India Weight Management Market Outlook to 2030

Region:Asia

Author(s):Shubham Kashyap

Product Code:KROD5488

December 2024

99

About the Report

India Weight Management Market Overview

- The India weight management market is valued at USD 22.0 billion, driven by rising obesity rates and increasing health consciousness among the population. Urbanization and sedentary lifestyles have contributed to a surge in demand for weight management solutions, including dietary supplements, fitness equipment, and wellness services. This growth is further supported by government initiatives promoting healthy living and the proliferation of digital health platforms.

- Metropolitan cities such as Mumbai, Delhi, and Bengaluru dominate the weight management market in India. The higher disposable incomes, greater health awareness, and access to fitness facilities in these urban centers contribute to their leading positions. Additionally, the presence of numerous health clubs, wellness centers, and a growing culture of fitness among urban dwellers bolster the market's expansion in these regions.

- The Food Safety and Standards Authority of India (FSSAI) has established comprehensive regulations for weight management products to ensure consumer safety and product efficacy. These guidelines mandate that such products must adhere to specified standards concerning ingredient composition, labeling, and health claims. For instance, the Food Safety and Standards Regulations, 2016, outline permissible ingredients and their maximum usage levels in weight management products. Additionally, the regulations require clear labeling of nutritional information and any potential allergens to inform consumers adequately.

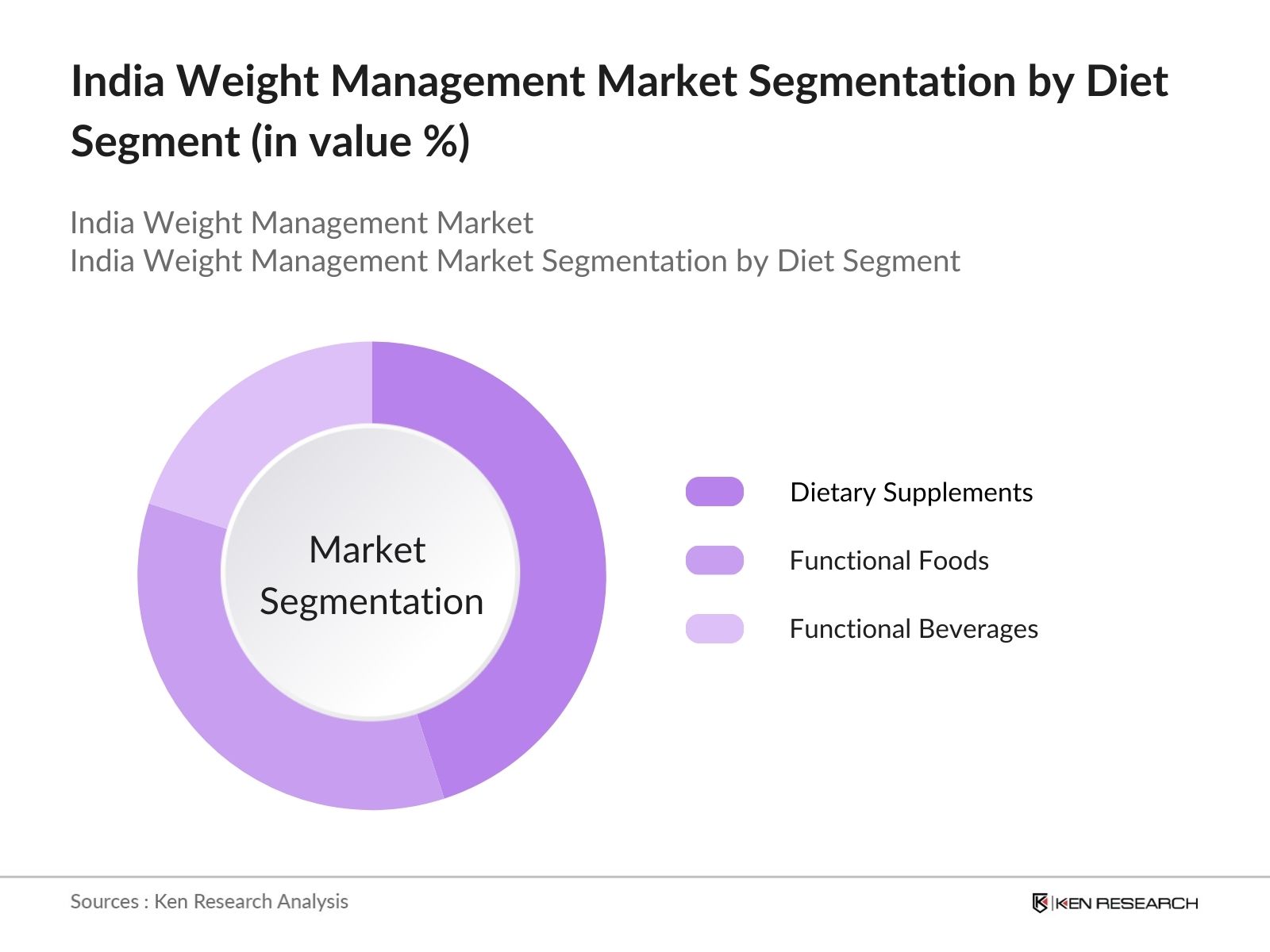

India Weight Management Market Segmentation

- By Diet: The market is segmented by diet into functional beverages, functional foods, and dietary supplements. Dietary supplements hold a dominant market share due to their convenience and the perception of quick results. Consumers are increasingly opting for supplements like protein powders, herbal extracts, and vitamins to aid weight loss, driven by aggressive marketing and endorsements by fitness influencers.

- By Equipment: The market is also segmented by equipment into fitness equipment and surgical equipment. Fitness equipment, including treadmills, stationary bikes, and strength training machines, leads this segment. The growing trend of home workouts, especially post-pandemic, and the establishment of numerous gyms and fitness centers have propelled the demand for fitness equipment.

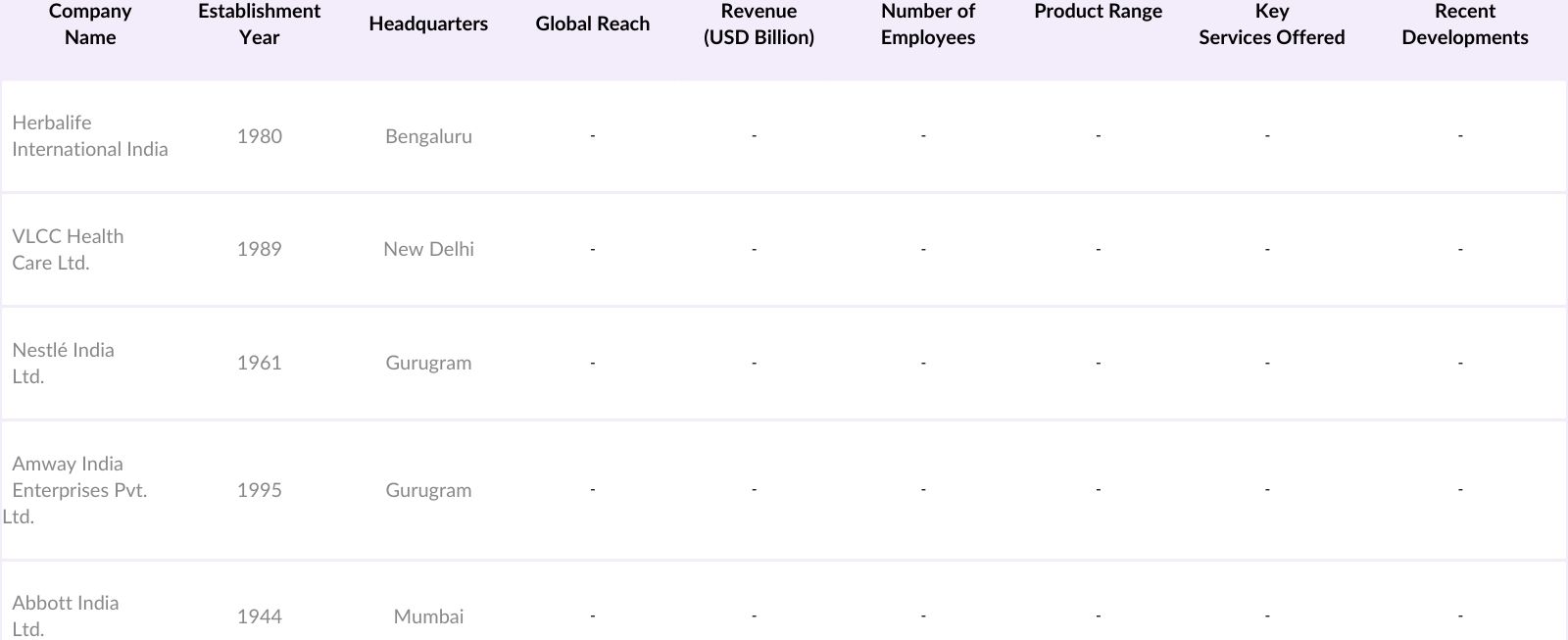

India Weight Management Market Competitive Landscape

The India weight management market is characterized by the presence of both domestic and international players offering a range of products and services. Key companies include:

India Weight Management Market Analysis

Growth Drivers

- Rising Obesity Rates: India is experiencing a significant increase in obesity rates, with approximately 135 million individuals affected by obesity-related health issues. The National Family Health Survey-5 (NFHS-5) indicates that the prevalence of overweight individuals has risen from 20.6% in 2015-16 to 24% in 2019-21 among women, and from 18.9% to 22.9% among men. This surge in obesity is contributing to a higher incidence of non-communicable diseases such as diabetes and hypertension, underscoring the urgent need for effective weight management solutions.

- Increasing Health Awareness: There is a growing awareness among Indians about the importance of maintaining a healthy lifestyle. The Ministry of Health and Family Welfare reports that health literacy initiatives have reached over 200 million people through various campaigns and programs. This heightened awareness is leading to increased participation in fitness activities and a greater demand for weight management services.

- Urbanization and Sedentary Lifestyles: India's urban population has grown to 519 million, accounting for 35% of the total population. Urbanization often leads to sedentary lifestyles due to desk-bound jobs and limited physical activity. The World Bank notes that urban residents are more susceptible to lifestyle-related health issues, including obesity, thereby increasing the demand for weight management programs.

Challenges

- High Cost of Weight Management Programs: The high expense of weight management programs presents a significant barrier to their accessibility for a broad segment of the population. Many individuals prioritize essential health expenditures, making it challenging to invest in specialized services. This cost factor often limits participation, especially among those with constrained financial resources or limited access to affordable weight management options.

- Cultural and Social Barriers: Cultural norms and traditional beliefs often link a fuller body with prosperity and health, creating resistance to weight management efforts. These societal perceptions can discourage individuals from seeking solutions, as the desire to conform to community expectations outweighs personal health concerns. This stigma complicates efforts to address obesity and promote healthier lifestyles effectively in various communities.

India Weight Management Market Future Outlook

The India weight management market is poised for robust growth, supported by increasing health awareness and government initiatives aimed at promoting wellness. The ongoing transition towards digital health platforms and personalized nutrition plans is expected to gain momentum as consumers seek convenient and tailored solutions. Additionally, advancements in fitness technology and the integration of traditional practices like Ayurveda with modern weight management approaches will enhance the market's growth trajectory, positioning it favorably for future expansion.

Future Market Opportunities

- Technological Advancements in Fitness Equipment: The adoption of advanced fitness equipment is on the rise in India. The Ministry of Electronics and Information Technology reports that the fitness technology sector has attracted investments totaling INR 1,500 crore, facilitating the development and availability of innovative fitness solutions that can enhance weight management efforts. These advancements are making fitness solutions more efficient and user-friendly.

- Expansion of Online Weight Loss Services: The digital health sector in India is expanding rapidly. The National Digital Health Mission aims to create a digital health ecosystem, providing a platform for online weight loss services. This initiative has the potential to reach millions of users, offering personalized and accessible weight management solutions. Increased internet penetration is further driving this trend.

Scope of the Report

|

By Diet |

Functional Beverages |

|

By Equipment |

Fitness Equipment |

|

By Service |

Health Clubs |

|

By Demographics |

Age Groups |

|

By Region |

North West |

Products

Key Target Audience

Dietary Supplement Manufacturers

Fitness Equipment Manufacturers

Health and Wellness Service Providers

Pharmaceutical Companies

Investors and Venture Capitalist Firms

Banks and Financial Institutions

Government and Regulatory Bodies (e.g., Ministry of Health and Family Welfare)

Online Health and Fitness Platforms

Companies

Players Mentioned in the Report

Herbalife International India Pvt. Ltd.

VLCC Health Care Ltd.

Nestl India Ltd.

Amway India Enterprises Pvt. Ltd.

Abbott India Ltd.

Dr. Reddy's Laboratories Ltd.

Cipla Ltd.

Sun Pharmaceutical Industries Ltd.

Biocon Ltd.

Zydus Wellness Ltd.

Himalaya Wellness Company

Patanjali Ayurved Ltd.

HealthifyMe Wellness Pvt. Ltd.

Cure.fit Healthcare Pvt. Ltd.

Talwalkars Better Value Fitness Ltd.

Table of Contents

India Weight Management Market Overview

Definition and Scope

Market Taxonomy

Market Growth Rate

Market Segmentation Overview

India Weight Management Market Size (In INR Crores)

Historical Market Size

Year-On-Year Growth Analysis

Key Market Developments and Milestones

India Weight Management Market Analysis

Growth Drivers

Rising Obesity Rates

Increasing Health Awareness

Urbanization and Sedentary Lifestyles

Government Initiatives and Policies

Market Challenges

High Cost of Weight Management Programs

Cultural and Social Barriers

Lack of Standardization in Services

Opportunities

Technological Advancements in Fitness Equipment

Expansion of Online Weight Loss Services

Integration of Traditional Practices (e.g., Ayurveda) with Modern Weight Management

Trends

Adoption of Wearable Fitness Technology

Growth of Plant-Based and Organic Diet Products

Personalized Nutrition and Fitness Plans

Government Regulations

FSSAI Guidelines on Weight Management Products

Policies Promoting Physical Fitness and Wellness

Tax Incentives for Health and Wellness Services

SWOT Analysis

Stakeholder Ecosystem

Porters Five Forces Analysis

Competitive Landscape

India Weight Management Market Segmentation

By Diet (In Value %)

Functional Beverages

Functional Foods

Dietary Supplements

By Equipment (In Value %)

Fitness Equipment

Surgical Equipment

By Service (In Value %)

Health Clubs

Consultation Services

Online Weight Loss Services

By Demographics (In Value %)

Age Groups

Gender

Income Levels

By Region (In Value %)

North

South

East

West

India Weight Management Market Competitive Analysis

Detailed Profiles of Major Companies

Herbalife International India Pvt. Ltd.

VLCC Health Care Ltd.

Nestl India Ltd.

Amway India Enterprises Pvt. Ltd.

Abbott India Ltd.

Dr. Reddy's Laboratories Ltd.

Cipla Ltd.

Sun Pharmaceutical Industries Ltd.

Biocon Ltd.

Zydus Wellness Ltd.

Himalaya Wellness Company

Patanjali Ayurved Ltd.

HealthifyMe Wellness Pvt. Ltd.

Cure.fit Healthcare Pvt. Ltd.

Talwalkars Better Value Fitness Ltd.

Cross Comparison Parameters (Number of Employees, Headquarters, Inception Year, Revenue, Market Share, Product Portfolio, R&D Investment, Distribution Channels)

Market Share Analysis

Strategic Initiatives

Mergers and Acquisitions

Investment Analysis

Venture Capital Funding

Government Grants

Private Equity Investments

India Weight Management Market Regulatory Framework

Standards for Weight Management Products

Compliance Requirements for Service Providers

Certification Processes for Equipment and Services

India Weight Management Future Market Size (In INR Crores)

Future Market Size Projections

Key Factors Driving Future Market Growth

India Weight Management Future Market Segmentation

By Diet (In Value %)

By Equipment (In Value %)

By Service (In Value %)

By Demographics (In Value %)

By Region (In Value %)

India Weight Management Market Analysts Recommendations

Total Addressable Market (TAM), Serviceable Available Market (SAM), and Serviceable Obtainable Market (SOM) Analysis

Customer Cohort Analysis

Marketing Initiatives

White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the India Weight Management Market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data pertaining to the India Weight Management Market. This includes assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics is conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations provide valuable operational and financial insights directly from industry practitioners, which are instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple weight management product manufacturers and service providers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction serves to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the India Weight Management Market.

Frequently Asked Questions

How big is the India Weight Management Market?

The India weight management market is valued at USD 22.0 billion, driven by rising obesity rates, increasing health awareness, and growing demand for fitness and wellness solutions across the country.

What are the key challenges in the India Weight Management Market?

Key challenges in the India weight management market include the high cost of weight management programs, cultural and social barriers to adopting certain practices, and a lack of standardization in products and services offered within the market.

Who are the major players in the India Weight Management Market?

Major players in the India weight management market include Herbalife International India, VLCC Health Care, Nestl India, Amway India, and Abbott India, among others. These companies dominate due to their extensive product portfolios, strong distribution networks, and brand recognition.

What are the growth drivers for the India Weight Management Market?

The India weight management market is propelled by increasing health awareness, urbanization, sedentary lifestyles, and government initiatives promoting wellness. The rise in digital health platforms and personalized nutrition also contributes to the market's growth.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.