India Water Purifier Industry Outlook to 2030

Region:Asia

Author(s):Shubham Kashyap

Product Code:KROD1207

June 2025

90

About the Report

India Water Purifier Market Overview

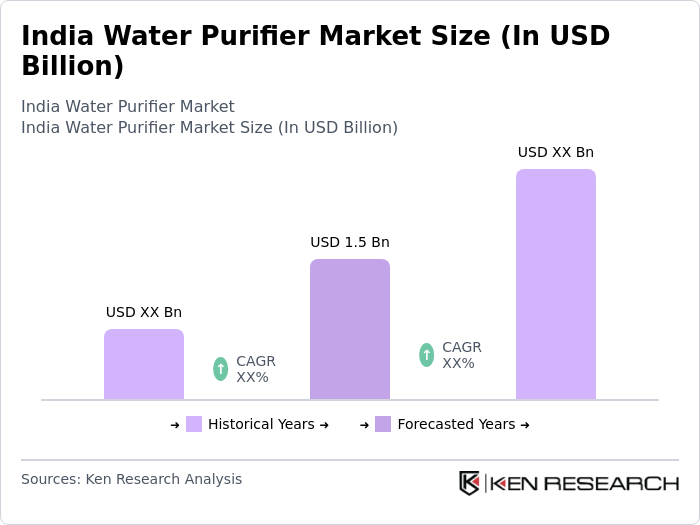

- The India Water Purifier Market was valued at USD 1.5 billion, based on a five-year historical analysis. This growth is primarily driven by increasing concerns over water quality, rising health awareness among consumers, and the growing urban population. The demand for clean drinking water has surged, leading to a significant rise in the adoption of water purification technologies across households and commercial establishments.

- Key cities such as Delhi, Mumbai, and Bangalore dominate the market due to their high population density and significant industrial activities. These urban centers face severe water quality issues, prompting residents to invest in water purification solutions. Additionally, the presence of major manufacturers and distributors in these cities further enhances their market dominance.

- Market growth is reinforced by technological advancements in purification systems, particularly reverse osmosis (RO) and ultraviolet (UV) technologies that address dissolved solids and microbial contamination. Affordable product ranges and installment payment options have expanded accessibility in rural and semi-urban areas.

India Water Purifier Market Segmentation

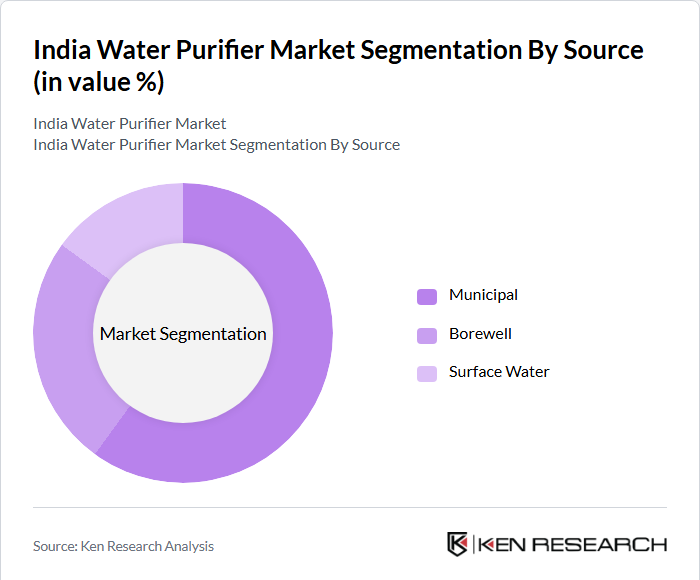

By Source: The market is segmented by source into municipal water, borewell, and river water. Municipal water–sourced purifiers dominate the India Water Purifier market. This dominance stems from rapid urbanization and municipal infrastructure improvements, which render treated tap water the primary supply in metropolitan and tier-2 cities. Consumers in Bengaluru, Mumbai, and Delhi increasingly rely on municipal water connections and, therefore, prefer purifiers specifically designed to remove residual chlorine, heavy metals, and microbiological contaminants typical of urban distribution systems

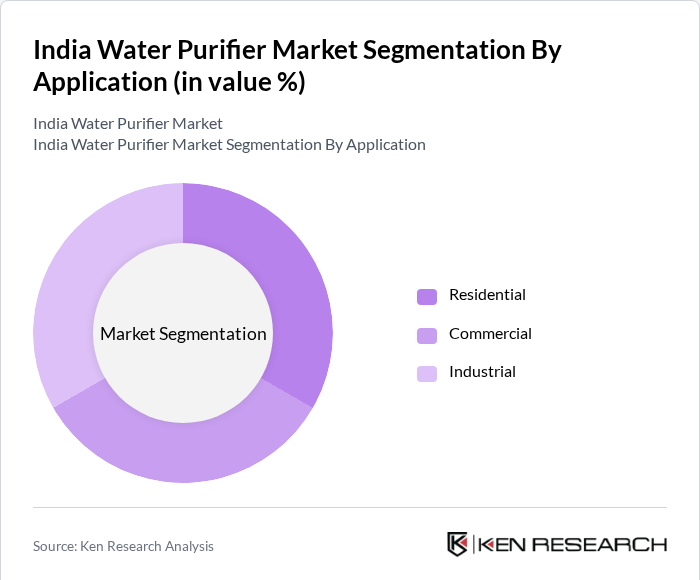

By Application: The market is segmented by application into residential, commercial, and industrial. Residential purifiers lead the application segmentation, driven by rising household disposable incomes and increased awareness of waterborne health risks. As more urban families in Hyderabad, Chennai, and Pune upgrade to multi-stage purification systems (e.g., RO+UV+UF), demand has surged in gated communities and apartment complexes.

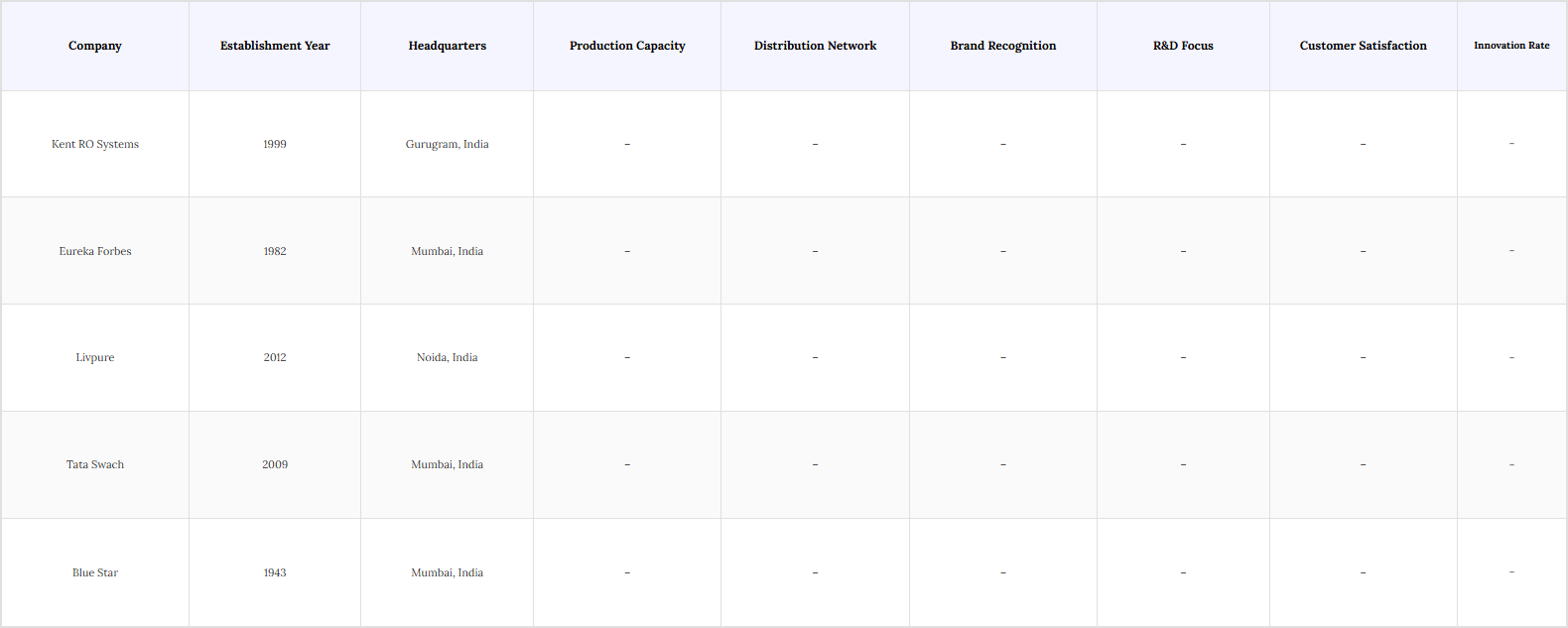

India Water Purifier Market Competitive Landscape

The market features established players including Kent RO Systems, Eureka Forbes, and Livpure, who dominate through extensive service networks and brand recognition. Tata Chemicals and Blue Star leverage industrial expertise to develop specialized solutions for hard water regions.

India Water Purifier Market Industry Analysis

Growth Drivers

- Increasing Awareness of Waterborne Diseases: The rising incidence of waterborne diseases in India has significantly heightened public awareness regarding the importance of clean drinking water. According to the World Health Organization (WHO), approximately 444,000 children under five die each year due to diarrheal diseases, many of which are linked to unsafe drinking water. This alarming statistic has prompted a surge in demand for water purifiers, as households seek to protect their families from health risks.

- Rising Urbanization and Population Growth: India is experiencing one of the fastest urbanization rates globally, with the urban population expected to reach 600 million by 2024, according to the United Nations. This rapid urbanization is accompanied by increased demand for clean drinking water, as urban areas often face challenges related to water quality and supply. The National Urban Water Policy emphasizes the need for sustainable water management practices, which includes the adoption of water purification technologies in urban households.

- Government Initiatives for Clean Drinking Water: The Indian government has launched several initiatives aimed at ensuring access to clean drinking water for all citizens. Programs such as the Jal Jeevan Mission, which aims to provide piped water supply to every rural household by 2024, are pivotal in addressing water quality issues. The mission has a budget of ?3.6 lakh crores (approximately USD 43 billion) and emphasizes the importance of water purification at the household level.

Market Challenges

- High Initial Investment Costs: One of the significant barriers to the widespread adoption of water purifiers in India is the high initial investment required for advanced purification systems. While the average cost of a basic water purifier can range from ?5,000 to ?10,000, more sophisticated systems, such as RO purifiers, can exceed ?15,000. This upfront cost can be prohibitive for many households, particularly in rural areas where income levels are lower.

- Lack of Consumer Awareness in Rural Areas: Despite the increasing awareness of waterborne diseases in urban areas, rural regions in India still face significant challenges related to consumer awareness regarding the benefits of water purifiers. A study conducted by the Indian Council of Medical Research (ICMR) found that only 30% of rural households are aware of the health risks associated with contaminated water. This lack of awareness is compounded by limited access to information and education about water purification technologies.

India Water Purifier Market Future Outlook

The future of the India water purifier market appears promising, driven by technological advancements and increasing consumer demand for safe drinking water. As urbanization continues to rise, the market is expected to adapt to changing consumer preferences, with a focus on smart and eco-friendly purification solutions.

Market Opportunities

- Technological Advancements in Water Purification: The water purifier market is poised for significant growth due to ongoing technological innovations. Companies are increasingly investing in research and development to create more efficient and user-friendly purification systems. For instance, the introduction of smart water purifiers equipped with IoT technology allows users to monitor water quality in real-time and receive alerts for maintenance.

- Expansion of E-commerce Platforms: The rise of e-commerce in India presents a significant opportunity for the water purifier market. With the increasing penetration of the internet and smartphone usage, more consumers are turning to online platforms for their purchasing needs. According to a report by the Internet and Mobile Association of India (IAMAI), the number of online shoppers in India is expected to reach 300 million by 2024.

Scope of the Report

| By Source |

Municipal Water Borewell River Water |

| By Application |

Residential Commercial Industrial |

| By Technology |

RO (Reverse Osmosis) UV (Ultraviolet) Gravity-based Activated Carbon |

| By Distribution Channel |

Online Offline |

| By End User |

Households Offices Restaurants Schools |

Products

Key Target Audience

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., Bureau of Indian Standards, Central Pollution Control Board)

Manufacturers and Producers

Distributors and Retailers

Water Treatment Technology Providers

Industry Associations (e.g., Indian Water Works Association)

Financial Institutions

Non-Governmental Organizations (NGOs) focused on water quality and sanitation

Companies

Players Mentioned in the Report:

Kent RO Systems

Eureka Forbes

Livpure

Tata Chemicals

Blue Star

AquaGuard Innovations

PureFlow Technologies

CrystalClear Solutions

AquaVita Systems

SafeWater Solutions

Table of Contents

1. India Water Purifier Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. India Water Purifier Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. India Water Purifier Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Awareness of Waterborne Diseases

3.1.2. Rising Urbanization and Population Growth

3.1.3. Government Initiatives for Clean Drinking Water

3.2. Market Challenges

3.2.1. High Initial Investment Costs

3.2.2. Lack of Consumer Awareness in Rural Areas

3.2.3. Competition from Unbranded Products

3.3. Opportunities

3.3.1. Technological Advancements in Water Purification

3.3.2. Expansion of E-commerce Platforms

3.3.3. Growing Demand for Eco-friendly Products

3.4. Trends

3.4.1. Shift Towards Smart Water Purifiers

3.4.2. Increasing Preference for Multi-Stage Filtration Systems

3.4.3. Rise in Subscription-based Services for Maintenance

3.5. Government Regulation

3.5.1. Standards for Water Quality and Safety

3.5.2. Regulations on Manufacturing and Distribution

3.5.3. Incentives for Sustainable Water Purification Technologies

3.5.4. Compliance with Environmental Protection Laws

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Porter’s Five Forces

3.9. Competition Ecosystem

4. India Water Purifier Market Segmentation

4.1. By Source

4.1.1. Municipal Water

4.1.2. Groundwater

4.1.3. Rainwater

4.1.4. Others

4.2. By Application

4.2.1. Residential

4.2.2. Commercial

4.2.3. Industrial

4.3. By Technology

4.3.1. RO (Reverse Osmosis)

4.3.2. UV (Ultraviolet)

4.3.3. Gravity-based

4.3.4. Activated Carbon

4.4. By Distribution Channel

4.4.1. Online

4.4.2. Offline

4.5. By End User

4.5.1. Households

4.5.2. Offices

4.5.3. Restaurants

4.5.4. Schools

5. India Water Purifier Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Kent RO Systems

5.1.2. Eureka Forbes

5.1.3. Livpure

5.1.4. Tata Chemicals

5.1.5. Blue Star

5.1.6. AquaGuard Innovations

5.1.7. PureFlow Technologies

5.1.8. CrystalClear Solutions

5.1.9. AquaVita Systems

5.1.10. SafeWater Solutions

5.2. Cross Comparison Parameters

5.2.1. Market Share

5.2.2. Product Range

5.2.3. Pricing Strategy

5.2.4. Distribution Network

5.2.5. Customer Service

5.2.6. Brand Reputation

5.2.7. Innovation Rate

5.2.8. Sustainability Practices

6. India Water Purifier Market Regulatory Framework

6.1. Environmental Standards

6.2. Compliance Requirements

6.3. Certification Processes

7. India Water Purifier Market Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. India Water Purifier Market Future Market Segmentation

8.1. By Source

8.1.1. Municipal Water

8.1.2. Groundwater

8.1.3. Rainwater

8.1.4. Others

8.2. By Application

8.2.1. Residential

8.2.2. Commercial

8.2.3. Industrial

8.3. By Technology

8.3.1. RO (Reverse Osmosis)

8.3.2. UV (Ultraviolet)

8.3.3. Gravity-based

8.3.4. Activated Carbon

8.4. By Distribution Channel

8.4.1. Online

8.4.2. Offline

8.5. By End User

8.5.1. Households

8.5.2. Offices

8.5.3. Restaurants

8.5.4. Schools

9. India Water Purifier Market Analysts’ Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the India Water Purifier Market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we will compile and analyze historical data pertaining to the India Water Purifier Market. This includes assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics will be conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations will provide valuable operational and financial insights directly from industry practitioners, which will be instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction will serve to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the India Water Purifier Market.

Frequently Asked Questions

01. How big is the India Water Purifier Market?

The India Water Purifier Market is valued at USD 1.5 billion, driven by factors such as increasing demand, technological advancements, and supportive government initiatives.

02. What are the key challenges in the India Water Purifier Market?

Key challenges in the India Water Purifier Market include intense competition, regulatory complexities, and infrastructure limitations affecting market dynamics.

03. Who are the major players in the India Water Purifier Market?

Major players in the India Water Purifier Market include Kent RO Systems, Eureka Forbes, Livpure, Tata Chemicals, Blue Star, among others.

04. What are the growth drivers for the India Water Purifier Market?

The primary growth drivers for the India Water Purifier Market are increasing consumer demand, favorable policies, innovation, and substantial investment inflows.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.