India Wealth Management Market Outlook to 2030

Region:Asia

Author(s):Shubham Kashyap

Product Code:KROD1211

June 2025

90

About the Report

India Wealth Management Market Overview

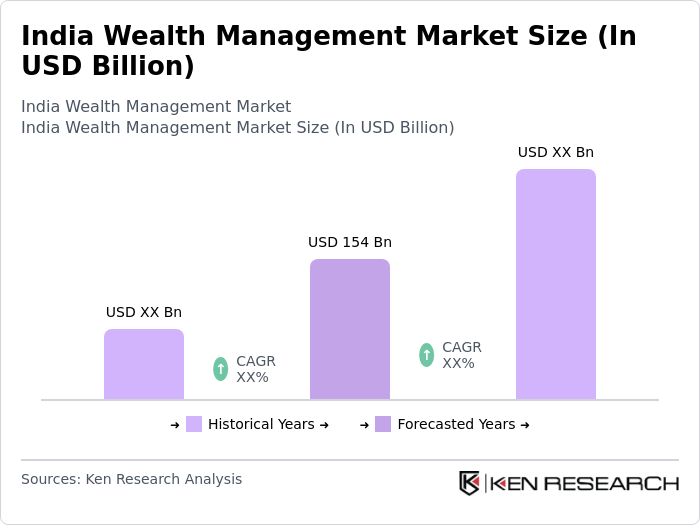

- The India Wealth Management Market was valued at USD 154 billion, based on a five-year historical analysis. This growth is driven by urbanization, regulatory reforms (Investment Advisers Regulation 2013 and Financial Advisors Regulations 2019), technological advancements in digital platforms, and increased access to global financial markets. Rising disposable incomes and financial literacy remain foundational drivers, supplemented by a cultural shift toward professional wealth management services.

- Mumbai, Delhi, and Bengaluru continue to dominate the market. Mumbai’s status as India’s financial capital is reinforced by its concentration of domestic and international wealth management firms. Delhi attracts high-net-worth individuals (HNWIs) through its political and business networks, while Bengaluru’s tech-driven economy fosters demand from affluent professionals.

- Regulatory frameworks have evolved to prioritize transparency and investor protection. The Financial Advisors Regulations (2019) mandate stricter compliance standards, requiring firms to provide unbiased advice and disclose conflicts of interest.

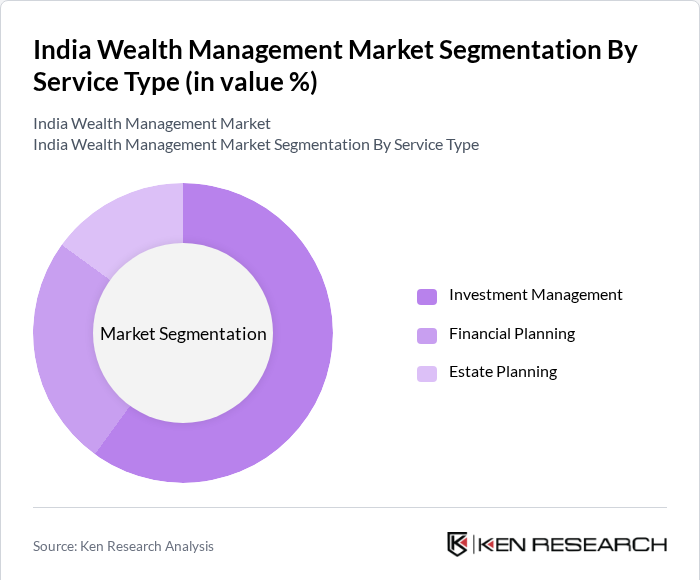

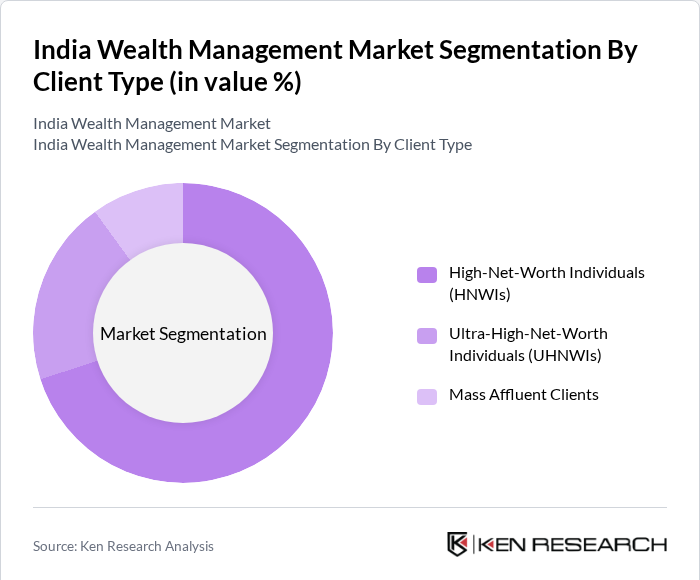

India Wealth Management Market Segmentation

By Service Type: The market is segmented by service type into Investment Management, Financial Planning, and Estate Planning. Investment Management commands the largest share, driven by affluent clients seeking actively managed, multi-asset portfolios that balance growth and risk. Leading wealth managers leverage robust equity research, alternative asset allocations, and customized risk models to deliver superior risk-adjusted returns, attracting high-net-worth inflows.

By Client Type: The market is segmented by client type into High-Net-Worth Individuals (HNWI), Ultra-High-Net-Worth Individuals (UHNWI), and Institutional Clients. HNWIs represent the largest segment, driven by a growing base of business owners and senior executives who require tailored portfolio construction, tax-efficient strategies, and legacy planning. UHNWI, allocate substantial capital to alternative investments—private equity, real estate funds, and hedge funds—leveraging multi-family office structures and bespoke advisory services.

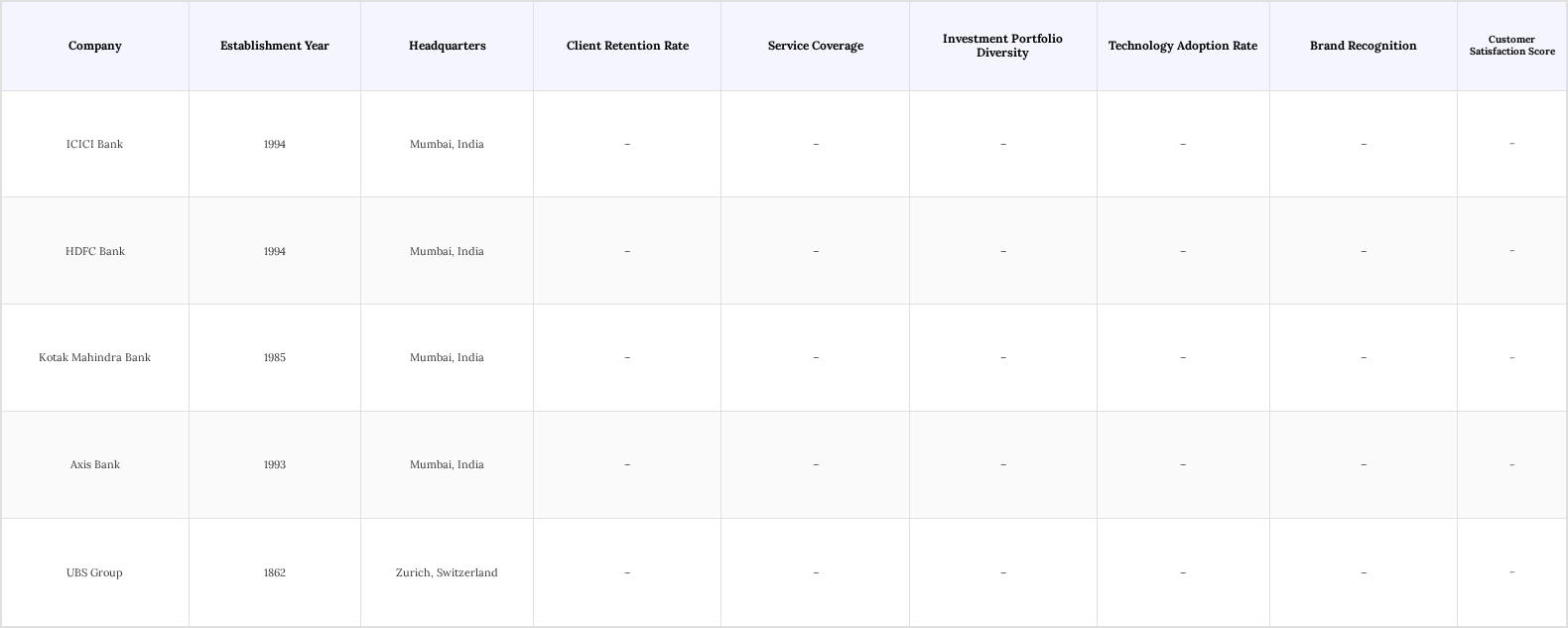

India Wealth Management Market Competitive Landscape

The market features established players like ICICI Prudential, HDFC Bank, and Kotak Mahindra Bank, which leverage omnichannel platforms and localized product offerings. Foreign firms like UBS compete through global expertise in alternative investments and cross-border wealth solutions.

India Wealth Management Market Industry Analysis

Growth Drivers

- Increasing Disposable Income Among the Population: The rise in disposable income in India has been a significant driver for the wealth management market. According to the World Bank, India's GDP per capita is projected to reach approximately USD 2,500 in 2024, up from USD 2,236 in 2023. This increase in income allows more individuals to invest in wealth management services. The number of High Net Worth Individuals (HNWIs) in India has also seen a substantial rise, with a report from Deloitte indicating that the population of HNWIs grew by 10% in 2023, reaching around 300,000 to 350,000. This demographic shift is crucial as HNWIs typically seek comprehensive wealth management services, including investment management and financial planning, thereby driving market growth.

- Rising Awareness of Financial Planning and Investment Options: The awareness regarding financial planning and investment options has significantly increased in India, particularly among the younger population. A survey conducted by the National Institute of Securities Markets (NISM) in 2023 revealed that 70% of respondents aged 25-35 are actively seeking financial advice and investment opportunities. This trend is supported by the proliferation of financial literacy programs and digital platforms that educate individuals about investment options such as mutual funds, equities, and fixed income.

- Growth of the Digital Economy and Online Investment Platforms: The digital economy in India is experiencing rapid growth, with the digital payments market projected to reach USD 1.5 trillion by the end of 2025, according to a report by the Boston Consulting Group. This growth is facilitating the rise of online investment platforms, which are becoming increasingly popular among investors. In 2023, the number of registered users on online investment platforms surged by 40%, reaching approximately 50 million. These platforms offer easy access to a variety of investment options, including stocks, mutual funds, and alternative investments, making wealth management services more accessible to a broader audience.

Market Challenges

- Regulatory Complexities and Compliance Issues: The wealth management sector in India faces significant regulatory complexities that can hinder market growth. The regulatory framework is governed by multiple bodies, including the Reserve Bank of India (RBI) and SEBI, which impose stringent compliance requirements on wealth management firms. In 2023, the compliance costs for wealth management firms increased by 20% due to new regulations aimed at enhancing transparency and investor protection. This increase in compliance costs can strain smaller firms, limiting their ability to compete effectively in the market.

- High Competition Among Wealth Management Firms: The wealth management market in India is characterized by intense competition, with numerous players vying for market share. In 2023, the top 10 wealth management firms accounted for majority of the total market, indicating a fragmented landscape. This high level of competition puts pressure on firms to differentiate their services and maintain competitive pricing. Additionally, the entry of fintech companies into the wealth management space has further intensified competition.

India Wealth Management Market Future Outlook

The future of the India wealth management market appears promising, driven by technological advancements and a growing emphasis on personalized financial services. As digital platforms continue to evolve, they will likely enhance client engagement and service delivery, fostering greater trust and satisfaction among investors.

Market Opportunities

- Expansion of Financial Literacy Programs: There is a significant opportunity for wealth management firms to engage in the expansion of financial literacy programs. With only 27% of the Indian population being financially literate as of 2023, according to the National Centre for Financial Education, there is a vast untapped market for educational initiatives. By investing in financial literacy, firms can empower potential clients to make informed investment decisions, thereby increasing the demand for wealth management services.

- Increasing Demand for Personalized Wealth Management Services: The trend towards personalized wealth management services presents a significant opportunity for firms to differentiate themselves in a competitive market. In 2025, 65% of investors prefer customized financial solutions tailored to their specific needs and goals. This demand for personalization is driven by the increasing complexity of financial products and the desire for more tailored investment strategies.

Scope of the Report

| By Service Type |

Investment management Financial planning Estate planning |

| By Client Type |

HNWIs UHNWIs Institutional clients |

| By Distribution Channel |

Direct Intermediaries Online platforms |

| By Geographic Region |

North South East West |

| By Investment Type |

Equities Fixed income Real estate Alternative investments |

Products

Key Target Audience

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., Securities and Exchange Board of India, Reserve Bank of India)

Private Wealth Management Firms

Family Offices

Insurance Companies

Pension Funds

Financial Technology (FinTech) Companies

Asset Management Companies

Companies

Players Mentioned in the Report:

ICICI Prudential

HDFC Bank

Kotak Mahindra Bank

Axis Bank

UBS

WealthSphere India

Prosperity Partners

FinVista Advisors

CapitalGuard Wealth Management

Zenith Wealth Solutions

Table of Contents

1. India Wealth Management Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. India Wealth Management Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. India Wealth Management Market Analysis

3.1. Growth Drivers

3.1.1. Increasing disposable income among the population

3.1.2. Rising awareness of financial planning and investment options

3.1.3. Growth of the digital economy and online investment platforms

3.2. Market Challenges

3.2.1. Regulatory complexities and compliance issues

3.2.2. High competition among wealth management firms

3.2.3. Economic fluctuations impacting investor confidence

3.3. Opportunities

3.3.1. Expansion of financial literacy programs

3.3.2. Increasing demand for personalized wealth management services

3.3.3. Growth in alternative investment options

3.4. Trends

3.4.1. Shift towards sustainable and responsible investing

3.4.2. Integration of technology in wealth management services

3.4.3. Increasing focus on holistic financial wellness

3.5. Government Regulation

3.5.1. Overview of regulatory bodies governing wealth management

3.5.2. Recent regulatory changes impacting the market

3.5.3. Compliance requirements for wealth management firms

3.5.4. Impact of taxation policies on wealth management strategies

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Porter’s Five Forces

3.9. Competition Ecosystem

4. India Wealth Management Market Segmentation

4.1. By Service Type

4.1.1. Investment management

4.1.2. Financial planning

4.1.3. Estate planning

4.2. By Client Type

4.2.1. HNWIs

4.2.2. UHNWIs

4.2.3. Institutional clients

4.3. By Distribution Channel

4.3.1. Direct

4.3.2. Intermediaries

4.3.3. Online platforms

4.4. By Geographic Region

4.4.1. North India

4.4.2. South India

4.4.3. East India

4.4.4. West India

4.5. By Investment Type

4.5.1. Equities

4.5.2. Fixed income

4.5.3. Real estate

4.5.4. Alternative investments

5. India Wealth Management Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. ICICI Prudential

5.1.2. HDFC Bank

5.1.3. Kotak Mahindra Bank

5.1.4. Axis Bank

5.1.5. UBS

5.1.6. WealthSphere India

5.1.7. Prosperity Partners

5.1.8. FinVista Advisors

5.1.9. CapitalGuard Wealth Management

5.1.10. Zenith Wealth Solutions

5.2. Cross Comparison Parameters

5.2.1. Market share of key players

5.2.2. Revenue growth rates

5.2.3. Client satisfaction ratings

5.2.4. Range of services offered

5.2.5. Technological adoption levels

5.2.6. Geographic presence

5.2.7. Investment performance metrics

5.2.8. Brand reputation and trustworthiness

6. India Wealth Management Market Regulatory Framework

6.1. Environmental Standards

6.2. Compliance Requirements

6.3. Certification Processes

7. India Wealth Management Market Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. India Wealth Management Market Future Market Segmentation

8.1. By Service Type

8.1.1. Investment management

8.1.2. Financial planning

8.1.3. Estate planning

8.2. By Client Type

8.2.1. HNWIs

8.2.2. UHNWIs

8.2.3. Institutional clients

8.3. By Distribution Channel

8.3.1. Direct

8.3.2. Intermediaries

8.3.3. Online platforms

8.4. By Geographic Region

8.4.1. North India

8.4.2. South India

8.4.3. East India

8.4.4. West India

8.5. By Investment Type

8.5.1. Equities

8.5.2. Fixed income

8.5.3. Real estate

8.5.4. Alternative investments

9. India Wealth Management Market Analysts’ Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves mapping the ecosystem of the India Wealth Management Market, identifying key stakeholders such as financial institutions, regulatory bodies, and clients. This step relies on extensive desk research, utilizing secondary data sources and proprietary databases to gather relevant industry information. The primary goal is to pinpoint and define the critical variables that drive market dynamics.

Step 2: Market Analysis and Construction

In this phase, we will compile and analyze historical data related to the India Wealth Management Market. This includes evaluating market penetration rates, the ratio of service providers to clients, and revenue generation trends. Additionally, we will assess service quality metrics to ensure the reliability and accuracy of the revenue estimates derived from the analysis.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be formulated and validated through structured interviews with industry experts from various sectors within wealth management. These consultations will provide critical operational and financial insights, helping to refine and corroborate the market data. Engaging with practitioners will enhance the understanding of market trends and challenges.

Step 4: Research Synthesis and Final Output

The final phase involves synthesizing insights gathered from multiple stakeholders, including financial institutions and clients, to gain a comprehensive understanding of product segments, sales performance, and consumer preferences. This engagement will validate and complement the data collected, ensuring a thorough and accurate analysis of the India Wealth Management Market outlook to 2029.

Frequently Asked Questions

01. How big is the India Wealth Management Market?

The India Wealth Management Market is valued at USD 154 billion, driven by factors such as increasing demand, technological advancements, and supportive government initiatives.

02. What are the key challenges in the India Wealth Management Market?

Key challenges in the India Wealth Management Market include intense competition, regulatory complexities, and infrastructure limitations affecting market dynamics.

03. Who are the major players in the India Wealth Management Market?

Major players in the India Wealth Management Market include ICICI Prudential, HDFC Bank, Kotak Mahindra Bank, Axis Bank, UBS, among others.

04. What are the growth drivers for the India Wealth Management Market?

The primary growth drivers for the India Wealth Management Market are increasing consumer demand, favorable policies, innovation, and substantial investment inflows.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.