India Wearable Device Market Outlook to 2030

Region:Asia

Author(s):Sanjeev

Product Code:KROD5320

November 2024

82

About the Report

India Wearable Device Market Overview

- The India wearable device market, valued at USD 134 million, is driven by a rising health-conscious population and increased adoption of smart technologies. Factors such as the growing penetration of fitness wearables and smartwatches, along with technological advancements in artificial intelligence and IoT integration, have contributed ly to the markets growth. With rising disposable income, especially in urban areas, there is a continuous demand for innovative wearable products, further supporting the markets expansion.

- Major cities like Bangalore, Delhi, and Mumbai dominate the wearable device market in India. These cities are centers of technological innovation and home to a large base of tech-savvy consumers who are early adopters of smart technology. Moreover, strong internet penetration and access to e-commerce platforms contribute to the widespread availability of wearable devices, bolstering sales in these regions.

- Indias evolving data privacy landscape is set to impact the wearable device market . The Personal Data Protection Bill, which is under review, mandates stricter data collection and processing regulations for devices like wearables. In 2023, the Ministry of Electronics and Information Technology highlighted the need for wearables to comply with data privacy standards, especially as more health-related data is collected through these devices. This regulation aims to safeguard user data while promoting transparency and consumer trust in wearable technology.

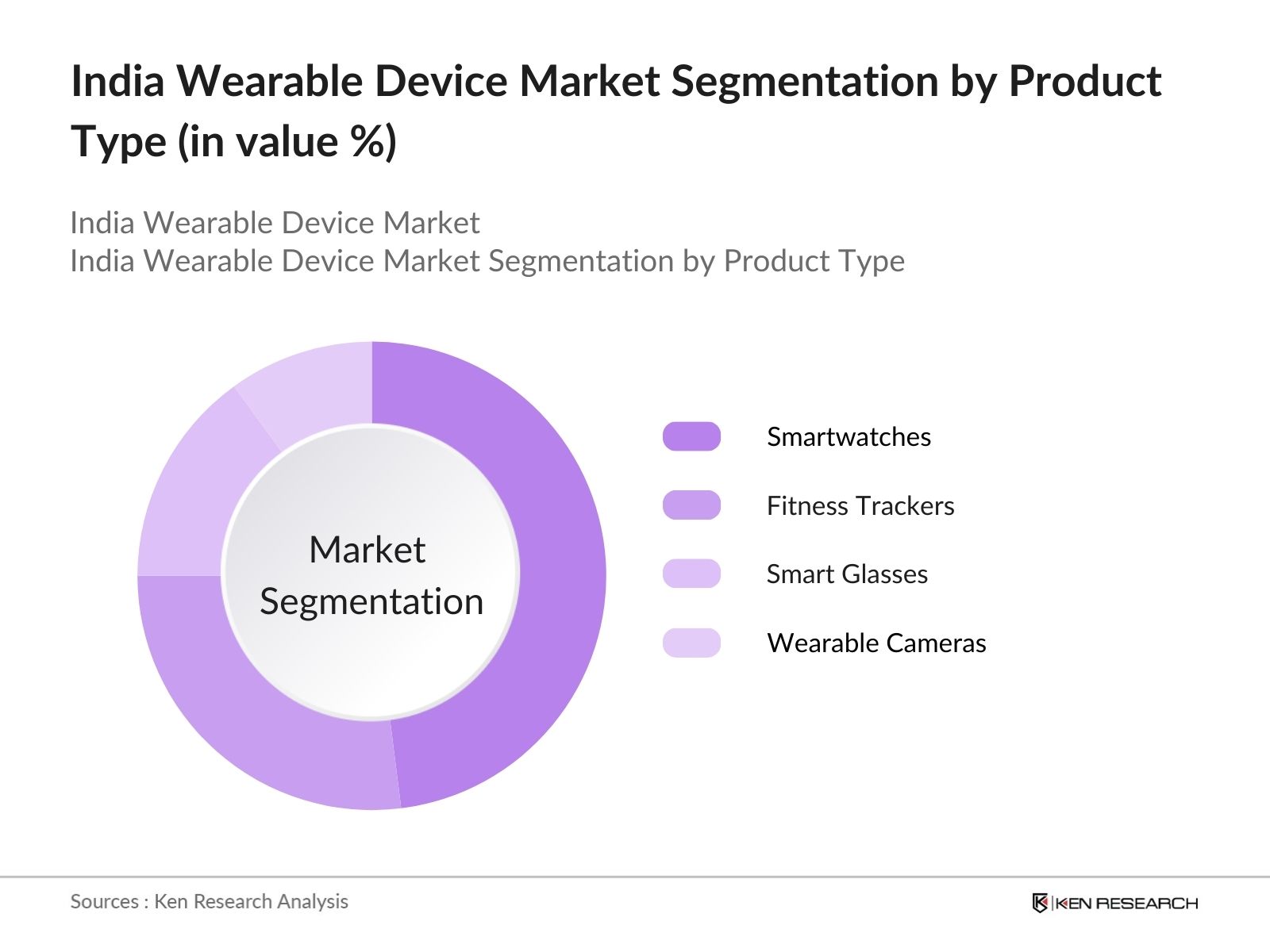

India Wearable Device Market Segmentation

- By Product Type: The market is segmented by product type into smartwatches, fitness trackers, smart glasses, and wearable cameras. Among these, smartwatches have a dominant market share due to their multifunctional capabilities, including health monitoring, mobile notifications, and payment solutions. Leading brands such as Apple and Samsung have contributed to the mass adoption of smartwatches by offering user-friendly interfaces and continuous innovation in features like heart rate monitoring and ECG capabilities.

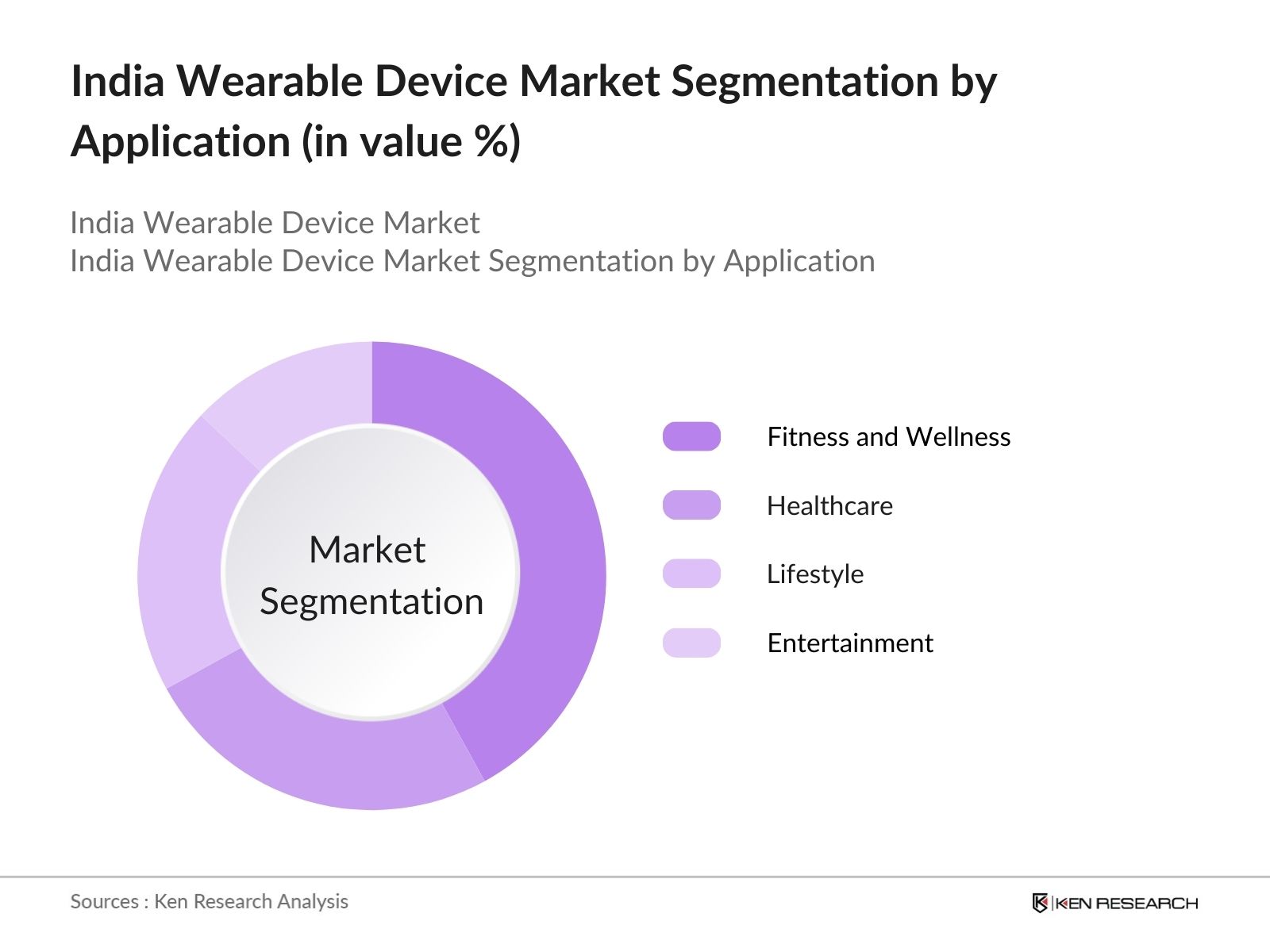

- By Application: The India wearable device market is also segmented by application into fitness and wellness, healthcare, lifestyle, and entertainment. Fitness and wellness dominate the market, with a portion of consumers opting for wearable devices to monitor physical activity, track fitness goals, and enhance overall well-being. The increased emphasis on preventive healthcare and the rising trend of fitness-conscious individuals have further strengthened the growth of this segment.

India Wearable Device Market Competitive Landscape

The India wearable device market is dominated by both global and domestic players, each offering a wide range of products. Leading brands such as Apple and Xiaomi have consistently maintained their positions due to strong brand loyalty and continuous innovation. In contrast, local players like Noise and Boat have capitalized on their understanding of consumer preferences and competitive pricing strategies, allowing them to capture a substantial share of the market.

|

Company |

Establishment Year |

Headquarters |

Product Range |

R&D Investment |

Innovation in Health Monitoring |

Marketing Strategy |

Sales Channels |

Global Reach |

|

Apple Inc. |

1976 |

Cupertino, USA |

||||||

|

Samsung Electronics |

1938 |

Suwon, South Korea |

||||||

|

Xiaomi Corporation |

2010 |

Beijing, China |

||||||

|

Noise |

2014 |

Gurugram, India |

||||||

|

Boat |

2016 |

Mumbai, India |

Industry Analysis

Growth Drivers

- Rising Health Consciousness: The increasing awareness of personal health in India has led to a rise in the demand for wearable fitness devices. As of 2023, more than 10 million units of fitness wearables were sold, according to data from India's Ministry of Electronics and Information Technology. The increasing focus on maintaining a healthy lifestyle is directly contributing to this growth, with more consumers opting for devices such as smartwatches and fitness bands. This shift is closely tied to rising urbanization and the proliferation of health-focused mobile applications integrated with wearable devices.

- Increasing Disposable Income: Indias disposable income has been rising, with the per capita income standing at 172,000 in 2023, as per the Ministry of Statistics and Programme Implementation. This rise in disposable income, along with a purchasing power parity (PPP) of 320,000 in 2022 (World Bank data), has increased consumer spending on technology, including wearable devices. As more individuals are able to afford advanced gadgets, the wearable market is seeing higher adoption across both urban and rural areas, reflecting the growing capacity to invest in health and tech-related products.

- Technological Advancements: Wearables in India are benefitting from the integration of cutting-edge technologies like Artificial Intelligence (AI) and the Internet of Things (IoT). In 2023, the Indian government reported a increase in IoT-enabled devices, exceeding 200 million units, many of which include wearable devices. AI integration is enabling more personalized health insights and real-time monitoring, enhancing the usability of wearable gadgets in fitness, medical diagnostics, and beyond. This technological shift is propelling the demand for wearables that offer smarter, more interconnected experiences.

Market Challenges

- High Initial Costs: Despite the growing demand, the high initial cost of advanced wearable devices poses a challenge to mass adoption. According to the National Sample Survey Office (NSSO) data, the price elasticity of demand for wearables in India suggests that a portion of the population is price-sensitive, with the average consumer income below 150,000 annually. This cost factor restricts the adoption of premium wearables, with budget constraints limiting access to higher-end features, particularly in rural and semi-urban regions.

- Data Security Concerns: India's growing wearable market faces concerns regarding data privacy and security. With the Personal Data Protection Bill currently under review, the Indian government has highlighted the need for stricter security standards for wearable devices. In 2023, the Ministry of Electronics and Information Technology reported over 2 million cybersecurity threats targeting IoT devices, including wearables. These concerns are a deterrent for consumers, with many questioning the safety of their health and personal data stored in wearables.

India Wearable Device Market Future Outlook

Over the next five years, the India wearable device market is expected to witness growth driven by advancements in health monitoring technologies, the increasing penetration of smart devices, and the rising popularity of fitness tracking applications. With evolving consumer preferences toward health-conscious lifestyles, coupled with continuous innovations in wearable technology, the market is poised for robust growth. In addition, government initiatives supporting digital transformation and the expansion of e-commerce will further facilitate the widespread adoption of wearable devices across urban and rural areas.

Market Opportunities

- Wearables in Healthcare: The adoption of wearable devices in healthcare is on the rise in India, with the National Health Authority noting a 35% increase in wearable health-monitoring devices used in hospitals and clinics in 2023. Wearables are playing a crucial role in remote patient monitoring, enabling real-time tracking of vital signs such as heart rate and blood pressure. With over 600 million people living in rural areas, wearables provide an opportunity to extend healthcare access where traditional infrastructure is limited, reflecting the growing importance of these devices in the health sector.

- Customizable Wearable Devices: Indian consumers are increasingly seeking personalized experiences, and the demand for customizable wearable devices is growing. In 2023, more than 40% of wearable device users indicated a preference for customized features such as interchangeable bands and personalized health data settings (according to the Ministry of Consumer Affairs). This trend is driving the market towards offering more personalized, adaptable wearables that cater to individual needs and preferences, opening up opportunities for manufacturers to offer differentiated products in a competitive market.

Scope of the Report

Products

Key Target Audience

Wearable Device Manufacturers

Consumer Electronics Distributors

Fitness and Wellness Companies

Healthcare Providers and Hospitals

Retail Chains and E-commerce Platforms

Technology Innovators and Startups

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (Ministry of Electronics and Information Technology, Telecom Regulatory Authority of India)

Banks and Financial Institute

Companies

Players Mention in the Report:

Apple Inc.

Samsung Electronics Co., Ltd.

Xiaomi Corporation

Fitbit (Google LLC)

Garmin Ltd.

Huawei Technologies Co., Ltd.

Lenovo Group Limited

OnePlus Technology Co., Ltd.

Noise (Nexxbase Technologies Pvt. Ltd.)

Boat (Imagine Marketing Pvt. Ltd.)

Realme

Titan Company Limited

Oppo Electronics Corporation

Amazfit (Huami Corporation)

Sony Corporation

Table of Contents

1. India Wearable Device Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. India Wearable Device Market Size (In INR Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. India Wearable Device Market Analysis

3.1. Growth Drivers

3.1.1. Rising Health Consciousness (Percentage of fitness wearables growth)

3.1.2. Increasing Disposable Income (Purchasing power parity in India)

3.1.3. Technological Advancements (Integration of AI, IoT in wearables)

3.1.4. Expanding E-commerce Channels (E-commerce market penetration for wearables)

3.2. Market Challenges

3.2.1. High Initial Costs (Price elasticity of wearables)

3.2.2. Data Security Concerns (Wearable device security standards)

3.2.3. Battery Limitations (Battery life impact on consumer adoption)

3.3. Opportunities

3.3.1. Wearables in Healthcare (Adoption in health monitoring)

3.3.2. Customizable Wearable Devices (Consumer demand for personalization)

3.3.3. Government Initiatives (Digital Indias role in wearables adoption)

3.4. Trends

3.4.1. Rise of Smartwatches and Fitness Trackers (Product penetration in consumer electronics)

3.4.2. Wearable Payment Solutions (Contactless payments via wearables)

3.4.3. Wearable Integration with Smart Homes (Smart device interoperability)

3.5. Government Regulations

3.5.1. Data Privacy Laws Impacting Wearables (Personal Data Protection Bill)

3.5.2. IoT Regulatory Framework (Compliance for wearable IoT devices)

3.6. SWOT Analysis

3.6.1. Strengths (Technological innovation)

3.6.2. Weaknesses (Limited battery life)

3.6.3. Opportunities (Healthcare applications)

3.6.4. Threats (Data security risks)

3.7. Stakeholder Ecosystem

3.7.1. OEMs (Original Equipment Manufacturers)

3.7.2. Distributors

3.7.3. Retailers

3.7.4. E-commerce Platforms

3.8. Porters Five Forces Analysis

3.8.1. Bargaining Power of Buyers

3.8.2. Bargaining Power of Suppliers

3.8.3. Threat of New Entrants

3.8.4. Threat of Substitutes

3.8.5. Competitive Rivalry

3.9. Competitive Ecosystem

4. India Wearable Device Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Smartwatches

4.1.2. Fitness Trackers

4.1.3. Smart Glasses

4.1.4. Wearable Cameras

4.2. By Application (In Value %)

4.2.1. Fitness and Wellness

4.2.2. Healthcare

4.2.3. Lifestyle

4.2.4. Entertainment

4.3. By Connectivity Technology (In Value %)

4.3.1. Bluetooth

4.3.2. Wi-Fi

4.3.3. Near Field Communication (NFC)

4.4. By Component Type (In Value %)

4.4.1. Display

4.4.2. Sensors

4.4.3. Battery

4.5. By Region (In Value %)

4.5.1. North India

4.5.2. South India

4.5.3. East India

4.5.4. West India

5. India Wearable Device Market Competitive Analysis

5.1 Detailed Profiles of Major Competitors

5.1.1. Apple Inc.

5.1.2. Samsung Electronics Co., Ltd.

5.1.3. Xiaomi Corporation

5.1.4. Fitbit (Google LLC)

5.1.5. Garmin Ltd.

5.1.6. Fossil Group, Inc.

5.1.7. Huawei Technologies Co., Ltd.

5.1.8. Lenovo Group Limited

5.1.9. OnePlus Technology Co., Ltd.

5.1.10. Noise (Nexxbase Technologies Pvt. Ltd.)

5.1.11. Boat (Imagine Marketing Pvt. Ltd.)

5.1.12. Realme

5.1.13. Titan Company Limited

5.1.14. Oppo Electronics Corporation

5.1.15. Amazfit (Huami Corporation)

5.2 Cross Comparison Parameters

5.2.1. Market Share

5.2.2. Product Portfolio

5.2.3. R&D Investment

5.2.4. Technology Partnerships

5.2.5. Manufacturing Capabilities

5.2.6. Marketing Strategies

5.2.7. Customer Reach

5.2.8. Product Differentiation

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

6. India Wearable Device Market Regulatory Framework

6.1 Data Privacy and Security Regulations

6.2 Compliance with Health Standards for Wearable Devices

6.3 IoT Device Certification

7. India Wearable Device Market Future Size (In INR Bn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. India Wearable Device Market Future Segmentation

8.1 By Product Type (In Value %)

8.2 By Application (In Value %)

8.3 By Connectivity Technology (In Value %)

8.4 By Component Type (In Value %)

8.5 By Region (In Value %)

9. India Wearable Device Market Analysts' Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort Analysis

9.3 White Space Opportunity Analysis

9.4 Strategic Partnerships and Collaborations

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

This phase involves constructing an ecosystem map of the India wearable device market. Desk research is conducted using secondary databases and proprietary resources to identify the key variables driving market dynamics, including product type, application, and regional adoption trends.

Step 2: Market Analysis and Construction

In this phase, historical data of the India wearable device market is compiled and analyzed. This involves studying market penetration of product segments, their distribution across regions, and revenue generation by major players. The service quality and technological advancements of wearables are also evaluated.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are validated through interviews with industry experts and representatives from major companies in the India wearable device market. These consultations provide critical insights into market dynamics, consumer behavior, and technological trends.

Step 4: Research Synthesis and Final Output

In the final stage, comprehensive data from manufacturers and market players is synthesized to deliver a validated analysis of the India wearable device market. This approach ensures a robust, reliable analysis of the market landscape.

Frequently Asked Questions

1. How big is the India Wearable Device Market?

The India wearable device market is valued at USD 134 million, driven by a rising health-conscious population and the increasing adoption of smartwatches and fitness trackers.

2. What are the challenges in the India Wearable Device Market?

India wearable device market Challenges include high initial costs, data security concerns, and the short battery life of devices, all of which impact consumer adoption.

3. Who are the major players in the India Wearable Device Market?

Key players in the India wearable device market include Apple Inc., Samsung Electronics, Xiaomi Corporation, Noise, and Boat, all of which have established strong brand loyalty and innovative product offerings.

4. What are the growth drivers of the India Wearable Device Market?

The India wearable device market is propelled by technological advancements in health monitoring, increased internet penetration, and rising disposable incomes, particularly in urban areas.

5. Which cities dominate the India Wearable Device Market?

Bangalore, Delhi, and Mumbai dominate the India wearable device market due to their tech-savvy populations, strong internet penetration, and availability of e-commerce platforms.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.