India Wireless Broadband Market Outlook to 2030

India Wireless Broadband Market

Region:Asia

Author(s):Shambhavi Awasthi

Product Code:KROD537

July 2024

100

About the Report

India Wireless Broadband Market Overview

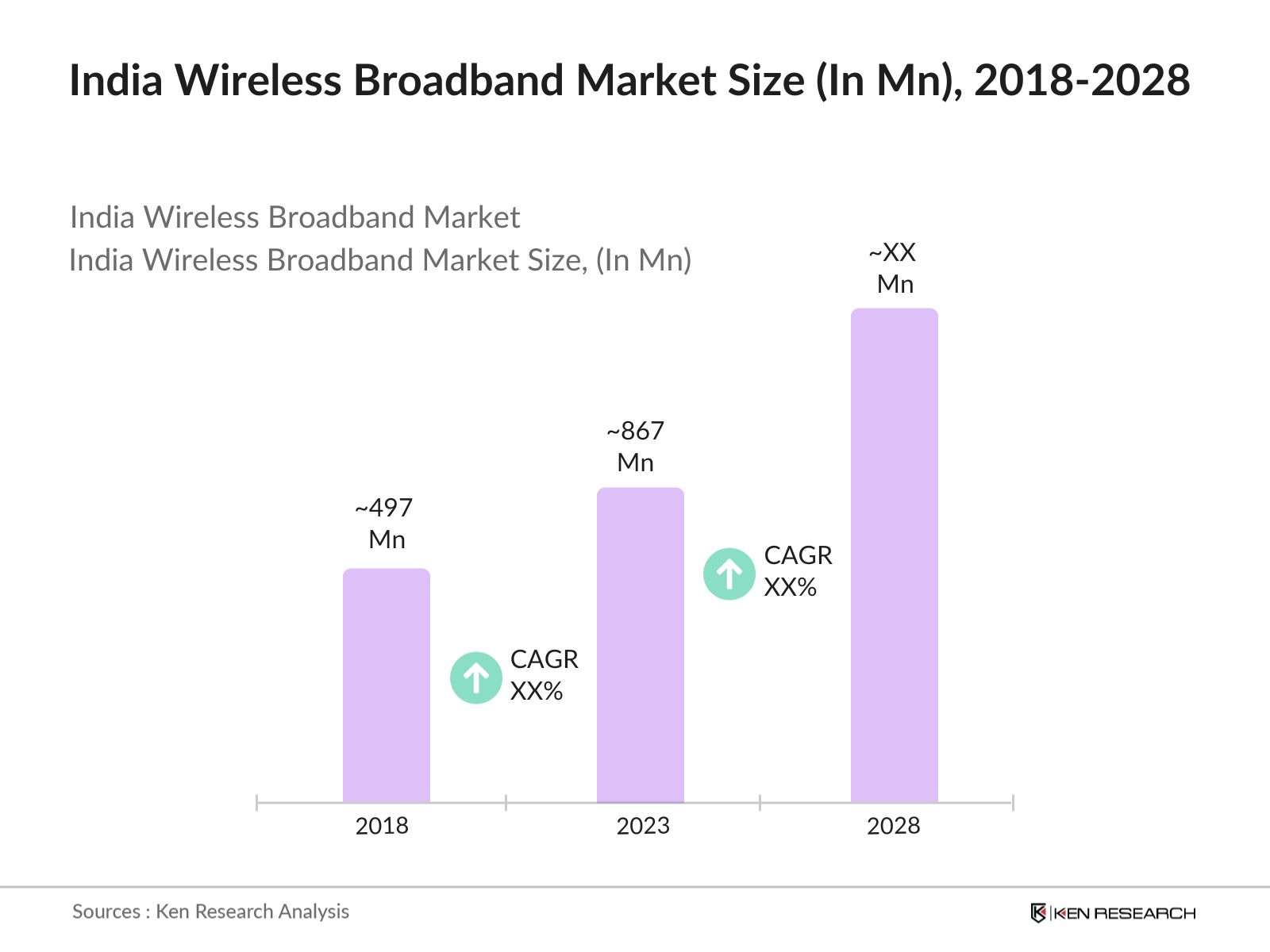

- The Indian wireless broadband market has experienced significant growth over the past five years. In 2023, the number of subscribers for wireless broadband had reached 867 million, up from 497 million in 2018. This growth has been driven by the increasing penetration of smartphones, affordable data plans, and the government's Digital India initiative aimed at improving internet connectivity across the country.

- Key players in the Indian wireless broadband market include Reliance Jio Infocomm Ltd., Bharti Airtel, Vodafone Idea, and BSNL (Bharat Sanchar Nigam Limited). These players have consistently invested in expanding their network infrastructure and launching competitive data plans to capture a larger market share.

- In March 2023, Jio had launched its True 5G services across over 2,300 cities and towns. The company aimed for pan-India coverage by December 2023, striving to expand its network reach and enhance connectivity nationwide.

- The state of Maharashtra, particularly the city of Mumbai, dominates the Indian wireless broadband market. In 2023, Maharashtra accounted for majority of the total wireless broadband subscriptions in India. The high urbanization rate, robust economic activities, and a large base of tech-savvy consumers have contributed to this dominance.

India Wireless Broadband Market Segmentation

India's Wireless Broadband Market is segmented by the following three major segments:

By Technology: The India Wireless Broadband Market is segmented by technology into 4G LTE, 5G, and Wi-Fi. In 2023, 4G LTE held a dominant market share in the technology segment. This dominance is attributed to the widespread availability of 4G networks, affordable data plans, and the high penetration of 4G-enabled smartphones.

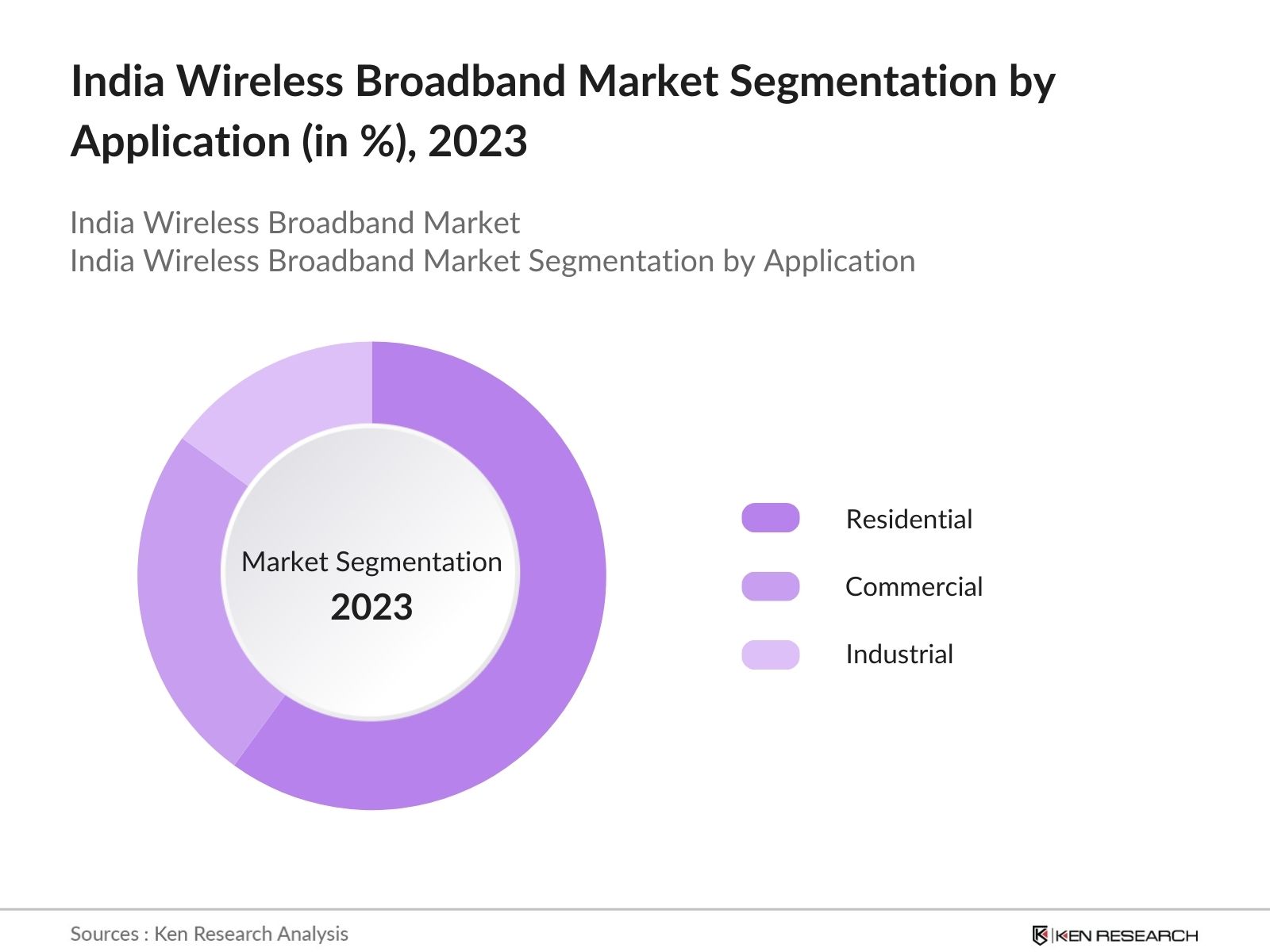

By Application: The market is segmented by application into residential, commercial, and industrial. In 2023, the residential segment held the largest market share. This is primarily due to the increasing number of households adopting high-speed internet for streaming, remote work, and online education, driven by the need for reliable connectivity during the pandemic.

By Region: The market is segmented by region into North, South, East, and West. In 2023, the Western region, particularly Maharashtra, held a dominant market share. This is due to the high concentration of urban populations, better infrastructure, and higher economic activities compared to other regions.

India Wireless Broadband Market Competitive Landscape

|

Company |

Establishment Year |

Headquarters |

|

Reliance Jio Infocom |

2007 |

Mumbai, India |

|

Bharti Airtel |

1995 |

New Delhi, India |

|

Vodafone Idea |

2018 |

Mumbai, India |

|

BSNL |

2000 |

New Delhi, India |

|

ACT Fibernet |

2008 |

Bengaluru, India |

- Vodafone Idea has entered into a strategic partnership with Nokia: Vodafone's next-generation network equipment, involving a USD 1 billion investment over three years to enhance network capacity and performance. In June 2024, Vodafone Idea's board approved the preferential allotment of nearly 1.7 billion equity shares worth Rs 2,458 crore to its vendors Nokia and Ericsson.

- BSNL's 4G Expansion Plan: BSNL has awarded a major contract worth over USD 1.83 billion to a consortium led by Tata Consultancy Services (TCS) to deploy a nationwide 4G network across India. The consortium also includes Tejas Networks, a Tata Group telecom gear manufacturer, and state-run ITI Ltd. The contract involves the supply, planning, design, installation, commissioning, and optimization of the mobile network, covering 100,000 telecom sites.

India Wireless Broadband Market Analysis

India Wireless Broadband Market Growth Analysis

- Rising Smartphone Penetration: In 2023, India had over 700 million active internet users aged 2 years and above. This includes 425 million users in rural India and 295 million in urban areas. The active internet user base aged 12 years and above will reach 595 million by the end of 2022, up over 20% year-over-year. This suggests the number of smartphone users in India is likely to continue growing rapidly.

- Increase in Data Consumption: Data consumption in India has been on the rise, with 2023 recording an average data usage of 21 GB per user per month. The increase in data consumption is driven by the proliferation of video streaming services, online gaming, and social media usage, which require high-speed internet.

- Government’s Digital Initiatives: The Indian government’s Digital India program, launched in 2015, has been instrumental in promoting internet connectivity. In 2023, the government allocated USD 8 billion to further enhance digital infrastructure, aiming to connect 500,000 villages with high-speed broadband by 2025.

India Wireless Broadband Market Challenges

- High Cost of Spectrum Acquisition: The high cost of spectrum acquisition remains a significant challenge for telecom operators. In the recent 5G spectrum auction held in India in June 2024, the government put up a total of 10.5 GHz of spectrum for sale, with a total value of around Rs 11,340 crore. which many operators found prohibitively expensive. This cost pressure affects the operators' ability to invest in infrastructure and expand their services.

- Financial Stress of Telecom Operators: Several telecom operators in India face financial stress due to high debt levels and competitive pricing pressures. In 2023, Vodafone Idea reported a net debt of USD 20 billion, impacting its ability to invest in network expansion and technology upgrades. The financial instability of key players can hinder the overall growth of the wireless broadband market, as it limits their capacity to innovate and expand their services.

India Wireless Broadband Government Initiatives

- BharatNet Project: The BharatNet project has received significant additional funding and focus in recent years to expand high-speed broadband connectivity to rural areas of India. In 2023, the government allocated an ₹39 lakh crore for the next phase of the BharatNet project. This takes the total allocation for the project to over ₹2 trillion so far.

- The National Broadband Mission: The National Broadband Mission, aims to provide universal and equitable access to broadband services across the country, especially in rural and remote areas, by 2025. The mission has set key objectives, including providing broadband access to all villages, improving the quality of mobile and internet services, and developing a Broadband Readiness Index. To achieve these goals, the government plans to invest Rs 7 lakh crore from stakeholders, including Rs 70,000 crore from the Universal Service Obligation Fund.

India Wireless Broadband Market Future Outlook

The future of the Indian wireless broadband market by 2028. The rollout of 5G technology is expected to be a major growth driver, alongside increasing demand for high-speed internet for remote work, online education, and digital entertainment.

Future Market Trends

- Nationwide 5G Deployment: By 2028, India is expected to achieve nationwide 5G coverage, driven by substantial investments from both the government and private telecom operators. The rollout of 5G will provide ultra-fast internet speeds, low latency, and enhanced connectivity, revolutionizing various sectors such as healthcare, education, and entertainment. The government's support, coupled with the telecom operators' aggressive network expansion plans, will play a crucial role in achieving this milestone.

- Increased Focus on Rural Connectivity: The government’s continued focus on bridging the digital divide is expected to result in significant improvements in rural connectivity by 2028. Initiatives such as the BharatNet project and private sector investments will ensure that a larger portion of the rural population has access to high-speed internet. This enhanced connectivity will drive digital inclusion, economic development, and social progress in rural areas.

Scope of the Report

|

By Technology |

4G LTE 5G Wi-Fi |

|

By Application |

Residential Commercial Industrial |

|

By Region |

North South West East |

Products

Key Target Audience – Organizations and Entities Who Can Benefit by Subscribing This Report:

Telecom Service Providers

Internet Service Providers (ISPs)

Government Institutions and Policy Regulators (e.g., TRAI)

Mobile Network Operators (MNOs)

Equipment Manufacturers

Broadband Infrastructure Providers

Banks and Financial Institutions

Content Delivery Network (CDN) Providers

Smart Device Manufacturers

Time Period Captured in the Report:

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2028

Companies

Players Mentioned in the Report:

Reliance Jio Infocomm Ltd.

Bharti Airtel

Vodafone Idea

BSNL

ACT Fibernet

Tata Communications

Mahanagar Telephone Nigam Limited (MTNL)

Hathway Cable and Datacom

You Broadband

Tikona Infinet Limited

Spectra

Excitel Broadband

SITI Networks

D-VoiS Communications

Den Networks

Table of Contents

1. India Wireless Broadband Market Overview

1.1 India Wireless Broadband Market Taxonomy

2. India Wireless Broadband Market Size by Volume (in Mn), 2018-2023

3. India Wireless Broadband Market Analysis

3.1 India Wireless Broadband Market Growth Drivers

3.2 India Wireless Broadband Market Challenges and Issues

3.3 India Wireless Broadband Market Trends and Development

3.4 India Wireless Broadband Market Government Regulation

3.5 India Wireless Broadband Market SWOT Analysis

3.6 India Wireless Broadband Market Stake Ecosystem

3.7 India Wireless Broadband Market Competition Ecosystem

4. India Wireless Broadband Market Segmentation, 2023

4.1 India Wireless Broadband Market Segmentation by Technology (in %), 2023

4.2 India Wireless Broadband Market Segmentation by Application (in %), 2023

4.3 India Wireless Broadband Market Segmentation by Region (in %), 2023

5. India Wireless Broadband Market Competition Benchmarking

5.1 India Wireless Broadband Market Cross-Comparison (no. of employees, company overview, business strategy, USP, recent development, operational parameters, financial parameters and advanced analytics)

6. India Wireless Broadband Market Future Market Size by Volume (in Mn), 2023-2028

7. India Wireless Broadband Market Future Market Segmentation, 2028

7.1 India Wireless Broadband Market Segmentation by Technology (in %), 2028

7.2 India Wireless Broadband Market Segmentation by Application (in %), 2028

7.3 India Wireless Broadband Market Segmentation by Region (in %), 2028

8. India Wireless Broadband Market Analysts’ Recommendations

8.1 India Wireless Broadband Market TAM/SAM/SOM Analysis

8.2 India Wireless Broadband Market Customer Cohort Analysis

8.3 India Wireless Broadband Market Marketing Initiatives

8.4 India Wireless Broadband Market White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 01: Identifying Key Variables

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry level information.

Step 02: Market Building

Collating statistics on India Wireless Broadband Market over the years, penetration of marketplaces and service providers ratio to compute revenue generated for this Market. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.

Step 03: Validating and Finalizing

Building market hypothesis and conducting CATIs with industry experts belonging to different companies to validate statistics and seek operational and financial information from company representatives.

Step 04: Research Output

Our team will approach multiple Wireless Broadband companies and understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from Wireless Broadband companies.

Frequently Asked Questions

01 How big is India Wireless Broadband Market?

The India wireless broadband market was volumed at 866 million subscribers in 2023, driven by the increasing penetration of smartphones, affordable data plans, and government initiatives aimed at improving internet connectivity.

02 What are the challenges in India Wireless Broadband Market?

Challenges in India wireless broadband market include high spectrum acquisition costs, infrastructure constraints in rural areas, financial stress faced by telecom operators, and regulatory and policy hurdles that create an uncertain business environment for service providers.

03 Who are the major players in the India Wireless Broadband Market?

Key players in the India wireless broadband market include Reliance Jio Infocomm Ltd., Bharti Airtel, Vodafone Idea, BSNL, and ACT Fibernet. These companies dominate due to their extensive network coverage, competitive data plans, and continuous investment in infrastructure.

04 What are the growth drivers of India Wireless Broadband Market?

The India wireless broadband market is driven by the rising smartphone penetration, increased data consumption, government digital initiatives, and the expansion of 5G services. These factors collectively enhance the demand for high-speed internet access across urban and rural areas.

05 What recent developments have occurred in the India Wireless Broadband Market?

Recent developments in India wireless broadband market include Reliance Jio's 5G trials in major cities, Bharti Airtel's investment in fibre network expansion, Vodafone Idea's network upgrades, and BSNL's collaboration with Google to deploy public Wi-Fi hotspots across rural areas.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.