India Wearable AI Market Outlook to 2030

Region:Asia

Author(s):Shreya Garg

Product Code:KROD2101

November 2024

97

About the Report

India Wearable AI Market Overview

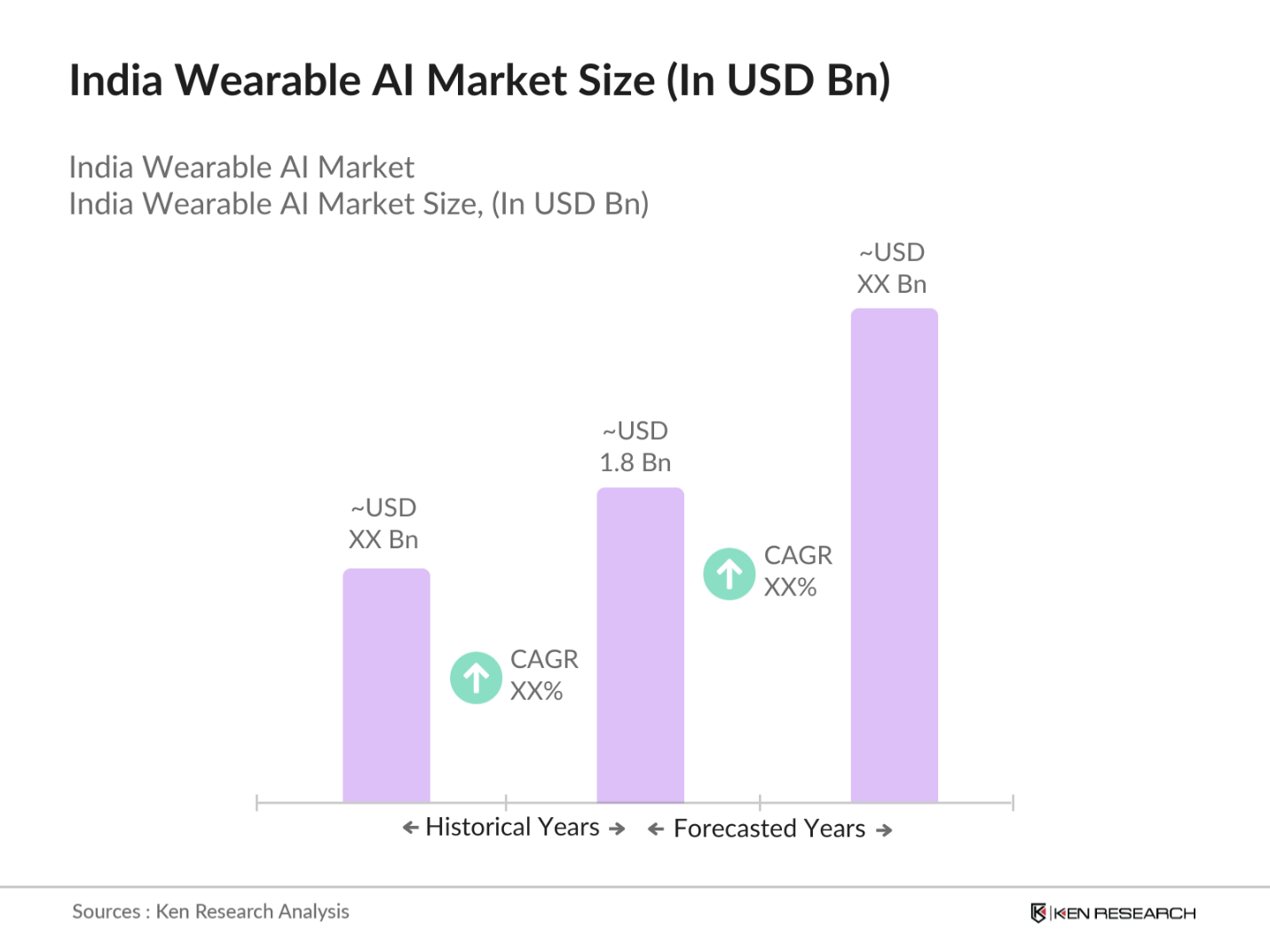

The India Wearable AI market is valued at USD 1.8 billion, based on a five-year historical analysis. This growth is largely driven by increasing consumer awareness regarding health and fitness, the adoption of AI-powered solutions, and supportive government initiatives promoting advanced technology adoption. The expansion of digital infrastructure and higher smartphone penetration have also propelled market growth, making wearable devices more accessible and appealing to a wider audience.

Major cities like Bengaluru, Delhi, and Mumbai lead the India Wearable AI market due to their strong tech ecosystems, higher consumer spending power, and early adoption of innovative technology. The presence of numerous tech hubs and a large population of tech-savvy consumers in these metropolitan areas contributes to their market dominance. Additionally, significant investments from both domestic and international tech companies bolster their leadership.

Indias legal framework for data protection has evolved to address the challenges posed by wearable AI technology. The Personal Data Protection Bill, revised in 2024, outlines stringent measures for data handling by wearable manufacturers. This regulation mandates compliance for any device collecting personal data, ensuring user privacy and security. The bill enforces penalties of up to 50 million INR for non-compliance, as reported by the Ministry of Law and Justice.

India Wearable AI Market Segmentation

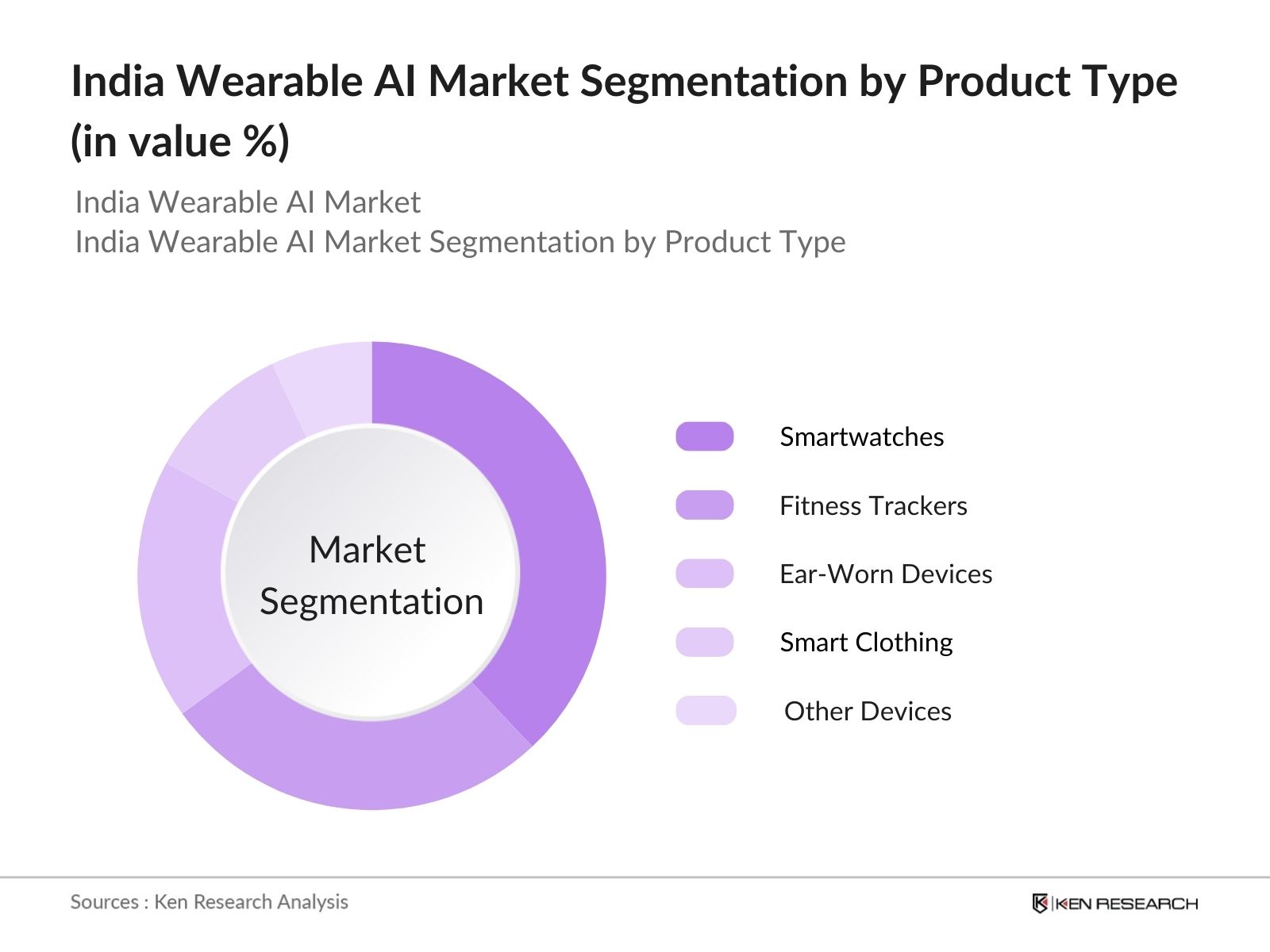

By Product Type: The market is segmented by product type into smartwatches, fitness trackers, ear-worn devices, smart clothing, and other wearable devices. Recently, smartwatches have gained a dominant market share in this segment due to their multifunctional capabilities such as health monitoring, communication, and integration with various mobile applications. Brands like Apple, Samsung, and Noise have solidified their presence with innovations that cater to the needs of fitness enthusiasts and tech-savvy individuals.

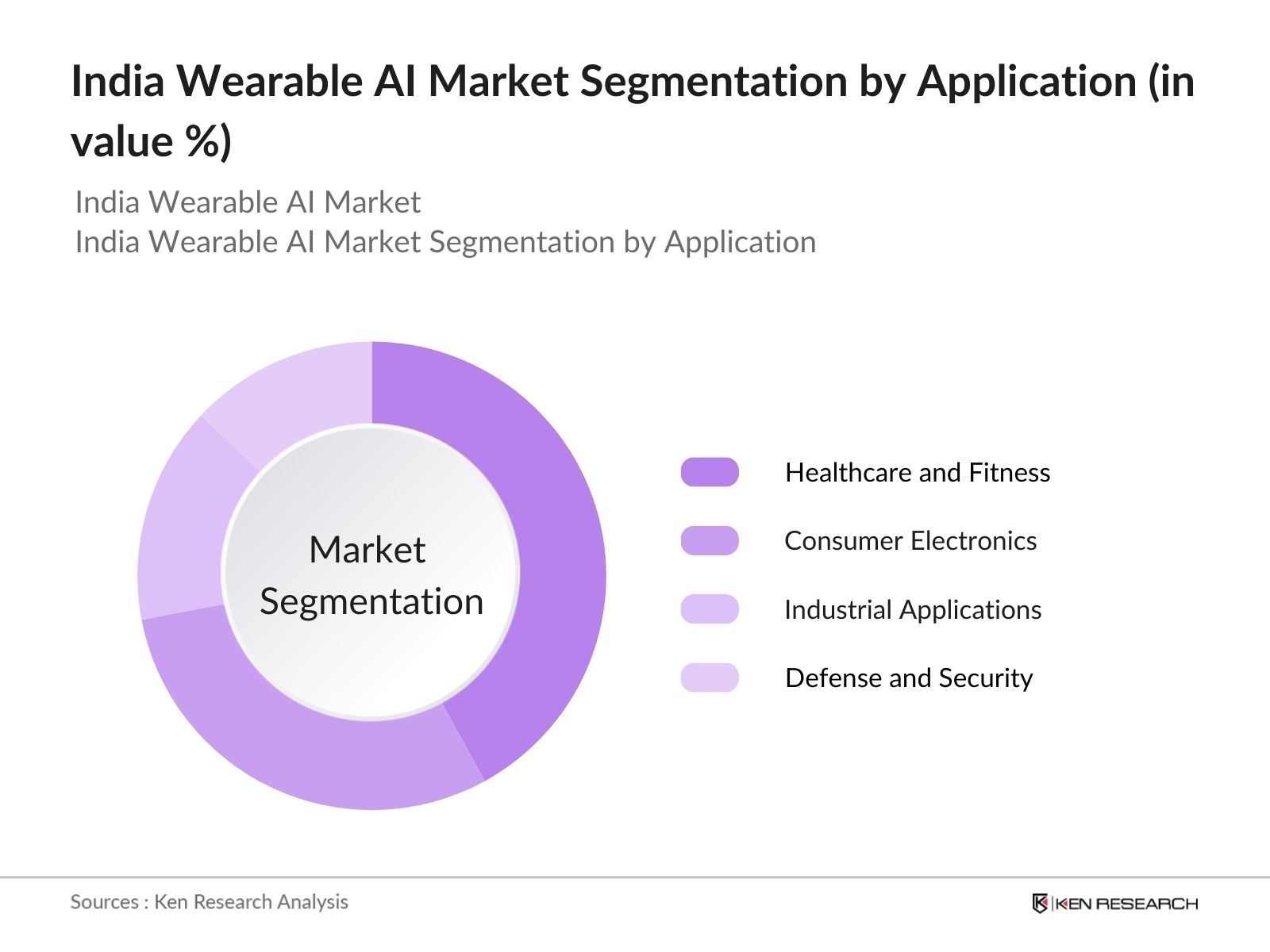

By Application: The market is also segmented by application into healthcare and fitness, consumer electronics, industrial applications, and defense and security. Healthcare and fitness applications are leading the market, driven by increasing health awareness and the desire for real-time health metrics. Wearable devices equipped with AI-based features such as heart rate monitoring, sleep tracking, and step counting have become essential for consumers looking to maintain a healthier lifestyle.

India Wearable AI Market Competitive Landscape

The India Wearable AI market is dominated by a combination of domestic and international players, showcasing a competitive and dynamic environment. The market is marked by rapid technological advancements and frequent product launches that shape competition.

India Wearable AI Industry Analysis

Growth Drivers

- Advancements in AI Algorithms: The rapid development of artificial intelligence algorithms has significantly impacted the wearable AI market in India. The introduction of machine learning and deep learning technologies has improved functionalities such as real-time health monitoring and predictive analytics. As of 2024, the Indian government reported a significant increase in R&D investments in AI, totaling 10 billion INR (Ministry of Electronics and Information Technology). These advancements enable wearables to provide more personalized and efficient user experiences, thereby attracting tech-savvy consumers.

- Increasing Health Awareness: The shift toward preventive healthcare in India has propelled demand for wearable AI devices that support health monitoring. In 2023, the Ministry of Health reported that approximately 1.2 million Indians adopted health-focused wearables to track parameters like heart rate and physical activity. The increased focus on maintaining wellness has made these devices essential tools for consumers seeking proactive healthcare management. This trend aligns with the WHOs statistics showing a rise in health awareness campaigns across Asia, including India.

- Rising Disposable Income: Indias rising disposable income has contributed significantly to the adoption of wearable technology. Data from the World Bank shows that in 2024, the per capita income in India reached $2,610, indicating an increase in spending power. This economic improvement supports the affordability and purchase of advanced technological devices such as wearable AI products. The increased economic security has expanded the middle class, fueling demand for innovative tech solutions.

Market Challenges

- High Product Costs: The initial high costs of wearable AI devices present a challenge to widespread adoption. According to 2023 data from the Ministry of Consumer Affairs, the average price of wearable devices with integrated AI remains out of reach for many low-income families in India. While tech innovations are advancing, accessibility remains limited, highlighting the income disparity. This limitation impacts the overall market expansion despite technological advancements. Source

- Data Privacy Concerns: Data privacy issues are a significant barrier in the growth of the wearable AI market. In 2022, the Indian Computer Emergency Response Team (CERT-In) documented over 500,000 reported cases of data breaches, raising public concern over personal data security in connected devices. Wearable AI products collect vast amounts of sensitive information, and without stringent privacy laws, consumer trust is compromised. The 2024 amendments to the Personal Data Protection Bill aim to address these issues but their effectiveness remains under scrutiny.

India Wearable AI Market Future Outlook

Over the next five years, the India Wearable AI market is poised for further expansion due to the continuous integration of AI in consumer electronics and increasing demand for personalized health insights. Additionally, growth will be supported by the development of new technologies, including AI-powered diagnostic tools and IoT integration. With consumers focus on health and convenience, companies are expected to invest significantly in R&D, fostering technological advancements that will drive further market penetration.

Future Market Opportunities

- Integration with IoT Devices: The integration of wearable AI with IoT devices presents a promising opportunity for market growth. In 2024, the Department of Telecommunications reported that over 300 million smart devices were connected in India, forming an extensive IoT network. This interconnected ecosystem allows wearables to interface with other smart devices for a seamless user experience, from home automation to health monitoring. This trend supports real-time data sharing and enhanced functionality.

- Growing Demand for Wearable Fitness Products: The demand for fitness-oriented wearable products has seen a surge due to the increased focus on physical health post-pandemic. A 2023 report by the Ministry of Sports indicated that nearly 2 million individuals participated in government-endorsed fitness initiatives, leading to a higher adoption of fitness tracking devices. This demand, combined with the growth of urban wellness programs, continues to drive interest in wearable AI.

Scope of the Report

|

Product Type |

Smartwatches Fitness Trackers Ear-Worn Devices Smart Clothing Other Wearable Devices Healthcare and Fitness |

|

Application |

Consumer Electronics Industrial Applications Defense and Security |

|

Technology |

AI-Based Data Analysis Voice Recognition Gesture Control |

|

End-User |

Individuals Corporates Healthcare Institutions |

|

Region |

North South East West |

Products

Key Target Audience

Tech Manufacturers

Healthcare Institutions

Government and Regulatory Bodies (e.g., Ministry of Electronics and Information Technology)

Retail and E-commerce Platforms

Consumer Electronics Distributors

Telecom Companies

Investors and Venture Capitalist Firms

Fitness and Wellness Brands

Companies

Major Players mentioned in the Report:

Apple Inc.

Samsung Electronics Co.

Xiaomi Corporation

Noise

Fitbit, Inc.

Garmin Ltd.

Huawei Technologies Co., Ltd.

Realme

boAt

Sony Corporation

Lenovo Group Limited

Oppo

Titan Company Limited

Google LLC

Fossil Group, Inc.

Table of Contents

1. India Wearable AI Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. India Wearable AI Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. India Wearable AI Market Analysis

3.1. Growth Drivers

3.1.1. Advancements in AI Algorithms

3.1.2. Increasing Health Awareness

3.1.3. Rising Disposable Income

3.1.4. Government Initiatives Supporting Technology

3.2. Market Challenges

3.2.1. High Product Costs

3.2.2. Data Privacy Concerns

3.2.3. Limited Battery Life

3.3. Opportunities

3.3.1. Integration with IoT Devices

3.3.2. Growing Demand for Wearable Fitness Products

3.3.3. Expanding E-commerce Platforms

3.4. Trends

3.4.1. Customization of Wearable Devices

3.4.2. AI-Powered Voice Assistants

3.4.3. Wearable AI in Healthcare Monitoring

3.5. Government Regulation

3.5.1. Data Protection Laws

3.5.2. Certification Standards

3.5.3. Import and Export Regulations

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. India Wearable AI Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Smartwatches

4.1.2. Fitness Trackers

4.1.3. Ear-Worn Devices

4.1.4. Smart Clothing

4.1.5. Other Wearable Devices

4.2. By Application (In Value %)

4.2.1. Healthcare and Fitness

4.2.2. Consumer Electronics

4.2.3. Industrial Applications

4.2.4. Defense and Security

4.3. By Technology (In Value %)

4.3.1. AI-Based Data Analysis

4.3.2. Voice Recognition

4.3.3. Gesture Control

4.4. By End-User (In Value %)

4.4.1. Individuals

4.4.2. Corporates

4.4.3. Healthcare Institutions

4.5. By Region (In Value %)

4.5.1. North

4.5.2. South

4.5.3. East

4.5.4. West

5. India Wearable AI Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Samsung Electronics Co., Ltd.

5.1.2. Apple Inc.

5.1.3. Huawei Technologies Co., Ltd.

5.1.4. Xiaomi Corporation

5.1.5. Fitbit, Inc.

5.1.6. Garmin Ltd.

5.1.7. Sony Corporation

5.1.8. Google LLC

5.1.9. Fossil Group, Inc.

5.1.10. Lenovo Group Limited

5.1.11. Noise

5.1.12. boAt

5.1.13. Realme

5.1.14. Oppo

5.1.15. Titan Company Limited

5.2. Cross Comparison Parameters (Revenue, Headquarters, No. of Employees, Market Share, Product Portfolio, Technological Innovations, Strategic Partnerships, Key Clients)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. India Wearable AI Market Regulatory Framework

6.1. Data Security Norms

6.2. Compliance Requirements

6.3. Certification Processes

7. India Wearable AI Future Market Segmentation

7.1. By Product Type (In Value %)

7.2. By Application (In Value %)

7.3. By Technology (In Value %)

7.4. By End-User (In Value %)

7.5. By Region (In Value %)

8. India Wearable AI Market Analysts Recommendations

8.1. TAM/SAM/SOM Analysis

8.2. Consumer Cohort Analysis

8.3. Marketing Initiatives

8.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The first step includes identifying essential factors impacting the India Wearable AI market. This involves comprehensive desk research using secondary sources such as government reports, trade publications, and proprietary databases to map out stakeholders and variables influencing market dynamics.

Step 2: Market Analysis and Construction

Historical market data was collated to analyze penetration levels and technological adoption rates. This analysis encompasses product usage trends and consumer adoption, aiding in estimating market conditions and validating data reliability.

Step 3: Hypothesis Validation and Expert Consultation

To ensure accurate market insights, interviews with industry experts and leading market players were conducted. This phase provided firsthand insights into product offerings, competitive strategies, and emerging trends, enriching the data gathered through secondary research.

Step 4: Research Synthesis and Final Output

The last phase synthesizes information from multiple sources and expert opinions to compile a comprehensive and accurate representation of the market. This synthesis confirmed data points, segment analyses, and market drivers to present a holistic market overview.

Frequently Asked Questions

01. How big is the India Wearable AI Market?

The India Wearable AI market was valued at USD 1.8 billion, driven by technological advancements and the increasing adoption of AI-integrated wearable devices.

02. What are the challenges in the India Wearable AI Market?

The India Wearable AI market faces challenges such as high product costs, data privacy concerns, and limited battery life, which can hinder market growth.

03. Who are the major players in the India Wearable AI Market?

Key players in the India Wearable AI market include Apple Inc., Samsung Electronics Co., Xiaomi Corporation, Noise, and Fitbit, Inc., among others.

04. What drives the growth of the India Wearable AI Market?

The growth in the India Wearable AI market is driven by factors such as increased consumer awareness of health and fitness, advancements in AI technology, and expanding digital infrastructure.

05. Which product type dominates the India Wearable AI Market?

Smartwatches dominate the India Wearable AI market due to their multifunctional capabilities, including health monitoring, notifications, and integration with various applications.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.