India Watch Market Outlook to 2030

Region:Asia

Author(s):Mukul

Product Code:KROD9033

October 2024

84

About the Report

India Watch Market Overview

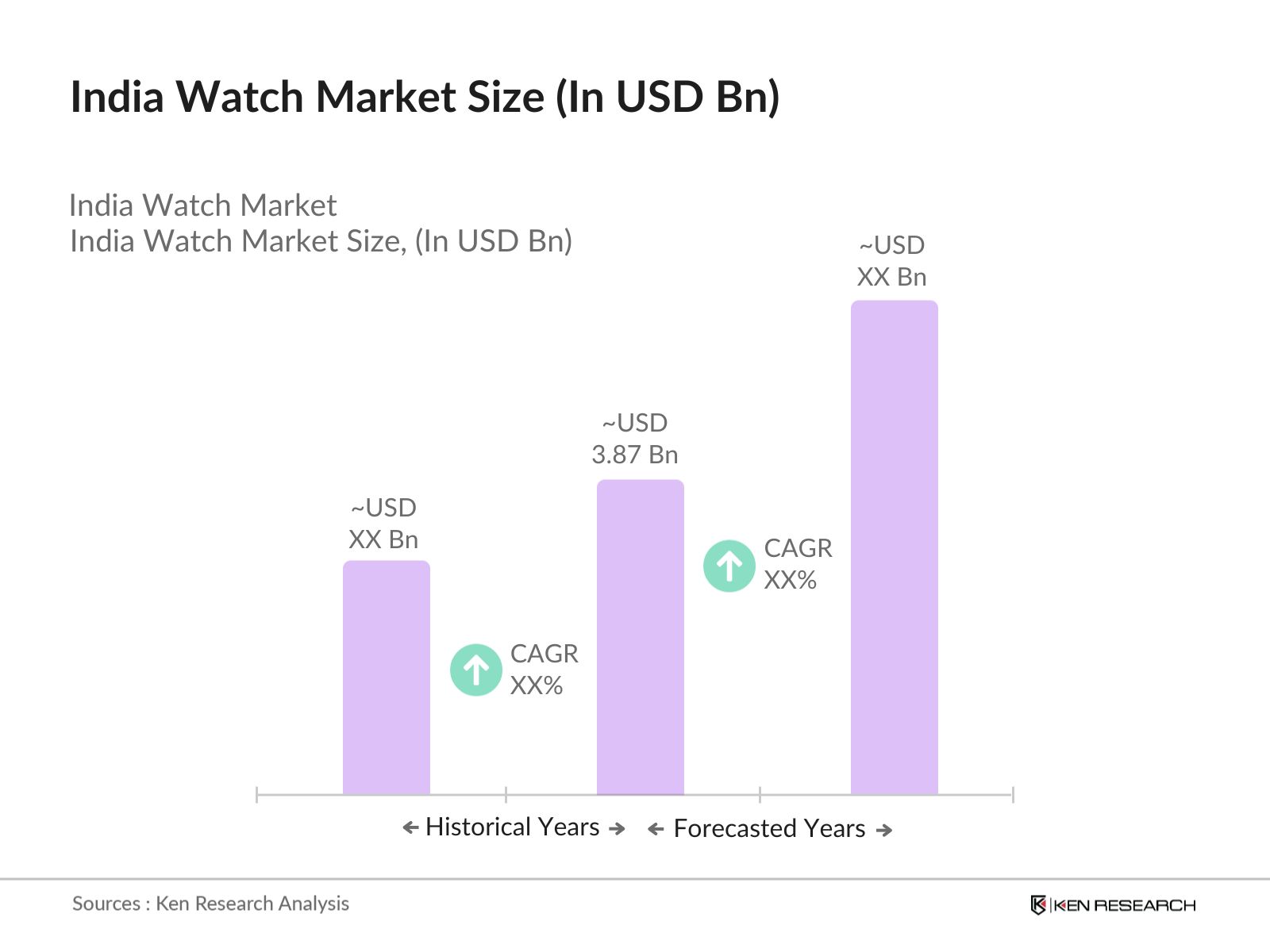

- The India Watch market is valued at USD 3.87 billion, driven by a combination of factors such as increasing disposable income, growing fashion consciousness, and the rising trend of smartwatches. Consumers, particularly in urban areas, are increasingly looking for watches that reflect personal style and integrate technology. The demand for high-end and luxury watches is also rising, especially in metro cities, due to the growing preference for premium accessories.

- Cities like Mumbai, Delhi, and Bengaluru dominate the watch market due to their larger populations of high-income individuals and a strong retail presence for luxury and premium brands. These cities are also home to a tech-savvy younger population that favors smartwatches. The presence of international brands and a developed e-commerce ecosystem further drive the market dominance of these cities.

- India maintains significant import duties on watches, especially luxury models. In 2023, the government continued enforcing a 30% import duty on watches, a measure aimed at promoting local manufacturing under the Make in India initiative. These high tariffs remain a barrier for international brands looking to enter the market, driving up the retail prices of imported watches.

India Watch Market Segmentation

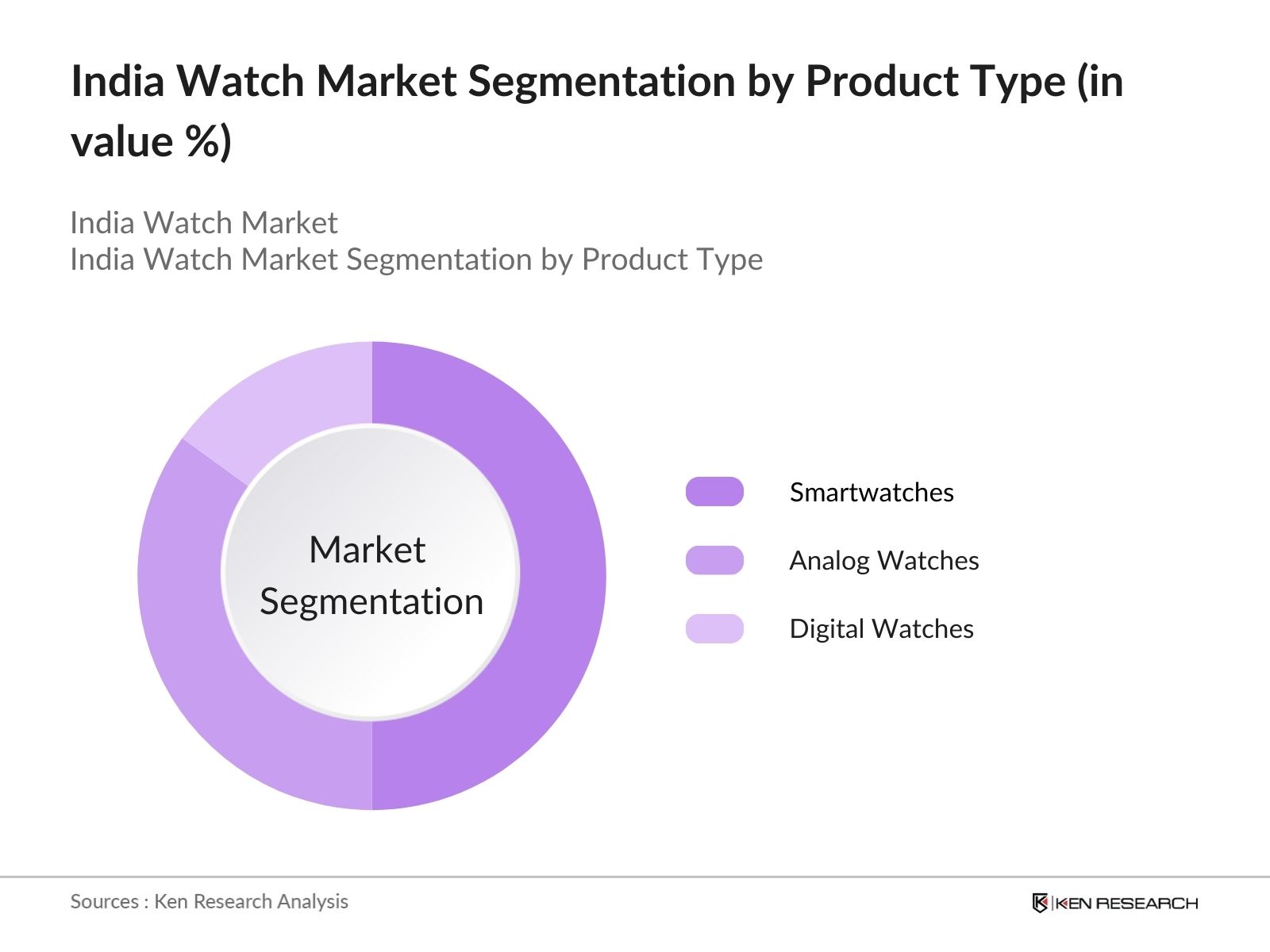

- By Product Type: India's watch market is segmented by product type into analog watches, digital watches, and smartwatches. Smartwatches have a dominant market share in India under this segmentation, owing to the rising popularity of wearable technology. Brands like Apple, Samsung, and Fossil have capitalized on this trend by offering watches that integrate health monitoring features, notifications, and fitness tracking. The growing inclination towards a more tech-integrated lifestyle among consumers, particularly millennials, has bolstered the demand for smartwatches.

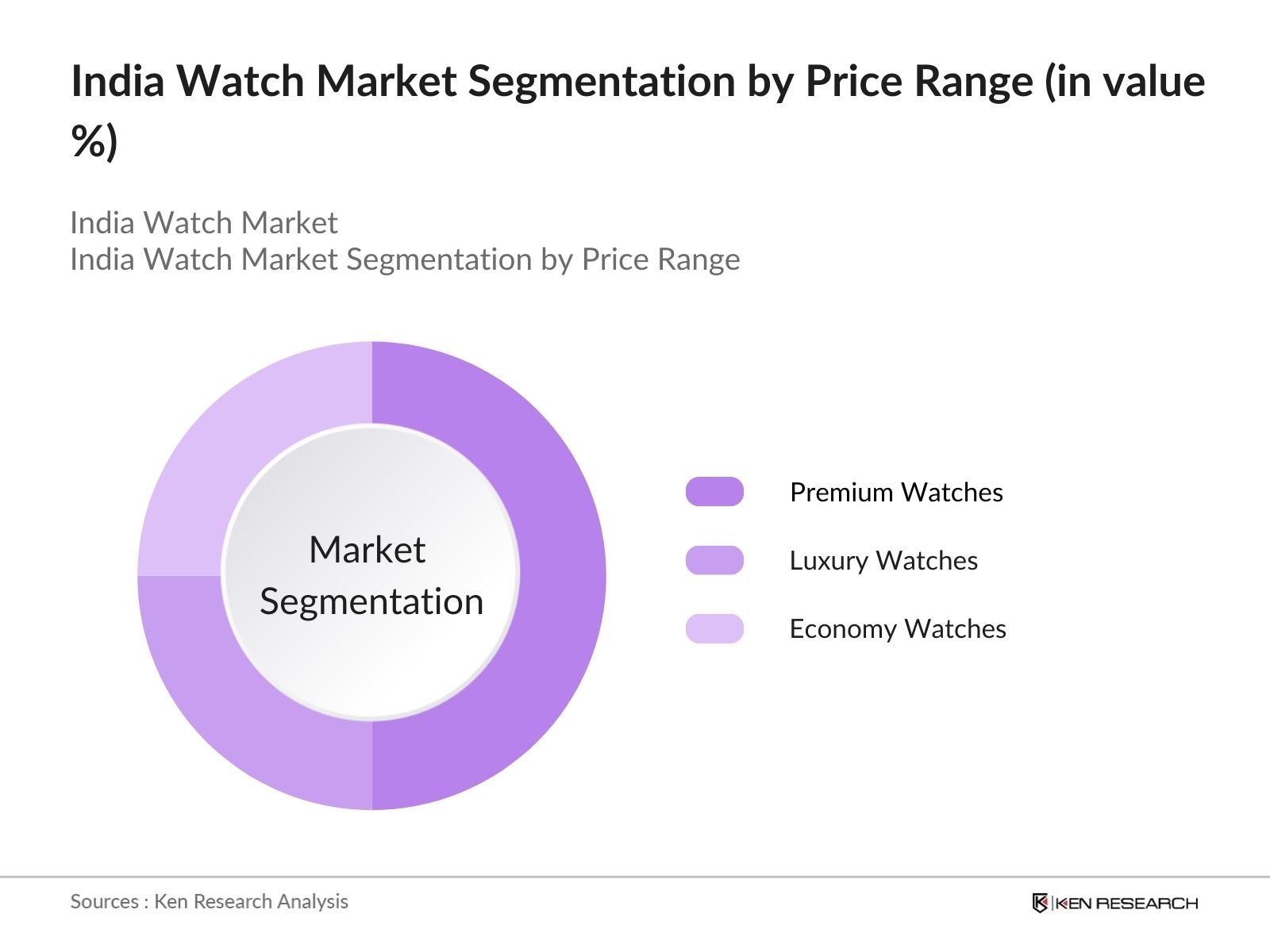

- By Price Range: India's watch market is further segmented by price range into economy watches, premium watches, and luxury watches. Premium watches hold a significant share in the market due to their ability to balance affordability with quality. Brands such as Titan and Seiko offer premium models that attract middle-class consumers looking for stylish yet reasonably priced watches. The popularity of premium watches is also driven by their versatile design and durability, appealing to a broad customer base.

India Watch Market Competitive Landscape

The India Watch market is highly competitive, with both international and domestic players. Major players include Titan Company Ltd., which dominates the domestic market with its range of analog and premium watches, and global players such as Fossil and Seiko, which cater to higher-end segments with innovative designs and brand heritage.

|

Company |

Establishment Year |

Headquarters |

Revenue (INR Bn) |

Product Portfolio |

Market Presence |

Key Market |

Brand Strength |

Innovation Focus |

Distribution Channel |

|

Titan Company Ltd. |

1984 |

Bengaluru, India |

13.2 |

||||||

|

Fossil India Pvt. Ltd. |

1984 |

Richardson, Texas |

2.9 |

||||||

|

Casio India Co. Pvt. Ltd. |

1946 |

Tokyo, Japan |

3.5 |

||||||

|

Seiko Watch India Pvt. Ltd. |

1881 |

Tokyo, Japan |

2.7 |

||||||

|

Apple India Pvt. Ltd. |

1976 |

Cupertino, California |

6.8 |

India Watch Industry Analysis

Growth Drivers

- Increasing Disposable Income: The Indian watch market is experiencing increased demand due to a rise in disposable income among the population. In 2023, the per capita income in India reached INR 170,620, reflecting the growing purchasing power of the middle class, which contributes significantly to the expansion of consumer goods, including watches. The increased affordability allows more consumers to purchase not only functional but also luxury and fashionable watches, leading to a rise in sales across both budget and high-end segments.

- Rise in Fashion Consciousness: Fashion awareness among Indian consumers has risen dramatically, particularly in urban areas. With a booming middle class, urban dwellers' focus on accessories, such as watches, has increased significantly. Reports indicate that consumer spending on fashion accessories grew to INR 4.5 trillion in 2023, supported by the diversification of watch designs and collaborations with fashion brands. This has created opportunities for watch brands to integrate style and functionality, offering trendy and fashion-forward timepieces.

- Technological Advancements (Smartwatches Integration): India has become a major market for smartwatches, with sales increasing as technology-savvy consumers seek gadgets that integrate health tracking, fitness monitoring, and communication features. In 2023, over 17 million smartwatches were sold in IndiaCompanies like Apple, Samsung, and local players have expanded offerings, driven by consumer interest in smartwatches that combine traditional aesthetics with modern functionality.

Market Restraints

- Presence of Counterfeit Products: Counterfeit products pose a significant challenge to the growth of the Indian watch market. In 2023, the counterfeit goods market in India was valued at INR 1.4 trillion, with a notable share consisting of fake luxury watches. These counterfeit products not only affect the sales of legitimate brands but also harm brand reputation. Regulatory authorities are struggling to curb the rise of these counterfeit goods.

- High Import Duty on Luxury Watches: India imposes substantial import duties on luxury watches, making them considerably more expensive compared to other global markets. In 2023, the import duty on luxury watches was set at 30%, which affects the purchasing decisions of high-income consumers and curtails the growth of luxury brands. This high duty level restricts the entry of international watch brands and dampens consumer demand.

India Watch Market Future Outlook

Over the next five years, the India Watch market is expected to grow significantly, driven by increasing consumer spending on luxury goods, a rising preference for smartwatches, and a shift towards premium accessories. The growth in the e-commerce sector, coupled with the expansion of online retail channels, is expected to play a crucial role in market expansion. Furthermore, technological advancements in smartwatches, such as health monitoring and fitness tracking features, will likely drive higher adoption rates.

Market Opportunities

- Expansion into Tier-2 and Tier-3 Cities: With urban markets becoming saturated, significant growth opportunities lie in tier-2 and tier-3 cities. These cities saw a combined increase in disposable income to INR 12 trillion in 2023, providing new avenues for the watch industry to expand. The penetration of organized retail and online shopping in these regions further supports the opportunity for brands to tap into these untapped markets.

- Collaborations between Fashion Brands and Watchmakers: Collaborations between fashion brands and watchmakers offer lucrative opportunities for both industries to innovate and capture new market segments. In 2023, collaborations between luxury fashion brands and watchmakers generated additional revenues worth INR 50 billion. These partnerships allow for the creation of exclusive, limited-edition products that attract both fashion-conscious buyers and watch enthusiasts.

Scope of the Report

|

By Product Type |

Analog Watches |

|

Digital Watches |

|

|

Smartwatches |

|

|

By Price Range |

Economy Watches |

|

Premium Watches |

|

|

Luxury Watches |

|

|

By End User |

Men |

|

Women |

|

|

Kids |

|

|

By Distribution Channel |

Online Stores |

|

Offline Stores (Retail Outlets) |

|

|

Authorized Dealers |

|

|

By Region |

North India |

|

South India |

|

|

East India |

|

|

West India |

Products

Key Target Audience

Watch Manufacturers

Watch Retailers

E-commerce Platforms

Fashion Brands

Smartwatch Technology Providers

Investor and Venture Capitalist Firms

Government and Regulatory Bodies (Ministry of Consumer Affairs, Bureau of Indian Standards)

Distributors and Wholesalers

Companies

Players Mentioned in the Report:

Titan Company Ltd.

Fossil India Pvt. Ltd.

Casio India Co. Pvt. Ltd.

Seiko Watch India Pvt. Ltd.

Timex Group India Ltd.

Apple India Pvt. Ltd.

Samsung Electronics India Pvt. Ltd.

Garmin India Pvt. Ltd.

Rolex India Pvt. Ltd.

Hublot India Pvt. Ltd.

Swatch Group India Pvt. Ltd.

Citizen Watches India Pvt. Ltd.

Michael Kors India Pvt. Ltd.

Armani Exchange Watches India

Rado Watch Co. Ltd.

Table of Contents

1. India Watch Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. India Watch Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. India Watch Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Disposable Income

3.1.2. Rise in Fashion Consciousness

3.1.3. Technological Advancements (Smartwatches Integration)

3.1.4. E-commerce and Omni-channel Retailing

3.2. Market Challenges

3.2.1. Presence of Counterfeit Products

3.2.2. High Import Duty on Luxury Watches

3.2.3. Limited Skilled Workforce in Manufacturing

3.3. Opportunities

3.3.1. Expansion into Tier-2 and Tier-3 Cities

3.3.2. Collaborations between Fashion Brands and Watchmakers

3.3.3. Rising Demand for Luxury and Customizable Watches

3.4. Trends

3.4.1. Popularity of Smartwatches Among Millennials

3.4.2. Vintage and Limited Edition Watch Trends

3.4.3. Use of Sustainable Materials in Watchmaking

3.5. Government Regulation

3.5.1. Import Duties and Custom Tariffs on Watches

3.5.2. FDI Policies in the Watch Manufacturing Industry

3.5.3. Make in India Initiatives

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem (Watchmakers, Retailers, Distributors)

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. India Watch Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Analog Watches

4.1.2. Digital Watches

4.1.3. Smartwatches

4.2. By Price Range (In Value %)

4.2.1. Economy Watches

4.2.2. Premium Watches

4.2.3. Luxury Watches

4.3. By End User (In Value %)

4.3.1. Men

4.3.2. Women

4.3.3. Kids

4.4. By Distribution Channel (In Value %)

4.4.1. Online Stores

4.4.2. Offline Stores (Retail Outlets)

4.4.3. Authorized Dealers

4.5. By Region (In Value %)

4.5.1. North India

4.5.2. South India

4.5.3. East India

4.5.4. West India

5. India Watch Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Titan Company Ltd.

5.1.2. Timex Group India Ltd.

5.1.3. Casio India Co. Pvt. Ltd.

5.1.4. Fossil India Pvt. Ltd.

5.1.5. Seiko Watch India Pvt. Ltd.

5.1.6. Swatch Group India Pvt. Ltd.

5.1.7. Citizen Watches India Pvt. Ltd.

5.1.8. Rolex India Pvt. Ltd.

5.1.9. Hublot India Pvt. Ltd.

5.1.10. Rado Watch Co. Ltd.

5.1.11. Michael Kors India Pvt. Ltd.

5.1.12. Armani Exchange Watches India

5.1.13. Movado Group Inc.

5.1.14. Garmin India Pvt. Ltd.

5.1.15. Apple India Pvt. Ltd.

5.2. Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue, Product Portfolio, Distribution Reach, Key Markets, Market Share)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. India Watch Market Regulatory Framework

6.1. Environmental Standards

6.2. Compliance Requirements

6.3. Certification Processes

7. India Watch Market Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. India Watch Market Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Price Range (In Value %)

8.3. By End User (In Value %)

8.4. By Distribution Channel (In Value %)

8.5. By Region (In Value %)

9. India Watch Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

In this initial phase, we map the entire India Watch Market ecosystem, identifying all significant stakeholders such as manufacturers, retailers, distributors, and technology providers. This is done through comprehensive desk research, utilizing proprietary and public databases, including government sources and market reports. Critical variables such as product types, consumer preferences, and regional demand are defined.

Step 2: Market Analysis and Construction

Historical data is analyzed to assess market performance, penetration rates, and revenue generation for different watch segments, such as analog and smartwatches. A thorough evaluation of industry trends and consumer behavior is also performed to validate the market growth trajectory and forecast future demand.

Step 3: Hypothesis Validation and Expert Consultation

Market assumptions and hypotheses are tested through expert consultations. These include interviews with watch manufacturers, distributors, and e-commerce platforms to gather insights on operational challenges, sales performance, and innovations in the watch market.

Step 4: Research Synthesis and Final Output

After validating data with industry experts, we compile the final report, ensuring the inclusion of verified statistics and up-to-date insights. The report provides a detailed analysis of the India Watch Market, backed by both primary and secondary research methodologies.

Frequently Asked Questions

01. How big is the India Watch Market?

The India Watch Market was valued at USD 3.87 billion, driven by increasing demand for premium and smartwatches. The market's growth is supported by rising disposable incomes and a growing consumer base in urban areas.

02. What are the challenges in the India Watch Market?

Challenges include the presence of counterfeit products, high import duties on luxury watches, and a lack of skilled workforce in watch manufacturing, which affects the overall quality and innovation in the sector.

03. Who are the major players in the India Watch Market?

Key players in the market include Titan Company Ltd., Casio India Co. Pvt. Ltd., Fossil India Pvt. Ltd., Seiko Watch India Pvt. Ltd., and Apple India Pvt. Ltd. These companies lead the market due to their strong brand presence and diverse product portfolios.

04. What are the growth drivers of the India Watch Market?

The market is primarily driven by the growing popularity of smartwatches, increasing disposable incomes, and rising demand for luxury watches among the affluent consumer base. Technological innovations in smartwatches are also a key growth driver.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.