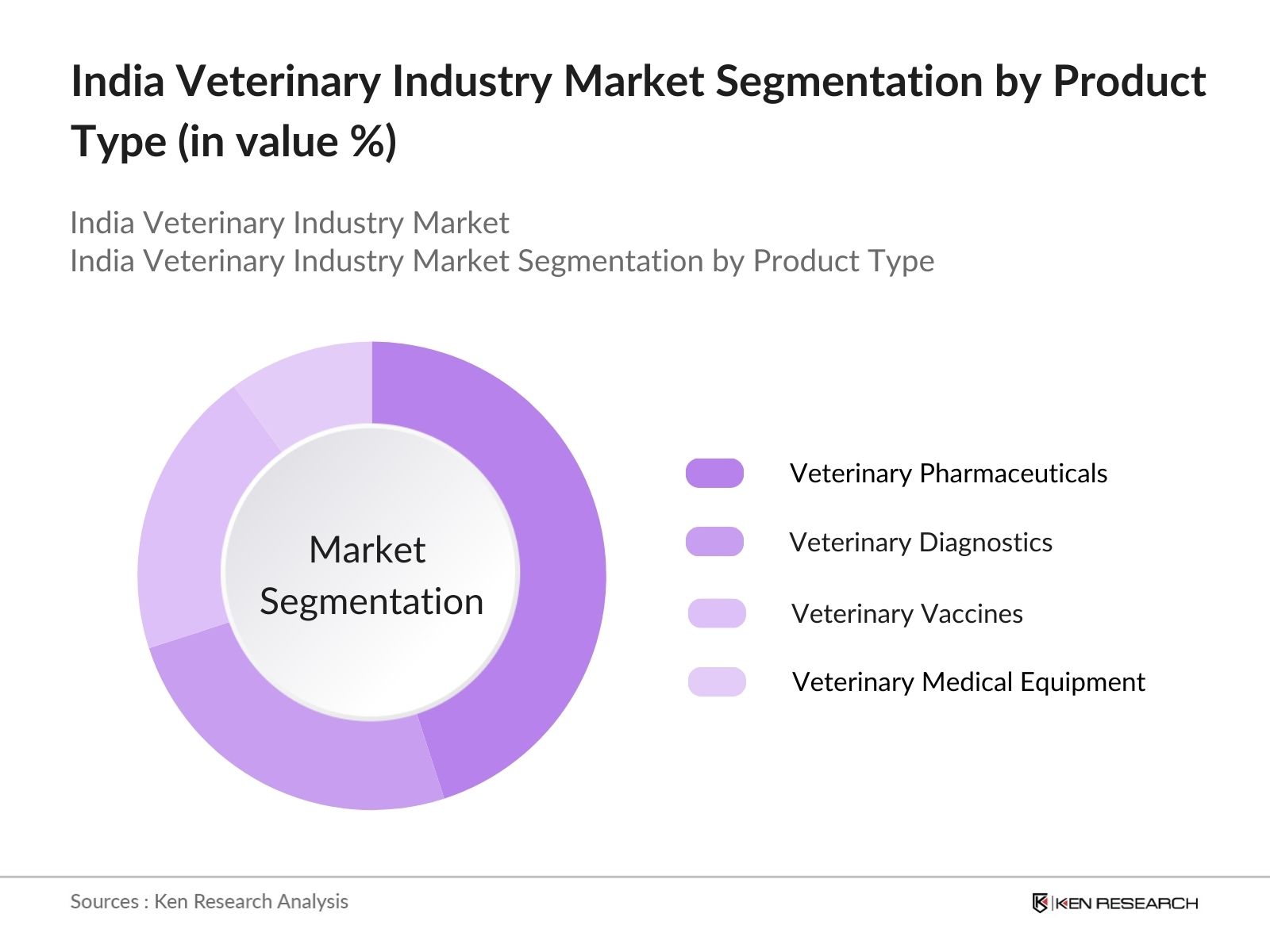

By Product Type: India's Veterinary Industry market is segmented by product type into veterinary pharmaceuticals, veterinary diagnostics, veterinary vaccines, and veterinary medical equipment. Among these, veterinary pharmaceuticals hold the dominant market share in India due to their critical role in treating various animal diseases and ensuring livestock health. This segment's dominance is driven by the growing prevalence of zoonotic diseases and the rising demand for antibiotics and anti-infectives in the livestock sector. Furthermore, the increasing investments in research and development for animal health products are also contributing to the rapid growth of this segment.

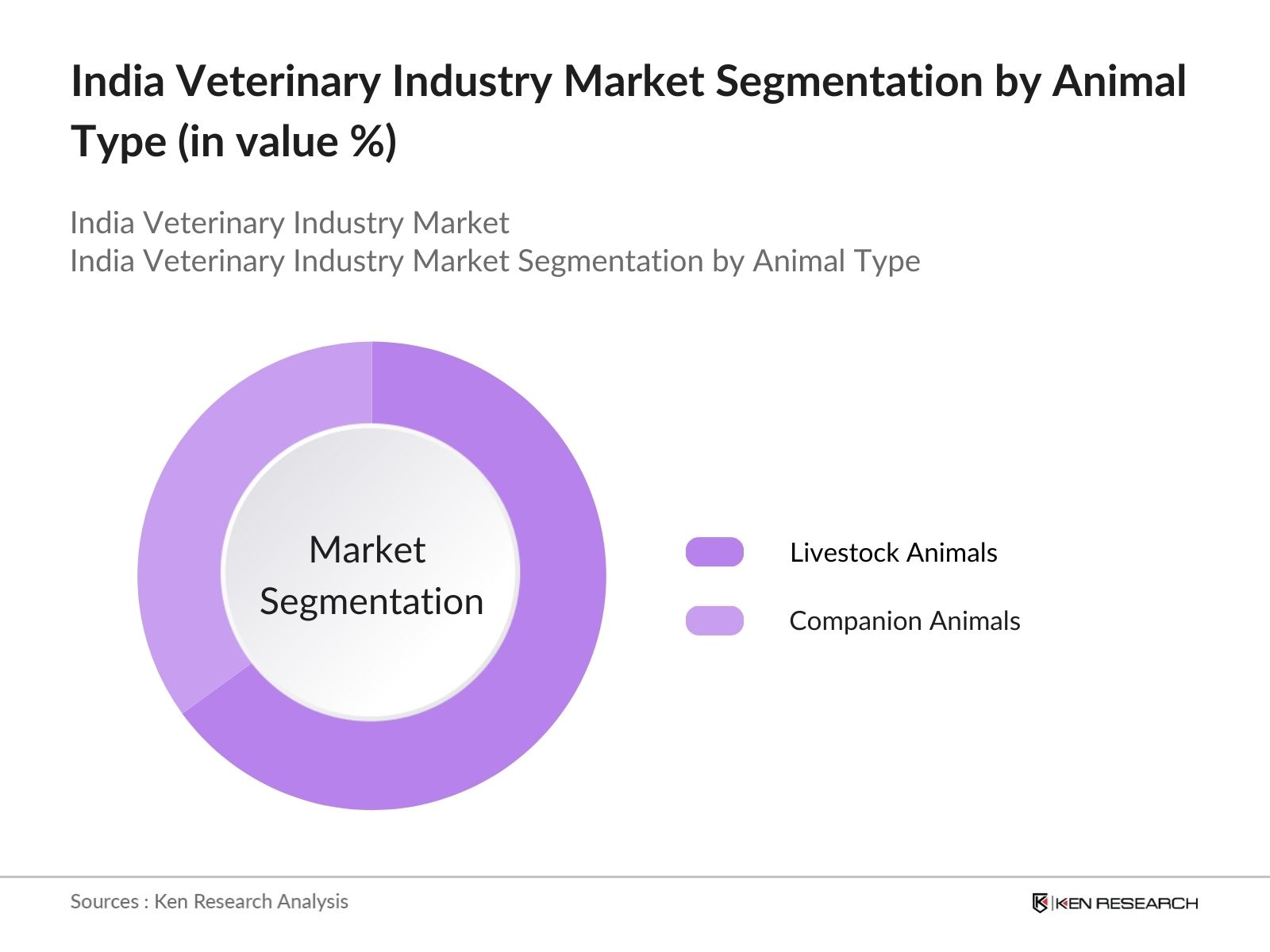

By Animal Type: The veterinary market in India is segmented by animal type into companion animals and livestock animals. Livestock animals, including cattle, poultry, and swine, dominate the market share due to India's agrarian economy, which is heavily reliant on livestock for income and sustenance. The livestock segments growth is driven by the increasing demand for meat, dairy products, and other animal-derived products, alongside government initiatives aimed at improving animal health through vaccination programs and disease control measures.

India Veterinary Industry Competitive Landscape

The India Veterinary Industry is characterized by the presence of several domestic and international players. These companies are competing on various parameters such as product innovation, market penetration, and price differentiation. Major companies are investing heavily in research and development to introduce advanced veterinary products, such as vaccines and diagnostics, aimed at improving animal health. This competitive landscape is further bolstered by the increasing collaboration between veterinary pharmaceutical companies and research institutes.

|

Company Name |

Establishment Year |

Headquarters |

Revenue (2023) |

Product Portfolio |

R&D Investment |

Market Share |

Key Partnerships |

Certifications |

Global Presence |

|

Zydus Animal Health |

1952 |

Ahmedabad, India |

- | - | - | - | - | - | - |

|

Merck Animal Health |

1891 |

New Jersey, USA |

- | - | - | - | - | - | - |

|

Zoetis |

1952 |

Parsippany, USA |

- | - | - | - | - | - | - |

|

Virbac |

1968 |

Carros, France |

- | - | - | - | - | - | - |

|

Hester Biosciences |

1987 |

Ahmedabad, India |

- | - | - | - | - | - | - |

India Veterinary Industry Analysis

Growth Drivers

- Rising Pet Ownership: India's rising pet ownership has been a significant growth driver for the veterinary industry. The country's pet population surged to 32 million in 2023, as reported by the World Bank, largely driven by increasing disposable incomes and urbanization. Additionally, with the average household income growing by 4.3% annually in 2023 according to the IMF, more families can afford to own and care for pets. This growth in pet ownership is fueling demand for veterinary services, including regular checkups, vaccinations, and advanced healthcare treatments, creating substantial opportunities for veterinarians and related service providers.

- Livestock Population: India holds one of the largest livestock populations in the world, with 535.8 million heads of livestock as per government estimates from the Ministry of Agriculture in 2023. The livestock sector contributes around 4.5% to Indias GDP, emphasizing its critical role in the national economy. This robust livestock population demands continuous veterinary attention for disease prevention, treatment, and overall healthcare. The introduction of government-backed disease control programs such as the National Animal Disease Control Program (NADCP) further supports the demand for veterinary services in rural and urban settings alike.

- Animal Health Awareness: The growing awareness of animal health, spurred by both government and non-government organizations, is a key factor driving veterinary industry growth in India. The Indian government has launched multiple initiatives aimed at improving livestock health and productivity, such as the Livestock Health and Disease Control Scheme. Public health campaigns related to zoonotic diseases have also emphasized the importance of regular veterinary care, resulting in an increase in animal health checkups. The World Organization for Animal Health (OIE) reports that India now has over 25,000 veterinarians, although there is still room for growth in this workforce.

Market Challenges

- High Cost of Veterinary Services: Veterinary services in India remain expensive for many pet and livestock owners, with the average cost of veterinary treatment ranging from INR 1,500 to INR 3,500 per visit, according to reports from the Veterinary Council of India. This cost is a barrier to accessing veterinary care, especially in rural areas where livestock farming is prevalent. Rising operational costs, import dependencies for advanced diagnostic tools, and the lack of government subsidies in this sector compound the issue, limiting the reach of high-quality veterinary services to a select few.

- Lack of Skilled Veterinary Workforce: India faces a significant shortage of trained veterinarians. While the country has around 25,000 registered veterinarians as per OIE data, the livestock and pet population demand nearly double this number. The ratio of veterinarians to livestock heads remains critically low, with approximately one veterinarian for every 20,000 animals, compared to the global average of one veterinarian per 5,000 animals. This shortage restricts the quality and availability of veterinary services, particularly in rural areas, affecting disease management and animal care.

India Veterinary Industry Future Outlook

Over the next five years, the India veterinary industry is expected to witness significant growth driven by factors such as increased awareness of animal health, rising pet ownership, and advancements in veterinary medical technology. The government's continuous efforts to improve livestock health, coupled with the introduction of various animal welfare programs, will further boost the demand for veterinary products and services. Additionally, the growing trend of telemedicine in veterinary care and the rising demand for companion animal diagnostics are set to fuel the industry's expansion. The increasing focus on rural healthcare development and the rising disposable incomes of consumers are also expected to drive the growth of the companion animal healthcare segment, leading to further investments in veterinary clinics and hospitals.

Market Opportunities

- Emerging Veterinary Diagnostics: The veterinary diagnostics sector is witnessing significant advancements, with innovations such as rapid testing kits, PCR diagnostics, and digital imaging technologies gaining traction. In 2023, Indias expenditure on veterinary diagnostics tools increased by 7.2% according to the Ministry of Agriculture. This growth is particularly pronounced in urban areas, where pet owners are more inclined to spend on advanced diagnostic services. These advancements allow veterinarians to offer better diagnostic accuracy and timely treatment, enhancing overall animal healthcare services across the country.

- Increasing Investment in Animal Healthcare: Investment in India's animal healthcare industry is rising, with private and public sector initiatives aimed at improving veterinary infrastructure. In 2023, the Indian government allocated INR 4,200 crores to boost veterinary services as part of the Livestock Health and Disease Control Scheme. This fund is expected to improve veterinary hospitals, enhance animal disease surveillance, and provide essential training for veterinary professionals, especially in rural areas. Such investments are opening up new opportunities for both local and international companies in the animal healthcare sector.

Scope of the Report

|

By Product Type |

Veterinary Pharmaceuticals Veterinary Diagnostics Veterinary Vaccines Veterinary Medical Equipment |

|

By Animal Type |

Companion Animals (Dogs, Cats, Other Pets) Livestock Animals (Cattle, Poultry, Swine, Sheep) |

|

By End-User |

Veterinary Hospitals Veterinary Clinics Animal Farms Research Institutes |

|

By Distribution Channel |

Retail Pharmacies Veterinary Hospitals & Clinics E-commerce Wholesalers & Distributors |

|

By Region |

North South East West |

Products

Key Target Audience

Veterinary Pharmaceutical Companies

Veterinary Diagnostic Equipment Manufacturers

Animal Health Service Providers

Government and Regulatory Bodies (Veterinary Council of India, Livestock Insurance Program)

Livestock Farmers

Companion Animal Clinics and Hospitals

Investments and Venture Capitalist Firms

Animal Welfare Organizations

Companies

Players Mentioned in the Report:

Zydus Animal Health

Merck Animal Health

Zoetis

Virbac

Hester Biosciences

Vetoquinol

Intas Pharmaceuticals

Elanco

Bayer Animal Health

Ceva Sant Animale

Table of Contents

1. India Veterinary Industry Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. India Veterinary Industry Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. India Veterinary Industry Market Analysis

3.1. Growth Drivers (Rising Pet Ownership, Livestock Population, Animal Health Awareness, Disease Control Programs)

3.2. Market Challenges (High Cost of Veterinary Services, Lack of Skilled Veterinary Workforce, Regulatory Hurdles)

3.3. Opportunities (Emerging Veterinary Diagnostics, Increasing Investment in Animal Healthcare, Rural Veterinary Clinics)

3.4. Trends (Telemedicine in Veterinary Care, Advanced Veterinary Imaging, Genomics in Animal Health)

3.5. Government Regulation (Animal Welfare Acts, Livestock Insurance Programs, Disease Surveillance)

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. India Veterinary Industry Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Veterinary Pharmaceuticals

4.1.2. Veterinary Diagnostics

4.1.3. Veterinary Vaccines

4.1.4. Veterinary Medical Equipment

4.2. By Animal Type (In Value %)

4.2.1. Companion Animals (Dogs, Cats, Other Pets)

4.2.2. Livestock Animals (Cattle, Poultry, Swine, Sheep)

4.3. By End-User (In Value %)

4.3.1. Veterinary Hospitals

4.3.2. Veterinary Clinics

4.3.3. Animal Farms

4.3.4. Research Institutes

4.4. By Distribution Channel (In Value %)

4.4.1. Retail Pharmacies

4.4.2. Veterinary Hospitals & Clinics

4.4.3. E-commerce

4.4.4. Wholesalers & Distributors

4.5. By Region (In Value %)

4.5.1. North India

4.5.2. South India

4.5.3. East India

4.5.4. West India

5. India Veterinary Industry Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Zydus Animal Health

5.1.2. Merck Animal Health

5.1.3. Zoetis

5.1.4. Virbac

5.1.5. Hester Biosciences

5.1.6. Vetoquinol

5.1.7. Intas Pharmaceuticals

5.1.8. Elanco

5.1.9. Bayer Animal Health

5.1.10. Ceva Sant Animale

5.1.11. Boehringer Ingelheim

5.1.12. Neogen Corporation

5.1.13. Phibro Animal Health

5.1.14. SeQuent Scientific

5.1.15. Ashish Life Sciences Pvt Ltd.

5.2. Cross Comparison Parameters (Revenue, Market Share, Product Portfolio, Geographic Presence, R&D Investments, Partnerships, Certifications, Sustainability Initiatives)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers And Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. India Veterinary Industry Market Regulatory Framework

6.1. Veterinary Council of India Guidelines

6.2. Animal Welfare Standards

6.3. Disease Surveillance Programs

6.4. Livestock Vaccination Mandates

6.5. Compliance Requirements

6.6. Certification Processes

7. India Veterinary Industry Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth (Expansion of Companion Animal Market, Advances in Veterinary Diagnostics, Growing Investment in Veterinary Clinics)

India Veterinary Industry Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Animal Type (In Value %)

8.3. By End-User (In Value %)

8.4. By Distribution Channel (In Value %)

8.5. By Region (In Value %)

9. India Veterinary Industry Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

In the initial phase, an ecosystem map was constructed to include all major stakeholders in the India Veterinary Industry. Desk research was performed using a combination of secondary sources, including proprietary databases, to identify and define key variables influencing the market dynamics.

Step 2: Market Analysis and Construction

Historical data from various government and industry reports were compiled and analyzed to assess market penetration and revenue generation across key segments. A detailed evaluation of the ratio between product types and their distribution channels was also performed.

Step 3: Hypothesis Validation and Expert Consultation

To validate market hypotheses, interviews were conducted with industry experts from major veterinary pharmaceutical companies, livestock farms, and veterinary hospitals. These consultations provided crucial insights into market trends, helping refine the overall analysis.

Step 4: Research Synthesis and Final Output

The final stage involved synthesizing the collected data through a combination of top-down and bottom-up approaches, ensuring an accurate, comprehensive report on the India Veterinary Industry. Detailed insights from veterinary professionals further verified the reports conclusions.

Frequently Asked Questions

01. How big is the India Veterinary Industry market?

The India veterinary industry, valued at USD 1.30 billion, is driven by increasing demand for animal healthcare services and a rising number of pet owners across urban areas.

02. What are the challenges in the India Veterinary Industry market?

Challenges in the India veterinary market include the high cost of veterinary services, a lack of skilled professionals, and stringent regulatory requirements that hinder market penetration.

03. Who are the major players in the India Veterinary Industry market?

Major players in the India veterinary market include Zydus Animal Health, Merck Animal Health, Zoetis, Virbac, and Hester Biosciences, all of which dominate due to their extensive product portfolios and research investments.

04. What are the growth drivers of the India Veterinary Industry market?

Key growth drivers include increased pet ownership, government initiatives aimed at improving animal health, and the rising demand for advanced veterinary pharmaceuticals and diagnostics.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.