India Wearables Market Outlook to 2030

Region:Asia

Author(s):Khushi Khatreja

Product Code:KROD427

July 2024

100

About the Report

India Wearables Market Overview

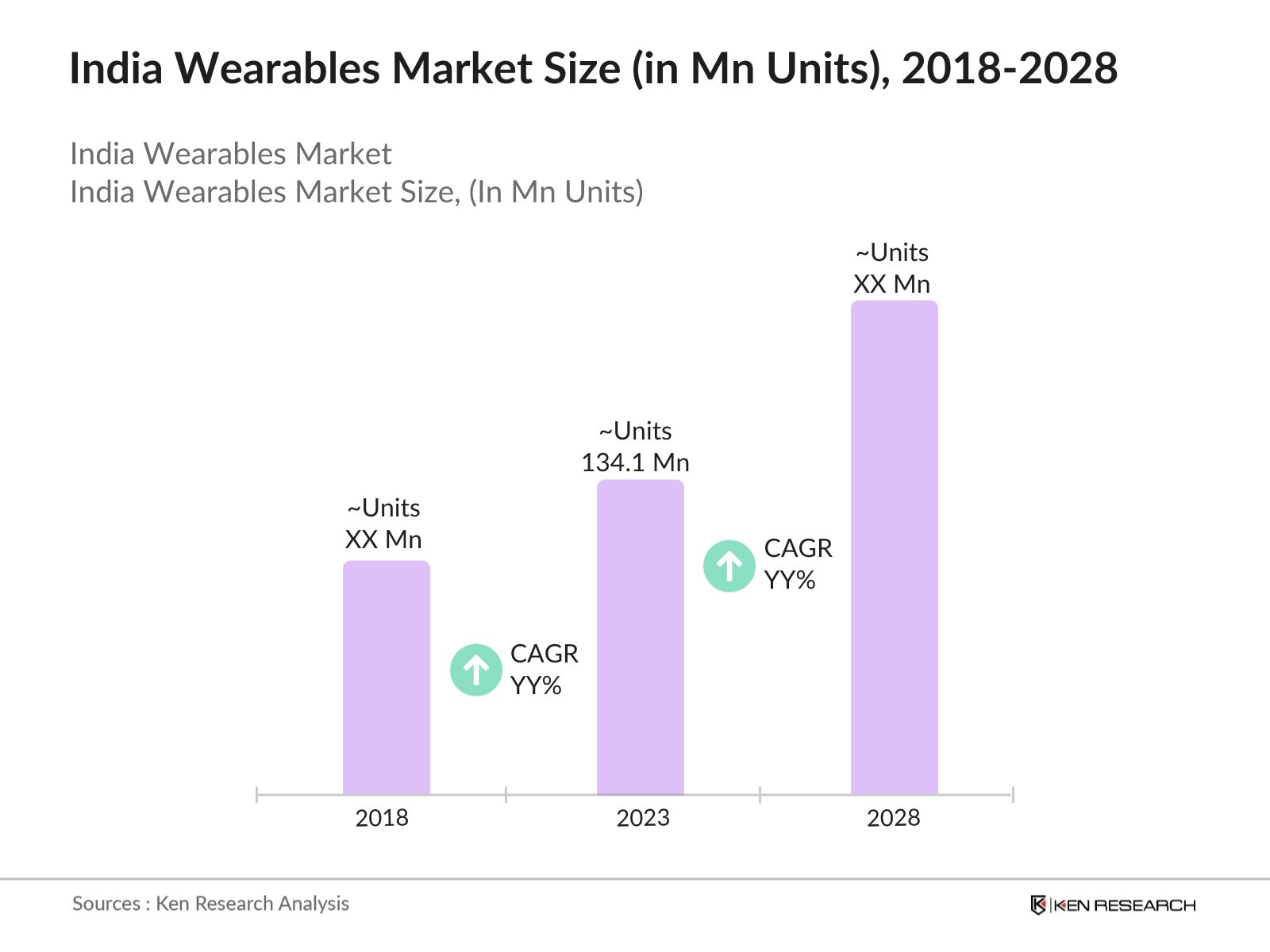

- The India Wearables Market has experienced notable growth, reaching a volume of 134.1 million units in 2023. This growth is primarily driven by increasing health consciousness, technological advancements, and rising disposable incomes.

- Prominent players in the India wearables market include Apple Inc., Samsung Electronics, Fitbit (now part of Google), Xiaomi Corporation, and Garmin Ltd. These companies have established strong brand recognition and continue to innovate, providing consumers with cutting-edge wearables that offer a combination of style, functionality, and advanced technology.

- In 2023, Apple Inc. announced the launch of its new Apple Watch Series 9, featuring enhanced health tracking capabilities and longer battery life. This development has further solidified Apple's position as a leader in the wearables market.

India Wearables Current Market Overview

- The increasing prevalence of lifestyle diseases such as diabetes and hypertension has spurred demand for health monitoring devices. In addition to it, the youth population's preference for smart gadgets and the rising fitness trends have significantly contributed to market expansion.

- Wearable technology has significantly impacted the healthcare sector by enabling continuous health monitoring and early detection of potential health issues. The widespread adoption of wearables has led to increased health awareness among consumers, prompting lifestyle changes and preventive healthcare measures.

- The southern region, which includes tech hubs like Chennai, Hyderabad, and Bangalore, has a high presence of major multinational companies (MNCs) that attract a growing young population, making it the biggest market for fitness trackers and smartwatches and it witnessed high adoption of wearable devices, making it the biggest market in the industry.

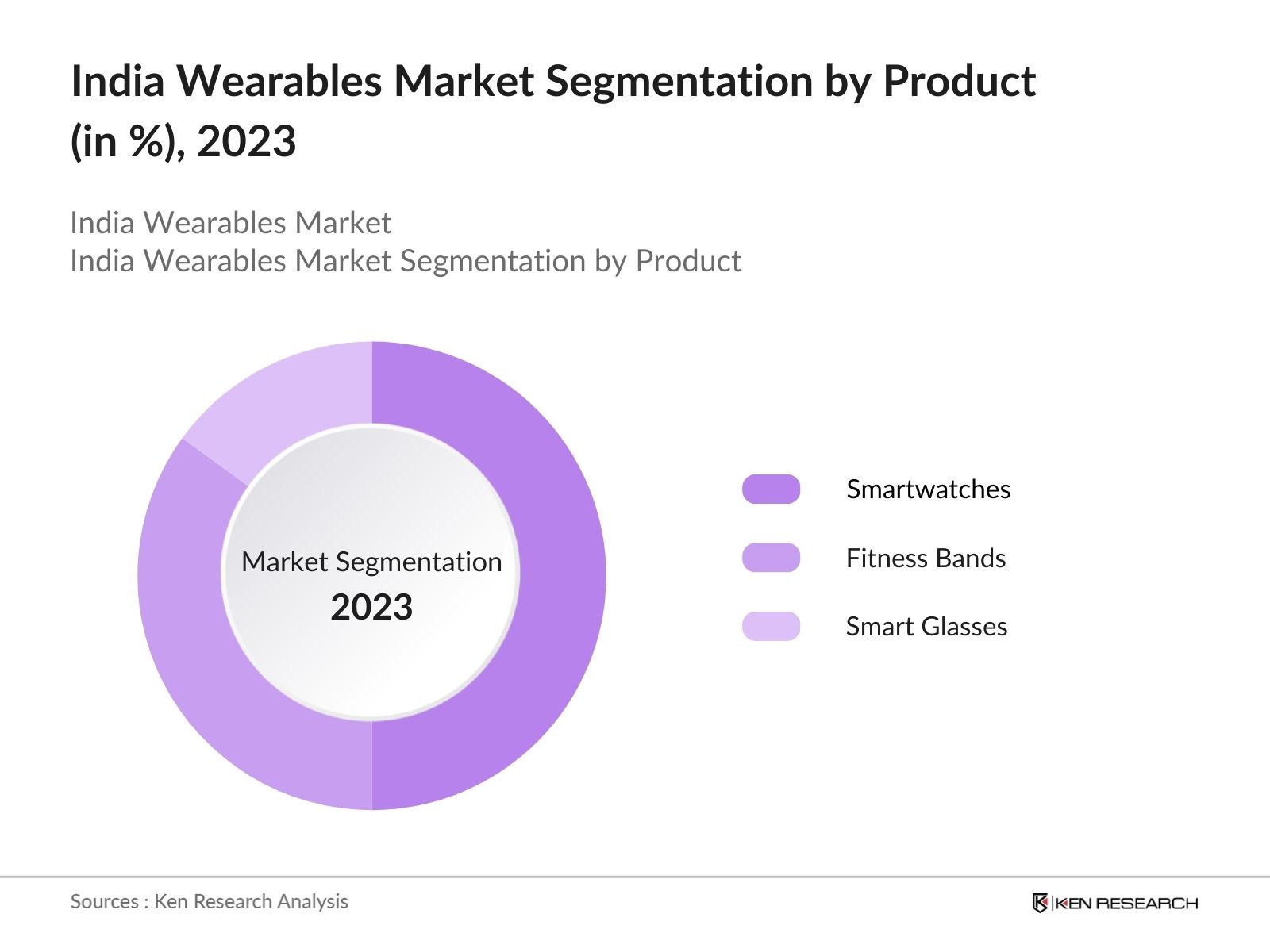

India Wearables Market Segmentation

- By Product: India Wearables Market is segmented by product into smartwatches, fitness bands, and smart glasses. In 2023, smartwatches held the significant market share due to their ability to offer various features such as notifications, fitness tracking, and health monitoring. The seamless integration with smartphones and other smart devices has made smartwatches a preferred choice among consumers.

- By End User: India Wearables Market is segmented by end users into individual consumers, corporate wellness programs, and healthcare institutions. In 2023, individual consumers lead the market primarily due to individual consumers because of increasing health awareness and the desire for personalized health monitoring solutions.

- By Region: The regional segmentation of the market includes North, South, East, and West India. In 2023, South India held the significant market share. The region's focus on health and fitness, coupled with the presence of major technology hubs, has contributed to its leading position in the market.

India Wearables Market Competitive Landscape

- Apple Inc.: Apple, the world's largest technology company by revenue and second-largest mobile phone manufacturer, offers iconic products like the iPhone, iPad, Mac, Apple Watch, Vision Pro, and Apple TV. In July 2024, Apple announced plans to integrate Google's Gemini AI chatbot into the iPhone. The company also launched the Apple Vision Pro in Australia and removed several VPN apps from its Russian App Store.

- Samsung: Samsung is one of the largest mobile phone makers by unit sales and the second-largest semiconductor maker. In 2024, Samsung announced plans to introduce a new health-tracking feature in Galaxy Watch models, launched an external washing machine filter, and began mass production of industry's most advanced 12nm-class DRAM.

- Xiaomi: Xiaomi is known for its focus on innovation, high-quality user experience, and operational efficiency. In 2023, Xiaomi announced plans to release a new operating system called HyperOS, replacing its previous MIUI platform. The company continues to expand its product portfolio and global footprint as it competes with other major tech giants.

India Wearables Industry Analysis

India Wearables Market Growth Drivers

- Health Awareness and Lifestyle Diseases: Proliferation of fitness and health monitoring features. The popularity of smartwatches and fitness trackers that can track activity, heart rate, and other health metrics has driven adoption, especially among health-conscious consumers. Smartwatch shipments in India surged year-over-year, totaling 53.4 million units in 2023.

- Increasing Smartphone Penetration: In 2023, India had 1.10 billion mobile connections, with a smartphone penetration rate of 71%. The compatibility of wearables with smartphones enhances their functionality and appeal, driving increased adoption.

- Declining Prices and Increasing Affordability: The growing popularity of affordable options from homegrown brands like Fire-Boltt, Noise, and boAt has contributed to make wearable devices more accessible to a wider range of consumers. Homegrown wearable brands like Fire-Boltt, Noise, and boAt have collectively captured 65-70% market share, competing against global players.

India Wearables Market Challenges

- Data Privacy Concerns: Wearable devices collect personal data that can be misused if exposed. In 2023, an unsecured database with over 61 million records from fitness trackers was breached, fueling concerns about wearable data security and privacy. The aggregation of personal health data by wearables has fueled heightened apprehensions about data security and privacy.

- Limited Battery Life: One of the primary complaints from consumers is the limited battery life of wearable devices. Despite technological advancements, many wearables still require frequent charging, which affects user experience and satisfaction. The average battery life of smartwatches is indeed around 2-3 days, which is a common range for many models.

- Inventory Challenges: The wearables market experienced high inventory levels in the second half of 2023, leading to a slowdown in growth. Vendors have had to focus on clearing this excess inventory. To clear this excess inventory, wearable brands had to resort to heavy discounting which cannot be a good idea in the long run.

India Wearables Market Government Initiatives

- Phased Manufacturing Program (PMP): In February 2022, the government unveiled a new PMP scheme to encourage domestic production of wearable and hearable devices. In 2022, the Ministry of Electronics and IT notified a PMP for wrist wearable devices (smartwatches) and their inputs/components.

- Make in India Campaign: The Make in India initiative has been encouraging the domestic production of electronic goods, including wearables. India's overall exports of goods and services are expected to reach $900 billion in the current fiscal year of 2024, with the Make in India initiative providing a platform for homegrown wearable brands to excel, innovate, and establish a global presence.

India Wearables Market Future Outlook

Looking ahead to 2028, the India wearables market will be advancing forward because of continuous technological advancements, increased adoption of IoT devices, and growing consumer awareness about health and fitness. The integration of AI and machine learning in wearables, coupled with the expansion of 5G technology, will provide new growth opportunities.

India Wearables Market Future Trends

-

- Increased Adoption of AI and Machine Learning: By 2028, wearables in India will extensively integrate AI and machine learning to offer personalized health insights and predictive analytics. Devices will become more intuitive, providing users with real-time health recommendations based on continuous monitoring.

- Growth in Healthcare Wearables: The healthcare sector will increasingly adopt wearables for patient monitoring and telemedicine. These devices will play a crucial role in remote patient monitoring, chronic disease management, and post-operative care. For example: Dozee's remote patient monitoring and AI-based early warning system is being used by the HCG Network of cancer centres to monitor oncology patients.

Scope of the Report

|

By Product |

Smartwatches Fitness brands Smart Glasses |

|

By End User |

Individual Consumers Corporate Wellness Healthcare Institutions |

|

By Region |

North South East West |

Products

Key Target Audience – Organizations and Entities who can benefit by Subscribing this Report:

Technology Companies

Healthcare Providers

Fitness Centers and Gyms

E-commerce Platforms

Telecommunication Companies

Insurance Companies

Corporate Wellness Programs

Consumer Electronics Manufacturers

Ministry of Health and Family Welfare

Investors and Venture Capitalist firms

Government and Regulatory Bodies (NHA, CDSCO, DHR)

Time Period Captured in the Report:

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2028

Companies

Players Mentioned in the Report:

Apple Inc.

Samsung Electronics

Fitbit (Google)

Xiaomi Corporation

Garmin Ltd.

Huawei Technologies

Fossil Group, Inc.

Noise

boAt

Realme

Titan Company

OnePlus

Sony Corporation

LG Electronics

Oppo

Table of Contents

1. India Wearables Market Overview

1.1 India Wearables Market Taxonomy

2. India Wearables Market Size (in Mn units), 2018-2023

3. India Wearables Market Analysis

3.1 India Wearables Market Growth Drivers

3.2 India Wearables Market Challenges and Issues

3.3 India Wearables Market Trends and Development

3.4 India Wearables Market Government Regulation

3.5 India Wearables Market SWOT Analysis

3.6 India Wearables Market Stake Ecosystem

3.7 India Wearables Market Competition Ecosystem

4. India Wearables Market Segmentation, 2023

4.1 India Wearables Market Segmentation by Product (in %), 2023

4.2 India Wearables Market Segmentation by End User (in %), 2023

4.3 India Wearables Market Segmentation by Region (in %), 2023

5. India Wearables Market Competition Benchmarking

5.1 India Wearables Market Cross-Comparison (no. of employees, company overview, business strategy, USP, recent development, operational parameters, financial parameters and advanced analytics)

6 India Wearables Future Market Size (in Mn units), 2023-2028

7 India Wearables Future Market Segmentation, 2028

7.1 India Wearables Market Segmentation by Product (in %), 2028

7.2 India Wearables Market Segmentation by End User (in %), 2028

7.3 India Wearables Market Segmentation by Region (in %), 2028

8. India Wearables Market Analysts’ Recommendations

8.1 India Wearables Market TAM/SAM/SOM Analysis

8.2 India Wearables Market Customer Cohort Analysis

8.3 India Wearables Market Marketing Initiatives

8.4 India Wearables Market White Space Opportunity Analysis

DisclaimerContact Us

Research Methodology

Step 1: Identifying Key Variables

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry level information.Â

Step 2: Market Building

Collating statistics on India Wearables Market over the years, penetration of marketplaces and service providers ratio to compute revenue generated for India Wearables industry. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.Â

Step 3: Validating and Finalizing

Building market hypothesis and conducting CATIs with industry experts belonging to different companies to validate statistics and seek operational and financial information from company representatives.Â

Step 4: Research Output

Our team will approach multiple wearables companies and understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from such wearables industry companies.

Frequently Asked Questions

01 How big is India wearables market?

The India wearables market has witnessed significant growth, reaching a volume of 134.1 million units in 2023. This growth is primarily fueled by the rising awareness of health and wellness, technological innovations, and increasing disposable incomes.

02 Who are the major players in the India wearables market?

Key players in the India wearables market include Apple Inc., Samsung Electronics, Fitbit (Google), Xiaomi Corporation, and Garmin Ltd. These companies dominate due to their continuous innovation, strong brand recognition, and extensive product offerings.

03 What are the growth drivers of India wearables market?

The India wearables market is propelled by increasing health awareness, the high prevalence of lifestyle diseases, widespread smartphone penetration, and the booming fitness and wellness industry. Technological advancements and AI integration also play a significant role in driving growth.

04 What are the challenges in India wearables market?

Challenges in the India wearables market include data privacy and security concerns, high costs of advanced devices, limited battery life, and regulatory hurdles related to health monitoring devices.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.